Professional Documents

Culture Documents

VW Group Annual Report 2019 Key Financial Indicators

Uploaded by

Ashish PatwardhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

VW Group Annual Report 2019 Key Financial Indicators

Uploaded by

Ashish PatwardhanCopyright:

Available Formats

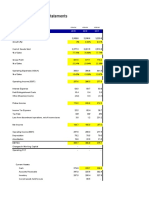

VOLKSWAGEN GROUP – ANNUAL REPORT 2019

Financial Key Performance Indicators

% 2019 2018 2017 2016 2015

Volkswagen Group

Gross margin 19.5 19.7 19.0 18.9 15.9

Personnel expense ratio 17.0 17.5 17.0 17.0 17.0

Operating return on sales 6.7 5.9 6.0 3.3 -1.9

Return on sales before tax 7.3 6.6 6.0 3.4 -0.6

Return on sales after tax 5.6 5.2 5.0 2.5 -0.6

Equity ratio 25.3 25.6 25.8 22.7 23.1

Automotive Division1

Change in unit sales year-on-year2 +0.5 +1.1 +3.7 +3.8 -2.0

Change in sales revenue year-on-year +5.7 +2.7 +5.3 +1.1 +3.6

Research and development costs as a percentage

of sales revenue 6.7 6.8 6.7 7.3 7.4

Operating return on sales 6.5 5.5 5.7 2.5 -3.4

EBITDA (in € million)3 29,706 26,707 26,094 18,999 7,212

Return on investment (ROI)4 11.2 11.0 12.1 8.2 -0.2

Cash flows from operating activities as a percentage of

sales revenue 14.5 9.2 6.0 10.9 12.9

Cash flows from investing activities attributable to

operating activities as a percentage of sales revenue 9.4 9.4 9.0 8.6 8.1

Capex as a percentage of sales revenue 6.6 6.6 6.5 6.9 6.9

Net liquidity as a percentage of sales revenue 8.4 8.2 9.7 12.5 11.5

Ratio of noncurrent assets to total assets5 26.4 23.3 23.7 23.4 23.1

Ratio of current assets to total assets6 17.0 17.6 16.3 15.9 15.2

Inventory turnover7 4.8 5.0 5.1 5.5 5.8

Equity ratio 37.6 37.9 36.9 31.4 32.6

Financial Services Division

Increase in total assets 7.9 11.2 6.0 8.3 13.9

Return on equity before tax8 10.8 9.9 9.8 10.8 12.2

Equity ratio 12.8 12.7 13.7 12.5 11.9

1 Including allocation of consolidation adjustments between the Automotive and Financial Services divisions.

2 Including the Chinese joint ventures. These companies are accounted for using the equity method.

3 Operating result plus net depreciation/amortization and impairment losses/reversals of impairment losses on property, plant and equipment, capitalized development costs, lease assets, goodwill and

financial assets as reported in the cash flow statement.

4 For details, see Value-based management.

5 Ratio of property, plant and equipment to total ass.

6 Ratio of inventories to total assets at the balance sheet date.

7 Ratio of sales revenue to average monthly inventories.

8 Earnings before tax as a percentage of average equity.

You might also like

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Presentation 1Document9 pagesPresentation 1Zubair KhanNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Bob's Baloney" (UVA-F-1942)Document4 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Bob's Baloney" (UVA-F-1942)LAWZ1017No ratings yet

- NH Financial Group Annual Report 2017Document121 pagesNH Financial Group Annual Report 2017b6No ratings yet

- RIAS Annual Financiel Account Statement 2019/20 1Document30 pagesRIAS Annual Financiel Account Statement 2019/20 1Leandro Mainumby Arapoty BorgesNo ratings yet

- Ten Year ReviewDocument10 pagesTen Year Reviewmaruthi631No ratings yet

- Five-Year Performance OverviewDocument2 pagesFive-Year Performance OverviewAjees AhammedNo ratings yet

- Financial Spreadsheet KOSONGAN FinalDocument7 pagesFinancial Spreadsheet KOSONGAN FinalDwi PermanaNo ratings yet

