Professional Documents

Culture Documents

Class Exercises - Accounting For Merchandising Business - Answers

Uploaded by

eshakaurOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class Exercises - Accounting For Merchandising Business - Answers

Uploaded by

eshakaurCopyright:

Available Formats

Class Exercises – Accounting for Merchandising Business

Question1

Mia Batik Enterprise is using a periodic inventory system in recording its

inventory. The following transactions occurred during the month of January 2020:

Date Transactions

2020

January 1 The owner brought additional cash of RM10,000 and immediately

bank in the amount into the business bank account.

2 Paid stationery RM150 by cheque.

4 Received an invoice for goods purchased worth RM1,000 from

Aina Enterprise. Credit term 2/10, n30.

8 The owner took RM50 worth of goods for personal use.

9 Sold goods on credit to Tasha worth of RM800 with credit term

2/15, n30.

12 Settled the amount due to Aina Enterprise by cheque.

16 Received a cheque for sales worth of RM900.

18 Issued a credit note to Tasha for goods returned amounting to

RM200.

22 Tasha settled her account by cash.

Required:

Journalise the above transactions in the appropriate special journals.

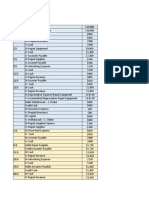

Date Particulars Debit Credit

(RM) (RM)

Jan 1 Dr Bank 10,000

Cr Capital 10,000

2 Dr Stationery expenses 150

Cr Bank 150

4 Dr Purchases 1,000

Cr A/P – Aina Enterprise 1,000

8 Dr Drawings 50

Cr Purchases 50

9 Dr A/R - Tasha 800

Cr Sales 800

12 Dr A/P – Aina Enterprise 1,000

Cr Bank 980

Cr Purchase discount (2%x1000) 20

16 Dr Bank 900

Cr Sales 900

18 Dr Sales return & allowances 200

Cr A/R - Tasha 200

22 Dr Bank 588

Sales Discount (2%x(800-200) 12

Cr A/R - Tasha 600

Question 2

Given below are transactions for the month of April 2020 for Muq Art and

Design, a business selling special design home decoration. The business uses

the perpetual system to record the inventory.

Date Transactions

Apr 1 The owner, Mr Mooqie, deposited RM50,000 cash into the business bank

account to start off the business.

2 Purchased goods worth RM4,500 and settled by cheque.

4 Cash sales RM1,000. The cost is RM300

5 Received an invoice worth RM6,000 from Rico Enterprise with credit

terms of 5/10, n30.

6 Issued an invoice to Aleef worth RM4,500. Credit terms of 5/10, n30. The

cost of the goods is RM1,500

7 Issued a credit note to Aleef amounting to RM500

8 Issued a debit note to Rico Enterprise for goods returned worth RM400.

9 Received settlement from Aleef by cash.

10 Home decoration worth RM1,500 was taken by Mr Mooqie as a wedding gift

to his brother.

11 Settled amount outstanding by cheque to Rico Enterprise.

Required:

Journalise the above transactions into the appropriate special journals. Narration is

not required.

General Journal

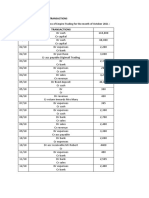

Date Particulars Debit Credit

(RM) (RM)

Apr 1 Dr Bank 50,000

Cr Capital 50,000

2 Dr Inventory 4,500

Cr Bank 4,500

4 Dr Cash 1,000

Cr Sales 1,000

Dr COGS 300

Cr Inventory 300

5 Dr Inventory 6,000

Cr A/P - Rico Enterprise 6,000

6 Dr A/R - Aleef 4,500

Cr Sales 4,500

Dr COGS 1,500

Cr Inventory 1,500

7 Dr Sales return & allowance 500

Cr A/R - Aleef 500

Dr Inventory 167

Cr COGS 167

8 Dr A/P - Rico Enterprise 400

Cr Inventory 400

9. Dr Bank/ cash 3,800

Sales discount 5%x(4,500-500) 200

Cr A/R – Aleef 4,000

10 Dr Drawings 1,500

Cr Inventory 1,500

11 Dr A/P – Rico Enterprise 5,600

Cr Bank 5,320

Purchase discount 5%x(6,000-400) 280

Question 3

On 1 June 2020, Mr. Arman started a business, Armani Enterprise, which

produces and sells shawls. He brought into the business RM5,000 furniture and

RM35,000 cash.

During the month of June 2020, these were the Armani Enterprise transactions:

June Transactions

3 Opened a business bank account with Hong Ling Bank and

transferred RM25,000 cash into the bank.

