Professional Documents

Culture Documents

Tutorial 7

Tutorial 7

Uploaded by

Irene WongCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tutorial 7

Tutorial 7

Uploaded by

Irene WongCopyright:

Available Formats

Chapter 9

Receivables

Review Questions

1. What is the difference between accounts receivable and notes receivable?

Accounts receivable represent the right to receive cash in the future from customers for goods sold

or for services performed. Accounts receivable are usually collected within a short period of time

such as 30 or 60 days. Notes receivable are usually longer in term than accounts receivable. Notes

receivable represent a written promise that a borrower will pay a fixed amount of principal plus

interest by a certain date in the future.

2. What do the terms ‘creditor’ and ‘debtor’ mean?.

The creditor is the one who receives a receivable (an asset). The creditor will collect cash from the

customer or borrower. The debtor is the party to a credit transaction who takes on an

obligation/payable (a liability). The debtor will pay cash later.

3. What is a critical element of internal control in the handling of receivables by a business? Explain

how this element is accomplished.

A critical element of internal control is the separation of cash-handling and cash-accounting duties.

For good internal control over cash collections from receivables, separation of duties must be

maintained and the credit department should have no access to cash. Additionally, those who handle

cash should not be in a position to grant credit to customers.

4. Separate customer accounts receivable are called subsidiary accounts. Why does a company create

subsidiary accounts?

A subsidiary account must be maintained for each customer in order to account for payments

received from the customer and amounts still owed.

5. What is the disadvantage of an account receivable?

The disadvantage of an account receivable is that some customers do not pay, creating uncollectible

receivables. Customers’ accounts receivable that are uncollectible must be written off or removed

from the books because the company does not expect to receive cash in the future. Instead, the

company must record an expense associated with the cost of the uncollectible account. This expense

is called bad debts expense.

6. What are some benefits to a business in accepting credit cards and debit cards?

The benefits to a business of accepting credit cards and debit cards include the ability to attract more

customers, not having to check each customer’s credit rating, and not having to keep accounts

receivable records or make collections from the customer.

© 2016 Pearson Education, Ltd. 9-1

7. What are two common methods used when accepting deposits for credit card and debit card

transactions?

Two common methods for deposits of proceeds from credit card sales are the net method and the

gross method. With the net method, the total sale less the processing fee assessed equals the net

amount of cash deposited by the processor, usually within a few days of the sale date. With the gross

method, the total sale is deposited daily, within a few days of the actual sale date. The processing

fees for all transactions processed for the month are deducted from the company’s bank account by

the processor, often on the last day of the month.

8. What occurs when a business factors its receivables?

When a business factors its receivables, it sells its receivables to a finance company or bank (often

called a factor). The business receives cash less an applicable fee from the factor for the receivables.

The factor, instead of the business, now collects the cash on the receivables. The business no longer

has to deal with the recordkeeping and collection of the receivables.

9. What occurs when a business pledges its receivables?

In a pledging situation, a business uses its receivables as security for a loan. The business borrows

money from a bank and offers its receivables as collateral. The business still is responsible for

collecting on the receivables and uses the money collected to pay off the loan along with interest. In

pledging, if the loan is not paid, the bank can collect on the receivables.

10. What are the advantages and disadvantages of selling on credit?

Bad Debts Expenses are the cost to the seller of extending credit. It arises from the failure to collect

from some credit customers. Bad debts expense is sometimes called doubtful accounts expense or

uncollectible accounts expense.

11. What is the bad debt expense? What is another term for the bad debt expense?

Limitations of the direct write-off method are that it violates the matching principle and is not

preferred by GAAP. The matching principle requires that the expense of uncollectible accounts be

matched with the related revenue. Under the direct write-off method the expense can occur in future

months or years. In addition, the accounts receivable (asset) are overstated on the balance sheet.

12. What are some limitations of using the direct write-off method?

Limitations of the direct write-off method are that it violates the matching principle and is not

preferred by GAAP. The matching principle requires that the expense of uncollectible accounts be

matched with the related revenue. Under the direct write-off method the expense can occur in future

months or years. In addition, the accounts receivable (asset) are overstated on the balance sheet.

13. When is bad debts expense recorded when using the allowance method?

Under the allowance method, bad debts expense is estimated and recorded in the same period as the

sales revenue as an adjusting entry at the end of the accounting period.

© 2016 Pearson Education, Ltd. 9-2

14. When using the allowance method, how are accounts receivable shown on the balance sheet?

Under the allowance method, accounts receivable are shown at the net realizable value. Net

realizable value is the net value that the company expects to collect from its receivables (Accounts

Receivable less Allowance for Bad Debts).

15. What should a company do when its customer pays a debt which had been written off?

The allowance for bad debts is a contra account, related to accounts receivable, that holds the

estimated amount of uncollectible accounts. Companies use their past experience as well as

considering the economy, the industry they operate in, and other variables. In short, they make an

educated guess, called an estimate. There are three basic ways to estimate uncollectibles: Percent-of-

sales, Percent-of-receivables, and Aging-of-receivables.

16. What is the allowance for bad debt or the Allowance for Doubtful Accounts? How do companies

determine bad debts?

The percent-of-sales method computes bad debts expense as a percentage of net credit sales.

17. How does the percent-of-sales method compute bad debts expense?

The percent-of-sales method computes bad debts expense as a percentage of net credit sales.

18. How do the percent-of-receivables and aging-of-receivables methods compute bad debts expense?

In both the percent-of-receivables method and aging-of-receivables method, the business determines

the target balance of the Allowance for Bad Debts account based on a percentage of accounts

receivable. This target balance is then used to determine the amount of bad debts expense after

considering the previous balance in the Allowance for Bad Debts.

19. What is the difference between the percent-of-receivables and aging-of-receivables methods?

In the percent-of-receivables method, the business uses only one percentage to determine the balance

of the Allowance for Bad Debts account. However, in the aging-of-receivables method, the business

groups’ individual accounts according to how long the receivable has been outstanding. They then

apply a different percentage to each aging category.

20. What is the formula to compute interest on a note receivable?

The formula for computing interest is as follows: Amount of interest = Principal × Interest rate ×

Time.

21. Why must companies record accrued interest revenue at the end of the accounting period?

The interest revenue earned on the note up to year-end is part of that year’s earnings. Interest

revenue is earned over time, not just when cash is received. Because of the revenue recognition

principle, a business must record the earnings from the note in the year in which they were earned.

© 2016 Pearson Education, Ltd. 9-3

22. How is the acid-test ratio calculated, and what does it signify?

The acid-test ratio is a ratio of the sum of cash (including cash equivalents) plus short-term

investments plus net current receivables to total current liabilities. The acid-test ratio reveals whether

the entity could pay all its current liabilities if they were to become due immediately.

23. What does the accounts receivable turnover ratio measure, and how is it calculated?

The accounts receivable turnover ratio measures the number of times the company collects the

average accounts receivable balance in a year. The higher the ratio, the faster the cash collections. It

is calculated by taking net credit sales divided by average net accounts receivable.

24. What does the days’ sales in receivables indicate, and how is it calculated?

Days’ sales in receivables, also called the collection period, indicates how many days it takes to

collect the average level of accounts receivable. The number of days’ sales in receivables should be

close to the number of days customers are allowed to pay when credit is extended. The shorter the

collection period, the more quickly the organization can use its cash. The longer the collection

period, the less cash is available for operations. It is calculated by taking 365 days divided by the

accounts receivable turnover ratio.

Short Exercises

S9-1 Ensuring internal control over the collection of receivables

Learning Objective 1

Consider internal control over receivables collections. What job must be withheld from a company’s

credit department in order to safeguard its cash? If the credit department does perform this job, what can

a credit department employee do to hurt the company?

SOLUTION

The company’s credit department should not take customer payments or have any other cash-handling

responsibilities. For example, if a credit department employee also handles cash, the company would

have no separation of duties. The employee could pocket money received from a customer. He or she

could then label the customer’s account as uncollectible, and the company would stop billing that

customer. The employee may be able to cover his or her theft.

© 2016 Pearson Education, Ltd. 9-4

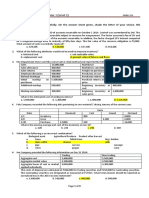

S9-2 Recording credit card and debit card sales

Learning Objective 1

Restaurants do a large volume of business by credit and debit cards. Suppose Summer, Sand, and

Castles Resort restaurant had these transactions on January 28, 2016:

Requirements

1. Suppose Summer, Sand, and Castles Resort’s processor charges a 2% fee and deposits sales net of

the fee. Journalize these sales transactions for the restaurant.

2. Suppose Summer, Sand, and Castles Resort’s processor charges a 2% fee and deposits sales using

the gross method. Journalize these sales transactions for the restaurant.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

Jan. 28 Cash 20,384

Credit Card Expense ($20,800 × 0.02) 416

Sales Revenue 20,800

Recorded credit card sales, net of fee.

