Professional Documents

Culture Documents

Self-Declaration For Claiming Housing Loan Principal & Interest Benefit

Uploaded by

inkedin linkedinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Self-Declaration For Claiming Housing Loan Principal & Interest Benefit

Uploaded by

inkedin linkedinCopyright:

Available Formats

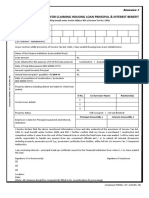

Annexure 3

SELF-DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL & INTEREST BENEFIT

(Availing benefit under Section 24(b) or 80C of Income Tax Act, 1961)

Employee Name

Employee SAP ID

(8 Digit – Numeric)

Employee PAN

(10 Character – AlphaNumeric)

As per sections 24(b) provisions of Income Tax Act, 1961, I have availed housing loan as per details below:

Name of the Finance Institution (Loan availed from)

Loan amount Rs.

Loan obtained for the purpose of (Tick the loan purpose) Construction / Acquisition / Renovation / Repair

Date of Final disbursement (DD-MMM-YYYY)

Amount repaid towards Principal Rs.

Annual Interest (paid + payable) – FY 2016-2017 Rs.

Date of completion of construction / possession

(DD-MMM-YYYY)

Property address including district and state for which loan

availed

Sl No. Co-borrower Name Relationship

1

Co-borrower details

2

3

Property status Self-occupied / Let-out (Rented)

Principal Amount(Rs.) Interest Amount(Rs.)

Employee’s claim for Principal repayment and Interest,

deduction

I hereby declare that the above mentioned information is true and also understood the provisions of Income Tax Act,

1961 to avail benefit under Section 24(b) and 80C. I further confirm that my house is purchased / constructed and

completed within 5 years from the end of the Financial Year in which the final home loan was availed. I will be solely and

wholly responsible to handle any queries from any competent officials and / or to submit all relevant documents

including property possession proof (e.g. possession certificate from builder, utility bill etc.) to Income Tax / Competent

Authorities.

I am enclosing interest – principal break-up certificate issued by the Financial Institution from where I / we have availed

the loan.

Signature of co-borrower(s) Signature of employee

(1)

(2)

(3)

Location:

Date:

(Note: All columns should be compulsorily filled in for consideration & processing)

You might also like

- Car RC Nexon (Ev)Document1 pageCar RC Nexon (Ev)Sarath Kumar100% (1)

- HOUSING LOAN SELF-DECLARATIONDocument1 pageHOUSING LOAN SELF-DECLARATIONNAGARAJ M O100% (6)

- IT Certificate 622197149Document1 pageIT Certificate 622197149karimshiekNo ratings yet

- Education Loan 2023-24 ProvisionalDocument1 pageEducation Loan 2023-24 ProvisionalSandeep Dubey100% (1)

- 2866100498386100000Document4 pages2866100498386100000E-World Cyber ZoneNo ratings yet

- NURS 366 Exam 1 Study Guide and RubricDocument7 pagesNURS 366 Exam 1 Study Guide and RubriccmpNo ratings yet

- Web It CertDocument1 pageWeb It CertGuna SeelanNo ratings yet

- Education Loan PDFDocument7 pagesEducation Loan PDFSuraj SinghNo ratings yet

- To Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961Document1 pageTo Whomsoever It May Concern Statement For Claiming Deductions Under Sections 24 (B) & 80C (2) (Xviii) of The Income Tax ACT, 1961senthil kumarNo ratings yet

- NPS Transaction Statement For Tier II Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier II Account: Current Scheme PreferencePradeep KumarNo ratings yet

- Max Bupa Health Insurance ReceiptDocument1 pageMax Bupa Health Insurance ReceiptSaurabh RaghuvanshiNo ratings yet

- Repay CertificateDocument1 pageRepay Certificateacrajesh50% (2)

- Self-Declaration For Claiming Additional Deduction On Housing Loan Interest U/s 80EE For The Financial Year Ending 31st March 2022Document2 pagesSelf-Declaration For Claiming Additional Deduction On Housing Loan Interest U/s 80EE For The Financial Year Ending 31st March 2022srikanthNo ratings yet

- EV Interest CertificateDocument1 pageEV Interest Certificatedavidgordan0207100% (1)

- NPS transaction statement summary for Apr 2022 to Dec 2022Document2 pagesNPS transaction statement summary for Apr 2022 to Dec 2022Satish Tiwari100% (1)

- 80D Pdf-AnkitDocument1 page80D Pdf-AnkitSaurabh RaghuvanshiNo ratings yet

- Donation Detail Partner Ngo Donation Giveindia Retention TotalDocument1 pageDonation Detail Partner Ngo Donation Giveindia Retention TotalSelvamNo ratings yet

- Sds d201 Diatro - Lyse-Diff v4.1Document7 pagesSds d201 Diatro - Lyse-Diff v4.1Fauzia BudimanNo ratings yet

