Professional Documents

Culture Documents

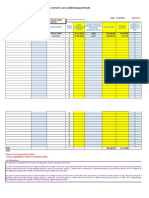

Grand Total 482,755 18,695 9,755 6,902

Uploaded by

quratulain0 ratings0% found this document useful (0 votes)

4 views3 pagesOriginal Title

Assignment

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views3 pagesGrand Total 482,755 18,695 9,755 6,902

Uploaded by

quratulainCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

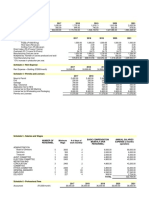

2021 2022

Employee's contribution Employer's contribution Employee's contribution Employer's contribution

Employee name Designation Base salary Base salary - 2021 Base salary - 2022 Deductions Fringe benefits Deductions Fringe benefits Total payroll cost Statutory benefits (CPP+EI) Employer's contribution Fringe benefit cost

Pension Insurance Pension Insurance Pension Insurance Pension Insurance

Rebecca Fernandez Director 172,000 86,000 86,000 2,257.5 679.4 2,257.5 951.2 2,343.5 679.4 2,343.5 951.2 178,503 12,463 6503 4,601

Sunil Joshi Analyst 80,000 - - 80,000 - - -

Jessica Cohen Analyst 83,000 - - 83,000 - - -

Takeshi Mirazawa Analyst 86,000 43,000 43,000 1,128.8 339.7 1,128.8 475.6 1,171.8 339.7 1,171.8 475.6 89,252 6,232 3,252 2,301

Claudia smith Administrative assistant 52,000 - - 52,000 - - -

Grand total 482,755 18,695 9,755 6,902

Canada Pension Plan (CPP) 2020 2021

Year's Maximum

$58,700 $61,600

Pensionable Earnings

Contribution Rate 5.25% 5.45%

Employment Insurance (EI) 2020 2021

Maximum Annual Insurable

$54,200 $56,300

Earnings

Regular EI Rates 2020 2021

Premium Rate (Employee) 1.58% 1.58%

Premium Rate (Employer)

2.21% 2.21%

(1.4 x Employee)

You might also like

- South Africa’s Renewable Energy IPP Procurement ProgramFrom EverandSouth Africa’s Renewable Energy IPP Procurement ProgramNo ratings yet

- Earned Value ChartDocument4 pagesEarned Value ChartRanda S JowaNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Abb Roi CalculationDocument1 pageAbb Roi Calculationapples.kingdom16No ratings yet

- The GE Way Fieldbook: Jack Welch's Battle Plan for Corporate RevolutionFrom EverandThe GE Way Fieldbook: Jack Welch's Battle Plan for Corporate RevolutionNo ratings yet

- ALTITUDE Presentation DeckDocument35 pagesALTITUDE Presentation DeckVikas ChaudharyNo ratings yet

- Income Statement - Annual - As Originally ReportedDocument6 pagesIncome Statement - Annual - As Originally ReportedSonia CrystalNo ratings yet

- Assignment 5.2 Note PayableDocument2 pagesAssignment 5.2 Note PayableKate HerederoNo ratings yet

- Aristro 73.74Document15 pagesAristro 73.74Bikash SedhainNo ratings yet

- Statement of Changes in Equity: Description Common Stock Retained Earning TotalDocument1 pageStatement of Changes in Equity: Description Common Stock Retained Earning TotalAldi JaelaniNo ratings yet

- Final Project Working1Document15 pagesFinal Project Working1Krutagna KadiaNo ratings yet

- Chandak Insurance Services: Magic Mix Illustration For Mr. - (Age 25)Document5 pagesChandak Insurance Services: Magic Mix Illustration For Mr. - (Age 25)Mohit DhakaNo ratings yet

- Acharya Electronics Bhakundebesi 07, Namobuddha Kavre Nepal Project Feasibility ReportDocument9 pagesAcharya Electronics Bhakundebesi 07, Namobuddha Kavre Nepal Project Feasibility ReportRamHari AdhikariNo ratings yet

- Shell, ResultadosDocument9 pagesShell, Resultadosandre.torresNo ratings yet

- Sno. Sections Amount (Inr) Sep-21 Civil and Structural ADocument4 pagesSno. Sections Amount (Inr) Sep-21 Civil and Structural AJay UseitNo ratings yet

- SubhashDocument1 pageSubhashsubhash221103No ratings yet

- Materiales Cerdanya IndividualDocument4 pagesMateriales Cerdanya IndividualSofía MargaritaNo ratings yet