Requirement 2

Date Accounts and Explanation Debit Credit

Jan. 28 Cash 20,800

Sales Revenue ($10,800 + $10,000) 20,800

Recorded credit card sales.

© 2016 Pearson Education, Ltd. 9-5

S9-3 Applying the direct write-off method to account for uncollectibles

Learning Objective 2

Susan Knoll is an attorney in Los Angeles. Knoll uses the direct write-off method to account for

uncollectible receivables.

At January 31, 2016, Knoll’s accounts receivable totaled $18,000. During February, she earned revenue

of $21,000 on account and collected $23,000 on account. She also wrote off uncollectible receivables of

$1,050 on February 29, 2016.

Requirements

1. Use the direct write-off method to journalize Knoll’s write-off of the uncollectible receivables.

2. What is Knoll’s balance of Accounts Receivable at February 29, 2016?

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

Feb. 29 Bad Debts Expense 1,050

Accounts Receivable 1,050

Wrote off uncollectible accounts.

Requirement 2

Accounts Receivable

Jan 31 Bal 18,000 23,000 collected

revenue 21,000 1,050 wrote off

Bal 14,950

© 2016 Pearson Education, Ltd. 9-6

S9-4 Collecting a receivable previously written off—direct write-off method

Learning Objective 2

Gate City Cycles had trouble collecting its account receivable from Shawna Brown. On June 19, 2016,

Gate City finally wrote off Brown’s $700 account receivable. On December 31, Brown sent a $700

check to Gate City.

Journalize the entries required for Gate City Cycles, assuming Gate City uses the direct write-off

method.

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Jun. 19 Bad Debts Expense 700

Accounts Receivable—Brown 700

Wrote off receivable.

Dec. 31 Accounts Receivable—Brown 700

Bad Debts Expense 700

Reinstated previously written off account.

31 Cash 700

Accounts Receivable—Brown 700

Collected cash on account.

S9-5 Applying the allowance method to account for uncollectibles

Learning Objective 3

The Accounts Receivable balance and Allowance for Bad Debts for Turning Leaves Furniture

Restoration at December 31, 2015, was $10,800 and $2,000 (credit balance). During 2016, Turning

Leaves completed the following transactions:

a. Sales revenue on account, $265,800 (ignore Cost of Goods Sold).

b. Collections on account, $220,000.

c. Write-offs of uncollectibles, $6,100.

d. Bad debts expense of $5,000 was recorded.

Requirements

1. Journalize Turning Leaves’s transactions for 2016 assuming Turning Leaves uses the allowance

method.

2. Post the transactions to the Accounts Receivable, Allowance for Bad Debts, and Bad Debts Expense

T-accounts, and determine the ending balance of each account.

3. Show how accounts receivable would be reported on the balance sheet at December 31, 2016.

© 2016 Pearson Education, Ltd. 9-7

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

a. Accounts Receivable 265,80

0

Sales Revenue 265,800

b. Cash 220,00

0

Accounts Receivable 220,000

c. Allowance for Bad Debts 6,100

Accounts Receivable 6,100

d. Bad Debts Expense 5,000

Allowance for Bad Debts 5,000

Requirement 2

Accounts Receivable

12/31/15, Bal 10,800 220,000 collected

revenue 265,800 6,100 wrote off

12/31/16, Bal 50,500

Allowance for Bad Debts

2,000 12/31/15, Bal

wrote off 6,100 5,000 expense

900 12/31/16, Bal

Bad Debts Expense

expense 5,000

Bal 5,000

Requirement 3

TURNING LEAVES FURNITURE RESTORATION

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 50,500

Less: Allowance for Bad Debts (900) $ 49,600

© 2016 Pearson Education, Ltd. 9-8

S9-6 Applying the allowance method (percent-of-sales) to account for uncollectibles

Learning Objective 3

During its first year of operations, Signature Lamp Company earned net credit sales of

$314,000. Industry experience suggests that bad debts will amount to 4% of net credit sales. At

December 31, 2016, accounts receivable total $45,000. The company uses the allowance method to

account for uncollectibles.

Requirements

1. Journalize Signature’s Bad Debts Expense using the percent-of-sales method.

2. Show how to report accounts receivable on the balance sheet at December 31, 2016.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense ($314,000 × 4%) 12,560

Allowance for Bad Debts 12,560

Recorded bad debts expense for the period.

Requirement 2

SIGNATURE LAMP COMPANY

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 45,000

Less: Allowance for Bad Debts (12,560) $ 32,440

© 2016 Pearson Education, Ltd. 9-9

S9-7 Applying the allowance method (percent-of-receivables) to account for uncollectibles

Learning Objective 3

The Accounts Receivable balance for Field, Inc. at December 31, 2015, was $25,000. During 2016,

Field earned revenue of $457,000 on account and collected $326,000 on account. Field wrote off $5,900

receivables as uncollectible. Industry experience suggests that uncollectible accounts will amount to 4%

of accounts receivable.

Requirements

1. Assume Field had an unadjusted $2,300 credit balance in Allowance for Bad Debts at December 31,

2016. Journalize Field’s December 31, 2016, adjustment to record bad debts expense using the

percent-of-receivables method.

2. Assume Field had an unadjusted $1,900 debit balance in Allowance for Bad Debts at December 31,

2016. Journalize Field’s December 31, 2016, adjustment to record bad debts expense using the

percent-of-receivables method.

SOLUTION

Requirement 1

Accounts Receivable

12/31/15, Bal 25,000 326,000 collected

revenue 457,000 5,900 wrote off

12/31/16, Bal 150,100

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 3,704

Allowance for Bad Debts 3,704

($150,100 × 4% = $6,004; $6,004 – $2,300 = $3,704)

Requirement 2

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 7,904

Allowance for Bad Debts 7,904

($150,100 × 4% = $6,004; $6,004 + $1,900 = $7,904)

© 2016 Pearson Education, Ltd. 9-10

S9-8 Applying the allowance method (aging-of-receivables) to account for uncollectibles

Learning Objective 3

World Class Work Shoes had the following balances at December 31, 2016, before the year-end

adjustments:

The aging of accounts receivable yields the following data:

Requirements

1. Journalize World Class’s entry to record bad debts expense for 2016 using the aging-of-receivables

method.

2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts.

SOLUTION

Requirement 1

Age of Accounts Receivable

0 – 60 Days Over 60 Days Total Receivables

Accounts Receivable $73,000 $5,000 $78,000

Percent uncollectible × 2% × 24%

Estimated total uncollectible $1,460 $1,200 $2,660 (Target Balance)

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 1,600

Allowance for Bad Debts 1,600

($2,660 – $1,060 = $1,600)

Requirement 2

Allowance for Bad Debts

1,060 Balance

1,600 expense

2,660 Balance

© 2016 Pearson Education, Ltd. 9-11

S9-9 Computing interest amounts on notes receivable

Learning Objective 4

A table of notes receivable for 2016 follows:

For each of the notes receivable, compute the amount of interest revenue earned during 2016. Round to

the nearest dollar.

SOLUTION

Interest Interest Revenue

Principal Interest Rate Period Earned

Note 1 $ 30,000 × 0.04 × 3/12 = $ 300

Note 2 8,000 × 0.05 ×180/360 = 200

Note 3 28,000 × 0.12 × 90/360 = 840

Note 4 110,000 × 0.10 × 6/12 = 5,500

S9-10 Accounting for a note receivable

Learning Objective 4

On June 6, Southside Bank & Trust lent $90,000 to Samantha Michael on a 60-day, 6% note.

Requirements

1. Journalize for Southside the lending of the money on June 6.

2. Journalize the collection of the principal and interest at maturity. Specify the date.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

June 6 Notes Receivable—Michael 90,000

Cash 90,000

Lent money to Samantha Michael.

© 2016 Pearson Education, Ltd. 9-12

S9-10, cont.

Requirement 2

Date Accounts and Explanation Debit Credit

Aug. 5 Cash ($90,000 + $900) 90,900

Notes Receivable—Michael 90,000

Interest Revenue ($90,000 × 0.06 × 60/360) 900

Collected note receivable plus interest.

S9-11 Accruing interest revenue and recording collection of a note

Learning Objective 4

On December 1, Kole Corporation accepted a 120-day, 6%, $17,000 note receivable from J. Peterman in

exchange for his account receivable.

Requirements

1. Journalize the transaction on December 1.

2. Journalize the adjusting entry needed on December 31 to accrue interest revenue.

3. Journalize the collection of the principal and interest at maturity. Specify the date.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

Dec. 1 Notes Receivable—Peterman 17,000

Accounts Receivable—Peterman 17,000

Accepted note receivable in exchange for an

account receivable.

Requirement 2

Date Accounts and Explanation Debit Credit

Dec. 31 Interest Receivable 85

Interest Revenue (17,000 × 0.06 × 30/360) 85

Accrued interest earned.

