Professional Documents

Culture Documents

CWS Balance Sheet and Income Statement Analysis

Uploaded by

yash saroha0 ratings0% found this document useful (0 votes)

7 views3 pagesAn assignemnt on the investment management

Original Title

IM CWS Assign

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAn assignemnt on the investment management

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

7 views3 pagesCWS Balance Sheet and Income Statement Analysis

Uploaded by

yash sarohaAn assignemnt on the investment management

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

IM Assignment (CWS)

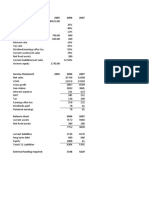

Balance Sheet

$ million

2013 2012

Cash and equivalents 149 83

Acc recievable 295 265

inventory 275 285

Total Current Assets 719 633

Gross fixed assets 9350 8900

accumulated depriciation 6160 5677

Net fixed assets 3190 3233

Total Assets 3909 3856

Acc payable 228 220

Notes payable 0 0

Accrued taxes and expenses 0 0

Total Current liabilities 228 220

Long term debt 1650 1800

Common stock 50 50

Additional paid-in capital 0 0

Retained earnings 1981 1786

Total shareholder' equity 2031 1836

Total liabilities and shareholders' equity 3909 3856

Income Statement

2013 2012

Total revenues 3425 3300

Operating Costs and expenses 2379 2319

Earnings before interest, taxes, depriciation

and amortization (EBIDTA) 1049 981

Depriciation and amortization 483 454

Operating Income 563 527

Interest expense 104 107

Income before taxes 459 420

Taxes (40%) 184 168

Net Income 275 252

Dividends 80 80

Change in retained earnings 195 172

EPS 2.75 2.52

DPS 0.8 0.8

Number of share outstanding (millions) 100 100

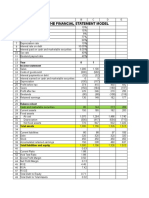

Finacial Statement data

2011 2010 2009

Total revenues 3175 3075 3000

Operating Income (EBIT) 495 448 433

Interest expense 104 101 99

Net Income 235 208 200

DPS 0.8 0.8 0.8

Total assets 3625 3414 3230

Long term debt 1750 1700 1650

Total Shareholders' equity 1664 1509 1380

Number od shares outstanding (mn) 100 100 100

Sustainable Growth rate

2010 2013 Change

ROE 0.150725 0.149782 -1%

Retention rate 0.615385 0.709091 15%

G* 0.092754 0.106209 15%

Financial leverage 1.231884 0.898693 -27%

IM Assignment (CWS)

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Ratios Analysis Case For FNFMDocument3 pagesRatios Analysis Case For FNFMsaikumarNo ratings yet

- Gone Rural Historical Financials Reveal Growth Over TimeDocument31 pagesGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeNo ratings yet

- Assignment - 1Document2 pagesAssignment - 1asfandyarkhaliq0% (1)

- Ejemplo de Analisis Vertical y Horizontal Caso NikeDocument14 pagesEjemplo de Analisis Vertical y Horizontal Caso NikeDiego Blanco CastroNo ratings yet

- DCF Valuation SolvedDocument13 pagesDCF Valuation Solvedhimanshi sharmaNo ratings yet

- BTVN Chap 03Document14 pagesBTVN Chap 03Nguyen Phuong Anh (K16HL)No ratings yet

- Case StudyDocument6 pagesCase Studyrajan mishraNo ratings yet

- Accounts AssignsmentDocument8 pagesAccounts Assignsmentadityatiwari8303No ratings yet

- Munjal Showa Financials- Revenue up, EPS growsDocument21 pagesMunjal Showa Financials- Revenue up, EPS growsDeepak SaxenaNo ratings yet

- Balance Sheet: Total Equity and LiabilitiesDocument11 pagesBalance Sheet: Total Equity and LiabilitiesSamarth LahotiNo ratings yet

