Professional Documents

Culture Documents

Form 12 BB Msir

Uploaded by

rajeshCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form 12 BB Msir

Uploaded by

rajeshCopyright:

Available Formats

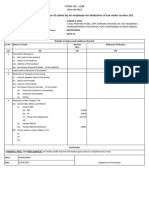

FORM NO.

12BB

(See ule 26C)

Statement showing particulars of claims by an emplovee for deduction of tax

under section 192

1Name and address of the employee

2Permanent Account Number of the

employee

3Financial year

DETAILSOF CLAIMS AND EVIDENCE THEREOF

SI

Nature of claim Amount (Rs.) Evidence / Particulars

No

|(1) (2) (3) (4)

1 House Rent Allowance:

(i) Rent paid to the landlord

(ii) Namne of the landlord

(ili) Address of the landlord

(iv) Permanent Account Number of the landlord

Note: Permanent Account Number shall be

|furnished if the aggregate rent paid during the

previous year exceeds one lakh rupees

2 Leave travel concessions or assistance

3 Deduction of interest on borrowing:

() Interest payable/paid to the lender

(ii) Name of the lender

(iii) Address of the lender

(iv) Permanent Account Number of the lender

(a) Financial Institutions (if available)

(b) Employer (if available)

(c) Others

4 Deduction under Chapter Vl-A

(A) Section 80C,80CCC and 80CCD

(i) Section 80C

(a)

(b)

(c)

(d)

(e)

()

(g)

(ii) Section 80CCC

(iii) Section 80CCD

(B) Other Sections (e.g. 80E, 80G, 80TTA, etc.)

under Chapter VI-A.

(i) Section.

(ii) Section.

(iii) Section..

(iv) Section.

(v) Section..

VERIFICATION

I,. .,son/daughter of. do hereby certif

that the information given above is complete and correc.

Place.

Date. l(Signature of the employee)

|Designation Full Name:

You might also like

- ZAMBIA BATA SHOE COMPANY LIMITED V VINDocument9 pagesZAMBIA BATA SHOE COMPANY LIMITED V VINlambwe MwanzaNo ratings yet

- Sample Proof of Service by E-Mail For CaliforniaDocument1 pageSample Proof of Service by E-Mail For CaliforniaStan BurmanNo ratings yet

- Blue Rider Decal Monograph 1 Aviation in Post WW1 AustriaDocument26 pagesBlue Rider Decal Monograph 1 Aviation in Post WW1 AustriaLaurentiu Ionescu100% (3)

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- BP040 Current Process ModelDocument1 pageBP040 Current Process Modelsastrylanka1980No ratings yet

- Tax DeclarationDocument2 pagesTax DeclarationVISHAKHA SHARMANo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBWater SpecNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBPrAbHaS DarLiNgNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMuhammed RiyazNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFRudolph Antony ThomasNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBDedyTo'tedongNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFSahil KumarNo ratings yet

- Itrform12bb PDFDocument3 pagesItrform12bb PDFMeghana JoshiNo ratings yet

- Fabdd PDFDocument3 pagesFabdd PDFSahil KumarNo ratings yet

- Itrform 12 BBDocument3 pagesItrform 12 BBAnonymous DbmKEDxNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192mayurNo ratings yet

- File 20042020153269734Document1 pageFile 20042020153269734Skill IndiaNo ratings yet

- Form - 12bb of Income TaxDocument2 pagesForm - 12bb of Income Taxchan chadoNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence Thereofvijay sharmaNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofsujupsNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form 12BB in Excel FormatDocument2 pagesForm 12BB in Excel FormatJTO NIBNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofSathish NakeerthaNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument2 pagesForm No.12Bb: Details of Claims and Evidence ThereofVighneshwarBhatNo ratings yet

- Form 12BBDocument2 pagesForm 12BBPintu pajaiNo ratings yet

- Form 12BB PDFDocument1 pageForm 12BB PDFbala_thegameNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofBSNL RBLNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- Form 12BB in Excel FormatDocument4 pagesForm 12BB in Excel Formatkumar45caNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument1 pageForm No.12Bb: Details of Claims and Evidence ThereofmaddymatNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofParmar NileshNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Rishabh 239Document1 pageRishabh 239Anikate SharmaNo ratings yet

- Form 12Document2 pagesForm 12sarathNo ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- Income Tax Savings Declaration Form EngDocument2 pagesIncome Tax Savings Declaration Form EngDedyTo'tedongNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Form No.12Bb: Details of Claims and Evidence ThereofDocument4 pagesForm No.12Bb: Details of Claims and Evidence ThereofsivaNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- Form12bb 23-24Document1 pageForm12bb 23-24hanu549549No ratings yet

