Professional Documents

Culture Documents

Introduction To Cost Management

Introduction To Cost Management

Uploaded by

sukesh0 ratings0% found this document useful (0 votes)

11 views4 pagesOriginal Title

introduction to cost management (2)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views4 pagesIntroduction To Cost Management

Introduction To Cost Management

Uploaded by

sukeshCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

ained an¢

relative!

eS With

towhich c

wand lich

like sal

service ¢

jer servi

involve in make/

nich

rn zations fe specific order

ne rant con nce co nga She TE SPE *

stor

costing ™ .

vet jobs oF POG ‘i Reeenuirementsanecac hy

eam Prete lowe csi Peialactuag

: ee : od is applies, as machine tool

jewhere workis ote costing Me ‘such as ma ool

ie i etna otto

ig Mor compara Lae

cee ol ran Be cen “peonrasoranaconiccd

cerns where Prod ale x and contra

manufacture, print oe ble where there is 802 erat beret work, such as is = § n of

js applica av ch ref fo cons! . gpecial requirements:

contract costing ork or ob. whe [er eT meet Ae ey period

*Ceomplishment of WOH OT action work Sted to be mit tinwed for = long period

“ris commenced Om site and not at the

of each portant feature tha J

‘contractor jn quantity of identical

premises ofthe conta . eronderscertaind

* sineases where acustomel OFC Pers

atch Costing This method is; icdincones rs rtueed orn a concern {0% splenishing

icine ora batch of identical parts oF

stocks

Continuous Operation Costing

CIMA defines continuous operation costing as the basic costing

Gr eorvices result front a series of eontinuols OF repetitive operations OF processes

or charged before being averaged over the units produced during the period”.

Where organizations which involve in mass production of products, through continuous opera:

tions, which will then be sold from stock ‘and will not be produced to the specific requirements of

aon ei re Theimportant feature of continuous operation costing is that, the process involves

inproduetio odntical unit of output and total costs are divided by number of units produced

to give the average cost per unit. The continuous operation costing is classified into the following:

method applicable where goods

to which costs

Process Costing It is used to ascertain the cost of each stas f fe

ol ge of manufacture where material

Fc a arin pains oan a al ra POMS products if

[ie n a final product saith bs

nat ier ges Ths met appa onde ceca, dairy,

Operation Costing This method is applic

pplicable where there i i

conducted though dierent operations. A See ee eerie Production

NE ita acer eaeh oan ig process may sometimes be sub-

a ration ion process is considered as a separate cost

cr alt hd ng pc

nae ‘sting’. tis applicable to the

of manufacture ‘i single artick

‘ eae nie articles luced are eae by acontinuous process

radio « is adopted in industries like logeneous or only a few

overheads are materials and labour ae ah continuous

‘horas in cas of continu ope cost ene bel cu

units produced, apportioned to eee Costing, all costs Hee a RE to cost unit and

centres from which shee materials, oe ql

IeSe Costs and overheads

Chapter 1 Introduction to Cost Accounting 17

{Types of Costing Systems

The important types of costing systems are discussed in brief as follows:

Historical Costing In this type of costing system, the costs are ascertained only after they have been

incurred. The main objective of it is to ascertain costs that have been incurred in past. Itis the

process of accumulation of costs after they are incurred in a systematic manner. The historical

costs are used only for postmortem examination of actual costs incurred and it would be too

late to control. The actual figures can be compared only when the standards of performance

exists.

Absorption Costing Under the ‘absorption costing system all fixed and variable costs are allotted

tocost units and total overheads are absorbed according to activity level. In absorption costing

system, fixed manufacturing overheads are allocated to products, and these are included in

stock valuation. Therefore, valuation of inventories of finished goods and WIP includes

manufacturing fixed cost and transferred to next period. Unlike manufacturing fixed overhead,

the administrative overhead, selling and distribution overheads are treated as fixed cost and

recorded only when they incurs. It is a traditional form of cost ascertainment. It is based on

the principle that costs should be charged or absorbed to whatever is being costed - be it cost

unit, cost centre - on the basis of the benefit received from these costs.

Direct Costing It is a method of costing in which the products charged with only those costs which

vary with volume. Variable or direct costs such as direct material, direct labour and variable

manufacturing expenses are examples of costs charged to the product. All indirect costs are

charged to profit and loss account of the period in which they arise. Indirect costs are

disregarded in inventory valuation.