- Consolidated Financial StatementsDocument16 pagesConsolidated Financial StatementsMku MkuNo ratings yet

- Technical Interview WSOmodel2003Document7 pagesTechnical Interview WSOmodel2003Li HuNo ratings yet

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 Questionsguan junyanNo ratings yet

- Abbott AnalysisDocument35 pagesAbbott Analysisahmad bilal sabirNo ratings yet

- TeslaDocument425 pagesTeslapop andreeaNo ratings yet

- Wolkswagen Trabajo FinalDocument337 pagesWolkswagen Trabajo FinalYULIANA VELASQUEZNo ratings yet

- Economic And: at Constant FC) %Document6 pagesEconomic And: at Constant FC) %Zeeshan WaqasNo ratings yet

- Shalby Limited BSE 540797 FinancialsDocument39 pagesShalby Limited BSE 540797 Financialsakumar4uNo ratings yet

- ORASCOM Financial Ratio AnalysisDocument11 pagesORASCOM Financial Ratio AnalysisMahmoud Elyamany100% (1)

- Annual 20report 202020Document226 pagesAnnual 20report 202020Alexandru DavidNo ratings yet

- DL 090227 2008 PDFDocument216 pagesDL 090227 2008 PDFcattleyajenNo ratings yet

- HUL Training ModelDocument27 pagesHUL Training ModelOMANSHU YADAVNo ratings yet

- ANJ Annual Report Highlights Sustainable GrowthDocument216 pagesANJ Annual Report Highlights Sustainable GrowthAry PandeNo ratings yet

- Sanitärtechnik Eisenberg GMBH - FinancialsDocument2 pagesSanitärtechnik Eisenberg GMBH - Financialsin_daHouseNo ratings yet

- Shalby Limited BSE 540797 FinancialsDocument51 pagesShalby Limited BSE 540797 Financialsakumar4uNo ratings yet

- 3 Spread Sheet For Corp & ME001 Sultan FeedDocument5 pages3 Spread Sheet For Corp & ME001 Sultan Feedmuhammad ihtishamNo ratings yet

- Gea Annual Report 2018 Tcm11 52655Document256 pagesGea Annual Report 2018 Tcm11 52655geniusMAHINo ratings yet

- WackerDocument200 pagesWackerpetar2001No ratings yet

- Pirelli in Figures 2023 9MDocument11 pagesPirelli in Figures 2023 9Mvictorfarima1385No ratings yet

- FY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Document1 pageFY2018 (12m) FY2017 (12m) FY2016 (12m) FY2015 (12m) FY2014 (12m) FY2013 (12m) FY2012 (12m)Divyank JyotiNo ratings yet

- Mobility For Generations To Come.: Annual Report 2019Document354 pagesMobility For Generations To Come.: Annual Report 2019utkarsh chaudharyNo ratings yet

- Alpha-Win: Company Research ReportDocument5 pagesAlpha-Win: Company Research Reportchoiand1No ratings yet

- STORAENSO RESULTS Key Figures 2018Document11 pagesSTORAENSO RESULTS Key Figures 2018Paula Tapiero MorenoNo ratings yet

- Hgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedDocument6 pagesHgs Q4 & Full Year Fy2018 Financials & Fact Sheet: Hinduja Global Solutions LimitedChirag LaxmanNo ratings yet

- Clicks Analyst Booklet 2022Document40 pagesClicks Analyst Booklet 2022theedypz82.emNo ratings yet

- 539770228.xls Sources and Uses (2) 1Document5 pages539770228.xls Sources and Uses (2) 1prati gumrNo ratings yet

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDocument39 pagesKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNo ratings yet

- Y_2016_eDocument422 pagesY_2016_eiamjatin.jNo ratings yet

- Custom VW Ar20 - 2021 06 07 - 14 32 41Document371 pagesCustom VW Ar20 - 2021 06 07 - 14 32 41Saba MasoodNo ratings yet

