Professional Documents

Culture Documents

Blockbuster's Role in the Enron Scandal

Uploaded by

AivOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Blockbuster's Role in the Enron Scandal

Uploaded by

AivCopyright:

Available Formats

Blockbuster Video's Role

One of the many unwitting players in the Enron scandal was Blockbuster, the former juggernaut video

rental chain. In July 2000, Enron Broadband Services and Blockbuster entered a partnership to enter the

burgeoning VOD market. The VOD market was a sensible pick, but Enron started logging expected

earnings based on the expected growth of the VOD market, which vastly inflated the numbers.

By mid-2000, EOL was executing nearly $350 billion in trades. When the dot-com bubble began to burst,

Enron decided to build high-speed broadband telecom networks. Hundreds of millions of dollars were

spent on this project, but the company ended up realizing almost no return.

When the recession hit in 2000, Enron had significant exposure to the most volatile parts of the market.

As a result, many trusting investors and creditors found themselves on the losing end of a vanishing

market cap.

The Wall Street Darling Crumbles

By the fall of 2000, Enron was starting to crumble under its own weight. CEO Jeffrey Skilling hid the

financial losses of the trading business and other operations of the company using mark-to-market

accounting. This technique measures the value of a security based on its current market value instead of

its book value. This can work well when trading securities, but it can be disastrous for actual businesses.

In Enron's case, the company would build an asset, such as a power plant, and immediately claim the

projected profit on its books, even though the company had not made one dime from the asset. If the

revenue from the power plant was less than the projected amount, instead of taking the loss, the

company would then transfer the asset to an off-the-books corporation where the loss would go

unreported. This type of accounting enabled Enron to write off unprofitable activities without hurting its

bottom line.

The mark-to-market practice led to schemes that were designed to hide the losses and make the

company appear more profitable than it really was. To cope with the mounting liabilities, Andrew

Fastow, a rising star who was promoted to chief financial officer in 1998, developed a deliberate plan to

show that the company was in sound financial shape despite the fact that many of its subsidiaries were

losing money.

You might also like

- An ENRON Scandal SummaryDocument7 pagesAn ENRON Scandal SummaryNimraa NoorNo ratings yet

- Enron ScandalDocument7 pagesEnron ScandalDhruv JainNo ratings yet

- Enron Scandal: How Accounting Tricks Led to CollapseDocument5 pagesEnron Scandal: How Accounting Tricks Led to Collapsenidhi nageshNo ratings yet

- Enron's Dramatic Rise and Staggering CollapseDocument7 pagesEnron's Dramatic Rise and Staggering Collapseislam hamdyNo ratings yet

- Enron Corporation: Enron's Energy OriginsDocument7 pagesEnron Corporation: Enron's Energy Originsislam hamdyNo ratings yet

- Enron Corporation: Enron's Energy OriginsDocument7 pagesEnron Corporation: Enron's Energy Originsislam hamdyNo ratings yet

- EnronDocument3 pagesEnronОксанаNo ratings yet

- Sythesis 8Document7 pagesSythesis 8Jhonerl YbañezNo ratings yet

- Enron, Worldcom, TycoDocument6 pagesEnron, Worldcom, TycoLealyn Martin BaculoNo ratings yet

- Enron Scandal The Fall of A Wall Street DarlingDocument3 pagesEnron Scandal The Fall of A Wall Street DarlingAnonymous 2LqTzfUHY50% (2)

- Assignment No 2Document6 pagesAssignment No 2Amazing worldNo ratings yet

- ENRON Case Study: Enron Was Formed in 1985 Following A Merger Between Houston Natural Gas Company andDocument7 pagesENRON Case Study: Enron Was Formed in 1985 Following A Merger Between Houston Natural Gas Company andarunNo ratings yet

- Enron ScandalDocument1 pageEnron ScandalJhulia MontecilloNo ratings yet

- Enron Scandal - The Fall of A Wall Street DarlingDocument11 pagesEnron Scandal - The Fall of A Wall Street DarlingElleNo ratings yet

- The Rise and Fall of Enron: A Guide to the ScandalDocument28 pagesThe Rise and Fall of Enron: A Guide to the ScandalJohn Philip De GuzmanNo ratings yet

- Enron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Document19 pagesEnron Scandal: The Fall of A Wall Street Darling: "America's Most Innovative Company"Jamielyn Dy DimaanoNo ratings yet

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocument2 pagesThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNo ratings yet

- How Enron's Fraud Led to Collapse and New RegulationsDocument5 pagesHow Enron's Fraud Led to Collapse and New RegulationsShubhankar ThakurNo ratings yet

