Professional Documents

Culture Documents

Ear N in G Season So Far - 51% of Sym Bols Were Positive After The Lookingfor Alower Pricedgold?

Uploaded by

CSOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ear N in G Season So Far - 51% of Sym Bols Were Positive After The Lookingfor Alower Pricedgold?

Uploaded by

CSCopyright:

Available Formats

Nov 2, 2021

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized

Options before deciding to invest.

Ear n in g Season so Far . 51% of symbols were positive after the Look in g f or a low er pr iced gold?

release of earnings. Check out IAU. The liquidity is not

quite as good as GLD -- but it is still

Below are the stocks with the biggest shocks this season: quite decent and the lower prices can

make it more appropriate to do naked

strategies for lower funded accounts.

Her e is t h e m at h t o set

expect at ion s.

- For every $10 move in the price

of Gold, expect to see IAU

move approximately $0.16.

- For every $10 move in the price

of Gold, expect to see GLD

move approximately $0.80.

M ost Popu lar on t ast yw or k s. We

have alot more information on the

next page on this.

Have a great week trading! Keep those positions small!

M ich ael Rech en t h in , Ph D

Jam es Blakew ay

M ost Popu lar on t ast yw or k s. We have alot more information on the next page on this.

© tastytrade, 2021 Michael Rechenthin, PhD | James Blakeway Page 2 of 7

Alph a Boost Nucor (NUE) reported earnings October 21st, causing the stock to rally off recent lows.

NUE still has an IVR above 47. We used the Alpha Boost system to find variety of trades in NUE.

If you would like more trade ideas in your inbox sign up at: QuietFoundation.com/AlphaBoost

© tastytrade, 2021 Michael Rechenthin, PhD | James Blakeway Page 3 of 7

Brazilian stocks continue to

struggle with the MSCI Brazil ETF

(EWZ) falling again today.

Implied volatility rank (IVR) is

currently 64 with individual IV

above 38%.

Activision Blizzard (ATVI) report

earnings after the close tonight.

After recovering from a

corporate reorganization a

couple of years ago, the

company is under some strain

due to recent allegations of a

toxic work environment and

harassment. Time will tell if

earnings can prop the stock up

or push it down further. IVR is

currently 58.

After a heroic rebound from the

lows of the pandemic, LYFT has

been trending lower again in

recent weeks. Like ATVI, LYFT

reports earnings tonight after

the close. IVR is around 33.

© tastytrade, 2021 Michael Rechenthin, PhD | James Blakeway Page 4 of 7

In t er est ed in join in g t h ou san ds of ot h er f in an ce geek s?

Sign up for a free weekly subscription at:

info.tastytrade.com/cherry-picks

© tastytrade, 2021 Michael Rechenthin, PhD | James Blakeway Page 5 of 7

Glossar y

IV. Implied Volatility is the estimated volatility of a security?s price derived from its option price; the higher the IV,

the more expensive the option and therefore the larger the expected price move. IV is an annualized number of

volatility, e.g. a IV of 27 means the option?s market is pricing in an annualized price range, either plus or minus, of

27%.

IV Ran k . IV by itself doesn?t tell us if if the volatility is high or low - but IV Rank does. An IV Rank of 70 means that

the IV is 70% between its low and high IV over the past year. The higher the IV Rank, the higher the security?s IV is

compared to its past year. We provide six levels to make evaluating easier

Opt ion Liqu idit y. At tastytrade we have our own theoretical measure of option liquidity, Poor, Moderate, Good,

or Great. It examines the options?bid/ask spread, open interest, and the number of strikes with non-zero bids

Cor r elat ion w it h S&P 500. Correlation is a statistical measure of how strong a relationship two securities have

with one another. A correlation of -1 means the stocks are perfectly negatively correlated (they move in opposite

directions), while a correlation of +1 means the stocks are perfectly positively correlated (they move in the same

direction). A correlation of 0 means there exist little relationship.

Ear n in gs. The earnings date of the security. In practice we tend to see stocks have a larger amount of implied

volatility (IV) nearer to earnings as the market is pricing in the fear of the upcoming earnings announcement. In

parenthesis, is BTO or AMC; "Before the Open" or "After Market Closes", respectively. Upcoming earnings dates do

sometimes change.

Disclosu r es

Options involve risk and are not suitable for all investors. Please read Characteristics and Risks of Standardized

Options before deciding to invest in options.

tastytrade content is provided solely by tastytrade, Inc. and is for informational and educational purposes only. It is not, nor is it

intended to be, trading or investment advice or a recommendation that any security, futures contract, transaction or investment

strategy is suitable for any person. Trading securities can involve high risk and the loss of any funds invested. tastytrade, through its

content, financial programming or otherwise, does not provide investment or financial advice or make investment recommendations.

