Professional Documents

Culture Documents

C Notes: Diagrammatic Derivation of Saving Curve From Consumption Curve

Uploaded by

GauravOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

C Notes: Diagrammatic Derivation of Saving Curve From Consumption Curve

Uploaded by

GauravCopyright:

Available Formats

CLASS Notes

Class: XII Topic: AD and its components

(derivation of Saving curve, Propensity to consume and

Subject: Economics Propensity to save)

Diagrammatic Derivation of Saving Curve from Consumption Curve :

We know that consumption + saving is always equal to Income because income is either consumed or

saved.

It implies that consumption and saving curves representing consumption and saving functions are

complementary curves.

Therefore, we can derive saving function or curve directly from consumption function or curve. This has

been

depicted in the adjoining Figure comprising Part-A showing consumption function and Part-B showing

saving

Function.

In Part-A of this Figure, CC curve shows consumption function corresponding to each level of income

whereas

45° line represents income. Recall that each point on 45° line is equidistant from X-axis and Y-axis. C

curve

intersects 45° line at point B at which BR = OR, i.e., consumption = Income. Therefore, point B is called

Break-

Even point.

It emphasises that saving curve must intersect x-axis at the same income level where consumption curve

and

45°. It emphasises that saving curve must intersect x-axis at the same income level where consumption

curve.

and 45° line intersect. Further, it will be seen that to the left of point B, consumption function lies above

45° line

showing that consumption is more than income, i.e., negative saving and to the right of point B,

consumption

function lies below 45° line showing positive saving

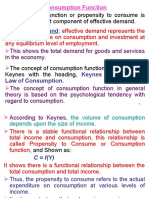

Propensity to Consume or Consumption Function

Consumption function refers to functional relationship between consumption and national income.

C=F(Y)

The concept of propensity to consume (i.e., willingness to consume) or the so-called

consumption

function is based on a ‘fundamental psychological law’ which states that “men are disposed, as

a rule,

and on an average, to increase consumption as their income increases but not by as much as

the

increase in their income.”

Keynes’ consumption function has the following attributes:

i. Consumption is a stable function of disposable income, i.e., C = f(Y).

ii. Consumption is assumed to vary directly with disposable income. As disposable income rises,

consumption rises.

iii. The rate of increase in consumption is less than the rate of increase in income.

Types :

(a) APC – Average Propensity to Consume

APC is the ratio of consumption to income. It is the proportion of income that is consumed. It is worked

out by

dividing total consumption expenditure (C) by total income (Y).

Symbolically, APC = C/Y

(b)MPC-Marginal Propensity to Consume

MPC measures the response of consumption spending to a change in income. It is the ratio of

change in

consumption to a change in income. It is worked out by dividing the change in consumption by

the

change in income.

Symbolically, MPC = ∆C/∆Y

Suppose, disposable national income rises from Rs. 100 crore to Rs. 200 crore. As a result,

consumption spending rises from Rs. 125 crore to Rs. 200 crore.

Thus,

MPC = 200-125/200-100

= 75/100 = 0.75 = ¾

In this example, MPC = 3/4. The economic meaning is that if national income rises by four

rupees,

consumption spending would increase by three rupees and the remainder one rupee would be

saved.

Note that, in this example, the value of MPC is positive but less than one (0 > MPC < 1).

Since at zero level of income, consumption is positive, so MPC must always be positive.

Because households divide their incomes between consumption expenditures and saving, the sum of the

propensity to consume and the propensity to save will always equal one.

Propensity to save, in Economics is the proportion of total income or of an increase in income

that consumers save rather than spend on goods and services.

Types-

1.APS- Average Propensity to Save

APS equals the ratio of total saving to total income.

Symbolically APS = S/Y

2. MPS- Marginal Propensity To Consume

Marginal propensity to save equals the ratio of a change in saving to a change in income

Symbolically MPS = ∆S/∆Y

Practice Questions

Q.1. What is the relationship between APS and APC. Can the value of APS be negative? If yes,

when?

Q 2.Giving reasons, state whether the following statements are true or false:

a) Value of average propensity to save can never be less than zero.

b) Average propensity to save is always greater than zero.

Q 3 Why can value of MPC be not greater than one?

Q 4. Let the consumption function be C = 50 + 0.75 Y, then calculate saving function?

Q 5. If disposable income is Rs 1000 Crores and consumption expenditure is Rs 750 crores, the value of

average propensity to save will be——————-.

(a) 0.25 (b) 0.9 (c) 0.85 (d) 0.2

Q 6. If the saving function is S = -50 + 0.2Y, then the MPC is .

