Professional Documents

Culture Documents

FORM12BB

Uploaded by

Botla Raja0 ratings0% found this document useful (0 votes)

8 views1 pageOriginal Title

FORM12BB (2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageFORM12BB

Uploaded by

Botla RajaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

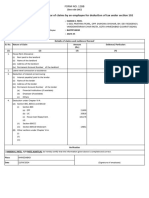

FORM NO.

12BB

See Rule (26C)

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name of the Employee : BOTLA RAHUL

2. Permanent Account Number of the Employee : DBNPB1352K

3. Financial year : 2022-2023

Details of claims and evidence thereof

Sl.No Nature of claim Amount (Rs.) Evidence/ particulars

(1) House Rent Allowance:

(i) Rent paid to the landlord 219600.00 Rent Reciept

(ii) Name and Address of the landlord

(iii) Permanent Account Number of the landlord BMWPM1075L

Note: Permanent Account Number shall be furnished if the aggregate rent paid during the previous

year exceeds one lakh rupees

(2) Leave travel concessions or assistance

(3) Deduction of interest on borrowing:

(i) Interest payable/paid to the lender 0.00

(ii) Name of the lender

(iii) Permanent Account Number of the lender

(4) Deduction under Chapter VI-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(1) Insurance Premium 29,554.00 Receipt/Statement

(2) Sukanya Samrudhi Account Scheme 100,000.00 Receipt/Statement

(ii) Section 80CCC

(iii) Section 80CCD

(1) Sec.80CCD(1B) - NPS Contribution 50,000.00 Receipt/Statement

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter

Verification

I BOTLA RAHUL, do hereby certify that the information given above is complete and correct.

Place : Hyderabad

Date : 29-Dec-2022 (Signature of Employee)

Designation : Software Engineer Full Name : BOTLA RAHUL

20254237 Form 12BB Page : 1

You might also like

- Form No. 16: Part BDocument3 pagesForm No. 16: Part Bsanjay chauhanNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Form 12BBDocument1 pageForm 12BBBiranchi DasNo ratings yet

- FormDocument2 pagesFormdileepNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- 2023-2024 FormNo12BBDocument1 page2023-2024 FormNo12BBvivek070176No ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- "FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pages"FORM NO.12BB (See Rule 26C) " Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Snehasish PadhyNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportANTHONI FERNANDESNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Roll No. ..................................... : New SyllabusDocument12 pagesRoll No. ..................................... : New Syllabuskevin12345555No ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportAnkit RajNo ratings yet

- Sample of Form 12BBDocument1 pageSample of Form 12BBphaniranjanNo ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Form16-2021-2022 Part BDocument3 pagesForm16-2021-2022 Part Bthaarini doraiswamiNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerAbhishekShuklaNo ratings yet

- Form12BB 1Document2 pagesForm12BB 1kolhe2377No ratings yet

- Form No. Chg-1: English Hindi Form LanguageDocument7 pagesForm No. Chg-1: English Hindi Form LanguageKunal ObhraiNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Epsf Form12bb 903949Document2 pagesEpsf Form12bb 903949MALLA SAI YASWANTH REDDYNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- Rent Receipt Tarak.Document3 pagesRent Receipt Tarak.Tarak ReddyNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- sdm16 ExpertisemodelingDocument9 pagessdm16 ExpertisemodelingBotla RajaNo ratings yet

- Local Transort and HotelsDocument2 pagesLocal Transort and HotelsBotla RajaNo ratings yet

- FeeIntimation SC 53340 GHMC 5057 202Document2 pagesFeeIntimation SC 53340 GHMC 5057 202Botla RajaNo ratings yet

- RevisedFee SC 53340 GHMC 5057 2021Document2 pagesRevisedFee SC 53340 GHMC 5057 2021Botla RajaNo ratings yet

- Com HeroDocument8 pagesCom HeroBotla RajaNo ratings yet