Professional Documents

Culture Documents

Factsheet NIFTY LargeMidcap 250 Index

Uploaded by

Srikanth VgOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factsheet NIFTY LargeMidcap 250 Index

Uploaded by

Srikanth VgCopyright:

Available Formats

May 31, 2023

The Nifty LargeMidcap 250 reflects the performance of a portfolio of 100 large cap and 150 mid cap companies listed on NSE,

represented through the Nifty 100 and the Nifty Midcap 150 index respectively. The aggregate weight of large cap stocks and mid cap

stocks is 50% each and are reset on a quarterly basis.

The index can be used for a variety of purposes such as benchmarking, creation of index funds, ETFs and structured products

Index Variant: Nifty LargeMidcap 250 Total Returns Index.

Portfolio Characteristics

Methodology Periodic Capped Free Float Index Since

QTD YTD 1 Year 5 Years

No. of Constituents 250 Returns (%) Inception

Launch Date November 30, 2017 Price Return 9.24 3.59 14.42 12.24 13.82

Base Date April 01, 2005 Total Return 9.40 3.86 15.43 13.40 15.32

Base Value 1000 Since

Calculation Frequency Real-Time Statistics ## 1 Year 5 Years

Inception

Index Rebalancing Semi-annual Std. Deviation * 12.56 18.59 20.84

Sector Representation Beta (NIFTY 50) 0.92 0.92 0.91

Sector Weight(%) Correlation (NIFTY 50) 0.92 0.96 0.95

Financial Services 28.24

Fundamentals

Information Technology 8.82

P/E P/B Dividend Yield

Automobile and Auto Components 7.46

23.69 3.84 1.26

Oil, Gas & Consumable Fuels 7.35

Healthcare 7.24

Top constituents by weightage

Capital Goods 7.12

Fast Moving Consumer Goods 5.97 Company’s Name Weight(%)

Chemicals 4.35

Consumer Durables 4.27 Reliance Industries Ltd. 4.33

Consumer Services 3.62 HDFC Bank Ltd. 3.68

Metals & Mining 2.98 ICICI Bank Ltd. 3.44

Power 2.63 Housing Development Finance Corporation 2.48

Construction Materials 2.26 Infosys Ltd. 2.44

Telecommunication 1.80

ITC Ltd. 2.04

Realty 1.78

Tata Consultancy Services Ltd. 1.75

Services 1.50

Construction 1.38 Kotak Mahindra Bank Ltd. 1.54

Media, Entertainment & Publication 0.59 Larsen & Toubro Ltd. 1.38

Textiles 0.36 Axis Bank Ltd. 1.30

Diversified 0.27

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice. 1

May 31, 2023

Index Methodology

• The index has a base date of April 01, 2005 and a base value of 1000

• Index consist of all Stocks forming part of Nifty 100 and Nifty Midcap 150 index.

• Aggregate weight of large cap stock and Midcap stocks are capped at 50% each.

• Index shall be reconstituted on a semi-annual basis along with Nifty 100 and Nifty Midcap 150 index.

• Weights of large cap and midcap stocks are rebalanced on a quarterly basis.

Index Re-Balancing:

Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of

indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of

change.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

Nifty 50 Nifty Bank Nifty CPSE Nifty100 Equal Weight Nifty 10 yr Benchmark G-Sec

Nifty Next 50 Nifty IT Nifty Commodities Nifty50 PR 1x Inverse Nifty 8-13 yr G-Sec

Nifty 100 Nifty PSU Bank Nifty Energy Nifty50 PR 2x Leverage Nifty 4-8 yr G-Sec

Nifty 200 Nifty FMCG Nifty Shariah 25 Nifty50 Value 20 Nifty 11-15 yr G-Sec

Nifty 500 Nifty Private Bank Nifty 100 Liquid15 Nifty100 Quality 30 Nifty 15 yr and above G-Sec

Nifty Midcap 50 Nifty Metal Nifty Infrastructure Nifty Low Volatility 50 Nifty Composite G-Sec

Nifty Midcap 100 Nifty Financial Services Nifty Corporate Group Nifty Alpha 50 Nifty 1D Rate

Contact Us:

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com

2

You might also like

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSumitNo ratings yet

- Factsheet NiftyTotalMarketDocument2 pagesFactsheet NiftyTotalMarketRAKESH SONINo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500sadhikastocks15042018No ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Meet RavalNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50S SinghNo ratings yet

- Ind Next50Document2 pagesInd Next50bhattjgNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Factsheet NiftyTotalMarketDocument2 pagesFactsheet NiftyTotalMarketthankyouji12345No ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectEshan ParekhNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100ketuNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Samriddh DhareshwarNo ratings yet

- Ind Nifty Divid Opp50Document2 pagesInd Nifty Divid Opp50santosh kumarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Nitin KumarNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50badasserytechNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Sagar V SoniNo ratings yet

- Factsheet NIFTY50 Equal WeightDocument2 pagesFactsheet NIFTY50 Equal Weightashwin_gajghateNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50Course ModeratorNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Aman JainNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Anil Kumar RanjanNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Nifty 50Document2 pagesNifty 50Pubg UpdateNo ratings yet

- Factsheet NiftyHousingDocument2 pagesFactsheet NiftyHousingPersonal NNo ratings yet

- Ind Next50Document2 pagesInd Next50Sagar V SoniNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Shivani SinghNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100SumitNo ratings yet

- 50 NiftyindDocument2 pages50 Niftyindconnect.worldofworldcupNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20swaroopr8No ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Prakash N RamaniNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Aqib MujtabaNo ratings yet