Requirement 3

Date Accounts and Explanation Debit Credit

Mar. 31 Cash ($17,000 + $85 + $255) 17,340

Notes Receivable—Peterman 17,000

Interest Receivable 85

Interest Revenue ($17,000 × 0.06 × 90/360) 255

Collected note receivable plus interest.

© 2016 Pearson Education, Ltd. 9-13

S9-12 Recording a dishonored note receivable

Learning Objective 4

Midway Corporation has a six-month, $24,000, 3% note receivable from L. Summers that was signed on

June 1, 2016. Summers defaults on the loan on December 1.

Journalize the entry for Midway to record the default of the loan.

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Dec. 1 Accounts Receivable—Summers 24,360

Notes Receivable—Summers 24,000

Interest Revenue ($24,000 × 0.03 × 6/12) 360

Recorded default of loan.

S9-13 Using the acid-test ratio, accounts receivable turnover ratio, and days’ sales in receivables to

evaluate a company

Learning Objective 5

Gold Clothiers reported the following selected items at September 30, 2016 (last year’s—2015—

amounts also given as needed):

Compute Gold’s (a) acid-test ratio, (b) accounts receivable turnover ratio, and (c) days’ sales in

receivables for 2016. Evaluate each ratio value as strong or weak. Gold sells on terms of net 30. (Round

days’ sales in receivables to a whole number.)

© 2016 Pearson Education, Ltd. 9-14

SOLUTION

a) Acid-test ratio = (Cash including cash equivalents + Short-term investments + Net current

receivables) / Total current liabilities

= ($302,900 + $151,000 + $303,000) / ($331,000 + $191,000)

= $756,900 / $522,000

= 1.45

The acid-test ratio is a strong ratio.

b) Accounts receivable turnover ratio = Net credit sales / Average net accounts receivables

= $3,321,500 / [($152,000 + $303,000) / 2]

= $3,321,500 / $227,500

= 14.60

The accounts receivable turnover ratio is strong relative to credit terms of net 30.

c) Days’ sales in receivables = 365 days / Accounts receivable turnover ratio

= 365 days / 14.60

= 25 days

The days’ sales in receivables is strong relative to credit terms of net 30.

Exercises

E9-14 Defining common receivables terms

Learning Objective 1

Match the terms with their correct definition.

SOLUTION

1. F

2. E

3. A

4. C

5. D

6. B

© 2016 Pearson Education, Ltd. 9-15

E9-15 Identifying and correcting internal control weakness

Learning Objective 1

Suppose The Right Rig Dealership is opening a regional office in Omaha. Cary Regal, the office

manager, is designing the internal control system. Regal proposes the following procedures for credit

checks on new customers, sales on account, cash collections, and write-offs of uncollectible receivables:

The credit department runs a credit check on all customers who apply for credit. When an account

proves uncollectible, the credit department authorizes the write-off of the accounts receivable.

Cash receipts come into the credit department, which separates the cash received from the customer

remittance slips. The credit department lists all cash receipts by customer name and amount of cash

received.

The cash goes to the treasurer for deposit in the bank. The remittance slips go to the accounting

department for posting to customer accounts.

The controller compares the daily deposit slip to the total amount posted to customer accounts. Both

amounts must agree.

Recall the components of internal control. Identify the internal control weakness in this situation, and

propose a way to correct it.

SOLUTION

The internal control weakness is that the credit department receives incoming cash from customers.

With access to cash, an employee in the credit department can pocket cash received from a customer and

destroy the remittance slip. The credit department can then write-off the customer’s account as

uncollectible, and the company will stop pursuing collection from the customer.

To strengthen the controls, the company can have cash go to a lock box belonging to the bank or to the

company mail room, not to the credit department. An employee that is outside of the credit department

should then handle the receipt of the cash.

Student responses may vary.

E9-16 Journalizing transactions using the direct write-off method

Learning Objectives 1, 2

On June 1, High Performance Cell Phones sold $19,000 of merchandise to Andrew Trucking Company

on account. Andrew fell on hard times and on July 15 paid only $7,000 of the account receivable. After

repeated attempts to collect, High Performance finally wrote off its accounts receivable from Andrew on

September 5. Six months later, March 5, High Performance received Andrew’s check for $12,000 with a

note apologizing for the late payment.

Requirements

1. Journalize the transactions for High Performance Cell Phones using the direct write-off method.

Ignore Cost of Goods Sold.

2. What are some limitations that High Performance will encounter when using the direct write-off

method?

© 2016 Pearson Education, Ltd. 9-16

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

June 1 Accounts Receivable—Andrew Trucking Company 19,000

Sales Revenue 19,000

Record sales on account.

July 15 Cash 7,000

Accounts Receivable—Andrew Trucking Company 7,000

Record payment on account.

Sep. 5 Bad Debts Expense 12,000

Accounts Receivable—Andrew Trucking Company 12,000

Wrote-off account balance.

Mar. 5 Accounts Receivable—Andrew Trucking Company 12,000

Bad Debts Expense 12,000

Reinstated previously written off account.

5 Cash 12,000

Accounts Receivable—Andrew Trucking Company 12,000

Collected cash on account.

Requirement 2

High Performance will encounter limitations with the direct write-off method because it violates the

matching principle. The matching principle requires that the expense of uncollectible accounts be

matched with the related revenue. For example when using the direct write-off method, a company

might record sales revenue in 2015 but not record the bad debts expense until 2016. By recording the

bad debts expense in a different year than when the revenue was recorded, the company is overstating

net income in 2015 and understating net income in 2016. In addition, on the balance sheet, Accounts

Receivable will be overstated in 2015 because the company will have some receivables that will be

uncollectible but are not yet written off. This method is only acceptable for companies that have very

few uncollectible receivables.

© 2016 Pearson Education, Ltd. 9-17

Use the following information to answer Exercises E9-17 and E9-18.

At January 1, 2016, Hilly Mountain Flagpoles had Accounts Receivable of $31,000, and Allowance for

Bad Debts had a credit balance of $3,000. During the year, Hilly Mountain Flagpoles recorded the

following:

a. Sales of $174,000 ($157,000 on account; $17,000 for cash). Ignore Cost of Goods Sold.

b. Collections on account, $131,000.

c. Write-offs of uncollectible receivables, $2,200.

E9-17 Accounting for uncollectible accounts using the allowance method (percent-of-sales) and

reporting receivables on the balance sheet

Learning Objectives 1, 3

2. AR, Dec. 31 $54,800

Requirements

1. Journalize Hilly’s transactions that occurred during 2016. The company uses the allowance method.

2. Post Hilly’s transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts.

3. Journalize Hilly’s adjustment to record bad debts expense assuming Hilly estimates bad debts as 4%

of credit sales. Post the adjustment to the appropriate T-accounts.

4. Show how Hilly Mountain Flagpoles will report net accounts receivable on its December 31, 2016,

balance sheet.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

a. Accounts Receivable 157,00

0

Cash 17,000

Sales Revenue 174,000

b. Cash 131,00

0

Accounts Receivable 131,000

c. Allowance for Bad Debts 2,200

Accounts Receivable 2,200

Requirement 2

Accounts Receivable

1/1 Bal 31,000 131,000 collected

revenue 157,000 2,200 wrote off

12/31 Bal 54,800

Allowance for Bad Debts

3,000 1/1 Bal

wrote off© 2016

2,200

Pearson Education, Ltd. 9-18

800 12/31 Unadj. Bal

E9-17, cont.

Requirement 3

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 6,280

Allowance for Bad Debts 6,280

4% × $157,000 = $6,280

Allowance for Bad Debts

3,000 1/1 Bal

wrote off 2,200

800 Unadj. Bal

6,280 expense

7,080 12/31Bal

Bad Debts Expense

1/1 Bal 0

12/31 exp. 6,280

12/31 Bal 6,280

Requirement 4

HILLY MOUNTAIN FLAGPOLES

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 54,800

Less: Allowance for Bad Debts (7,080) $ 47,720

© 2016 Pearson Education, Ltd. 9-19

E9-18 Accounting for uncollectible accounts using the allowance method (percent-of-receivables)

and reporting receivables on the balance sheet

Learning Objectives 1, 3

3. Bad Debts Expense $844

Requirements

1. Journalize Hilly’s transactions that occurred during 2016. The company uses the allowance method.

2. Post Hilly’s transactions to the Accounts Receivable and Allowance for Bad Debts T-accounts.

3. Journalize Hilly’s adjustment to record bad debts expense assuming Hilly estimates bad debts as 3%

of accounts receivable. Post the adjustment to the appropriate T-accounts.

4. Show how Hilly Mountain Flagpoles will report net accounts receivable on its December 31, 2016,

balance sheet.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

a. Accounts Receivable 157,00

0

Cash 17,000

Sales Revenue 174,000

b. Cash 131,00

0

Accounts Receivable 131,000

c. Allowance for Bad Debts 2,200

Accounts Receivable 2,200

Requirement 2

Accounts Receivable

1/1 Bal 31,000 131,000 collected

revenue 157,000 2,200 wrote off

12/31 Bal 54,800

Allowance for Bad Debts

3,000 1/1 Bal

wrote off 2,200

800 12/31 Unadj.Bal

© 2016 Pearson Education, Ltd. 9-20

E9-18, cont.

