Professional Documents

Culture Documents

Marginal Costing: Profit

Uploaded by

ravi kumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marginal Costing: Profit

Uploaded by

ravi kumarCopyright:

Available Formats

Marginal Costing

Variable Cost xxx

Fixed Cost xxx

+

Total Cost xxxx

Variable Cost: The cost which varies with production is called variable cost. Ex: Direct material, direct labour

Fixed Cost: The cost which remains fixed even if production increases or decreases. Ex: Factory rent, Production

manager’s salary etc.

Break Even Point:

Loss BEP Profit

No Profit No Loss

Cost of Production = 10,000 for 100 items

Selling Price per unit = 200

BEP = 10000/200 = 50 units

At least 50 units to be sold to achieve Break even point of no profit, no loss.

Marginal cost statement:

Sales (S) = 100

– Variable Cost (V) = 40

_______________ ______

Contribution (C) = 60

– Fixed Cost (F) = 20

_______________ ______

Profit/Loss (P/L) = 40

Formulae:

Profit Volume Ratio (PV Ratio)

1. P. V. Ratio = (S-V) / S *100

= C / S *100

2. BEP (In Rupees) = F / (PV Ratio)

BEP (in units) = Fixed Cost / Contribution per unit

3. Contribution = Sales – Variable

= Sales X PV Ratio

= (Fixed Cost + Profit) or (Fixed Cost - Loss)

4. Margin of Safety = Present Sales – BEP Sales

5. Sales required to earn a desired profit = (Fixed Cost + Desired Profit) / PV Ratio

Problem:

Selling Price Per unit = Rs. 50

Variable Cost per unit = Rs. 30

Fixed Cost = Rs. 60,000

Calculate:

1. Contribution

2. PV ratio

3. BEP

4. Sales to earn a Profit of Rs 40,000

1. Contribution = S–V = 50 – 30

= Rs 20

2. PV Ratio = C / S * 100 = 20/50 *100

= 40%

3. BEP = F / PV Ratio = 60,000 / 40%

= Rs. 1,50,000

BEP in units = F / C per unit

= 60,000 / 20

= 3000 units

4. Sales to earn a Profit of Rs 40,000 = (F + Desired Profit) / PV Ratio

= (60,000 + 40,000) / 40 %

= Rs. 2,50,000

Problem:

Sales = Rs 10,00,000

Variable Cost = 40% of Sales

Fixed Cost = Rs 2,50,000

Calculate,

1. PV ratio

2. BEP

3. Margin of Safety

4. Sales required to earn a profit of Rs 5,00,000

1. PV Ratio = (S-V) / S *100

= 60%

2. BEP = F / PV ratio = 2,50,000 / 60%

= 4,16,667

3. Margin of Safety = Present Sales – BEP Sales

= 10,00,000 - 4,16,667

= 5,83,333

4. Sales required to earn a profit of Rs 5,00,000 = (F + Desired Profit) / PV Ratio

= (2,50,000 + 5,00,000) / 60%

= 12,50,000

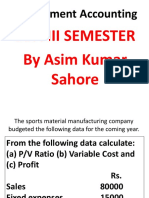

Problem:

The following are the estimates for the year ending 2021, related to the manufacturing concern.

Sales Unit = 25,000 units

Fixed Cost = Rs. 1,20,000

Sales value = Rs 4,00,000

Variable Cost = Rs 8 per unit

You are required to,

Find PV ratio, BEP and Margin of Safety

Calculate revised PV ratio, BEP and Margin of Safety in each of the following cases

a. Increase of 10% in variable cost

b. Decrease of 10% in selling price

c. Increase of Sales volume by 5000 units

d. Increase in fixed cost by 15,000

Solution:

Sales Unit = 25,000 unit

Fixed Cost = Rs. 1,20,000

Sales value = Rs 4,00,000

Variable Cost = Rs 8 per unit

Selling Price = Rs 16 per unit

Contribution = Rs 8 per unit

1. PV Ratio = C / S * 100

= 8/16 *100

= 50%

2. BEP = F / PV ratio = 1,20,000 / 50%

= 2,40,000

3. Margin of Safety = Present Sales – BEP Sales

= 4,00,000 - 2,40,000

= 1,60,000

Particulars PV Ratio (C / S * 100) BEP (F / PV ratio) Margin of Safety (Present

Sales – BEP Sales)

