Professional Documents

Culture Documents

Financial Research and Analysis: Submitted To

Uploaded by

kartik0 ratings0% found this document useful (0 votes)

5 views3 pagesThis document provides an overview of a corporate governance report submitted by Group 4. It lists the typical items included in such reports, such as information on board composition and compliance procedures. It describes the role and functions of a board of directors, including creating policies, overseeing business, and making critical decisions. It explains that corporate governance reports are intended to demonstrate that companies are properly managing stakeholder expectations and following best practices. Such reports promote transparency and efficiency, helping companies attract resources and provide long-term value.

Original Description:

Original Title

FRA - CG Report

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of a corporate governance report submitted by Group 4. It lists the typical items included in such reports, such as information on board composition and compliance procedures. It describes the role and functions of a board of directors, including creating policies, overseeing business, and making critical decisions. It explains that corporate governance reports are intended to demonstrate that companies are properly managing stakeholder expectations and following best practices. Such reports promote transparency and efficiency, helping companies attract resources and provide long-term value.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views3 pagesFinancial Research and Analysis: Submitted To

Uploaded by

kartikThis document provides an overview of a corporate governance report submitted by Group 4. It lists the typical items included in such reports, such as information on board composition and compliance procedures. It describes the role and functions of a board of directors, including creating policies, overseeing business, and making critical decisions. It explains that corporate governance reports are intended to demonstrate that companies are properly managing stakeholder expectations and following best practices. Such reports promote transparency and efficiency, helping companies attract resources and provide long-term value.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

FINANCIAL RESEARCH AND ANALYSIS

Submitted to:

Submitted by:

Group 4

A list of items included in the reports

Statements of disclosure of governance procedures and compliance

Information on board composition

Statements on the company's performance

Information about compliance and conformance with best practices for good

corporate governance

Board of directors

Audit committee

Nomination and remuneration committee

Performance evaluation

Stakeholders’ relationship committee

Corporate social responsibility committee

Risk management committee

CEO/ CFO certification

General body meetings

Means of communication

General shareholder information

Listing on stock exchanges and stock code

Commodity price risk or foreign exchange risk and hedging activities

Plant locations

Credit rating

Management discussion and analysis report

Disclosures

Certificate of non-disqualification of directors

Role of the Board

A board of directors is simply a group of people chosen by shareholders to represent them.

Every public corporation is required by law to appoint a board of directors; many nonprofit

organizations and private companies, while not compelled, do so as well. The board is in

charge of safeguarding shareholders' interests, creating management policies, overseeing the

business or organization, and making critical decisions about the company's or organization's

concerns.

Functions of a Board

Creating dividend policies

Creating options policies

Hiring and firing of senior executives (especially the CEO)

Establishing compensation for executives

Supporting executives and their teams

Maintaining company resources

Setting company goals

Corporate Governance Report – Purpose and Significance

Corporate governance is a report which is given by the company to the management.

Corporate governance report significant varies from one company to another company. Each

company follows its own set of rules, practices and process and ensures that the company is

being managed in a proper way which does not jeopardize with working of the company. The

ultimate aim of all the companies is to meet the stakeholders and shareholders expectations.

Also, good corporate governance practices steps from the dynamic culture and positive

mindset of the organisation. A corporate governance report is also called the annual corporate

report. It includes a statement of corporate governance procedures and compliance,

information on board composition, statements on the company's performance, and

information about compliance and conformance with best practices for good corporate

governance. It should also disclose the principles and codes that guide the company's

procedures. Disclosure statements usually details the distribution of powers between the

board chair and the CEO.

Need for corporate governance arise due to separation of management from ownership. For a

firm success it is necessary to concentrate on both aspects social as well as economic. It

needs to protect the interest of stakeholders and to be fair with producers, shareholders,

communities etc. It needs to serve its all responsibilities in a best possible manner.

Transparency in any business is pre requisite condition for the growth, profitability and

stability of any business. The need for good corporate governance arises due to growing

competition amongst business in all economic sectors at national as well as international

level.

Significance of the Report

All rules, regulations, procedures, and practices that control how a company is run are

referred to as corporate governance. It establishes the rights and obligations of all active

agents inside an organization in order to attract talent and financial resources, improve

internal efficiency, and provide long-term economic value to stakeholders.

The beneficial effects that emerge when risks are controlled and organizational procedures

are streamlined and consistent demonstrate the relevance of corporate governance. Good

corporate governance has a number of immediate benefits for businesses.