- Enron Casr StudyDocument12 pagesEnron Casr StudyAbhijeet KumawatNo ratings yet

- Audit CaseDocument30 pagesAudit CaseAnnisa Kurnia100% (1)

- Major Corporate Scams PresentationDocument24 pagesMajor Corporate Scams PresentationGanesh Prasad PandaNo ratings yet

- Assignment - Busiiness EthicsDocument6 pagesAssignment - Busiiness EthicsEmad BelalNo ratings yet

- Edades, Angelica T. Bsba-Fm The Enron'S CollapseDocument7 pagesEdades, Angelica T. Bsba-Fm The Enron'S Collapsearman atipNo ratings yet

- Case Study: WorldcomDocument8 pagesCase Study: WorldcomNishant SatamkarNo ratings yet

- Enron Accounting Scandal and Its Impact To Stakeholders Voice Over (Pictures or Videos of Enron C/O Youtube)Document3 pagesEnron Accounting Scandal and Its Impact To Stakeholders Voice Over (Pictures or Videos of Enron C/O Youtube)Raven ShadowsNo ratings yet

- EnronDocument8 pagesEnronjualNo ratings yet

- Current Business Affairs: Assignment-1Document17 pagesCurrent Business Affairs: Assignment-1Salman JanNo ratings yet

- IntroductionDocument5 pagesIntroductionLydia MasrudyNo ratings yet

- Enron's Desperate Remedial Actions Before BankruptcyDocument3 pagesEnron's Desperate Remedial Actions Before BankruptcyblahblahblueNo ratings yet

- Fortune - The Revenue Games Like People Like Enron PlayDocument4 pagesFortune - The Revenue Games Like People Like Enron Playanudeep05No ratings yet

- The Rise and Fall of EnronDocument7 pagesThe Rise and Fall of Enronyatz24No ratings yet

- The Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallyDocument3 pagesThe Enron Corporation Story Depicts A Company That Reached Dizzying Heights Only To Plummet DramaticallySi Reygie Rojas KoNo ratings yet

- Subject:-Investigative Journalism Topic: - Case Study On Enron Scandal Name: - Shray Ved Class: - T.Y.B.A.MMC - B ROLL No.: - 3151Document23 pagesSubject:-Investigative Journalism Topic: - Case Study On Enron Scandal Name: - Shray Ved Class: - T.Y.B.A.MMC - B ROLL No.: - 3151ShrayNo ratings yet

- What Could Have Been Done To Prevent The Enron Case?Document2 pagesWhat Could Have Been Done To Prevent The Enron Case?Joshua BautistaNo ratings yet

- Accounting Scandal & Sarbanes OxleyDocument41 pagesAccounting Scandal & Sarbanes OxleyMd. Jabed Ali ShaonNo ratings yet

- SPEs and Mark-to-Market Accounting Fueled Enron's Rise and FallDocument8 pagesSPEs and Mark-to-Market Accounting Fueled Enron's Rise and FallMustansar RanjhaNo ratings yet

- GovernDocument2 pagesGovernLilac heartNo ratings yet

- Acc394 - Edited Case Study Answers 1Document10 pagesAcc394 - Edited Case Study Answers 1api-607959293No ratings yet

- Dot Com Bubble Burst and Its Impact on the EconomyDocument4 pagesDot Com Bubble Burst and Its Impact on the EconomyjoseluckNo ratings yet

- Dot Com Bubble Burst and Its Impact on the EconomyDocument4 pagesDot Com Bubble Burst and Its Impact on the EconomyjoseluckNo ratings yet

- DocxDocument4 pagesDocxjoseluckNo ratings yet

- DocxDocument4 pagesDocxjoseluckNo ratings yet

- Enron Scandal: Assignment 1Document5 pagesEnron Scandal: Assignment 1Afnan TufailNo ratings yet

- ENRON Group1Document10 pagesENRON Group1Akanksha JaiswalNo ratings yet

- Assignment: # 1: Reasons of Enron's CollapseDocument3 pagesAssignment: # 1: Reasons of Enron's CollapseZahid KhanNo ratings yet

- University of Central Punjab: Assignment No 2Document3 pagesUniversity of Central Punjab: Assignment No 2Shehar BanoNo ratings yet

- The Collapse of Enron CORPORATION (USA) (2001) : Pre-Final in Internal AuditingDocument7 pagesThe Collapse of Enron CORPORATION (USA) (2001) : Pre-Final in Internal AuditingKathlynJoySalazarNo ratings yet

- How To Hide 3.8 Billion in ExpensesDocument2 pagesHow To Hide 3.8 Billion in ExpensesShpat DedaNo ratings yet

- Enron Scandal Case StudyDocument3 pagesEnron Scandal Case StudyData CentrumNo ratings yet