Actual Values 8/16 *100 = 50% 1,20,000 / 50% 4,00,000 - 2,40,000

= 2,40,000 = 1,60,000

Sales Unit = 25,000 units

Fixed Cost = Rs. 1,20,000

Sales value = Rs 4,00,000

Variable Cost = Rs 8 per unit

Selling Price = Rs 16 per unit

Contribution = Rs 8 per unit

Increase of 10% in variable 7.2 / 16 * 100 = 45% 1,20,000 / 45% = 2,66,667 4,00,000 - 2,66,667

cost = 1,33,333

V = 8 + (10% of 8) = 8.80

C = 16 – 8.80 = 7.20

Decrease of 10% in selling 6.40 / 14.40 * 100 1,20,000 / 44.44% 3,60,000 - 2,70,000

price = 44.44% = 2,70,000 = 90,000

S = 16 – (10% of 16)

= 14.40

C = 14.40 – 8 = 6.40

Present Sales = 25,000 *

14.40 = 3,60,000

Increase of Sales volume by 50% (Same as Original) 2,40,000 (Same as Original) 4,80,000 – 2,40,000

5000 units = 2,40,000

Sales Unit = 30,000

Present Sales = 4,80,000

Increase in fixed cost by 50% (Same as Original) 1,35,000/50% = 2,70,000 4,00,000 – 2,70,000

15,000 = 1,30,000

F = 1,35,000

You might also like

- Marginal CostingDocument39 pagesMarginal CostingMeet LalchetaNo ratings yet

- Marginal CostingDocument9 pagesMarginal CostingprataikNo ratings yet

- CVP AnalysisDocument11 pagesCVP AnalysisPratiksha GaikwadNo ratings yet

- Marginal Costing Problems&Solutions 2Document51 pagesMarginal Costing Problems&Solutions 2Dr.Ashok Kumar Panigrahi100% (4)

- Marginal Costing Technique: Break-Even AnalysisDocument9 pagesMarginal Costing Technique: Break-Even AnalysisAadarshNo ratings yet

- Class WorkDocument10 pagesClass WorkRajesh MongerNo ratings yet

- Bep Problems Unit 2Document29 pagesBep Problems Unit 2CHENNAKESAVA MAMILLANo ratings yet

- Marginal Costing-Problems&Solutions-2Document45 pagesMarginal Costing-Problems&Solutions-2nahi batanaNo ratings yet

- Cost Management Anudeep Velagapudi PGDM6 1967Document9 pagesCost Management Anudeep Velagapudi PGDM6 1967Harsh Vardhan SinghNo ratings yet

- FP 03 Questions On Cost Volume Profit AnanlysisDocument4 pagesFP 03 Questions On Cost Volume Profit AnanlysisMana PlanetNo ratings yet

- 30 12 22Document8 pages30 12 22vasanthgurusamynsNo ratings yet

- CostingDocument15 pagesCostingPavan ChitragarNo ratings yet

- 3 Nov Cost-Volume - Profit Analysis - QusetionsDocument44 pages3 Nov Cost-Volume - Profit Analysis - QusetionsAbhinavNo ratings yet

- 02 29 11 2023 Bep Q 1 - 3Document17 pages02 29 11 2023 Bep Q 1 - 3Gokul KulNo ratings yet

- Break Even MathDocument2 pagesBreak Even MathMuhammad Akmal HossainNo ratings yet

- Chapter 22Document14 pagesChapter 22Nguyên BảoNo ratings yet

- Break Even AnalysisDocument37 pagesBreak Even Analysissidra khanNo ratings yet

- Cost Volume Profit Analysis and Cost Behavior SDocument2 pagesCost Volume Profit Analysis and Cost Behavior SMary Faith SullezaNo ratings yet

- Marginal Costing Formulas & ExamplesDocument8 pagesMarginal Costing Formulas & ExamplesHEMANT RAJNo ratings yet

- Solution For Chapter 22 - Part2Document4 pagesSolution For Chapter 22 - Part2Dương Xuân ĐạtNo ratings yet

- CVP AnalysisDocument3 pagesCVP AnalysisTERRIUS AceNo ratings yet

- Practical Problems & Solutions Class Work Upto IL.10Document20 pagesPractical Problems & Solutions Class Work Upto IL.10Dhanishta PramodNo ratings yet

- MC SolDocument3 pagesMC SolIqra DrabooNo ratings yet

- Topic 11 - Cost Volume Profit Analysis - LectureDocument23 pagesTopic 11 - Cost Volume Profit Analysis - LectureshamimahNo ratings yet

- Cost Volume Profit AnalysisDocument20 pagesCost Volume Profit AnalysisSidharth RayNo ratings yet

- CVP AnalysisDocument5 pagesCVP AnalysisAzumi RaeNo ratings yet

- Managerial Accounting: Osama KhaderDocument37 pagesManagerial Accounting: Osama Khaderroaa ghanimNo ratings yet

- Break Even PointDocument20 pagesBreak Even PointVannoj AbhinavNo ratings yet

- Break - Even Point AnalysisDocument39 pagesBreak - Even Point AnalysisKelly Ng0% (1)

