Professional Documents

Culture Documents

Trugo, Karluz Mhore BT - MIDTERM

Trugo, Karluz Mhore BT - MIDTERM

Uploaded by

more0 ratings0% found this document useful (0 votes)

9 views29 pagesOriginal Title

Trugo, Karluz Mhore BT_MIDTERM

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views29 pagesTrugo, Karluz Mhore BT - MIDTERM

Trugo, Karluz Mhore BT - MIDTERM

Uploaded by

moreCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 29

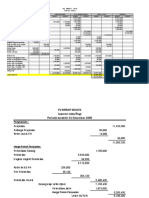

OUTPUT VAT

Lease of residential units 436,800

TAX PAYABLE 436,800

OUTPUT VAT

Lease of residential units 434,400

TAX PAYABLE 434,400

OUTPUT VAT

Lease of residential units 172,800

Lease of commercial units 264,000 436,800

INPUT VAT (200,000)

TAX PAYABLE 236,800

OUTPUT VAT

Lease of residential units 194,400

Lease of commercial units 240,000 434,400

INPUT VAT (250,000)

TAX PAYABLE 184,400

OUTPUT VAT

Sale of goods to private entities 600,000

Sale goods to GOCC 144,000 744,000

INPUT VAT

Purchases - private entities 72,000

Purchases - GOCC 84,000 (156,000)

WITHHOLDING VAT (60,000)

VAT PAYABLE 528,000

Purchases - private entities 72,000

Purchases - GOCC 84,000

INPUT VAT 156,000

Sale of goods to private entities, net of VAT 600,000

Sale to a government owned corporations (GOCC), gross of 12% vat 144,000

OUTPUT VAT 744,000

From January acquisition

Jan.1 4,000

Jan.15 5,000

From June acquisition

Jun. 1 3,750

Jun.15 1,000

From July acquisition

Unclaimed input vat for Jul 1 acquisition 440,000

From September acquisition

Sept. 1 & 15 0

From December acquisition

Dec.20 240,000

Creditable input vat 693,750

2021 acquisitions

From January acquisition

Jan.1 4,000

Jan.15 5,000

From June acquisition

Jun. 1 3,750

Jun.15 1,000

2020 acquisition

From July acquisition

Jul. 1 240,000

Creditable input vat 253,750

From January acquisition

Jan.1 4,000

Jan.15 5,000

From June acquisition

Jun. 1 3,750

Jun.15 1,000

From July acquisition

Jul.1 8,000

From September acquisition

Sept. 1 & 15 100,800

Creditable input vat 122,550

OUTPUT VAT

Hotel rooms - collections 300,000

Sale of food and refreshments 102,000

Sale of wine, beer and liquor 78,000

Total 480,000

OUTPUT VAT

Domestic sales, total invoice price 360,000

To Adams 400,000

To Brenda 150,000

To Cristie 150,000

Gross Gifts 700,000

Non-resident alien w/o reciprocity

To Adams 400,000

To Cristie 150,000

Gross gifts 550,000

Non-resident Alien w/ reciprocity

To Adams 400,000

Citizen

To Danielle 1,500,000

To Evelyn 500,000

To Fairy 400,000

Gross Gifts 2,400,000

Non-resident Alien w/o reciprocity

To Evelyn 500,000

Non-resident Alien w/ reciprocity

To evelyn 500,000

Citizen

To Gina 1,500,000

Receivable from Hannah 200,000

To Fairy 400,000

Gross Gifts 2,100,000

Non-resident Alien w/o reciprocity

To Fairy 400,000

Receivable from Hannah 200,000

600,000

NRA- reciprocity

To Fairy 400,000

Receivable from Hannah 200,000

Gross gifts 600,000

Citizen

SP FMV Insufficient consideration

Car, Cebu 200,000 300,000 100,000

Car, Indonesia 300,000 200,000 0

Rest house, Palawan 1,500,000 2,000,000 500,000

Rest house, Thailand 1,500,000 2,500,000 1,000,000

Total gross gifts 1,600,000

NRA- w/o reciprocity

SP FMV Insufficient consideration

Car, Cebu 200,000 300,000 100,000

Rest house, Palawan 1,500,000 2,000,000 500,000

Total gross gifts 600,000

NRA- reciprocity

SP FMV Insufficient consideration

Car, Cebu 200,000 300,000 100,000

Rest house, Palawan 1,500,000 2,000,000 500,000

Total gross gifts 600,000

Net gift 4,000,000

Tax exempt gift (250,000)