Requirement 3

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 844

Allowance for Bad Debts 844

3% × $54,800 = $1,644; $1,644 – $800 = $844

Allowance for Bad Debts

3,000 1/01 Bal

wrote off 2,200

800 Unadj. Bal

844 expense

1,644 12/31 Bal

Bad Debts Expense

1/1 Bal 0

12/31 exp. 844

12/31 Bal 844

Requirement 4

HILLY MOUNTAIN FLAGPOLES

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 54,800

Less: Allowance for Bad Debts (1,644) $ 53,156

© 2016 Pearson Education, Ltd. 9-21

E9-19 Accounting for uncollectible accounts using the allowance method (aging- of-receivables)

and reporting receivables on the balance sheet

Learning Objective 3

2. Allowance CR Bal. $25,100

At December 31, 2016, the Accounts Receivable balance of TM Manufacturer is $230,000. The

Allowance for Bad Debts account has a $24,000 debit balance. TM Manufacturer prepares the following

aging schedule for its accounts receivable:

Requirements

1. Journalize the year-end adjusting entry for bad debts on the basis of the aging schedule. Show the T-

account for the Allowance for Bad Debts at December 31, 2016.

2. Show how TM Manufacturer will report its net accounts receivable on its December 31, 2016,

balance sheet.

SOLUTION

Requirement 1

Age of Accounts Receivable

1 – 30 31 – 60 61 – 90 Over 90 Total Receivables

Days Days Days Days

Accounts Receivable $75,000 $80,000 $35,000 $40,000 $230,000

Percent uncollectible × 0.8% × 4.0% × 6.0% × 48.0%

Estimated total $ 600 $ 3,200 $ 2,100 $19,200 $ 25,100 (Target

uncollectible Balance)

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 49,100

Allowance for Bad Debts 49,100

$24,000 + $25,100 = $49,100

© 2016 Pearson Education, Ltd. 9-22

Requirement 2

Allowance for Bad Debts

Bal 24,000

49,100 expense

25,100 Bal

TM MANUFACTURER

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 230,000

Less: Allowance for Bad Debts (25,100) $ 204,900

© 2016 Pearson Education, Ltd. 9-23

E9-20 Journalizing transactions using the direct write-off method versus the allowance method

Learning Objectives 1, 2, 3

During August 2016, Ritter Company recorded the following:

Sales of $62,100 ($55,000 on account; $7,100 for cash). Ignore Cost of Goods Sold.

Collections on account, $37,800.

Write-offs of uncollectible receivables, $1,690.

Recovery of receivable previously written off, $500.

Requirements

1. Journalize Ritter’s transactions during August 2016, assuming Ritter uses the direct write-off

method.

2. Journalize Ritter’s transactions during August 2016, assuming Ritter uses the allowance method.

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Aug. Accounts Receivable 55,000

Cash 7,100

Sales Revenue 62,100

Record sales for the month.

Cash 37,800

Accounts Receivable 37,800

Record collections on account.

Bad Debts Expense 1,690

Accounts Receivable 1,690

Write-off uncollectible receivables.

Accounts Receivable 500

Bad Debts Expense 500

Reinstate previously written off account.

Cash 500

Accounts Receivable

Record collection of account. 500

© 2016 Pearson Education, Ltd. 9-24

E9-20, cont.

Requirement 2

Date Accounts and Explanation Debit Credit

2016

Aug. Accounts Receivable 55,000

Cash 7,100

Sales Revenue 62,100

Recorded sales for the month.

Cash 37,800

Accounts Receivable 37,800

Recorded collections on account.

Allowance for Bad Debts 1,690

Accounts Receivable 1,690

Wrote-off uncollectible receivables.

Accounts Receivable 500

Allowance for Bad Debts 500

Reinstated previously written off account.

Cash 500

Accounts Receivable 500

Recorded collection of account.

© 2016 Pearson Education, Ltd. 9-25

E9-21 Journalizing credit card sales, note receivable transactions, and accruing interest

Learning Objectives 1, 4

Marathon Running Shoes reports the following:

Journalize all entries required for Marathon Running Shoes.

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Feb 4 Cash 95,040

Credit Card Expense ($96,000 × 0.01) 960

Sales Revenue 96,000

Recorded sales for the month.

Sep. 1 Notes Receivable—Jess Prichett 23,000

Cash 23,000

Recorded loan to employee.

Dec. 31 Interest Receivable 920

Interest Revenue ($23,000 × 0.12 × 4/12) 920

Accrued interest earned on Prichett note.

2017

Sep. 1 Cash ($23,000 + $920 + $1,840) 25,760

Interest Receivable 920

Interest Revenue ($23,000 × 0.12 × 8/12) 1,840

Notes Receivable—Jess Prichett 23,000

Collected note and interest from Prichett.

© 2016 Pearson Education, Ltd. 9-26

E9-22 Journalizing note receivable transactions including a dishonored note

Learning Objective 4

On September 30, 2016, Regal Bank loaned $92,000 to Kim Warner on a one-year, 6% note. Regal’s

fiscal year ends on December 31.

Requirements

1. Journalize all entries for Regal Bank related to the note for 2016 and 2017.

2. Which party has a

a. note receivable?

b. note payable?

c. interest revenue?

d. interest expense?

3. Suppose that Kim Warner defaulted on the note. What entry would Regal record for the dishonored

note?

© 2016 Pearson Education, Ltd. 9-27

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Sep. 30 Notes Receivable—Kim Warner 92,000

Cash 92,000

Recorded loan to Kim Warner.

Dec. 31 Interest Receivable 1,380

Interest Revenue ($92,000 × 0.06 × 3/12) 1,380

Accrued interest earned on Warner note.

2017

Sep. 30 Cash ($92,000 + $4,140 + $1,380) 97,520

Interest Receivable 1,380

Interest Revenue ($92,000 × 0.06 × 9/12) 4,140

Notes Receivable—Kim Warner 92,000

Collected note and interest from Warner.

Requirement 2

a. note receivable Regal Bank

b. note payable Kim Warner

c. interest revenue Regal Bank

d. interest expense Kim Warner

Requirement 3

Date Accounts and Explanation Debit Credit

2017

Sep. 30 Accounts Receivable—Kim Warner 97,520

Interest Receivable 1,380

Interest Revenue ($92,000 × 0.06 × 9/12) 4,140

Notes Receivable—Kim Warner 92,000

To record dishonored note.

© 2016 Pearson Education, Ltd. 9-28

E9-23 Journalizing note receivable transactions

Learning Objective 4

Feb. 1, 2017 Cash DR $21,200

The following selected transactions occurred during 2016 and 2017 for Mediterranean Importers. The

company ends its accounting year on April 30.

Journalize all required entries. Make sure to determine the missing maturity date.

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Feb. 1 Notes Receivable—Candace Smith 20,000

Cash 20,000

Recorded loan to Candace Smith.

Apr. 6 Notes Receivable—Green Masters 10,000

Sales Revenue 10,000

Sold goods for a note.

30 Interest Receivable 360

Interest Revenue ($300 + $60) 360

($20,000 × 0.06 × 3/12)+($10,000 × 0.09 ×

24/360)

Accrued interest earned on the two notes.

Jul. 5 Cash ($10,000 + $60 + $165) 10,225

Interest Receivable 60

Interest Revenue ($10,000 × 0.09 × 66/360) 165

Notes Receivable—Green Masters 10,000

Collected note and interest from Green Masters.

2017

Feb. 1 Cash ($20,000 + $300 + $900) 21,200

Interest Receivable 300

Interest Revenue ($20,000 × 0.06 × 9/12) 900

Notes Receivable—Candace Smith 20,000

Collected note and interest from Smith.

© 2016 Pearson Education, Ltd. 9-29

E9-24 Journalizing note receivable transactions

Learning Objective 4

Oct. 31 Cash DR $24,240

Like New Steam Cleaning performs services on account. When a customer account becomes four

months old, Like New converts the account to a note receivable. During 2016, the company completed

the following transactions:

Record the transactions in Like New’s journal.

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Apr. 28 Accounts Receivable—Java Club 24,000

Service Revenue 24,000

Performed services on account.

Sep. 1 Notes Receivable—Java Club 24,000

Accounts Receivable—Java Club 24,000

Received note in satisfaction of past due account

Oct. 31 Cash ($24,000 + $240) 24,240

Interest Revenue ($24,000 × 0.06 × 60/360) 240

Notes Receivable—Java Club 24,000

Collected note and interest from Java.

© 2016 Pearson Education, Ltd. 9-30

E9-25 Evaluating ratio data

Learning Objective 5

Chippewa Carpets reported the following amounts in its 2016 financial statements. The 2015 figures are

given for comparison.

