Professional Documents

Culture Documents

Suggested Answer of Case Study Cs

Uploaded by

Sharif MahmudCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Suggested Answer of Case Study Cs

Uploaded by

Sharif MahmudCopyright:

Available Formats

lOMoARcPSD|5214407

Suggested Answer of Case Study (CS)

Corporate Finance (BRAC University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Draft Report

On

The evaluation of business performance and expansion scheme,

strategic plans on future prospects and associated issues, covering

economic, social and ethical matters involved in the Obokash Ltd.

05 December 2020

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Table of Contents

Reference Contents Page #

01 Terms of Reference (TOR) 3

02 Executive Summary 4-5

03 Responses to Requirement-(a)

Assessment of viability of business expansion plan considering the 6-9

financial performance and the best financing option for acquisition.

04 Responses to Requirement-(b)

(i) Evaluation of strategic planning of the company and SWOT analysis 10-12

with recommendations to the Board justifying the acquisition and

(ii) Advice regarding the appointment of ABC Co. Chartered

Accountant firm.

05 Responses to Requirement-(c)

Assessment of economic and social impacts and evaluation of ethical 13-13

issues

06 Appendix 14-19

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Terms of Reference (TOR)

This report is prepared for the management of Obokash Ltd. (company) based on the information

provided by the management. No attempt has been made to verify the authenticity of the data and

information produced by the management. Necessary adjustments have been made to present the

financial statements fairly and perform the analysis of data for economic decision making

purposes.

The report covers the following:

i. Evaluation of financial performance, assessment of viability of business expansion plan

and its financing options.

ii. Evaluation of the strategic plan of the company and SWOT analysis justifying the

acquisition of business.

iii. Advice regarding appointment of second auditor, ABC & Co.

iv. Assessment of economic and social impacts and evaluation of ethical issues.

This report is prepared solely for the internal use of the management and the Board of Directors

of Obokash Ltd.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Executive Summary

Obokash Ltd. is a well-established company in tourism industry of Bangladesh which leads with

providing tour packages to the customers. It has been experiencing impressive business and

financial growth since incorporation except the year 2020 due to the outbreak of Covid 19 and

other regional chaos. The company intended to acquire K&Q Tourism Company for business

expansion through diversification of services.

Performance Analysis:

We have calculated the adjusted net profit of the company considering the accounting and tax

adjustments which is attached in Appendix-A. The adjusted net profit shows net profit after tax of

Tk. 39.78 million for the year 2019-20.

The performance of the company has been evaluated based on ratio analysis. The revenue has

decreased by 24 percent in 2019-20 due to restricted travelling as a result of Covid-19 pandemic

from early December 2019 globally. The gross profit and net profit of the company has decreased

by 34 percent and 68 percent respectively in 2019-20 from 2018-19 because of the higher cost of

sales caused by Covid-19 pandemic. ROCE has also reduced to 3.75 percent in 2019-20 compared

to that of 7.17 percent in 2018-19 whereas ROA has declined to 1 percent in 2019-20 compared to

that of 4 percent in 2018-19.

The liquidity ratio- current ratio and quick ratio has soared to 1.2 times and 1.09 times respectively

in 2019-20 from 1.16 times and 1.06 times in 2018-19 which shows that the company has enough

current assets to meet the current obligations.

The receivable turnover period of the company has ascended to 44 days in 2019-20 in comparison

with 37 days in 2018-19. The supplier payment period has also increased to 74 days in 2019-2020

from 53 days in 2018-19. This outgoing ratio indicates poor management of the company in terms

of recovery of accounts receivable and working capital management.

Conclusion & Recommendations:

The performance of the company is satisfactory. However, the company should comply with the

rules and regulations of IFRS and guidelines issued by the regulators.

Expansion plan and viability of the acquisition scheme:

We have reviewed the business expansion scheme and financing plan of the company. We

calculated the Net Present Value (NPV) of the future cash flows using discounted cash flow

technique. The calculated net asset value (NAV) of K&Q is Tk. 190 million, which is considered

to be the purchase consideration of acquiring K&Q. The discounted projected future cash flows

(Appendix-B) indicated positive NPV of Tk. 137.12 million. Therefore, the expansion scheme

may be viable and acceptable. However, management should look at the non-financial factors

while taking decision.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Financing of acquisition scheme

EPS and dividend payout ratio of the company is remarkably low for the last five years. Given the

unutilized debt capacity of the company, it is recommended that equity finance should be avoided.

However, the company may raise funds either by issuing subordinated bonds or taking bank loans.

The bank loan is limited to Tk. 30 crore at interest rate 9 percent per annum plus 5 percent penal

charge on delinquent payment. The interest rate of bank loan is higher than the rate of subordinated

bonds. Hence the company should choose bond financing to accommodate merger and working

capital of the merged company.

SWOT Analysis

The company has earned net profit and offered good value to the customers because of its low

overhead costs. The company has loyal customers and few staffs who are able to negotiate price

in and outside the country for tourists. However, the company has a small number of staffs with

shallow skill base in many areas. Besides, the government is giving infrastructural support to

expand Islamic tourism in the country. Moreover, the foreigners are keen to invest in tourism

industry which may increase competition. Diversification of customer services may distinguish

them from the competitors.