7 Received invoices from:

Prima Holdings RM5,000 (before trade discount of 3%)

Marvellous Sdn Bhd RM9,000 (before trade discount of 3%)

9 Received a credit note from Marvellous Sdn Bhd for goods returned

amounting to RM150

13 Issued an invoice to Mr. Jamal for goods sold amounting to RM2,000.

The credit term is 5/10, net 30.

17 Issued a cheque for RM2,000 to Prima Holdings as partial settlement.

Armani Enterprise uses periodic inventory system in recording its inventories.

Required:

Record the above transactions into the appropriate ledger accounts (three columns

ledger).

Date Particulars Debit Credit

(RM) (RM)

Jun 3 Dr Bank 25,000

Cr Capital 25,000

7 Dr Purchases 14,000

Cr A/P - Prima Holdings 5,000

A/P - Marvellous Sdn Bhd 9,000

9 Dr A/P - Marvellous Sdn Bhd 150

Cr Purchase return & allowances 150

13 Dr A/R – Mr Jamal 2,000

Cr Sales 2,000

17 Dr A/P - Prima Holdings 2,000

Cr Bank 2,000

(Prepare the T-accounts by yourself)

You might also like

- Shale Trading - Journal EntriesDocument5 pagesShale Trading - Journal Entriessayali matkar100% (1)

- Answer AccountingDocument5 pagesAnswer Accountingأحمد عبد الحميدNo ratings yet

- An Introduction To Double-Entry Bookkeeping: Answers To End-Of-Chapter QuestionsDocument50 pagesAn Introduction To Double-Entry Bookkeeping: Answers To End-Of-Chapter QuestionsRuchira Sanket KaleNo ratings yet

- Chapter 1 - Recording Business TransactionDocument14 pagesChapter 1 - Recording Business TransactionThủy NguyễnNo ratings yet

- Shale Trading General Journal April 2004Document8 pagesShale Trading General Journal April 2004PiyushNo ratings yet

- Acc Formula PNS CycleDocument19 pagesAcc Formula PNS CycleJING RONG GOHNo ratings yet

- T2 - ABFA1153 (Extra)Document2 pagesT2 - ABFA1153 (Extra)LOO YU HUANGNo ratings yet

- Accounting 5Document5 pagesAccounting 5SCRIBDerNo ratings yet

- Hsslive Xii Acc 3 Admission of A Partner KeyDocument8 pagesHsslive Xii Acc 3 Admission of A Partner KeyShinu ShinadNo ratings yet

- Acc Unit-5-AnswersDocument5 pagesAcc Unit-5-AnswersGeorgeNo ratings yet

- Book 1Document6 pagesBook 1Jane VillanuevaNo ratings yet

- T accounts and TB by Riffat JabeenDocument4 pagesT accounts and TB by Riffat JabeenAbie AsifNo ratings yet

- Ch4principlesofdoubleentry 130406003853 Phpapp02Document24 pagesCh4principlesofdoubleentry 130406003853 Phpapp02ryanNo ratings yet

- Section 5 Adusting. (3)Document5 pagesSection 5 Adusting. (3)com01156499073No ratings yet

- Tutorial-Double EntryDocument3 pagesTutorial-Double EntryElayana SyafiqahNo ratings yet

- As Level Accounting Topic 1 OddDocument45 pagesAs Level Accounting Topic 1 OddShoaib AslamNo ratings yet

- PE ACCO5305 NHOM 8 chưa hoàn chỉnhDocument9 pagesPE ACCO5305 NHOM 8 chưa hoàn chỉnhKhánh HàNo ratings yet

- General Journal, General Ledger and Trial Balance TemplateDocument14 pagesGeneral Journal, General Ledger and Trial Balance TemplateAnoop VgNo ratings yet

- Pine Ltd Share Capital Journal EntriesDocument2 pagesPine Ltd Share Capital Journal EntriesMya Hmuu KhinNo ratings yet

- Acc030 Assessment Group ProjectDocument7 pagesAcc030 Assessment Group ProjectAqilahNo ratings yet

- Symbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Document7 pagesSymbiosis International (Deemed University) : (Established Under Section 3 of The UGC Act 1956)Aniket RauthanNo ratings yet

- PROBLEMS SOLUTIONS FOR ACCOUNTSDocument246 pagesPROBLEMS SOLUTIONS FOR ACCOUNTSK. Pavithraa SreeNo ratings yet

- Journal EntryDocument3 pagesJournal EntryJane VillanuevaNo ratings yet

- Acc AliabatDocument3 pagesAcc AliabatNUR AUNI DIYANA MOHD ROZALINo ratings yet

- Business Combination Answers (Manav)Document58 pagesBusiness Combination Answers (Manav)Harshit ChauhanNo ratings yet