(a) 0.45 (b) 0.8 (c) 0.65 (d) 0.25

Q 7. Briefly state the concept of consumption function. Explain with schedule and diagram.

Q 8. With the help of consumption schedule or curve bring out meaning of break-even point.

Q 9 Differentiate between a) APC and APS b) MPS and MPC

Q 10. Draw a straight line consumption curve. From it derive the saving curve. Explain the process of

derivation On the diagram, show:

(i) The income level at which APC =1.

(ii) The income level at which APS is negative.

You might also like

- Apc ApsDocument10 pagesApc ApsVansh ChadhaNo ratings yet

- Presentation On:-Consumption Function: Presented By: - Ashpak KhanDocument22 pagesPresentation On:-Consumption Function: Presented By: - Ashpak KhanAshpak KhanNo ratings yet

- Lecture Notes # 3 - Basic Keynesian ModelsDocument25 pagesLecture Notes # 3 - Basic Keynesian ModelsAndre MorrisonNo ratings yet

- Determination of Income, Consumption, SavingsDocument24 pagesDetermination of Income, Consumption, SavingsAmit PrabhakarNo ratings yet

- Macro Chap 8 Exercises Macsg08 PDFDocument30 pagesMacro Chap 8 Exercises Macsg08 PDFAA BB MM100% (1)

- Consumption FunctionDocument24 pagesConsumption FunctionDeep Raj JangidNo ratings yet

- THEORY OF INCOME & EMPLOYMENT 264ca933 8c27 4eb9 Aa6a 2f9554bcb988Document10 pagesTHEORY OF INCOME & EMPLOYMENT 264ca933 8c27 4eb9 Aa6a 2f9554bcb988Yash JainNo ratings yet

- Read - Econ Handout ConsumptionDocument8 pagesRead - Econ Handout ConsumptionOnella GrantNo ratings yet

- Macsg 08Document30 pagesMacsg 08JudithNo ratings yet

- Consumption Function and Its TypesDocument13 pagesConsumption Function and Its TypesTashiTamangNo ratings yet

- Namma Kalvi Economics Unit 4 Surya Economics Guide emDocument34 pagesNamma Kalvi Economics Unit 4 Surya Economics Guide emAakaash C.K.No ratings yet

- Managerial Economics-II Unit-2 Consumption AnalysisDocument15 pagesManagerial Economics-II Unit-2 Consumption AnalysisNaresh Kumar100% (1)

- Share Income and Employment VishwajeetDocument44 pagesShare Income and Employment Vishwajeetsinssix56No ratings yet

- DEY'S ECONOMICS-XII - Exam Handbook For 2024 ExamDocument62 pagesDEY'S ECONOMICS-XII - Exam Handbook For 2024 ExamYash Shrivastava100% (1)

- Consumption, Savings and InvestmentDocument26 pagesConsumption, Savings and InvestmentProfessor Tarun DasNo ratings yet

- Macroeconomics Group 4Document19 pagesMacroeconomics Group 4Crystal ValdezNo ratings yet

- Keynesian Model Income DeterminationDocument12 pagesKeynesian Model Income DeterminationHemant KumarNo ratings yet

- Lecture 3Document14 pagesLecture 3skye080No ratings yet

- The Keynesian Model of Income Determination in a Two Sector EconomyDocument34 pagesThe Keynesian Model of Income Determination in a Two Sector EconomyJannat MalhotraNo ratings yet

- GE - Economics: Semester-VI /B.A. (Programme)Document100 pagesGE - Economics: Semester-VI /B.A. (Programme)anukul kumarNo ratings yet

- DPP's AD & As Unit (Youtube)Document14 pagesDPP's AD & As Unit (Youtube)Rahul MajumdarNo ratings yet

- Economics (National Income Analysis)Document7 pagesEconomics (National Income Analysis)Karissa Kate CamurunganNo ratings yet

- Chapter 23 - Aggregate Expenditure and Equilibrium Output Part IDocument19 pagesChapter 23 - Aggregate Expenditure and Equilibrium Output Part IAta Deniz BişenNo ratings yet

- Saving FunctionDocument12 pagesSaving FunctionDeep Raj Jangid0% (1)

- Consumption FunctionDocument5 pagesConsumption FunctionAisha ismailNo ratings yet

- Chapter-6 Determination of Income and Employment: Aggregate DemandDocument33 pagesChapter-6 Determination of Income and Employment: Aggregate DemandVansh ThakurNo ratings yet