- Tata Steel LTD.: Margins On Income On Total IncomeDocument4 pagesTata Steel LTD.: Margins On Income On Total IncomepriyaNo ratings yet

- Ey Aarsrapport 2021 22 25Document1 pageEy Aarsrapport 2021 22 25Ronald RunruilNo ratings yet

- Economic IndicatorsDocument6 pagesEconomic IndicatorsKhawaja BurhanNo ratings yet

- Claas Gb14 EnDocument134 pagesClaas Gb14 Enalaynnastaabx786No ratings yet

- Financial Statements-Kingsley AkinolaDocument4 pagesFinancial Statements-Kingsley AkinolaKingsley AkinolaNo ratings yet

- Cours 2 Essec 2018 Lbo PDFDocument81 pagesCours 2 Essec 2018 Lbo PDFmerag76668No ratings yet

- Burberry AR 2016-17 CleanDocument10 pagesBurberry AR 2016-17 Cleanqiaocheng2023No ratings yet

- CL EducateDocument7 pagesCL EducateRicha SinghNo ratings yet

- Berger Paints Ratio Analysis Summary 2015Document8 pagesBerger Paints Ratio Analysis Summary 2015KARIMSETTY DURGA NAGA PRAVALLIKANo ratings yet

- Also Annual Report Gb2022 enDocument198 pagesAlso Annual Report Gb2022 enmihirbhojani603No ratings yet

- Gymboree LBO Model ComDocument7 pagesGymboree LBO Model ComrolandsudhofNo ratings yet

- Consolidated Income and Financial Statements 2018Document4 pagesConsolidated Income and Financial Statements 2018Aayush PrakashNo ratings yet

- BAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTDocument1 pageBAJAJ AUTO LTD QUANTAMENTAL EQUITY RESEARCH REPORTVivek NambiarNo ratings yet

- Ten Year Review - Standalone: Asian Paints LimitedDocument10 pagesTen Year Review - Standalone: Asian Paints Limitedmaruthi631No ratings yet

- Excel Bodyshop EFDocument18 pagesExcel Bodyshop EFgestion integralNo ratings yet

- Earnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - NsDocument34 pagesEarnings Presentation: Bse Code: 524558 - Nse Symbol: Neulandlab - Bloomberg: Nll:In - Reuters: Neul - Nssunil.dasarath jadhavNo ratings yet

- This Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)Document7 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "Guna Fibres, LTD." (UVA-F-1687)karanNo ratings yet

- 2018 Financial Review - IBDocument4 pages2018 Financial Review - IBNicolas SuarezNo ratings yet

- EBRD Ukraine Strategy 2011-2014Document70 pagesEBRD Ukraine Strategy 2011-2014consta7751No ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- Baani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionDocument4 pagesBaani Milk Producer Co. LTD.: Executive Summary: Mar 2015 - Mar 2018: Non-Annualised: Rs. MillionNikku SinghNo ratings yet

- Nyse Post 2018 PDFDocument116 pagesNyse Post 2018 PDFLM_SNo ratings yet

- Finance Exam ToolkitDocument14 pagesFinance Exam ToolkitAshish PatwardhanNo ratings yet

- Slides Lbo MfeDocument7 pagesSlides Lbo MfeAshish PatwardhanNo ratings yet

- Maru Batting Center Case Study Excel Group YellowDocument26 pagesMaru Batting Center Case Study Excel Group YellowAshish PatwardhanNo ratings yet

- Bernard Loiseau CS Leadership - Anglais2Document4 pagesBernard Loiseau CS Leadership - Anglais2Ashish PatwardhanNo ratings yet

- The Cash Cows Mathias Bohn, Rodrigo Garcia, Marlène Luce, Roman Zanoli HEC Paris Paris, March 1, 2019Document106 pagesThe Cash Cows Mathias Bohn, Rodrigo Garcia, Marlène Luce, Roman Zanoli HEC Paris Paris, March 1, 2019ArvinNo ratings yet

- CORDIS Project 783132 enDocument21 pagesCORDIS Project 783132 enAshish PatwardhanNo ratings yet