Marginal Costing Under marginal costing, costs are classified into fixed and variable costs.

Variable costs are charged to unit cost and the fixed costs attributable to the relevant period

is written-off in full against the contribution for that period. Contribution margin indicates the

recovery of fixed cost before contributing towards the operational profit. This technique is

widely used for internal management purpose for decision making rather than for external

reporting.

Standard Costing Under standard costing system, the ascertainment and use of standard costs and

the measurement and analysis of variances is done for control purpose. Standard cost is a

predetermined cost which is computed in advance of production on the basis of a specification

of all the factors affecting costs and used in Standard Costing. Its main purpose is to provide

abase for control through Variance Accounting, for valuation of stock and work-in-prozress

and, in some cases, for fixing selling prices,

Uniform Costing It is not a distinct method of costing. It is the adoption of identical costing

principles and procedures by several units of the same industry or several undertakings by

mutual agreement. It facilitate valid comparisons between organizations and helpsin elimination

of inefficiencies.

Cost It represents the resources that have been or must be sacrificed to attain a particular objective.

Costing It involves in classification, recording, allocation, appropriation of expenses incurred to

facilitate the determination of the cost of the product or service.

Cost Accounting It deals with collection and analysis of relevant cost data for interpretation and

presentation for managerial decision making.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- IDirect Glenmark Q3FY22Document9 pagesIDirect Glenmark Q3FY22sukeshNo ratings yet

- Corporate Finance V2Document80 pagesCorporate Finance V2sukeshNo ratings yet

- Financing of Projects: Prof - Ashalatha Jkshim, NitteDocument27 pagesFinancing of Projects: Prof - Ashalatha Jkshim, NittesukeshNo ratings yet

- Project Management NotesDocument5 pagesProject Management NotessukeshNo ratings yet

- Investment Criteria: Prof - Ashalatha J.K.S.H I M, NitteDocument13 pagesInvestment Criteria: Prof - Ashalatha J.K.S.H I M, NittesukeshNo ratings yet

- Investment MGT MCQDocument19 pagesInvestment MGT MCQsukeshNo ratings yet

- Ilovepdf MergedDocument212 pagesIlovepdf MergedsukeshNo ratings yet

- 2nd Case StudyDocument2 pages2nd Case StudysukeshNo ratings yet

- Project Cash Flows: Prof - Ashalatha Jkshim, NitteDocument24 pagesProject Cash Flows: Prof - Ashalatha Jkshim, NittesukeshNo ratings yet

- Module 2 Question BankDocument3 pagesModule 2 Question BanksukeshNo ratings yet

- Lesson Plan: 20MBA42: Enterprise Systems Course Instructor - MR Raghupathi PaiDocument5 pagesLesson Plan: 20MBA42: Enterprise Systems Course Instructor - MR Raghupathi PaisukeshNo ratings yet

- Modified LESSON PLAN Mergers and Acquisitions 19 FinalDocument7 pagesModified LESSON PLAN Mergers and Acquisitions 19 FinalsukeshNo ratings yet

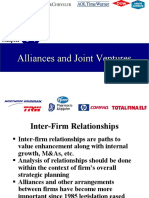

- Alliances and Joint VenturesDocument18 pagesAlliances and Joint VenturessukeshNo ratings yet

- 1 Basic Concepts Quiz-MergedDocument50 pages1 Basic Concepts Quiz-MergedsukeshNo ratings yet

- Supporting Facility: Creating The Right EnvironmentDocument63 pagesSupporting Facility: Creating The Right EnvironmentsukeshNo ratings yet

- Build Customer RelationshipsDocument50 pagesBuild Customer RelationshipssukeshNo ratings yet

- International Takeovers and RestructuringDocument18 pagesInternational Takeovers and RestructuringsukeshNo ratings yet

- Module 1 Part 2Document21 pagesModule 1 Part 2sukeshNo ratings yet

- Employee Stock Ownership and MlpsDocument20 pagesEmployee Stock Ownership and MlpssukeshNo ratings yet

- CH 05Document33 pagesCH 05sukeshNo ratings yet

- Case Study of ERP ImplementationDocument29 pagesCase Study of ERP ImplementationsukeshNo ratings yet

- Hersheys ERP ProjectDocument3 pagesHersheys ERP ProjectsukeshNo ratings yet

- Prime Cost Factory OHD VariableDocument7 pagesPrime Cost Factory OHD VariablesukeshNo ratings yet