Professional Documents

Culture Documents

Ind Niftymidcap100

Uploaded by

SumitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ind Niftymidcap100

Uploaded by

SumitCopyright:

Available Formats

March 31, 2023

The Nifty Midcap 100 Index is designed to capture the movement of the midcap segment of the market.

The Nifty Midcap 100 Index comprises 100 tradable stocks listed on the National Stock Exchange (NSE). NIFTY Midcap 100 Index is

computed using free float market capitalization method, wherein the level of the index reflects the total free float market value of all

the stocks in the index relative to particular base market capitalization value.

Nifty Midcap 100 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and

structured products.

Index Variant: Nifty Midcap 100 Total Returns Index.

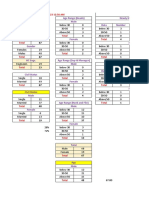

Portfolio Characteristics

Methodology Free Float Market Capitalization Index Since

QTD YTD 1 Year 5 Years

No. of Constituents 100 Returns (%) Inception

Launch Date July 18, 2005 Price Return -4.68 -4.68 1.15 9.87 18.29

Base Date January 01, 2003 Total Return -4.55 -4.55 2.01 10.92 19.99

Base Value 1000 Since

Calculation Frequency Real-Time Statistics ## 1 Year 5 Years

Inception

Index Rebalancing Semi-Annually Std. Deviation * 17.43 20.87 22.21

Sector Representation Beta (NIFTY 50) 0.96 0.92 0.86

Sector Weight(%) Correlation (NIFTY 50) 0.81 0.85 0.85

Financial Services 23.16

Fundamentals

Healthcare 12.88

P/E P/B Dividend Yield

Capital Goods 9.98

21.68 2.47 1.4

Automobile and Auto Components 8.54

Information Technology 6.71

Top constituents by weightage

Consumer Services 6.62

Chemicals 4.91 Company’s Name Weight(%)

Oil, Gas & Consumable Fuels 4.81

Consumer Durables 4.58 Shriram Finance Ltd. 2.61

Metals & Mining 3.91 Max Healthcare Institute Ltd. 2.44

Power 3.31 Trent Ltd. 2.27

Realty 2.04 Indian Hotels Co. Ltd. 2.14

Construction Materials 1.88 Federal Bank Ltd. 2.10

Services 1.75

AU Small Finance Bank Ltd. 2.08

Media, Entertainment & Publication 1.72

Tube Investments of India Ltd. 1.99

Telecommunication 1.66

Fast Moving Consumer Goods 1.26 TVS Motor Company Ltd. 1.88

Textiles 0.25 Persistent Systems Ltd. 1.74

Cummins India Ltd. 1.66

## Based on Price Return Index.

# QTD,YTD and 1 year returns are absolute returns.Returns for greater than one year are CAGR returns.

* Average daily standard deviation annualised.

Disclaimer: All information contained herewith is provided for reference purpose only. NSE Indices Limited (formerly known as India Index Services & Products Limited-IISL) ensures accuracy and reliability of the above

information to the best of its endeavors. However, NSE Indices Limited makes no warranty or representation as to the accuracy, completeness or reliability of any of the information contained herein and disclaim any and all

liability whatsoever to any person for any damage or loss of any nature arising from or as a result of reliance on any of the information provided herein. The information contained in this document is not intended to provide any

professional advice. 1

March 31, 2023

Index Methodology

Eligibility Criteria for Selection of Constituent Stocks:

i. It includes all companies from Nifty Midcap 50. Constituents added in Nifty Midcap 50 which are not in Nifty Midcap

100 shall be included in the Index.

ii. For remaining companies, securities will be included if rank based on average daily turnover is among top 70 from constituents in

Nifty Midcap 150.

iii. Securities will be excluded if rank based on average daily turnover of existing constituent is below 130 among constituents in

Nifty Midcap 150 or if constituent is excluded from Nifty Midcap 150.

iv. Eligibility criteria for newly listed security is checked based on the data for a three-month period instead of a six-month period.