- EOG ResourcesDocument16 pagesEOG ResourcesAshish PatwardhanNo ratings yet

- Elysee Module 18543 FRDocument23 pagesElysee Module 18543 FRAshish PatwardhanNo ratings yet

- India: After A Dramatic Second Wave, The Pandemic Is Steadily RecedingDocument4 pagesIndia: After A Dramatic Second Wave, The Pandemic Is Steadily RecedingAshish PatwardhanNo ratings yet

- Gupta Media: Group YELLOW: Elias Tannous, FlorinDocument12 pagesGupta Media: Group YELLOW: Elias Tannous, FlorinAshish PatwardhanNo ratings yet

- Function CatalogueDocument591 pagesFunction CatalogueAshish PatwardhanNo ratings yet

- 1INDEA2021001Document89 pages1INDEA2021001Ashish PatwardhanNo ratings yet

- Chips Act Factsheet 20220208 FINAL XsC5TsNXlyer6N2NSftbi86EQ 83080Document2 pagesChips Act Factsheet 20220208 FINAL XsC5TsNXlyer6N2NSftbi86EQ 83080Ashish PatwardhanNo ratings yet

- RP Photonics Marketing SolutionsDocument4 pagesRP Photonics Marketing SolutionsAshish PatwardhanNo ratings yet

- 11-40 - SINUMERIK Edge - Concept - AppsDocument15 pages11-40 - SINUMERIK Edge - Concept - AppsAshish PatwardhanNo ratings yet

- BH 07 2007 en en-USDocument1,000 pagesBH 07 2007 en en-USAshish PatwardhanNo ratings yet

- Fly Ash Brick Project - Feasibility Study Using CVP AnalysisDocument6 pagesFly Ash Brick Project - Feasibility Study Using CVP AnalysisAshish PatwardhanNo ratings yet

- Sentron Pac3200 Manual en 04Document182 pagesSentron Pac3200 Manual en 04serban_elNo ratings yet

- Introduction to PROFIBUS and PROFINET FieldbusesDocument15 pagesIntroduction to PROFIBUS and PROFINET FieldbusesAshish PatwardhanNo ratings yet

- GH9 0414 Eng en-USDocument354 pagesGH9 0414 Eng en-USAshish PatwardhanNo ratings yet

- Sinumerik One: The CNC For Highest ProductivityDocument28 pagesSinumerik One: The CNC For Highest ProductivityAshish PatwardhanNo ratings yet

- GH9 0414 Eng en-USDocument354 pagesGH9 0414 Eng en-USAshish PatwardhanNo ratings yet

- PN PN Koppler enDocument104 pagesPN PN Koppler enSagar PawarNo ratings yet

- Airline RatiosDocument10 pagesAirline RatiosAshish PatwardhanNo ratings yet

- BMW-GB18 en Finanzbericht 190315 ONLINE PDFDocument260 pagesBMW-GB18 en Finanzbericht 190315 ONLINE PDFAnandNo ratings yet

- Introduction to PROFIBUS and PROFINET FieldbusesDocument15 pagesIntroduction to PROFIBUS and PROFINET FieldbusesAshish PatwardhanNo ratings yet

- Brochure Sinumerik 840d SLDocument28 pagesBrochure Sinumerik 840d SLmihir123786No ratings yet

- BMW-GB18 en Finanzbericht 190315 ONLINE PDFDocument260 pagesBMW-GB18 en Finanzbericht 190315 ONLINE PDFAnandNo ratings yet

- Supply and Demand - Face MasksDocument3 pagesSupply and Demand - Face MasksAshish PatwardhanNo ratings yet

- United Nations Statistics Division: Greenhouse Gas (GHG) Emissions by Sectors (Absolute Values and Percentages)Document16 pagesUnited Nations Statistics Division: Greenhouse Gas (GHG) Emissions by Sectors (Absolute Values and Percentages)Ashish PatwardhanNo ratings yet

- Irregular Past Tense Past Participle VerbsDocument3 pagesIrregular Past Tense Past Participle VerbsKieran HealeyNo ratings yet