- Aisha Steel Mills LTDDocument19 pagesAisha Steel Mills LTDEdnan HanNo ratings yet

- Development Phase: PhasingDocument8 pagesDevelopment Phase: PhasingRahul lodhaNo ratings yet

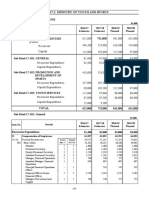

- Ministry of Power: Demand No. 77Document6 pagesMinistry of Power: Demand No. 77deepak sharmaNo ratings yet

- 2022full Year Audited Group ResultsDocument1 page2022full Year Audited Group ResultsGithui KiunaNo ratings yet

- Mr. Nittin Rastogi ,: Page 1 of 4Document5 pagesMr. Nittin Rastogi ,: Page 1 of 4manashvi mishraNo ratings yet

- Harrisons 2022 Annual Report Final CompressedDocument152 pagesHarrisons 2022 Annual Report Final Compressedarusmajuenterprise80No ratings yet

- Avocado TeaDocument61 pagesAvocado TeaManto RoderickNo ratings yet

- 2 Break-Even-Point-Of-Production - Công Thức Tính Điểm Hòa Vốn Sản Xuất Đơn GiảnDocument6 pages2 Break-Even-Point-Of-Production - Công Thức Tính Điểm Hòa Vốn Sản Xuất Đơn GiảnJA BLOGNo ratings yet

- 1663923012kelani Cables PLC Annual Report 2021Document128 pages1663923012kelani Cables PLC Annual Report 2021Sasindu GimhanNo ratings yet

- Cost BaselineDocument2 pagesCost BaselineRaisa MoniNo ratings yet

- Cost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesDocument2 pagesCost Estimate: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesRanda S JowaNo ratings yet

- Cargills Ceylon Sustainability 2020-21 FinalDocument52 pagesCargills Ceylon Sustainability 2020-21 FinalPasindu HarshanaNo ratings yet

- Gyoo 1Document2 pagesGyoo 1Jihane TanogNo ratings yet

- Cost Baseline: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesDocument2 pagesCost Baseline: Project Name: Date: Month 1 2 3 4 5 6 WBS CategoriesEka RinjaniNo ratings yet

- FY2024 Proposed BudgetDocument17 pagesFY2024 Proposed BudgetArif EWSNo ratings yet

- Tax CalDocument10 pagesTax CalPuneet AggarwalNo ratings yet

- 011 September 2022Document21 pages011 September 2022John Louie LagunaNo ratings yet

- Webinar ESG OJK Institute - 20 Mei 2021 Rev 19052021FDocument12 pagesWebinar ESG OJK Institute - 20 Mei 2021 Rev 19052021FManonsih Victorya100% (2)

- Error and Corrections Solutionpa CheckDocument5 pagesError and Corrections Solutionpa Checkmartinfaith958No ratings yet

- ToyotaDocument4 pagesToyotaعبدالرحمن منصورNo ratings yet

- Financial Projection Master DistributorDocument3 pagesFinancial Projection Master DistributorArié WibowoNo ratings yet

- Beckwith Crossing Homeowners Association Inc: 1/31/2022 Balance Sheet ForDocument5 pagesBeckwith Crossing Homeowners Association Inc: 1/31/2022 Balance Sheet ForKsk sidkdNo ratings yet

- Jinkosolar Holding Co., LTD.: Q3 2017 Earnings Call PresentationDocument10 pagesJinkosolar Holding Co., LTD.: Q3 2017 Earnings Call PresentationAshutosh KumarNo ratings yet

- Indr 202 hw5Document5 pagesIndr 202 hw5Arda SahinNo ratings yet

- Target Market Every Month 3,600.00 Average Sales Per Customer 25.00Document4 pagesTarget Market Every Month 3,600.00 Average Sales Per Customer 25.00Mark Harold RaspadoNo ratings yet

- Summer Placement Report 2021-23Document8 pagesSummer Placement Report 2021-23SHIVAM BAREJANo ratings yet

- Sales Report 2020 Vs 2021Document114 pagesSales Report 2020 Vs 2021Hongyi KaltimNo ratings yet

- Ab Ipc9Document1 pageAb Ipc9hagos aregawiNo ratings yet

- Year 1 Expenses and Cashflow ForecastDocument1 pageYear 1 Expenses and Cashflow ForecastTully HamutenyaNo ratings yet

- MKWD Budget Summary 2012 2014Document19 pagesMKWD Budget Summary 2012 2014Roland AnaumNo ratings yet

- SCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Document7 pagesSCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Nathalie PadillaNo ratings yet

