Professional Documents

Culture Documents

Rent 3 BHK: in This Case You Should

Uploaded by

Sudhir Chitla0 ratings0% found this document useful (0 votes)

12 views1 pageOriginal Title

3BHK

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageRent 3 BHK: in This Case You Should

Uploaded by

Sudhir ChitlaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

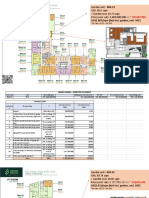

Analysis Period 15 years

In this case you should RENT your house 3 BHK

Renting a house - what are the financials? Buying a house - what are the financials?

Monthly Rent? 28,000 Cost of the property 85,00,000

HRA Tax Benefit? 30% Registration % 7%

Effective Monthly Rent 19,600 Registration Amount 5,95,000

Downpayment % 25%

Yearly Rent you will pay 2,35,200 Downpayment Amount 21,25,000

Avg. yearly rent increase 10% Total upfront amount (incl registration) 27,20,000

Loan Amount 63,75,000

Total rent over the period 74,72,888 Interest rate on loan % 8%

(this amount is not inflation adjusted) Loan Duration in years 15

EMI per month 60,923

This is your expense. But you also gain Tax bracket 30%

if you invest the amount of downpayment Effective Interest Rate % 6%

and also the additional interest you will pay Effection EMI per month 52,428

beyond your monthly rent

So this should be added as a benefit to Total Interest over the period 30,62,036

renting a house

Maintenance Amount (% of cost) 0.8%

Total upfront amount 27,20,000 Maintenance Amount per month 5,313

Additional monthly amount Avg. yearly increase % 5%

you can invest 32,828 Total maintenance over the period 13,75,633

Monthly Interest minus rent (which increases every year)

Return you can generate 7% Total cost of buying the house 1,35,32,669

Cost of house + Interest + maintenance

Value of upfront amount

after the period 75,04,566 The value of the house increases as well every year

Value of monthly amounts Property will increase by what %

after the period 56,32,276 every year 5%

Value of property after this period 1,76,70,890

Net benefit of renting a house 56,63,954 Adjusted for inflation

So net benefit of buying a house is 41,38,220

You might also like

- What The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeFrom EverandWhat The Banks Ask & Why: Everything You Need to Know before Applying for a Mortgage If You're Self-Employed or Have a Complex IncomeNo ratings yet

- BUY 2.5 BHK: in This Case You ShouldDocument1 pageBUY 2.5 BHK: in This Case You ShouldSudhir ChitlaNo ratings yet

- Buy or Rent A House Calculator - Ankur WarikooDocument6 pagesBuy or Rent A House Calculator - Ankur WarikooAryanNo ratings yet

- Retirement Plan 8 Year CycleDocument4 pagesRetirement Plan 8 Year CyclesultanNo ratings yet

- Buy or Rent A House Calculations - Ankur WarikooDocument6 pagesBuy or Rent A House Calculations - Ankur WarikooVivek GuptaNo ratings yet

- Buy or Rent House - CalculatorDocument1 pageBuy or Rent House - CalculatorRahul VermaNo ratings yet

- Buy or Rent House - CalculatorDocument2 pagesBuy or Rent House - CalculatorHardik PandeyNo ratings yet

- 1 MW - Solar Power Financial ModelDocument15 pages1 MW - Solar Power Financial Modelannu priyaNo ratings yet

- HF Calculator (UMI) 2Document13 pagesHF Calculator (UMI) 2FierceNo ratings yet

- World Trade Center, Noida CBD: Down Payment 12% Super Area (SQ - FT.) 255 BSP (RS./PSF) 7,200 Total Cost (RS.) 1,836,000Document1 pageWorld Trade Center, Noida CBD: Down Payment 12% Super Area (SQ - FT.) 255 BSP (RS./PSF) 7,200 Total Cost (RS.) 1,836,000Rohit ChhabraNo ratings yet

- Case Study SpreadsheetDocument17 pagesCase Study SpreadsheetExpert Answers100% (1)

- Financial Model v1.0 - 20210105Document5 pagesFinancial Model v1.0 - 20210105Tu CanNo ratings yet

- 1bedroom + Balc. Unit 14a 48.50sqm PromoDocument2 pages1bedroom + Balc. Unit 14a 48.50sqm PromoSimone Matthew YaterNo ratings yet

- Sun Life ProductDocument3 pagesSun Life ProductCatherine Joy ManaloNo ratings yet

- Computations Trial 2Document1 pageComputations Trial 2John Alex OliverNo ratings yet

- Intacc2-Quiz ExamDocument5 pagesIntacc2-Quiz ExamCmNo ratings yet

- Group Case 3 - It's Better Late Than NeverDocument8 pagesGroup Case 3 - It's Better Late Than NeverHannahPojaFeria0% (1)

- Ch4 Spreadsheets Update 2 13Document19 pagesCh4 Spreadsheets Update 2 13Toàn ĐìnhNo ratings yet

- BA 540 (Homework-1)Document6 pagesBA 540 (Homework-1)MariaNo ratings yet

- Ba 540 (HW1) Osuid 934268766Document6 pagesBa 540 (HW1) Osuid 934268766MariaNo ratings yet