- Valuation PracticeDocument19 pagesValuation PracticeAkash PatilNo ratings yet

- Assets Liabilities and Owner's EquityDocument8 pagesAssets Liabilities and Owner's EquityAsef KhademiNo ratings yet

- Financials at GlanceDocument1 pageFinancials at GlanceSrikanth Marriboyanna MNo ratings yet

- Drreddy - Ratio AnalysisDocument8 pagesDrreddy - Ratio AnalysisNavneet SharmaNo ratings yet

- COH Financial Report and ProjectionsDocument9 pagesCOH Financial Report and ProjectionsLim JaehwanNo ratings yet

- Chapter 3. Exhibits y AnexosDocument24 pagesChapter 3. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- Five Years' Financial Summary: REPORT 2015Document2 pagesFive Years' Financial Summary: REPORT 2015Rizwan ZisanNo ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- Key Figures (Euros, Thousands) - Source: Annual Reports 2005-2013Document10 pagesKey Figures (Euros, Thousands) - Source: Annual Reports 2005-2013Wassi Ademola MoudachirouNo ratings yet

- 2006 2007 June 2008Document18 pages2006 2007 June 2008Rishabh GigrasNo ratings yet

- Financials at GlanceDocument1 pageFinancials at Glancekanwal23No ratings yet

- SGR Calculation Taking Base FY 2019Document38 pagesSGR Calculation Taking Base FY 2019Arif.hossen 30No ratings yet

- Commonsize StatementDocument14 pagesCommonsize StatementSimratpal SinghNo ratings yet

- Microtech Company Blance Sheet - (HW2) : Year 1 Year 2Document4 pagesMicrotech Company Blance Sheet - (HW2) : Year 1 Year 2Vemuri SudheerNo ratings yet

- Midterm Excel Worksheet Olivieri Version 2Document21 pagesMidterm Excel Worksheet Olivieri Version 2Emanuele OlivieriNo ratings yet

- gLLjeluWEem7ixL - 6m9HFg - PolyPanel TO DO Before WEEK 1Document2 pagesgLLjeluWEem7ixL - 6m9HFg - PolyPanel TO DO Before WEEK 1Mohammed Soliman MasliNo ratings yet

- TargetDocument8 pagesTargetGLORIA GUINDOS BRETONESNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- ForecastingDocument1 pageForecastingKwaku Obeng-AppiahNo ratings yet

- Dreddy FinalDocument11 pagesDreddy FinalNavneet SharmaNo ratings yet

- Hobby Horse Financial Highlights and Ratios 2014Document6 pagesHobby Horse Financial Highlights and Ratios 2014Mashaal FNo ratings yet

- Calculate key financial ratios and returns for Heifer Sports CorporationDocument4 pagesCalculate key financial ratios and returns for Heifer Sports CorporationBảoNgọcNo ratings yet

- Liston Mechanic CorporationDocument14 pagesListon Mechanic CorporationKunal MehtaNo ratings yet

- UntitledDocument11 pagesUntitledKhang ĐặngNo ratings yet

- The Body ShopDocument4 pagesThe Body ShopKhalid MehmoodNo ratings yet

- Hull Fund 9 Ech 12 Problem SolutionsDocument8 pagesHull Fund 9 Ech 12 Problem SolutionsJitendra YadavNo ratings yet

- Group ProjectDocument9 pagesGroup ProjectsnsahaNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- PDF Processed With Cutepdf Evaluation EditionDocument125 pagesPDF Processed With Cutepdf Evaluation Editionshreya.agrawalNo ratings yet

- Almarai's Quality and GrowthDocument128 pagesAlmarai's Quality and GrowthHassen AbidiNo ratings yet

- Project EngieDocument32 pagesProject EngieVijendra Kumar DubeyNo ratings yet

- Earnings and Financial Ratios StatementDocument10 pagesEarnings and Financial Ratios StatementGiovani R. Pangos RosasNo ratings yet

- Amazon SCM Finance DataDocument2 pagesAmazon SCM Finance DataSagar KansalNo ratings yet