Advice on the appointment of Second Auditor

The company management cannot appoint a second auditor in order to get an approval of IPO

prospectus at premium, compromising compliance of accounting and reporting issues. Moreover,

such appointment is a threat to the principles of ethics. As per company Act 1994 law, auditor

must be appointed in annual general meeting (AGM) where the auditor has to get approved by the

shareholders. Since no decision was taken in AGM regarding the appointment of second auditor,

company management at subsequent stage cannot appoint second auditor.

However, company management can appoint ABC & Co, as an Adviser or a Financial Consultant

under a separate terms of reference for non-audit services.

Economic, Social and Ethical issues:

The company has been paying income tax and value added tax (VAT) to the government for last

5 years and it is expected that the amalgamated company will pay more taxes going forward. They

have contributed to the GDP growth and economic development by creating new employment

opportunities and attracting foreigners at our tourist spots consequently earning foreign currencies.

Moreover, the company has been performing its social responsibilities by contributing assistance

to the charity fund, infrastructure developments and under privileged people. However, the

compliance of ethical principles and standards in the company is found to be very poor.

Conclusion & Recommendation:

The company should comply with the ethical issues to uphold the image and reputation of the

organization.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Detail Report

Responses to Requirements: (a)

We have prepared the adjusted net profit of the company which is attached in ‘Appendix-A’ of

this report. We have considered the adjusting events of inadequate tax provisions, loss on sale of

fixed assets. Nevertheless we have not accounted for the forgery in selling flats.

We have evaluated the company performances based on ratio and basic trend analysis. We have

further compared the data with industry average where applicable.

Business Performance of Obokash Ltd.:

The adjusted net profit shows net profit after tax of Tk. 39.78 million for the year 2019-20 whereas

the net profit after tax was Tk. 123.23 million in the year 2018-19.

Revenue:

The gross revenue of the company has declined to Tk. 343.64 million in 2019-20 which is 24

percent lower than the previous year. The tourism business has been highly affected by the Covid-

19 pandemic globally. The company management is trying their best to capture global

business/partnering for reviving their condition. The management of the company is negotiating

with K&Q for merger.

Profitability:

Gross profit of the company has declined to 34 percent in 2019-20 compared to that of the previous

year due to decrease of sales and increase of cost of sales in this business. Supply chain has been

unable to negotiate cost efficiently and marketing team has failed to attract foreign tourists during

Covid-19.

Net profit has also decreased during the year by 68% percent compared to that of the previous year

due to increase of the operating expenses and outbreak of Covid-19 pandemic.

ROCE of the company stands at 3.75 percent in 2019-20 as against 7.17 percent in 2018-19. ROA

of the company has also declined to 1 percent in 2019-20 from 4 percent in 2018-19.

Liquidity:

Both current ratio and quick ratio have improved during the year with 1.2 times and 1.09 times in

comparison with 1.16 times and 1.06 times of previous year respectively. It indicates the company

has enough current assets to meet the demand of its current obligations.

Efficiency:

Trade receivable turnover period has increased during the year to 44 days from 37 days in last

year. No improvement has occurred in case of payments to the suppliers. It shows poor

management capacity to negotiate with the suppliers and institutional customers for improving the

working capital and finance costs of the company.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Inventory holding period has increased to 74 days in this year from 53 days in the previous year

which indicates management inefficiency in terms of working capital management. The probable

reasons for this can be slow items included in the inventory due to Covid-19 pandemic. Moreover,

the quality of services being impacted by coronavirus outbreak can be another possible reason for

restructuring.

Business size, growth and related party:

Investments in fixed assets and human capital have been downsizing every year which indicates

that the company has been narrowing its management efficiency and operational capacity.

Mahin Ltd. is a related party and it may sell goods to Obokash in loaded price than usual market

price.

Conclusion:

The company has purchased 25 percent of supplies from Mahin Ltd. which may adversely impact

the performances of the company. Given the global Covid-19 outbreak, the overall performance

of the company can be considered ‘satisfactory’.

Recommendation:

We recommend the company to diversify its services to meet the customer demands. The company

is recommended to review its existing strategic plans to improve profitability. System re-

engineering of the collection process and inventory management should be used to improve

efficiency ratios.

Viability of business expansion through acquisition of K&Q

The incremental revenue of 10 percent over the year for the next 16 years and thereafter, is

evaluated in terms of its present value at expected rate of return @11 percent per annum. The

acquisition consideration is computed at net assets value of Tk. 190 million. The project then gave

positive Net Present Value (NPV) of Tk. 137.12 million (Please refer to Annexure –B).

Henceforth, the company should go for acquisition because of increase in market shares and

revenue generation along with the following synergy impacts:

Revenue synergy- 10 percent revenue will increase over the years for the next 16 years because

of better negotiation skills with international tour operators, hotels and best air ticket sellers for

tourists.

Cost synergy – The overhead costs of the amalgamated company may be reduced because of the

economies of scale and better negotiation skills of the supply chain employees.

