Professional Documents

Culture Documents

Case 16.2: Sunlight Paints Limited: Assumptions

Uploaded by

Mukul KadyanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 16.2: Sunlight Paints Limited: Assumptions

Uploaded by

Mukul KadyanCopyright:

Available Formats

Case 16.

2: Sunlight Paints Limited

Assumptions:

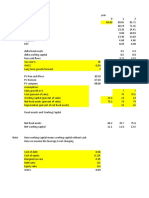

Tax rate 35% Year 2004 2005 2006 2007

Equity beta 1.05 Working Capital 67.00 70.81 78.72 98.40

D/E ratio (1:5) 0.20 Capex* 75.00 50.00 20.60 18.80

E/V ratio 83.33% * It is assumed that capex is incurred in the beginning of the current year and therefore, treated as at the end of the previous

D/V ratio 16.67% in year 14 is assumed equal to depreciation.

Cost of equity 18.00% 2004.00 2005.00 2006.00 2007.00

Cost of debt 8.10% Sales 202.30 224.91 281.14

Pre-tax WACC (OCC) 16.35% Cash expenses 161.27 173.70 204.63

Interest (A) 20.13 20.13 20.13

Risk-free rate 7.50% Depreciation (B) 135.92 105.20 77.72

Risk premium 10.00% Profit after tax( C ) 26.67 33.29 49.73

Unlevered beta 0.88 Change in NWC (D) -3.81 -7.91 -19.68

Capex (E) -75.00 -50.00 -20.60 -18.80

New debt 125.00 After-tax cash flows, F = B+C+D+E -75.00 108.78 109.98 88.97

Interest rate 8.10% Add: After-tax Interest (G) 13.08 13.08 13.08

Existing debt 100.00 Unlevered (or free) cash flow, H = F+G -75.00 121.86 123.06 102.05

Market interest rate (BTCOD) 8.10% SV

ATCOD 5.27% NCF 121.86 123.06 102.05

Value 774.20

PV of Interest tax shield 47.05 7.04 7.04 7.04

Total value 821.25

Less: Value of debt 225.00

Equity value 596.25

Value per share 23.85

Loam Amortisation and Interest

2004 2005 2006 2007

New debt 125 125 125 125

Repayment 0.00 0.00 0.00

Interest 10.13 10.13 10.13

Existing debt 100 100 100 100

Repayment 0 0 0

Interest 10 10 10

Total interest 20.13 20.13 20.13

Capital Cash Flow Approac (vs. ANPV Approach)

ANPV Dis. Rate CCF Dis. Rate

Value 774.2 16.35% 774.2 16.35%

PV of Interest 47.1 8.10% 33.61 16.35%

Total value 821.3 807.8

Less: Value of debt 225 225

Equity value 596.3 582.8

Value per share 23.9 23.3

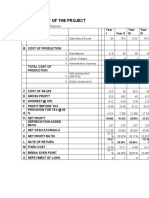

2008 2009 2010 2011 2012 2013 2014

117.09 130.18 144.28 151.50 159.07 167.03 175.38

18.00 16.60 15.00 16.20 13.20 13.50 12.15

herefore, treated as at the end of the previous year. Capex

2008.00 2009.00 2010.00 2011.00 2012.00 2013.00 2014.00

334.55 386.07 443.99 497.26 546.99 601.69 649.83

234.00 262.34 294.19 323.50 350.84 380.93 407.40

20.13 20.13 20.13 20.13 20.13 20.13 20.13

59.63 44.72 34.29 26.05 20.10 15.52 12.15

65.36 80.42 97.37 112.94 127.50 143.49 157.58

-18.69 -13.09 -14.10 -7.22 -7.57 -7.96 -8.35

-18.00 -16.60 -15.00 -16.20 -13.20 -13.50 -12.15

88.30 95.45 102.56 115.57 126.83 137.55 149.23

13.08 13.08 13.08 13.08 13.08 13.08 13.08

101.38 108.54 115.64 128.66 139.91 150.64 162.31

1252.29 Discount rate

101.38 108.54 115.64 128.66 139.91 150.64 1414.60 OCC, 16.35%

7.04 7.04 7.04 7.04 7.04 7.04 7.04 BTCOD, 10%

2008 2009 2010 2011 2012 2013 2014

125 125 125 125 125 125 125

0.00 0.00 0.00 0.00 0.00 0.00 125.00

10.13 10.13 10.13 10.13 10.13 10.13 10.13

100 100 100 100 100 100 0

0 0 0 0 0 0 100

10 10 10 10 10 10 10

20.13 20.13 20.13 20.13 20.13 20.13 20.13

You might also like

- Berkshire Partners Bidding For Carter S Group 6Document21 pagesBerkshire Partners Bidding For Carter S Group 6Þorgeir DavíðssonNo ratings yet

