Professional Documents

Culture Documents

Mitigation of Orders and Cause For Price

Mitigation of Orders and Cause For Price

Uploaded by

Crypto BitcoinOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mitigation of Orders and Cause For Price

Mitigation of Orders and Cause For Price

Uploaded by

Crypto BitcoinCopyright:

Available Formats

Mitigation of Orders and Cause

for Price

Created @August 4, 2021 2:05 AM

Tags

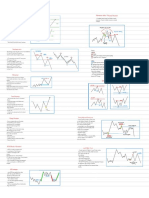

What is mitigation?

In simple terms, mitigation is a close of current positions from banks and institutions.

The market makers will return price to an OB, to collect their orders, close out, and

then stact more orders which is why we usually see price reverse from these OBs.

Price will get manipulated, in order to close their positions before reversing price.

Here we have a chart of gold, which is showing a great example. So if we start from

the bottom and just work all the way up from this whole move, we can see we are

completely trending to the upside HHs and HLs.

Mitigation of Orders and Cause for Price 1

So if we had this move down which was probably due to a bit of news from that

candle but then saying that we are on gold which can move aggressively. But

anyway we have this move down, on this candle we left some imbalance and we can

see price pulled back to half of this candle, before then pushing down.

Mitigation of Orders and Cause for Price 2

And then we can see is here we had this move up, now this isn´t considered a bos,

because we had this LL here and then we our swing point or our LH would be

somewhere up here.

So we pulled back but we didn´t put in a new LL, so price didn´t break this LL. So

this highs isn´t confirmed as a LH, so we pushed up with this move, but this is not a

bos because we didn´t get a confirmed LH from here.

So this isn´t considered an OB, so what we may have is the last down candle which

would be here, but its not considered valid for me because we didn´t break this LH

here.

If we just move on we can see we push up but then we do pullback, then we do bos

thats a valid bos for me, so I mark it. So whats mean? Once we bos we have the last

down candle which is here, so price is likely to come back, it doesn´t have to, it can

be left unmitigated and then price can continue.

So what we can see is we bos, we put in a new HH which really was up here, new

HL, last down candle before the up move, this is a bullish OB, price came back in

and this is a mitigation.

So money came into the market here, you know larger orders, price then came back

into that level, mitigated their orders or any sell positions that they had prior, came

back into that area, we had a bit of imbalance in price that was mitigated basically

Mitigation of Orders and Cause for Price 3

meaning filled and more orders are being entered here from large interests of

money, and then we can see price reversed from that area.

This is not just happening by luck, its all calculated and that is a mitigation.

So if we carry the next valid bos would be here, now again it wasn´t with that candle

but the move did start from here, because we pullback, then we had a quite an

impulsive move up, we had a doji here, but then we had another candle

momentously breaking that high there.

So bos which is that high, so prior to this we had a HH, HL, a mitigation of that OB,

HH, HL and the exact same thing here, have a bullish OB which is the last down

candle, but we can refine it to that candle, because this hasn´t actually engulfed the

OB, so thats the candle that we can look at.

Then we bos, we had a wick mitigation, so is that by change that we come back into

fill at least 50% of that OB or their orders closing out some orders and then stacking

more and then continuing price.

So its just textbook and this is basically how the need to move,

so this is just market makers manipulating price, closing previous

Mitigation of Orders and Cause for Price 4

positions, mitigation any imbalance that was left which is

important in some degree but imbalance isn´t always needed. In

this OBs and this mitigations we do have LTF entries that we can

take but Im not going to get into that in this video this is just

showcasing mitigation and why price is doing this.

So if we just carry on this is the most recent HH so where did price bos, where it was

on this move here. We broke that wick, we put in a new HH, we have a clear range

or a consolidation here so price is moving sideways.

What we can see is we have this move that is moving up, so we can sort of

disregard this and then we can look at moves from here, because this is where price

is moving sideways, so we can see a clear demand level, this is just building liquidity

and price is getting ready to initiate out.

So what we have here is a range or consolidation, price then initiates out which

basically means moving away and bos, and then we have a mitigation which is as

Mitigation of Orders and Cause for Price 5

we have discussed price comes back in mitigates, fills orders, more orders being

placed and then finally the fourth.

