Professional Documents

Culture Documents

NIFTY100 ESG Index Performance and Methodology

Uploaded by

Tash KentOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NIFTY100 ESG Index Performance and Methodology

Uploaded by

Tash KentCopyright:

Available Formats

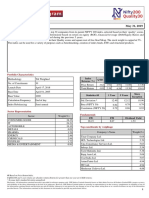

September 30, 2021

NIFTY100 ESG Index is designed to reflect the performance of companies within NIFTY 100 index based on Environmental, Social

and Governance (ESG) score. The weight of each constituent in the index is tilted based on ESG score assigned to the company, i.e.

the constituent weight is derived from its free float market capitalization and ESG score.

The index can be used for a variety of purposes such as benchmarking, creation of index funds, ETFs and structured products.

Portfolio Characteristics

Methodology Tilt Weighted Index Since

QTD YTD 1 Year 5 Years

No. of Constituents 88 Returns (%) Inception

Launch Date March 27, 2018 Price Return 12.92 30.61 61.32 17.74 12.93

Base Date April 01, 2011 Total Return 13.40 31.83 63.34 19.13 14.50

Base Value 1000 Since

Calculation Frequency End of day Statistics ## 1 Year 5 Years

Inception

Index Rebalancing Quarterly Std. Deviation * 14.38 17.76 17.45

Sector Representation Beta (NIFTY 50) 0.90 0.96 0.99

Sector Weight(%) Correlation (NIFTY 50) 0.96 0.99 0.98

FINANCIAL SERVICES 28.49

Fundamentals

IT 22.62

P/E P/B Dividend Yield

CONSUMER GOODS 12.90

32.23 5.93 1.27

AUTOMOBILE 7.98

PHARMA 4.66

Top constituents by weightage

OIL & GAS 4.23

CONSUMER SERVICES 3.53 Company’s Name Weight(%)

CEMENT & CEMENT PRODUCTS 3.48

TELECOM 3.12 Infosys Ltd. 6.75

CONSTRUCTION 2.37 Tata Consultancy Services Ltd. 5.45

POWER 2.36 Housing Development Finance Corporation 5.11

METALS 2.04 HCL Technologies Ltd. 3.30

FERTILISERS & PESTICIDES 0.79 HDFC Bank Ltd. 3.17

HEALTHCARE SERVICES 0.45

Tech Mahindra Ltd. 2.98

CHEMICALS 0.40

Wipro Ltd. 2.79

SERVICES 0.39

INDUSTRIAL MANUFACTURING 0.20 Bajaj Finance Ltd. 2.77

Titan Company Ltd. 2.76

Kotak Mahindra Bank Ltd. 2.54

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice. 1

September 30, 2021

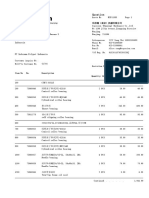

Index Methodology

• The index has a base date of April 01, 2011 and a base value of 1000

• To form part of the NIFTY100 ESG Index, stocks should qualify the following eligibility criteria:

o Stocks should form part of NIFTY 100

o Companies should have an ESG score

o Companies with a controversy category of 4 and 5 will be excluded (scale: 1-5, category 1 being least controversial)

o Companies engaged in the business of tobacco, alcohol, controversial weapons and gambling operations shall be excluded.

The number of constituents in the index is variable. Sector weights are based on free float market capitalization. Each constituent

within sector is ESG tilt weighted and capped at 10%. Index is reconstituted on a semi-annual basis.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

NIFTY 50 NIFTY Bank NIFTY CPSE NIFTY100 Equal Weight NIFTY 10 yr Benchmark G-Sec

NIFTY Next 50 NIFTY IT NIFTY Commodities NIFTY50 PR 1x Inverse NIFTY 8-13 yr G-Sec

NIFTY 100 NIFTY PSU Bank NIFTY Energy NIFTY50 PR 2x Leverage NIFTY 4-8 yr G-Sec

NIFTY 200 NIFTY FMCG NIFTY Shariah 25 NIFTY50 Value 20 NIFTY 11-15 yr G-Sec

NIFTY 500 NIFTY Private Bank NIFTY 100 Liquid15 NIFTY100 Quality 30 NIFTY 15 yr and above G-Sec

