Professional Documents

Culture Documents

Ind Nifty Infra

Uploaded by

Himasis PoddarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ind Nifty Infra

Uploaded by

Himasis PoddarCopyright:

Available Formats

December 31, 2021

NIFTY Infrastructure Index includes companies belonging to Telecom, Power, Port, Air, Roads, Railways, shipping and other Utility

Services providers. The Index comprises of maximum 30 companies listed on National Stock Exchange of India (NSE).

NIFTY Infrastructure Index is computed using free float market capitalization method, wherein the level of the index reflects the total

free float market value of all the stocks in the index relative to particular base market capitalization value.

NIFTY Infrastructure Index can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds,

ETFs and structured products.

Index Variant: NIFTY Infrastructure Total Returns Index.

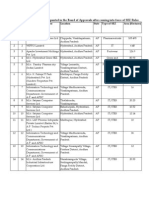

Portfolio Characteristics

Methodology Periodic Capped Free Float Index Since

QTD YTD 1 Year 5 Years

No. of Constituents 30 Returns (%) Inception

Launch Date August 07, 2007 Price Return -1.46 35.58 35.58 12.79 9.29

Base Date January 01, 2004 Total Return -0.99 37.77 37.77 14.79 10.72

Base Value 1000 Since

Calculation Frequency Real-Time Statistics ## 1 Year 5 Years

Inception

Index Rebalancing Semi-Annually Std. Deviation * 17.47 19.76 26.31

Sector Representation Beta (NIFTY 50) 0.99 0.95 1.06

Sector Weight(%) Correlation (NIFTY 50) 0.88 0.88 0.90

OIL & GAS 31.83

Fundamentals

CONSTRUCTION 17.36

P/E P/B Dividend Yield

CEMENT & CEMENT PRODUCTS 15.39

17.81 2.94 2.14

TELECOM 11.46

POWER 10.50

Top constituents by weightage

SERVICES 5.68

AUTOMOBILE 3.26 Company’s Name Weight(%)

HEALTHCARE SERVICES 3.18

INDUSTRIAL MANUFACTURING 1.33 Reliance Industries Ltd. 19.72

Larsen & Toubro Ltd. 14.46

Bharti Airtel Ltd. 10.19

UltraTech Cement Ltd. 5.53

Power Grid Corporation of India Ltd. 4.41

Grasim Industries Ltd. 3.84

NTPC Ltd. 3.73

Adani Ports and Special Economic Zone Ltd. 3.39

Oil & Natural Gas Corporation Ltd. 3.28

Apollo Hospitals Enterprise Ltd. 3.18

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice. 1

December 31, 2021

Index Methodology

Eligibility Criteria for Selection of Constituent Stocks:

i. Companies should form part of NIFTY 500 at the time of review. In case, the number of eligible stocks representing a particular

sector within NIFTY 500 falls below 10, then deficit number of stocks shall be selected from the universe of stocks ranked within top

800 based on both average daily turnover and average daily full market capitalisation based on previous six months period data used

for index rebalancing of NIFTY 500.

ii. Companies should form a part of infrastructure sector.

iii. Companies that are allowed to trade in F&O segment are only eligible to be constituent of the index.

iv. The company's trading frequency should be at least 90% in the last six months.

v. The company should have a listing history of 6 months. A company, which comes out with an IPO will be eligible for inclusion in

the index, if it fulfills the normal eligibility criteria for the index for a 3 month period instead of a 6 month period.

vi. Final selection of companies shall be done based on the free-float market capitalization of the companies.

vii. Weightage of each stock in the index is calculated based on its free-float market capitalization such that no single stock shall be

more than 20% at the time of rebalancing.

Index Re-Balancing:

Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of

indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of

change.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

NIFTY 50 NIFTY Bank NIFTY CPSE NIFTY100 Equal Weight NIFTY 10 yr Benchmark G-Sec

NIFTY Next 50 NIFTY IT NIFTY Commodities NIFTY50 PR 1x Inverse NIFTY 8-13 yr G-Sec

NIFTY 100 NIFTY PSU Bank NIFTY Energy NIFTY50 PR 2x Leverage NIFTY 4-8 yr G-Sec

NIFTY 200 NIFTY FMCG NIFTY Shariah 25 NIFTY50 Value 20 NIFTY 11-15 yr G-Sec

NIFTY 500 NIFTY Private Bank NIFTY 100 Liquid15 NIFTY100 Quality 30 NIFTY 15 yr and above G-Sec