Operational efficiency –The company has loyal customers and good network with foreign tourists

particularly in the USA and the Middle East whereas K&Q has staff experienced in negotiation

and reputation in booking hotels and tickets at reasonably lower prices.

Economies of scale – Economies of scale will arise due to synergy effect of acquisition.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

However, the company has been working on fixing the complaints made by the customers in terms

of arranging quality foods and secured services, shortage of company working capital, holding

higher inventory and adequate capable tour guides. The sector is enjoying comparative advantages

of getting government support in terms of infrastructure for Islamic Tourism and strengthening

security of the tourists to have higher contribution in GDP.

Financing options for business expansion:

The Obokash has three financing options which are Initial Public Offering (IPO), issuance of

subordinate bonds and bank loan. The calculated value per share of the amalgamated company as

per earnings based valuation technique is Tk. 2.66. The company may not get 50 percent premium

over face value in offering shares to the general public through IPO.

Initial Public Offer (IPO):

The company expects a 50 percent premium of Tk. 5 over face value of the shares of Tk. 10 each

while issuing initial public offering (IPO) for raising fund of Tk. 2000 million. The calculated

value per shares of amalgamated company (Appendix-C) is computed to be in between Tk. 1.84

and Tk. 35.85 per share.

The EPS for last 5 years has remained within Tk. 0.28 to Tk. 0.62 whereas dividend per share

(DPS) has remained within Tk. 0.25 to Tk. 0.50. The dividend payout ratio of the company and

governance culture here indicates that the BSEC may not approve of the IPO application with a

premium of Tk. 5 each.

Advantages of IPO include wider pool of finance, enhancement of public reputation and growth

in confidence although it comes with disadvantages of dilution of control, high issuing cost,

consumption of time and strict regulations.

Issue of subordinate bonds:

The company may raise the fund through issuance of subordinated bonds. It is easier to arrange

the fund through this option which is also comparatively a cheaper source of finance than equity.

It has no dilution impact on EPS and interest is tax deductible increasing the growth ratio of the

company.

Bank loan:

The company may raise fund through bank loan which is again easier to arrange and cheaper than

equity finance. In this case, no dilution of controls arises in the company and bank interest is tax

deductible.

Conclusion

The company should pursue the project due to projection of the expected growth. IPO appears to

be a preferable choice for this case other than bank loan or issue of subordinate bonds.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Recommendation:

We recommend the company to issue IPO for raising the required fund for acquisition. For issuing

the IPO with expected premium, the company should maintain proper book of accounts and should

comply with the BESC rules.

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Responses to Requirements: (b) (i)

Comment on strategic planning and evaluation of SWOT analysis and recommendations

on the appointment of second auditor, ABC & Co. Chartered Accountants

Comments on the strategic planning of the business:

The company has been providing tour services to the customers and achieving substantial growth

till the year 2019. Covid-19 pandemic has unfortunately pulled down the growth of the business

and its performances. However, Bangladesh has great opportunities in the tourism sector and

therefore the company can expect to have better business prospects in future. In this regard the

company has undertaken some strategic business decisions to bring back its business in a positive

platform which are:

Purchasing of K&Q Ltd., a tourism company

Negotiating with the international tourism companies for air ticket booking and hotel

fixation at discounted prices throughout the year

Expending company assets efficiently and keeping the resources healthy all the time

Preserving high quality services, and

Delivering superior financial performances etc.

Conclusion:

With the above mentioned strategic plans, the company is presuming to reach its goal and achieve

its objectives.

SWOT Analysis and justification of the acquisition of K&Q

Strengths:

The company is well established and operates it business throughout the country. It offers services

to the global village particularly in the Middle East countries and the USA. The company has a

large operating capacity, experienced resource pool, leading brand reputation, delivery of quality

services, and good relationship with customers along with the compliance of applicable rules and

regulations, to use the diversity and abundance of tourist places in Bangladesh at its best.

Weakness:

The growth of the company is slow owing to its high capital cost but low investment. There is also

shortage of adequate infrastructural development and lack of security and hygiene measures in

Bangladesh.

10

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Opportunity:

The service of the company has huge demand both at home and abroad. Due to globalization and

its scope for dissemination of information and communication, there arises possibilities of making

the tourist spots more attractive and creating new business segments. The company has earned a

reputation for providing quality services to the customers and has probabilities of further obtaining

synergy benefits for acquisition. Furthermore, the number of new entrants in this business is

comparatively lower.

Threats:

The company has huge competition and higher market shares. The company also has to face

serious threats like conservative social and religious systems, absence of proper tourism policies,

strict regulations of the government, technological changes, political collision between tribal and

Bengali people, and political instability in the country.

Conclusion & Recommendation:

Every weakness and threat create an opportunity for reconsidering the strategic plans. We

recommend the company to comply with the rules and regulations and maintain the integrity issues

in line with the code of conduct issued by the authority.

