Professional Documents

Culture Documents

Adjusting Entries2

Adjusting Entries2

Uploaded by

Audrey Janae SorianoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Adjusting Entries2

Adjusting Entries2

Uploaded by

Audrey Janae SorianoCopyright:

Available Formats

ADJUSTING ENTRIES:

Circle the letter of the best answer in each of the following items.

1. Adjusting entries are necessary because

a. They remove understatements from the financial statements.

b. Some revenue and expense activities are only partially complete at the end of the

accounting period

c. They remove overstatements from the financial statements.

d. Accrual accounting reflects the accomplishments of the business rather than merely cash

receipts and payments.

e. All of the above.

2. Why is it necessary to make adjustments?

a. The accountant has made errors in recording transactions.

b. Certain facts about the affairs of the business are not included in the accounts before the

adjustments are made.

c. The accountant wants to show the largest possible net income for the period.

d. The accountant wants to show the net cash flow for the period

e. None of the above is the case.

3. An adjusting entry:

a. Involves parties external to the entity. c. Is not recorded in any journal

b. Is an external transaction. d. Is an internal transaction

e. None of the above.

4. The broad classification of adjusting entries are:

a. Accruals and closing d. Closing and trials

b. Accrual and deferrals e. None of the above

c. Trials and deferrals

5. A prepaid expense is not an:

a. Asset c. Expired Cost e. None of the above

b. Unexpired Cost d. Economic Resource

6. The following account will have a normal debit balance:

a. Accumulated Depreciation d. Equipment

b. Depreciation Expense e. None of the above

c. Unearned Revenue

7. The following account will most likely require an accrual type of adjustment entry:

a. Prepaid Insurance d. Equipment

b. Unearned Revenue e. None of the Above

c. Office Supplies on Hand

8. Adjusting entries are entries:

a. that bring accounts up-to-date so as to reflect the correct account balances at a designated

time

b. prepare at the end of each accounting period to zero out nominal accounts and carry their

balances to capital

c. prepared at the beginning of each accounting period and that refer to certain adjustments.

d. Prepared at any time during the accounting period to correct errors.

e. Answer not given

9. The purpose of adjusting entries is to:

a. prepare revenue and expense accounts for recording the transaction of the next accounting

period.

b. Apply the realization principle and the matching principle to transactions affecting two or

more accounting periods.

c. Adjust daily the balances in asset, liability, revenue, and expense accounts for the effects of

business transactions.

d. Adjust the owner’s capital account for the revenue, expense and withdrawal transactions

which occurs during the year

10. The purpose of adjusting entries is to:

a. Correct errors made in the accounting records

b. Update the balance of the owner’s capital account for changes in owner’s equity temporarily

recorded in revenue and expense accounts.

c. Prepare the revenue and expense accounts for recording the transactions of the next

accounting period.

d. Allocate revenue and expenses among accounting periods when the related business

transactions affect more than one period.

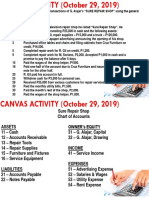

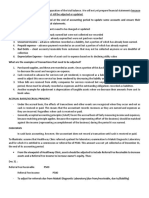

B. PREPARING ADJUSTING ENTRIES AT YEAR-END

The MJ Pedernal Company presented the following information pertaining to accounts that will need

adjustments for its Nov. 30, 2009 year-end financial statements:

a. On Oct.1, 2009, MJ Pedernal Company paid P10,800 for 6-months’ insurance premiums.

b. The balance in the ledger account Office Supplies amounted to P32,000. A count of the office

supplies on Nov. 30, 2009 totaled P12,800.

c. MJ Pedernal Company received P22,800 on Nov. 1, 2009 from a customer for services to be rendered

during the months of November, December, January and February.

d. MJ Pedernal Acquired Office Equipment costing P352,800 on April 1, 2009. The equipment is

expected to last 5 years after which it will be worthless.

e. Nov. 30, 2009 is a Saturday and that MJ Pedernal pays its employees a total of P87,500 on Fridays.

You might also like

- Bizmates Trainers' Briefing On BIR ComplianceDocument8 pagesBizmates Trainers' Briefing On BIR Compliancejoahnabulanadi100% (2)

- Your RBC Personal Savings Account StatementDocument1 pageYour RBC Personal Savings Account Statementmilad safiNo ratings yet

- ANSWER KEY Adjustments Quiz 2Document6 pagesANSWER KEY Adjustments Quiz 2Christine Mae BurgosNo ratings yet

- Credit DerivativeDocument5 pagesCredit DerivativedomomwambiNo ratings yet

- Chapter 3 Adjusting The Accounts PDFDocument56 pagesChapter 3 Adjusting The Accounts PDFJed Riel BalatanNo ratings yet

- Financing Mining Projects PDFDocument7 pagesFinancing Mining Projects PDFEmil AzhibayevNo ratings yet

- Partnership LiquidationDocument5 pagesPartnership LiquidationChristian PaulNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch07Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch07Kevin Molly KamrathNo ratings yet

- Bailment: (Pactum de Commodando)Document19 pagesBailment: (Pactum de Commodando)Jerry YanNo ratings yet