Taxable gift 3,750,000

Donor's tax rate 6%

Donor's tax payable 225,000

Jan. 25

Car 500,000

Mortagage asssumed (100,000)

Net gift 400,000

Tax exempt gift (250,000)

Taxale net gift 150,000

Donor's tax rate 6%

Donor's Tax due/payable 9,000

Jan. 25

Car 500,000

Mortagage asssumed (100,000)

Net gift 400,000

Tax exempt gift (250,000)

Taxale net gift 150,000

Donor's tax rate 6%

Donor's Tax due/payable 9,000

FMV 5,000,000

Selling price 4,000,000

Gift 1,000,000

Tax exempt gif (250,000)

Taxable gift 750,000

Tax rate 6%

Donor's tax 45,000

FMV 16,000,000

Selling price 14,000,000

Gift 2,000,000

Tax exempt gift (250,000)

Taxable gift 1,750,000

Tax rate 6%

Donor's tax 105,000

You might also like

- Accounting For Architecture FirmsDocument6 pagesAccounting For Architecture FirmsAsmaa Farouk100% (2)

- Problems (Donor's Tax)Document3 pagesProblems (Donor's Tax)Jevyl CajandabNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Payroll Accounting and Other SBT 2021Document39 pagesPayroll Accounting and Other SBT 2021Maria Nicole OroNo ratings yet

- Pakam Khiezna E. Bsac 1B Group Seatwork FarDocument26 pagesPakam Khiezna E. Bsac 1B Group Seatwork FarKhiezna PakamNo ratings yet

- Donors Tax For DiscussionDocument5 pagesDonors Tax For DiscussionCyril John ReyesNo ratings yet

- Vat ComputationDocument18 pagesVat ComputationWillowNo ratings yet

- Illustration On Situs and Gross EstateDocument2 pagesIllustration On Situs and Gross EstateClaire BarbaNo ratings yet

- Bustax Midtem Quiz 1 Answer Key Problem SolvingDocument2 pagesBustax Midtem Quiz 1 Answer Key Problem Solvingralph anthony macahiligNo ratings yet

- Investment Analysis1Document9 pagesInvestment Analysis1Kanchanit BangthamaiNo ratings yet

- Assets Date Transaction Cash Account ReceivableDocument4 pagesAssets Date Transaction Cash Account Receivablelyka garciaNo ratings yet

- Final Output - Ais Elect 1Document18 pagesFinal Output - Ais Elect 1Joody CatacutanNo ratings yet

- Merchandising Business - Perpetual PeriodicDocument11 pagesMerchandising Business - Perpetual PeriodicMilrosePaulinePascuaGudaNo ratings yet

- EX1 13 CashFlowDocument6 pagesEX1 13 CashFlowMOESHANo ratings yet

- Meet Your GardenDocument10 pagesMeet Your GardenNI KOLNo ratings yet

- Amount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsDocument6 pagesAmount REVENUE From Sales (-) COGS Total Revenue Expenses Direct CostsGurucharan BhatNo ratings yet

- Aditya05-Updated Dec 2020Document3 pagesAditya05-Updated Dec 2020aditya_kavangalNo ratings yet

- Assets Base Year Current AssetsDocument4 pagesAssets Base Year Current AssetsRegi Antonette AsuncionNo ratings yet