11

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Requirement No.: (b) (ii)

Appointment of ABC & Co. Chartered Accountants as a 2nd auditor after AGM

The company management intended to appoint ABC & Co. as a second auditor of the amalgamated

company after holding annual general meeting (AGM). The company management has decided to

appoint a second auditor in order to achieve the following:

ABC & Co. Chartered Accountants will prepare the IPO prospectus fulfilling certain

requirements to get an approval of the prospectus at premium even at lower EPS and

dividend pay-out ratio.

ABC & Co. has agreed to compromise the compliance of reporting issues.

ABC & Co. being an expert in taxation services, has suggested to release the deferred tax

liabilities

The above matters are threats to the fundamental principles of ethics. Therefore, the appointment

of ABC & Co. would be illegal because the previous auditor has already accepted the appointment

for the next year and submitted Form 23B to RJSC. Every company should appoint an external

auditor in accordance with section 210 of Company Act 1994 and Section 31 of the Financial

Reporting Act 2015. Moreover, as per Companies Act, auditor must be appointed in annual general

meeting (AGM) where the auditor has to get approved by the shareholders. Since no decision was

taken in AGM regarding the appointment of second auditor, the company management cannot

appoint ABC & Co, as a second auditor for next year.

Conclusion & Recommendation:

The primary objective is to appoint the new auditor possess threats to the fundamental principles

of ethics. The company should comply with the above procedures to appoint auditors of the

company. Accordingly, the appointment of ABC & Co. is illegal as the existing auditor has

submitted its acceptance in 23B. However, company management can appoint ABC & Co, as an

Adviser or Financial Consultant.

12

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Responses to Requirements: (C)

Assessment of economic and social impacts and evaluation of ethical issues

Economic impact:

The company has paid taxes regularly over last five years except few disputes with the tax

authorities. They also coordinated and arranged ample tour packages for foreign nationals in the

country. Accordingly, number of foreigners visited tourist spots in Bangladesh and the country

earned much foreign currencies to contribute in GDP.

Social impact:

The company is actively performing its social responsibilities by generating new employment

opportunities, helping underprivileged people for improvement of their standard of living, advising

people on health and safety issues and carrying out other social works. It has also donated to the

charitable fund and helped the poor and underprivileged people by providing assistance for

medical treatment.

Conclusion & Recommendation:

The company has contributed directly to the GDP and overall economic growth of the country.

Ethical issues:

The company has failed to submit its withholding tax return timely on quarterly basis. Besides it

has followed inappropriate accounting and commercial practices violating rules and guidelines of

the applicable laws and regulations. The company also does not have a formal audit committee to

review its accounting and control issues. Moreover, the company has not maintained proper books

of accounts and tried to appoint second auditor for ill purposes.

Conclusion & Recommendation:

The company should comply with the ethical issues which can affect the goodwill and reputation

of the organization. We recommend the company to further follow the rules and regulations of the

country. A formal audit committee should be formed to evaluate integrity issues of the company.

13

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Appendix-A

Calculation of Adjusted Net Profit:

The Obokash Ltd

Statement of Profit & Loss Accounts (Extract)

For the year ended 30 June 2020

Figures in million

Amount in Tk.

Operating Profit 95.30

Add: non- Operating income 1.26

Less: Loss on Sales of Property (3 million- 2 million) (1.00)

Less: Provision for Gratuity (assuming that no provision was (20.00)

made by the management for gratuity)

Profit before WPPF 75.56

Less: Contribution of WPPF (3.78)

Profit before Tax 71.78

Income Tax Provision (32.00)

Net profit after tax 39.78

EPS 0.20

Selling of flats at substantially lower price to the relatives is a fraudulent activity and

related party transaction, which need to be disclosed. The company management and BOD

must comply with the regulations and IFRS to record such transaction in the company

accounts.

Notes:

i. Calculation of Income Tax:

Current tax on Profit before Tax at 25% 17.95

Previous year’s short provision 4.7

Disallowances on Account of-

i. Excess perquisites/ not deducting taxes and 18.00

submission of withholding tax returns

ii. Excess expenditure over limit on account of 4.5

entertainment and foreign travelling

iii. Promotional expenses 12.78

iv. Other expenses 2.1

Total disallowances 37.38

Tax on disallowances at 25% 9.35

Total income tax 32.00

14

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

ii. Property sales Tk. 2 million which book value was Tk. 3 million. Tk. 1 million loss is

charged to the P/L Account during the year 2019-20 and also property value decreased

Tk. 3 million from the Balance Sheet during the year.

iii. Special discount for supplier 5% not effect during the financial statement because it

just completed negotiation.

iv. 20 Katha Land in Bandarban gave the power of attorney on 30 June 2020, this is not

accounts for because this is not financial transaction, Need to disclosures.

