Professional Documents

Culture Documents

Mindmap Chapter 15 Financial Statement Analysis & Ratio Analysis

Uploaded by

Simon Erick100%(1)100% found this document useful (1 vote)

99 views1 pageCopyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

99 views1 pageMindmap Chapter 15 Financial Statement Analysis & Ratio Analysis

Uploaded by

Simon ErickCopyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 1

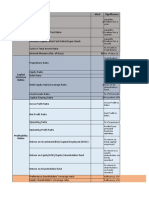

CHAPTER-15

Horizontal Analysis (Trend Analysis)

Dollar & Percentage

Year-to-Year Changes within Changes on Statements

a Set of Financial Statements

Vertical Analysis Common-Size Current Asset

Relations among Financial Statement Accounts Statements 1. Working Capital

Current Liabilities

2. Current Ratio Current Asset

Net Income

Current Liabilities

Preferred Dividends 1. Earnings per Share

Cash

Average Number of Common Shares Marketable Securities

Market Price per Share

2. Price-Earnings Ratio

Ratio Analysis for 3. Acid-Test (Quick) Ratio Accounts Receivable

Earnings per Share Short Term Creditor

Short-term Notes Receiveables

Dividends per Share Financial Statement Current Liabilities

3. Divident Payout Ratio

Earnings per Share Analysis Sales on Account

4. Accounts Receiveable

Dividends per Share 4. Divident Yield Ratio Turnover Average Accounts

Receiveable Balance

Market Price per Share Ratio Analysis for Cost of Goods Sold

Net Income Common Stockholder 5. Inventory Turnover

Average Inventory Balance

Interest Expense 5. Return on Total Assets

Tax Rate Earnings before Interest Expen

and Income Taxes

Average Total Assets 1. Times Interest Earned Ratio

Ratio Analysis for Interest Expense

Net Income 6. Return on Common Long Term Creditor

Preferred Dividends Stakeholder's Equity 2. Debt-to-Equity Ratio

Total Liabilities

Average Common

Stockholder's Equity

Stockholders Equity

Total Stockholder's Equity

7. Book Value per Share

Preferred Stock

Number of Common Shares

You might also like

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- CFA Level 1 Financial Ratios SheetDocument3 pagesCFA Level 1 Financial Ratios SheetVineet Kumar100% (1)

- Ratio Analysis: 1. Liquidity RatiosDocument2 pagesRatio Analysis: 1. Liquidity RatiosJawad AliNo ratings yet

- How Formula Expressed Meaning: Current Assets Current LiabilitiesDocument5 pagesHow Formula Expressed Meaning: Current Assets Current LiabilitiesHemraj VermaNo ratings yet

- Handout AP 2301Document13 pagesHandout AP 2301Dyosa MeNo ratings yet

- Liquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Document3 pagesLiquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Akinola WinfulNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- Ratio Analysis NepalDocument10 pagesRatio Analysis NepalDeep KrishnaNo ratings yet

- Ratio AnalysisDocument26 pagesRatio AnalysisDeep KrishnaNo ratings yet

- Financial Ratio Analysis-RatiosDocument3 pagesFinancial Ratio Analysis-RatiosMikaela LacabaNo ratings yet

- Nas 33 EpsDocument61 pagesNas 33 EpsbinuNo ratings yet

- SL No Description A Liquidity RatiosDocument10 pagesSL No Description A Liquidity RatiosMohamed SururrNo ratings yet

- Financial Statement Analysis: Exhibit 12-10Document1 pageFinancial Statement Analysis: Exhibit 12-10prince100% (1)

- Summary of RatiosDocument1 pageSummary of RatiosShamima AkterNo ratings yet

- Metalanguage: Big Picture in Focus: UlocDocument24 pagesMetalanguage: Big Picture in Focus: Ulocedwen pajeNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisSHENo ratings yet

- Accounting Measures & Firm Performance: Ratio CalculationDocument7 pagesAccounting Measures & Firm Performance: Ratio CalculationVítor Gularte de OliveiraNo ratings yet

- Unit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToDocument55 pagesUnit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToMohammad Ehsan IrfanNo ratings yet

- The Analysis and Interpretation of Financial StatementsDocument5 pagesThe Analysis and Interpretation of Financial StatementsBrenda ChatendeukaNo ratings yet

- Client: Subject: Interpretation of Financial StatementsDocument1 pageClient: Subject: Interpretation of Financial StatementsMichel Bryan SemwoNo ratings yet

- Current Assets Current Liabilties: Tests of LiquidityDocument5 pagesCurrent Assets Current Liabilties: Tests of LiquidityCesNo ratings yet