- Income-Tax-Calculator 2023-24Document8 pagesIncome-Tax-Calculator 2023-24AlokNo ratings yet

- Ion of Oestrus With Pros Tag Land in F2 Alpha Analogue in Non-Descript CowDocument2 pagesIon of Oestrus With Pros Tag Land in F2 Alpha Analogue in Non-Descript CowSuraj_SubediNo ratings yet

- Precoro Capture (Autosaved)Document264 pagesPrecoro Capture (Autosaved)Steffany NoyaNo ratings yet

- Ksfe Organisation StudyDocument71 pagesKsfe Organisation StudyKrishna Priya100% (7)

- Complaint For Maintenance of Possession and of Agricultural LeaseholdDocument12 pagesComplaint For Maintenance of Possession and of Agricultural LeaseholdluckyNo ratings yet

- NACH FormDocument1 pageNACH FormPrem Singh Mehta75% (4)

- People v. Orita DigestDocument3 pagesPeople v. Orita Digestkathrynmaydeveza100% (3)

- Vintage Airplane - Sep 1988Document32 pagesVintage Airplane - Sep 1988Aviation/Space History LibraryNo ratings yet

- The Art of Strategic Leadership Chapter 2 - The BusinessDocument6 pagesThe Art of Strategic Leadership Chapter 2 - The BusinessAnnabelle SmythNo ratings yet

- Bank of AmericaDocument113 pagesBank of AmericaMarketsWikiNo ratings yet

- Report of The Online Survey On Homophobic and Transphobic BullyingDocument23 pagesReport of The Online Survey On Homophobic and Transphobic BullyingTRANScending BordersNo ratings yet

- TNNLU National Med-Arb CompetitionDocument12 pagesTNNLU National Med-Arb CompetitionAkhil SreenadhNo ratings yet

- Engineering Guide-Fans BlowerDocument4 pagesEngineering Guide-Fans BlowershaharyarNo ratings yet

- Retailing, Wholesaling and LogisticsDocument31 pagesRetailing, Wholesaling and LogisticsBilal Raja100% (2)

- Defensa Civil Colombia roles sanitation emergenciesDocument15 pagesDefensa Civil Colombia roles sanitation emergenciesJuanSebastianDiazNo ratings yet

- Review Quality Assurance PDFDocument339 pagesReview Quality Assurance PDFBelayneh TadesseNo ratings yet

- REBUILDING LEGO WITH INNOVATION AND FAN COLLABORATION (39Document15 pagesREBUILDING LEGO WITH INNOVATION AND FAN COLLABORATION (39yhusofiNo ratings yet

- SPI Firefight Rules (1976)Document20 pagesSPI Firefight Rules (1976)Anonymous OUtcQZleTQNo ratings yet

- French Revolution Notes Class 9Document6 pagesFrench Revolution Notes Class 9NonuNo ratings yet

- Electrical MentorDocument3 pagesElectrical Mentoresk1234No ratings yet

- Encuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénDocument3 pagesEncuesta Sesión 6 - Inglés 3 - Septiembre 29 - Prof. Oscar NiquénRobacorazones TkmNo ratings yet

- Understanding The Mindanao ConflictDocument7 pagesUnderstanding The Mindanao ConflictInday Espina-VaronaNo ratings yet

- Gensoc ReviewerDocument50 pagesGensoc ReviewerAdora AdoraNo ratings yet

- The Science of Cop Watching Volume 004Document1,353 pagesThe Science of Cop Watching Volume 004fuckoffanddie23579No ratings yet

- RPH ActivitiesDocument10 pagesRPH ActivitiesFrance Dorothy SamortinNo ratings yet

- Carnatic ComposersDocument5 pagesCarnatic Composersksenthil kumarNo ratings yet

- Class Program 2023-2024Document1 pageClass Program 2023-2024Cheryl Jane A. MusaNo ratings yet

- Inverted SentencesDocument36 pagesInverted SentencesCygfrid Buenviaje100% (1)