Professional Documents

Culture Documents

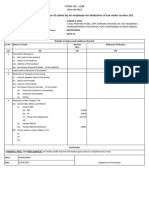

Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192

Uploaded by

Chandra Shekar0 ratings0% found this document useful (0 votes)

8 views2 pagesThis document contains Chandrashekar J's statement of claims for tax deduction under section 192 of the Income Tax Rules 1962. It includes details of the claims being made for house rent allowance, leave travel concessions, interest deductions on borrowing, and deductions under Chapter VI-A of the tax code. Chandrashekar certifies that the information provided is complete and accurate.

Original Description:

Form 12bb

Original Title

Form_12BB_38610

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains Chandrashekar J's statement of claims for tax deduction under section 192 of the Income Tax Rules 1962. It includes details of the claims being made for house rent allowance, leave travel concessions, interest deductions on borrowing, and deductions under Chapter VI-A of the tax code. Chandrashekar certifies that the information provided is complete and accurate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192

Uploaded by

Chandra ShekarThis document contains Chandrashekar J's statement of claims for tax deduction under section 192 of the Income Tax Rules 1962. It includes details of the claims being made for house rent allowance, leave travel concessions, interest deductions on borrowing, and deductions under Chapter VI-A of the tax code. Chandrashekar certifies that the information provided is complete and accurate.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

INCOME-TAX RULES, 1962

FORM NO. 12BB

(See rule 26c)

Statement showing particulars of claims by an employee for deduction of

tax under section 192

1. Name and address of the employee: Chandrashekar J

2. Permanent Account Number of the employee:

3. Financial year : -

Details of claims and evidence thereof

SL.NO Nature of claim Amount (Rs.) Evidence/ Particulars

(1) (2) (3) (4)

1 House Rent Allowance:

(i) Rent Paid to the landlord 0

(ii) Name of the landlord

(iii) Address of the landlord

(iv) Permanent Account number of the landlord

Note: Permanent Account Number shall be furnished if the aggregate rent paid during the previous year exceeds one lakh

rupees

2 Leave travel concessions or assistance

3 Deduction of interest on borrowing:

(i) Interest payable/paid to the lender

(ii) Name of the lender

(iii) Address of the landlord

(iv) Permanent Account number of the landlord

(v) Financial Institutions(if available)

(vi) Employer(if available)

(vii) others

(i) Interest payable/paid to the lender

(ii) Name of the lender

(iii) Address of the landlord

(iv) Permanent Account number of the landlord

(v) Financial Institutions(if available)

(vi) Employer(if available)

(vii) others

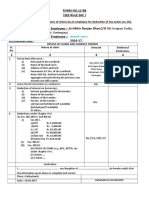

4 Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

( a )Five Years of Fixed Deposits in Scheduled Bank 150000

( b )Employee Provident Fund 0

( c )Public Provident Fund (PPF) 150000

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g 80E, 80G, 80TTA etc.) under

Chapter VI-A

Verification

I, Chandrashekar J , son of Mr. do hereby certify that the information given above is complete and correct.

Place: 3i Infotech Bangalore

Date: 19 Jan, 2022 (Signature of the employee)

Designation: Full Name: Chandrashekar J

You might also like

- Construction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerFrom EverandConstruction Liens for the Pacific Northwest Alaska Idaho Oregon Washington Federal Public Works: A PrimerNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Form 12BB PDFDocument1 pageForm 12BB PDFbala_thegameNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongNo ratings yet

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- Tax Investment Form FY 2023-24Document3 pagesTax Investment Form FY 2023-24rishabh.vermaNo ratings yet

- ONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Document1 pageONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Mriganko DharNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Sample of Form 12BBDocument1 pageSample of Form 12BBphaniranjanNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Day1 10daysaccountingchallengeDocument16 pagesDay1 10daysaccountingchallengeSeungyun ChoNo ratings yet

- QUIZ - PPE PART 1 Answer KeyDocument4 pagesQUIZ - PPE PART 1 Answer KeyRena Rose MalunesNo ratings yet

- Goa University International Economics Sem V SyllabusDocument3 pagesGoa University International Economics Sem V SyllabusMyron VazNo ratings yet