- Final Report - Financial ModelDocument10 pagesFinal Report - Financial ModelDrishti SrivatavaNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- CVR - Case - Excel FileDocument7 pagesCVR - Case - Excel FileVinay JajuNo ratings yet

- M&M Pizza With 20% TaxDocument5 pagesM&M Pizza With 20% TaxAnkitNo ratings yet

- 9 Cash Flow Navneet EnterpriseDocument5 pages9 Cash Flow Navneet EnterpriseChanchal MisraNo ratings yet

- Berkshire Partners Bidding For Carter'S - Group 6Document21 pagesBerkshire Partners Bidding For Carter'S - Group 6Versha100% (1)

- Nike Inc Cost of Capital Blaine KitchenwDocument11 pagesNike Inc Cost of Capital Blaine KitchenwAlvaro Gallardo FernandezNo ratings yet

- Midsem Sol - WACC QuestionDocument2 pagesMidsem Sol - WACC QuestionSarthak JainNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2deepika0% (1)

- CPKDocument6 pagesCPKBilly GemaNo ratings yet

- Target ExerciseDocument18 pagesTarget ExerciseJORGE PUENTESNo ratings yet

- Problem1 Section 19.2Document2 pagesProblem1 Section 19.2SANSKAR JAINNo ratings yet

- DSCR Case Study FinalDocument7 pagesDSCR Case Study FinalVISHAL PATILNo ratings yet

- Exercises and Answers Chapter 3Document12 pagesExercises and Answers Chapter 3MerleNo ratings yet

- Saving For The User by Taking Car On Lease 3,82,878.80Document1 pageSaving For The User by Taking Car On Lease 3,82,878.80shettyNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2Art EuphoriaNo ratings yet

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- Task 1 AnswerDocument9 pagesTask 1 AnswerSiddhant Aggarwal0% (4)

- DFM 15 SolutionDocument17 pagesDFM 15 SolutionAbhinav JainNo ratings yet

- Income Based Valuation Unit Exam Answer Key NewDocument6 pagesIncome Based Valuation Unit Exam Answer Key NewAMIKO OHYANo ratings yet

- The Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021Document11 pagesThe Forecast For A Company's P&L Is Provided Below. Forecast The Operating Cash Flow For 2021ShivamNo ratings yet

- TMRD Sample Comp APR2020 With SpotDocument1 pageTMRD Sample Comp APR2020 With SpotLiv ValdezNo ratings yet

- Profitibility of The Project: (All Values in Lacs of Rupees)Document1 pageProfitibility of The Project: (All Values in Lacs of Rupees)Sanjay MalhotraNo ratings yet

- Manaal - Commercial Banking W J.P MorganDocument9 pagesManaal - Commercial Banking W J.P Morganmanaal.murtaza1No ratings yet

- Business Valuation ExercisesDocument12 pagesBusiness Valuation Exercisesanamul haqueNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2Yash JasaparaNo ratings yet

- Managerial Economics 3rd Assignment Bratu Carina Maria EXCELDocument11 pagesManagerial Economics 3rd Assignment Bratu Carina Maria EXCELCarina MariaNo ratings yet

- 006 Bonds-2Document3 pages006 Bonds-2caparvez25No ratings yet

- Financial Plan TemplateDocument104 pagesFinancial Plan Templatewerewolf2010No ratings yet

- Is Excel Participant - Simplified v2Document10 pagesIs Excel Participant - Simplified v2Aaron Pool0% (2)

- Term Loan Eligibility Calc by BankDocument16 pagesTerm Loan Eligibility Calc by Bankdsp varmaNo ratings yet

- Lease Option: Planet Club Karaoke: Equity DebtDocument39 pagesLease Option: Planet Club Karaoke: Equity DebtebasyaNo ratings yet

- Emv Case Study 1Document8 pagesEmv Case Study 1ViddhiNo ratings yet

- AR ManagementDocument7 pagesAR ManagementJoshua CabinasNo ratings yet

- AR Management WorkbookDocument7 pagesAR Management WorkbookyukiNo ratings yet

- Turnover - 8 Turnover - 10 BenefitsDocument7 pagesTurnover - 8 Turnover - 10 BenefitsJoshua CabinasNo ratings yet

- Balance Sheet: Larry's Landscaping & Garden SupplyDocument2 pagesBalance Sheet: Larry's Landscaping & Garden SupplyBelle B.No ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Total Operating Costs Overheads: Administration License FeeDocument10 pagesTotal Operating Costs Overheads: Administration License FeeAshish Mani LamichhaneNo ratings yet

