Professional Documents

Culture Documents

Nike Inc - Financial Management

Uploaded by

Simon Erick0 ratings0% found this document useful (0 votes)

6 views1 pageCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageNike Inc - Financial Management

Uploaded by

Simon ErickCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

Nike Inc.

: Cost of Capital

Syndicate 6

Mitranti Anindya Ayu – 29121020

Joseph Gunawan – 29121035

Aditya Erawan –

Simon Erick - 29121289

1. What is WACC?

WACC or the Weighted Average Cost of Capital is a rate which firms can raise investment for

ongoing or future project. WACC is an average cost because it is a weighted average of the

firm’s component cost of capital, included the cost of debt to debt holders and cost of equity

to shareholders. WACC is calculated by consider the relative weight of each component of

the capital structure (debt and equity) and used to see if the investment is worth taking.

Why is it so important to estimate firm’s cost?

WACC can be used to estimate a firm’s cost of capital to decide capital budging decision.

Cost of capital is used to decide whether an investment proposal should be undertaken or

not. In the other hands, WACC can be observed constantly to see the market changes in

interest rate on load and dividend rates on stocks to make a better choice of the source

financing when the firm needs financing. And last, WACC can be used as a measure to

evaluate the performance of the firm based on comparing the returns that it is getting from

a selected project and the cost it is incurring in raising the finance for this project.

Do you agree with Joanna Cohen’s WACC calculation? Why?

Joanna Cohen’s calaculation is using 8.4% CAPM model and I do not agree with her WACC

because Joanna’s calculation is using the book value for debt and equity, which they are uses

as an estimate of market value and the book value of equity should not be used when

calculating cost of capital.

You might also like

- Integrative Approach Blemba 65Document26 pagesIntegrative Approach Blemba 65Simon ErickNo ratings yet

- Distributive Approach (Student)Document19 pagesDistributive Approach (Student)Simon ErickNo ratings yet

- Syndicate 6 - Vitality Health Enterprise CaseDocument6 pagesSyndicate 6 - Vitality Health Enterprise CaseSimon ErickNo ratings yet

- Rational Negotiation: Manahan SiallaganDocument28 pagesRational Negotiation: Manahan SiallaganSimon ErickNo ratings yet

- Vacation Plans: Preparation & DiscussionDocument8 pagesVacation Plans: Preparation & DiscussionSimon ErickNo ratings yet

- Syndicate 6 - Gainesboro Machine Tools CorporationDocument12 pagesSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickNo ratings yet

- Scenario Planning - Syndicate 6Document13 pagesScenario Planning - Syndicate 6Simon ErickNo ratings yet

- Sky Deutschland (A) Summary - 29121289 - Simon ErickDocument1 pageSky Deutschland (A) Summary - 29121289 - Simon ErickSimon ErickNo ratings yet

- Financial Management Ratio Analysis - 29121289 - Simon ErickDocument7 pagesFinancial Management Ratio Analysis - 29121289 - Simon ErickSimon ErickNo ratings yet

- Demand Management and Forecasting (Wilkins Case) - Syndicate 6Document8 pagesDemand Management and Forecasting (Wilkins Case) - Syndicate 6Simon ErickNo ratings yet

- Room 3 - BrandingDocument10 pagesRoom 3 - BrandingSimon ErickNo ratings yet

- Analytic Hierarchi Process - 29121289 Simon ErickDocument11 pagesAnalytic Hierarchi Process - 29121289 Simon ErickSimon ErickNo ratings yet

- Breakout Room 6 Class Exercise 11Document3 pagesBreakout Room 6 Class Exercise 11Simon ErickNo ratings yet

- Assignment 3 Business Economics Sweet Potato CaseDocument7 pagesAssignment 3 Business Economics Sweet Potato CaseSimon Erick50% (2)

- Mindmap Chapter 13 Capital BudgetingDocument1 pageMindmap Chapter 13 Capital BudgetingSimon ErickNo ratings yet

- Mindmap Chapter 5 Cost-Volumn Profit AnalysisDocument1 pageMindmap Chapter 5 Cost-Volumn Profit AnalysisSimon Erick50% (2)

- Sindikat 6 - Assignment 1 - Business EconomicsDocument11 pagesSindikat 6 - Assignment 1 - Business EconomicsSimon ErickNo ratings yet

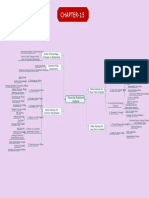

- Mindmap Chapter 15 Financial Statement Analysis & Ratio AnalysisDocument1 pageMindmap Chapter 15 Financial Statement Analysis & Ratio AnalysisSimon Erick100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)