- Break Even AnalysisDocument6 pagesBreak Even AnalysisNafi AhmedNo ratings yet

- Exercise 5-8Document8 pagesExercise 5-8Kaye MagbirayNo ratings yet

- CVP ExerciseDocument4 pagesCVP ExerciseKhiks ObiasNo ratings yet

- Cost Volume Profit Analysis Cost Accounting 2022 P1Document6 pagesCost Volume Profit Analysis Cost Accounting 2022 P1jay-an DahunogNo ratings yet

- Solution AccountDocument12 pagesSolution Accountbikaspatra89No ratings yet

- Managerial accountingBEP, CM T. ProfitDocument4 pagesManagerial accountingBEP, CM T. ProfitZeinab MohamadNo ratings yet

- Module 4Document42 pagesModule 4Eshael FathimaNo ratings yet

- Num 2Document4 pagesNum 2nilesh nagureNo ratings yet

- CVP ExerciseDocument7 pagesCVP ExerciseKhiks ObiasNo ratings yet

- See Zhao Wei U2003083 Costing AnalysisDocument5 pagesSee Zhao Wei U2003083 Costing AnalysiszhaoweiNo ratings yet

- MA CHAPTER 4 Marginal Costing 2Document93 pagesMA CHAPTER 4 Marginal Costing 2Mohd Zubair KhanNo ratings yet

- Calculate break-even sales, operating income for companiesDocument6 pagesCalculate break-even sales, operating income for companiesAsdfghjkl LkjhgfdsaNo ratings yet

- Assgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Document10 pagesAssgment 1 (Chapter 1-4) : Agung Rizal / 2201827622Agung Rizal DewantoroNo ratings yet

- Decision Making in Finance at The Operational LevelDocument11 pagesDecision Making in Finance at The Operational LevelAsad NaveedNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Break Even AnalysisDocument6 pagesBreak Even Analysisemmanuel Johny100% (1)

- Prepared by DR - Hassan Sweillam University of 6 of October, EgyptDocument18 pagesPrepared by DR - Hassan Sweillam University of 6 of October, EgyptjgjghNo ratings yet

- Volume Profit AnalysisDocument24 pagesVolume Profit AnalysisJean MaltiNo ratings yet

- Accounting 202 Chapter 7 NotesDocument15 pagesAccounting 202 Chapter 7 NotesnitinNo ratings yet

- Jawaban Assignment#8 - A. JuliadiDocument2 pagesJawaban Assignment#8 - A. JuliadiSubdit KPKPPNo ratings yet

- 320C03Document33 pages320C03ArjelVajvoda100% (3)

- Shalini Chaurasia Break Even Analysis Part 2 New Converted M.Com. Sem.-II Management AccountingDocument10 pagesShalini Chaurasia Break Even Analysis Part 2 New Converted M.Com. Sem.-II Management AccountingNetai DasNo ratings yet

- Exercise Chapter 6Document15 pagesExercise Chapter 6thaole.31221026851No ratings yet

- Breakeven Analysis 0Document35 pagesBreakeven Analysis 0Nistha Bisht100% (1)

- The Contribution Margin Ratio Will DecreaseDocument7 pagesThe Contribution Margin Ratio Will DecreaseSaeym SegoviaNo ratings yet

- Numericals On CVP AnalysisDocument2 pagesNumericals On CVP AnalysisAmil SaifiNo ratings yet

- PRICING EXERCISES ANALYSISDocument14 pagesPRICING EXERCISES ANALYSISvineel kumarNo ratings yet

- Cost AnalysisDocument13 pagesCost AnalysistheNo ratings yet

- Marginal Costing - M4Document21 pagesMarginal Costing - M4sukeshNo ratings yet

- Practical Problems and Break-Even Analysis for Various CompaniesDocument7 pagesPractical Problems and Break-Even Analysis for Various Companieshrmohan8667% (3)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Accounting 13032021Document4 pagesAccounting 13032021ravi kumarNo ratings yet

- Accounting 10032021Document4 pagesAccounting 10032021ravi kumarNo ratings yet

- Accounting 06022021Document6 pagesAccounting 06022021ravi kumarNo ratings yet

- Accounting 13022021Document4 pagesAccounting 13022021ravi kumarNo ratings yet

- Robinhood Case StudyDocument2 pagesRobinhood Case StudyUdaya ChoudaryNo ratings yet

- Singapore and UAEDocument1 pageSingapore and UAEravi kumarNo ratings yet

- N20283009 - Ravi Kumar - MRCB Assignment 1Document2 pagesN20283009 - Ravi Kumar - MRCB Assignment 1ravi kumarNo ratings yet

