Professional Documents

Culture Documents

Daily Equity Market Report - 21.02.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 21.02.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

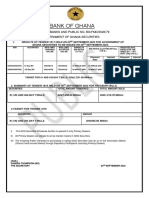

21ST FEBRUARY 2022

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI gained 4.07 points to Indicator Current Previous Change

GSE-Composite Index 2,697.18 2,693.11 4.07 pts

close at 2,697.18; returns -3.30% YTD.

YTD (GSE-CI) -3.30% -3.45% -4.35%%

The benchmark GSE Composite Index (GSE-CI) gained 4.07 points to close GSE-Financial index 2,120.28 2,112.90 7.38 pts

at 2,697.18 on the first trading day of the week representing a YTD return YTD (GSE-FSI) -1.47% -1.81% -18.78%%

Market Cap. (GHMN) 63,383.01 63,340.44 42.57

of -3.30%. The GSE Financial Stock Index (GSE-FSI) also gained 7.38 points to

Volume Traded 615,728 837,592 -26.49%

close trading at 2,120.28 translating into a YTD return of -1.47%. Enterprise Value Traded (GH¢) 953,965.18 761,110.25 25.34%

Group PLC. (EGL) gained GH¢0.30 to close at GH¢ 3.30 whilst Access Bank

TOP TRADED EQUITIES

Ghana PLC. (ACCESS) lost GH¢0.05 to close at GH¢2.10.

Ticker Volume Value (GH¢)

MTNGH 452,500 475,125.00

Market Capitalization therefore inched up by GH¢42.57 million to close at EGL 72,551 239,040.90

GH¢63.38 billion representing a YTD decline of -1.72% in 2022. SOGEGH 26,623 31,947.60

GCB 22,265 115,778.00

CAL 20,351 17,298.35 49.80%

A total of 615,728 shares valued at GH¢953,965.18 were traded in nineteen of

equities (19) compared to 837,592 shares valued at GH¢761,110.25 which value

KEY ECONOMIC INDICATORS

changed hands on Friday. Today's data shows 26.49% decreased in volume

Indicator Current Previous

and 25.34% improvement in value traded. Scancom PLC. (MTNGH) traded Monetary Policy Rate January 2022 14.50% 14.50%

Real GDP Growth Q3 2021 6.6% 3.9%

the most, accounting for 49.80% of the total value traded.

Inflation January 2022 13.9% 12.6%

Reference rate February 2022 14.01% 13.90%

Source: GSS, BOG, GBA

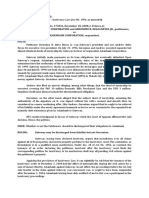

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH)

Share Price GH¢1.05 GAINER & DECLINER

Price Change (YtD) -5.41% Ticker Close Price Open Price Change YTD

(GH¢) (GH¢) Change

Market Capitalization GH¢12,905.00 million

Dividend Yield 0.00% EGL 3.30 3.00 10.00% 18.28%

Earnings Per Share GH¢0.1532 ACCESS 2.10 2.15 -2.33% -33.33%

Avg. Daily Volume Traded 1,528,679

Value Traded (YtD) GH¢ 47,386,164 GSE-CI & GSE-FSI YTD PERFORMANCE

0.50%

0.00%

6-Jan

10-Jan

14-Jan

18-Jan

26-Jan

12-Jan

20-Jan

28-Jan

17-Feb

4-Jan

8-Jan

22-Jan

24-Jan

7-Feb

19-Feb

9-Feb

11-Feb

13-Feb

15-Feb

16-Jan

3-Feb

30-Jan

1-Feb

5-Feb

21-Feb

SBL RECOMMENDED PICKS -0.50%

Equity Price Outlook (Reason) -1.00% -1.47%

MTN GHANA GH¢ 1.05 Strong 2021 Q3 Financials -1.50%

BOPP GH¢ 6.00 Strong 2021 FY Financials -2.00%

CAL BANK GH¢ 0.85 Strong 2021 Q3 Financials -2.50%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials -3.00%

SOGEGH GH¢ 1.20 Strong 2021 Q3 Financials -3.50%

-4.00%

-3.30%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Ts309: Tourism Business Operation Major Group Assignment: Business PlanDocument40 pagesTs309: Tourism Business Operation Major Group Assignment: Business PlanJosephine LalNo ratings yet