- FInancial Mangku BC (15.11.v1) CompleteDocument163 pagesFInancial Mangku BC (15.11.v1) CompleteTurangga DayaNo ratings yet

- Is Excel Participant - Simplified v2Document9 pagesIs Excel Participant - Simplified v2dikshapatil6789No ratings yet

- Weighted Average Cost of Capital (WACC) : Ultra TechDocument6 pagesWeighted Average Cost of Capital (WACC) : Ultra TechNipsi DasNo ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Charter Feasibility Study - Bruneko Elan 50.1 Realno 2022Document2 pagesCharter Feasibility Study - Bruneko Elan 50.1 Realno 2022Vedran IvanovićNo ratings yet

- Mattel - Financial ModelDocument13 pagesMattel - Financial Modelharshwardhan.singh202No ratings yet

- DCF ModelDocument58 pagesDCF Modelishaan0311No ratings yet

- Development CostsDocument2 pagesDevelopment CostsDhanushka MadhushankaNo ratings yet

- Atlas Honda Financial AnalysisDocument24 pagesAtlas Honda Financial AnalysisSyed Huzayfah FaisalNo ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- Lesson 4 - Case Study StatementDocument6 pagesLesson 4 - Case Study StatementMila DautovicNo ratings yet

- CRDocument19 pagesCRVijay HemwaniNo ratings yet

- Revision Excel SheetsDocument9 pagesRevision Excel SheetsPhan Phúc NguyênNo ratings yet

- IS Excel Participant (Risit Savani) - Simplified v2Document9 pagesIS Excel Participant (Risit Savani) - Simplified v2risitsavaniNo ratings yet

- IS Excel Participant - Simplified v2Document9 pagesIS Excel Participant - Simplified v2animecommunity04No ratings yet

- FM09-CH 16Document12 pagesFM09-CH 16Mukul KadyanNo ratings yet

- FM09-CH 14Document12 pagesFM09-CH 14Mukul KadyanNo ratings yet

- FM09-CH 18Document5 pagesFM09-CH 18Mukul KadyanNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- Financial Planning and Strategy Problem 1 Bajaj Auto LTDDocument4 pagesFinancial Planning and Strategy Problem 1 Bajaj Auto LTDMukul KadyanNo ratings yet

- FM09-CH 15Document7 pagesFM09-CH 15Mukul Kadyan100% (1)

- CH 22: Lease, Hire Purchase and Project FinancingDocument7 pagesCH 22: Lease, Hire Purchase and Project FinancingMukul KadyanNo ratings yet

- FM09-CH 08Document9 pagesFM09-CH 08Mukul KadyanNo ratings yet

- FM09-CH 07Document9 pagesFM09-CH 07Mukul KadyanNo ratings yet

- Chapter 16Document8 pagesChapter 16Mukul KadyanNo ratings yet

- Chapter 27Document10 pagesChapter 27Mukul KadyanNo ratings yet

- FM09-CH 30Document4 pagesFM09-CH 30Mukul KadyanNo ratings yet

- FM09-CH 04Document4 pagesFM09-CH 04Mukul KadyanNo ratings yet

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- FM09-CH 17Document5 pagesFM09-CH 17Mukul KadyanNo ratings yet

- FM09-CH 21Document4 pagesFM09-CH 21Mukul KadyanNo ratings yet

- Real Options, Investment Strategy and Process: Problem 1Document4 pagesReal Options, Investment Strategy and Process: Problem 1Mukul KadyanNo ratings yet

- FM09-CH 05Document4 pagesFM09-CH 05Mukul KadyanNo ratings yet

- FM09-CH 33Document3 pagesFM09-CH 33Mukul KadyanNo ratings yet

- Chapter 12Document4 pagesChapter 12Mukul KadyanNo ratings yet

- Chapter 28Document7 pagesChapter 28Mukul KadyanNo ratings yet

- CH 34: International Financial ManagementDocument2 pagesCH 34: International Financial ManagementMukul KadyanNo ratings yet

- Essentials of Economics 9Th Edition John Sloman Full ChapterDocument67 pagesEssentials of Economics 9Th Edition John Sloman Full Chapterpeter.voit454100% (5)

- Business and Transfer Taxation Business Taxation - VAT (Students' Handouts)Document1 pageBusiness and Transfer Taxation Business Taxation - VAT (Students' Handouts)Angelica Jem Ballesterol CarandangNo ratings yet