Index Re-Balancing:

Index is re-balanced on semi-annual basis. The cut-off date is January 31 and July 31 of each year, i.e. For semi-annual review of

indices, average data for six months ending the cut-off date is considered. Four weeks prior notice is given to market from the date of

change.

Index Governance:

A professional team manages all NSE indices. There is a three-tier governance structure comprising the Board of Directors of NSE

Indices Limited, the Index Advisory Committee (Equity) and the Index Maintenance Sub-Committee.

Key Indices

Broad Market Sectoral Indices Thematic Indices Strategy Indices Fixed Income

Nifty 50 Nifty Bank Nifty CPSE Nifty100 Equal Weight Nifty 10 yr Benchmark G-Sec

Nifty Next 50 Nifty IT Nifty Commodities Nifty50 PR 1x Inverse Nifty 8-13 yr G-Sec

Nifty 100 Nifty PSU Bank Nifty Energy Nifty50 PR 2x Leverage Nifty 4-8 yr G-Sec

Nifty 200 Nifty FMCG Nifty Shariah 25 Nifty50 Value 20 Nifty 11-15 yr G-Sec

Nifty 500 Nifty Private Bank Nifty 100 Liquid15 Nifty100 Quality 30 Nifty 15 yr and above G-Sec

Nifty Midcap 50 Nifty Metal Nifty Infrastructure Nifty Low Volatility 50 Nifty Composite G-Sec

Nifty Midcap 100 Nifty Financial Services Nifty Corporate Group Nifty Alpha 50 Nifty 1D Rate

Contact Us: Bloomberg - NSEMCAP Index

Email: indices@nse.co.in | Tel: +91 22 26598386 | Fax: +91 22 26598120

Learn more at: www.niftyindices.com Thomson Reuters - .NIMDCP

2

You might also like

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 Indexrahulojha123No ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Anil Kumar RanjanNo ratings yet

- Ind Niftysmallcap100Document2 pagesInd Niftysmallcap100Samriddh DhareshwarNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Samriddh DhareshwarNo ratings yet

- Ind Niftymidcap100Document2 pagesInd Niftymidcap100Meet RavalNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Sagar V SoniNo ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50S SinghNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200badasserytechNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSrikanth VgNo ratings yet

- Factsheet NiftyTotalMarketDocument2 pagesFactsheet NiftyTotalMarketthankyouji12345No ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100ketuNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Fighter BullNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500sadhikastocks15042018No ratings yet

- Factsheet NiftySmallcap250Quality50Document2 pagesFactsheet NiftySmallcap250Quality50badasserytechNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Aman JainNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Factsheet NIFTY50 Equal WeightDocument2 pagesFactsheet NIFTY50 Equal WeightS SinghNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSumitNo ratings yet

- Factsheet NIFTY Alpha Low-Volatility 30Document2 pagesFactsheet NIFTY Alpha Low-Volatility 30namharidwarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Nitin KumarNo ratings yet

- Ind Nifty 200Document2 pagesInd Nifty 200Sagar V SoniNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100gopalsb15898No ratings yet

- Factsheet NiftyTotalMarketDocument2 pagesFactsheet NiftyTotalMarketRAKESH SONINo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50Aqib MujtabaNo ratings yet

- Ind Next50Document2 pagesInd Next50bhattjgNo ratings yet

- Nifty 50Document2 pagesNifty 50Pubg UpdateNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50swaroopr8No ratings yet

- New Imp VV ImpvDocument2 pagesNew Imp VV ImpvNeeraj KohliNo ratings yet

- Factsheet NIFTY50 Equal WeightDocument2 pagesFactsheet NIFTY50 Equal Weightashwin_gajghateNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Shivani SinghNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30Kiran SunkuNo ratings yet

- Factsheet NFTY Alpha Q LV 30Document2 pagesFactsheet NFTY Alpha Q LV 30Ankit JoshiNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Akshay KumarNo ratings yet

- Factsheet Nifty India Manufacturing IndexDocument2 pagesFactsheet Nifty India Manufacturing IndexShubhamNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectRishabh GeeteNo ratings yet

