Professional Documents

Culture Documents

Ind NIFTY TATA GROUP

Uploaded by

Gautam NatrajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ind NIFTY TATA GROUP

Uploaded by

Gautam NatrajCopyright:

Available Formats

July 30, 2021

The corporate group indices are designed to reflect performance of listed companies belonging to a particular corporate group.

The NIFTY Tata Group Index consists of all companies belonging to the Tata Group. The index is computed using the full market

capitalisation method. This method is used to measure the total equity value of the Tata group companies listed on National Stock

Exchange of India Ltd.

Index Variant: NIFTY Tata Group Cap 25% Index

Portfolio Characteristics

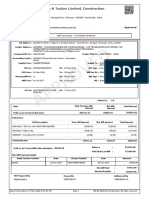

Methodology Full Market Capitalization Index Since

QTD YTD 1 Year 5 Years

No. of Constituents 24 Returns (%) Inception

Launch Date December 16, 2015 Price Return -2.03 22.83 63.42 17.90 16.01

Base Date April 01, 2005 Total Return -1.88 23.88 65.57 19.82 17.91

Base Value 1000 Since

Calculation Frequency EOD Daily Statistics ## 1 Year 5 Years

Inception

Index Rebalancing - Std. Deviation * 19.17 20.98 25.14

Sector Representation Beta (NIFTY 50) 0.71 0.75 0.90

Sector Weight(%) Correlation (NIFTY 50) 0.61 0.66 0.81

IT 62.43

Fundamentals

CONSUMER GOODS 13.59

P/E P/B Dividend Yield

METALS 9.48

50.09 7.92 1.15

AUTOMOBILE 5.46

CONSUMER SERVICES 2.64

Top constituents by weightage

TELECOM 2.53

POWER 2.08 Company’s Name Weight(%)

CHEMICALS 1.01

FERTILISERS & PESTICIDES 0.33 Tata Consultancy Services Ltd. 61.02

FINANCIAL SERVICES 0.30 Tata Steel Ltd. 8.98

INDUSTRIAL MANUFACTURING 0.15 Titan Company Ltd. 7.93

Tata Motors Ltd. 5.08

Tata Consumer Products Ltd. 3.63

Tata Communications Ltd. 2.14

Tata Power Co. Ltd. 2.08

Voltas Ltd. 1.83

Trent Ltd. 1.71

Tata Elxsi Ltd. 1.37

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice. 1

July 30, 2021

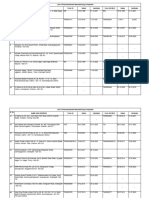

Index Methodology

Eligibility Criteria for Selection of Constituent Stocks:

i. To form part of the index, the company should be listed on the National Stock Exchange of India Ltd. (NSE).

ii. The company should be forming part of the Tata corporate group.

iii. All companies that meet the above criteria's are eligible to form part of the index.

Index Re-Balancing:

Inclusion to the index will be done in case of IPO / new listing

Exclusion from the index is done due to suspension or delisting or in case of corporate event such as scheme of arrangement /

demerger / acquisition.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

NIFTY 50 NIFTY Bank NIFTY CPSE NIFTY100 Equal Weight NIFTY 10 yr Benchmark G-Sec

NIFTY Next 50 NIFTY IT NIFTY Commodities NIFTY50 PR 1x Inverse NIFTY 8-13 yr G-Sec

NIFTY 100 NIFTY PSU Bank NIFTY Energy NIFTY50 PR 2x Leverage NIFTY 4-8 yr G-Sec

NIFTY 200 NIFTY FMCG NIFTY Shariah 25 NIFTY50 Value 20 NIFTY 11-15 yr G-Sec

NIFTY 500 NIFTY Private Bank NIFTY 100 Liquid15 NIFTY100 Quality 30 NIFTY 15 yr and above G-Sec

NIFTY Midcap 50 NIFTY Metal NIFTY Infrastructure NIFTY Low Volatility 50 NIFTY Composite G-Sec

NIFTY Midcap 100 NIFTY Financial Services NIFTY Corporate Group NIFTY Alpha 50 NIFTY 1D Rate

Contact Us:

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com

2

You might also like

- Ind Nifty PseDocument2 pagesInd Nifty Pserajit kumarNo ratings yet

- Ind NIFTY ADITYA BIRLA GROUPDocument2 pagesInd NIFTY ADITYA BIRLA GROUPUmesh ThawareNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50riteshsoniNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50prateekNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50saumilshah1990No ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50sumonNo ratings yet

- Ind Nifty InfraDocument2 pagesInd Nifty InfraDharmik UndaviyaNo ratings yet

- Alpha Low-Vy 30Document2 pagesAlpha Low-Vy 30Ankit JoshiNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Cheat SheetNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50kurapati_sivajiNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Gita ThoughtsNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Nitin KumarNo ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50tushar agaleNo ratings yet

- Ind Nifty InfraDocument2 pagesInd Nifty InfrasamkarthickNo ratings yet

- Nifty 500Document2 pagesNifty 500ramesh kumarNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Mohan KrishnaNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Samriddh DhareshwarNo ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50siddharthNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Srisilpa KadiyalaNo ratings yet