- 2006 CSL Income Statement Financial RatiosDocument15 pages2006 CSL Income Statement Financial RatiosUZAIR300No ratings yet

- Alpha Paints - Gap AnalysisDocument2 pagesAlpha Paints - Gap AnalysisVinay SuriNo ratings yet

- Particulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeDocument4 pagesParticulars Mar'21 Mar'20 Mar'19 Mar'18 Mar'17 Mar'21 Mar'20 Mar'19 IncomeShruti SrivastavaNo ratings yet

- Annual Report 2012Document225 pagesAnnual Report 2012BETTY ELIZABETH JUI�A QUILACHAMINNo ratings yet

- A. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Document11 pagesA. CF - 500 Tine 5 Years Discount Rate 10% PV $310.46 B. PV $1,895.39 C. Time 50 Years PV $4,957.41 D. Time 100 Years PV $4,999.64Hoàng QuânNo ratings yet

- INR Crore FY 16 FY 17 FY 18 FY 19 FY 20Document5 pagesINR Crore FY 16 FY 17 FY 18 FY 19 FY 20Shivani SinghNo ratings yet

- Liabilites 2000 2001 Assets 2000 2001: Balance SheetDocument9 pagesLiabilites 2000 2001 Assets 2000 2001: Balance SheetGiri SukumarNo ratings yet

- Source: Company DataDocument9 pagesSource: Company DataPhang Yu ShangNo ratings yet

- BHEL Valuation of CompanyDocument23 pagesBHEL Valuation of CompanyVishalNo ratings yet

- Fy 2010-11Document3 pagesFy 2010-11chhayachouhanNo ratings yet

- Sun and Crocs ValuationDocument7 pagesSun and Crocs ValuationKshitishNo ratings yet

- Income Statement: Excess CashDocument9 pagesIncome Statement: Excess CashAlejandra San Roman AmadorNo ratings yet

- Financial Modeling - Benninga - Chap 3Document21 pagesFinancial Modeling - Benninga - Chap 3Hira HasanNo ratings yet

- MERCURY ACTION ATHLETIC Synergies & Assumptions AnalysisDocument10 pagesMERCURY ACTION ATHLETIC Synergies & Assumptions AnalysisSimón SegoviaNo ratings yet

- DRL Complete SolutionDocument3 pagesDRL Complete SolutionAnonymous aOj6NKBNo ratings yet

- A Simple Model: Integrating Financial StatementsDocument10 pagesA Simple Model: Integrating Financial Statementssps fetrNo ratings yet

- Impact of Cloud Computing and AI on Business CommunicationDocument13 pagesImpact of Cloud Computing and AI on Business Communicationyash sarohaNo ratings yet

- Cost Analysis and Process ImprovementDocument13 pagesCost Analysis and Process Improvementyash sarohaNo ratings yet

- Impact of Trust On Knowledge Sharing: Kicm Innovative ProjectDocument15 pagesImpact of Trust On Knowledge Sharing: Kicm Innovative Projectyash sarohaNo ratings yet

- History of Organizations-:: AmazonDocument3 pagesHistory of Organizations-:: Amazonyash sarohaNo ratings yet

- Eco Assignment (K)Document7 pagesEco Assignment (K)yash sarohaNo ratings yet

- Eco Micro and MacroDocument4 pagesEco Micro and Macroyash sarohaNo ratings yet

- Microeconomics: Demand and SupplyDocument56 pagesMicroeconomics: Demand and SupplyThế KiênNo ratings yet

- 3rd INTERNATIONAL WORKSHOP ON UI GREENMETRICDocument36 pages3rd INTERNATIONAL WORKSHOP ON UI GREENMETRICNugroho Widyo P, SNo ratings yet

- SMDM Project Report - Shubham Bakshi - 07.05.2023Document23 pagesSMDM Project Report - Shubham Bakshi - 07.05.2023Abhishek Arya0% (1)

- Group 7 - ABFRL in Ethnic ApparelDocument66 pagesGroup 7 - ABFRL in Ethnic ApparelSWETANJALI MEHER Jaipuria JaipurNo ratings yet