- Enron AssignmentDocument15 pagesEnron AssignmentnaarvnaNo ratings yet

- Reading Assignment 8 (Royal Bank of Scotland)Document14 pagesReading Assignment 8 (Royal Bank of Scotland)Valentine AyiviNo ratings yet

- Individual AssignmentDocument4 pagesIndividual AssignmentNguyen Dang Duong (K16HL)No ratings yet

- Corporate and Accounting ScandalsDocument2 pagesCorporate and Accounting ScandalsJewel GonzalesNo ratings yet

- Expand Further On EnronDocument2 pagesExpand Further On EnronSean Chris ConsonNo ratings yet

- Enron bankruptcy report: How accounting fraud led to collapseDocument2 pagesEnron bankruptcy report: How accounting fraud led to collapsemohidul islamNo ratings yet

- Corporate Fraud AnalysisDocument29 pagesCorporate Fraud AnalysisAsghar IqbalNo ratings yet

- Assignment 1 (Answered)Document6 pagesAssignment 1 (Answered)Areez IsrarNo ratings yet

- Enron's rise and fall from America's largest energy companyDocument10 pagesEnron's rise and fall from America's largest energy companyShunNo ratings yet

- Summary of Scott Davis, Carter Copeland & Rob Wertheimer's Lessons from the TitansFrom EverandSummary of Scott Davis, Carter Copeland & Rob Wertheimer's Lessons from the TitansNo ratings yet

- Summary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionFrom EverandSummary of Howard M. Schilit, Jeremy Perler & Yoni Engelhart's Financial Shenanigans, Fourth EditionNo ratings yet

- A Discretionary Fixed CostDocument2 pagesA Discretionary Fixed CostAivNo ratings yet

- A Discretionary Fixed CostDocument2 pagesA Discretionary Fixed CostAivNo ratings yet

- Research MethodDocument2 pagesResearch MethodAivNo ratings yet

- A Discretionary Fixed CostDocument2 pagesA Discretionary Fixed CostAivNo ratings yet

- A Discretionary Fixed CostDocument2 pagesA Discretionary Fixed CostAivNo ratings yet

- What Is SentenceDocument1 pageWhat Is SentenceAivNo ratings yet

- Quantitative Research MethodsDocument1 pageQuantitative Research MethodsAivNo ratings yet

- What Is ResearchDocument2 pagesWhat Is ResearchAivNo ratings yet

- Research DefinitionDocument2 pagesResearch DefinitionRaissa DeaNo ratings yet

- Research DefinitionDocument2 pagesResearch DefinitionRaissa DeaNo ratings yet

- What Is ResearcDocument1 pageWhat Is ResearcShizuko Shasimie KazueNo ratings yet

- Research DefinitionDocument2 pagesResearch DefinitionRaissa DeaNo ratings yet

- What Is The Purpose of ResearchDocument1 pageWhat Is The Purpose of ResearchAivNo ratings yet

- Types of ResearchDocument2 pagesTypes of ResearchAivNo ratings yet

- EnronDocument1 pageEnronAivNo ratings yet

- What Is ResearchDocument1 pageWhat Is ResearchAivNo ratings yet

- The Legacy of EnronDocument1 pageThe Legacy of EnronAivNo ratings yet

- Arthur Andersen and EnronDocument2 pagesArthur Andersen and EnronAivNo ratings yet

- Mark To MarketDocument1 pageMark To MarketAivNo ratings yet

- What Is ResearchDocument1 pageWhat Is ResearchAivNo ratings yet

- How Did Enron Hide Its DebtDocument1 pageHow Did Enron Hide Its DebtAivNo ratings yet

- Arthur Andersen's Role in the Enron ScandalDocument2 pagesArthur Andersen's Role in the Enron ScandalAivNo ratings yet

- SoxDocument2 pagesSoxAivNo ratings yet

- Essentials of Measurement ScaleDocument1 pageEssentials of Measurement ScaleAivNo ratings yet

- SOXDocument1 pageSOXAivNo ratings yet

- Contents of A Comprehensive Reasearch ReportDocument1 pageContents of A Comprehensive Reasearch ReportAiv100% (1)

- EnronDocument1 pageEnronAivNo ratings yet

- Different Wiriting StagesDocument3 pagesDifferent Wiriting StagesAivNo ratings yet

- Advantages and Disadvantages of Secondary DataDocument1 pageAdvantages and Disadvantages of Secondary DataAivNo ratings yet

- Draytek 2 Cisco VPNDocument8 pagesDraytek 2 Cisco VPNMarco ManzanoNo ratings yet

