Professional Documents

Culture Documents

Abdul Azis Faisal - 041611333243 - Kelas L

Uploaded by

Abdul AzisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abdul Azis Faisal - 041611333243 - Kelas L

Uploaded by

Abdul AzisCopyright:

Available Formats

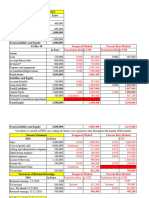

Solution P14-3

1 Soo Company, Ltd.

Translation Worksheet for 2011

British Exchange

Pounds Rate US Dollars

Debits

Cash 20,000 $1.65 C $ 33,000

Accounts receivable — net 70,000 1.65 C 115,500

Inventories 50,000 1.65 C 82,500

Equipment 800,000 1.65 C 1,320,000

Cost of sales 350,000 1.63 A 570,500

Depreciation expense 80,000 1.63 A 130,400

Operating expenses 100,000 1.63 A 163,000

Dividends 30,000 1.62 R 48,600

1,500,000 $2,463,500

Credits

Accumulated depreciation 330,000 $1.65 C $ 544,500

Accounts payable 70,000 1.65 C 115,500

Capital stock 400,000 1.60 H 640,000

Retained earnings 100,000 measured 160,000

Sales 600,000 1.63 978,000

Equity adjustment from translation 25,500

1,500,000 $2,463,500

2 Journal entries — 2011

January 1, 2011

Investment in Soo $800,000

Cash $800,000

To record purchase of Soo at book value.

During 2011

Cash $ 48,600

Investment in Soo $ 48,600

To record dividends from Soo.

December 31, 2011

Investment in Soo $139,600

Income from Soo $114,100

Equity adjustment from translation 25,500

To record income from Soo and enter equity adjustment for

currency fluctuations.

Check:

Investment in Soo 1/1 $800,000 Capital stock 400,000 £

Dividends (48,600) Retained earnings 1/1 100,000 £

Income from Soo 114,100 Add: Income 70,000 £

Equity adjustment 25,500 Less: Dividends (30,000)£

Investment in Soo 12/31 $891,000 Stockholders’ equity 540,000 £

Current rate $ 1.65

$891,000

3.

Book Value Beginning Net Assets 50,000 pounds x ($1.65 - $1.60) $25,000

Add: Net income 70,000 pounds x ($1.65 - $1.63) 1,400

Less: Dividends 30,000 pounds x ($1.65 - $1.62) (900)

Effect of exchange rate changes on net assets $25,500

You might also like

- Philippine Taxation Encyclopedia Third Release 2019 - 01Document173 pagesPhilippine Taxation Encyclopedia Third Release 2019 - 01Patricia Arpilleda100% (1)

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Translation of Foreign Currency StatementDocument5 pagesTranslation of Foreign Currency StatementPea Del Monte AñanaNo ratings yet

- PR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Document15 pagesPR AKLII Bab 14 Dan 15 Sarah Puspita Anggraini (411796)Satrio Saja67% (3)

- Depletion: Valix, C. T. Et Al. Intermediate GIC Enterprises & Co. IncDocument21 pagesDepletion: Valix, C. T. Et Al. Intermediate GIC Enterprises & Co. IncJoris YapNo ratings yet

- Acca Afm (P4)Document36 pagesAcca Afm (P4)SamanMurtazaNo ratings yet

- University of Luzon College of Accountancy Acc 412 - Equity Part 2Document5 pagesUniversity of Luzon College of Accountancy Acc 412 - Equity Part 2fghhnnnjmlNo ratings yet

- Revision1 2 3Document4 pagesRevision1 2 3Diệu QuỳnhNo ratings yet

- P1 Cash FlowDocument2 pagesP1 Cash FlowBeth Diaz LaurenteNo ratings yet

- 6 - Pat & Sat Co. - PALACIODocument7 pages6 - Pat & Sat Co. - PALACIOPinky DaisiesNo ratings yet

- Kunci Kuis AKL 2Document9 pagesKunci Kuis AKL 2Ilham Dwi NoviantoNo ratings yet

- Advance Accounting P14-3Document2 pagesAdvance Accounting P14-3Jeremy BastantaNo ratings yet

- KASUS 1 - TranslasiDocument3 pagesKASUS 1 - TranslasiainopeNo ratings yet

- Ujian 1 AdvDocument33 pagesUjian 1 AdvaraNo ratings yet

- CH 14 - Translation SolutionDocument3 pagesCH 14 - Translation SolutionJosua PranataNo ratings yet

- Corporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Document9 pagesCorporate Finance Practice Problems: Jeter Corporation Income Statement For The Year Ended 31, 2001Eunice NanaNo ratings yet

- Final RevisionDocument100 pagesFinal RevisionhuongtratranthibnNo ratings yet

- ACCT103 Supplementary Notes Cash and Cash EquivalentsDocument1 pageACCT103 Supplementary Notes Cash and Cash EquivalentsChrislyn Janna BeljeraNo ratings yet

