Professional Documents

Culture Documents

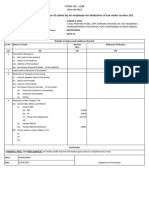

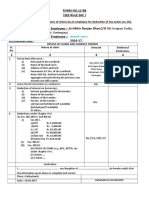

Form 12BB

Uploaded by

shailesh0 ratings0% found this document useful (0 votes)

5 views1 pageCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageForm 12BB

Uploaded by

shaileshCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

FORM NO.

12BB

(See Rule 26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Employee Code : W0622

2. Name of employee : Gaurahari Rana

3. Permanent Account Number of the employee : ARQPR8911G

4. Financial year 2018-19

Details of claims and evidence thereof

Sl Nature Amount (Rs.) Evidence / particulars

No. of claim

(1) (2) (3) (4)

1 House Rent Allowance:

(i) Rent paid to the landlord 98400

(ii) Name of the landlord Ms. Pratima

C.Chandankar

(iii) Address of the landlord A 504 Enclave Socity,

Donapula Goa

(iv) Permanent Account Number of the landlord

Note: Permanent Account Number shall be furnished

if the aggregate rent paid during the previous year

exceeds one lakh rupees

2 Leave travel concessions or assistance

3 Deduction of interest on borrowing:

(i) Interest payable/paid to the lender 241,004

(ii) Name of the lender IDBI Limited

(iii) Address of the lender Marigold House Plot No-

A-34-Cross Road No-2

Marol Midc Andri-E

Mumbai-

(iv) Permanent Account Number of the lender AABC18842G

(a) Financial Institutions(if available)

(b) Employer(if available)

(c) Others

4 Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80C

(i) Section 80C

(a) 241,004 Housing Loan Principal Rep Certificate Attached

(b) Life Insurance Premium 182703

(c) Children Education Fee (Tuition Fees)

20075

(d) Deposit In Post Office Tax Saving Scheme

(e) Housing Loan - Principal amount

repayment only 76866

(f) Fixed Depost with Scheduled Bank for a

period of 5 years or more 0

(g)

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter (i) VI-A.

section……………….

(ii) section……………….

(iii) section……………….

(iv) section……………….

(v) section……………….

Verification

I, Gaurahari Rana hereby certify that the information given above is complete and correct.

Place Goa

Date 16.1.2020

Designation..Style Manager Full Name.. Gaurahari Rana

You might also like

- Awake! - 1954 IssuesDocument769 pagesAwake! - 1954 IssuessirjsslutNo ratings yet

- Tesco Bank No Claim Discount 28-11-17Document2 pagesTesco Bank No Claim Discount 28-11-17jamNo ratings yet

- Balanta AnaliticaDocument8 pagesBalanta AnaliticaVlad PorochNo ratings yet

- CementDocument4 pagesCementafsan21100% (1)

- Bekaert International Financial Management 2eDocument6 pagesBekaert International Financial Management 2essinh100% (1)

- Microeconomics Chapter 4Document15 pagesMicroeconomics Chapter 4Ian Jowmariell GonzalesNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form No.12bb1Document1 pageForm No.12bb1DIVYANo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- ONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Document1 pageONGC Road, Patharkandi. Dist. Karimganj.: Form No.12 BB (See Rule 26C)Mriganko DharNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Form - 12BBDocument2 pagesForm - 12BBmudassir mNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Tax Investment Form FY 2023-24Document3 pagesTax Investment Form FY 2023-24rishabh.vermaNo ratings yet

- Form - 12bb of Income TaxDocument2 pagesForm - 12bb of Income Taxchan chadoNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Assignment January 2018 Semester: There Are Four (4) Pages of Questions, Excluding This PageDocument12 pagesAssignment January 2018 Semester: There Are Four (4) Pages of Questions, Excluding This PageSaid Mohamed MahadNo ratings yet

- JLL Asia Pacific Capital Tracker 4q23Document35 pagesJLL Asia Pacific Capital Tracker 4q23zhaoyynNo ratings yet

- FFS - NumericalsDocument5 pagesFFS - NumericalsFunny ManNo ratings yet

- 1, Mid-Course Exam 2020 IIDocument7 pages1, Mid-Course Exam 2020 IIDo Huyen TrangNo ratings yet

- DRAFT Southern Highlands Destination Plan 2020-2030Document36 pagesDRAFT Southern Highlands Destination Plan 2020-2030Vera DemertzisNo ratings yet

- UNIT-05 Industrial Patterns During The Five Year Plans in IndiaDocument8 pagesUNIT-05 Industrial Patterns During The Five Year Plans in IndiaSAJAHAN MOLLANo ratings yet

- SenthilkumarDocument1 pageSenthilkumarYazh EnterpriseNo ratings yet

- General Ledger-PSP PresentationDocument19 pagesGeneral Ledger-PSP PresentationOmar TarekNo ratings yet

- Top Largest Central Bank Rankings by Total AssetsDocument24 pagesTop Largest Central Bank Rankings by Total AssetsMayank AhujaNo ratings yet

- China, The United States, and Central Bank Digital Currencies How Important Is It To Be FirstDocument22 pagesChina, The United States, and Central Bank Digital Currencies How Important Is It To Be FirstJan BerkaNo ratings yet

- 59 - Mosspark - Glasgow City Centre - Mosspark McGill's BusesDocument1 page59 - Mosspark - Glasgow City Centre - Mosspark McGill's Busesmasudfarah386No ratings yet

- XXSCM Standard LPO Report 020124Document1 pageXXSCM Standard LPO Report 020124Ashfaque Ahmed Oracle Functional ConsultantNo ratings yet

- Entrep Mind Chapter 2Document2 pagesEntrep Mind Chapter 2Yeho ShuaNo ratings yet

- Impact of Globalization On National Security: March 2019Document12 pagesImpact of Globalization On National Security: March 2019Rohit Agrawal PG19CM008No ratings yet

- Fin 121 ResearchDocument6 pagesFin 121 ResearchCj ReyesNo ratings yet

- Lietuvos Banknotai. Lithuanian Banknotes (Juozas Galkus)Document238 pagesLietuvos Banknotai. Lithuanian Banknotes (Juozas Galkus)Mikhail BeloshevskiNo ratings yet

- Raus IAS Economy Compass 2022Document205 pagesRaus IAS Economy Compass 2022MansiNo ratings yet

- Financial Reporting 3rd Edition - (CHAPTER 23 Foreign Currency Transactions and Forward Exchange Contract... )Document46 pagesFinancial Reporting 3rd Edition - (CHAPTER 23 Foreign Currency Transactions and Forward Exchange Contract... )Jacx 'sNo ratings yet

- Macp Latest Book 2022 23Document189 pagesMacp Latest Book 2022 23gajendraNo ratings yet

- University of The Immaculate Conception: Master in Business Administration ProgramDocument21 pagesUniversity of The Immaculate Conception: Master in Business Administration ProgramCINDY MAE DUMAPIASNo ratings yet

- Banking Q & A at A GlanceDocument45 pagesBanking Q & A at A GlanceSreenivas KuppachiNo ratings yet

- Brief Talk On The Alienation of Human Nature - From A Curtain of Green and Other StoriesDocument3 pagesBrief Talk On The Alienation of Human Nature - From A Curtain of Green and Other StoriesJhon Renren LogatocNo ratings yet

- RisCo Firme Nou Infiintate 20221205Document55 pagesRisCo Firme Nou Infiintate 20221205Andrei MaresNo ratings yet

- QuizDocument1 pageQuizAbegail PanangNo ratings yet