- Setup Manual 0if-Plus B-64647en - 01 - 01Document400 pagesSetup Manual 0if-Plus B-64647en - 01 - 01Aloisio Gonzaga100% (1)

- Project Procedure IMP 16Document22 pagesProject Procedure IMP 16Jose R C FernandesNo ratings yet

- Annul. Press. Bleed Off Proced.Document3 pagesAnnul. Press. Bleed Off Proced.eng7mohamed7hashimNo ratings yet

- 4) Transport and InsuranceDocument10 pages4) Transport and InsuranceBianca AlecuNo ratings yet

- 1 s2.0 S0304885323009770 MainDocument8 pages1 s2.0 S0304885323009770 Mainzmaxprom5No ratings yet

- LG AnalysisDocument4 pagesLG AnalysisAnkit MishraNo ratings yet

- Green Economy in The Transport SectorDocument138 pagesGreen Economy in The Transport Sectorclayton MaramwidzeNo ratings yet

- 5 Dossier SampleDocument22 pages5 Dossier SampleSabeehuddin SafdarNo ratings yet

- Mid 185 - Pid 70 - Fmi 2Document3 pagesMid 185 - Pid 70 - Fmi 2Akbar100% (1)

- Easergy PS100 48VDC Power SupplyDocument2 pagesEasergy PS100 48VDC Power SupplyRichard SyNo ratings yet

- Comparisonbetweenvrv Vrfbrandssuppliersuaemarket May2016 Bygetco 160430182626Document128 pagesComparisonbetweenvrv Vrfbrandssuppliersuaemarket May2016 Bygetco 160430182626phuongnhsfc100% (1)

- The Delta-Sigma Modulator: A Circuit For All SeasonsDocument6 pagesThe Delta-Sigma Modulator: A Circuit For All SeasonsSohaib AkhtarNo ratings yet

- Motion in A Straight Line: Initial PositionDocument7 pagesMotion in A Straight Line: Initial PositionEngelbert Bicoy AntodNo ratings yet

- Haslinda Mohd Anuar Senior Lecturer School of Law ColgisDocument24 pagesHaslinda Mohd Anuar Senior Lecturer School of Law ColgisSHAHEERANo ratings yet

- InvoiceDocument2 pagesInvoiceamalNo ratings yet

- Edmonton Report On Flood MitigationDocument6 pagesEdmonton Report On Flood MitigationAnonymous TdomnV9OD4No ratings yet

- Hotel Reservation System: Hotel OAK-RAY, KandyDocument22 pagesHotel Reservation System: Hotel OAK-RAY, KandysaminaNo ratings yet

- MD Anderson Medical Oncology 4th Edition 2022Document1,694 pagesMD Anderson Medical Oncology 4th Edition 2022Iskandar414100% (6)

- Altair Flow Simulator 2021.2 Release Notes HighlightsDocument4 pagesAltair Flow Simulator 2021.2 Release Notes HighlightsOliver RailaNo ratings yet

- IH May-June 2022Document60 pagesIH May-June 2022Omkar R PujariNo ratings yet

- 11608-Driving Women Fiction and PDFDocument240 pages11608-Driving Women Fiction and PDFAleksi KnuutilaNo ratings yet

- C31 C31M 03aDocument5 pagesC31 C31M 03aJesus Luis Arce GuillermoNo ratings yet

- SSL: Smart Street Lamp Based On Fog Computing.: GUIDE: Asst. Prof. Haseena ADocument21 pagesSSL: Smart Street Lamp Based On Fog Computing.: GUIDE: Asst. Prof. Haseena ATeenaNo ratings yet

- OSN 9800 U64, U32, U16, UPS Installation GuideDocument157 pagesOSN 9800 U64, U32, U16, UPS Installation GuidedonekeoNo ratings yet

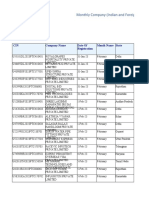

- Monthly-Company (Indian-and-Foreign) - and LLPs-20230301Document724 pagesMonthly-Company (Indian-and-Foreign) - and LLPs-20230301Yogesh Paigude0% (1)

- IELTS PART 1 (Autoguardado)Document8 pagesIELTS PART 1 (Autoguardado)CARLOS CAICEDONo ratings yet

- Draft WPSDocument3 pagesDraft WPSWale OyeludeNo ratings yet

- Colloquium: A Learner-Centric View of Mobile Seamless Learning Lung-Hsiang WongDocument5 pagesColloquium: A Learner-Centric View of Mobile Seamless Learning Lung-Hsiang WongWayne LeungNo ratings yet

- Electricity (Innovative Licence) Regulations 2023Document16 pagesElectricity (Innovative Licence) Regulations 2023BernewsAdminNo ratings yet