NIFTY Midcap 50 NIFTY Metal NIFTY Infrastructure NIFTY Low Volatility 50 NIFTY Composite G-Sec

NIFTY Midcap 100 NIFTY Financial Services NIFTY Corporate Group NIFTY Alpha 50 NIFTY 1D Rate

Contact Us:

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com

2

You might also like

- NIFTY Midcap 50 overviewDocument2 pagesNIFTY Midcap 50 overviewSamriddh DhareshwarNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Umesh ThawareNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- NIFTY Aditya Birla Group Index PerformanceDocument2 pagesNIFTY Aditya Birla Group Index PerformanceUmesh ThawareNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50sumonNo ratings yet

- Factsheet NIFTY200 Quality30Document2 pagesFactsheet NIFTY200 Quality30Rajesh KumarNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- NIFTY200 Quality 30 index methodologyDocument2 pagesNIFTY200 Quality 30 index methodologyAtul KaulNo ratings yet

- Nifty FactsheetDocument2 pagesNifty FactsheetTudou patelNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Factsheet NIFTY50 Equal WeightDocument2 pagesFactsheet NIFTY50 Equal WeightS SinghNo ratings yet

- NIFTY100 Equal Weight Index methodologyDocument2 pagesNIFTY100 Equal Weight Index methodologyAnkit JoshiNo ratings yet

- Nifty100 Quality30 PDFDocument2 pagesNifty100 Quality30 PDFGita ThoughtsNo ratings yet

- Ind NIFTY TATA GROUPDocument2 pagesInd NIFTY TATA GROUPGautam NatrajNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Srisilpa KadiyalaNo ratings yet

- NIFTY Alpha Quality Value Low-Volatility 30 Index Fact SheetDocument2 pagesNIFTY Alpha Quality Value Low-Volatility 30 Index Fact SheetdrsubramanianNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Hiren PatelNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Sagar V SoniNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500R SarkarNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Nagaraj BVNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500Darl DranzerNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Aqib MujtabaNo ratings yet

- Nifty 200 overviewDocument2 pagesNifty 200 overviewAman JainNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Cheat SheetNo ratings yet

- Nifty 500Document2 pagesNifty 500ramesh kumarNo ratings yet

- Factsheet Nifty500 Multicap50-25-25 IndexDocument2 pagesFactsheet Nifty500 Multicap50-25-25 Indexramesh kumarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100ketuNo ratings yet

- NIFTY Infrastructure Index MethodologyDocument2 pagesNIFTY Infrastructure Index MethodologyHimasis PoddarNo ratings yet

- 50 NiftyindDocument2 pages50 Niftyindconnect.worldofworldcupNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio CharacteristicsVenkata Ramana PothulwarNo ratings yet

- NIFTY PSE Index overviewDocument2 pagesNIFTY PSE Index overviewHarDik PatelNo ratings yet

- NIFTY 50 Index Methodology and PerformanceDocument2 pagesNIFTY 50 Index Methodology and Performancekurapati_sivajiNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectRishabh GeeteNo ratings yet

- NIFTY High Beta 50 Index overviewDocument2 pagesNIFTY High Beta 50 Index overviewsiddharthNo ratings yet

- NIFTY High Beta 50 Index overviewDocument2 pagesNIFTY High Beta 50 Index overviewAlloySebastinNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50janarthananNo ratings yet

- NIFTY Smallcap 50 Index OverviewDocument2 pagesNIFTY Smallcap 50 Index OverviewSantosh TandaleNo ratings yet

- In123d Nifty50Document2 pagesIn123d Nifty50praNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30Aswin PoomangalathNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500VIGNESH RKNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50SumitNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Sagar V SoniNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Nitin KumarNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Prasad ChowdaryNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50ilen nayakNo ratings yet

- Alpha Low-Vy 30Document2 pagesAlpha Low-Vy 30Ankit JoshiNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100gopalsb15898No ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20shahid aliNo ratings yet

- Ind Nifty Midcap 150Document2 pagesInd Nifty Midcap 150Kushal BnNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30Aswin PoomangalathNo ratings yet

- NIFTY Alpha 50 Index InsightsDocument2 pagesNIFTY Alpha 50 Index InsightsSunil ChawdaNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Rajesh KumarNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500nagendraNo ratings yet