- hw032 Question 1Document3 pageshw032 Question 1Mai Hương NguyễnNo ratings yet

- BAb X Buku Bu IInDocument16 pagesBAb X Buku Bu IInAditya Agung SatrioNo ratings yet

- Acct 4010 Ch2-Handout-SolutionDocument4 pagesAcct 4010 Ch2-Handout-Solutionlokyee801mikiNo ratings yet

- Chapter 13 (4) Additional QuestionDocument2 pagesChapter 13 (4) Additional QuestionJason BickertNo ratings yet

- Purchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalanceDocument14 pagesPurchase Price and Implied Value Less: Book Value of Equity Acquired: Difference Beetwen Implied and Book Value Record New Goodwil BalancesallyNo ratings yet

- Study Unit Three Activity Ratios and Special IssuesDocument11 pagesStudy Unit Three Activity Ratios and Special IssuessimarjeetNo ratings yet

- Cost of Goods ManufacturedDocument3 pagesCost of Goods ManufacturedLorie RoncalNo ratings yet

- Jawaban Soal Hitungan Bab 4Document16 pagesJawaban Soal Hitungan Bab 4Aheir lessNo ratings yet

- Bonifacio Written ReportDocument4 pagesBonifacio Written ReportAnonymous qi4PZkNo ratings yet

- Financial Statement Analysis Basic ConceptsDocument32 pagesFinancial Statement Analysis Basic ConceptsLester KhanNo ratings yet

- Unit 3Document13 pagesUnit 3hassan19951996hNo ratings yet

- Task AccountingDocument2 pagesTask AccountingQudsia BanoNo ratings yet

- Accounting AssignmentDocument5 pagesAccounting AssignmentVivek SinghNo ratings yet

- Solution To Problems - Chapter 9Document25 pagesSolution To Problems - Chapter 9GFGSHSNo ratings yet

- IFRS 9 Non-Strategic Equity Investments ExampleDocument10 pagesIFRS 9 Non-Strategic Equity Investments Examplenicklewandowski87No ratings yet

- Chapter 15Document5 pagesChapter 15Renzo RamosNo ratings yet

- Chapter 15 PDFDocument5 pagesChapter 15 PDFRenzo RamosNo ratings yet

- Case 8 2 Palmerstown Company - CompressDocument4 pagesCase 8 2 Palmerstown Company - CompressPhương Nguyễn HàNo ratings yet

- Latihan Aklan 2 Lab UTSDocument10 pagesLatihan Aklan 2 Lab UTSpermataayu31No ratings yet

- Bsa-1e Amor, Roma Jane B.Document4 pagesBsa-1e Amor, Roma Jane B.Roma Jane AmorNo ratings yet

- LESSON 2 Financial StaementDocument6 pagesLESSON 2 Financial StaementSHININo ratings yet

- Balances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareDocument4 pagesBalances Preference Dividend Liquidation Premium Balance To Common Outstanding Shares Book Value/ShareJhazreel BiasuraNo ratings yet

- Bab III Buku Bu IinDocument14 pagesBab III Buku Bu IinAditya Agung SatrioNo ratings yet

- Febbinia Dwigna P - Week7 AKL 1Document5 pagesFebbinia Dwigna P - Week7 AKL 1febbiniaNo ratings yet

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDocument17 pagesA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONo ratings yet

- Mojks Uas 2010 GasalDocument13 pagesMojks Uas 2010 GasalHayyin Nur AdisaNo ratings yet

- AccountingDocument4 pagesAccountingAimie Licos EstradaNo ratings yet

- Stock Acquisition Quiz 100% AnswerDocument2 pagesStock Acquisition Quiz 100% AnswerJohn BalanquitNo ratings yet

- Q1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDDocument8 pagesQ1) May 2011 ZA Q1 - Ear, Mouth & Nose Mouth LTD Nose LTDduong duongNo ratings yet

- Dian Sari (A031171703) Tugas Akl IiDocument3 pagesDian Sari (A031171703) Tugas Akl Iidian sariNo ratings yet

- Financial Management 1 ProblemsDocument12 pagesFinancial Management 1 ProblemsXytusNo ratings yet

- Forex Translation Computational: Total P564,000Document6 pagesForex Translation Computational: Total P564,000Elizabeth DumawalNo ratings yet

- Chapter 15Document12 pagesChapter 15Nikki GarciaNo ratings yet

- Club A/c's: TopicDocument16 pagesClub A/c's: TopicJames KAGWAPENo ratings yet

- Solutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)Document36 pagesSolutions To Exercises and Problems Exercises E5.1 Combination and Consolidation, Date of Acquisition (See Related E3.1)sunnyauliaNo ratings yet