NIFTY Midcap 50 NIFTY Metal NIFTY Infrastructure NIFTY Low Volatility 50 NIFTY Composite G-Sec

NIFTY Midcap 100 NIFTY Financial Services NIFTY Corporate Group NIFTY Alpha 50 NIFTY 1D Rate

Contact Us: Bloomberg - NSEINFR Index

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com Thomson Reuters - .NIFTYINFR

2

You might also like

- Ind Nifty InfraDocument2 pagesInd Nifty InfraDharmik UndaviyaNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50kurapati_sivajiNo ratings yet

- Nifty 500Document2 pagesNifty 500ramesh kumarNo ratings yet

- Ind NIFTY ADITYA BIRLA GROUPDocument2 pagesInd NIFTY ADITYA BIRLA GROUPUmesh ThawareNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500Darl DranzerNo ratings yet

- Alpha Low-Vy 30Document2 pagesAlpha Low-Vy 30Ankit JoshiNo ratings yet

- Ind Nifty InfraDocument2 pagesInd Nifty InfrasamkarthickNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Cheat SheetNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50prateekNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50yctgfjyNo ratings yet

- Ind Nifty InfraDocument2 pagesInd Nifty InfraSiddharth RejaNo ratings yet

- Factsheet Nifty500 Multicap50-25-25 IndexDocument2 pagesFactsheet Nifty500 Multicap50-25-25 Indexramesh kumarNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50saumilshah1990No ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Srisilpa KadiyalaNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Prasad ChowdaryNo ratings yet

- Ind Nifty Midcap 150Document2 pagesInd Nifty Midcap 150Kushal BnNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFwartan solarNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Venu MadhavNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Rajesh KumarNo ratings yet

- Nifty50 Fact SheetDocument2 pagesNifty50 Fact SheetI am IndianNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50riteshsoniNo ratings yet

- Ind Nifty MidSmallcap 400Document2 pagesInd Nifty MidSmallcap 400Parag SaxenaNo ratings yet

- Ind Nifty50gdsgDocument2 pagesInd Nifty50gdsgPayal AgarwalNo ratings yet

- Ind Nifty Pse PDFDocument2 pagesInd Nifty Pse PDFAman DagaNo ratings yet

- Ind NIFTY TATA GROUPDocument2 pagesInd NIFTY TATA GROUPGautam NatrajNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Mohan KrishnaNo ratings yet

- Nifty100 Liquid 15Document2 pagesNifty100 Liquid 15adityazade03No ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Umesh ThawareNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Aqib MujtabaNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Sagar V SoniNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- Factsheet Nifty 100 EW IndexDocument2 pagesFactsheet Nifty 100 EW IndexAnkit JoshiNo ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50siddharthNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500R SarkarNo ratings yet

- Ind Nifty MediaDocument2 pagesInd Nifty MediaJackNo ratings yet

- In123d Nifty50Document2 pagesIn123d Nifty50praNo ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50tushar agaleNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Subhash DhakarNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Nifty Top 50Document2 pagesNifty Top 50BillionaireNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexRahul RanjanNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFSantanu Mitra RayNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFAnonymous WsqC9mzqc0No ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Shiv PratapNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Berkshire Hathway coldNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFAJAY KUMAR TALATHOTANo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50market moneyNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Jimit ShahNo ratings yet

- Nifty 50Document2 pagesNifty 50Pubg UpdateNo ratings yet

- July 30, 2021: Portfolio CharacteristicsDocument2 pagesJuly 30, 2021: Portfolio CharacteristicsPrashant AhirNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30namharidwarNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahAjmal Lakshadweep AJNo ratings yet

- Ind Nifty India ConsumptionDocument2 pagesInd Nifty India ConsumptionbhattjgNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500nagendraNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio Characteristicsmoresushant849643No ratings yet

- Financial Management Theory and Practice An Asia 1St Edition Brigham Test Bank Full Chapter PDFDocument45 pagesFinancial Management Theory and Practice An Asia 1St Edition Brigham Test Bank Full Chapter PDFMeganPrestonceim100% (12)