- Homework Solutions - Business Combinations AcquisitionsDocument4 pagesHomework Solutions - Business Combinations AcquisitionsPhượng ViNo ratings yet

- MACAssignment 1Document15 pagesMACAssignment 1khirad afNo ratings yet

- Kendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 1 AccountancyDocument2 pagesKendriya Vidyalaya Sangthan, Mumbai Region Marking Scheme Set 1 AccountancyNitesh KumarNo ratings yet

- ACC407 - Chapter 4b - Trial BalanceDocument18 pagesACC407 - Chapter 4b - Trial BalanceA24 Izzah100% (1)

- Income Statement and Balance SheetDocument25 pagesIncome Statement and Balance SheetKhizer Waseem100% (1)

- Acquisition Analysis: Dr. CRDocument4 pagesAcquisition Analysis: Dr. CRYubraj ThapaNo ratings yet

- Accounting ProjectDocument36 pagesAccounting ProjectNin QetelauriNo ratings yet

- Btap KTTCDocument5 pagesBtap KTTChuongcute2003No ratings yet

- Assignment 5Document2 pagesAssignment 5Phuong DungNo ratings yet

- AF210 Q2.3 Corrected SolutionDocument1 pageAF210 Q2.3 Corrected SolutionChand DivneshNo ratings yet

- Assignment 4 AnswersDocument5 pagesAssignment 4 AnswersĐào Huệ ChiNo ratings yet

- Homework 27-02-2023 (Journal)Document3 pagesHomework 27-02-2023 (Journal)Akshayaa PrakashNo ratings yet

- Journal - Ledger in Class WorksheetDocument9 pagesJournal - Ledger in Class WorksheetAnurag KapoorNo ratings yet

- Accounting CycleDocument10 pagesAccounting CycleJane VillanuevaNo ratings yet

- UntitledDocument3 pagesUntitled20cab244 NavineshNo ratings yet

- Tally Sample Exercise - 4Document7 pagesTally Sample Exercise - 4Velu SNo ratings yet

- Answer Chapter 1Document5 pagesAnswer Chapter 1Nguyễn Châu Mỹ KiềuNo ratings yet

- Solution For SharesDocument10 pagesSolution For SharesMohammad Tariq AnsariNo ratings yet

- Lecture 2 Part 2 - Emily - SolutionDocument8 pagesLecture 2 Part 2 - Emily - SolutionIsyraf Hatim Mohd TamizamNo ratings yet

- Mr Sinha and Mr Emran journal entriesDocument2 pagesMr Sinha and Mr Emran journal entriespratyushNo ratings yet

- Final Accounts Wbut QP SumDocument7 pagesFinal Accounts Wbut QP Sumsiddhartha RajNo ratings yet

- Advanced Corporate Accounting Online ClassDocument21 pagesAdvanced Corporate Accounting Online ClassHariNo ratings yet

- Chapter 5Document7 pagesChapter 5YousefNo ratings yet

- Correction of ErrorsDocument16 pagesCorrection of ErrorsBaekhyunee PubbyNo ratings yet

- Account ShaleDocument15 pagesAccount Shalenisha deotaleNo ratings yet

- Internal Reconstruction PQ SolDocument17 pagesInternal Reconstruction PQ SolKaran MokhaNo ratings yet

- FINANCIAL ACCOUNTING TESTDocument7 pagesFINANCIAL ACCOUNTING TESTSoumyadip DasNo ratings yet

- Accounting Equation ExplainedDocument5 pagesAccounting Equation ExplainedMuhammad Saad UmarNo ratings yet

- Anser Key of Rectification of ErrorsDocument3 pagesAnser Key of Rectification of ErrorsmenekyakiaNo ratings yet

- Sample QSDocument12 pagesSample QSIsha KatiyarNo ratings yet

- Journal Entries and Trial BalanceDocument6 pagesJournal Entries and Trial BalanceBarcelona, Tricia Mae F.No ratings yet

- Partnership Accounts - IDocument23 pagesPartnership Accounts - IM JEEVARATHNAM NAIDU100% (1)

- Project report on starting a sandwich businessDocument13 pagesProject report on starting a sandwich businessnishan pantNo ratings yet

- Winning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinFrom EverandWinning the Trading Game: Why 95% of Traders Lose and What You Must Do To WinNo ratings yet

- Atw 159-Full ReportDocument61 pagesAtw 159-Full ReporteshakaurNo ratings yet

- Argumentative EssayDocument1 pageArgumentative EssayeshakaurNo ratings yet

- Investment PDFDocument96 pagesInvestment PDFeshakaurNo ratings yet

- ATW108 Group Project BriefingDocument24 pagesATW108 Group Project BriefingeshakaurNo ratings yet

- ATW111-153 - Midterm TestDocument5 pagesATW111-153 - Midterm TesteshakaurNo ratings yet