1. Performance Analysis:

a. Trend Analysis Figure in million

2020 2019 Change in Tk % of change

Revenue 343.64 453.61 (109.97) 24%

Costs of sales 171.97 193.18 (21.21) 11%

Gross profit 171.67 260.43 (88.76) 34%

Operating Profit 95.30 184.68 (89.38) 48%

Net profit 39.78 123.23 (83.45) 68%

b. Ratio Analysis:

Profitability Ratio 2020 2019

Gross profit 171.67 260.43

X 100 X 100

343.64 453.61

= 50% = 57%

Net Profit 39.78 123.23

343.64 X 100 453.61 X 100

=12% = 27%

ROCE 95.30 184.68

2540.88 X 100 2575.63 X 100

= 3.75% = 7.17%

ROA 39.78 123.23

2845.28 X 100 2853.74 X 100

= 1% = 4%

Liquidity ratio:

Current Ratio 368.02 323.45

305.40 278.11

= 1.2 times 1.16 times

Quick Ratio 368.02-35 323.45-28

305.40 278.11

= 1.09 times =1.06 times

15

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Efficiency Ratio:

Receivable turnover period 41.52 45.52

343.64 X 365 453.61 X 365

= 44 days = 36.63 days

Payable payment period 0.24 28.04

178.97 X 365 193.18 X 365

= 74 days = 53 days

Assumption:

i. We assume all bales are credit sales considering the receivable turnover period.

ii. Year Consider as 365 days

iii. Purchase Consider as closing inventory plus COGS minus Opening inventory for payable

period.

iv. Inventory Consider as cost of sales for calculation of inventory holding period.

16

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Appendix-B

A. Viability of business expansion proposal for acquisitions.

1. Computation of Acquisition Tk’000

Cost:

Non-Current Asset: 260,000

Freehold property (fair value) 384,000

Plant

Current Assets:

Inventory 160,000

Receivable 104,000

Total Asset 908,000

Liabilities:

Secured Loan (200,000)

Bank over draft (180,000)

Sundry payable 100% 208,000

50% 130,000 (338,000)

Net Asset 190,000

Total No. of shares 20,000

NAV per shares Tk. 9.50

17

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Viability of the business expansion plan:

Cost of equity (CAPM) = 0.06+1.25 (.10-.06) = 11%

NPV Calculation:

PV of Cash in-flows 327.12 million

Less: Acquisition Cost 190.00 million

NPV 137.12 million

For the above calculation the NPV of the project is positive of Tk. 137.12 million. So, project may

be accepted from financial consideration point of view.

Assumption:

i. Additional income consider 50% of incremental sales revenue.

ii. Tax rate will remain unchanged i.e. @25%

iii. Assume the project is continue in foreseeable future. So, consider terminal value as

valuation of PV of cash flow.

iv. Acquisition Cost consider as net assets value of acquisition @ 190 million. No goodwill

consider for the valuation of K&Q Tourism Company Limited.

v. NPV of the project is positive. So the management of the company should acquire the

K&Q Tourism Company Limited.

18

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

lOMoARcPSD|5214407

Appendix-C

B. Valuation of Shares Figures in million

(i) NAV Basis Valuation Net Assets 2,484/200

No. of Shares NAV is Tk. 12.42 per

share

(ii) Earning based valuation

EPS Tk. 0.20 per Share

P/E ratio 9.18

Value of share = 9.18 X 0.20

= 1.84

(iii) Average Market Price of similar company basis

valuation

Value of share = (34+75.93+18.71+15.87+35.32)/5= Tk. 35.85 per share

So, the above calculation, the indicative price of a share could be between Tk. 1.84 to Tk. 35.85.

The face value of amalgamated shares would be Tk. 10.

19

Downloaded by Sharif Mahmud (sharif.aramitgroup@gmail.com)

You might also like

- Suggested Answer of Case Study (CS)Document19 pagesSuggested Answer of Case Study (CS)FarhadNo ratings yet

- Case PlanningDocument18 pagesCase PlanningRasel AshrafulNo ratings yet

- Case Planning - Khourshed AlamDocument9 pagesCase Planning - Khourshed AlamSohelNo ratings yet

- Mahindra Annual Report SummaryDocument3 pagesMahindra Annual Report Summaryvishakha AGRAWALNo ratings yet

- Term PaperDocument12 pagesTerm PapersakilahmedrezaofficialNo ratings yet

- Cebbco Annual Report 2013Document118 pagesCebbco Annual Report 2013didwaniasNo ratings yet

- Law Chapter 9 QPDocument8 pagesLaw Chapter 9 QPlostworld2005777No ratings yet

- Shree Gautam Construction Co. Ltd.Document7 pagesShree Gautam Construction Co. Ltd.Tanya SNo ratings yet

- F MauditDocument4 pagesF MauditPaulomee JhaveriNo ratings yet

- Law T4Document8 pagesLaw T4Badhrinath ShanmugamNo ratings yet

- Prime Bank Annual Report 2013Document412 pagesPrime Bank Annual Report 2013Shoreless ShaikatNo ratings yet

- IASB Publishes Discussion Paper On Goodwill and Impairment: BackgroundDocument3 pagesIASB Publishes Discussion Paper On Goodwill and Impairment: BackgroundNeriza PonceNo ratings yet

- Compulsory MCQS: (Just Select The Correct Answer, No Need For Reasoning)Document17 pagesCompulsory MCQS: (Just Select The Correct Answer, No Need For Reasoning)shivam wadhwaNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- Statement of Adoption and Adherence With The International Integrated Reporting FrameworkDocument34 pagesStatement of Adoption and Adherence With The International Integrated Reporting FrameworkAmna NaseerNo ratings yet

