Professional Documents

Culture Documents

Digital Enterpise Strategy

Uploaded by

ayush khare0 ratings0% found this document useful (0 votes)

16 views10 pagesdigital enterpise strategy byjus

Original Title

digital enterpise strategy

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentdigital enterpise strategy byjus

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views10 pagesDigital Enterpise Strategy

Uploaded by

ayush kharedigital enterpise strategy byjus

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 10

DES - Group A10

B LITZSCALING

YJU'S

Learn more about - How Byju's blitzscaled their business.

What is Blitzscaling

Blitzscaling is what you do when you

need to grow really, really quickly.

It's the science and art of rapidly

building out a company to serve a

large market, with the goal of

becoming the first mover at scale.

Reid Hoffman, Co-founder - LinkedIn

"Prioritizing speed of growth over efficiency"

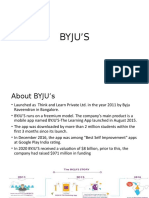

It is a platform and a way for students, especially

What is Byju's? K-12, to learn different educational concepts

through the app and understand them better.

It was created by Byju Raveendran, He was initially working in

UK based shipping company as an engineer. He became quite

famous among his group of friends when he helped them

crack the IIM entrance exams using his shortcuts.

2015 - 2016 - BYJU’s Learning App was

launched With a healthy mix of animation,

Growth of BYJUs in a blitz span of time

gamification, and live-action formats. The

launch of BYJU’s coincided perfectly with the

period which is now known as the Indian Digital

revolution in 2016, fueled by the launch of highly

Byju's Roadmap affordable high-speed internet plans by Indian

conglomerate Reliance JIO.

2018 - Byju’s had grown to 1.5 crores (15 million)

users and 900,000 paid users. Raised $540 m

2006 - 2010 - From helping friends crack the funding from General Atlantic & Tencent Holdings.

CAT exam to tutoring over 1,000 at crowded

venues across metro cities like Pune, Mumbai, 2019 - Byju’s displaced Oppo to win the

Bangalore, and Delhi. sponsorship rights for the Indian cricket team

jersey. $150 m funding from Qatar Investment

Authority & Owl Ventures. Became the world’s

2011 - A shift from exclusively serving aspiring most valuable ed-tech company.

graduate school applicants to the larger

untapped market of 250 million+ K-12 students 2021 - the number of registered users on

in India. Think and Learn (BYJU’s the learning BYJU’s app had increased to 100 million.

app’s parent name) was launched. Raised close to $1 b from several top ventures

with a post-money valuation figure of $13 b

Counterintuitive

Blitzscaling attributes

in Byju's growth

Bold Hiring Strategy Launch Innovative

Products - Take Risks

As of October 2021 - the company plans to

recruit over 6,000-8,000 people across technical BYJU'S Early Learn app was launched in 2019 with

and non-technical roles. The company is a learning programs for children in classes 1-3 (for

millennial-driven organization with an average children aged 6-8 years) and was later updated

employee age of 23-24 years, across various with programs for children in Kinder garden in

departments, and believes in mentoring young June 2020 but the product was not so successful

talent to explore their potential and to streamline as others because parents tend to believe that

their goals. To that end, BYJU’S focuses majorly physical classes are much more effective and will

on recruiting through campuses, even from tier 2, be of less strain to the kinder garden kids,

tier 3 colleges to some extent. especially in their very early stage of learning.

Bad management Sales at BYJU’s means chasing massive quotas,

Focus on getting things done aggressive door-to-door knocking, and making

customer meetings personal to every household.

creating localized sales teams in each region

who can speak to parents and students alike in

their native tongue — leading to more trusting

Achieving Sales by relationships. BYJU’s sales representatives go to

whatever means possible the extent of hounding parents and guilt-tripping

students into thinking BYJU’s paid app is the only

way for them to be educated. There’s been a few

startling internal reports and whistle-blowers

calling out ethically questioning practices on the

business side. Thus far, it hasn’t caused a crazy

stir. We have to wait and watch how it plays out.

Funded with cash, cash,

and more cash

Current valuation at $13 B. A Decacorn - refers to private

startup companies that are valued at $10 billion or more. Only

20 in the world. Funding rounds have come from:

Tencent Holdings — the premier Chinese investing

conglomerate with notable stakes in WeChat, Riot Games,

Snap, and Tesla.

Sequoia Capital — Silicon Valley’s biggest brand name w/

investments in Apple, PayPal, WhatsApp.

