Professional Documents

Culture Documents

Problem Solving

Problem Solving

Uploaded by

Jerck Joshua Pascual0 ratings0% found this document useful (0 votes)

7 views2 pagesThe document provides a cost of production report for the mixing department of Southern Aggregate Company for May. It details the units accounted for, costs assigned, and ending inventory. Key details include:

- 17,200 total units were accounted for, with 16,000 transferred to finished goods and 1,200 units remaining as inventory.

- Total costs for May were $98,800 for direct materials and $28,980 for conversion. The costs per equivalent unit were $6.50 for materials and $1.80 for conversion.

- Total costs assigned were $141,480, with $132,600 allocated to completed units transferred to finished goods and $8,880 to the ending inventory of 1

Original Description:

Original Title

pacncit

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides a cost of production report for the mixing department of Southern Aggregate Company for May. It details the units accounted for, costs assigned, and ending inventory. Key details include:

- 17,200 total units were accounted for, with 16,000 transferred to finished goods and 1,200 units remaining as inventory.

- Total costs for May were $98,800 for direct materials and $28,980 for conversion. The costs per equivalent unit were $6.50 for materials and $1.80 for conversion.

- Total costs assigned were $141,480, with $132,600 allocated to completed units transferred to finished goods and $8,880 to the ending inventory of 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views2 pagesProblem Solving

Problem Solving

Uploaded by

Jerck Joshua PascualThe document provides a cost of production report for the mixing department of Southern Aggregate Company for May. It details the units accounted for, costs assigned, and ending inventory. Key details include:

- 17,200 total units were accounted for, with 16,000 transferred to finished goods and 1,200 units remaining as inventory.

- Total costs for May were $98,800 for direct materials and $28,980 for conversion. The costs per equivalent unit were $6.50 for materials and $1.80 for conversion.

- Total costs assigned were $141,480, with $132,600 allocated to completed units transferred to finished goods and $8,880 to the ending inventory of 1

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Problem Solving

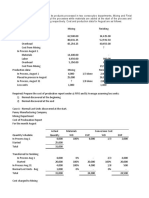

Requirement 1: Cost of production report

Southern Aggregate Company

Cost of Production Report - Mixing Department

For the Month Ended May 31

Equivalent Units

Units Whole Units Direct Materials Conversion

Units charged to the production:

Inventory in process, May 1 2,000

Received from Baking 15,000

Total Units accounted for by

The Mixing Department 17,200

Units to be assigned costs:

Inventory in process, May 1(25%) 2,000 - 1,500

Started and Completed in May 14,000 14,000 14,000

Transferred to finished goods in May 16,000 14,000 15,500

Inventory in process, May 31 (50%) 1,200 1,200 600

Total units to be assigned costs 17,200 15,200 16,100

Cost Direct Materials Conversion Total

Costs per equivalent unit:

Total costs for May in Mixing Department $98,800 $28,980

Total equivalent units / 15,200 / 16,100

Cost per equivalent unit $6.50 $1.80

Cost assigned to production:

Inventory in process, May 1 $13,700

Costs incurred in May 127,780

Total costs accounted for by the Mixing Department $141,480

Costs allocated to completed and partially completed units:

Inventory in process, May 1 - balance $13,700

To complete inventory in process, May 1 - $2,700 2,700

Costs of completed May 1 work in process $16,400

Started and completed in May 91,000 25,200 116,200

Transferred to finished goods in May $132,600

Inventory in process, May 31 7,800 1,080 8,880

Total costs assigned by the Mixing Department $141,480

Supporting computation:

1,500 x 1.80 = 2,700

14,000 x 6.50 = 91,000

14,000 x 1.80 = 25,200

1,200 x 6.50 = 7,800

600 x 1.80 = 1,080

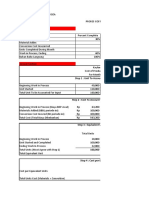

Requirement 2: Cost of goods sold

1,800 units at $8.00 $14,400

2,000 units at $8.20 16,400

12,000 units at $8.30 99,600

15,800 units $130,400

Supporting computation:

(13,700 + 2,700) / 2,000 = $8.20

116,200 / 14,000 = $8.30

Requirement 3: Finished goods inventory, May 31, 2014

2,000 units at $8.30 = $16,600

You might also like

- The Market Maker's MatrixDocument72 pagesThe Market Maker's Matrixjlaudirt100% (4)