- The Consumption Function (Keynesian)Document5 pagesThe Consumption Function (Keynesian)Kiandra AaronNo ratings yet

- What Is Excess Demand in MacroeconomicsDocument9 pagesWhat Is Excess Demand in Macroeconomicssridharvchinni_21769No ratings yet

- Consumption and Saving Function: Group MembersDocument23 pagesConsumption and Saving Function: Group MembersSarosh HassanNo ratings yet

- Consumption FunctionDocument12 pagesConsumption FunctionSargun KaurNo ratings yet

- Chapter 4: Equilibrium Output and Multiplier EffectDocument27 pagesChapter 4: Equilibrium Output and Multiplier EffectChristian Jumao-as MendozaNo ratings yet

- LECTURE 5 and 6 - Consumption Savings and InvestmentDocument16 pagesLECTURE 5 and 6 - Consumption Savings and Investmentdavid underscore100% (1)

- Attachment Video 1 - Consumption Function Lyst9751Document16 pagesAttachment Video 1 - Consumption Function Lyst9751raahul dubeyNo ratings yet

- Macro Economics 03 - Daily Class Notes - Mission JRF June 2024 - EconomicsDocument25 pagesMacro Economics 03 - Daily Class Notes - Mission JRF June 2024 - Economicskg704939No ratings yet

- Theory of Consumption FINALDocument32 pagesTheory of Consumption FINALChowdhury GKNo ratings yet

- Test Ii-Theory-Review 2022Document3 pagesTest Ii-Theory-Review 2022Henil BhalaniNo ratings yet

- Lesson 4 - Consumption and Savings PDFDocument15 pagesLesson 4 - Consumption and Savings PDFJoshua CabinasNo ratings yet

- Module 3 Aggregate Exp SKMDocument78 pagesModule 3 Aggregate Exp SKMVrinda RajoriaNo ratings yet

- TOPIC 10 (Aggregate Expenditure Equilibrium Output)Document57 pagesTOPIC 10 (Aggregate Expenditure Equilibrium Output)刘伟康No ratings yet

- C A+Byd: What Is The 'Consumption Function'Document3 pagesC A+Byd: What Is The 'Consumption Function'Pulasthi Prabashana KuruppuarachchiNo ratings yet

- Chapter 23Document25 pagesChapter 23Vince Orebey BelarminoNo ratings yet

- Consumption FunctionDocument13 pagesConsumption FunctionMaster 003No ratings yet

- Consumption FunctionDocument13 pagesConsumption FunctionShoukat IrfanNo ratings yet

- Insurance and Risk Management NotesDocument11 pagesInsurance and Risk Management NotesNaomi WakiiyoNo ratings yet

- Consumption and Savings-Lesson 4 (Repaired) - NewDocument7 pagesConsumption and Savings-Lesson 4 (Repaired) - NewMerry Rosalie AdaoNo ratings yet

- Chapter 3 - Determination of National IncomeDocument54 pagesChapter 3 - Determination of National IncomeHafizul Akmal100% (4)

- Agg Demand....Document16 pagesAgg Demand....Lariza PakmaNo ratings yet

- © 2014 Pearson Education, IncDocument33 pages© 2014 Pearson Education, IncKiri SorianoNo ratings yet

- Determination of Income & Employment Powerpoint PresentationDocument38 pagesDetermination of Income & Employment Powerpoint Presentationdevesh soniNo ratings yet

- 2 Macroeconomic VariablesDocument33 pages2 Macroeconomic VariablesDilshan SathsaraNo ratings yet

- Two Sector ModelDocument84 pagesTwo Sector Modelvisha183240No ratings yet

- BASIC MACROECONOMIC RELATIONSHIPS & THE AGGREGATE EXPENDITURE MODELDocument86 pagesBASIC MACROECONOMIC RELATIONSHIPS & THE AGGREGATE EXPENDITURE MODELKealeboga WirelessNo ratings yet

- Estimating Aggregate Demand Using Consumption FunctionsDocument8 pagesEstimating Aggregate Demand Using Consumption FunctionsYDELVAN LLANONo ratings yet

- Consumption FunctionDocument10 pagesConsumption Functionvivek.birlaNo ratings yet

- Determination of Income and EmploymentDocument43 pagesDetermination of Income and EmploymentNainika ReddyNo ratings yet

- Topic 3 and 4 Intro MakroDocument34 pagesTopic 3 and 4 Intro MakroSobanah ChandranNo ratings yet