- Jawaban Ukk 20116Document98 pagesJawaban Ukk 20116tiara mutiaraNo ratings yet

- Dressny IncDocument10 pagesDressny Incancla.theaalenaNo ratings yet

- Agency and BranchDocument25 pagesAgency and BranchChelsea VisperasNo ratings yet

- Japc Worksheet AGUST 31, 2017Document6 pagesJapc Worksheet AGUST 31, 2017Dy Ju Arug ALNo ratings yet

- Monthly Budget - 06Document16 pagesMonthly Budget - 06Boy BastosNo ratings yet

- Periodic and Perpetual 2Document20 pagesPeriodic and Perpetual 2Edmond De Guerto100% (1)

- Gen. Luna ST, Poblacion, Caloocan, Metro Manila. Land Line: (02) 0210-11-20 Mobile: 09497901990Document6 pagesGen. Luna ST, Poblacion, Caloocan, Metro Manila. Land Line: (02) 0210-11-20 Mobile: 09497901990Krishia Belacsi BajanaNo ratings yet

- A Non Vat Tax Payer Has The Following Sales: NotesDocument68 pagesA Non Vat Tax Payer Has The Following Sales: NotesEirolNo ratings yet

- Pd. Mirah Wijaya - FORMDocument4 pagesPd. Mirah Wijaya - FORMBilqis SalsabilaNo ratings yet

- Awadh City Tennis ClubDocument4 pagesAwadh City Tennis ClubKanishka KartikeyaNo ratings yet

- Finacre Ass3 M1Document12 pagesFinacre Ass3 M1Rosette SANTOSNo ratings yet

- Donor's Taxation AssignmentDocument5 pagesDonor's Taxation AssignmentJaypee Verzo SaltaNo ratings yet

- Prv-Tax 1Document4 pagesPrv-Tax 1Kathylene GomezNo ratings yet

- AMV Bookstore JournalDocument10 pagesAMV Bookstore JournalFranchNo ratings yet

- Sue Feria Travel AgencyDocument5 pagesSue Feria Travel AgencyMa Sophia Mikaela Erece100% (1)

- 301 LQ2 ProbDocument10 pages301 LQ2 ProbHina SanNo ratings yet

- Individual Corporation Within: Requirement 1 Requirement 2Document12 pagesIndividual Corporation Within: Requirement 1 Requirement 2brianrusselsanchezNo ratings yet

- Exercise 9 (Answer)Document5 pagesExercise 9 (Answer)Chi Kei KeungNo ratings yet

- Examen Ali Mendoza CruzDocument9 pagesExamen Ali Mendoza Cruz5btg97yz7tNo ratings yet

- Palbot's Barber Shop Income Statement For The Year EndedDocument21 pagesPalbot's Barber Shop Income Statement For The Year EndedCocoy Llamas HernandezNo ratings yet

- ActivityDocument4 pagesActivityDom PaciaNo ratings yet

- Tax Exam SolDocument3 pagesTax Exam SolMark Edgar De GuzmanNo ratings yet

- Accounting CycleDocument19 pagesAccounting Cyclequia perezNo ratings yet

- Cookie Avenue - FSDocument18 pagesCookie Avenue - FS버니 모지코No ratings yet

- AccountsDocument135 pagesAccountsChinnam LalithaNo ratings yet

- RedeemanswersheetDocument6 pagesRedeemanswersheetLAZARO III DILEMNo ratings yet

- Trust Accounts - Example Q and ADocument7 pagesTrust Accounts - Example Q and AChamela MahiepalaNo ratings yet

- Pre Parcial CostosDocument8 pagesPre Parcial CostosKelving Ruiz MejiaNo ratings yet

- Gache, Rosette L. 3-BSA-1 Business Taxation Activity 7 P 6.1 Gross GiftsDocument5 pagesGache, Rosette L. 3-BSA-1 Business Taxation Activity 7 P 6.1 Gross GiftsMystic LoverNo ratings yet

- Assignment 4 - MCQ AnswerDocument2 pagesAssignment 4 - MCQ AnswerCarl Elmo Bernardo MurosNo ratings yet