- N20283009 - BPSM Assignement 1 - Power of CommunicationDocument2 pagesN20283009 - BPSM Assignement 1 - Power of Communicationravi kumarNo ratings yet

- N20283009 - Ravi Kumar - MRCB Assignment 2Document2 pagesN20283009 - Ravi Kumar - MRCB Assignment 2ravi kumarNo ratings yet

- Introduction Programming C EngineersDocument648 pagesIntroduction Programming C EngineersClaudio Di LivioNo ratings yet

- Arraystorm Consolidated Product CatalogueDocument44 pagesArraystorm Consolidated Product Cataloguesuhasacharya117No ratings yet

- Payroll Calculator SpreadsheetDocument7 pagesPayroll Calculator SpreadsheetbagumbayanNo ratings yet

- Thailand International Mathematical Olympiad Syllabus: Kindergarten GroupDocument5 pagesThailand International Mathematical Olympiad Syllabus: Kindergarten GroupEly SoemarniNo ratings yet

- Domekt CF 400 V C6M ENDocument1 pageDomekt CF 400 V C6M ENnpnickNo ratings yet

- CHM 256: Basic Analytical Chemistry: Evaluation of Experimental DataDocument42 pagesCHM 256: Basic Analytical Chemistry: Evaluation of Experimental DataSPMUSER9ANo ratings yet

- 1SXP403001B0202 Su200mDocument10 pages1SXP403001B0202 Su200mAkash kumarNo ratings yet

- INMATEH-Agricultural Engineering Vol.42 - 2014Document175 pagesINMATEH-Agricultural Engineering Vol.42 - 2014Popa LucretiaNo ratings yet

- Mandatory Reading 00 3438581Document26 pagesMandatory Reading 00 3438581AgalievNo ratings yet

- GHDL Latest PDFDocument111 pagesGHDL Latest PDFArpanNo ratings yet

- Lecture-SULAMAN SADIQ - TSE-SDH and SONETDocument51 pagesLecture-SULAMAN SADIQ - TSE-SDH and SONETSulaman SadiqNo ratings yet

- Thread Types & IssuesDocument20 pagesThread Types & IssuesBilal Khan RindNo ratings yet

- Apr24-3g CDocument4 pagesApr24-3g COscar Payan ViamonteNo ratings yet

- ISO 9001 certified burner control box technical guideDocument6 pagesISO 9001 certified burner control box technical guideVijay BhureNo ratings yet

- Corrosion and Protection of Submarine Metal Components in SeawaterDocument4 pagesCorrosion and Protection of Submarine Metal Components in SeawaterSamuel GarciaNo ratings yet

- ONLINE VOTINGDocument42 pagesONLINE VOTINGShaju Afridi100% (2)

- General Purpose & Power Relays GuideDocument20 pagesGeneral Purpose & Power Relays GuideMahesh KumbharNo ratings yet

- Na'am J-2017 JOIV 1 (1) 5-11Document7 pagesNa'am J-2017 JOIV 1 (1) 5-11Prof. Dr. H. Jufriadif Naam, S.Kom, M.KomNo ratings yet

- Topographic Map of VenusDocument1 pageTopographic Map of VenusHistoricalMapsNo ratings yet

- IOP Conference Series: Materials Science and Engineering - Comprehensive model of a hermetic reciprocating compressorDocument11 pagesIOP Conference Series: Materials Science and Engineering - Comprehensive model of a hermetic reciprocating compressorFrancisco OppsNo ratings yet

- AMD64 16h InstrLatency 1.1Document79 pagesAMD64 16h InstrLatency 1.1mario nogueraNo ratings yet

- Ad 7780Document16 pagesAd 7780alcplmNo ratings yet

- Chemical Equations and Reactions of Alcohols, Phenols and EthersDocument11 pagesChemical Equations and Reactions of Alcohols, Phenols and EthersDeekshaNo ratings yet

- Activity DiagramsDocument26 pagesActivity Diagramskant.beleNo ratings yet

- Copia de ISLMDocument16 pagesCopia de ISLMcristianmondacaNo ratings yet

- Inter-Cell Interference Coordination For Control Channels in LTE Heterogeneous NetworksDocument13 pagesInter-Cell Interference Coordination For Control Channels in LTE Heterogeneous Networkssolarisan6No ratings yet

- Green Pin - Green Pin® Sling Shackle BNDocument6 pagesGreen Pin - Green Pin® Sling Shackle BNSimen EllingsenNo ratings yet

- Review 1Document11 pagesReview 1Anonymous gfbLDQPgNo ratings yet

- AM054KNMDCH1AZDocument3 pagesAM054KNMDCH1AZaandresleo86No ratings yet

- Biological Buffer SystemDocument4 pagesBiological Buffer SystemSharm Jarin-AlonzoNo ratings yet