- Income Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document5 pagesIncome Tax Rules, 1962: Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Santosh Aditya Sharma ManthaNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Income Tax Declaration Form - FORM-NO. 12BBDocument10 pagesIncome Tax Declaration Form - FORM-NO. 12BBPrince MittalNo ratings yet

- Form 12BB in Word FormatDocument2 pagesForm 12BB in Word FormatAlka Joshi0% (1)

- LTA Reimbursement Claim Form For 2020-2021: Company NameDocument3 pagesLTA Reimbursement Claim Form For 2020-2021: Company NameAnish JainNo ratings yet

- Form 12BBDocument2 pagesForm 12BBSales PrintBrixNo ratings yet

- Form. 12BBDocument6 pagesForm. 12BBaruyl001No ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- 1.4 FORM NO 12 BB FinalDocument2 pages1.4 FORM NO 12 BB FinalVinit KayarkarNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- IT Declaration-1555459035665Document1 pageIT Declaration-1555459035665Pooja ParabNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- BBPK MCQ PciDocument3 pagesBBPK MCQ PcirajeshNo ratings yet

- WJPR Shivaleela Rev ArticleDocument26 pagesWJPR Shivaleela Rev ArticlerajeshNo ratings yet

- I ST Pharm.D Remedial MathsDocument1 pageI ST Pharm.D Remedial MathsrajeshNo ratings yet

- Circular To Dental CollegesDocument3 pagesCircular To Dental CollegesrajeshNo ratings yet

- 3.6 Pharmaceutical Formulations (Theory)Document2 pages3.6 Pharmaceutical Formulations (Theory)rajeshNo ratings yet

- JNTUH Revised Academic Calendar 2020-21 For B.Tech. and B.Pharm. II, III & IV Years I & II SemestersDocument1 pageJNTUH Revised Academic Calendar 2020-21 For B.Tech. and B.Pharm. II, III & IV Years I & II SemestersrajeshNo ratings yet

- B.Pharmacy IY - R17 - Remedial MathsDocument2 pagesB.Pharmacy IY - R17 - Remedial MathsrajeshNo ratings yet

- B.Pharmacy IY - R17 - Remedial Maths PDFDocument2 pagesB.Pharmacy IY - R17 - Remedial Maths PDFrajeshNo ratings yet

- 5.3 Clinical Pharmacokinetics and Pharmacotherapeutic Drug Monitoring (Theory)Document1 page5.3 Clinical Pharmacokinetics and Pharmacotherapeutic Drug Monitoring (Theory)rajeshNo ratings yet

- Formulation of Emulsions: Marie Wahlgren, Björn Bergenståhl, Lars Nilsson, and Marilyn RaynerDocument55 pagesFormulation of Emulsions: Marie Wahlgren, Björn Bergenståhl, Lars Nilsson, and Marilyn RaynerrajeshNo ratings yet

- Gaumet2008 PDFDocument9 pagesGaumet2008 PDFrajeshNo ratings yet

- M Vitro: 1 B. C H A N C E, Acta Chem. Scand. 1, 236 (1947)Document6 pagesM Vitro: 1 B. C H A N C E, Acta Chem. Scand. 1, 236 (1947)rajeshNo ratings yet

- Functional Materials in Food NanotechnologyDocument10 pagesFunctional Materials in Food NanotechnologyrajeshNo ratings yet

- Statistical Graphics in Pharmacokinetics and Pharmacodynamics: A TutorialDocument11 pagesStatistical Graphics in Pharmacokinetics and Pharmacodynamics: A TutorialrajeshNo ratings yet

- 4pain ManagementDocument1 page4pain ManagementrajeshNo ratings yet

- Regulatory Issues & Addiction: Case SnippetDocument1 pageRegulatory Issues & Addiction: Case SnippetrajeshNo ratings yet

- SyllabusDocument107 pagesSyllabusrajeshNo ratings yet

- Population Pharmacokinetics II: Estimation MethodsDocument9 pagesPopulation Pharmacokinetics II: Estimation MethodsrajeshNo ratings yet

- European Journal of Pharmaceutics and Biopharmaceutics: Yanzhuo Zhang, Tongying Jiang, Qiang Zhang, Siling WangDocument7 pagesEuropean Journal of Pharmaceutics and Biopharmaceutics: Yanzhuo Zhang, Tongying Jiang, Qiang Zhang, Siling WangrajeshNo ratings yet