Requirements

1. Calculate Chippewa’s acid-test ratio for 2016. (Round to two decimals.) Determine whether

Chippewa’s acid-test ratio improved or deteriorated from 2015 to 2016. How does Chippewa’s acid-

test ratio compare with the industry average of 0.80?

2. Calculate Chippewa’s accounts receivable turnover ratio. (Round to two decimals.) How does

Chippewa’s ratio compare to the industry average accounts receivable turnover of 10?

3. Calculate the days’ sales in receivables for 2016. (Round to the nearest day.) How do the results

compare with Chippewa’s credit terms of net 30?

© 2016 Pearson Education, Ltd. 9-31

SOLUTION

Requirement 1

Acid-test ratio = (Cash including cash equivalents + Short-term investments + Net current

receivables) / Total current liabilities

2016

= ($3,000 + $21,000 + $52,000) / $105,000

= $76,000 / $105,000

= 0.72 (rounded)

2015

= ($9,000 + $10,000 + $66,000) / $107,000

= $85,000 / $107,000

= 0.79 (rounded)

The acid-test ratio deteriorated from 2015 to 2016. The company’s acid-test ratio is a little worse

than the industry average of 0.80.

Requirement 2

Accounts receivable turnover ratio = Net credit sales / Average net accounts receivable

2016

= $654,900 / [($66,000 +$52,000) / 2]

= $654,900 / $59,000

= 11.10

The company’s accounts receivable turnover ratio is better than the industry average of 10.

Requirement 3

Days’ sales in receivables = 365 days / Accounts receivable turnover ratio

= 365 days / 11.10

= 33 days (rounded)

Chippewa’s days’ sales in receivables calculation is a little worse than the company’s net 30-day credit

period.

© 2016 Pearson Education, Ltd. 9-32

E9-26 Computing the collection period for receivables

Learning Objective 5

New Media Sign Incorporated sells on account. Recently, New reported the following

figures:

Requirements

1. Compute New’s days’ sales in receivables for 2016. (Round to the nearest day.)

2. Suppose New’s normal credit terms for a sale on account are “2/10, net 30.” How well does New’s

collection period compare to the company’s credit terms? Is this good or bad for New?

SOLUTION

Requirement 1

Accounts receivable turnover ratio = Net credit sales / Average net accounts receivables

2016

= $539,220 / [($38,600 + $43,100) / 2]

= $539,220 / $40,850

= 13.20

Days’ sales in receivables = 365 days / Accounts receivable turnover ratio

= 365 days / 13.20

= 28 days (rounded)

Requirement 2

New’s collection period is shorter than the 30 day credit terms. This is good for New. It appears that

some of their credit customers are taking advantage of the discount for early payment.

© 2016 Pearson Education, Ltd. 9-33

Problems (Group A)

P9-27A Accounting for uncollectible accounts using the allowance (percent-of-sales) and direct

write-off methods and reporting receivables on the balance sheet

Learning Objectives 1, 2, 3

1. Bad Debts Expense $5,400

On August 31, 2016, Lily Floral Supply had a $145,000 debit balance in Accounts Receivable and a

$5,800 credit balance in Allowance for Bad Debts. During September, Lily made

Sales on account, $540,000. Ignore Cost of Goods Sold.

Collections on account, $581,000.

Write-offs of uncollectible receivables, $5,000.

Requirements

1. Journalize all September entries using the allowance method. Bad debts expense was estimated at

1% of credit sales. Show all September activity in Accounts Receivable, Allowance for Bad Debts,

and Bad Debts Expense (post to these T-accounts).

2. Using the same facts, assume that Lily used the direct write-off method to account for uncollectible

receivables. Journalize all September entries using the direct write-off method. Post to Accounts

Receivable and Bad Debts Expense, and show their balances at September 30, 2016.

3. What amount of Bad Debts Expense would Lily report on its September income statement under

each of the two methods? Which amount better matches expense with revenue? Give your reason.

4. What amount of net accounts receivable would Lily report on its September 30, 2016, balance sheet

under each of the two methods? Which amount is more realistic? Give your reason.

© 2016 Pearson Education, Ltd. 9-34

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Sep. 30 Accounts Receivable 540,00

0

Sales Revenue 540,000

30 Cash 581,00

0

Accounts Receivable 581,000

30 Allowance for Bad Debts 5,000

Accounts Receivable 5,000

30 Bad Debts Expense 5,400

Allowance for Bad Debts 5,400

(1% × $540,000 = $5,400)

Accounts Receivable

8/31 Bal 145,000 581,000 collected

revenue 540,000 5,000 wrote off

9/30 Bal 99,000

Allowance for Bad Debts

5,800 8/31 Bal

wrote off 5,000 5,400 expense

6,200 9/30 Bal

Bad Debts Expense

expense 5,400

Bal 5,400

© 2016 Pearson Education, Ltd. 9-35

P9-27A, cont.

Requirement 2

Date Accounts and Explanation Debit Credit

2016

Sep. 30 Accounts Receivable 540,00

0

Sales Revenue 540,000

30 Cash 581,00

0

Accounts Receivable 581,000

30 Bad Debts Expense 5,000

Accounts Receivable 5,000

Accounts Receivable

8/31 Bal 145,000 581,000 collected

revenue 540,000 5,000 wrote off

9/30 Bal 99,000

Bad Debts Expense

expense 5,000

Bal 5,000

Requirement 3

Allowance Direct Write-

Income Statement Method Off Method

Bad Debts Expense $5,400 $5,000

Bad Debts Expense under the allowance method better matches expense with revenue because the

expense is recorded in the same period the sales are made.

Requirement 4

Allowance Direct Write-

Balance Sheet Method Off Method

Accounts Receivable $ 99,000 $ 99,000

Less: Allowance for Bad Debts (6,200)

Accounts Receivable, net $ 92,800

Net accounts receivable under the allowance method is more realistic because it shows the amount of the

receivables that the company expects to collect.

© 2016 Pearson Education, Ltd. 9-36

P9-28A Accounting for uncollectible accounts using the allowance method (aging-of-receivables)

and reporting receivables on the balance sheet

Learning Objective 3

2. Allowance CR Bal. $7,539 at Dec. 31, 2016

At September 30, 2016, the accounts of Park Terrace Medical Center (PTMC) include the following:

During the last quarter of 2016, PTMC completed the following selected transactions:

Requirements

1. Journalize the transactions.

2. Open the Allowance for Bad Debts T-account, and post entries affecting that account. Keep a

running balance.

3. Show how Park Terrace Medical Center should report net accounts receivable on its December 31,

2016, balance sheet.

© 2016 Pearson Education, Ltd. 9-37

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Dec. 28 Allowance for Bad Debts 2,800

Accounts Receivable—Silver, Co. 1,200

Accounts Receivable—Oscar Wells 1,000

Accounts Receivable—Rain Company 600

31 Bad Debts Expense 7,039

Allowance for Bad Debts 7,039

($7,539 – $500 = $7,039)

Age of Accounts Receivable

1 – 30 31 – 60 61 – 90 Over 90 Total Receivables

Days Days Days Days

Accounts Receivable $103,000 $41,000 $13,000 $ 6,000 $163,000

Percent uncollectible × 0.3% × 3.0% × 30.0% × 35.0%

Estimated total $ 309 $ 1,230 $ 3,900 $ 2,100 $7,539 (Target

uncollectible Balance)

Requirement 2

Allowance for Bad Debts

3,300 9/30 Bal

wrote off 2,800

500 12/28 Bal

7,039 expense

7,539 12/31 Bal

Requirement 3

PARK TERRACE MEDICAL CENTER

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 163,000

Less: Allowance for Bad Debts (7,539) $ 155,461

© 2016 Pearson Education, Ltd. 9-38

P9-29A Accounting for uncollectible accounts using the allowance method (percent-of-sales) and

reporting receivables on the balance sheet

Learning Objectives 1, 3

3. Net AR $107,300

Beta Watches completed the following selected transactions during 2016 and 2017:

Requirements

1. Open T-accounts for Allowance for Bad Debts and Bad Debts Expense. Keep running balances,

assuming all accounts begin with a zero balance.

2. Record the transactions in the general journal, and post to the two T-accounts.

3. Assume the December 31, 2017, balance of Accounts Receivable is $131,000. Show how net

accounts receivable would be reported on the balance sheet at that date.

© 2016 Pearson Education, Ltd. 9-39

SOLUTION

Requirements 1 and 2

Allowance for Bad Debts

0 Bal

12,000

12,000 12/31/2016 Bal

Jun. 29 900

11,100 06/29/2017 Bal

900 Aug. 6

12,000 08/06/2017 Bal

Dec. 31 3,300

8,700 12/31/2017 Bal

15,000 Dec. 31

23,700 12/31/2017 Bal

Bad Debts Expense

Bal 0

Dec. 31 12,000

12/31/2016 Bal 12,000

12,000 closing entry

01/1/2017 Bal 0

Dec. 31 15,000

12/31/2017 Bal 15,000

15,000 closing entry

01/1/2018 Bal 0

© 2016 Pearson Education, Ltd. 9-40

P9-29A, cont.