The process becomes efficient as a result of the repeatability and consistency of tasks

completed, and this repeatability and consistency aids in swiftly identifying nonconformities

in processes. Companies can eliminate waste from junk, rework, and other costly

inefficiencies by streamlining activities. Regular disturbances from inconsistent processes are

eliminated as operation specifics become either 'conform' or 'non-conform.' A corporate

governance-friendly culture permits a company's product to reach the market while satisfying

its planned specifications and functioning properly.

You might also like

- "Reigning the Boardroom: A Trailblazing Guide to Corporate Governance Success": GoodMan, #1From Everand"Reigning the Boardroom: A Trailblazing Guide to Corporate Governance Success": GoodMan, #1No ratings yet

- The Board of Directors and Audit Committee Guide to Fiduciary Responsibilities: Ten Crtical Steps to Protecting Yourself and Your OrganizationFrom EverandThe Board of Directors and Audit Committee Guide to Fiduciary Responsibilities: Ten Crtical Steps to Protecting Yourself and Your OrganizationNo ratings yet

- Corporate Governance: Acctg 216: Governance, Business Ethics, Risk Management and Internal ControlDocument67 pagesCorporate Governance: Acctg 216: Governance, Business Ethics, Risk Management and Internal ControlGilner PomarNo ratings yet

- Auditing It Governance ControlsDocument29 pagesAuditing It Governance ControlsJaira MoradaNo ratings yet

- REvision Pack 08-Questions and AnswersDocument45 pagesREvision Pack 08-Questions and Answerssunshine9016No ratings yet

- Auditing Presentation-Corporate GovernaceDocument26 pagesAuditing Presentation-Corporate GovernaceMohsin ShaikhNo ratings yet

- Corporate Strategy and Corporate GovernanceDocument34 pagesCorporate Strategy and Corporate GovernanceDhivya Devakumar0% (1)

- CH 1 Conceptual Frameworkof CGDocument30 pagesCH 1 Conceptual Frameworkof CGKhushali OzaNo ratings yet

- Corporate Social ResponsibilityDocument7 pagesCorporate Social ResponsibilitydhafNo ratings yet

- Acf PresenntationDocument6 pagesAcf PresenntationanjuNo ratings yet

- Corporate NotesDocument89 pagesCorporate NotesDon GordonNo ratings yet

- CSC-AE10-GBERMIC-Module 2Document6 pagesCSC-AE10-GBERMIC-Module 2Marjorie Rose GuarinoNo ratings yet

- Topic:-Corporate Governance: Assignment ofDocument9 pagesTopic:-Corporate Governance: Assignment oftauh_ahmadNo ratings yet

- Business EthicsDocument86 pagesBusiness EthicsSagar Parekh100% (1)

- Corporate Governance: That Dictate How A Company's Board of Directors Manages and Oversees The Operations of A CompanyDocument12 pagesCorporate Governance: That Dictate How A Company's Board of Directors Manages and Oversees The Operations of A CompanyMagadia Mark JeffNo ratings yet

- Corporate Governance and Its Role in Strategic ManagementDocument30 pagesCorporate Governance and Its Role in Strategic ManagementSanjeev PradhanNo ratings yet

- Module 5 EthicsDocument10 pagesModule 5 EthicsGodzon Seban PullattNo ratings yet

- Good Corporate Governance WritingDocument6 pagesGood Corporate Governance Writingnor anis safiahNo ratings yet

- Sec Code of Corporate GovernanceDocument25 pagesSec Code of Corporate GovernanceRey ViloriaNo ratings yet

- P.S.Swathi Ssim: Corporate Governance: Theories, Principles, PracticesDocument20 pagesP.S.Swathi Ssim: Corporate Governance: Theories, Principles, PracticesNarayana ReddyNo ratings yet

- Govern AceDocument32 pagesGovern AceAnonymous jSTkQVC27bNo ratings yet

- What Is Corporate GovernanceDocument9 pagesWhat Is Corporate GovernanceNitin TembhurnikarNo ratings yet

- Corporate Governance Tutorial Week 1 N 2Document11 pagesCorporate Governance Tutorial Week 1 N 2Faidhi RazakNo ratings yet

- Business Ethics and Corporate GovernanceDocument55 pagesBusiness Ethics and Corporate GovernanceVaidehi ShuklaNo ratings yet

- Unit - 1 - Conceptual Framework of Corporate GovernanceDocument15 pagesUnit - 1 - Conceptual Framework of Corporate GovernanceRajendra SomvanshiNo ratings yet

- CadburyDocument7 pagesCadburymahesh_thadani6743No ratings yet

- BE Week 2Document27 pagesBE Week 2nikhilkhemka123No ratings yet

- Corporate Governance - Is A Myth or RealityDocument15 pagesCorporate Governance - Is A Myth or Realitymehta_vikram19868766100% (1)