- MSA-2-Winter-2017 QNDocument19 pagesMSA-2-Winter-2017 QNAsad TariqNo ratings yet

- Aa Ma 2022Document5 pagesAa Ma 2022M Kazi ShuvoNo ratings yet

- November 2020 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument24 pagesNovember 2020 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- May 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeDocument19 pagesMay 2021 Professional Examinations Advanced Audit & Assurance (Paper 3.2) Chief Examiner'S Report, Questions and Marking SchemeVonnieNo ratings yet

- Iktva 2021 - V2Document40 pagesIktva 2021 - V2Hassan Al EidNo ratings yet

- Company Analysis and Financial Due Diligence: August 2013Document50 pagesCompany Analysis and Financial Due Diligence: August 2013HitechSoft HitsoftNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Audit Mid Spring 24 (V-2)Document3 pagesAudit Mid Spring 24 (V-2)Nouman ShamasNo ratings yet

- QIMC - CG Report 2022 - English FinalDocument52 pagesQIMC - CG Report 2022 - English FinalGioni PepperNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionNo ratings yet

- Audit Papers DecDocument164 pagesAudit Papers DecKeshav SethiNo ratings yet

- India Secretarial Practice 2020 CDocument28 pagesIndia Secretarial Practice 2020 CHaresh SwaminathanNo ratings yet

- Annual Report 2015Document393 pagesAnnual Report 2015minhazdu159No ratings yet

- CFAP 6 AARS Summer 2023Document4 pagesCFAP 6 AARS Summer 2023hassanlatif803No ratings yet

- Financial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteFrom EverandFinancial Reporting and Auditing in Sovereign Operations: Technical Guidance NoteNo ratings yet

- Automotive Axles LTD.: An Assignment ReportDocument8 pagesAutomotive Axles LTD.: An Assignment ReportAshwani RaiNo ratings yet

- AR Rites 2015 EnglishDocument152 pagesAR Rites 2015 EnglishGanesh BabuNo ratings yet

- P2 Audit Practice August 2018Document18 pagesP2 Audit Practice August 2018Vitalis MbuyaNo ratings yet

- Chapter 2 - Tutorial SetDocument6 pagesChapter 2 - Tutorial SetAngel Pria David LunchaNo ratings yet

- DHFL Annual Report 2019-20Document292 pagesDHFL Annual Report 2019-20hyenadogNo ratings yet

- Baker Tilly Report PriceDocument25 pagesBaker Tilly Report PriceHafiz Saddique MalikNo ratings yet

- Strategic Finance Section B & C MBAD 1B FinalDocument4 pagesStrategic Finance Section B & C MBAD 1B FinalSumama IkhlasNo ratings yet

- PNBDocument20 pagesPNBShuchita BhutaniNo ratings yet

- Accounting Analsis of Crown CementDocument13 pagesAccounting Analsis of Crown CementTareq RahmanNo ratings yet

- Ashok Ley LandDocument105 pagesAshok Ley LandAmit NagarNo ratings yet

- L & W Building Solutions PVT LTDDocument7 pagesL & W Building Solutions PVT LTDhesham zakiNo ratings yet

- EVALUATING Financial Business PlanDocument21 pagesEVALUATING Financial Business PlanEunice GithuaNo ratings yet

- Merger and Acquisition in Banking SectorDocument10 pagesMerger and Acquisition in Banking SectordesaikeyurNo ratings yet

- Rites Annual Report (English) 2013 PDFDocument96 pagesRites Annual Report (English) 2013 PDFGanesh BabuNo ratings yet

- Fauji Cement: Financial Accounting Project ReportDocument7 pagesFauji Cement: Financial Accounting Project ReportMuhammad SabihNo ratings yet

- Advanced Auditing and Assurance - Revision KitDocument244 pagesAdvanced Auditing and Assurance - Revision Kitmulika99No ratings yet

- Working Capital Management of EscortDocument74 pagesWorking Capital Management of EscortKavita NadarNo ratings yet

- Ford Rhodes Parks Co LLP: Chartered AccountantsDocument14 pagesFord Rhodes Parks Co LLP: Chartered Accountantsadipawar2824No ratings yet

- Barrick 3Document6 pagesBarrick 3jessi graceaNo ratings yet

- A Study of Financial Statement Analysis of Chassis Brakes International CompanyDocument19 pagesA Study of Financial Statement Analysis of Chassis Brakes International CompanySanjay TalegaonkarNo ratings yet

- Ad Audit August 2022Document21 pagesAd Audit August 2022Thomas nyadeNo ratings yet

- Subsidiary Report 2019 2020 PDFDocument112 pagesSubsidiary Report 2019 2020 PDFElizabeth Sánchez LeónNo ratings yet

- 2020 Bao Cao TCDocument93 pages2020 Bao Cao TChienys huynhNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- LG Chem 2020 Contingent Financial StatementsDocument102 pagesLG Chem 2020 Contingent Financial StatementsAyushika SinghNo ratings yet