Requirements 1 and 2, cont.

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 12,000

Allowance for Bad Debts 12,000

(3% × $400,000 = $12,000)

31 Income Summary 12,000

Bad Debts Expense 12,000

2017

Jan. 17 Accounts Receivable—Marty Viller 900

Sales Revenue 900

Jun. 29 Allowance for Bad Debts 900

Accounts Receivable—Marty Viller 900

Aug. 6 Accounts Receivable—Marty Viller 900

Allowance for Bad Debts 900

6 Cash 900

Accounts Receivable—Marty Viller 900

Dec. 31 Allowance for Bad Debts 3,300

Accounts Receivable—Bob Keffer 1,900

Accounts Receivable—Mary Martin 1,000

Accounts Receivable—Robert Ronson 400

31 Bad Debts Expense 15,000

Allowance for Bad Debts 15,000

(3% × $500,000 = $15,000)

31 Income Summary 15,000

Bad Debts Expense 15,000

Requirement 3

BETA WATCHES

Balance Sheet−Partial

December 31, 2017

Assets

Current Assets:

Accounts Receivable $ 131,000

Less: Allowance for Bad Debts (23,700) $ 107,300

© 2016 Pearson Education, Ltd. 9-41

P9-30A Accounting for uncollectible accounts (aging-of-receivables method), credit card sales,

notes receivable, and accrued interest revenue

Learning Objectives 1, 3, 4

Dec. 31, 2016 Interest Receivable $3,600

Quality Recliner Chairs completed the following selected transactions:

Record the transactions in the journal of Quality Recliner Chairs. Explanations are not required. (For

notes stated in days, use a 360-day year. Round to the nearest dollar.)

© 2016 Pearson Education, Ltd. 9-42

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Jul. 1 Notes Receivable—Gray Mart 45,000

Sales Revenue 45,000

Oct. 31 Cash 23,000

Sales Revenue 23,000

Nov. 3 Credit Card Expense 460

Cash 460

Dec. 31 Interest Receivable 3,600

Interest Revenue 3,600

($45,000 × 0.16 × 6/12)

31 Bad Debts Expense 3,800

Allowance for Bad Debts 3,800

($15,200 – $11,400 = $3,800)

2017

Apr. 1 Cash ($45,000 + $1,800 + $3,600) 50,400

Interest Receivable 3,600

Interest Revenue ($45,000 × 0.16 × 3/12) 1,800

Notes Receivable—Gray Mart 45,000

Jun. 23 Notes Receivable—Artist Company 8,000

Sales Revenue 8,000

Aug. 22 Accounts Receivable—Artist, Company 8,080

Interest Revenue ($8,000 × 0.06 × 60/360) 80

Notes Receivable – Artist Company 8,000

Nov. 16 Notes Receivable—Creed Company 22,000

Cash 22,000

Dec. 5 Cash 8,080

Accounts Receivable—Artist Company 8,080

31 Interest Receivable 330

Interest Revenue 330

($22,000 × 0.12 × 45/360)

© 2016 Pearson Education, Ltd. 9-43

P9-31A Accounting for notes receivable and accruing interest

Learning Objective 4

1. Note 3 Dec. 18, 2016

Cathy Realty loaned money and received the following notes during 2016.

Requirements

1. Determine the maturity date and maturity value of each note.

2. Journalize the entries to establish each Note Receivable and to record collection of principal and

interest at maturity. Include a single adjusting entry on December 31, 2016, the fiscal year-end, to

record accrued interest revenue on any applicable note. Explanations are not required.

SOLUTION

Requirement 1

Principal Interest Interest Interest Maturity Maturity Date

Rate Period Revenue Value

Earned (P + I)

Note 1 $ 18,000 × 0.08 × 12/12 $ 1,440 $ 19,440 Jun 1, 2017

Note 2 24,000 × 0.12 × 6/12 1,440 25,440 Mar 30, 2017

Note 3 10,000 × 0.09 × 60/360 150 10,150 Dec. 18, 2016

© 2016 Pearson Education, Ltd. 9-44

P9-31A, cont.

Requirement 2

Date Accounts and Explanation Debit Credit

2016

Jun. 1 Notes Receivable (Note 1) 18,000

Cash 18,000

Sep. 30 Notes Receivable (Note 2) 24,000

Cash 24,000

Oct. 19 Notes Receivable (Note 3) 10,000

Cash 10,000

Dec. 18 Cash ($10,000 + $150) 10,150

Interest Revenue ($10,000 × 0.09 ×60/360) 150

Notes Receivable (Note 3) 10,000

31 Interest Receivable 1,540

Interest Revenue 1,540

Principal Interest Interest Interest

Rate Period Revenue

Earned

Note 1 $ 18,000 × 0.08 × 7/12 $ 840

Note 2 24,000 × 0.12 × 3/12 720

$ 1,540

Date Accounts and Explanation Debit Credit

2017

Mar. 30 Cash ($24,000 + $720 + $720) 25,440

Interest Receivable 720

Interest Revenue ($24,000 × 0.12 × 3/12) 720

Notes Receivable (Note 2) 24,000

Jun. 1 Cash ($18,000 + $600 + $840) 19,440

Interest Receivable 840

Interest Revenue ($18,000 × 0.08 × 5/12) 600

Notes Receivable (Note 1) 18,000

© 2016 Pearson Education, Ltd. 9-45

P9-32A Accounting for notes receivable, dishonored notes, and accrued interest revenue

Learning Objective 4

Dec. 31, 2016 Income Summary CR $75

Consider the following transactions for Jo Jo Music.

Journalize all transactions for Jo Jo Music. Round all amounts to the nearest dollar. (For notes stated in

days, use a 360-day year.)

© 2016 Pearson Education, Ltd. 9-46

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Dec. 6 Notes Receivable—Concord Sounds 9,000

Accounts Receivable—Concord Sounds 9,000

31 Interest Receivable 75

Interest Revenue ($9,000 × 0.12 × 25/360) 75

31 Interest Revenue 75

Income Summary 75

2017

Mar. 6 Cash 9,270

Interest Receivable 75

Interest Revenue ($9,000 × 0.12 × 65/360) 195

Notes Receivable—Concord Sounds 9,000

Jun. 30 Notes Receivable—Main Street Music 11,000

Cash 11,000

Oct. 2 Notes Receivable—Salem Sounds 9,000

Sales Revenue 9,000

Dec. 1 Accounts Receivable—Salem Sounds 9,180

Interest Revenue ($9,000 × 0.12 × 60/360) 180

Notes Receivable—Salem Sounds 9,000

1 Allowance for Bad Debts 9,180

Accounts Receivable—Salem Sounds 9,180

30 Cash 11,660

Interest Revenue ($11,000 × 0.12 × 6/12) 660

Notes Receivable—Main Street Music 11,000

© 2016 Pearson Education, Ltd. 9-47

P9-33A Using ratio data to evaluate a company’s financial position

Learning Objective 5

1. Acid-test ratio (2016) 0.86

The comparative financial statements of Perfection Cosmetic Supply for 2016, 2015, and 2014 include

the data shown here:

Requirements

1. Compute these ratios for 2016 and 2015:

a. Acid-test ratio (Round to two decimals.)

b. Accounts receivable turnover (Round to two decimals.)

c. Days’ sales in receivables (Round to the nearest whole day.)

2. Considering each ratio individually, which ratios improved from 2015 to 2016 and which ratios

deteriorated? Is the trend favorable or unfavorable for the company?

© 2016 Pearson Education, Ltd. 9-48

SOLUTION

Requirement 1

a. Acid-test ratio = (Cash including cash equivalents + Short-term investments + Net current

receivables) / Total current liabilities

2016

= ($60,000 + $135,000 + $270,000) / ($540,000)

= $465,000 / $540,000

= 0.86

2015

= ($80,000 + $150,000 + $280,000) / ($570,000)

= $510,000 / $570,000

= 0.89

b. Accounts receivable turnover ratio = Net credit sales / Average net accounts receivables

2016

= $5,860,000 / [($270,000 + $280,000) / 2]

= $5,860,000 / $275,000

= 21.31

2015

= $5,120,000 / [($280,000 + $260,000) / 2]

= $5,120,000 / $270,000

= 18.96

c. Days’ sales in receivables = 365 days / Accounts receivable turnover ratio

2016

= 365 days / 21.31

= 17 days (rounded)

2015

= 365 days / 18.96

= 19 days (rounded)

Requirement 2

The acid-test ratio decreased from 2015 to 2016. This trend is unfavorable to the company.

The accounts receivable turnover increased from 2015 to 2016. This trend is favorable to the company.

The days’ sales in receivables decreased from 2015 to 2016. This trend is favorable to the company.