- Corporate Governance SM AssignmentDocument6 pagesCorporate Governance SM AssignmentAjmal sNo ratings yet

- Business Ethics: Assignment OnDocument9 pagesBusiness Ethics: Assignment OnSomesh KumarNo ratings yet

- Corporate GovernanceDocument32 pagesCorporate GovernanceummarimtiyazNo ratings yet

- Corporate Governance: Gayatri Iyer MBADocument18 pagesCorporate Governance: Gayatri Iyer MBARajiv LamichhaneNo ratings yet

- BODY (Slide 2) : CindyDocument11 pagesBODY (Slide 2) : CindymichelleNo ratings yet

- Statement On RIsk Management and Internal COntrolDocument18 pagesStatement On RIsk Management and Internal COntrolkien91No ratings yet

- Business Ethics Chapter FourDocument16 pagesBusiness Ethics Chapter Fourdro landNo ratings yet

- CH3: Corporate Governance and Risk ManagementDocument9 pagesCH3: Corporate Governance and Risk ManagementMohammad AbudoolahNo ratings yet

- CH3: Corporate Governance and Risk ManagementDocument9 pagesCH3: Corporate Governance and Risk ManagementMohammad AbudoolahNo ratings yet

- Corporate Goverance PDFDocument53 pagesCorporate Goverance PDFashwanpreet singhNo ratings yet

- What Is Corporate Governance?Document28 pagesWhat Is Corporate Governance?Diana SaidNo ratings yet

- Corporate GovernanceDocument8 pagesCorporate GovernanceKrishnateja YarrapatruniNo ratings yet

- Week 3Document41 pagesWeek 3Charles OkwalingaNo ratings yet

- Module I. Governance and Internal ControlDocument9 pagesModule I. Governance and Internal ControlCleofe Jane PatnubayNo ratings yet

- Contracts ReviewerDocument123 pagesContracts Reviewertan2masNo ratings yet

- Corporate Govenance and Ethical ConsiderationsDocument10 pagesCorporate Govenance and Ethical ConsiderationsCristine Joy AsduloNo ratings yet

- ReportDocument5 pagesReportMark Hizon BellosilloNo ratings yet

- Corporate Governance Is The System of Rules, Practices and Processes by Which A Company Is Directed and ControlledDocument8 pagesCorporate Governance Is The System of Rules, Practices and Processes by Which A Company Is Directed and ControlledNicefebe Love SampanNo ratings yet

- Corporate Governance - A Conceptual AnalysisDocument36 pagesCorporate Governance - A Conceptual Analysissameer_kiniNo ratings yet

- A Presentation On Corporate Governance: Anusuya Mehra Harmeet Singh Manish Sharma Rajkumar Ranwa Roopal Jain Vijay MundelDocument26 pagesA Presentation On Corporate Governance: Anusuya Mehra Harmeet Singh Manish Sharma Rajkumar Ranwa Roopal Jain Vijay Mundelvishalbi100% (1)

- Project On Corporate GovernanceDocument22 pagesProject On Corporate GovernancePallavi PradhanNo ratings yet

- The Objective of The Study Was To Find Out If Corporate Governance Has An Effect On The Performance of The CompanyDocument5 pagesThe Objective of The Study Was To Find Out If Corporate Governance Has An Effect On The Performance of The CompanyStevo JjNo ratings yet

- Role of Directors and Auditors in Corporate GovernanceDocument19 pagesRole of Directors and Auditors in Corporate GovernanceankitadheerNo ratings yet

- Corporate GovernanceDocument9 pagesCorporate GovernanceRiz WanNo ratings yet

- Summarize in GovernanceDocument12 pagesSummarize in GovernanceNoemie OpisNo ratings yet

- 202004181917242491nlbharti CORPORATE GOVERNANCEDocument26 pages202004181917242491nlbharti CORPORATE GOVERNANCEAnurag SinghNo ratings yet

- What Is Corporate Governance?: Key TakeawaysDocument1 pageWhat Is Corporate Governance?: Key TakeawaysFatima TawasilNo ratings yet

- Acc Ethics Ch3-1Document45 pagesAcc Ethics Ch3-1Zaki TigerNo ratings yet

- Need of Corporate GovernanceDocument3 pagesNeed of Corporate GovernanceAmmy k100% (1)

- ETHICSDocument12 pagesETHICSImranNo ratings yet

- Corporate Governance 3Document4 pagesCorporate Governance 3silvernitrate1953No ratings yet