- Rent Vs Buy CalculatorDocument6 pagesRent Vs Buy CalculatorShihab MohammedNo ratings yet

- Basic Rental Analysis WorksheetDocument8 pagesBasic Rental Analysis WorksheetGleb petukhovNo ratings yet

- Ex 02a NOIDocument15 pagesEx 02a NOIgiannimizrahi5No ratings yet

- HW Tut 5 - Dang Thuy Huong - 1704040049Document7 pagesHW Tut 5 - Dang Thuy Huong - 1704040049Đặng Thuỳ HươngNo ratings yet

- TVM & JLR - Case SolutionDocument3 pagesTVM & JLR - Case SolutionAmit Kr GodaraNo ratings yet

- Quiz 10 - CH 16Document4 pagesQuiz 10 - CH 16JamNo ratings yet

- IHVRS Computation 216sqm CommercialDocument1 pageIHVRS Computation 216sqm CommercialJohn Alex OliverNo ratings yet

- Book 1Document2 pagesBook 1cootaraktarakNo ratings yet

- Existing Building AnalysisDocument15 pagesExisting Building AnalysisAmir H.TNo ratings yet

- Module 9-DIRECT FINANCING LEASE - LESSORDocument10 pagesModule 9-DIRECT FINANCING LEASE - LESSORJeanivyle CarmonaNo ratings yet

- Reversion Net Operating Income:: Five Year Leveraged IRR AnalysisDocument15 pagesReversion Net Operating Income:: Five Year Leveraged IRR Analysisalexs617No ratings yet

- 12-Month Interest 3 Months Hence Interest Paid On CP 15 Months Hence Realized P/L of FRA 3 Months Hence Future Value of P/L On FraDocument2 pages12-Month Interest 3 Months Hence Interest Paid On CP 15 Months Hence Realized P/L of FRA 3 Months Hence Future Value of P/L On FraIvan WangNo ratings yet

- PD Interest RateDocument2 pagesPD Interest RatecraftylandofficialNo ratings yet

- Cyberthum Retail Space Calculation Sheet 100 SQ FTDocument11 pagesCyberthum Retail Space Calculation Sheet 100 SQ FTkanshika yadavNo ratings yet

- Ba540 HW1Document3 pagesBa540 HW1MariaNo ratings yet

- PropertyDocument8 pagesPropertyRameeshaAmanNo ratings yet

- Kajian Finansial MFOnisasi PLTD Kanaan 06012017Document18 pagesKajian Finansial MFOnisasi PLTD Kanaan 06012017Yulia Reza FirdaniaNo ratings yet

- Multifamily Apartment ProformaDocument4 pagesMultifamily Apartment Proformaartsan3No ratings yet

- Sample Computation: 10% Bank FinDocument1 pageSample Computation: 10% Bank FinjonNo ratings yet

- Chapter 13 Ia2Document18 pagesChapter 13 Ia2JM Valonda Villena, CPA, MBANo ratings yet

- TSB10190 WebDocument4 pagesTSB10190 WebAnno NymousNo ratings yet

- KPR Vs CashDocument6 pagesKPR Vs CashZanisaNo ratings yet

- Presentation 1Document4 pagesPresentation 1Huynh VoNo ratings yet

- Rental Cash FlowDocument3 pagesRental Cash FlowHelmy WidjajaNo ratings yet

- RLLR SchemeDocument1 pageRLLR SchemeBhushan Singh BadgujjarNo ratings yet

- Promo: Option 1: Straight Payment No LsDocument2 pagesPromo: Option 1: Straight Payment No LsShandrilyne TanNo ratings yet

- Project 1 Mortgage CalculationsDocument3 pagesProject 1 Mortgage CalculationsJulius Hörner100% (1)

- SFH Rental AnalysisDocument6 pagesSFH Rental AnalysisA jNo ratings yet

- Part of Argus Enterptise ManualDocument27 pagesPart of Argus Enterptise Manualrocketman19911No ratings yet

- ComputationDocument1 pageComputationAL GreyNo ratings yet

- Satori Residences Rahu Building Unit and Parking Slot Computation (February 2020 Reservations)Document7 pagesSatori Residences Rahu Building Unit and Parking Slot Computation (February 2020 Reservations)Lem MikeeNo ratings yet

- Lot Computation PH 2 BLK 5 LOT 10Document1 pageLot Computation PH 2 BLK 5 LOT 10Bryan PongaoNo ratings yet

- FAR QUIZ 1 - ProblemsDocument4 pagesFAR QUIZ 1 - ProblemsAEHYUN YENVYNo ratings yet

- PNB Fixed Deposit FormDocument6 pagesPNB Fixed Deposit FormKaushal DidwaniaNo ratings yet

- Primus Automation: Robert Clark Rey Mendez Nate Wills Katie YoungDocument26 pagesPrimus Automation: Robert Clark Rey Mendez Nate Wills Katie YoungfmulyanaNo ratings yet

- RP and EB Vishnu Kant BhadauriaDocument6 pagesRP and EB Vishnu Kant Bhadauriavishnu bhadauriaNo ratings yet