- SDocument18 pagesSdebate dd0% (1)

- Account PT Adi JayaDocument3 pagesAccount PT Adi JayaSafri SafriNo ratings yet

- Loss by Roberry 3 Months After Death Unpaid Income Tax For 2014 Legacy in Favor of Philippines National Red Cross Legacy To City of MakatiDocument7 pagesLoss by Roberry 3 Months After Death Unpaid Income Tax For 2014 Legacy in Favor of Philippines National Red Cross Legacy To City of MakatiClaire BarbaNo ratings yet

- Chapter 12Document10 pagesChapter 12Jyan GayNo ratings yet

- Audit Module 1 - Variance Analysis TemplateDocument15 pagesAudit Module 1 - Variance Analysis TemplatelibinNo ratings yet

- Kaya Koto Merchandise WorksheetDocument4 pagesKaya Koto Merchandise WorksheetAeron John MORALESNo ratings yet

- Financial Plan BPDocument11 pagesFinancial Plan BPLei GerioNo ratings yet

- All SonsDocument14 pagesAll SonsMay BalangNo ratings yet

- TeteDocument5 pagesTeteT.J. LuaNo ratings yet

- Problems Merchandising Business - 511375108Document22 pagesProblems Merchandising Business - 511375108savannahtrikzyNo ratings yet

- 1 John Hassan Financial ManagementDocument4 pages1 John Hassan Financial Management7cbnfq6d6cNo ratings yet

- The Accounting Process 7th EditionDocument9 pagesThe Accounting Process 7th EditionPaula Anyssa Tobias BerbaNo ratings yet

- 5Document1 page5moreNo ratings yet

- Art 1458-1544Document124 pagesArt 1458-1544moreNo ratings yet

- Audit of Inventory 2021 - ExamDocument9 pagesAudit of Inventory 2021 - ExammoreNo ratings yet

- 2021 Prelim Exam Auditing Concepts and Applications 1Document15 pages2021 Prelim Exam Auditing Concepts and Applications 1moreNo ratings yet

- Auditing Theory - TOCDocument16 pagesAuditing Theory - TOCmoreNo ratings yet

- Audit Sampling Quiz - TrugoDocument7 pagesAudit Sampling Quiz - TrugomoreNo ratings yet

- Sample PaperDocument3 pagesSample PapermoreNo ratings yet

- Audit Documentation - TRUGODocument2 pagesAudit Documentation - TRUGOmoreNo ratings yet

- Factor Analysis & RegressionDocument2 pagesFactor Analysis & RegressionmoreNo ratings yet

- Trugo - Assignment Proof of CashDocument3 pagesTrugo - Assignment Proof of CashmoreNo ratings yet

- CH 19 Not For Profit EntitiesDocument82 pagesCH 19 Not For Profit EntitiesmoreNo ratings yet

- Factor Analysis and Regression - Frilles - TrugoDocument7 pagesFactor Analysis and Regression - Frilles - TrugomoreNo ratings yet

- Trugo, Karluz BT - SW1 - C9Document15 pagesTrugo, Karluz BT - SW1 - C9moreNo ratings yet

- Income Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpDocument11 pagesIncome Statement Hide Corp. Seek Corp. Dr. CR.: Book Value of Stocholders' Equity of Seek CorpmoreNo ratings yet

- Point-in-Time/ Cost Recovery (Zero Profit)Document8 pagesPoint-in-Time/ Cost Recovery (Zero Profit)moreNo ratings yet

- List of Departed Soul For Daily PrayerDocument12 pagesList of Departed Soul For Daily PrayermoreNo ratings yet

- Immaculate Conception Academy West Campus: Selfie Syndrome and Social Media Addiction of Grade 10 StudentsDocument19 pagesImmaculate Conception Academy West Campus: Selfie Syndrome and Social Media Addiction of Grade 10 StudentsmoreNo ratings yet