- I. True or False: Pre TestDocument18 pagesI. True or False: Pre TestErina SmithNo ratings yet

- Adjusting The Book of AccountsDocument33 pagesAdjusting The Book of Accountsjoshua zabala100% (1)

- ACC101 Quiz Test 2 STDocument6 pagesACC101 Quiz Test 2 STNguyen Thi Kim ChuyenNo ratings yet

- Activity 6 - Adjusting Entries - Depreciation (Ans)Document5 pagesActivity 6 - Adjusting Entries - Depreciation (Ans)angela flores100% (1)

- Adjusting Entries ExampleDocument5 pagesAdjusting Entries ExampleSiak Ni LynnLadyNo ratings yet

- Lesson 1 ExtendDocument6 pagesLesson 1 ExtendRoel Cababao50% (2)

- 12 - Tolentino V GonzalesDocument3 pages12 - Tolentino V GonzalesAthanasia Zoe Gonzales100% (2)

- C. Identification, Recording, Communication.: ExceptDocument9 pagesC. Identification, Recording, Communication.: ExceptSylvia Al-a'maNo ratings yet

- ADDU Worksheet, FS, CJE and EtcDocument67 pagesADDU Worksheet, FS, CJE and EtcKen BorjaNo ratings yet

- FABM Assignment WS FS P C TB 1Document34 pagesFABM Assignment WS FS P C TB 1memae0044No ratings yet

- 2021 FAR Straight Problem - Hyc2Document2 pages2021 FAR Straight Problem - Hyc2Mariecris BatasNo ratings yet

- Accounting 1Document117 pagesAccounting 1Mary Alyssa Claire Capate II100% (1)

- PDF Journal Entries Tradingdocx CompressDocument79 pagesPDF Journal Entries Tradingdocx CompressMaskter TwinsetsNo ratings yet

- Theory of AccountDocument1 pageTheory of Accountzee abadilla100% (1)

- Accounting For A Service CompanyDocument9 pagesAccounting For A Service CompanyAnnie RapanutNo ratings yet

- Mr. Lindbergh Lendl S. Soriano Practice Set 2Document33 pagesMr. Lindbergh Lendl S. Soriano Practice Set 2Kevin MagdayNo ratings yet

- Adjustments Quiz 2Document6 pagesAdjustments Quiz 2Loey ParkNo ratings yet

- 2.0assessment ExamDocument2 pages2.0assessment ExamyeshaNo ratings yet

- Lesson 21 - Closing Entries, Post-Closing, Trial Balance and Reversing EntriesDocument8 pagesLesson 21 - Closing Entries, Post-Closing, Trial Balance and Reversing EntriesMayeng MonayNo ratings yet

- Chapter 3 Basic AccountingDocument35 pagesChapter 3 Basic AccountingDeanna LuiseNo ratings yet

- 162 001Document1 page162 001Christian Mark AbarquezNo ratings yet

- Comprehensive ProblemDocument1 pageComprehensive ProblemDavid Con RiveroNo ratings yet

- Effects of Transactions Instructions: Indicate The Effects of Each Transaction by Writing The ChoicesDocument1 pageEffects of Transactions Instructions: Indicate The Effects of Each Transaction by Writing The ChoicesHessiel Mae Jumalon Garcines100% (1)

- Cost Accounting Midterm ExamDocument37 pagesCost Accounting Midterm Examshynebright.phNo ratings yet

- Accounting ExercisesDocument41 pagesAccounting ExercisesKayla MirandaNo ratings yet

- Module 2 - Completing The Accounting CycleDocument45 pagesModule 2 - Completing The Accounting CycleShane TorrieNo ratings yet

- Chapter 5 Double Entry Bookkeeping For A Service ProviderDocument8 pagesChapter 5 Double Entry Bookkeeping For A Service ProviderPaw Verdillo100% (1)

- Canvas Activity - Journalizing - Oct - 29 PDFDocument2 pagesCanvas Activity - Journalizing - Oct - 29 PDFJian Francisco100% (2)

- JE, GL, TB Magpantay RevisedDocument22 pagesJE, GL, TB Magpantay RevisedJasmine Acta100% (1)

- Santos ChaDocument18 pagesSantos ChaSANTOS, CHARISH ANNNo ratings yet

- FSDocument44 pagesFSMaria Beatriz Aban Munda100% (2)

- Inventory Sample ProblemDocument2 pagesInventory Sample ProblemJohn Rey Bantay RodriguezNo ratings yet

- Acctg Equation and Journal EntriesDocument3 pagesAcctg Equation and Journal EntriesNiño Dwayne TuboNo ratings yet

- Journalizing To Adjusting Entries QuizDocument3 pagesJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- Set IDocument2 pagesSet IAdoree RamosNo ratings yet

- Basic Accounting ModelDocument3 pagesBasic Accounting Modeldlinds2X1No ratings yet

- 2 Abm Fabm2 12 W2 3 Melc 4 1Document9 pages2 Abm Fabm2 12 W2 3 Melc 4 1Rializa Caro BlanzaNo ratings yet