- Ind Nifty PseDocument2 pagesInd Nifty PseHarDik PatelNo ratings yet

- Ind Nifty Divid Opp50Document2 pagesInd Nifty Divid Opp50santosh kumarNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500Darl DranzerNo ratings yet

- Ind Nifty50gdsgDocument2 pagesInd Nifty50gdsgPayal AgarwalNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Venu MadhavNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Aqib MujtabaNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50Course ModeratorNo ratings yet

- Ind Next50Document2 pagesInd Next50bhattjgNo ratings yet

- Ind Nifty InfraDocument2 pagesInd Nifty InfraHimasis PoddarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNo ratings yet

- In123d Nifty50Document2 pagesIn123d Nifty50praNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Sagar V SoniNo ratings yet

- Ind Nifty CPSEDocument1 pageInd Nifty CPSEAnjalidevi TNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Hiren PatelNo ratings yet

- Factsheet NiftyHousingDocument2 pagesFactsheet NiftyHousingPersonal NNo ratings yet

- Factsheet Nifty100 Alpha30Document2 pagesFactsheet Nifty100 Alpha30Aswin PoomangalathNo ratings yet

- Nifty50 Fact SheetDocument2 pagesNifty50 Fact SheetI am IndianNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFwartan solarNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectPrakash N RamaniNo ratings yet

- Ind Nifty India ConsumptionDocument2 pagesInd Nifty India ConsumptionbhattjgNo ratings yet

- NIFTY100 ESG Index FactsheetDocument2 pagesNIFTY100 ESG Index FactsheetSanket SharmaNo ratings yet

- Ind Nifty Pse PDFDocument2 pagesInd Nifty Pse PDFAman DagaNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Portfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Document2 pagesPortfolio Characteristics: 1 Year YTD QTD 5 Years Since Inception Index Returns (%)Praise and worshipNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Aman JainNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)m KumarNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Shivani SinghNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Umesh ThawareNo ratings yet

- Factsheet Nifty 100 EW IndexDocument2 pagesFactsheet Nifty 100 EW IndexAnkit JoshiNo ratings yet

- Ind Nifty50 PDFDocument2 pagesInd Nifty50 PDFPankaj LodwalNo ratings yet

- Ind Nifty CommoditiesDocument2 pagesInd Nifty CommoditiesVamsi JeevanNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- Factsheet NIFTY50 Equal WeightDocument2 pagesFactsheet NIFTY50 Equal Weightashwin_gajghateNo ratings yet

- Factsheet Nifty500 Multicap50-25-25 IndexDocument2 pagesFactsheet Nifty500 Multicap50-25-25 Indexramesh kumarNo ratings yet

- 9 Factsheet - Nifty - Consumer - DurablesDocument2 pages9 Factsheet - Nifty - Consumer - DurablesKapilSahuNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNo ratings yet

- Factsheet NFTY Alpha Q LV 30Document2 pagesFactsheet NFTY Alpha Q LV 30Ankit JoshiNo ratings yet

- Advertisement - 2021 - Biomass AdvisorDocument5 pagesAdvertisement - 2021 - Biomass AdvisorGautam NatrajNo ratings yet

- Intensive Care MedicineDocument3 pagesIntensive Care MedicineGautam NatrajNo ratings yet

- Lecture Notes On Transport of Respiratory GasesO2 by Prof Y JaggiDocument8 pagesLecture Notes On Transport of Respiratory GasesO2 by Prof Y JaggiGautam NatrajNo ratings yet

- Covid-19 Outbreak Control and Prevention State Cell Health & Family Welfare Department Govt. of KeralaDocument12 pagesCovid-19 Outbreak Control and Prevention State Cell Health & Family Welfare Department Govt. of KeralaGautam NatrajNo ratings yet

- Media Bulletin 14 05 20 COVID 19 6 PMDocument17 pagesMedia Bulletin 14 05 20 COVID 19 6 PMGautam NatrajNo ratings yet

- Gowthaman Natarajan Prabha P: Name Name of SpouseDocument1 pageGowthaman Natarajan Prabha P: Name Name of SpouseGautam NatrajNo ratings yet

- Eligibility Certificate Student Axpplication Manual - UpdatedDocument12 pagesEligibility Certificate Student Axpplication Manual - UpdatedGautam Natraj50% (4)

- Emgrg. Med P-IvDocument2 pagesEmgrg. Med P-IvGautam NatrajNo ratings yet

- XJXNDDocument56 pagesXJXNDGautam NatrajNo ratings yet

- Emergency Medicine PDFDocument29 pagesEmergency Medicine PDFGautam NatrajNo ratings yet

- Important Instructions:: Emergency MedicineDocument2 pagesImportant Instructions:: Emergency MedicineGautam NatrajNo ratings yet

- Checklist For Epic Report Verification Volunteer ServicesDocument1 pageChecklist For Epic Report Verification Volunteer ServicesGautam NatrajNo ratings yet