- ALPHACAM 3D Machining 2020Document376 pagesALPHACAM 3D Machining 2020haziqzin100% (1)

- Management Accounting (Mba002) Assignment 4Document2 pagesManagement Accounting (Mba002) Assignment 4John Michael Yu100% (1)

- 06 Process Cost Accounting Additional ProceduresDocument28 pages06 Process Cost Accounting Additional ProceduresRey Joyce Abuel100% (1)

- Reasons Why Entrepreneurial Organizations Seek Opportunities For InnovationDocument5 pagesReasons Why Entrepreneurial Organizations Seek Opportunities For InnovationOliver AloyceNo ratings yet

- Chapter 6 Quiz and AssignmentDocument25 pagesChapter 6 Quiz and AssignmentSaeym SegoviaNo ratings yet

- Process Costing - Loss UnitsDocument10 pagesProcess Costing - Loss UnitsAkira Marantal ValdezNo ratings yet

- Process ManufacturingDocument4 pagesProcess Manufacturinglaurentinus fikaNo ratings yet

- Tugas Warren Ex 20-16Document1 pageTugas Warren Ex 20-16Wezzulfrico AlfasaNo ratings yet

- Lec3 ProcesscostingDocument25 pagesLec3 Processcostingnathan panNo ratings yet

- Quizzes For Finals 1 Compilation Chap6,7,1,2Document35 pagesQuizzes For Finals 1 Compilation Chap6,7,1,2Saeym SegoviaNo ratings yet

- Afar ProcessDocument2 pagesAfar ProcessRyan Julius RullanNo ratings yet

- Template Dan LatiihanDocument11 pagesTemplate Dan Latiihanlaurentinus fikaNo ratings yet

- Exercise 4-23: Cost of Goods Completed and Transferred Out During February $ 279,000Document3 pagesExercise 4-23: Cost of Goods Completed and Transferred Out During February $ 279,000SoniaNo ratings yet

- PR18 5BDocument2 pagesPR18 5BDiệu Linh Phan ThịNo ratings yet

- MANACC Class Handout - Process Costing-1Document6 pagesMANACC Class Handout - Process Costing-1Ritwik MahajanNo ratings yet

- Multiple Choice QuestionsDocument7 pagesMultiple Choice QuestionsMitch Tokong MinglanaNo ratings yet

- Process Costing - Lecture NotesDocument11 pagesProcess Costing - Lecture NotesOtenyo MeshackNo ratings yet

- Chapter V: Process Cost Accounting - General ProceduresDocument3 pagesChapter V: Process Cost Accounting - General ProceduresSweet Jenesie MirandaNo ratings yet

- Copr PR 20-5BDocument8 pagesCopr PR 20-5Blaurentinus fikaNo ratings yet

- Copr P6-6 - FifoDocument2 pagesCopr P6-6 - Fifolaurentinus fikaNo ratings yet

- Assignment For Chapter 4 Job Order Costing: AnswersDocument7 pagesAssignment For Chapter 4 Job Order Costing: AnswersMitch Tokong MinglanaNo ratings yet

- Process Costing - Loss UnitsDocument7 pagesProcess Costing - Loss UnitsNikki GarciaNo ratings yet

- Process CostingDocument2 pagesProcess CostingwhosccccNo ratings yet

- JM CompanyDocument3 pagesJM CompanyMeghan Kaye LiwenNo ratings yet

- Cost Accounting ProblemsDocument9 pagesCost Accounting ProblemsLia AtilanoNo ratings yet

- Process Costing Set B QuestionDocument4 pagesProcess Costing Set B QuestionTrixie HicaldeNo ratings yet

- Chapter 4 ExercisesDocument8 pagesChapter 4 ExercisesLy VõNo ratings yet

- Tech-Tonic Sports Drinks: Most Appropriate MethodDocument2 pagesTech-Tonic Sports Drinks: Most Appropriate Methodchaitannya goelNo ratings yet

- 5 Week Activity Additions Spoilage Rework ScrapDocument3 pages5 Week Activity Additions Spoilage Rework ScrapAlrac GarciaNo ratings yet

- BANITOG - Systems Design Process CostingDocument5 pagesBANITOG - Systems Design Process CostingMyunimintNo ratings yet