Qatar Investment Authority

Chan-Zuckerberg Initiative

Owl Ventures

By creating a FOMO effect for every reputable venture capital

fund in the globe, they’re roping in more cash to expand their

international ambitions.

Byju's Bitzscaling Stages

Thank you!

DES - Group A10

Pradeepkumar R - P212A033 Abhishek Guha - P212B032

Ayush Khare - P212B007 Pakhi Gupta - P212B054

You might also like

- History of BYJU'S: Business Communication ReportDocument8 pagesHistory of BYJU'S: Business Communication ReportSanJana NahataNo ratings yet

- PMK Group9Document24 pagesPMK Group9DeepNo ratings yet

- ByjusDocument22 pagesByjusandrewjosoeph6No ratings yet

- BYJUDocument6 pagesBYJURaghav Khandelwal100% (1)

- Grey Minimalist Business Project PresentationDocument13 pagesGrey Minimalist Business Project PresentationFaizan SiddiquiNo ratings yet

- Target Audience of ByjusDocument7 pagesTarget Audience of ByjusNamanNo ratings yet

- BYJUS and WHite Hatt MergerDocument2 pagesBYJUS and WHite Hatt MergerShubham SinghNo ratings yet

- Corporate Report PDFDocument21 pagesCorporate Report PDFRipunjoy SonowalNo ratings yet

- MP ProjectDocument3 pagesMP ProjectHimanshu BohraNo ratings yet

- Bussiness Development ASSOCIATE (Person Description) : About UsDocument4 pagesBussiness Development ASSOCIATE (Person Description) : About UsAtul BishtNo ratings yet

- Business Development Associate (Bda) : About UsDocument4 pagesBusiness Development Associate (Bda) : About UsHARIHARAN MECNo ratings yet

- Recent Acquisitions by ByjuDocument4 pagesRecent Acquisitions by ByjuSanJana NahataNo ratings yet

- Business Development Associate (Bda) : About UsDocument4 pagesBusiness Development Associate (Bda) : About UsGVR MurthyNo ratings yet

- GUVIDocument4 pagesGUVIPrakashNo ratings yet

- Person Description Byjus BDADocument4 pagesPerson Description Byjus BDASandeep GargNo ratings yet

- How BYJU's Became The Most Valued Startup of India?Document31 pagesHow BYJU's Became The Most Valued Startup of India?Aahan Kashyap100% (1)

- Business Communication Assignment On: "BYJU'S - The Learning App"Document8 pagesBusiness Communication Assignment On: "BYJU'S - The Learning App"VISHAL MEHTANo ratings yet

- OSX Magazine III - 2Document46 pagesOSX Magazine III - 2Jasmine MehtaNo ratings yet

- Byju'S Off-Campus DriveDocument5 pagesByju'S Off-Campus DriveSachin TiwariNo ratings yet

- BYJU'SDocument10 pagesBYJU'SPiyush Kumar100% (1)

- BYJU'S Campus JD - BDADocument5 pagesBYJU'S Campus JD - BDASMRITI singhNo ratings yet

- Byju Blitzscaling2Document11 pagesByju Blitzscaling2PARTH TANDONNo ratings yet

- Bussiness Development Associate (Bda) : About UsDocument4 pagesBussiness Development Associate (Bda) : About Ussrawannath100% (1)

- Byju's Is Growing. But Are Its Customers Learning Better - ET PrimeDocument8 pagesByju's Is Growing. But Are Its Customers Learning Better - ET PrimeLinh Giang PhamNo ratings yet

- Organizational Design - Project - ReportDocument10 pagesOrganizational Design - Project - ReportJUHI CHAKRABORTYNo ratings yet

- Rakshit Bhandari - Byju'sTheLearningAppDocument15 pagesRakshit Bhandari - Byju'sTheLearningAppRakshit BhandariNo ratings yet

- SWOT AnalysisDocument19 pagesSWOT AnalysissherlyNo ratings yet

- BYJUSDocument4 pagesBYJUSArjun SinghNo ratings yet

- Slide 1 & 2 Hiral Intro Slide3 & 4 Rishabh Why Education Sector?Document10 pagesSlide 1 & 2 Hiral Intro Slide3 & 4 Rishabh Why Education Sector?Vircio FintechNo ratings yet

- Paatal LokDocument2 pagesPaatal LokAbimanyu ShenilNo ratings yet

- Bujy 2Document24 pagesBujy 2Prasad Polytechnic ICNo ratings yet

- Team Power - EF Term PaperDocument11 pagesTeam Power - EF Term PaperSally ClarkNo ratings yet

- Byju'S - Latest Billionaire Entry: Engineering Education Presented By:-Mehul UID: - 17BCS2557Document8 pagesByju'S - Latest Billionaire Entry: Engineering Education Presented By:-Mehul UID: - 17BCS2557Mehul ThapaNo ratings yet

- A Project Report ON "A Study of International Marketing"Document61 pagesA Project Report ON "A Study of International Marketing"Ayush WankhedeNo ratings yet

- Aayushi Rathore Sept2023Document7 pagesAayushi Rathore Sept2023Aayushi RathoreNo ratings yet

- Research Project Report On: "Factors Affecting Consumer Perception Towards Online Learning Platforms"Document55 pagesResearch Project Report On: "Factors Affecting Consumer Perception Towards Online Learning Platforms"Kirti BafnaNo ratings yet

- The Fall of Byju'sDocument4 pagesThe Fall of Byju'sjaskNo ratings yet

- Summer Project: "Think & Learn Pvt. LTD."Document12 pagesSummer Project: "Think & Learn Pvt. LTD."LaxmiNo ratings yet

- Student Success Specialist (SSS) : About UsDocument6 pagesStudent Success Specialist (SSS) : About UsMahesh GarlapatiNo ratings yet

- 62 EEB Assignment 1Document3 pages62 EEB Assignment 1Dhiraj VinzarNo ratings yet

- Lecture 04 05 2020Document4 pagesLecture 04 05 2020thedigital blendNo ratings yet

- Analyzing The Existing Business Strategy of ByjuDocument5 pagesAnalyzing The Existing Business Strategy of Byjuashwin moviesNo ratings yet

- A&pr Cia1Document4 pagesA&pr Cia1kkkNo ratings yet

- Final SipDocument19 pagesFinal SipMANAS OLINo ratings yet

- BCG-CII Big Picture Final Report Dec 2020Document114 pagesBCG-CII Big Picture Final Report Dec 2020Meet Mukesh PaswanNo ratings yet

- Top 10 Edtech Startups Shaping The Indian Education IndustryDocument4 pagesTop 10 Edtech Startups Shaping The Indian Education Industrygangtharan MNo ratings yet

- Institue of Management, Nirma UniversityDocument7 pagesInstitue of Management, Nirma UniversityYash ShahNo ratings yet

- Institue of Management, Nirma UniversityDocument7 pagesInstitue of Management, Nirma UniversityYash ShahNo ratings yet

- Training Report Byju'sDocument59 pagesTraining Report Byju'sKaushal Tiwari42% (12)

- Parth Tyagi BYJU'sDocument6 pagesParth Tyagi BYJU'sParth TyagiNo ratings yet

- Education Technology Market ResearchDocument11 pagesEducation Technology Market ResearchSandeep TekkaliNo ratings yet

- A Study On Exploring The Effectiveness of Digital Marketing: Customer Relations During Covid-19 (Byjus)Document8 pagesA Study On Exploring The Effectiveness of Digital Marketing: Customer Relations During Covid-19 (Byjus)Radhika RachhadiyaNo ratings yet

- 4.1 Marketing Mix Concept - 4Ps: 4.1.1 Product StrategyDocument2 pages4.1 Marketing Mix Concept - 4Ps: 4.1.1 Product StrategyDhrumil JoshiNo ratings yet

- Campus JD - Byjus ATPDocument5 pagesCampus JD - Byjus ATPJitendra SharmaNo ratings yet

- Digging DeeperDocument8 pagesDigging DeeperRubiyaNo ratings yet

- An Exciting Edtech Giant Announced A Funding of USD 800 MillionDocument6 pagesAn Exciting Edtech Giant Announced A Funding of USD 800 MillionGANGATHARAN MNo ratings yet

- Parcial 1 SIG PDFDocument22 pagesParcial 1 SIG PDFValentina GomezNo ratings yet

- Success Story of ByjuDocument10 pagesSuccess Story of ByjuAnsul GuptaNo ratings yet

- Understanding B2B Brand BuildingDocument21 pagesUnderstanding B2B Brand BuildingPalak ShahNo ratings yet

- Incubating Indonesia’s Young Entrepreneurs:: Recommendations for Improving Development ProgramsFrom EverandIncubating Indonesia’s Young Entrepreneurs:: Recommendations for Improving Development ProgramsNo ratings yet

- Img 20150510 0001Document2 pagesImg 20150510 0001api-284663984No ratings yet

- DJ Crypto ResumeDocument1 pageDJ Crypto ResumeNitin MahawarNo ratings yet

- RARE Manual For Training Local Nature GuidesDocument91 pagesRARE Manual For Training Local Nature GuidesenoshaugustineNo ratings yet

- Institutional Group Agencies For EducationDocument22 pagesInstitutional Group Agencies For EducationGlory Aroma100% (1)

- Generation III Sonic Feeder Control System Manual 20576Document32 pagesGeneration III Sonic Feeder Control System Manual 20576julianmataNo ratings yet

- APA Vs Harvard Referencing - PDFDocument4 pagesAPA Vs Harvard Referencing - PDFTalo Contajazz Chileshe50% (2)

- Pioneer 1019ah-K Repair ManualDocument162 pagesPioneer 1019ah-K Repair ManualjekNo ratings yet

- PlateNo 1Document7 pagesPlateNo 1Franz Anfernee Felipe GenerosoNo ratings yet

- BBL PR Centralizer Rig Crew Handout (R1.1 2-20-19)Document2 pagesBBL PR Centralizer Rig Crew Handout (R1.1 2-20-19)NinaNo ratings yet

- Maths Formulas For IGCSEDocument2 pagesMaths Formulas For IGCSEHikma100% (1)

- Been There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerDocument8 pagesBeen There, Done That, Wrote The Blog: The Choices and Challenges of Supporting Adolescents and Young Adults With CancerNanis DimmitrisNo ratings yet

- Dating Apps MDocument2 pagesDating Apps Mtuanhmt040604No ratings yet

- VRPIN 01843 PsychiatricReportDrivers 1112 WEBDocument2 pagesVRPIN 01843 PsychiatricReportDrivers 1112 WEBeverlord123No ratings yet

- 8 A - 1615864446 - 1605148379 - 1579835163 - Topic - 8.A.EffectiveSchoolsDocument9 pages8 A - 1615864446 - 1605148379 - 1579835163 - Topic - 8.A.EffectiveSchoolsYasodhara ArawwawelaNo ratings yet

- Immunity Question Paper For A Level BiologyDocument2 pagesImmunity Question Paper For A Level BiologyJansi Angel100% (1)

- Debate ReportDocument15 pagesDebate Reportapi-435309716No ratings yet

- Philodendron Plants CareDocument4 pagesPhilodendron Plants CareSabre FortNo ratings yet

- D&D 5.0 Combat Reference Sheet Move Action: Interact With One Object Do Other Simple ActivtiesDocument2 pagesD&D 5.0 Combat Reference Sheet Move Action: Interact With One Object Do Other Simple ActivtiesJason ParsonsNo ratings yet

- D25KS Sanvick PDFDocument4 pagesD25KS Sanvick PDFJiménez Manuel100% (1)

- SIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04Document1 pageSIVACON 8PS - Planning With SIVACON 8PS Planning Manual, 11/2016, A5E01541101-04marcospmmNo ratings yet

- Inspección, Pruebas, Y Mantenimiento de Gabinetes de Ataque Rápido E HidrantesDocument3 pagesInspección, Pruebas, Y Mantenimiento de Gabinetes de Ataque Rápido E HidrantesVICTOR RALPH FLORES GUILLENNo ratings yet

- Isi Rumen SBG Subtitusi HijauanDocument3 pagesIsi Rumen SBG Subtitusi HijauanBagas ImamsyahNo ratings yet

- PostScript Quick ReferenceDocument2 pagesPostScript Quick ReferenceSneetsher CrispyNo ratings yet

- Session 1Document18 pagesSession 1Akash GuptaNo ratings yet

- Johnson & Johnson Equity Research ReportDocument13 pagesJohnson & Johnson Equity Research ReportPraveen R V100% (3)

- 3D Printing & Embedded ElectronicsDocument7 pages3D Printing & Embedded ElectronicsSantiago PatitucciNo ratings yet

- 40 Sink and FloatDocument38 pages40 Sink and Floatleandro hualverdeNo ratings yet

- CH-5 Further Percentages AnswersDocument5 pagesCH-5 Further Percentages AnswersMaram MohanNo ratings yet

- CATaclysm Preview ReleaseDocument52 pagesCATaclysm Preview ReleaseGhaderalNo ratings yet

- 7Document6 pages7Joenetha Ann Aparici100% (1)