Investment information provided may not be appropriate for all investors, and is provided without respect to individual investor

financial sophistication, financial situation, investing time horizon or risk tolerance. tastytrade is not in the business of transacting

securities trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client?s

situation or investment objectives. Supporting documentation for any claims (including claims made on behalf of options programs),

comparison, statistics, or other technical data, if applicable, will be supplied upon request. Multi-leg option strategies incur higher

transaction costs as they involve multiple commission charges. tastytrade is not a licensed financial advisor, registered investment

advisor, or a registered broker-dealer. Options involve risk and are not suitable for all investors. Please read Characteristics and Risks

of Standardized Options before deciding to invest in options.

Futures accounts are not protected by the Securities Investor Protection Corporation (SIPC). All customer futures accounts' positions

and cash balances are segregated by Apex Clearing Corporation. Futures and futures options trading is speculative and is not suitable

for all investors. Please read the Risk Disclosure for Futures and Options prior to trading futures products found in Disclosures under

the Documents tab.

© tastytrade, 2021 Michael Rechenthin, PhD | James Blakeway Page 6 of 7

© tastytrade, 2021 Michael Rechenthin, PhD | James Blakeway Page 7 of 7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5796)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TM Pathways - Short - Path DescriptionsDocument1 pageTM Pathways - Short - Path DescriptionsCSNo ratings yet

- Suddenly Hybrid - c09Document2 pagesSuddenly Hybrid - c09CSNo ratings yet

- L0629 - Koerners Ultrarunning - BonusPDFDocument5 pagesL0629 - Koerners Ultrarunning - BonusPDFCSNo ratings yet

- Servant Leadership ThemesDocument1 pageServant Leadership ThemesCSNo ratings yet

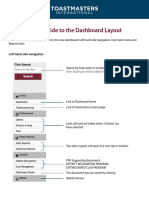

- TI Dashboard GuideDocument7 pagesTI Dashboard GuideCSNo ratings yet

- How To Build A Toastmasters ClubDocument20 pagesHow To Build A Toastmasters ClubCSNo ratings yet

- Advanced TM Legacy ManualsDocument1 pageAdvanced TM Legacy ManualsCSNo ratings yet

- Table Topics - 2022 EditionDocument11 pagesTable Topics - 2022 EditionCSNo ratings yet

- 23 03 21 Futures Cheat SheetDocument2 pages23 03 21 Futures Cheat SheetCSNo ratings yet

- Food & Nutrition For RunnersDocument13 pagesFood & Nutrition For RunnersCSNo ratings yet

- Topic:: Core Message: Catch Phrase (10 Words or Less) : Transition: 1. Hook: 2. Setup: 3. Main TakeawayDocument1 pageTopic:: Core Message: Catch Phrase (10 Words or Less) : Transition: 1. Hook: 2. Setup: 3. Main TakeawayCSNo ratings yet

- Security-Checklist - AllThingsSecuredDocument5 pagesSecurity-Checklist - AllThingsSecuredCSNo ratings yet

- Condo ACT Changes 2017Document13 pagesCondo ACT Changes 2017CSNo ratings yet

- Suddenly Hybrid - c12Document2 pagesSuddenly Hybrid - c12CSNo ratings yet

- Critical Thinking ResourcesDocument1 pageCritical Thinking ResourcesCSNo ratings yet

- LL Hits & Miss Gen Eval FormDocument2 pagesLL Hits & Miss Gen Eval FormCSNo ratings yet

- 104 - TM Debate HandbookDocument18 pages104 - TM Debate HandbookCSNo ratings yet

- Bitoisnot Asuitablelongterm Investment - TheDocument6 pagesBitoisnot Asuitablelongterm Investment - TheCSNo ratings yet

- TABLE TOPICS - Inspriring QuotesDocument18 pagesTABLE TOPICS - Inspriring QuotesCSNo ratings yet

- Ear N in G Season "Officially" BeginsDocument14 pagesEar N in G Season "Officially" BeginsCSNo ratings yet

- TM Club-Officer - Nomination Committee - Pre-Election TimelineDocument1 pageTM Club-Officer - Nomination Committee - Pre-Election TimelineCSNo ratings yet

- Pathways: Base Camp Manager DutiesDocument44 pagesPathways: Base Camp Manager DutiesCSNo ratings yet

- 21 11 16 Tastytrade ResearchDocument5 pages21 11 16 Tastytrade ResearchCSNo ratings yet

- CH An Ges in IV. More Volat IleDocument6 pagesCH An Ges in IV. More Volat IleCSNo ratings yet

- 21 12 07 Tastytrade ResearchDocument6 pages21 12 07 Tastytrade ResearchCSNo ratings yet

- Fu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidDocument5 pagesFu T U R Es Sizes? We Got The Hook Up For You! Don't Trade Without Knowing The True Size! That SaidCSNo ratings yet

- 22 01 11 Tastytrade ResearchDocument6 pages22 01 11 Tastytrade ResearchCSNo ratings yet

- TH e S&P 500's Expect Ed M Ove For Now Until The End ofDocument6 pagesTH e S&P 500's Expect Ed M Ove For Now Until The End ofCSNo ratings yet

- Jan U Ar Y 18, 2022: Earningseason, Birdsof A Feat H Er Flock Toget H ErDocument8 pagesJan U Ar Y 18, 2022: Earningseason, Birdsof A Feat H Er Flock Toget H ErCSNo ratings yet