- CorpoDocument16 pagesCorpoErica JoannaNo ratings yet

- CFASDocument3 pagesCFASataydeyessaNo ratings yet

- Henny Fausta - 2201750295 - Le53Document3 pagesHenny Fausta - 2201750295 - Le53Henny FaustaNo ratings yet

- 1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Document9 pages1130 - 89 - Tugas Pribadi Akl Pertemuan 9 Dan 11Maulana AmriNo ratings yet

- Name: Shania Rose P. Binwag Illustration 1Document3 pagesName: Shania Rose P. Binwag Illustration 1ShaniaRose BinwagNo ratings yet

- 5-1 and 5-4Document2 pages5-1 and 5-4Rundhille AndalloNo ratings yet

- Corporate Liquidation Hand Outs SolutionsDocument21 pagesCorporate Liquidation Hand Outs SolutionsJack HererNo ratings yet

- MGMT AssignmentDocument79 pagesMGMT AssignmentLuleseged Gebre100% (1)

- Nama: Dian Sari NIM: A031171703 Mid Akuntansi Keuangan Lanjutan IiDocument3 pagesNama: Dian Sari NIM: A031171703 Mid Akuntansi Keuangan Lanjutan Iidian sariNo ratings yet

- Exercises On DividendsDocument16 pagesExercises On DividendsGrace RoqueNo ratings yet

- Unit 4. Financial Statement Analysis - LimitationsDocument8 pagesUnit 4. Financial Statement Analysis - LimitationsWoodsville HouseNo ratings yet

- Trial BalanceDocument9 pagesTrial BalanceJasmine ActaNo ratings yet

- FS Mo IiiDocument67 pagesFS Mo Iiiarul kumarNo ratings yet

- Intermediate Accounting 8Th Edition Spiceland Test Bank Full Chapter PDFDocument67 pagesIntermediate Accounting 8Th Edition Spiceland Test Bank Full Chapter PDFchanelleeymanvip100% (11)

- Kaplan Ruback - Apv 1995 PDFDocument39 pagesKaplan Ruback - Apv 1995 PDFAlejandro Arispe PlazaNo ratings yet

- Project VipDocument71 pagesProject VipsamiNo ratings yet

- AssignmentDocument5 pagesAssignmentSanchay BhararaNo ratings yet

- Ratios AnalysisDocument17 pagesRatios AnalysisAbraham LinkonNo ratings yet

- 320 (April 2013) PDFDocument19 pages320 (April 2013) PDFChanzey ɢғxNo ratings yet

- Justdial Quarterly Financials (FY 2019 20) 191021095203Document10 pagesJustdial Quarterly Financials (FY 2019 20) 191021095203Govardhan RaviNo ratings yet

- DIVIDENDS ON PREFERENCE AND ORDINARY SHARES - Del RosarioDocument17 pagesDIVIDENDS ON PREFERENCE AND ORDINARY SHARES - Del RosarioPamela Ledesma SusonNo ratings yet

- Assigment 3Document7 pagesAssigment 3lobo.larisseNo ratings yet

- UCLA - SyllabusDocument7 pagesUCLA - SyllabushoalongkiemNo ratings yet

- Intermediate Accounting 17th Edition Kieso Test BankDocument56 pagesIntermediate Accounting 17th Edition Kieso Test Bankesperanzatrinhybziv100% (28)

- Timber Flooring Financial Data Student Clean 11-2-2021Document67 pagesTimber Flooring Financial Data Student Clean 11-2-2021Aditya HonguntiNo ratings yet

- Understanding Financial StatementsDocument32 pagesUnderstanding Financial StatementsAravinda RuwanNo ratings yet

- Rise FAR 2 LecturesDocument288 pagesRise FAR 2 LecturesEll EssNo ratings yet

- FABM 2 Part 1 SCIDocument39 pagesFABM 2 Part 1 SCIKeshlyn Kelly ToledoNo ratings yet

- Jai Balaji Ind-Q3 Result LegalDocument10 pagesJai Balaji Ind-Q3 Result LegalRaghav HNo ratings yet

- Pricing Mechanisms - Paul Hastings - PWCDocument8 pagesPricing Mechanisms - Paul Hastings - PWCcontactpulkitagarwalNo ratings yet

- MB0025 Financial and Management AccountingDocument7 pagesMB0025 Financial and Management Accountingvarsha100% (1)

- Charter Communication - DATADocument4 pagesCharter Communication - DATARahil VermaNo ratings yet

- Preparation of Financial StatementsDocument5 pagesPreparation of Financial StatementsOji ArashibaNo ratings yet

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDocument11 pagesSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNo ratings yet

- Financial Management-Part 1Document44 pagesFinancial Management-Part 1Papa KingNo ratings yet

- Ratio AnalysisDocument5 pagesRatio AnalysisAnu VenkateshNo ratings yet