What happens next is basically continuation.

So where could we mark on our range?

Well we could look at this but thats the move that was continuing up, is sort of from

here. So we can take the sort of highest point and the lowest point of the range,

before price moves out.

Now of course we do have an OB which would be this little candle refined to that

candle there, but in this example thats quite a small area to be looking at, so what

we can do is take the range from the higher to the low and then look for long

opportunities within that area on the LTF.

Mitigation of Orders and Cause for Price 6

So again price comes in to mitigate, rebalance all of this sort of moves, because we

definitely do have more buyers than sellers.

Now we could be asking, well this is the last down candle here, before some clear

momentum which to some degree is correct but is hasn´t really broken structure, or it

isn´t a valid break for me, because its just one candle and the move has started from

here, this is where price initiated out that broke the high and also another thing to

look at is how price came into this level here, we can see a lot of momentum, a lot of

bearish pressure and there is no entries on a LTF in this area here.

So its better to wait for LTF confirmation and look to see where our actual areas are,

where price will more than likely need to mitigate before continuing and we can see

its here clear demand and we know thats what happened.

So one thing we can see on the 1h is price came in but then closed above the

demand, so what this wick basically means is he is just bos on LTF, because at one

point price was down here, but then it closed up here, so what does that say on a

LTF?

Well that basically means we have got bullish candles on a LTF, thats bos and one

thing to look at as well.

Mitigation of Orders and Cause for Price 7

If we was to drop down to a LTF which I won´t do, but we will have areas on the 15m

and 5m on this move here, so what we can see is, we have the exact same thing, we

can take.

So we have the exact same thing as here, so we have the range, bos, so this is the

same but its on a smaller degree. And if we was to drop down to a LTF we could see

this we have a range on this candles here, initiation out which bos, a mitigation of

that area and then the continuations.

So we have entries within entries, and then we can see what price is doing now is,

we know continuing and this is showing us clear order flow to the upside, and there

is no real saying price won´t continue up, bos again.

So we know whether it be this move here or price will build liquidity range

consolidate, and then initiate out, but there is no saying that we couldn´t put in

another bos and then see this happen again, mitigate, rabalance more orders being

placed, looking for them demand areas then OBs.

And because that is where price is more than likely going to gravitate to before we

do see continuation

Mitigation of Orders and Cause for Price 8

Order Flow and Price Mitigation.

So I got asked by a member why gold pushed up from here. Here’s my views and

the why.. this is the 1 hour timeframe.

Mitigation of Orders and Cause for Price 9

This is an update on gold.

Please find the correct colours and then match it with the coloured circles next to the

texts, so you understand it.

Mitigation of Orders and Cause for Price 10

You might also like

- Exhibition of ThothDocument11 pagesExhibition of ThothAlex Voorhees75% (4)

- Tactical Trading Concepts Liquidity Pools and Stop OrdersDocument13 pagesTactical Trading Concepts Liquidity Pools and Stop OrdersHi27069333% (3)

- Liquidity PrinciplesDocument21 pagesLiquidity PrinciplesAnurag Nauriyal93% (15)

- Flipping Markets: Trading PlanDocument28 pagesFlipping Markets: Trading PlanDario Anchava88% (8)

- Flipping Markets: PDF Cheat SheetDocument59 pagesFlipping Markets: PDF Cheat SheetAsh Sam100% (9)

- Order Blocks: Supply & DemandDocument5 pagesOrder Blocks: Supply & DemandTradewith Dev100% (1)

- What Is An Order BlockDocument16 pagesWhat Is An Order BlockLeonardo Caverzan100% (5)

- FX Trading Supply and DemandDocument18 pagesFX Trading Supply and DemandZack Ming100% (1)

- Rule Based TradingDocument3 pagesRule Based TradingAlex Almeida100% (2)

- Understanding The Eight Prayer WatchesNew LeveDocument15 pagesUnderstanding The Eight Prayer WatchesNew LeveKim Dickey100% (1)