- Nifty100 Liquid 15Document2 pagesNifty100 Liquid 15adityazade03No ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30namharidwarNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50sumonNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectSumitNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexRahul RanjanNo ratings yet

- Ind NIFTY TATA GROUP 25 CapDocument2 pagesInd NIFTY TATA GROUP 25 Capshubhankar.ue198098.itNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectRishabh GeeteNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- Factsheet Nifty Alpha50Document2 pagesFactsheet Nifty Alpha50aimailid01No ratings yet

- Ind Nifty India ConsumptionDocument2 pagesInd Nifty India ConsumptionbhattjgNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectthetrade180No ratings yet

- Ind Nifty50Document2 pagesInd Nifty50SumitNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Akshay KumarNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20shahid aliNo ratings yet

- Factsheet NIFTY50 Equal WeightDocument2 pagesFactsheet NIFTY50 Equal WeightS SinghNo ratings yet

- Factsheet NFTY Alpha Q LV 30Document2 pagesFactsheet NFTY Alpha Q LV 30Ankit JoshiNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- Ind Nifty PseDocument2 pagesInd Nifty Pserajit kumarNo ratings yet

- July 31, 2019: Portfolio CharacteristicsDocument2 pagesJuly 31, 2019: Portfolio Characteristicsmoresushant849643No ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Sagar V SoniNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- Ind Niftysmallcap 50Document2 pagesInd Niftysmallcap 50Google finderNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50swaroopr8No ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100gopalsb15898No ratings yet

- Ind Nifty Pse PDFDocument2 pagesInd Nifty Pse PDFAman DagaNo ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50Bidah64717No ratings yet

- Chapter 2 - Premium Liabilities PDFDocument3 pagesChapter 2 - Premium Liabilities PDFMarx Yuri JaymeNo ratings yet

- Hotel Revenue Management Guide by EzeeDocument31 pagesHotel Revenue Management Guide by Ezeesagar9985100% (2)

- Introduction To Financial Services MarketingDocument14 pagesIntroduction To Financial Services MarketingJitender Kaushal100% (1)

- Company Analysis and Valuation Project PDFDocument19 pagesCompany Analysis and Valuation Project PDFAugusto LopezNo ratings yet

- IMC Lecture 1Document23 pagesIMC Lecture 1Abdul Hanan RasoolNo ratings yet

- Gaurav PDFDocument70 pagesGaurav PDFSandesh GajbhiyeNo ratings yet

- Quiz Tutor IFA Week 5-6Document13 pagesQuiz Tutor IFA Week 5-6Ersha NatachiaNo ratings yet

- Asian PaintDocument12 pagesAsian PaintAnkit DubeyNo ratings yet

- Gap Analysis: Dr. N. BhaskaranDocument4 pagesGap Analysis: Dr. N. BhaskaranNagarajan BhaskaranNo ratings yet

- PSAK 56 - Earnings Per Share PDFDocument34 pagesPSAK 56 - Earnings Per Share PDFFendi WijayaNo ratings yet

- Exercise - Part 2Document5 pagesExercise - Part 2lois martinNo ratings yet

- 4 - Multiproduct Break-Even PointDocument2 pages4 - Multiproduct Break-Even PointSusan BvochoraNo ratings yet

- Review of Literature For Foreign Exchange or ForexDocument2 pagesReview of Literature For Foreign Exchange or Forexrajesh bathulaNo ratings yet

- Global Pricing Strategies For Pharmaceutical Product LaunchesDocument8 pagesGlobal Pricing Strategies For Pharmaceutical Product LaunchesLion HeartNo ratings yet

- South-Tek Systems Appoints Jens Bolleyer As CEODocument3 pagesSouth-Tek Systems Appoints Jens Bolleyer As CEOPR.comNo ratings yet

- Comentario IB Economia 1Document5 pagesComentario IB Economia 1Santiago Ramirez100% (1)

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- Presentation 1Document10 pagesPresentation 1nicasavio2725No ratings yet

- Mari (Eting: Theory and PracticeDocument12 pagesMari (Eting: Theory and PracticeTewodros KassayeNo ratings yet

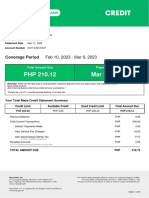

- MayaCredit SoA 2023MARDocument2 pagesMayaCredit SoA 2023MARJan SaysonNo ratings yet

- Chapter ThreeDocument25 pagesChapter Threeshraddha amatyaNo ratings yet

- MicroCap Review Spring 2018Document110 pagesMicroCap Review Spring 2018Planet MicroCap Review MagazineNo ratings yet

- Cost Accounting Quiz 1 - Statement of Cost of Goods ManufacturedDocument4 pagesCost Accounting Quiz 1 - Statement of Cost of Goods ManufacturedMarkJoven BergantinNo ratings yet

- Qualities of A Successful Marketing ExecutiveDocument2 pagesQualities of A Successful Marketing Executivesumith1990No ratings yet

- Principles of Marketing FinalDocument14 pagesPrinciples of Marketing FinalANGELA ADRIOSULANo ratings yet

- ExpressDocument45 pagesExpressHina IlyasNo ratings yet

- Cost Concepts and ClassificationsDocument6 pagesCost Concepts and ClassificationsNailiah MacakilingNo ratings yet

- Assignment 1 Q-ADocument2 pagesAssignment 1 Q-ASarmad Tahir ButtNo ratings yet

- Marks Spencer Case StudyDocument12 pagesMarks Spencer Case Studycarleil arde100% (3)

- TF Factoring+and+Forfaiting+ICFAIDocument1 pageTF Factoring+and+Forfaiting+ICFAISumit Tiwari HindustaniNo ratings yet