- WH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsDocument4 pagesWH at Is T H e M Ar K Et Doin G? Take A Look at The M Ajor Indices (SPY, IWM, QQQ) and The Equity SectorsCSNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Grumpy - Social Media QuotationDocument4 pagesGrumpy - Social Media QuotationrameezasifNo ratings yet

- ED Business Idea and Feasibility Analysis-1608105799-1634598810ED - Business - Idea - Feasbility - AnalysisDocument22 pagesED Business Idea and Feasibility Analysis-1608105799-1634598810ED - Business - Idea - Feasbility - AnalysisJõshy JøhñNo ratings yet

- INTERNSHIP ProjectDocument65 pagesINTERNSHIP ProjectTarun SainiNo ratings yet

- Evaluation of Training EffectivenessDocument24 pagesEvaluation of Training EffectivenessROHIT KANTANo ratings yet

- Rns First Grade College: Consumer Behaviour Unit 3Document12 pagesRns First Grade College: Consumer Behaviour Unit 3Jeevan ShettyNo ratings yet

- Chapter 1 MarketingDocument27 pagesChapter 1 MarketingAfsar AhmedNo ratings yet

- Dempster Mills Manufacturing Case Study BPLsDocument15 pagesDempster Mills Manufacturing Case Study BPLstycoonshan24No ratings yet

- Michael Porter's 5 Forces Model: Asian PaintsDocument4 pagesMichael Porter's 5 Forces Model: Asian PaintsrakeshNo ratings yet

- Types of Marketing StrategiesDocument4 pagesTypes of Marketing StrategiesShiny NatividadNo ratings yet

- CH08 CartaDocument12 pagesCH08 CartaTeresa ManNo ratings yet

- 4 Customer Perception - 220810 - 215902Document32 pages4 Customer Perception - 220810 - 215902Neeraj raiNo ratings yet

- Strategic Human Resource ManagementDocument2 pagesStrategic Human Resource ManagementPriyanka DashNo ratings yet

- MGL Registration FormDocument2 pagesMGL Registration FormVinu's StudioNo ratings yet

- Staffing Chapter QuizDocument1 pageStaffing Chapter QuizAnne DeligosNo ratings yet

- K174091078 - Nguyễn Hoàng Thanh Uyên - ACR4.1Document35 pagesK174091078 - Nguyễn Hoàng Thanh Uyên - ACR4.1Uyên Nguyễn Hoàng Thanh100% (1)

- Versus - Case: de C I S I 0 NDocument16 pagesVersus - Case: de C I S I 0 NRandy LorenzanaNo ratings yet

- Distribution - MMDocument49 pagesDistribution - MMRihanshu SinghalNo ratings yet

- Chapter 2Document18 pagesChapter 2Yosef KetemaNo ratings yet

- Sem - VI FR 0 FSA (Ratio 0 Intro.) Sample TestDocument1 pageSem - VI FR 0 FSA (Ratio 0 Intro.) Sample TestAmit SinghNo ratings yet

- Filed: 2022 AUG 09 09:00 AM King County Superior Court Clerk E-Filed CASE #: 22-2-12549-7 SEADocument25 pagesFiled: 2022 AUG 09 09:00 AM King County Superior Court Clerk E-Filed CASE #: 22-2-12549-7 SEAGeekWireNo ratings yet

- Supplier Evaluation Checklist F-PU-05 - FILLEDDocument2 pagesSupplier Evaluation Checklist F-PU-05 - FILLEDNav Talukdar100% (1)

- AdvertisingDocument43 pagesAdvertisingRuchi RathiNo ratings yet

- Operations Management and TQM - An OverviewDocument10 pagesOperations Management and TQM - An OverviewKenma ApplePiNo ratings yet

- B1 Reading Test: Curriculum Vitaes: Tips That Can HelpDocument2 pagesB1 Reading Test: Curriculum Vitaes: Tips That Can HelpANDREEA URZICA100% (1)

- Tutorial 4 - Industrial Building AllowanceDocument3 pagesTutorial 4 - Industrial Building AllowanceChan YingNo ratings yet

- Ch.05-02 Fulfillment Process - S4HANA 2020 MCC V1.6Document38 pagesCh.05-02 Fulfillment Process - S4HANA 2020 MCC V1.6Arqam Usman AliNo ratings yet

- Statement 20220501 20220517Document5 pagesStatement 20220501 20220517Mrr Roth OfficialNo ratings yet

- ENTREPRENEURIAL MANAGEMENT ReviewerDocument3 pagesENTREPRENEURIAL MANAGEMENT ReviewerlapNo ratings yet

- Philippine Dragon Fruit 2 S ' M: ND Takeholder S EetingDocument52 pagesPhilippine Dragon Fruit 2 S ' M: ND Takeholder S EetingMark Jay BaclaanNo ratings yet

- Business Card: Business Cards Are Cards Bearing Business Information About A Company or IndividualDocument8 pagesBusiness Card: Business Cards Are Cards Bearing Business Information About A Company or Individualangel8sanchez-7No ratings yet