- Constitutional Law 1 Digests Part 2Document391 pagesConstitutional Law 1 Digests Part 2Gayle Limlingan-Poblete100% (6)

- Market Structure Cheat SheetDocument55 pagesMarket Structure Cheat SheetMuralidaran Selvaraj100% (7)

- WWA Market StructureDocument1 pageWWA Market StructureMus'ab Abdullahi BulaleNo ratings yet

- Liquidity and ManipulationDocument20 pagesLiquidity and ManipulationAtharva Sawant82% (22)

- Liquidity and ManipulationDocument20 pagesLiquidity and ManipulationAtharva Sawant82% (22)

- Order Blocks and Flow Market StrutureDocument5 pagesOrder Blocks and Flow Market StrutureVikas Bhati86% (21)

- Trading Terminology and MeaningDocument2 pagesTrading Terminology and MeaningAtharva Sawant100% (1)

- Trading Terminology and MeaningDocument2 pagesTrading Terminology and MeaningAtharva Sawant100% (1)

- Understanding Accelerated Life-Testing AnalysisDocument17 pagesUnderstanding Accelerated Life-Testing AnalysisRobin TanNo ratings yet

- 63e3d96ecd160 EbookDocument51 pages63e3d96ecd160 Ebookkhin khinsan100% (6)

- Entry Criteria, Targets and Market DirectionDocument16 pagesEntry Criteria, Targets and Market DirectionRui Almeida100% (2)

- UnileverDocument28 pagesUnileverVaibhav MakkarNo ratings yet

- Tutti: Structure and Time Momentum Shifts / Reversal StructureDocument1 pageTutti: Structure and Time Momentum Shifts / Reversal StructureMus'ab Abdullahi BulaleNo ratings yet

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- ResourcesDocument10 pagesResourcesAtharva Sawant50% (2)

- Week 1 Markup 4 NotesDocument3 pagesWeek 1 Markup 4 Notesabas100% (1)

- FTM Strategy Manual PDFDocument64 pagesFTM Strategy Manual PDFjair100% (5)

- Our Free PDF!: Welcome ToDocument42 pagesOur Free PDF!: Welcome ToPragya Richhariya100% (4)

- Order BlocksDocument8 pagesOrder Blocksdaniel75% (4)

- Liquidity Inducement Trap Case StudyDocument4 pagesLiquidity Inducement Trap Case Studyyoussef marzak86% (7)

- WABO Bridge and Highway BrochureDocument20 pagesWABO Bridge and Highway BrochureRiccardo MordecaNo ratings yet

- Snowflake2 @FOREXSyllabusDocument27 pagesSnowflake2 @FOREXSyllabusHamzah Ahmed100% (3)

- Associated Bank Vs TanDocument15 pagesAssociated Bank Vs TanMike SorianoNo ratings yet

- Safe - Target - and - LTF - Price - ActionDocument9 pagesSafe - Target - and - LTF - Price - ActionRui Almeida100% (1)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceAtharva Sawant100% (5)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceAtharva Sawant100% (5)

- Iso 45001Document106 pagesIso 45001Black Gold100% (2)

- Lower Timeframe Order Block RefinementDocument14 pagesLower Timeframe Order Block RefinementAtharva Sawant83% (12)

- Lower Timeframe Order Block RefinementDocument14 pagesLower Timeframe Order Block RefinementAtharva Sawant83% (12)

- Flipping Markets: Trading Plan 2.0.1Document60 pagesFlipping Markets: Trading Plan 2.0.1Lentera95% (19)

- Liquidity: Quantum Stone CapitalDocument6 pagesLiquidity: Quantum Stone CapitalCapRa Xubo100% (5)

- Part 6 - 2 Important RulesDocument19 pagesPart 6 - 2 Important RulesCrypto BitcoinNo ratings yet

- Entry Types Continuation Part 1Document9 pagesEntry Types Continuation Part 1Atharva Sawant100% (3)

- Entry Types Continuation Part 1Document9 pagesEntry Types Continuation Part 1Atharva Sawant100% (3)

- Market StructureDocument21 pagesMarket StructureAtharva Sawant100% (10)