© 2016 Pearson Education, Ltd. 9-49

Problems (Group B)

P9-34B Accounting for uncollectible accounts using the allowance (percent-of-sales) and direct

write-off methods and reporting receivables on the balance sheet

Learning Objectives 1, 2, 3

1. Sep. 30 Bal. AR $128,000

On August 31, 2016, Bouquet Floral Supply had a $170,000 debit balance in Accounts Receivable and a

$6,800 credit balance in Allowance for Bad Debts. During September, Bouquet made the following

transactions:

Sales on account, $550,000. Ignore Cost of Goods Sold.

Collections on account, $584,000.

Write-offs of uncollectible receivables, $8,000.

Requirements

1. Journalize all September entries using the allowance method. Bad debts expense was estimated at

2% of credit sales. Show all September activity in Accounts Receivable, Allowance for Bad Debts,

and Bad Debts Expense (post to these T-accounts).

2. Using the same facts, assume that Bouquet used the direct write-off method to account for

uncollectible receivables. Journalize all September entries using the direct write-off method. Post to

Accounts Receivable and Bad Debts Expense, and show their balances at November 30, 2016.

3. What amount of Bad Debts Expense would Bouquet report on its September income statement under

each of the two methods? Which amount better matches expense with revenue? Give your reason.

4. What amount of net accounts receivable would Bouquet report on its September 30, 2016, balance

sheet under each of the two methods? Which amount is more realistic? Give your reason.

© 2016 Pearson Education, Ltd. 9-50

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Sep. 30 Accounts Receivable 550,00

0

Sales Revenue 550,000

30 Cash 584,00

0

Accounts Receivable 584,000

30 Allowance for Bad Debts 8,000

Accounts Receivable 8,000

30 Bad Debts Expense 11,000

Allowance for Bad Debts 11,000

(2% × $550,000 = $11,000)

Accounts Receivable

8/31 Bal 170,000 584,000 collected

revenue 550,000 8,000 wrote off

9/30 Bal 128,000

Allowance for Bad Debts

6,800 8/31 Bal

wrote off 8,000 11,000 expense

9,800 9/30 Bal

Bad Debts Expense

expense 11,000

Bal 11,000

© 2016 Pearson Education, Ltd. 9-51

P9-34B, cont.

Requirement 2

Date Accounts and Explanation Debit Credit

2016

Sep. 30 Accounts Receivable 550,00

0

Sales Revenue 550,000

30 Cash 584,00

0

Accounts Receivable 584,000

30 Bad Debts Expense 8,000

Accounts Receivable 8,000

Accounts Receivable

8/31 Bal 170,000 584,000 collected

revenue 550,000 8,000 wrote off

9/30 Bal 128,000

Bad Debts Expense

expense 8,000

Bal 8,000

Requirement 3

Allowance Direct Write-

Income Statement Method Off Method

Bad Debts Expense $ 11,000 $ 8,000

Bad Debts Expense under the allowance method better matches expense with revenue because the

expense is recorded in the same period the sales are made.

© 2016 Pearson Education, Ltd. 9-52

P9-34B, cont.

Requirement 4

Allowance Direct Write-

Balance Sheet Method Off Method

Accounts Receivable $ 128,000 $ 128,000

Less: Allowance for Bad Debts (9,800)

Accounts Receivable, net $ 118,200

Net accounts receivable under the allowance method is more realistic because it shows the amount of the

receivables that the company expects to collect.

P9-35B Accounting for uncollectible accounts using the allowance method (aging-of-receivables)

and reporting receivables on the balance sheet

Learning Objective 3

2. Dec. 31, 2016 Allowance CR Bal. $4,616

At September 30, 2016, the accounts of Spring Heights Medical Center (SHMC) include the following:

During the last quarter of 2016, SHMC completed the following selected transactions:

Requirements

1. Journalize the transactions.

2. Open the Allowance for Bad Debts T-account, and post entries affecting that account. Keep a

running balance.

3. Show how Spring Heights Medical Center should report net accounts receivable on its December 31,

2016, balance sheet.

© 2016 Pearson Education, Ltd. 9-53

SOLUTION

Requirement 1

Date Accounts and Explanation Debit Credit

2016

Dec. 28 Allowance for Bad Debts 2,800

Accounts Receivable—Silver Co. 1,400

Accounts Receivable—Owen Reis 700

Accounts Receivable—Pristine, Inc. 700

31 Bad Debts Expense 4,116

Allowance for Bad Debts 4,116

($4,616 − $500 = $4,116)

Age of Accounts Receivable

1 – 30 31 – 60 61 – 90 Over 90 Total Receivables

Days Days Days Days

Accounts Receivable $103,000 $ 43,000 $ 14,000 $ 3,000 $ 163,000

Percent uncollectible × 0.2% × 2.0% × 20.0% × 25.0%

Estimated total $ 206 $ 860 $ 2,800 $ 750 $ 4,616 (Target

uncollectible Balance)

Requirement 2

Allowance for Bad Debts

3,300 9/30 Bal

wrote off 2,800

500 12/28 Bal

4,116 expense

4,616 12/31 Bal

Requirement 3

SPRING HEIGHTS MEDICAL CENTER

Balance Sheet−Partial

December 31, 2016

Assets

Current Assets:

Accounts Receivable $ 163,000

Less: Allowance for Bad Debts (4,616) $ 158,384

© 2016 Pearson Education, Ltd. 9-54

P9-36B Accounting for uncollectible accounts using the allowance method (percent-of-sales) and

reporting receivables on the balance sheet

Learning Objectives 1, 3

1. Dec. 31, 2017, Allowance CR Bal. $5,900

Quality Watches completed the following selected transactions during 2016 and 2017:

Requirements

1. Open T-accounts for Allowance for Bad Debts and Bad Debts Expense. Keep running balances,

assuming all accounts begin with a zero balance.

2. Record the transactions in the general journal, and post to the two T-accounts.

3. Assume the December 31, 2017, balance of Accounts Receivable is $136,000. Show how net

accounts receivable would be reported on the balance sheet at that date.

© 2016 Pearson Education, Ltd. 9-55

SOLUTION

Requirements 1 and 2

Allowance for Bad Debts

0 Bal

4,400

4,400 12/31/2016 Bal

Jun. 29 500

3,900 6/29/2017 Bal

500 Aug. 6

4,400 8/06/2017 Bal

Dec. 31 3,500

900 12/31/2017 Bal

5,000 Dec. 31

5,900 12/31/2017 Bal

Bad Debts Expense

Bal. 0

Dec. 31 4,400

12/31/2016 Bal 4,400

4,400 closing entry

1/01/2017 Bal 0

Dec. 31 5,000

12/31/2017 Bal 5,000

5,000 closing entry

1/01/2018 Bal 0

© 2016 Pearson Education, Ltd. 9-56

P9-36B, cont.

Requirements 1 and 2, cont.

Date Accounts and Explanation Debit Credit

2016

Dec. 31 Bad Debts Expense 4,400

Allowance for Bad Debts 4,400

(1% × $440,000 = $4,400)

31 Income Summary 4,400

Bad Debts Expense 4,400

2017

Jan. 17 Accounts Receivable—Malcom Monet 500

Sales Revenue 500

Jun. 29 Allowance for Bad Debts 500

Accounts Receivable—Malcom Monet 500

Aug. 6 Accounts Receivable—Malcom Monet 500

Allowance for Bad Debts 500

6 Cash 500

Accounts Receivable—Malcom Monet 500

Dec. 31 Allowance for Bad Debts 3,500

Accounts Receivable—Bernard Klaus 1,800

Accounts Receivable—Mo Vanez 1,500

Accounts Receivable—Russell Reeves 200

31 Bad Debts Expense 5,000

Allowance for Bad Debts 5,000

(1% × $500,000 = $5,000)

31 Income Summary 5,000

Bad Debts Expense 5,000

Requirement 3

QUALITY WATCHES

Balance Sheet−Partial

December 31, 2017

Assets

Current Assets:

Accounts Receivable $ 136,000

Less: Allowance for Bad Debts (5,900) $ 130,100

© 2016 Pearson Education, Ltd. 9-57

P9-37B Accounting for uncollectible accounts (aging-of-receivables method), credit card sales,

notes receivable, and accrued interest revenue

Learning Objectives 1, 3, 4

Dec. 31, 2016 Bad Debts Expense $3,900

Comfy Recliner Chairs completed the following selected transactions:

Record the transactions in the journal of Comfy Recliner Chairs. Explanations are not required. (For

notes stated in days, use a 360-day year. Round to the nearest dollar.)