- A7 Quiz 3Document26 pagesA7 Quiz 3Garcia Alizsandra L.No ratings yet

- Principles of Cost Accounting 15Th Edition Vanderbeck Test Bank Full Chapter PDFDocument48 pagesPrinciples of Cost Accounting 15Th Edition Vanderbeck Test Bank Full Chapter PDFmirabeltuyenwzp6f100% (8)

- Cost Accounting Chapter 4Document18 pagesCost Accounting Chapter 4Matthew cNo ratings yet

- Units: Mixing Units Baking: Illustration On Process CostingDocument5 pagesUnits: Mixing Units Baking: Illustration On Process CostingNora AlghanemNo ratings yet

- Local Media4025535226716561108Document3 pagesLocal Media4025535226716561108MA ValdezNo ratings yet

- Cost of Production ReportDocument6 pagesCost of Production ReportJomari FalibleNo ratings yet

- Accounting For Lost Units - Part 1Document17 pagesAccounting For Lost Units - Part 1Unnamed homosapienNo ratings yet

- BUS 5431 Fall 1 2019 Homework Solutions - Week 2Document3 pagesBUS 5431 Fall 1 2019 Homework Solutions - Week 2Makame Mahmud DiptaNo ratings yet

- Mymie B. Maandig MBA-1 Dr. Marco Ilano Problem 4-13A RequiredDocument9 pagesMymie B. Maandig MBA-1 Dr. Marco Ilano Problem 4-13A RequiredMymie MaandigNo ratings yet

- Chapter 18 Process CostingDocument9 pagesChapter 18 Process CostingSandra Moussa100% (1)

- Universidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesDocument5 pagesUniversidad Interamericana de Puerto Rico Recinto de San Germán Departamento de Ciencias EmpresarialesAqib LatifNo ratings yet

- FSA Finals Quiz 1Document11 pagesFSA Finals Quiz 1fanchasticommsNo ratings yet

- 2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Document8 pages2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Nadilla NurNo ratings yet

- Anisa Yuniarti - 41033403200012 - Akuntansi A - Tugas 3 Ak - Manaj PDFDocument4 pagesAnisa Yuniarti - 41033403200012 - Akuntansi A - Tugas 3 Ak - Manaj PDFAnisa YuniartiNo ratings yet

- Process CostingDocument3 pagesProcess Costingjannatuldu03No ratings yet

- Chapter 04 WorksheetDocument13 pagesChapter 04 WorksheetqpelinsubcNo ratings yet

- Laureen Manufacturing CPRDocument4 pagesLaureen Manufacturing CPRjose abalayanNo ratings yet

- (Computation of Fifo and Wa Eups Case-To-Case) : B.C.VillaluzDocument2 pages(Computation of Fifo and Wa Eups Case-To-Case) : B.C.VillaluzBob Ghian ToveraNo ratings yet

- Ae 211 Module 6 - Exercise 6-5 To 6-9Document7 pagesAe 211 Module 6 - Exercise 6-5 To 6-9Nhel AlvaroNo ratings yet

- Kasus 6 Proses Costing (FIFO) Biizatil SR - 1Document12 pagesKasus 6 Proses Costing (FIFO) Biizatil SR - 1Bzatil RzNo ratings yet

- Product - Midterm ACC C203-205A: SolutionDocument5 pagesProduct - Midterm ACC C203-205A: SolutionMarkJoven BergantinNo ratings yet

- Process Costing Part 2 IllustrationsDocument3 pagesProcess Costing Part 2 IllustrationsNCTNo ratings yet

- Multiple Choices - TheoreticalDocument8 pagesMultiple Choices - TheoreticalIsabelle AmbataliNo ratings yet

- Process CostingDocument4 pagesProcess CostingAndrea Nicole MASANGKAY100% (1)

- Process Costing Average PDFDocument1 pageProcess Costing Average PDFKharen ValdezNo ratings yet

- Homework Week 3Document4 pagesHomework Week 3bxp9b56xv4No ratings yet

- LEC 2 Additions, Spoilage, Rework, and ScrapDocument37 pagesLEC 2 Additions, Spoilage, Rework, and ScrapKelvin CulajaráNo ratings yet

- Chapter 6 Practice QuestionsDocument9 pagesChapter 6 Practice QuestionsAbdul Wajid Nazeer CheemaNo ratings yet