- Consumer SurveyDocument18 pagesConsumer SurveyJahnvi DoshiNo ratings yet

- Sir AnsleyDocument2 pagesSir Ansleyqf2008802No ratings yet

- RAD TorqueDocument16 pagesRAD TorqueRaziel Postigo MezaNo ratings yet

- CM1 PAS1 Presentation of Financial StatementsDocument16 pagesCM1 PAS1 Presentation of Financial StatementsMark GerwinNo ratings yet

- Financial Statement Analysis of Suzuki MotorsDocument21 pagesFinancial Statement Analysis of Suzuki MotorsMuhammad AliNo ratings yet

- Mandatory Registration Information: TransactionDocument2 pagesMandatory Registration Information: TransactionRalphNo ratings yet

- Online Business (E-Commerce) in Indonesia TaxationDocument12 pagesOnline Business (E-Commerce) in Indonesia TaxationIndah NovitasariNo ratings yet

- Wayne Johnson AnnouncementDocument5 pagesWayne Johnson AnnouncementAlexandria DorseyNo ratings yet

- LAWDocument5 pagesLAWFrancis AbuyuanNo ratings yet

- University of Delhi: Semester Examination TERM I MARCH 2023 Statement of Marks / GradesDocument2 pagesUniversity of Delhi: Semester Examination TERM I MARCH 2023 Statement of Marks / GradesDev ChauhanNo ratings yet

- Adekunle 2018Document21 pagesAdekunle 2018GADIS ALMIRANo ratings yet

- Formulaire Accepteur Agrege Marchand English VERSIONDocument2 pagesFormulaire Accepteur Agrege Marchand English VERSIONGerald NONDIANo ratings yet

- Chapter 8 Corporate Social Responsibility and Corruption in A Global ContextDocument12 pagesChapter 8 Corporate Social Responsibility and Corruption in A Global ContextKaye Joy TendenciaNo ratings yet

- Student Advising Course Planning Tool-FALL2020-V2.3Document56 pagesStudent Advising Course Planning Tool-FALL2020-V2.3Ngan NguyenNo ratings yet

- Income Tax Ordinance, 2001: Government of PakistanDocument715 pagesIncome Tax Ordinance, 2001: Government of PakistanAmir MughalNo ratings yet

- Lecture 3 - Supply Chain Drivers and MetricsDocument35 pagesLecture 3 - Supply Chain Drivers and MetricsNadine AguilaNo ratings yet

- Audit Program Licensing TermsDocument8 pagesAudit Program Licensing TermsPrem Prakash PoddarNo ratings yet

- 5 10 pp.62 66Document6 pages5 10 pp.62 66timesave240No ratings yet

- Strategic Management Concepts Competitiveness and Globalization Hitt 11th Edition Solutions ManualDocument29 pagesStrategic Management Concepts Competitiveness and Globalization Hitt 11th Edition Solutions ManualJohnny Adams100% (28)

- Commodity Forwards and FuturesDocument22 pagesCommodity Forwards and FuturesAliza RajaniNo ratings yet

- ACE Recruitment GlobalDocument2 pagesACE Recruitment GlobalQuratulain WahabNo ratings yet

- Research Proposal: Lee Hui Chien (Erica) B00374777Document12 pagesResearch Proposal: Lee Hui Chien (Erica) B00374777John LimNo ratings yet

- LIst of CA AgentDocument12 pagesLIst of CA AgentParikshit SalvepatilNo ratings yet

- ACTIVITY DESIGN - Labor For Asean Scout JamboreeDocument1 pageACTIVITY DESIGN - Labor For Asean Scout JamboreeLuigie BagoNo ratings yet

- Complete IELTS Unit 06 (Pp. 57-67)Document11 pagesComplete IELTS Unit 06 (Pp. 57-67)rifqi bambangNo ratings yet

- Brief History of Saint Michael CollegeDocument4 pagesBrief History of Saint Michael CollegeAdoremus DueroNo ratings yet

- Subject: Revised DPWH Program On Awards And: Ou - Tl.UeDocument15 pagesSubject: Revised DPWH Program On Awards And: Ou - Tl.Uebrian paul ragudoNo ratings yet

- 7 Steps To Building Your Personal BrandDocument5 pages7 Steps To Building Your Personal BrandGladz C CadaguitNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsFrom EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsRating: 5 out of 5 stars5/5 (1)

- Mind over Money: The Psychology of Money and How to Use It BetterFrom EverandMind over Money: The Psychology of Money and How to Use It BetterRating: 4 out of 5 stars4/5 (24)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsFrom EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)From EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Rating: 4 out of 5 stars4/5 (5)