© 2016 Pearson Education, Ltd. 9-58

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Jul. 1 Notes Receivable—Gray Mart 43,000

Sales Revenue 43,000

Oct. 31 Cash 21,000

Sales Revenue 21,000

Nov. 3 Credit Card Expense 400

Cash 400

Dec. 31 Interest Receivable 2,580

Interest Revenue 2,580

($43,000 × 0.12 × 6/12)

31 Bad Debts Expense 3,900

Allowance for Bad Debts 3,900

($14,600 – $10,700 = $3,900)

2017

Apr. 1 Cash ($43,000 + $2,580 + $1,290) 46,870

Interest Receivable 2,580

Interest Revenue ($43,000 × 0.12 × 3/12) 1,290

Notes Receivable—Gray Mart 43,000

Jun. 23 Notes Receivable—Aglow, Corp. 13,000

Sales Revenue 13,000

Aug. 22 Accounts Receivable—Aglow, Corp. 13,195

Interest Revenue ($13,000 × 0.09 × 60/360) 195

Notes Receivable—Aglow, Corp. 13,000

Nov. 16 Notes Receivable—Crowe, Inc. 22,000

Cash 22,000

Dec. 5 Cash 13,195

Accounts Receivable—Aglow, Corp. 13,195

31 Interest Receivable 440

Interest Revenue 440

($22,000 × 0.16 × 45/360)

© 2016 Pearson Education, Ltd. 9-59

P9-38B Accounting for notes receivable and accruing interest

Learning Objective 4

1. Note 2 Maturity Value $20,300

Christie Realty loaned money and received the following notes during 2016.

Requirements

1. Determine the maturity date and maturity value of each note.

2. Journalize the entries to establish each Note Receivable and to record collection of principal and

interest at maturity. Include a single adjusting entry on December 31, 2016, the fiscal year-end, to

record accrued interest revenue on any applicable note. Explanations are not required.

© 2016 Pearson Education, Ltd. 9-60

SOLUTION

Requirement 1

Principal Interest Interest Interest Maturity Maturity Date

Rate Period Revenue Value

Earned (P + I)

Note 1 $ 24,000 × 0.07 × 12/12 $ 1,680 $ 25,680 Aug 1, 2017

Note 2 20,000 × 0.06 × 3/12 300 20,300 Feb 28, 2017

Note 3 10,000 × 0.12 × 30/360 100 10,100 Jan 18, 2017

Requirement 2

Date Accounts and Explanation Debit Credit

2016

Aug. 1 Notes Receivable (Note 1) 24,000

Cash 24,000

Nov. 30 Notes Receivable (Note 2) 20,000

Cash 20,000

Dec. 19 Notes Receivable (Note 3) 10,000

Cash 10,000

31 Interest Receivable 840

Interest Revenue 840

Principal Interest Interest Interest

Rate Period Revenue

Earned

Note 1 $ 24,000 × 0.07 × 5/12 $ 700

Note 2 20,000 × 0.06 × 1/12 100

Note 3 10,000 × 0.12 × 12/360 40

$ 840

© 2016 Pearson Education, Ltd. 9-61

P9-38B, cont.

Requirement 2, cont.

Date Accounts and Explanation Debit Credit

2017

Jan. 18 Cash ($10,000 + $40 + $60) 10,100

Interest Receivable 40

Interest Revenue ($10,000 × 0.12 × 18/360) 60

Notes Receivable (Note 3) 10,000

Feb. 28 Cash ($20,000 + $100 + $200) 20,300

Interest Receivable 100

Interest Revenue ($20,000 × 0.06 × 2/12) 200

Notes Receivable (Note 2) 20,000

Aug. 1 Cash ($24,000 + $980 + $700) 25,680

Interest Receivable 700

Interest Revenue ($24,000 × 0.07 × 7/12) 980

Notes Receivable (Note 1) 24,000

P9-39B Accounting for notes receivable, dishonored notes, and accrued interest revenue

Learning Objective 4

March 6, 2017 Interest Revenue $325

Consider the following transactions for Smith’s Publishing.

Journalize all transactions for Smith’s Publishing. Round all amounts to the nearest dollar. (For notes

stated in days, use a 360-day year.)

© 2016 Pearson Education, Ltd. 9-62

SOLUTION

Date Accounts and Explanation Debit Credit

2016

Dec. 6 Notes Receivable—Jazz Music 15,000

Accounts Receivable—Jazz Music 15,000

31 Interest Receivable 125

Interest Revenue ($15,000 × 0.12 × 25/360) 125

31 Interest Revenue 125

Income Summary 125

2017

Mar. 6 Cash 15,450

Interest Receivable 125

Interest Revenue ($15,000 × 0.12 × 65/360) 325

Notes Receivable—Jazz Music 15,000

Jun. 30 Notes Receivable—RS Publishing 11,000

Cash 11,000

Oct. 2 Notes Receivable—Tusk Music 3,000

Sales Revenue 3,000

Dec. 1 Accounts Receivable—Tusk Music 3,060

Interest Revenue ($3,000 × 0.12 × 60/360) 60

Notes Receivable—Tusk Music 3,000

1 Allowance for Bad Debts 3,060

Accounts Receivable—Tusk Music 3,060

30 Cash 11,660

Interest Revenue ($11,000 × 0.12 × 6/12) 660

Notes Receivable—RS Publishing 11,000

© 2016 Pearson Education, Ltd. 9-63

P9-40B Using ratio data to evaluate a company’s financial position

Learning Objective 5

1. Days’ sales in receivables (2016) 16 days

The comparative financial statements of True Beauty Cosmetic Supply for 2016, 2015, and 2014 include

the data shown here:

Requirements

1. Compute these ratios for 2016 and 2015:

a. Acid-test ratio (Round to two decimals.)

b. Accounts receivable turnover (Round to two decimals.)

c. Days’ sales in receivables (Round to the nearest whole day.)

2. Considering each ratio individually, which ratios improved from 2015 to 2016 and which ratios

deteriorated? Is the trend favorable or unfavorable for the company?

© 2016 Pearson Education, Ltd. 9-64

SOLUTION

Requirement 1

a. Acid-test ratio = (Cash including cash equivalents + Short-term investments + Net current

receivables) / Total current liabilities

2016

= ($90,000 + $140,000 + $270,000) / $540,000

= $500,000 / $540,000

= 0.93 (rounded)

2015

= ($80,000 + $150,000 + $260,000) / $580,000

= $490,000 / $580,000

= 0.84 (rounded)

b. Accounts receivable turnover ratio = Net credit sales / Average net accounts receivables

2016

= $5,880,000 / [($270,000 + $260,000) / 2]

= $5,880,000 / $265,000

= 22.19 (rounded)

2015

= $5,210,000 / [($260,000 + $220,000) / 2]

= $5,210,000 / $240,000

= 21.7

c. Days' sales in receivables = 365 days / Accounts receivable turnover ratio

2016

= 365 days / 22.19

= 16 days (rounded)

2015

= 365 days / 21.7

= 17 days (rounded)

Requirement 2

The acid-test ratio increased from 2015 to 2016. This trend is favorable to the company.

The accounts receivable turnover increased from 2015 to 2016. This trend is favorable to the company.

The days’ sales in receivables decreased from 2015 to 2016. This trend is favorable to the company.

© 2016 Pearson Education, Ltd. 9-65

Continuing Problem

P9-41 Accounting for uncollectible accounts using the allowance method

This problem continues the Daniels Consulting situation from Problem P8-33 of Chapter 8. Daniels

Consulting reviewed the receivables list from the January transactions. Daniels uses the allowance

method for receivables, estimating uncollectibles to be 6% of January sales revenue of $8,180. Daniels

identified on February 15 that a customer was not going to pay his receivable of $176.

Requirements

1. Journalize the January 31 entry to record and establish the allowance using the percent-of-sales

method for January sales revenue.

2. Journalize the entry to record the write-off of the customer’s bad debt.

SOLUTION

Requirements 1 and 2

Date Accounts and Explanation Debit Credit

Jan. 31 Bad Debts Expense 491

Allowance for Bad Debts 491

(6% × $8,180 = $491)

Feb. 15 Allowance for Bad Debts 176

Accounts Receivable 176

© 2016 Pearson Education, Ltd. 9-66

Practice Set

This problem continues the Crystal Clear Cleaning problem begun in Chapter 2 and continued through

Chapters 3–8.

P9-42 Accounting for uncollectible accounts using the allowance method and reporting net

accounts receivable on the balance sheet

Crystal Clear Cleaning uses the allowance method to estimate bad debts. Consider the following January

transactions for Crystal Clear:

Requirements

1. Prepare all required journal entries for Crystal Clear.

2. Show how net accounts receivable would be reported on the balance sheet as of January 31, 2018.

© 2016 Pearson Education, Ltd. 9-67

SOLUTION

Date Accounts and Explanation Debit Credit

2018

Jan. 1 Accounts Receivable—Debbie’s D-list 9,000

Service Revenue 9,000

10 Cash 20,000

Notes Payable—High Roller Bank 20,000

12 Allowance for Bad Debts 275

Accounts Receivable—Merry Cleaners 275

15 Accounts Receivable—Westford 8,000

Sales Revenue 8,000

Cost of Goods Sold 400

Merchandise Inventory 400

28 Cash 2,000

Sales Revenue 2,000

Cost of Goods Sold 350

Merchandise Inventory 350