- Organizing Library MaterialsDocument3 pagesOrganizing Library MaterialsTash KentNo ratings yet

- Personal Information AreaDocument47 pagesPersonal Information AreaTash KentNo ratings yet

- Important Phone Numbers and Reminders: Technical "How To"Document5 pagesImportant Phone Numbers and Reminders: Technical "How To"Tash KentNo ratings yet

- Pointer To Exercise During ConstructionDocument3 pagesPointer To Exercise During ConstructionTash KentNo ratings yet

- Work at Home Set Up Guide - PC V 2.0Document17 pagesWork at Home Set Up Guide - PC V 2.0Tash KentNo ratings yet

- 6130 Test 2.1 SolutionsDocument1 page6130 Test 2.1 SolutionsTash KentNo ratings yet

- How To Cure PsoriasisDocument7 pagesHow To Cure Psoriasispallavsharma1987No ratings yet

- SupportDocument1,766 pagesSupportTash KentNo ratings yet

- 6130 Test 2.1 PracticeDocument13 pages6130 Test 2.1 PracticeTash KentNo ratings yet

- An Exchange-Rate-Centred Monetary Policy System: Singapore's ExperienceDocument9 pagesAn Exchange-Rate-Centred Monetary Policy System: Singapore's ExperienceTash KentNo ratings yet

- 6130 Test 2.2 SolutionsDocument1 page6130 Test 2.2 SolutionsTash KentNo ratings yet

- 6130 Test 2.2 PracticeDocument15 pages6130 Test 2.2 PracticeTash KentNo ratings yet

- Harr's View: The W in Europe, A Biden Win and The Outlook For MarketsDocument2 pagesHarr's View: The W in Europe, A Biden Win and The Outlook For MarketsTash KentNo ratings yet

- Buffett's Alpha: Andrea Frazzini, David Kabiller, and Lasse Heje PedersenDocument34 pagesBuffett's Alpha: Andrea Frazzini, David Kabiller, and Lasse Heje PedersenRafaelNo ratings yet

- An Exchange-Rate-Centred Monetary Policy System: Singapore's ExperienceDocument9 pagesAn Exchange-Rate-Centred Monetary Policy System: Singapore's ExperienceTash KentNo ratings yet

- 80962-00065283 RFX REGULAR 03-Sep-21 ENDocument5 pages80962-00065283 RFX REGULAR 03-Sep-21 ENTash KentNo ratings yet

- MUFG Global Markets Monthly: Emerging Markets Assessment and Economic OutlookDocument30 pagesMUFG Global Markets Monthly: Emerging Markets Assessment and Economic OutlookTash KentNo ratings yet

- FX Weekly - Are Markets Dumb or NotDocument21 pagesFX Weekly - Are Markets Dumb or NotTash KentNo ratings yet

- Sentence Correction Session 4: All These Questions Will Be Discussed in DetailDocument8 pagesSentence Correction Session 4: All These Questions Will Be Discussed in DetailTash KentNo ratings yet

- The Global Week AheadDocument13 pagesThe Global Week AheadTash KentNo ratings yet

- GDocument19 pagesGMRAAKNo ratings yet

- Select ProcedureDocument1 pageSelect ProcedureMegha SharmaNo ratings yet

- Detective AnalysisDocument11 pagesDetective AnalysisTash KentNo ratings yet

- Question Do Stocks Rise More Than FallDocument2 pagesQuestion Do Stocks Rise More Than FallTash KentNo ratings yet

- Syllabus For Cat-A (Physics, Chemistry, Maths)Document7 pagesSyllabus For Cat-A (Physics, Chemistry, Maths)Tash KentNo ratings yet

- Voting Daze?: He Eek HeadDocument8 pagesVoting Daze?: He Eek HeadTash KentNo ratings yet

- James Goulding-Research Notes For TradersDocument214 pagesJames Goulding-Research Notes For TradersTash KentNo ratings yet

- Select ProcessDocument2 pagesSelect ProcessvineetthesupermanNo ratings yet

- ILZSG Market Outlook April 2018Document11 pagesILZSG Market Outlook April 2018Tash KentNo ratings yet

- MID-TERM Examination # 1 (30%) : Interest Paid 6 MillionDocument7 pagesMID-TERM Examination # 1 (30%) : Interest Paid 6 MillionTimbas TNo ratings yet