- Own A HomeDocument2 pagesOwn A HomehelpmewinNo ratings yet

- Gurpreet Case Study - Only AnswersDocument12 pagesGurpreet Case Study - Only Answerspooja katariya0% (1)

- Problem 13-12 To 13-15Document3 pagesProblem 13-12 To 13-15Dominic RomeroNo ratings yet

- TFM ProjectDocument11 pagesTFM ProjectKnowledge PediaNo ratings yet

- Tax Avoidance or Tax EvasionDocument13 pagesTax Avoidance or Tax EvasionmahabaleshNo ratings yet

- School Fees 1Document2 pagesSchool Fees 1babusonaiitkgpNo ratings yet

- Self-Assessment Questionnaire B: and Attestation of ComplianceDocument20 pagesSelf-Assessment Questionnaire B: and Attestation of Compliancemustafaanis786No ratings yet

- PRR 9946 Payments To Active NetworkDocument15 pagesPRR 9946 Payments To Active NetworkRecordTrac - City of OaklandNo ratings yet

- Telangana State Council of Higher Education: Provisional Allotment OrderDocument1 pageTelangana State Council of Higher Education: Provisional Allotment Orderrahul reddyNo ratings yet

- Australian Corporate Tax Rate: Local Income TaxesDocument35 pagesAustralian Corporate Tax Rate: Local Income TaxesNadine DiamanteNo ratings yet

- Abc Chapter 1 Solman 2020 Millan Abc - CompressDocument9 pagesAbc Chapter 1 Solman 2020 Millan Abc - CompressErna DavidNo ratings yet

- Goods & Service Tax (GST) - User DashboardDocument3 pagesGoods & Service Tax (GST) - User DashboardRAJORAJI CO.No ratings yet

- Prospects of GST in IndiaDocument6 pagesProspects of GST in IndiaShayan ZafarNo ratings yet

- ACFrOgA5Xk3doyEu0R BblKbHoEhcyalPcKrE15XRyAdhgiw6Fd4a34RHchWB 6mey TWHzb7Oex7 Ti0c6yfVqujPQV8ZDZq3ZUITpdE K2lsl839iKK6 PVsCVc4Document2 pagesACFrOgA5Xk3doyEu0R BblKbHoEhcyalPcKrE15XRyAdhgiw6Fd4a34RHchWB 6mey TWHzb7Oex7 Ti0c6yfVqujPQV8ZDZq3ZUITpdE K2lsl839iKK6 PVsCVc4SIVARAMANJAGANATHANNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- Irctcs E-Ticketing Service Electronic Reservation Slip (Agent)Document1 pageIrctcs E-Ticketing Service Electronic Reservation Slip (Agent)Maa Shakti TravelsNo ratings yet

- Taxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDocument7 pagesTaxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDenny Kridex OmolonNo ratings yet

- Zafar Iqbal S/O Muhammad Iqbal ST No.2 Baba Farid Colony. .: Web Generated BillDocument1 pageZafar Iqbal S/O Muhammad Iqbal ST No.2 Baba Farid Colony. .: Web Generated BillMuhammad AfzaalNo ratings yet

- Img 20221210 0001-1Document1 pageImg 20221210 0001-1Sandy MNo ratings yet

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyNo ratings yet

- BIR 10-2003 Implementing The Tax Incentives Provisions RA 8525 Adopt-A-School Act of 1998Document5 pagesBIR 10-2003 Implementing The Tax Incentives Provisions RA 8525 Adopt-A-School Act of 1998LakanPH100% (1)

- Electro Power PVT LTD-1Document1 pageElectro Power PVT LTD-1VickyNo ratings yet

- Canara Credit Cards User Manual - For WebsiteDocument11 pagesCanara Credit Cards User Manual - For WebsiteSuperdudeGauravNo ratings yet

- Guidelines For Submission of Investment (India) 2020-21Document6 pagesGuidelines For Submission of Investment (India) 2020-21sriharshamysuruNo ratings yet

- Lecture On General Principles of TaxationDocument75 pagesLecture On General Principles of TaxationJayen100% (1)

- Navigating TAX Regulations in Bangladesh - A 2023 GuideDocument60 pagesNavigating TAX Regulations in Bangladesh - A 2023 Guidereazvat786No ratings yet

- Septemeber ICCIDocument2 pagesSeptemeber ICCIShivendra KumarNo ratings yet

- UntitledDocument4 pagesUntitledRJN CabinetmakingNo ratings yet

- Payments BankDocument33 pagesPayments BankAdnan patelNo ratings yet

- Info Edge (India) LTD: Tax InvoiceDocument1 pageInfo Edge (India) LTD: Tax Invoicephani raja kumarNo ratings yet

- CHAPTER 6 TaxDocument24 pagesCHAPTER 6 TaxVencint LaranNo ratings yet

- Situs of TaxationDocument3 pagesSitus of Taxationhanabi_13100% (1)

- (Decision Lab) - Epayments U&A Report1Document47 pages(Decision Lab) - Epayments U&A Report1Leo LuuNo ratings yet

- Cir vs. FisherDocument3 pagesCir vs. FisherAnna BautistaNo ratings yet