- 19 Ratio Analysis TheoryDocument22 pages19 Ratio Analysis TheoryAkriti ShahNo ratings yet

- FL CFA Formula Sheet FRA 2020Document1 pageFL CFA Formula Sheet FRA 2020Opal Chais100% (1)

- Unit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToDocument56 pagesUnit 2: Indian Accounting Standard 33: Earnings Per Share: After Studying This Unit, You Will Be Able ToAudit MarathonNo ratings yet

- Earnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesDocument6 pagesEarnings Per Share (EPS) : Accounting Topics CPA Exam QuizzesHassleBustNo ratings yet

- Summary of Financial RatiosDocument9 pagesSummary of Financial RatiosEdrian CabagueNo ratings yet

- Finman Formulas PDFDocument4 pagesFinman Formulas PDFAvliah Tabao DatimbangNo ratings yet

- Kelompok 2 - Ch. 4 Analisis Laporan Keuangan & Ch. 6 Perencanaan Keuangan (Rev)Document57 pagesKelompok 2 - Ch. 4 Analisis Laporan Keuangan & Ch. 6 Perencanaan Keuangan (Rev)Remano GitzkyNo ratings yet

- Follow Up QuestionsDocument27 pagesFollow Up QuestionsVishal PoduriNo ratings yet

- Chapter Content: Rapid ReviewDocument6 pagesChapter Content: Rapid Reviewai li h tongNo ratings yet

- Chapter 5 by in PDF Book Basics of Credit Analysis: Alexandru CebotariDocument24 pagesChapter 5 by in PDF Book Basics of Credit Analysis: Alexandru CebotariAbdul QadirNo ratings yet

- IntroductionDocument11 pagesIntroductionGokul BansalNo ratings yet

- Elements: Capital Adequecy Operating Performance Ratio (OPR)Document3 pagesElements: Capital Adequecy Operating Performance Ratio (OPR)HMS DeedNo ratings yet

- Financial Ratio AnalysisDocument2 pagesFinancial Ratio AnalysisFayad CalúNo ratings yet

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Document3 pagesRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNo ratings yet

- Finman Formulas Legit Eto Na Talaga HuhuDocument7 pagesFinman Formulas Legit Eto Na Talaga Huhulizie elizaldeNo ratings yet

- Ratios Analysis Notes AND ONE SOLVED QUIZDocument6 pagesRatios Analysis Notes AND ONE SOLVED QUIZDaisy Wangui100% (1)

- Financial ManagementDocument9 pagesFinancial ManagementKristine dela CruzNo ratings yet

- Share CapitalDocument10 pagesShare CapitalMae PanganibanNo ratings yet

- Financial Ratios SDocument1 pageFinancial Ratios SchechotenisNo ratings yet

- 8 Financial RatiosDocument3 pages8 Financial Ratios- fridaNo ratings yet

- Ratio Formula Comments: A. Liquidity RatiosDocument2 pagesRatio Formula Comments: A. Liquidity RatiosPaula FornollesNo ratings yet

- Liquidity Ratios: Working Capital To Total Asset RatioDocument3 pagesLiquidity Ratios: Working Capital To Total Asset RatioBlueBladeNo ratings yet

- Basics of Credit Analysis: Alexandru CebotariDocument24 pagesBasics of Credit Analysis: Alexandru CebotariStephaney KippleNo ratings yet

- Afm - 21421134Document13 pagesAfm - 21421134Mehak SharmaNo ratings yet

- Cheat Sheet Earnings Per ShareDocument2 pagesCheat Sheet Earnings Per ShareJaneNo ratings yet

- Lecture TWO Accounting Fo ManagerDocument40 pagesLecture TWO Accounting Fo Managermohamed elsabahiNo ratings yet

- Ratios Analysis Notes and Questions NewDocument7 pagesRatios Analysis Notes and Questions NewAnthony OtiatoNo ratings yet

- Financial RatiosDocument15 pagesFinancial RatiosKeith Joshua GabiasonNo ratings yet

- Summary of RatiosDocument2 pagesSummary of RatiosakjrflNo ratings yet

- Financial Accounting: Tools For Business Decision-Making, Third Canadian EditionDocument6 pagesFinancial Accounting: Tools For Business Decision-Making, Third Canadian Editionapi-19743565100% (1)

- Ratios PDFDocument1 pageRatios PDFSayan AcharyaNo ratings yet

- Ratio AnalysisDocument9 pagesRatio AnalysisAbdullah shah khavreenNo ratings yet

- Fundamentals of Banking Institutions: AgendaDocument23 pagesFundamentals of Banking Institutions: AgendaYulan ShenNo ratings yet