- Rolling Stock Design CriteriaDocument17 pagesRolling Stock Design CriteriahamzaNo ratings yet

- Housing Loan Self DeclarationDocument1 pageHousing Loan Self DeclarationSreenivasa RaoNo ratings yet

- Housing loan interest and principal declarationDocument1 pageHousing loan interest and principal declarationappsectesting3100% (1)

- Declaration For Housing Loan.Document4 pagesDeclaration For Housing Loan.srikanthNo ratings yet

- KK EV Auto Loan CertificateDocument1 pageKK EV Auto Loan CertificateKranthi Kumar KingNo ratings yet

- Branch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:02186 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest Certificatesudarsan kingNo ratings yet

- Rent Paid Receipt: Revenue Stamp Rs.1Document1 pageRent Paid Receipt: Revenue Stamp Rs.1Pankaj AgarwalNo ratings yet

- Declaration 80D 80DDBDocument1 pageDeclaration 80D 80DDBShobit0% (1)

- Possession Certificate Bangalore RuralDocument1 pagePossession Certificate Bangalore RuralShanka ShankaNo ratings yet

- NPSPayment ReceiptDocument1 pageNPSPayment ReceiptSanthosh DamaNo ratings yet

- 80EEA DeclarationDocument1 page80EEA DeclarationNAGARJUNANo ratings yet

- NPS Transaction Statement For Tier I Account: Current Scheme PreferenceDocument2 pagesNPS Transaction Statement For Tier I Account: Current Scheme PreferenceKuldeep JadhavNo ratings yet

- Homeloan IT Lcertificate Mithun 2023Document1 pageHomeloan IT Lcertificate Mithun 2023yaligartechNo ratings yet

- NPS Statement SummaryDocument3 pagesNPS Statement Summaryvikas_2No ratings yet

- Branch Code:03160 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:03160 Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateAnonymous UjEPpvYDNo ratings yet

- Branch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateDocument1 pageBranch Code:07339 Bank's PAN: Branch Name:: To Whomsoever It May Concern Provisional Home Loan Interest CertificateRavi Kumar100% (1)

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- PPFCertificateSikha PDFDocument1 pagePPFCertificateSikha PDFsikha singhNo ratings yet

- Car Loan Interest RateDocument9 pagesCar Loan Interest RateOnkar ChavanNo ratings yet

- Aditya Birla Sun Life Insurance Receipt for Rajendra Prasad Shrivastava Rs. 30,675 Renewal PremiumDocument2 pagesAditya Birla Sun Life Insurance Receipt for Rajendra Prasad Shrivastava Rs. 30,675 Renewal PremiumSourabh ShrivastavaNo ratings yet

- HDFC Home Loan Deduction StatementDocument1 pageHDFC Home Loan Deduction StatementArunNo ratings yet

- Interest CertificateDocument1 pageInterest CertificateKaja NajeemudinNo ratings yet

- Self Declaration Form - Sec-80DDocument1 pageSelf Declaration Form - Sec-80DDrVarsha Priya SinghNo ratings yet

- Provisional Certificate 2018-2019Document1 pageProvisional Certificate 2018-2019RohanNo ratings yet

- Form 10IADocument1 pageForm 10IAmanickam.ramlakshNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- Homeloancertificate 75543875Document1 pageHomeloancertificate 75543875Pradeep Chauhan100% (1)

- Education Loan Interest CertificateDocument1 pageEducation Loan Interest CertificatePavan KumarNo ratings yet

- 80D SelfDocument1 page80D Selfnikhil nadakuditiNo ratings yet

- Max Bupa Premium Reeipt Parents PDFDocument1 pageMax Bupa Premium Reeipt Parents PDFSatyaNo ratings yet

- 1563614521775Document1 page1563614521775JatinderPalNo ratings yet

- PPF Receipt Jan 2020Document1 pagePPF Receipt Jan 2020prasad_batheNo ratings yet

- Form No 10-IaDocument1 pageForm No 10-IaMd Waseem KNo ratings yet

- NPS Statement SummaryDocument4 pagesNPS Statement SummaryabhishekNo ratings yet

- Renewal of Your Optima Restore Floater Insurance PolicyDocument4 pagesRenewal of Your Optima Restore Floater Insurance PolicyNikky KapoorNo ratings yet

- Home Loan - Certificate - 2022-23Document1 pageHome Loan - Certificate - 2022-23cont2chandu100% (1)

- InterestDocument1 pageInterestsatya.undapalliNo ratings yet

- Himanshu Tiwari - Rental Agreement - BangaloreDocument3 pagesHimanshu Tiwari - Rental Agreement - Bangaloreprinshu123No ratings yet

- Canara Bank Education LoanDocument23 pagesCanara Bank Education Loanprashun ChoudharyNo ratings yet