- Market StructureDocument21 pagesMarket StructureAtharva Sawant100% (10)

- The Trading Bible: Supply/Demand & Liquidity ConceptsDocument46 pagesThe Trading Bible: Supply/Demand & Liquidity ConceptsLuiz Fernando Teixeira94% (17)

- Market Structure Masterclass - Inside Market StructureDocument44 pagesMarket Structure Masterclass - Inside Market Structuremunzerkhzy100% (4)

- Imam Mehdi in Sunni UlemaDocument35 pagesImam Mehdi in Sunni Ulemafeeamali1445No ratings yet

- Types of LiquidityDocument12 pagesTypes of LiquidityAtharva Sawant100% (8)

- Types of LiquidityDocument12 pagesTypes of LiquidityAtharva Sawant100% (8)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- Asia Session Range and Anticipation That Liquidity To Be SweptDocument6 pagesAsia Session Range and Anticipation That Liquidity To Be SweptAtharva Sawant100% (1)

- Change of CharacterDocument3 pagesChange of CharacterFrom Shark To Whale75% (4)

- Entry Types Continuations Liquidity Part 2Document7 pagesEntry Types Continuations Liquidity Part 2Crypto Bitcoin100% (1)

- FX Personal Trading Strategy ACLDocument29 pagesFX Personal Trading Strategy ACLAlberto Campos López100% (2)

- Entry Time: Entries 101Document5 pagesEntry Time: Entries 101quentin oliver100% (1)

- Skin CancerDocument37 pagesSkin CancerSangita Sonwane100% (1)

- 22template22 Backtest of Alex GU PDFDocument13 pages22template22 Backtest of Alex GU PDFjair100% (1)

- Supply and DemandDocument18 pagesSupply and DemandAtharva Sawant100% (5)

- Supply and DemandDocument18 pagesSupply and DemandAtharva Sawant100% (5)

- HP Sex StorDocument117 pagesHP Sex StorRanjan Roy Jacob100% (1)

- MahadFX Course 5Document11 pagesMahadFX Course 5Tuong Nguyen100% (1)

- Supply and Demand PDFDocument95 pagesSupply and Demand PDFRodrigoGomezGallego100% (2)

- Bullish - Bearish - Order - BlocksDocument17 pagesBullish - Bearish - Order - BlocksAtharva Sawant100% (7)

- Bullish - Bearish - Order - BlocksDocument17 pagesBullish - Bearish - Order - BlocksAtharva Sawant100% (7)

- Tradingview Getting Started: Created TagsDocument8 pagesTradingview Getting Started: Created TagsAtharva Sawant100% (1)

- Tradingview Getting Started: Created TagsDocument8 pagesTradingview Getting Started: Created TagsAtharva Sawant100% (1)

- Understanding LiquidityDocument7 pagesUnderstanding LiquidityNitesh Mistry80% (5)

- Tradable Order BlocksDocument24 pagesTradable Order BlocksFelipe Silva93% (15)

- Price Action ImbalanceDocument22 pagesPrice Action ImbalanceVillaca KeneteNo ratings yet

- Entry Types Continuations & Liquidity Part 2: Created TagsDocument7 pagesEntry Types Continuations & Liquidity Part 2: Created TagsThero Raseasala100% (1)

- Lower - Timeframe - Bullish - Order - FlowDocument30 pagesLower - Timeframe - Bullish - Order - FlowAleepha Lelana100% (5)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- GU Live Example The Markets Need That Fuel To MoveDocument3 pagesGU Live Example The Markets Need That Fuel To MoveAtharva Sawant100% (1)

- GU Live Example The Markets Need That Fuel To MoveDocument3 pagesGU Live Example The Markets Need That Fuel To MoveAtharva Sawant100% (1)

- Maruti Suzuki Questionnaire On Brand EquityDocument2 pagesMaruti Suzuki Questionnaire On Brand EquityAnkit_466872% (18)

- Market StructureDocument12 pagesMarket StructureHODAALE MEDIANo ratings yet

- BOS CHoCHDocument6 pagesBOS CHoCHFelipe Silva100% (1)