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Sahil SharmaNo ratings yet

- De Cuong Tieng Anh 7 - HK2 - UYENDocument4 pagesDe Cuong Tieng Anh 7 - HK2 - UYENUyên TạNo ratings yet

- Accounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Document10 pagesAccounting Concepts and Priciples: Fundamentals of Accountancy, Business and Management 1Marilyn Nelmida TamayoNo ratings yet

- Information About Indian Companies: ChennaiDocument1 pageInformation About Indian Companies: Chennailingeshsaikumar030No ratings yet

- Pidsdps 1907Document68 pagesPidsdps 1907Rico MaligayaNo ratings yet

- How To Transfer Vehicle From One State To AnotherDocument24 pagesHow To Transfer Vehicle From One State To AnothernpsNo ratings yet

- European Politics in Transition 6th Edition PDFDocument2 pagesEuropean Politics in Transition 6th Edition PDFGunaraj0% (3)

- Audit A Financial Model With Macabacus (Complete)Document7 pagesAudit A Financial Model With Macabacus (Complete)Kayerinna PardosiNo ratings yet

- Monetary Policy Guidelines For 2020 - 2022: MoscowDocument135 pagesMonetary Policy Guidelines For 2020 - 2022: MoscowMary Femina KSNo ratings yet

- Indonesian Domestic IRF GuideDocument20 pagesIndonesian Domestic IRF GuideMenot OmarNo ratings yet

- Rekening Koran Bank Mandiri Bulan Mei 20022Document11 pagesRekening Koran Bank Mandiri Bulan Mei 20022gedearNo ratings yet

- Final Assessment - Introduction To Economics - 05082021Document1 pageFinal Assessment - Introduction To Economics - 05082021TabishNo ratings yet

- International Finance BBA - 403: Lectures 2 September 30, 2020Document23 pagesInternational Finance BBA - 403: Lectures 2 September 30, 2020ifrah ahmadNo ratings yet

- Dear Naveen Gutpa, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingDocument5 pagesDear Naveen Gutpa, Congratulations! Now You Are One Step Closer To Achieving Your Financial Goals by ChoosingAnkit Maheshwari /WealthMitra/Delhi/Dwarka/No ratings yet

- Burton (2015) Organizational Design BDocument22 pagesBurton (2015) Organizational Design BCarol Viviana Zanetti DuranNo ratings yet

- Trade Lic-2021-2024Document1 pageTrade Lic-2021-2024Sadam KhanNo ratings yet

- Lecture 2 - Statement of Comprehensive IncomeDocument52 pagesLecture 2 - Statement of Comprehensive IncomeGonzalo Jr. RualesNo ratings yet

- ECO121Document25 pagesECO121Cao Ngoc Mai Thao (K17 QN)No ratings yet

- Prepare Financial Report IbexDocument13 pagesPrepare Financial Report Ibexfentahun enyewNo ratings yet

- Ac312, Assignment 1, Dela CruzDocument4 pagesAc312, Assignment 1, Dela CruzChelsea Dela CruzNo ratings yet

- List of Filipino Architects and Their Works Architect Works: SebreroDocument12 pagesList of Filipino Architects and Their Works Architect Works: SebreroEllebanna OritNo ratings yet

- Operations ManagementDocument6 pagesOperations Managementashish sunnyNo ratings yet

- Operations Management 12th Edition Stevenson Test BankDocument25 pagesOperations Management 12th Edition Stevenson Test BankMrDustinAllisongmer100% (42)

- List of Formal Approval SEZDocument34 pagesList of Formal Approval SEZsampuran.das@gmail.comNo ratings yet

- Documents - Pub - Pakistan Hosiery Manufacturers Final Voter Listpdf Pakistan Hosiery ManufacturersDocument60 pagesDocuments - Pub - Pakistan Hosiery Manufacturers Final Voter Listpdf Pakistan Hosiery ManufacturersAdeel Ali0% (1)

- Answer: CDocument4 pagesAnswer: CwendychenNo ratings yet

- Activity-Partnerships-METRILLO, JOHN KENNETH R.Document4 pagesActivity-Partnerships-METRILLO, JOHN KENNETH R.LordCelene C MagyayaNo ratings yet

- ATOLE 1 NigeriaDocument24 pagesATOLE 1 NigeriaDaniel AigbeNo ratings yet

- Inventory ManagementDocument6 pagesInventory ManagementHimanshu SharmaNo ratings yet