- Arts App ScriptDocument8 pagesArts App ScriptmoreNo ratings yet

- Local Revenue Forecast and Resource Mobilization StrategyDocument2 pagesLocal Revenue Forecast and Resource Mobilization StrategyDennis PadolinaNo ratings yet

- Pooja AgarwalDocument2 pagesPooja AgarwalThe Cultural CommitteeNo ratings yet

- Basic Principles of TaxationDocument18 pagesBasic Principles of TaxationAlexandra Nicole IsaacNo ratings yet

- Ram Baan - Direct Tax MAY - 23: Ca Vikram BiyaniDocument179 pagesRam Baan - Direct Tax MAY - 23: Ca Vikram Biyanigirish bhattNo ratings yet

- ICAI Nagapoor Branch - Relevent Case LawDocument1 pageICAI Nagapoor Branch - Relevent Case LawkrishnaNo ratings yet

- Taxation Suggested SolutionsDocument3 pagesTaxation Suggested SolutionsSteven Mark MananguNo ratings yet

- IRaksha TROP Version2 Brochure WebDocument5 pagesIRaksha TROP Version2 Brochure WebNazeerNo ratings yet

- CIR vs. Goodyear 216130Document1 pageCIR vs. Goodyear 216130magenNo ratings yet

- Tax Deductions For ProfessionalsDocument109 pagesTax Deductions For Professionalsparallax1957No ratings yet

- Adjustment and Closing Entry-SolutionDocument3 pagesAdjustment and Closing Entry-SolutionSerazul Arafin MrinmoyNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- Arrears Relief Calculator For W.B.govt Employees 2Document4 pagesArrears Relief Calculator For W.B.govt Employees 2Rana BiswasNo ratings yet

- EMBA Notes - US Compay FormationDocument4 pagesEMBA Notes - US Compay FormationGloria TaiNo ratings yet

- RLW 313 Tax Law 1 Course Outline 2023Document5 pagesRLW 313 Tax Law 1 Course Outline 2023Boldwin NdimboNo ratings yet

- Partnership Operations - Sample ProblemsDocument1 pagePartnership Operations - Sample ProblemsKate MercadoNo ratings yet

- Salem Telephone CompanyDocument8 pagesSalem Telephone Companyasheesh0% (1)

- Pfizer: Margins Expansion Helps Net Earnings Growth Despite Revenue DeclineDocument6 pagesPfizer: Margins Expansion Helps Net Earnings Growth Despite Revenue DeclineGuarachandar ChandNo ratings yet

- BIR Ruling No. 206-90Document2 pagesBIR Ruling No. 206-90Raiya Angela100% (2)

- Taxation of Churches in Zimbabwe - AssignmentDocument2 pagesTaxation of Churches in Zimbabwe - AssignmentWELLINGTONNo ratings yet

- Cost Sheet ExamplesDocument16 pagesCost Sheet ExamplesJayaKhemani82% (11)

- Amrutha Feb Salary SlipDocument1 pageAmrutha Feb Salary SlipAmrutha H NNo ratings yet

- 0400012155946apr 2024Document2 pages0400012155946apr 2024maazraza123No ratings yet

- Nontaxable Exchanges Like-Kind Exchanges - 1031Document6 pagesNontaxable Exchanges Like-Kind Exchanges - 1031张心怡No ratings yet

- The Following Unadjusted Trial Balance Is For Ace Construction CoDocument1 pageThe Following Unadjusted Trial Balance Is For Ace Construction Cotrilocksp SinghNo ratings yet

- P3 Pertemuan 3Document8 pagesP3 Pertemuan 3Ahsan FirdausNo ratings yet

- CIR vs. Esso Standard EasternDocument4 pagesCIR vs. Esso Standard EasternCharish DanaoNo ratings yet

- Idoc - Pub - Icse X Maths Project On Home BudgetDocument21 pagesIdoc - Pub - Icse X Maths Project On Home BudgetLinga Alex75% (4)

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet