Professional Documents

Culture Documents

Mcdonalds Corporation: Case Study

Uploaded by

Angelique Tammie Abellar0 ratings0% found this document useful (0 votes)

53 views6 pagesOriginal Title

McDonalds Corporation - fINAL

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

53 views6 pagesMcdonalds Corporation: Case Study

Uploaded by

Angelique Tammie AbellarCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

McDonalds Corporation

Case Study

Researchers:

Abellar, Ma. Angelique Tammie K.

Acaya, Arvin Jay A.

Anadon, Eutemio B.

Castillo, Jojo G.

Palileo, Karren Cassandra R.

Raymundo, Timmy Joy R.

I. Statement of the Problem

The main purpose of this study is to determine how they are

going to spend the excess cash for the benefit of the company.

II. Objectives

This study aims to discover the best possible solution in the

problem of the McDonalds Corporation and to suggest strategies

to carry such solutions.

III. Factors of Consideration

Within the study, the researchers found out that the key

features, internal and external, to be considered in determining

the best possible solution are the following:

degree of government regulation in the region/country

they are operating

state of currency fluctuation and the responsiveness of

the currency to changes in economic

threat of competitors and the degree of its competitors

influence to price manipulations an price war

competitors’ advantage on product quality

competitors market shares

shareholder’s perception an responses to the courses of

action taken by the management.

In lieu with this study, the researchers found out that the

McDonalds give higher dividends out of its excess cash in the

previous years.

IV. Alternative Forces of Action

Plan A – McDonald Coporation will utilize its

excess cash in paying large dividends.

Plan B – Acquire other assets / business of the

same industry.

Plan C – Diversification

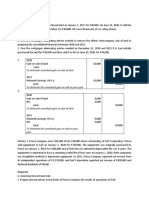

Key Features of the Three Plans

Plan Advantage Disadvantage

Some investors may

Attractive to potential think that the company

investors due to the given doesn’t want to invest in

rate of the dividend payout. the growth of the

A

Beneficial to present company.

investors for they will receive Decrease available cash

the return of their investment. for the company’s

operation.

May be costly.

Increase its market May encounter

B

share in the industry. opposition from the both

sides of the companies.

C Lesser risk. Uncertain stability.

New opportunity to other Costly.

industry. May encounter

New market segment. opposition from the both

Greater power. sides of the companies.

V. Decision

The researchers, upon careful evaluation, decided to adopt

Plan B for the following reasons:

No substantial training required because only the

successful and well establish firms will be acquired.

Less chance of failure.

In the long run, investing “excess” cash is more

beneficial for the company than paying large dividends.

VI. Implementation

We, the researchers, would like to suggest the following

measures of implementing Plan B:

Invest 55% of available cash in the acquisition of

successful small restaurants, either local or regional,

offering the same product or close substitute to

McDonald’s products and services.

Use 30% of the available fund as dividend payment, so

as to please potential investors. Paying “reasonable but

not excessive” dividends will project a vey good image

for the company, both for the stockholders an for the

investors in the open market.

Spend 15% of the fund into advertising / promotional

campaign for the newly acquired firms.

You might also like

- Day Trading Strategies - For Beginners To Advanced Day Traders, Strategy Is KeyDocument16 pagesDay Trading Strategies - For Beginners To Advanced Day Traders, Strategy Is KeysumonNo ratings yet

- SM Chapter 4 Industry & Competitive AnalysisDocument22 pagesSM Chapter 4 Industry & Competitive AnalysisMD. ANWAR UL HAQUE100% (1)

- Business Plan-Compressed 2 1Document18 pagesBusiness Plan-Compressed 2 1api-550939695100% (1)

- Fundamentals of Investments. Chapter1: A Brief History of Risk and ReturnDocument34 pagesFundamentals of Investments. Chapter1: A Brief History of Risk and ReturnNorina100% (1)

- Financial Management and ControlDocument18 pagesFinancial Management and ControlcrystalNo ratings yet

- Critical Financial Review: Understanding Corporate Financial InformationFrom EverandCritical Financial Review: Understanding Corporate Financial InformationNo ratings yet

- 2014 CFA Level 2 Mock Exam Afternoon - AnsDocument55 pages2014 CFA Level 2 Mock Exam Afternoon - AnsElsiiieNo ratings yet

- It’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceFrom EverandIt’S Business, It’S Personal: From Setting a Vision to Delivering It Through Organizational ExcellenceNo ratings yet

- Shams Textile Annual ReportDocument48 pagesShams Textile Annual Reportasadsunnypk100% (1)

- Strategic Management Accounting PDFDocument101 pagesStrategic Management Accounting PDFlauri larjavaaraNo ratings yet

- Financial Accounting: A Managerial PerspectiveDocument22 pagesFinancial Accounting: A Managerial Perspectivegajalpeshin100% (3)

- Income Certificate GeneratorDocument1 pageIncome Certificate GeneratorFaisal Imran100% (1)

- Accounting For LeasesDocument4 pagesAccounting For LeasesSebastian MlingwaNo ratings yet

- Habib Oil Mills Compensation Management ReportDocument22 pagesHabib Oil Mills Compensation Management Reportsjay cwNo ratings yet

- CafDocument5 pagesCaftokeeer100% (1)

- Packages Internship Report On I.R Dept, by A HRM, by M.kashif Iqbal 03336866227Document40 pagesPackages Internship Report On I.R Dept, by A HRM, by M.kashif Iqbal 03336866227M Kashif IqbalNo ratings yet

- Gul Ahmed Annual Report 2007Document73 pagesGul Ahmed Annual Report 2007AISHASABAHATNo ratings yet

- Analyzing Sales Force Performance at Hanover-Bates ChemicalsDocument9 pagesAnalyzing Sales Force Performance at Hanover-Bates ChemicalsRai Xeeshan HussainNo ratings yet

- PGDFM Finacial Mangment Final PDFDocument260 pagesPGDFM Finacial Mangment Final PDFAnonymous H4xWhTmNo ratings yet

- Cma ReportDocument15 pagesCma Reporttaranair86No ratings yet

- Final Citi BankDocument9 pagesFinal Citi BankBilal EhsanNo ratings yet

- Phase 3 - Porter's Five Forces AnalysisDocument3 pagesPhase 3 - Porter's Five Forces AnalysistheNo ratings yet

- Colony Textile Mills CorrectDocument30 pagesColony Textile Mills Correcttahirkazmi12140% (1)

- ACT430 Mid 1 Fall 2020Document12 pagesACT430 Mid 1 Fall 2020Antor Podder 1721325100% (1)

- The Fall of Enron: Group 1Document20 pagesThe Fall of Enron: Group 1Thiện NhânNo ratings yet

- Strategic Business Management Exam Nov 2019Document22 pagesStrategic Business Management Exam Nov 2019Wong AndrewNo ratings yet

- Current Problems of Corporate Sector of PakistanDocument5 pagesCurrent Problems of Corporate Sector of Pakistanaliasif198No ratings yet

- Final Report of Financial Statement Analysis of Packages Limited LahoreDocument138 pagesFinal Report of Financial Statement Analysis of Packages Limited Lahoreshahid Ali100% (1)

- Activity Based CostingDocument19 pagesActivity Based CostingChristine Mae MataNo ratings yet

- Cost and Pricing MGT For Competitive AdvantageDocument45 pagesCost and Pricing MGT For Competitive Advantageilona gabrielNo ratings yet

- Bhel Case StudyDocument15 pagesBhel Case StudySanjeev SinghNo ratings yet

- Fauji Fertilizer Company (FFC) : Target Price StanceDocument17 pagesFauji Fertilizer Company (FFC) : Target Price StanceAli CheenahNo ratings yet

- F7 AccaDocument112 pagesF7 AccaChheng ChhunNo ratings yet

- TSB CFAP 6 Mock 1 - April 27 2019Document3 pagesTSB CFAP 6 Mock 1 - April 27 2019KAMRAN BAIG0% (1)

- Family BusinessDocument12 pagesFamily BusinessJagadeesh PutturuNo ratings yet

- Financial Reporting Final ProjectDocument7 pagesFinancial Reporting Final ProjectMehwish ButtNo ratings yet

- Consumer Satisfaction on Biscuit in BangladeshDocument18 pagesConsumer Satisfaction on Biscuit in BangladeshKaziTanvirAhmedNo ratings yet

- A Report ON A Study of Indian Economy AND Steel Industry of IndiaDocument6 pagesA Report ON A Study of Indian Economy AND Steel Industry of Indiakavan_shah_2No ratings yet

- The Cost of Trade CreditDocument4 pagesThe Cost of Trade CreditWawex DavisNo ratings yet

- Executive Summary:: Introduction of Ghee/Oil IndustryDocument18 pagesExecutive Summary:: Introduction of Ghee/Oil IndustryMuhammad Irfań MustafaiNo ratings yet

- Attock Petroleum Financial Report 2010Document6 pagesAttock Petroleum Financial Report 2010Naveed JavedNo ratings yet

- Comparative Analysis and Cash Flow Statements of Hul & Itc: - Group A2Document11 pagesComparative Analysis and Cash Flow Statements of Hul & Itc: - Group A2DEBANGEE ROYNo ratings yet

- Analyzing Lease vs Buy for Assembly Line EquipmentDocument6 pagesAnalyzing Lease vs Buy for Assembly Line EquipmentToufiqul IslamNo ratings yet

- Financial Statement Analysis of Pakistan Tobacco CompanyDocument38 pagesFinancial Statement Analysis of Pakistan Tobacco CompanyNauman Rashid67% (3)

- Case Study DiversificationDocument10 pagesCase Study DiversificationSebinKJosephNo ratings yet

- anthonyIM 01Document15 pagesanthonyIM 01Julz JuliaNo ratings yet

- Practical Study of The Organization Introduction To Habib Oil MillsDocument3 pagesPractical Study of The Organization Introduction To Habib Oil MillsRaja Israr AhmedNo ratings yet

- Vimal Oil& Food Pvt. LTDDocument51 pagesVimal Oil& Food Pvt. LTDDastaan PatelNo ratings yet

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- SCM ReportDocument12 pagesSCM ReportFurqan MahmoodNo ratings yet

- Chapter 7 Notes Question Amp SolutionsDocument7 pagesChapter 7 Notes Question Amp SolutionsPankhuri SinghalNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- Welcome to IIMU's Post Graduate Program in ManagementDocument47 pagesWelcome to IIMU's Post Graduate Program in Managementkushalmadke11No ratings yet

- Bajaj TilesDocument27 pagesBajaj TilesAkash GuptaNo ratings yet

- IBA Marketing Management Course OutlineDocument12 pagesIBA Marketing Management Course OutlineSauban AhmedNo ratings yet

- Al-Hamd Academy Company Law Module D ICAP AnswersDocument17 pagesAl-Hamd Academy Company Law Module D ICAP AnswersMuhammad Hassan TahirNo ratings yet

- Case StudyDocument5 pagesCase StudyAshwin KumarNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- Inventory valuation Complete Self-Assessment GuideFrom EverandInventory valuation Complete Self-Assessment GuideRating: 4 out of 5 stars4/5 (1)

- Firms QestionsDocument7 pagesFirms QestionsAbdusalom MuhammadjonovNo ratings yet

- ENTREPRENEURSHIP-QUARTER-3-FULL-REVIEWERDocument9 pagesENTREPRENEURSHIP-QUARTER-3-FULL-REVIEWERBukhari DiangkaNo ratings yet

- Investment Plan ExampleDocument13 pagesInvestment Plan ExampleSan Thida SweNo ratings yet

- Blockbuster's Role in the Enron ScandalDocument1 pageBlockbuster's Role in the Enron ScandalAivNo ratings yet

- DDM Valuation of KDC StockDocument5 pagesDDM Valuation of KDC StockTran UyenNo ratings yet

- Assignment 1 Chapter OneDocument12 pagesAssignment 1 Chapter OneJerron Mart Salazar UrbanozoNo ratings yet

- Acctg3&4 - QuizDocument2 pagesAcctg3&4 - QuizJobesonNo ratings yet

- CAPITAL BUDGETING METHODS EXPLAINED: NPV, IRR, PAYBACK PERIOD & ACCOUNTING RATE OF RETURNDocument38 pagesCAPITAL BUDGETING METHODS EXPLAINED: NPV, IRR, PAYBACK PERIOD & ACCOUNTING RATE OF RETURNshazlina_liNo ratings yet

- Let's Check: To Eliminate Unrealized Gain On Sale of LandDocument4 pagesLet's Check: To Eliminate Unrealized Gain On Sale of Landalmira garciaNo ratings yet

- Foreign Exchange Risk Management Practices of Ludhiana Textile ExportersDocument9 pagesForeign Exchange Risk Management Practices of Ludhiana Textile ExportersrohanNo ratings yet

- A Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Document19 pagesA Potential USD 140 BN Industry: Kuwait Financial Centre S.A.K "Markaz"Adama KoneNo ratings yet

- Name of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Document2 pagesName of Investors (Bidders) Interest Rate (%) Auction Volume (Billion Dong)Trần Phương AnhNo ratings yet

- Copywriting PortfolioDocument17 pagesCopywriting PortfolioAastha NathwaniNo ratings yet

- Financial MarketsDocument7 pagesFinancial MarketsLeo Andrei BarredoNo ratings yet

- ICP Teaser Border Control RDocument9 pagesICP Teaser Border Control Rian4599No ratings yet

- International Finance Course ObjectivesDocument4 pagesInternational Finance Course ObjectivesShyam MaariNo ratings yet

- Market Research Report - Entrepreneur IndiaDocument1 pageMarket Research Report - Entrepreneur IndiaSulemanNo ratings yet

- How Many Mutual Funds Constitute A Diversified Mutual Fund PortfolioDocument10 pagesHow Many Mutual Funds Constitute A Diversified Mutual Fund PortfolioKris SzczerbinskiNo ratings yet

- 989898Document16 pages989898sara100% (1)

- Impacts of development on agriculture and farmersDocument8 pagesImpacts of development on agriculture and farmersCelestiaNo ratings yet

- Finance Case StudiesDocument12 pagesFinance Case StudiesWasp_007_007No ratings yet

- A L-U-V-Wy Recovery: April 6, 2020Document11 pagesA L-U-V-Wy Recovery: April 6, 2020Mike HammondNo ratings yet

- Ashok Leyland's Working Capital ManagementDocument5 pagesAshok Leyland's Working Capital ManagementAnas FareedNo ratings yet

- Chapter Five Part One: Business ValuationDocument57 pagesChapter Five Part One: Business ValuationMikias DegwaleNo ratings yet

- Effective Cash Management at KFDCDocument77 pagesEffective Cash Management at KFDCshravan suvarna-mangaloreNo ratings yet

- Chapter 6 - Capital BudgetingDocument14 pagesChapter 6 - Capital BudgetingThuyDuong BuiNo ratings yet

- CO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFDocument12 pagesCO - MSc28 - FM - Avanced Corporate Finance 2019-2020 DEFshalabh_hscNo ratings yet

- Utility TheoryDocument21 pagesUtility Theoryfiza akhterNo ratings yet

- Bangladesh Investment Development Authority (BIDA) : Application For Registration of Industrial Investment ProjectDocument3 pagesBangladesh Investment Development Authority (BIDA) : Application For Registration of Industrial Investment ProjectJyotirmoy DharNo ratings yet

- Portfolio Management 1Document29 pagesPortfolio Management 1Fariwar WahezyNo ratings yet