- Apple Cash StatementDocument4 pagesApple Cash StatementbaltongraceNo ratings yet

- 2023 CA Seal Catalog - Low ResDocument920 pages2023 CA Seal Catalog - Low ResĐức Văn HữuNo ratings yet

- Cpa Review School of The Philippines Manila Corporations Dela Cruz / de Vera / Lopez / LlamadoDocument9 pagesCpa Review School of The Philippines Manila Corporations Dela Cruz / de Vera / Lopez / LlamadoSophia PerezNo ratings yet

- GTU Previous Year Question PaperDocument2 pagesGTU Previous Year Question PaperRami RohanNo ratings yet

- Gurgaon Industrial Association PDFDocument30 pagesGurgaon Industrial Association PDFMamta Jain100% (3)

- Solutions For Financial Services: Openlink Opencomponents - Next Generation Component Development StrategyDocument4 pagesSolutions For Financial Services: Openlink Opencomponents - Next Generation Component Development StrategyMata KikuniNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Market Survey For Instrument CablesDocument4 pagesMarket Survey For Instrument CablesN.Effandy A.MokhtarNo ratings yet

- Business ProcessesDocument122 pagesBusiness ProcessesMAKENGO ELIASNo ratings yet

- Sap MM - Cin User ManualDocument30 pagesSap MM - Cin User ManualRavindra DevarapalliNo ratings yet

- 5 AFM - 004 - Distribution - and - Retention - Policy - NotesDocument3 pages5 AFM - 004 - Distribution - and - Retention - Policy - NotesDerickNo ratings yet

- Unit 4 MFRBDocument46 pagesUnit 4 MFRBSweety TuladharNo ratings yet

- GUILLERMO-Gateway Electronics Corp vs. Delos Reyes (Preference of Credits)Document2 pagesGUILLERMO-Gateway Electronics Corp vs. Delos Reyes (Preference of Credits)PATRICIA MAE GUILLERMONo ratings yet

- PPGDocument10 pagesPPGReyna Jane YuntingNo ratings yet

- UNIT IV Material ManagementDocument3 pagesUNIT IV Material ManagementHIMANSHU DARGANNo ratings yet

- Top 10 Edtech Startups Shaping The Indian Education IndustryDocument4 pagesTop 10 Edtech Startups Shaping The Indian Education Industrygangtharan MNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument33 pagesResponsibility Acctg Transfer Pricing GP AnalysisMoonNo ratings yet

- Tax Administration TheoryDocument16 pagesTax Administration TheoryTrung HiếuNo ratings yet

- Coral CastlesDocument27 pagesCoral CastlesPolygondotcomNo ratings yet

- The Cost ProductionDocument17 pagesThe Cost ProductionKhizzyia Paula Gil ManiscanNo ratings yet

- Businees Fight Child Labour en 20131025 WebDocument166 pagesBusinees Fight Child Labour en 20131025 WebnikhilNo ratings yet

- NSS Exploring Economics 5 (3 Edition) : Revision NotesDocument2 pagesNSS Exploring Economics 5 (3 Edition) : Revision NotesinkeNo ratings yet

- Payslip 2023030Document1 pagePayslip 2023030Sivaram PopuriNo ratings yet

- R.Kanchanamala: Faculty Member IibfDocument74 pagesR.Kanchanamala: Faculty Member Iibfmithilesh tabhaneNo ratings yet

- Pengenalan KeusahwananDocument52 pagesPengenalan KeusahwananNUR HANANI BT DAUD (POLISAS)No ratings yet

- KatniDocument1 pageKatniRUPNIT PHOTOGRAPHYNo ratings yet

- Leadership Style of Udaan: Group 5 (A)Document11 pagesLeadership Style of Udaan: Group 5 (A)Aditya Raj100% (1)

- Dokumen - Tips Pantaloons Retail CompanyDocument36 pagesDokumen - Tips Pantaloons Retail CompanyPragnya NandaNo ratings yet

- Business Strategy - Case Study of WalmartDocument30 pagesBusiness Strategy - Case Study of WalmartOwais JunaidNo ratings yet

- Instant Download Thomas Calculus 14th Edition Hass Solutions Manual PDF Full ChapterDocument32 pagesInstant Download Thomas Calculus 14th Edition Hass Solutions Manual PDF Full ChapterBryanHarriswtmi100% (5)