- 2017 06 CPE-Full-Audit.-June-2017-QuestionsDocument10 pages2017 06 CPE-Full-Audit.-June-2017-Questionskellz accountingNo ratings yet

- Annual Report 2023Document299 pagesAnnual Report 2023Aakriti JainNo ratings yet

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- AFM Test 1Document3 pagesAFM Test 1Syeda IsmailNo ratings yet

- Samsung 2018 AGM Reference Material v2Document54 pagesSamsung 2018 AGM Reference Material v2Aung Myin KoNo ratings yet

- Customer PositionDocument10 pagesCustomer PositionSharif MahmudNo ratings yet

- Islamic Study RB Class 6 EnglishDocument116 pagesIslamic Study RB Class 6 EnglishSharif MahmudNo ratings yet

- Account Statement: Transaction Date Description Reference Value Date Debits Credits BalanceDocument1 pageAccount Statement: Transaction Date Description Reference Value Date Debits Credits BalanceSharif MahmudNo ratings yet

- CR Ma 21Document22 pagesCR Ma 21Sharif MahmudNo ratings yet

- Principles of Taxation ND2020Document2 pagesPrinciples of Taxation ND2020Sharif MahmudNo ratings yet

- Financial Reporting Law-2015-2Document31 pagesFinancial Reporting Law-2015-2Sharif MahmudNo ratings yet

- Proposed Purchase - ModuleDocument4 pagesProposed Purchase - ModuleSharif MahmudNo ratings yet

- Evsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Document1 pageEvsjv 'K M Ru: Iwr÷Vw© Bs WW G-1Sharif MahmudNo ratings yet

- DATA Sheet of ARAMIT.Document22 pagesDATA Sheet of ARAMIT.Sharif MahmudNo ratings yet

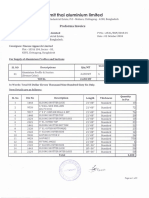

- Aramit Thai Aluminium Limi Ed: PR F M I V IDocument2 pagesAramit Thai Aluminium Limi Ed: PR F M I V ISharif MahmudNo ratings yet

- Al Emran Ahad: Personal DetailsDocument2 pagesAl Emran Ahad: Personal DetailsSharif MahmudNo ratings yet

- ICAEW Advanced Level Strategic Business Management Study Manual Fifth Edition 2017Document1,457 pagesICAEW Advanced Level Strategic Business Management Study Manual Fifth Edition 2017Optimal Management Solution100% (5)

- Ey CTools IFRS Update March 2018Document41 pagesEy CTools IFRS Update March 2018Rajesh VNo ratings yet

- PROTONNPOTRODocument1 pagePROTONNPOTROSharif MahmudNo ratings yet

- CV of Palash ChowdhuryDocument5 pagesCV of Palash ChowdhurySharif MahmudNo ratings yet

- BIN CertificationDocument1 pageBIN CertificationSharif MahmudNo ratings yet

- Suggested Answer of Case Study CsDocument20 pagesSuggested Answer of Case Study CsSharif MahmudNo ratings yet

- Issued by The Hongkong and Shanghai Banking Corporation LimitedDocument1 pageIssued by The Hongkong and Shanghai Banking Corporation LimitedSharif MahmudNo ratings yet

- AstechDocument65 pagesAstechSharif MahmudNo ratings yet

- ICAB Advanced Level Suggested Answers November December 2019Document61 pagesICAB Advanced Level Suggested Answers November December 2019Sharif MahmudNo ratings yet

- Desh Knitting LTD.: 2019 Year-2 Year-3 Year-4 Year-5Document3 pagesDesh Knitting LTD.: 2019 Year-2 Year-3 Year-4 Year-5Sharif MahmudNo ratings yet

- ICAB Advanced Level Strategic Business Management Suggested Answer November December 2019Document19 pagesICAB Advanced Level Strategic Business Management Suggested Answer November December 2019Sharif MahmudNo ratings yet

- Details Summary of Budget 2020-21 PDFDocument41 pagesDetails Summary of Budget 2020-21 PDFSharif MahmudNo ratings yet

- New Product Development and Marketing Procedure of Astech Limited (An Analytical Study) "Document5 pagesNew Product Development and Marketing Procedure of Astech Limited (An Analytical Study) "Sharif MahmudNo ratings yet

- Full List of Gift Achiever Aramit Sales FestivalDocument13 pagesFull List of Gift Achiever Aramit Sales FestivalSharif MahmudNo ratings yet

- Requires The Entity: Commented (HS1) : Is This A Summary or The ActualDocument2 pagesRequires The Entity: Commented (HS1) : Is This A Summary or The ActualSharif MahmudNo ratings yet

- Assurance ManualDocument350 pagesAssurance Manualrubel khanNo ratings yet

- Question Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Document41 pagesQuestion Bank - App. Level - Audit & Assurance-Nov-Dec 2011 To May-June-2016Sharif MahmudNo ratings yet

- New Microsoft Office Excel WorksheetDocument1 pageNew Microsoft Office Excel WorksheetSharif MahmudNo ratings yet