- Accounting Equation Practice Problems and SolutionsDocument8 pagesAccounting Equation Practice Problems and SolutionseshakaurNo ratings yet

- Accounting Errors CorrectionsDocument4 pagesAccounting Errors Correctionseshakaur100% (2)

- Class Exercises - Internal Control Accounting For Cash (Answers)Document7 pagesClass Exercises - Internal Control Accounting For Cash (Answers)eshakaurNo ratings yet

- Air Synapsis - Aeronautical Design Services Pre-qualification-LDocument74 pagesAir Synapsis - Aeronautical Design Services Pre-qualification-LsureeshNo ratings yet

- 2 R00005 PDFDocument5 pages2 R00005 PDFJean Yves AllasNo ratings yet

- 6018-P1-Kunci-Bu EndahDocument39 pages6018-P1-Kunci-Bu EndahLilik SuryawanNo ratings yet

- Braddock Export GuideDocument133 pagesBraddock Export Guidevanan7157No ratings yet

- JIT and Lean OperationsDocument20 pagesJIT and Lean Operationsmahmoud bahaaNo ratings yet

- Aviation Resource ManagementDocument72 pagesAviation Resource ManagementPurushothaman RamachandaranNo ratings yet

- Analysis of Management Code 17 - Jun 2019 - Human PeritusDocument7 pagesAnalysis of Management Code 17 - Jun 2019 - Human PeritusnitishNo ratings yet

- Lecture 2 - Operations Strategy(s)Document45 pagesLecture 2 - Operations Strategy(s)adrian proudNo ratings yet

- Nivea Case StudyDocument2 pagesNivea Case StudyAmol MahajanNo ratings yet

- Safety Campaign-Bypassing Safety Control-Feb 2022Document4 pagesSafety Campaign-Bypassing Safety Control-Feb 2022HSE99 BHDCNo ratings yet

- MGT6206 Group Assignment-1Document8 pagesMGT6206 Group Assignment-1Lyu JingNo ratings yet

- Ind Nifty RealtyDocument2 pagesInd Nifty RealtyKevinSuriyanNo ratings yet

- Value Chain and Porters Forces: Exercise 1Document4 pagesValue Chain and Porters Forces: Exercise 1Ốc Sên NhỏNo ratings yet

- CAAP Concession Manual 2017v2Document29 pagesCAAP Concession Manual 2017v2Jo VicNo ratings yet

- B. Break-Even Oil Changes in UnitsDocument5 pagesB. Break-Even Oil Changes in Unitsbelle crisNo ratings yet

- Xerox Case Study AnalysisDocument2 pagesXerox Case Study AnalysisManishNo ratings yet

- How Quality Teams and Empowerment Lead to MotivationDocument40 pagesHow Quality Teams and Empowerment Lead to MotivationJamaica Shaine O. Ramos50% (2)

- Batch Management From SAP SD PointDocument9 pagesBatch Management From SAP SD PointnabigcsNo ratings yet

- Absorption vs Variable Costing CalculationsDocument6 pagesAbsorption vs Variable Costing CalculationsVexana NecromancerNo ratings yet

- Assignment 4 Nebosh Solved PaperDocument7 pagesAssignment 4 Nebosh Solved PaperSaad MalikNo ratings yet

- Full Download Ebook PDF Aucm Auditing Professional Ethics Cquniversity PDFDocument41 pagesFull Download Ebook PDF Aucm Auditing Professional Ethics Cquniversity PDFkimberly.davis644100% (35)

- Bill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageBill To / Ship To:: Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountMohit SachdevNo ratings yet

- Wood Therapy ToolsDocument21 pagesWood Therapy ToolsDashin MeNo ratings yet

- Bungo Stray Dogs - Chapter 24.5Document1 pageBungo Stray Dogs - Chapter 24.5VeeNo ratings yet

- Analysis of Gross Profit ExampleDocument28 pagesAnalysis of Gross Profit ExampleMuhammad azeem100% (3)

- Regular Design Services of An ArchitectDocument5 pagesRegular Design Services of An ArchitectRej SwiftNo ratings yet

- Thoughts On Kaizen and Its Evolution: Three Different Perspectives and Guiding PrinciplesDocument24 pagesThoughts On Kaizen and Its Evolution: Three Different Perspectives and Guiding PrinciplesMohammed AwolNo ratings yet

- Accounts Payable ExplainedDocument3 pagesAccounts Payable ExplainedD Suresh BabuNo ratings yet

- Manpower Planning MethodsDocument15 pagesManpower Planning Methodsdonnellvineeth50% (2)

- EduSphere Sales Packages V04Document1 pageEduSphere Sales Packages V04Dian KokNo ratings yet