- MpsDocument2 pagesMpsSum WhosinNo ratings yet

- 2.office of The AdministratorDocument7 pages2.office of The AdministratorVIRGILIO OCOY IIINo ratings yet

- Rencana Kegiatan Dan Anggaran Sekolah (Rkas) SMK Negeri 1 Tampaksiring TAHUN 2019Document27 pagesRencana Kegiatan Dan Anggaran Sekolah (Rkas) SMK Negeri 1 Tampaksiring TAHUN 2019DESA PUTERANo ratings yet

- Statement - The Spirit School LayyahDocument1 pageStatement - The Spirit School LayyahSheraz AhmadNo ratings yet

- Analisis Beban Kerja: Nama Jabatan Unit Kerja Ikhtisar JabatanDocument4 pagesAnalisis Beban Kerja: Nama Jabatan Unit Kerja Ikhtisar Jabatanfitri66 GembrotNo ratings yet

- Recurrent Capital: Vote 17-1: Ministry of Youth and SportsDocument7 pagesRecurrent Capital: Vote 17-1: Ministry of Youth and SportsKimmy2010No ratings yet

- AUDITDocument12 pagesAUDITdavid giriNo ratings yet

- Income Statment of RideyaDocument4 pagesIncome Statment of Rideyafaizan mughalNo ratings yet

- Ilovepdf - MRPDocument3 pagesIlovepdf - MRPPramod ramprsad PàtidarNo ratings yet

- June 7 2021 Grand Forks Mayors 2022 Budget PreviewDocument29 pagesJune 7 2021 Grand Forks Mayors 2022 Budget PreviewJoe BowenNo ratings yet

- CVX CfraDocument9 pagesCVX CfraWilliam RomeroNo ratings yet

- SFUC Heartlab 1st Disbursement 2020Document4 pagesSFUC Heartlab 1st Disbursement 2020Mickey MeowNo ratings yet

- Varieties of CapitalismDocument9 pagesVarieties of CapitalismquratulainNo ratings yet

- Audit and AssuranceDocument11 pagesAudit and AssurancequratulainNo ratings yet

- HRM - Assignment One - V10Document8 pagesHRM - Assignment One - V10quratulainNo ratings yet

- Assessment 3 A. Information Technology (It)Document6 pagesAssessment 3 A. Information Technology (It)quratulainNo ratings yet

- Business Proposal: Executive SummaryDocument5 pagesBusiness Proposal: Executive SummaryquratulainNo ratings yet

- Are Humans Inherently Good or EvilDocument6 pagesAre Humans Inherently Good or EvilquratulainNo ratings yet

- Reflective JournalDocument7 pagesReflective JournalquratulainNo ratings yet

- Managing People and Employee RelationsDocument10 pagesManaging People and Employee RelationsquratulainNo ratings yet

- Workbook - Moving and HandlingDocument7 pagesWorkbook - Moving and HandlingquratulainNo ratings yet

- Charles Sturt University: Student Name: Student Number: Subject Code: Submission Date: Final Word CountDocument10 pagesCharles Sturt University: Student Name: Student Number: Subject Code: Submission Date: Final Word CountquratulainNo ratings yet

- Leadership and Managerial Crises in Woolworth: Bma547 Organizational BehaviourDocument9 pagesLeadership and Managerial Crises in Woolworth: Bma547 Organizational BehaviourquratulainNo ratings yet

- Funding A Listed Shipping CompanyDocument15 pagesFunding A Listed Shipping CompanyquratulainNo ratings yet

- Leadership and Managerial Crises in Woolworth: Bma547 Organizational BehaviourDocument9 pagesLeadership and Managerial Crises in Woolworth: Bma547 Organizational BehaviourquratulainNo ratings yet

- Case Study Part 2 - ACG512Document11 pagesCase Study Part 2 - ACG512quratulainNo ratings yet

- Are Humans Inherently Good or Evil 2Document6 pagesAre Humans Inherently Good or Evil 2quratulainNo ratings yet

- Analysis of The Relationship Between Crude Palm Kernel Oil (CPKO) Spot Price and Futures Crude Palm Oil Contract (FCPO) in MalaysiaDocument7 pagesAnalysis of The Relationship Between Crude Palm Kernel Oil (CPKO) Spot Price and Futures Crude Palm Oil Contract (FCPO) in MalaysiaquratulainNo ratings yet

- Grade Sheet - October 2015 GraduatingDocument19 pagesGrade Sheet - October 2015 GraduatingEppie SeverinoNo ratings yet