- Elecon Eng Bba ReportDocument47 pagesElecon Eng Bba Reportarjunj_4No ratings yet

- 10-05-07 BANK OF AMERICA CORP - DE - (Form - 10-Q, Received - 05 - 07 - 2010 07 - 49 - 51 SDocument595 pages10-05-07 BANK OF AMERICA CORP - DE - (Form - 10-Q, Received - 05 - 07 - 2010 07 - 49 - 51 SHuman Rights Alert - NGO (RA)No ratings yet

- Accounting For Installment SalesDocument16 pagesAccounting For Installment SalesLeimonadeNo ratings yet

- Joint Products Activity With AnswersDocument4 pagesJoint Products Activity With AnswersPatrick SalvadorNo ratings yet

- Songambele Sacco Bizplan 508Document22 pagesSongambele Sacco Bizplan 508Andinet100% (1)

- Third Party Authorization Letter - BDSwiss BDS Markets MAU - (1) Copy 2Document2 pagesThird Party Authorization Letter - BDSwiss BDS Markets MAU - (1) Copy 2yerimNo ratings yet

- PF Calculation Sheet SL - No. Location No - of Employee PF Salary Emps Cont. (12%) Empr Cont (3.67%)Document4 pagesPF Calculation Sheet SL - No. Location No - of Employee PF Salary Emps Cont. (12%) Empr Cont (3.67%)maninder_10No ratings yet

- Tugas Mike P5-3ADocument6 pagesTugas Mike P5-3Awinda dwi lestariNo ratings yet

- 06-Receivables TheoryDocument2 pages06-Receivables TheoryRegenLudevese100% (4)

- Subject: Accountancy Class: Xi Commerce PGT: Mrs. Vibhuti MoreDocument13 pagesSubject: Accountancy Class: Xi Commerce PGT: Mrs. Vibhuti MoreVibhuti MoreNo ratings yet

- Understanding Mutual FundsDocument6 pagesUnderstanding Mutual FundspareshhadkarNo ratings yet

- Department of Education: Caraga Region Schools Division of Surigao Del SurDocument1 pageDepartment of Education: Caraga Region Schools Division of Surigao Del SurJoeynel PontevedraNo ratings yet

- Accounting I Assignment CH 3 and 4 - 2Document8 pagesAccounting I Assignment CH 3 and 4 - 2Mahmoud AminNo ratings yet

- (CAPSTONE 1) Budgie - A Web-Based Budgeting System For Personal UseDocument2 pages(CAPSTONE 1) Budgie - A Web-Based Budgeting System For Personal UseAngela Louise TomasNo ratings yet

- 04 - Chapter 2Document33 pages04 - Chapter 2baby0310No ratings yet

- Lehman Swap Swap Indices PDFDocument28 pagesLehman Swap Swap Indices PDFcvacva1No ratings yet

- Course Title: Financial Reporting and Analysis Course Code: FIN-454 Credit Hours: 3+0 Course Instructor: PrerequisitesDocument5 pagesCourse Title: Financial Reporting and Analysis Course Code: FIN-454 Credit Hours: 3+0 Course Instructor: PrerequisitesMuhammad EhtishamNo ratings yet

- CHAPTER 26 Statement of Comprehensive Income (Concept Map)Document1 pageCHAPTER 26 Statement of Comprehensive Income (Concept Map)kateyy99100% (1)

- Merger Management - 1Document26 pagesMerger Management - 1boka987No ratings yet

- PR1Document146 pagesPR1Veera JainNo ratings yet

- Objectives of Portfolio ManagementDocument2 pagesObjectives of Portfolio ManagementJigar KotakNo ratings yet

- And Fixing A Flawed Business Model: by Marius Kerdel and Jolmer SchukkenDocument60 pagesAnd Fixing A Flawed Business Model: by Marius Kerdel and Jolmer SchukkenvettebeatsNo ratings yet

- Quiz On Partnership Operations - Final Term Period (1) (Repaired)Document3 pagesQuiz On Partnership Operations - Final Term Period (1) (Repaired)Ceejay MancillaNo ratings yet

- Doc. 153-1 - Affidavit of R. Lance FloresDocument13 pagesDoc. 153-1 - Affidavit of R. Lance FloresR. Lance FloresNo ratings yet

- Governmental Financial Statement Analysis: Who Uses S & L Government Financial Statements?Document7 pagesGovernmental Financial Statement Analysis: Who Uses S & L Government Financial Statements?gosaye desalegnNo ratings yet

- II PU Accountancy QPDocument13 pagesII PU Accountancy QPLokesh RaoNo ratings yet

- Record MMMDocument30 pagesRecord MMMAhmad NizarNo ratings yet

- 01 Company Final Accounts QuestionsDocument10 pages01 Company Final Accounts QuestionsMd. Iqbal Hasan0% (1)

- Info - BOP Tier 2 Capital InstrumentDocument6 pagesInfo - BOP Tier 2 Capital InstrumentInformation everythingNo ratings yet

- Event ManagementDocument3 pagesEvent ManagementAirene Abear PascualNo ratings yet