- PDFDocument3 pagesPDFKritarth KapoorNo ratings yet

- Central Bank of India RTGS NEFT FormDocument1 pageCentral Bank of India RTGS NEFT FormAnkit Moses Yoel0% (1)

- DocumentDocument1 pageDocumentkalyan0% (1)

- 80D CertificateDocument2 pages80D CertificateSiva KadaliNo ratings yet

- Mphasis PF Guidelines for Employees With PF Numbers Starting KN/16573 and KN/46330Document10 pagesMphasis PF Guidelines for Employees With PF Numbers Starting KN/16573 and KN/46330Binoy Xavier RajuNo ratings yet

- Declaration For Housing LoanDocument2 pagesDeclaration For Housing LoanjaberyemeniNo ratings yet

- APA Style Guide for Student PapersDocument24 pagesAPA Style Guide for Student PapersHeureuse MamanNo ratings yet

- Managing Hypertension and Insomnia Through Family Nursing Care PlansDocument4 pagesManaging Hypertension and Insomnia Through Family Nursing Care PlansChristian UmosoNo ratings yet

- Shortened Dental Arch ConceptDocument3 pagesShortened Dental Arch ConceptVivek ShankarNo ratings yet

- Urine Eaxmintaion ReportDocument7 pagesUrine Eaxmintaion Reportapi-3745021No ratings yet

- Global Leader: in Glass IonomerDocument2 pagesGlobal Leader: in Glass IonomerAnggini ZakiyahNo ratings yet

- Sectors of The Indian EconomyDocument5 pagesSectors of The Indian EconomyhavejsnjNo ratings yet

- 2) VT Report Test FormatDocument3 pages2) VT Report Test FormatMoin KhanNo ratings yet

- Chromosomal Basis of Inheritance - Final PDF-1Document3 pagesChromosomal Basis of Inheritance - Final PDF-1Aishwarya ShuklaNo ratings yet

- 2017 Aso Security TrainingDocument60 pages2017 Aso Security TrainingTanzila SiddiquiNo ratings yet

- Slide BP Texas City RefineryDocument20 pagesSlide BP Texas City Refineryamaleena_muniraNo ratings yet

- Grundfosliterature 743129Document7 pagesGrundfosliterature 743129Ted Andrew AbalosNo ratings yet

- FB6100 DSCDocument132 pagesFB6100 DSCTahir FadhilNo ratings yet

- University of Groningen MagazineDocument14 pagesUniversity of Groningen MagazineKhanh Phuong PhamNo ratings yet

- RMLNLU Moot Court Competition (Funding & Reimbursement) Policy, 2019.Document4 pagesRMLNLU Moot Court Competition (Funding & Reimbursement) Policy, 2019.Aakash ChauhanNo ratings yet

- Contracts Summary: 601 Totaling $4.76 BillionDocument186 pagesContracts Summary: 601 Totaling $4.76 BillionJAGUAR GAMINGNo ratings yet

- Biosample Urine Sample Collection Protocol Infant v2Document2 pagesBiosample Urine Sample Collection Protocol Infant v2api-531349549No ratings yet

- Principle of Economics Consolidated Assignements-2 - 10th February 22Document27 pagesPrinciple of Economics Consolidated Assignements-2 - 10th February 22Mani Bhushan SinghNo ratings yet

- Hospital Acquired Infections-IIDocument52 pagesHospital Acquired Infections-IIFATHIMA ANo ratings yet

- Exercise 5 - Journalizing TransactionsDocument10 pagesExercise 5 - Journalizing TransactionsMichael DiputadoNo ratings yet

- Stress and Coping in Families With Deaf Children: Terri Feher-Prout University of PittsburghDocument12 pagesStress and Coping in Families With Deaf Children: Terri Feher-Prout University of PittsburghGolfiNo ratings yet

- Working at Height PolicyDocument7 pagesWorking at Height PolicyAniekan AkpaidiokNo ratings yet

- SOP - APS - PUR - 02A - Flow Chart For PurchaseDocument2 pagesSOP - APS - PUR - 02A - Flow Chart For Purchaseprakash patelNo ratings yet

- Quotes by Clarissa Pinkola Estés (Author of Women Who Run With The Wolves)Document1 pageQuotes by Clarissa Pinkola Estés (Author of Women Who Run With The Wolves)Nes GillNo ratings yet

- Practical 5.17 Protein MaterialsDocument2 pagesPractical 5.17 Protein MaterialsdeeyamullaNo ratings yet

- Nichita Stanescu - The Poet of Loneliness and LossDocument28 pagesNichita Stanescu - The Poet of Loneliness and LossEmanuelaCiocanNo ratings yet

- Manual de Reparacion TXV75Document16 pagesManual de Reparacion TXV75Ovh MaquinariasNo ratings yet

- RUPEX Coupling RWNDocument26 pagesRUPEX Coupling RWNWaris La Joi WakatobiNo ratings yet