- Keynesian Model of Income Determination ExplainedDocument46 pagesKeynesian Model of Income Determination ExplainedAnkita MalikNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Chart Champions Tracker USD 1Document39 pagesChart Champions Tracker USD 1gogozdNo ratings yet

- Financial Accounting - IA QPDocument2 pagesFinancial Accounting - IA QPShreeniwas BhawnaniNo ratings yet

- Zomato BillDocument1 pageZomato Billhrh84v4j8kNo ratings yet

- Surveilans Aktif Rs Penyakit Menular & KLB: Rumah Sakit Daerah Idaman Kota BanjarbaruDocument15 pagesSurveilans Aktif Rs Penyakit Menular & KLB: Rumah Sakit Daerah Idaman Kota BanjarbaruIRNA RSDINo ratings yet

- Amazing Krabi & Phuket - 6 Nights (15-03-2022T23 - 32) - QuoteId-20459626Document12 pagesAmazing Krabi & Phuket - 6 Nights (15-03-2022T23 - 32) - QuoteId-20459626Radhika RampalNo ratings yet

- Agreement for Contractual CustomersDocument2 pagesAgreement for Contractual Customerssam yadav100% (1)

- Kevin John Paglinawan: Case StudyDocument2 pagesKevin John Paglinawan: Case StudyKevin John PaglinawanNo ratings yet

- 04meg 02Document5 pages04meg 02Joney GargNo ratings yet

- Procedures in Recording Business Transaction in A 2-ColumnDocument12 pagesProcedures in Recording Business Transaction in A 2-ColumnPauline Pearl FranciaNo ratings yet

- Paytm Money Limited: Combined Margin Statement For The Day: Apr 22 2021Document1 pagePaytm Money Limited: Combined Margin Statement For The Day: Apr 22 2021Lekkalapudi SricharanNo ratings yet

- Construction Site Layout PlanningDocument18 pagesConstruction Site Layout PlanningIkechukwu OkekeNo ratings yet

- Komatsu 27R8-7Document264 pagesKomatsu 27R8-7ВикторNo ratings yet

- Ricardian Model ExplainedDocument37 pagesRicardian Model ExplainedLiễu Uyên VũNo ratings yet

- Practice AssessmentDocument4 pagesPractice AssessmentShannan RichardsNo ratings yet

- وعده بهشتDocument262 pagesوعده بهشتM.Shahir IsmailzadaNo ratings yet

- Activity-Based Management and Activity-Based Costing: Cost Accounting: Foundations and Evolutions, 8eDocument37 pagesActivity-Based Management and Activity-Based Costing: Cost Accounting: Foundations and Evolutions, 8eErika Dawn BalderasNo ratings yet

- Fundamentals of Applied Econometrics: by Richard A. AshleyDocument26 pagesFundamentals of Applied Econometrics: by Richard A. AshleyDerek SmartNo ratings yet

- S-56ACIT v. Narendra I BhuvaDocument16 pagesS-56ACIT v. Narendra I BhuvaeurokidsshastringrjodNo ratings yet

- Chapter 3-1 ExerciseDocument3 pagesChapter 3-1 ExerciseAnson LoNo ratings yet

- Liberalization, Privatisation and Globalisation!Document37 pagesLiberalization, Privatisation and Globalisation!Nivesh GuptaNo ratings yet

- 85105918499Document3 pages85105918499Mulalo MasindiNo ratings yet

- Guided Practice - 396Document5 pagesGuided Practice - 396waqas ITNo ratings yet

- Advising Bank Uob: Irrevocable Non TransferableDocument4 pagesAdvising Bank Uob: Irrevocable Non TransferableHarry MdnNo ratings yet

- ICT's 2022 Mentorship SummarizedDocument11 pagesICT's 2022 Mentorship SummarizedChristiana OnyinyeNo ratings yet

- NARL3 Ry WL Iuca KEJDocument5 pagesNARL3 Ry WL Iuca KEJdineshNo ratings yet

- Stocks Land M Have Yielded The Following Returns For The Past Two YearsDocument4 pagesStocks Land M Have Yielded The Following Returns For The Past Two YearsDharmendra Behera75% (4)

- HJKJK PDFDocument1 pageHJKJK PDFDocumentaries onlineNo ratings yet

- Rate Analysis For DewateringDocument4 pagesRate Analysis For DewateringBabin Saseendran100% (1)

- Lessee DetailsDocument18 pagesLessee DetailsSiddhartha Ku PradhanNo ratings yet

- Evoluția Sectorului PFNL RMDocument26 pagesEvoluția Sectorului PFNL RMGheorghe NovacNo ratings yet