- Accounting 2018Document32 pagesAccounting 2018zacrasheed2No ratings yet

- How to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsFrom EverandHow to Select Investment Managers and Evaluate Performance: A Guide for Pension Funds, Endowments, Foundations, and TrustsNo ratings yet

- Internal Control of Fixed Assets: A Controller and Auditor's GuideFrom EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideRating: 4 out of 5 stars4/5 (1)

- Depreciation Reports in British Columbia: The Strata Lot Owners Guide to Selecting Your Provider and Understanding Your ReportFrom EverandDepreciation Reports in British Columbia: The Strata Lot Owners Guide to Selecting Your Provider and Understanding Your ReportNo ratings yet

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsFrom EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsNo ratings yet

- Integrative Approach Blemba 65Document26 pagesIntegrative Approach Blemba 65Simon ErickNo ratings yet

- Syndicate 1 - An Introduction To Debt Policy and ValueDocument11 pagesSyndicate 1 - An Introduction To Debt Policy and ValueAntonius CliffSetiawanNo ratings yet

- Syndicate 6 - Gainesboro Machine Tools CorporationDocument12 pagesSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickNo ratings yet

- Debt, Policy & Value - Syndicate 6Document8 pagesDebt, Policy & Value - Syndicate 6Simon ErickNo ratings yet

- Rev1 Scenario Planning - Syndicate 6Document14 pagesRev1 Scenario Planning - Syndicate 6Simon ErickNo ratings yet

- Distributive Approach (Student)Document19 pagesDistributive Approach (Student)Simon ErickNo ratings yet

- Syndicate 6 - Vitality Health Enterprise CaseDocument6 pagesSyndicate 6 - Vitality Health Enterprise CaseSimon ErickNo ratings yet

- Scenario Planning - Syndicate 6Document13 pagesScenario Planning - Syndicate 6Simon ErickNo ratings yet

- Bond Valuation Assignment (Simon Erick)Document1 pageBond Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Bond Valuation Assignment (Simon Erick)Document1 pageBond Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Bond Valuation Assignment (Simon Erick)Document1 pageBond Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Theory 29121289 Simon ErickDocument1 pageTheory 29121289 Simon ErickSimon ErickNo ratings yet

- Bond Valuation Assignment (Simon Erick)Document1 pageBond Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Stock Valuation Assignment (Simon Erick)Document2 pagesStock Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Stock Valuation Assignment (Simon Erick)Document2 pagesStock Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Rational Negotiation: Manahan SiallaganDocument28 pagesRational Negotiation: Manahan SiallaganSimon ErickNo ratings yet

- Vacation Plans: Preparation & DiscussionDocument8 pagesVacation Plans: Preparation & DiscussionSimon ErickNo ratings yet

- Finance DetectiveDocument2 pagesFinance DetectiveSimon ErickNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Theory 29121289 Simon ErickDocument1 pageTheory 29121289 Simon ErickSimon ErickNo ratings yet

- Data For Ratio DetectiveDocument1 pageData For Ratio DetectiveRoyan Nur HudaNo ratings yet

- Bond Valuation Assignment (Simon Erick)Document1 pageBond Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Stock Valuation Assignment (Simon Erick)Document2 pagesStock Valuation Assignment (Simon Erick)Simon ErickNo ratings yet

- Nike Inc - Financial ManagementDocument1 pageNike Inc - Financial ManagementSimon ErickNo ratings yet

- Analytic Hierarchi Process - 29121289 Simon ErickDocument11 pagesAnalytic Hierarchi Process - 29121289 Simon ErickSimon ErickNo ratings yet

- Sky Deutschland (A) Summary - 29121289 - Simon ErickDocument1 pageSky Deutschland (A) Summary - 29121289 - Simon ErickSimon ErickNo ratings yet

- Analytic Hierarchi Process - 29121289 Simon ErickDocument11 pagesAnalytic Hierarchi Process - 29121289 Simon ErickSimon ErickNo ratings yet

- Financial Management Ratio Analysis - 29121289 - Simon ErickDocument7 pagesFinancial Management Ratio Analysis - 29121289 - Simon ErickSimon ErickNo ratings yet

- Demand Management and Forecasting (Wilkins Case) - Syndicate 6Document8 pagesDemand Management and Forecasting (Wilkins Case) - Syndicate 6Simon ErickNo ratings yet

- Sindikat 6 - Sky Deutschland Case Group AssignmentDocument5 pagesSindikat 6 - Sky Deutschland Case Group AssignmentSimon ErickNo ratings yet