- BTVN Chap 4Document4 pagesBTVN Chap 4Hà LêNo ratings yet

- ISM-06 (Global E-Business and Collaboration)Document31 pagesISM-06 (Global E-Business and Collaboration)hats1234No ratings yet

- C1 Wordlist Unit 8Document6 pagesC1 Wordlist Unit 8Phạm Nguyễn Hồng LựcNo ratings yet

- MGT 600 Rodrigues T A00036662 Critical DiscussionDocument5 pagesMGT 600 Rodrigues T A00036662 Critical DiscussionJeeva VenkatramanNo ratings yet

- Slide Pinch Point PEPC - RUDocument12 pagesSlide Pinch Point PEPC - RUanzafidandiNo ratings yet

- Final HBL PresentationDocument75 pagesFinal HBL PresentationShehzaib Sunny100% (4)

- Unit Name: BSBMGT617Develop and Implement A Business Plan: Assessment Cover SheetDocument41 pagesUnit Name: BSBMGT617Develop and Implement A Business Plan: Assessment Cover SheetBibek KandelNo ratings yet

- Sop: Kaizen Implementation& Evaluation: DefinitionDocument11 pagesSop: Kaizen Implementation& Evaluation: DefinitionDhrubo BaruaNo ratings yet

- Organic World 2021Document340 pagesOrganic World 2021fernandoriiizzzoNo ratings yet

- Tesla Pricing Strategy Analysis: Take Model 3 As An Example: Jiangxi Ding, Yuting HeDocument5 pagesTesla Pricing Strategy Analysis: Take Model 3 As An Example: Jiangxi Ding, Yuting HePhương ThảoNo ratings yet

- Situational AnalysisDocument18 pagesSituational AnalysisJD LacanlaleNo ratings yet

- Roland Berger Operating ModelDocument16 pagesRoland Berger Operating ModelBogdanIonescuNo ratings yet

- Cambridge IGCSE™: Enterprise 0454/11 May/June 2021Document24 pagesCambridge IGCSE™: Enterprise 0454/11 May/June 2021Sraboni ChowdhuryNo ratings yet

- Analysis of National Cyber Security Policy (NCSP - 2013)Document7 pagesAnalysis of National Cyber Security Policy (NCSP - 2013)IcarusNo ratings yet

- Nike Case StudyDocument5 pagesNike Case StudyNimisha PalawatNo ratings yet

- Regulatory Permits & Licenses Monitoring: Permit Number Remarks O.R./Invoice NumberDocument26 pagesRegulatory Permits & Licenses Monitoring: Permit Number Remarks O.R./Invoice NumberCommercial AdminNo ratings yet

- Dissertation Topics in Public AdministrationDocument8 pagesDissertation Topics in Public AdministrationSomeoneWriteMyPaperForMeUK100% (1)

- 7F Advanced Gas Path A Power Flexefficiency SolutionDocument2 pages7F Advanced Gas Path A Power Flexefficiency Solutiondm mNo ratings yet

- D Management Overide of Controls HandoutDocument4 pagesD Management Overide of Controls Handoutys.yeetslNo ratings yet

- A Study On Home Loans - SbiDocument57 pagesA Study On Home Loans - Sbirajesh bathulaNo ratings yet

- Solavei MarketingDocument254 pagesSolavei MarketingKelvin WilsonNo ratings yet

- The Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsDocument1 pageThe Business Model Canvas: Customer Segments Value Propositions Key Activities Key Partners Customer RelationshipsJAISHINI SIVARAM 2023259No ratings yet

- Payment Plan ConfigurationDocument3 pagesPayment Plan Configurationraymart copiarNo ratings yet

- M.a.D's SWOT Analysis of Meezan Bank!Document10 pagesM.a.D's SWOT Analysis of Meezan Bank!Muhammad Ali DanishNo ratings yet

- Bill Williams Fractals Description of Fractals IndicatorDocument3 pagesBill Williams Fractals Description of Fractals IndicatorMichael MarioNo ratings yet

- COMSOL Product Pricelist PDFDocument1 pageCOMSOL Product Pricelist PDFleksremeshNo ratings yet

- Delta AirlinesDocument3 pagesDelta AirlinesAlexander ColarNo ratings yet

- Trade Cycle or Business CycleDocument23 pagesTrade Cycle or Business Cyclesujata dawadiNo ratings yet