- Nifty 50 FactsheetDocument2 pagesNifty 50 FactsheetShubhashish SaxenaNo ratings yet

- Ind Nifty Divid Opp50Document2 pagesInd Nifty Divid Opp50santosh kumarNo ratings yet

- Ind Nifty Smallcap 250Document2 pagesInd Nifty Smallcap 250Anil KumarNo ratings yet

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Document2 pagesPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)G gfgjNo ratings yet

- Factsheet NIFTY100 ESG IndexDocument2 pagesFactsheet NIFTY100 ESG IndexTash KentNo ratings yet

- Ind Nifty 100Document2 pagesInd Nifty 100Prakash N RamaniNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50Hiren PatelNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectSumitNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectPrakash N RamaniNo ratings yet

- Nifty100 Liquid 15Document2 pagesNifty100 Liquid 15adityazade03No ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50prateekNo ratings yet

- Nifty50 Value20Document2 pagesNifty50 Value20shahid aliNo ratings yet

- Ind Nifty Midcap 150Document2 pagesInd Nifty Midcap 150Kushal BnNo ratings yet

- Factsheet NiftyHousingDocument2 pagesFactsheet NiftyHousingPersonal NNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50janarthananNo ratings yet

- Factsheet NiftyIndiaDefenceDocument2 pagesFactsheet NiftyIndiaDefencesubhashismukherjee5No ratings yet

- Factsheet Nifty High Beta50Document2 pagesFactsheet Nifty High Beta50aditya_kavangalNo ratings yet

- 50 NiftyindDocument2 pages50 Niftyindconnect.worldofworldcupNo ratings yet

- Ind Next50Document2 pagesInd Next50Sagar V SoniNo ratings yet

- Ind Nifty India ConsumptionDocument2 pagesInd Nifty India ConsumptionbhattjgNo ratings yet

- Factsheet Nifty50 ShariahDocument2 pagesFactsheet Nifty50 ShariahMonu GamerNo ratings yet

- Ind Nifty Pse PDFDocument2 pagesInd Nifty Pse PDFAman DagaNo ratings yet

- Ind Nifty 500Document2 pagesInd Nifty 500R SarkarNo ratings yet

- Factsheet Nifty200 Momentum30Document2 pagesFactsheet Nifty200 Momentum30swaroopr8No ratings yet

- Balance Sheet StructuresFrom EverandBalance Sheet StructuresAnthony N BirtsNo ratings yet

- MW NIFTY MIDCAP 150 03 Apr 2023Document8 pagesMW NIFTY MIDCAP 150 03 Apr 2023SumitNo ratings yet

- Investor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?Document56 pagesInvestor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?SumitNo ratings yet

- Nifty & Bank Nifty Daily Aanalysis - SmmryDocument8 pagesNifty & Bank Nifty Daily Aanalysis - SmmrySumitNo ratings yet

- Fundamental Analysis HandoutsDocument68 pagesFundamental Analysis HandoutsSumitNo ratings yet

- Factsheet NiftyMidcapSelectDocument2 pagesFactsheet NiftyMidcapSelectSumitNo ratings yet

- Factsheet NIFTY LargeMidcap 250 IndexDocument2 pagesFactsheet NIFTY LargeMidcap 250 IndexSumitNo ratings yet

- Ind Nifty50Document2 pagesInd Nifty50SumitNo ratings yet

- Ind Nifty Midcap50Document2 pagesInd Nifty Midcap50SumitNo ratings yet

- Walter Schloss 06 Aug 2020 1221Document6 pagesWalter Schloss 06 Aug 2020 1221SumitNo ratings yet

- XII STD - Economics EM Combined 11.03.2019 PDFDocument296 pagesXII STD - Economics EM Combined 11.03.2019 PDFMonika AnnaduraiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)MelbinGeorgeNo ratings yet

- Solved Jan Owns The Mews Bar and Grill Every Year atDocument1 pageSolved Jan Owns The Mews Bar and Grill Every Year atAnbu jaromiaNo ratings yet