- Accounting CycleDocument21 pagesAccounting CycleJc GappiNo ratings yet

- Problem 3 ACCA101Document3 pagesProblem 3 ACCA101Nicole FidelsonNo ratings yet

- Tutorial Week 6Document7 pagesTutorial Week 6Mai Hoàng100% (1)

- Journalizing Merchandising TransactionsDocument3 pagesJournalizing Merchandising TransactionsMarian Augelio PolancoNo ratings yet

- Financial Accounting and ReportingDocument1 pageFinancial Accounting and ReportingPaula BautistaNo ratings yet

- Semis 1 WorksheetDocument15 pagesSemis 1 WorksheetDexter BangayanNo ratings yet

- Basic Accounting Equation ExercisesDocument7 pagesBasic Accounting Equation ExerciseshIgh QuaLIty SVT100% (1)

- Lesson 7.1 - AJE Accrued ExpensesDocument22 pagesLesson 7.1 - AJE Accrued ExpensesYra Dominique ChuaNo ratings yet

- Partnership OperationDocument3 pagesPartnership OperationShane NayahNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Midterm 2nd 3rd Meeting RevisedDocument6 pagesMidterm 2nd 3rd Meeting RevisedChristopher CristobalNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- ACTIVITY 2-Fundamentals of Accounting 1Document1 pageACTIVITY 2-Fundamentals of Accounting 1shelou_domantay100% (1)

- Basic Acctg 4th SatDocument11 pagesBasic Acctg 4th SatJerome Eziekel Posada PanaliganNo ratings yet

- Darantan, KC T. - FAR Module 6Document3 pagesDarantan, KC T. - FAR Module 6Li LiNo ratings yet

- List Accounting 2 2013Document5 pagesList Accounting 2 2013Ondoy PorlaresNo ratings yet

- Accounting Cycle of A Merchandising BusinessDocument2 pagesAccounting Cycle of A Merchandising BusinessAnne Alag100% (1)

- Accounting ReviewerDocument21 pagesAccounting ReviewerAdriya Ley PangilinanNo ratings yet

- Pilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksDocument16 pagesPilar Company Bank Reconciliation Statement SEPTEMBER 30, 2020 Balance Per Bank Statement Add: Deposit in Transit Receipts Not Yet Deposited Total: P139,314.20 Deduct: Outstanding ChecksStudent Core GroupNo ratings yet

- Activity 2 - Cash and Cash EquivalentsDocument2 pagesActivity 2 - Cash and Cash EquivalentsSean Lester S. NombradoNo ratings yet

- Sep 2022 - Current Acc 30681946Document17 pagesSep 2022 - Current Acc 30681946Linella LinellaNo ratings yet

- Asish PMDocument59 pagesAsish PMAryan Sharma54No ratings yet

- SBI & BMB MergerDocument12 pagesSBI & BMB MergerShubham naharwal (PGDM 17-19)No ratings yet

- Tianjin PlasticsDocument19 pagesTianjin PlasticsruccaruNo ratings yet

- Cgi DD XML MappingDocument3 pagesCgi DD XML MappingRajendra PilludaNo ratings yet

- 5 Deposit ProductsDocument19 pages5 Deposit ProductsLAMOUCHI RIMNo ratings yet

- BoholDocument11 pagesBoholLevi L. BinamiraNo ratings yet

- Vanguard Acct Xfer Forms 06 PDFDocument62 pagesVanguard Acct Xfer Forms 06 PDFwlamillerNo ratings yet

- Cashback Redemption FormDocument1 pageCashback Redemption FormPapuKaliyaNo ratings yet

- Introduction YES BankDocument29 pagesIntroduction YES Bankparag03No ratings yet

- E - Commerce Chapter 11Document19 pagesE - Commerce Chapter 11Md. RuHul A.No ratings yet

- MBF Homework 5Document19 pagesMBF Homework 5JerryNo ratings yet

- State Bank of India - VaibhavDocument1 pageState Bank of India - VaibhavVaibhav GuptaNo ratings yet

- Jorion VaR DisclosuresDocument35 pagesJorion VaR DisclosuresMatheus Monteiro RossaNo ratings yet

- Book ReportDocument4 pagesBook ReportMarivicTalomaNo ratings yet

- My ResumeDocument2 pagesMy Resumeanon-477710No ratings yet

- International Escorted Group Tours 2014Document208 pagesInternational Escorted Group Tours 2014Prabhat JainNo ratings yet

- Hsslive XII Comp Accounting Model Practical Book Binoy PDFDocument56 pagesHsslive XII Comp Accounting Model Practical Book Binoy PDFSusmitha kNo ratings yet

- KrazyBee Services Private LimitedDocument9 pagesKrazyBee Services Private LimitedBalakrishnan IyerNo ratings yet

- 65 Less YearsDocument5 pages65 Less YearsBhanu Pratap Singh YadavNo ratings yet

- Checklist Japan Visa Application PDFDocument3 pagesChecklist Japan Visa Application PDFRossanne TagabanNo ratings yet

- Financial TheoryDocument21 pagesFinancial Theoryমুসফেকআহমেদনাহিদ0% (1)