- 3107en Contempt of Court in Family Law Cases The BasicsDocument8 pages3107en Contempt of Court in Family Law Cases The BasicsJason Howard100% (1)

- Condom Nation by Emily LimbaughDocument1 pageCondom Nation by Emily LimbaughCrisostomo GregNo ratings yet

- English Lesson Plan KSSR Year 2: Responding With Wonderment and AweDocument3 pagesEnglish Lesson Plan KSSR Year 2: Responding With Wonderment and Awehady91No ratings yet

- TCS BaNCS Brochure Core Banking 1212-1Document8 pagesTCS BaNCS Brochure Core Banking 1212-1Muktheshwar ReddyNo ratings yet

- Exercise 1.3: Predicate and QuantifiersDocument17 pagesExercise 1.3: Predicate and QuantifiersBaby balochNo ratings yet

- English II TAP Guidebook: Tomball Memorial High SchoolDocument32 pagesEnglish II TAP Guidebook: Tomball Memorial High SchoolaakarshNo ratings yet

- 400,450 7 PDFDocument766 pages400,450 7 PDFNguyễn Huy100% (1)

- Principles and Practices of Analytical Method Validation: Validation of Analytical Methods Is Time Consuming But EssentialDocument4 pagesPrinciples and Practices of Analytical Method Validation: Validation of Analytical Methods Is Time Consuming But EssentialMaulik PatelNo ratings yet

- Free Time Is For The Untouched: Ricardo Rodriguez Novel Chapter 9/21/15Document3 pagesFree Time Is For The Untouched: Ricardo Rodriguez Novel Chapter 9/21/15api-299832803No ratings yet

- Semana2Document66 pagesSemana2Edward A TuerosNo ratings yet

- Moot CourtDocument7 pagesMoot CourtsushmaNo ratings yet

- Corporate Finance North South University ReportDocument44 pagesCorporate Finance North South University ReportTahsin UddinNo ratings yet

- ResumeDocument3 pagesResumeapi-259841700No ratings yet

- Technical ReportDocument2 pagesTechnical ReportsihamNo ratings yet

- En 2018Document5 pagesEn 2018Violeta LefterNo ratings yet

- Volkswagen: BY Sai SarathDocument10 pagesVolkswagen: BY Sai SarathSarath YarramalliNo ratings yet

- Ain't No Mountain High Enough: Electric Bass GuitarDocument2 pagesAin't No Mountain High Enough: Electric Bass GuitarJules PeirlinckxNo ratings yet

- Booth ProposalDocument3 pagesBooth ProposalChristian ResustaNo ratings yet

- The Burden (And Freedom) of PhotographyDocument12 pagesThe Burden (And Freedom) of PhotographysatyabashaNo ratings yet

- Unit1-3 Advanc Grad 8Document6 pagesUnit1-3 Advanc Grad 8Diệu Hương Trần ThịNo ratings yet

- Dedicated Server in Chisinau Choose Dedicated Server FR M o U R B e S T D e D I C A T Ed Server in Chisinau Ata CenterDocument10 pagesDedicated Server in Chisinau Choose Dedicated Server FR M o U R B e S T D e D I C A T Ed Server in Chisinau Ata Centersonuseo55No ratings yet

- Poetry TestDocument6 pagesPoetry TestKatarina PuzicNo ratings yet

- Data Processing and Coding Tabulation and Data PresentationDocument20 pagesData Processing and Coding Tabulation and Data PresentationMohaimen macodNo ratings yet

- 09 Revelation PPTDocument16 pages09 Revelation PPTr_mukuyuNo ratings yet

- Building and Other Construction Workers' Welfare Cess Act, 1996Document6 pagesBuilding and Other Construction Workers' Welfare Cess Act, 1996Gens GeorgeNo ratings yet

- 400 881 1 SMDocument11 pages400 881 1 SMroloheNo ratings yet

- Vuyo's Funerals: Social Media Post (Funeral Rituals)Document2 pagesVuyo's Funerals: Social Media Post (Funeral Rituals)LCNo ratings yet

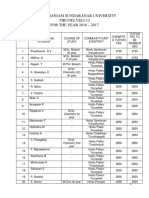

- Manonmaniam Sundaranar University Tirunelveli-12 FOR THE YEAR 2016 - 2017Document10 pagesManonmaniam Sundaranar University Tirunelveli-12 FOR THE YEAR 2016 - 2017David MillerNo ratings yet

- Module 7Document9 pagesModule 7Lance AustriaNo ratings yet

- Planning Technical ActivitiesDocument29 pagesPlanning Technical ActivitiesMaria Cecille Sarmiento GarciaNo ratings yet