- Donchian 4 W PDFDocument33 pagesDonchian 4 W PDFTheodoros Maragakis100% (2)

- ZerodhaDocument20 pagesZerodhaThava Selvan100% (2)

- Final Raj TrivediDocument12 pagesFinal Raj TrivediNisha SainiNo ratings yet

- Curvature Tradingpt1Document5 pagesCurvature Tradingpt1steveNo ratings yet

- "How Well Am I Doing?" Financial Statement AnalysisDocument61 pages"How Well Am I Doing?" Financial Statement AnalysisSederiku KabaruzaNo ratings yet

- Selamat Sempurna's 2016 Performance and Commitment to GrowthDocument290 pagesSelamat Sempurna's 2016 Performance and Commitment to GrowthDimas32No ratings yet

- Matching Assets-Liabilities ExercisesDocument3 pagesMatching Assets-Liabilities ExercisesWill KaneNo ratings yet

- Stock Broker Registration DetailsDocument304 pagesStock Broker Registration DetailsKelly Bailey0% (1)

- Financial performance analysis of Hup Seng IndustriesDocument24 pagesFinancial performance analysis of Hup Seng Industriesotaku hime100% (2)

- FX Risk Types and Hedging MethodsDocument20 pagesFX Risk Types and Hedging MethodsanushaNo ratings yet

- SBI Mutual Funds: Financial ServicesDocument9 pagesSBI Mutual Funds: Financial ServicesShivam MutkuleNo ratings yet

- Valuing Control and LiquidityDocument41 pagesValuing Control and LiquidityharleeniitrNo ratings yet

- Build a Smart Career with NCFM/NISM Financial Certification TrainingDocument45 pagesBuild a Smart Career with NCFM/NISM Financial Certification TrainingDowlathAhmedNo ratings yet

- Summer Internship: " Perception Towards Mutual Fund - A Study of Probable Individual Investors"Document53 pagesSummer Internship: " Perception Towards Mutual Fund - A Study of Probable Individual Investors"Gayatri DasNo ratings yet

- Stoxx Index GuideDocument370 pagesStoxx Index GuideThierry de PortzamparcNo ratings yet

- CFA Level 1 - 2020 Curriculum Changes (300hours)Document1 pageCFA Level 1 - 2020 Curriculum Changes (300hours)priyanka kumariNo ratings yet

- Gartley Velcoty RelativeDocument3 pagesGartley Velcoty Relativenaren.bansalNo ratings yet

- Financial Market Is A Marketplace Wherein TheDocument13 pagesFinancial Market Is A Marketplace Wherein TheJeanette Bayona CumayasNo ratings yet

- Securitization of DebtDocument52 pagesSecuritization of Debtnjsnghl100% (1)

- Lesson 3 News Scalping StrategyDocument19 pagesLesson 3 News Scalping StrategyIsmael ShNo ratings yet

- ENPC CreditRisk Lecture5Document33 pagesENPC CreditRisk Lecture5Phạm Hoàng NguyênNo ratings yet

- Project Report On Technical AnalysisDocument97 pagesProject Report On Technical Analysisvishalnabde80% (59)

- Bharti Airtel Capital Structure and Financing AnalysisDocument11 pagesBharti Airtel Capital Structure and Financing AnalysisDavid WilliamNo ratings yet

- Vpbank: Fe Credit Deal A Positive Increasing PTDocument19 pagesVpbank: Fe Credit Deal A Positive Increasing PTDIDINo ratings yet

- Market Segmenting Targeting and PositioningDocument45 pagesMarket Segmenting Targeting and PositioningJustine Elissa Arellano MarceloNo ratings yet

- NIP11383 CoperionDocument2 pagesNIP11383 CoperionAgustantoNo ratings yet

- BUSMGT 714 Week 8 Topic: Exchange Rates and Current AccountsDocument9 pagesBUSMGT 714 Week 8 Topic: Exchange Rates and Current AccountsYusufNo ratings yet

- Emerging Markets Bond List - en - 1182931Document136 pagesEmerging Markets Bond List - en - 1182931Bing LiNo ratings yet

- Mid Caps: Through The Magnifying Glass: Regional Morning NotesDocument4 pagesMid Caps: Through The Magnifying Glass: Regional Morning NotesElynnTayNo ratings yet