- In-Vitro Fertilisation: Shruti Samal ROLL NUMBER - 1120096 B.Sc. Life Science Second SemesterDocument20 pagesIn-Vitro Fertilisation: Shruti Samal ROLL NUMBER - 1120096 B.Sc. Life Science Second SemesterSHRUTI SAMALNo ratings yet

- Ecr CHLN Rec GNGGN2181420000 2032402009318 1707564018901 2024021060618902769Document1 pageEcr CHLN Rec GNGGN2181420000 2032402009318 1707564018901 2024021060618902769Brijesh GuptaNo ratings yet

- IVF Family Law IDocument8 pagesIVF Family Law IJaishree KaushikNo ratings yet

- Alonge, Mark - The Hymn To Zeus From Palaikastro. Religion and Tradition in Post-Minoan Crete (Greece) (PHD Thesis Stanford, UMI 2006, 275pp)Document275 pagesAlonge, Mark - The Hymn To Zeus From Palaikastro. Religion and Tradition in Post-Minoan Crete (Greece) (PHD Thesis Stanford, UMI 2006, 275pp)Marko MilosevicNo ratings yet

- Analisis Fertilitas Provinsi Maluku Tahun 2010-2035: October 2020Document12 pagesAnalisis Fertilitas Provinsi Maluku Tahun 2010-2035: October 2020Sindi FatikasaryNo ratings yet

- Formal Letter For Dole For NocDocument2 pagesFormal Letter For Dole For Nocricardo paculanNo ratings yet

- InfertilityDocument8 pagesInfertilityrivannyNo ratings yet

- Challan Jan 2023Document1 pageChallan Jan 2023taxin haryanaNo ratings yet

- Antenatal ExaminationDocument18 pagesAntenatal ExaminationMiu MiuNo ratings yet

- Natural Method To Control BirthDocument8 pagesNatural Method To Control BirthManish OliNo ratings yet

- Products: List of Products/Riders With UIN'sDocument9 pagesProducts: List of Products/Riders With UIN'sRahul JeswaniNo ratings yet

- Penerapan Clinical Audit Untuk DokterDocument23 pagesPenerapan Clinical Audit Untuk DokterPratiwi DewiNo ratings yet

- Egg DonationDocument36 pagesEgg DonationJuneNo ratings yet

- Sympto Thermal MethodDocument2 pagesSympto Thermal MethodCJ PorrasNo ratings yet

- Introduction To Birth ControlDocument3 pagesIntroduction To Birth Contrololarewaju AnimasahunNo ratings yet

- March 2021 Payslip CPSDocument41 pagesMarch 2021 Payslip CPSWjz WjzNo ratings yet

- Blank DTRDocument5 pagesBlank DTRKelly Shaye BaynoNo ratings yet

- TataDocument8 pagesTataSherry SahaNo ratings yet

- Retirement Benefits: Modes of Retirement Under R.A 1616Document1 pageRetirement Benefits: Modes of Retirement Under R.A 1616RonaldDechosArnocoGomezNo ratings yet

- I Gusti Nyoman Anton Surya Diputra - Assignment 2Document2 pagesI Gusti Nyoman Anton Surya Diputra - Assignment 2I Gusti Nyoman Anton Surya DiputraNo ratings yet

- Multi Age Child CareDocument2 pagesMulti Age Child Carechhagan maganNo ratings yet

- LIC WorksheetDocument4 pagesLIC Worksheetamit sharmaNo ratings yet

- Prospectus Crèche - TT EnglishDocument1 pageProspectus Crèche - TT EnglishPradines MameloNo ratings yet

- TijuanaDocument6 pagesTijuanaRoy MarínNo ratings yet

- Assisted Reproductive Techniques For Class 12 Investigatory ProjectDocument9 pagesAssisted Reproductive Techniques For Class 12 Investigatory Projectjerusha50% (6)

- FERTILITY Concepts and MeasuresDocument27 pagesFERTILITY Concepts and MeasuresMark Emann Baliza MagasNo ratings yet

- Faktor - Faktor Risiko Terjadinya Infertilitas Pada Wanita Pasangan Usia Subur Di Dusun V Desa Kolam Kecamatan Percut Sei Tuan Tahun 2020Document6 pagesFaktor - Faktor Risiko Terjadinya Infertilitas Pada Wanita Pasangan Usia Subur Di Dusun V Desa Kolam Kecamatan Percut Sei Tuan Tahun 2020Anastasia AbrahamNo ratings yet

- InVitroFertilization IVF KP AnalysisDocument14 pagesInVitroFertilization IVF KP AnalysisOvn Murthy100% (1)

- GenderDocument14 pagesGenderiko552000No ratings yet