- Northern Province Third Term Examination - 2019 NovemberDocument4 pagesNorthern Province Third Term Examination - 2019 NovemberAshley GazeNo ratings yet

- Sip Report On SbiDocument46 pagesSip Report On SbiRashmi RanjanNo ratings yet

- The Chicago Plan Revisited - 2d Paper IMFDocument85 pagesThe Chicago Plan Revisited - 2d Paper IMFuser909No ratings yet

- S.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateDocument2 pagesS.No Code Bank Name Netbanking Debit Card Sponsor Bank: Bank Status in API E-MandateChockalingam RamanathanNo ratings yet

- Monetary Policy and CB Module-7Document18 pagesMonetary Policy and CB Module-7Eleine Taroma AlvarezNo ratings yet

- Activity 1.3 - Think Like An AuditorDocument2 pagesActivity 1.3 - Think Like An AuditorIan Christian Alangilan BarrugaNo ratings yet

- The Integrated Approach To Management of PDFDocument12 pagesThe Integrated Approach To Management of PDFMeera ManoharNo ratings yet

- March 2020 Insight Part IDocument88 pagesMarch 2020 Insight Part INifezNo ratings yet

- Bai Tap InsuranceDocument12 pagesBai Tap InsuranceVũ HoàngNo ratings yet

- Partnership Formation and OperationDocument3 pagesPartnership Formation and OperationArden LlantoNo ratings yet

- FM Case - First National BankDocument32 pagesFM Case - First National BankBilal Shakil Qureshi100% (3)

- Unit - 3 Bank Reconciliation StatementDocument21 pagesUnit - 3 Bank Reconciliation StatementMrutyunjay SaramandalNo ratings yet

- 20221218145638D6181 - Datar - 17e - Accessible - Fullppt - 04 - Job CostingDocument31 pages20221218145638D6181 - Datar - 17e - Accessible - Fullppt - 04 - Job CostingMateus AriatamaNo ratings yet

- What Is Euro BondDocument5 pagesWhat Is Euro Bondpranoti_shinde8167No ratings yet

- Kalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaDocument6 pagesKalyan City - Blogspot.com 2010 09 Functions of Reserve Bank of IndiaAlokdev MishraNo ratings yet

- ACC5116 - HOBA - Additional ProblemsDocument6 pagesACC5116 - HOBA - Additional ProblemsCarl Dhaniel Garcia Salen100% (1)

- Report On Micro FinanceDocument55 pagesReport On Micro Financearvind.vns14395% (73)

- Bank Reconciliation: Financial Accounting & Reporting 1Document20 pagesBank Reconciliation: Financial Accounting & Reporting 1Malvin Roix OrenseNo ratings yet

- Yes Bank FinalDocument107 pagesYes Bank FinalDrMehul JoshiNo ratings yet

- GovREVIEWER in FINALS (Compilatioin of Assignmenst and Exercises)Document74 pagesGovREVIEWER in FINALS (Compilatioin of Assignmenst and Exercises)Hazel Morada100% (1)

- Bulk Mro Industrial Supply Private Limited: Detailed ReportDocument10 pagesBulk Mro Industrial Supply Private Limited: Detailed ReportAnishNo ratings yet

- Chapter - Ii: Chit Funds - A Conceptual OverviewDocument26 pagesChapter - Ii: Chit Funds - A Conceptual OverviewsairishikeshNo ratings yet

- Chapter 02Document15 pagesChapter 02sanket_yavalkarNo ratings yet

- Crossroads Capital 2019 Annual FINALDocument31 pagesCrossroads Capital 2019 Annual FINALYog MehtaNo ratings yet

- Finance in Dental CareDocument42 pagesFinance in Dental CarePuspa AdhikariNo ratings yet

- HDFC Life Insurance Ltd. Co.: Fundamental & Technical Analysis OF "HOSPITALITY SECTOR (Mid-Cap) "Document68 pagesHDFC Life Insurance Ltd. Co.: Fundamental & Technical Analysis OF "HOSPITALITY SECTOR (Mid-Cap) "Shubham SuryavanshiNo ratings yet

- Audit - Cash and Cash Equivalents PDFDocument15 pagesAudit - Cash and Cash Equivalents PDFSiena Farne100% (1)

- Assignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Document4 pagesAssignment Questions - Suggested Answers (E1-9, E1-11, P1-1, P1-2)Ivy KwokNo ratings yet

- Slide F3 ACCA-1Document446 pagesSlide F3 ACCA-1Thùy Vân Nguyễn100% (1)

- Islamic Accounting Case StudyDocument9 pagesIslamic Accounting Case StudyRabeeka SiddiquiNo ratings yet