- Consumer Promotions Event Time Type (p3, Last Paragraph) CostDocument8 pagesConsumer Promotions Event Time Type (p3, Last Paragraph) CostDuyên NguyễnNo ratings yet

- Nmims HRM AssignmentDocument9 pagesNmims HRM AssignmentDurvas KarmarkarNo ratings yet

- Get Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024Document26 pagesGet Download All Report - 27ADMPJ5260G1ZG - 2023 - 2024ajay.patelNo ratings yet

- Alternative Beta Matters 2017 Q2 NewsletterDocument13 pagesAlternative Beta Matters 2017 Q2 NewsletterLydia AndersonNo ratings yet

- Strategic Management Practices of Selected State Universities and Colleges in Samar Island, PhilippinesDocument13 pagesStrategic Management Practices of Selected State Universities and Colleges in Samar Island, PhilippinesChelsie ColifloresNo ratings yet

- 5G Connectivity and Its Effects in NigeriaDocument15 pages5G Connectivity and Its Effects in NigeriastephendivineoluwaseunNo ratings yet

- Indian Footwear Industry: Global Production and Export PowerhouseDocument6 pagesIndian Footwear Industry: Global Production and Export PowerhouseVishal DesaiNo ratings yet

- Performance ManagementDocument8 pagesPerformance ManagementBassam AlqadasiNo ratings yet

- Trademark Infringement SDocument6 pagesTrademark Infringement SJose Li ToNo ratings yet

- Final Report1Document77 pagesFinal Report1oearnings450No ratings yet

- Hilton Glossary of Terms PDFDocument33 pagesHilton Glossary of Terms PDFgokhans7650% (2)

- Affidavit of Neil J. Gillespie Re Marion Senior Services, Inc.Document72 pagesAffidavit of Neil J. Gillespie Re Marion Senior Services, Inc.Neil GillespieNo ratings yet

- Research On World Agricultural Economy - Vol.4, Iss.3 September 2023Document112 pagesResearch On World Agricultural Economy - Vol.4, Iss.3 September 2023Bilingual PublishingNo ratings yet

- Chapter 4. Food Commodity MarketingDocument24 pagesChapter 4. Food Commodity MarketingEyerusalemNo ratings yet

- CKH Indrusties Vs CA DIGESTDocument3 pagesCKH Indrusties Vs CA DIGESTHana Danische ElliotNo ratings yet

- Introduction To Data Mining, 2 Edition: by Tan, Steinbach, Karpatne, KumarDocument95 pagesIntroduction To Data Mining, 2 Edition: by Tan, Steinbach, Karpatne, KumarsunilmeNo ratings yet

- Chapter 4Document16 pagesChapter 4iwang saudjiNo ratings yet

- Slomins Home Heating Oil ServiceDocument2 pagesSlomins Home Heating Oil ServiceRohin Cookie SharmaNo ratings yet

- Pricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDocument11 pagesPricing Issues and Post-Transaction Issues: Chapter Learning ObjectivesDINEO PRUDENCE NONGNo ratings yet

- Gei Portal Training Revamp d15!8!16 16Document22 pagesGei Portal Training Revamp d15!8!16 16Rahul SharmaNo ratings yet

- Final PaperDocument11 pagesFinal Paperapi-601299997No ratings yet

- Strategy PDFDocument18 pagesStrategy PDFveraNo ratings yet

- FluidLab-PA MPS-PA 3 0 Manual EN PDFDocument90 pagesFluidLab-PA MPS-PA 3 0 Manual EN PDFAngelica May BangayanNo ratings yet

- Sealed ComplaintDocument28 pagesSealed ComplaintAJROKNo ratings yet

- Introduction of OngcDocument11 pagesIntroduction of OngcPIYUSH RAWAT100% (2)

- Strategic Thinking Lessons for Ghana's Technical UniversitiesDocument15 pagesStrategic Thinking Lessons for Ghana's Technical Universitieswawi5825No ratings yet