- n360 Process RecordingDocument7 pagesn360 Process Recordingapi-272566401100% (1)

- 3c. Azn-Aee-Avv-Amzn (Transcribed On 10-Sep-2023 22-02-14)Document5 pages3c. Azn-Aee-Avv-Amzn (Transcribed On 10-Sep-2023 22-02-14)邱维No ratings yet

- World Economic ForumDocument5 pagesWorld Economic ForumAtharva SawantNo ratings yet

- (Report Title) (2018) : (DATE)Document2 pages(Report Title) (2018) : (DATE)Atharva SawantNo ratings yet

- Adsp - Exp 5Document3 pagesAdsp - Exp 5Atharva SawantNo ratings yet

- Name of Experiment:: Study of Logic GatesDocument7 pagesName of Experiment:: Study of Logic GatesAtharva SawantNo ratings yet

- Document 7Document4 pagesDocument 7Atharva SawantNo ratings yet

- Name of Experiment:: Study of Logic GatesDocument6 pagesName of Experiment:: Study of Logic GatesAtharva SawantNo ratings yet

- Model Internship Guidelines ManualDocument44 pagesModel Internship Guidelines ManualAtharva SawantNo ratings yet

- Campus Schedule 16.8.2018Document2 pagesCampus Schedule 16.8.2018Atharva SawantNo ratings yet

- To Capture What We Cannot Keep by Beatrice Colin - ExcerptDocument15 pagesTo Capture What We Cannot Keep by Beatrice Colin - ExcerptAllen & UnwinNo ratings yet

- APUSH FRQ Prompt Unit IV Prompt IIDocument2 pagesAPUSH FRQ Prompt Unit IV Prompt IIMisha PonnurajuNo ratings yet

- Note-Making Practice Question 3Document2 pagesNote-Making Practice Question 3Pooja KediaNo ratings yet

- Conditional Sentence Group 7Document13 pagesConditional Sentence Group 7Cinta Yulistra TindaonNo ratings yet

- I Idea-Based Lesson Exemplar For Co Pamamaraan Monday English Modular LearningDocument3 pagesI Idea-Based Lesson Exemplar For Co Pamamaraan Monday English Modular Learningcia-gail cuetoNo ratings yet

- Bowen 2011 Summary of Phonological ProcessesDocument1 pageBowen 2011 Summary of Phonological Processesbridget ludemanNo ratings yet

- Text Approach: From Student To Employee - Making The TransitionDocument12 pagesText Approach: From Student To Employee - Making The TransitionLauraNo ratings yet

- 3 Simplex PDFDocument87 pages3 Simplex PDFM Rifky FarrasNo ratings yet

- Braveman y Gruskin - 2003 - Defining Equity in Health PDFDocument5 pagesBraveman y Gruskin - 2003 - Defining Equity in Health PDFPAULA ANDREA TABORDA RESTREPONo ratings yet

- Study Guide 1 Learning ActivitiesDocument4 pagesStudy Guide 1 Learning ActivitiesAdrian EspinozaNo ratings yet

- What Is SocialismDocument1 pageWhat Is SocialismAly FahadNo ratings yet

- Best Things in LifeDocument9 pagesBest Things in LifeDương ĐăngNo ratings yet

- General Technologies Group LTD.: CASE 2.5Document9 pagesGeneral Technologies Group LTD.: CASE 2.5Hana Amalia VirantiNo ratings yet

- Lab Report 1 (Handwritten)Document3 pagesLab Report 1 (Handwritten)Nurul NadiaNo ratings yet

- Conversation With KrenekDocument10 pagesConversation With KrenekPencils of PromiseNo ratings yet

- Corporate Branding, Emotional Attachment and Brand Loyalty The Case of Luxury Fashion BrandingDocument24 pagesCorporate Branding, Emotional Attachment and Brand Loyalty The Case of Luxury Fashion Brandingdhrupody4No ratings yet

- Mid Exam Answer Sheet For Previous SemesterDocument3 pagesMid Exam Answer Sheet For Previous SemesterFarah TadrosNo ratings yet