- Gmail - Your Hotel Booking Is Confirmed at Hotel Pearls, Madurai, India, HTLK47CBARDocument4 pagesGmail - Your Hotel Booking Is Confirmed at Hotel Pearls, Madurai, India, HTLK47CBARGautam NatrajNo ratings yet

- Boulders ApronDocument2 pagesBoulders ApronamrkiplNo ratings yet

- IC Elem Unit 1 Wordlist Afl1Document6 pagesIC Elem Unit 1 Wordlist Afl1azeneth santosNo ratings yet

- Economic Globalization, Poverty, and InequalityDocument5 pagesEconomic Globalization, Poverty, and InequalityJude Daniel AquinoNo ratings yet

- Soal Latihan Telling The TimeDocument2 pagesSoal Latihan Telling The TimeDewi Ummu KarimaNo ratings yet

- Tender: IST F Pproved Anufacturers OR Tems Aterials Quipment F OrksDocument11 pagesTender: IST F Pproved Anufacturers OR Tems Aterials Quipment F OrksAamir RiazNo ratings yet

- International BusinessDocument14 pagesInternational BusinessМарiя ДеремендаNo ratings yet

- Quiz 2 Final Term Assets - /15Document3 pagesQuiz 2 Final Term Assets - /15Kristina Angelina ReyesNo ratings yet

- Antima TybmsDocument32 pagesAntima TybmsAntima ChoubeNo ratings yet

- Questor NotesDocument41 pagesQuestor NotesBrion ReynosoNo ratings yet

- e-StatementBRImo 810401016697532 Sep2023 20230907 162917-2Document2 pagese-StatementBRImo 810401016697532 Sep2023 20230907 162917-2Syamsinar KinanNo ratings yet

- Major Functions of International BankingDocument7 pagesMajor Functions of International BankingSandra Clem SandyNo ratings yet

- Sample Questions:: Section I: Subjective QuestionsDocument8 pagesSample Questions:: Section I: Subjective QuestionsVandana P GNo ratings yet

- SSB800-1000-1000TL Installation Instructions en 06.2018 US 1Document72 pagesSSB800-1000-1000TL Installation Instructions en 06.2018 US 1daboo sanatNo ratings yet

- Shinthia Ghosh - Roll No-20js031003 - Law & Justice in A Globalizing World - Paper Code-Plo4003 - ProjectDocument11 pagesShinthia Ghosh - Roll No-20js031003 - Law & Justice in A Globalizing World - Paper Code-Plo4003 - ProjectShinthia GhoshNo ratings yet

- 2059 s21 QP 02 RemovedDocument5 pages2059 s21 QP 02 RemovedHasan MehmoodNo ratings yet

- Derivatives Security MarketDocument18 pagesDerivatives Security MarketYujinNo ratings yet

- Tute 1 QuestionsDocument4 pagesTute 1 QuestionsLê Thiên Giang 2KT-19No ratings yet

- LED PPT Chapter 2Document22 pagesLED PPT Chapter 2FuadNo ratings yet

- IHS Markit PMI IntroductionDocument14 pagesIHS Markit PMI IntroductionCuriousMan87No ratings yet

- Pooran 180 (Bohr)Document1 pagePooran 180 (Bohr)Accounts ARNo ratings yet

- CHAPTER SEVEN Source SelectionDocument14 pagesCHAPTER SEVEN Source SelectionTessema TeshomeNo ratings yet

- Assignment 2 ECON1194 2022A - NguyenHoangAnh - s3915023Document15 pagesAssignment 2 ECON1194 2022A - NguyenHoangAnh - s3915023Anh NguyenNo ratings yet

- Larsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000602 WOMDocument2 pagesLarsen & Toubro Limited, Construction.: Bill Summary - EC578BIL7000602 WOMKannan GnanaprakasamNo ratings yet

- Max's Group, Inc. - SEC Form I-ACGR Integrated Annual Corporate Governance Report - 30may2023-1Document97 pagesMax's Group, Inc. - SEC Form I-ACGR Integrated Annual Corporate Governance Report - 30may2023-1Cm BeNo ratings yet

- FOR Hinjawadi PH - I: Morning 6.15 PM 7.30 PM 9.00 PM 10.00 PM Ph-I Dlfa Total RoutesDocument41 pagesFOR Hinjawadi PH - I: Morning 6.15 PM 7.30 PM 9.00 PM 10.00 PM Ph-I Dlfa Total RoutesAnuNo ratings yet

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDocument3 pagesCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisAli AwanNo ratings yet

- The Age of Exploration and Early CapitalismDocument2 pagesThe Age of Exploration and Early CapitalismSára UhercsákNo ratings yet

- ARMADA Annual Report 2018Document249 pagesARMADA Annual Report 2018LiewKianHongNo ratings yet

- Location: Chennai Outer Ring Road Project: Ashoka Buildcon LTDDocument22 pagesLocation: Chennai Outer Ring Road Project: Ashoka Buildcon LTDrushikshNo ratings yet

- Manufacturers List AllopathiDocument60 pagesManufacturers List AllopathiA K SubramaniNo ratings yet