- Law Notes by CA Ravi AgarwalDocument58 pagesLaw Notes by CA Ravi AgarwalJoystan MonisNo ratings yet

- BADRI UAE Annual Preliminary Industry Report 2022 Q4Document13 pagesBADRI UAE Annual Preliminary Industry Report 2022 Q4Monica AhujaNo ratings yet

- People v. Serrano G.R. No. L 7973Document2 pagesPeople v. Serrano G.R. No. L 7973Tootsie GuzmaNo ratings yet

- Opening SpeechDocument2 pagesOpening Speechapi-276904992No ratings yet

- GE 9 - Pre TestDocument2 pagesGE 9 - Pre TestMay Pearl BernaldezNo ratings yet

- Dme Information Form Cms-10125 - External Infusion PumpsDocument2 pagesDme Information Form Cms-10125 - External Infusion PumpsSonof GoddNo ratings yet

- Home Insurance - Google SearchDocument1 pageHome Insurance - Google Searchayesha wahidNo ratings yet

- Y%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H:, Yq Ifr Rdehaf Nrhryprf Fbaur Tu J JKHDG GJ JpupifDocument8 pagesY%S, XLD M Dka %SL Iudcjd Ckrcfha .Eiü M %H:, Yq Ifr Rdehaf Nrhryprf Fbaur Tu J JKHDG GJ JpupifRamesh RKNo ratings yet

- Treasury Code Vol-Ii: (See Subsidiary Rule 256 (1) )Document9 pagesTreasury Code Vol-Ii: (See Subsidiary Rule 256 (1) )Zorex ZisaNo ratings yet

- Puig vs. PenafloridaDocument4 pagesPuig vs. PenafloridaMonikkaNo ratings yet

- AHB Hong KongDocument46 pagesAHB Hong KongPraveen SankaranNo ratings yet

- 3568c-2 Gs Pre Exp 4151 e 2024 1335784Document41 pages3568c-2 Gs Pre Exp 4151 e 2024 1335784sumitnapit2No ratings yet

- Ipc ProjectDocument37 pagesIpc ProjectNonit HathilaNo ratings yet

- Mandela Leadership TheoryDocument27 pagesMandela Leadership TheoryLOVERS NGOBENINo ratings yet

- 40 - Reyes v. CA S.C. L-5620 July 31, 1954Document2 pages40 - Reyes v. CA S.C. L-5620 July 31, 1954November Lily OpledaNo ratings yet

- ACE Personal Trainer Manual Chapter 17Document54 pagesACE Personal Trainer Manual Chapter 17Đạt NguyễnNo ratings yet

- G.R. No. 203754Document4 pagesG.R. No. 203754Ryw100% (1)

- Why Did The Provisional Government FailDocument2 pagesWhy Did The Provisional Government Failsanjayb1008491No ratings yet

- Notes On Special Proceedings: de Leon, 2020 EditionDocument14 pagesNotes On Special Proceedings: de Leon, 2020 EditionNorjanisa DimaroNo ratings yet

- Daycare CertificateDocument14 pagesDaycare CertificateWalter JensenNo ratings yet

- CV Muhammad Arif Alwi SalamDocument1 pageCV Muhammad Arif Alwi SalamALDO FEWNo ratings yet

- OLDHAM MBC SCHEDULE of PERSONS NOMINATEDDocument20 pagesOLDHAM MBC SCHEDULE of PERSONS NOMINATEDPoliceCorruptionNo ratings yet

- Let Review 2023 Teaching Profession Legal Issues in EducationDocument10 pagesLet Review 2023 Teaching Profession Legal Issues in EducationJeah Asilum Dalogdog100% (2)

- Pearce v. FBI Agent Doe 5th Circuit Unpublished DecisionDocument6 pagesPearce v. FBI Agent Doe 5th Circuit Unpublished DecisionWashington Free BeaconNo ratings yet

- Sample Format of Certification of Legally, Peacefully and Orderly Execution of Search WarrantDocument2 pagesSample Format of Certification of Legally, Peacefully and Orderly Execution of Search WarrantEly A Zar0% (1)

- 8 Types of Companies in MalaysiaDocument9 pages8 Types of Companies in MalaysiaYingfang HuangNo ratings yet

- 15 Lourdes Hospital Vs CapanzanaDocument8 pages15 Lourdes Hospital Vs CapanzanaBeau BautistaNo ratings yet