- Study and Analysis of Financial A ReportDocument26 pagesStudy and Analysis of Financial A Reportpriyanka81287No ratings yet

- 5% LDRRMF Coa CircularDocument13 pages5% LDRRMF Coa Circulardan neri100% (1)

- Employee Data Sheet As of June 21, 2023Document90 pagesEmployee Data Sheet As of June 21, 2023Marie Anne RemolonaNo ratings yet

- Ch01-Discussion Questions and AnswersDocument3 pagesCh01-Discussion Questions and Answerseeman kNo ratings yet

- Growth, Poverty, and Income Distribution PovertyDocument6 pagesGrowth, Poverty, and Income Distribution PovertyMija DiroNo ratings yet

- Product Quote Template InstructionsDocument6 pagesProduct Quote Template InstructionsNakata Lintong SiagianNo ratings yet

- Universiti Teknologi Mara Final Assessment: Confidential AC/JULY 2021/ACC416Document8 pagesUniversiti Teknologi Mara Final Assessment: Confidential AC/JULY 2021/ACC416Abdul HakimNo ratings yet

- Ghana SME LandscapeDocument11 pagesGhana SME LandscapeWasili MfungweNo ratings yet

- Prepared By: Abdulkaf Shehabo ID:7570/09 Advisor: Meaza (MSC)Document41 pagesPrepared By: Abdulkaf Shehabo ID:7570/09 Advisor: Meaza (MSC)Marshet yohannesNo ratings yet

- Microeconomics 4th Edition Krugman Test BankDocument35 pagesMicroeconomics 4th Edition Krugman Test Banksintochenge62100% (27)

- Electronic PaymentDocument8 pagesElectronic Paymentqa diiNo ratings yet

- Sector Analysis of BFSI - Axis BankDocument11 pagesSector Analysis of BFSI - Axis BankAbhishek Kumawat (PGDM 18-20)No ratings yet

- Justdial SWOTDocument2 pagesJustdial SWOTweedemboy9393No ratings yet

- Product Life CycleDocument19 pagesProduct Life Cyclenuplin.zain100% (6)

- MarketWars Case StudyDocument15 pagesMarketWars Case StudyABILESH R 2227204No ratings yet

- Start A Bike Shop by Following These 9 StepsDocument31 pagesStart A Bike Shop by Following These 9 StepsFritz GayasNo ratings yet

- PR 5 Akuntansi ManajemenDocument2 pagesPR 5 Akuntansi ManajemenAhmad Sulthon Alauddin0% (1)

- Ekonomi Paint SectorDocument4 pagesEkonomi Paint SectorDilansu KahramanNo ratings yet

- EMS Project On SARBDocument2 pagesEMS Project On SARBMichael-John ReelerNo ratings yet

- Bank StatementDocument2 pagesBank StatementZakaria EL MAMOUNNo ratings yet

- TCSDocument19 pagesTCSswapvj100% (3)

- SUBJECT: Principles of Management Topic: Adabi SDN BHD GROUP MEMBERS: Ahmad Adil Bin Adlan (62214222210) Muhammad Afiq Kasim (62214222292)Document13 pagesSUBJECT: Principles of Management Topic: Adabi SDN BHD GROUP MEMBERS: Ahmad Adil Bin Adlan (62214222210) Muhammad Afiq Kasim (62214222292)Muhammad AfiqNo ratings yet

- ESOP Best PracticesDocument44 pagesESOP Best PracticesPrateek Goel100% (1)

- Ssab 2022Document187 pagesSsab 2022Megha SenNo ratings yet

- IntroductionDocument5 pagesIntroductionKemy CameliaNo ratings yet

- What Is Strategy and Why Is It Important?Document35 pagesWhat Is Strategy and Why Is It Important?Martinus WarsitoNo ratings yet

- This Agreement, Was Made in 24/02/2021 Between:: Unified Employment ContractDocument9 pagesThis Agreement, Was Made in 24/02/2021 Between:: Unified Employment ContractMajdy Al harbiNo ratings yet