- Financial Controller Job DescriptionDocument3 pagesFinancial Controller Job Descriptionrahulxtc100% (2)

- Quiz 1 - Balance SheetDocument3 pagesQuiz 1 - Balance SheetCindy Craus100% (1)

- Chapter 11 - Part 1 - Accounting FranchisesDocument13 pagesChapter 11 - Part 1 - Accounting FranchisesJane Dizon100% (1)

- Work PaystubDocument1 pageWork Paystubjoelryan2019No ratings yet

- Fundamentals of Accountancy, Business and Management 1Document20 pagesFundamentals of Accountancy, Business and Management 1Lhana Denise100% (5)

- DigiKhata PDFDocument2 pagesDigiKhata PDFtufailnazir Muhammad tufailNo ratings yet

- Law of Financial Institutions and Securities BLO3405: Vu - Edu.auDocument28 pagesLaw of Financial Institutions and Securities BLO3405: Vu - Edu.auYuting WangNo ratings yet

- Accounting For Decision Making Mid TermDocument5 pagesAccounting For Decision Making Mid Termumer12No ratings yet

- SA13 Consulting Services WednesdayDocument31 pagesSA13 Consulting Services WednesdayAhmed AlyaniNo ratings yet

- Real Estate Business PlanDocument3 pagesReal Estate Business PlanJio Victorino100% (2)

- Banking RatiosDocument7 pagesBanking Ratioszhalak04No ratings yet

- QUESTION 4 - Financial-Reporting - QUESTION 4 - NEETADocument7 pagesQUESTION 4 - Financial-Reporting - QUESTION 4 - NEETALaud ListowellNo ratings yet

- Assignment 2 POF Muhammad Yaseen (48535)Document5 pagesAssignment 2 POF Muhammad Yaseen (48535)Muhammad Yaseen ShiekhNo ratings yet

- V. Commissioner of Internal Revenue, RespondentDocument3 pagesV. Commissioner of Internal Revenue, RespondentJenifferRimandoNo ratings yet

- Rythu Bandhu Group Life Insurance Scheme Form 971Document5 pagesRythu Bandhu Group Life Insurance Scheme Form 971CHETTI SAGARNo ratings yet

- Module 2 - Risk Management ProcessDocument13 pagesModule 2 - Risk Management ProcessLara Camille CelestialNo ratings yet

- 1 Alfino Borrowed Money From Yakutsk and Agreed in WritingDocument1 page1 Alfino Borrowed Money From Yakutsk and Agreed in Writingjoanne bajetaNo ratings yet

- Quiz in ObligationDocument8 pagesQuiz in ObligationSherilyn BunagNo ratings yet

- Rules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedDocument2 pagesRules Governing Acceptance of Fixed Deposit: Kerala Transport Development Finance Corporation LimitedemilsonusamNo ratings yet

- BSBCRT611 BriefDocument2 pagesBSBCRT611 BriefJohnNo ratings yet

- Ayush Gaur First Internship Project ReportDocument43 pagesAyush Gaur First Internship Project Report777 FamNo ratings yet

- Berkshire's Corporate Performance vs. The S&P 500Document23 pagesBerkshire's Corporate Performance vs. The S&P 500FirstpostNo ratings yet

- DeAngelo - 1990 - Equity Valuation and Corporate ControlDocument21 pagesDeAngelo - 1990 - Equity Valuation and Corporate ControlAna Luisa EisenlohrNo ratings yet

- PERCENTAGEDocument7 pagesPERCENTAGEPrakash KumarNo ratings yet

- Finance Case - Blaine Kitchenware - GRP - 11Document4 pagesFinance Case - Blaine Kitchenware - GRP - 11Shona Baroi100% (3)

- Case Study Vijay Mallya - Another Big NaDocument10 pagesCase Study Vijay Mallya - Another Big Najai sri ram groupNo ratings yet

- GR 11 Accounting P2 (English) November 2022 Question PaperDocument14 pagesGR 11 Accounting P2 (English) November 2022 Question Paperphafane2020No ratings yet