Professional Documents

Culture Documents

Financials at Glance

Uploaded by

Srikanth Marriboyanna MCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financials at Glance

Uploaded by

Srikanth Marriboyanna MCopyright:

Available Formats

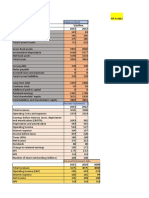

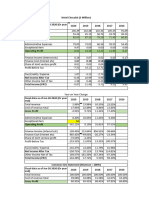

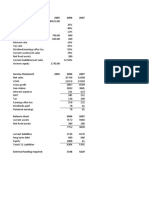

Financials at a Glance

(Rupees in Crores)

Particulars 2004-05 2005-06 2006-07 2007-08 2008-09

Sales ( nos) 2621400 3000751 3336756 3337142 3722000

Growth in Sales (nos) (%) 26.60 14.50 11.20 0.01 11.53

Total net income 7559 8870 10090 10517 12540

Growth in Total Income (%) 26.10 17.40 13.70 4.20 19.20

Profit before Tax 1217 1412 1246 1410 1781

Profit after Tax 810 971 858 968 1282

Share Capital 39.94 39.94 39.94 39.94 39.94

Reserves and Surplus 1453 1969 2430 2946 3761

Total Debt 202 186 165 132 78

Net Fixed Assets 715 994 1355 1549 1694

Total Assets (net) 1695 2195 2635 3118 3879

Market Capitalisation 10943 17781 13753 13869 21390

Economic Value Added (EVA) 564 641 485 575 835

KEY RATIOS

Particulars 2004-05 2005-06 2006-07 2007-08 2007-08

Long Term Debt/Equity Nil Nil Nil Nil Nil

OPBIT*/Income from operations-% 16.00 16.00 12.20 13.30 14.20

OPBT**/Income from

operations*(%) 14.80 14.60 10.80 11.80 12.70

Profit after tax/Total Income(%) 10.90 11.10 8.60 9.30 10.40

Return on Avg. Equity (%) 61.60 55.50 38.30 35.50 37.80

Return on Avg. Capital

Employed(%) 80.90 72.30 51.60 49.00 50.90

EVA/Capital Employed(%) 37.50 32.90 20.10 20.00 23.90

Dividend Per Share ( Rs.) 20 20 17 19 20

Dividend Payout (%) 56.30 46.90 46.30 45.90 36.50

Earnings Per Share (Rs.) 40.60 48.60 43.00 48.50 64.20

Market Value/Book Value 7.30 8.80 5.60 4.60 5.60

Notes:

* OPBDIT = Operating Profit before Depreciation, Interest and Tax.

**OPBT= PBT before Other income

You might also like

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Financials at GlanceDocument1 pageFinancials at Glancekanwal23No ratings yet

- Sun and Crocs ValuationDocument7 pagesSun and Crocs ValuationKshitishNo ratings yet

- Key Figures (Euros, Thousands) - Source: Annual Reports 2005-2013Document10 pagesKey Figures (Euros, Thousands) - Source: Annual Reports 2005-2013Wassi Ademola MoudachirouNo ratings yet

- Balance Sheet: Total Equity and LiabilitiesDocument11 pagesBalance Sheet: Total Equity and LiabilitiesSamarth LahotiNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- 1996 Revenue Growth Rate Ebitda Margin Net Working Capital Percent of RevenueDocument14 pages1996 Revenue Growth Rate Ebitda Margin Net Working Capital Percent of RevenueRohith ThatchanNo ratings yet

- $ Million 2013 2012: Balance SheetDocument3 pages$ Million 2013 2012: Balance Sheetyash sarohaNo ratings yet

- Puma R To L 2020 Master 3 PublishDocument8 pagesPuma R To L 2020 Master 3 PublishIulii IuliikkNo ratings yet

- SAS AirlineDocument9 pagesSAS AirlinejamilkhannNo ratings yet

- Dr. Sen's FFDocument16 pagesDr. Sen's FFnikhilluniaNo ratings yet

- Accounts AssignsmentDocument8 pagesAccounts Assignsmentadityatiwari8303No ratings yet

- 100 BaggerDocument12 pages100 BaggerRishab WahalNo ratings yet

- Fadm Project 3Document11 pagesFadm Project 3Vimal AgrawalNo ratings yet

- CFM Lbo ModelDocument3 pagesCFM Lbo ModelReusNo ratings yet

- Five Years' Financial Summary: REPORT 2015Document2 pagesFive Years' Financial Summary: REPORT 2015Rizwan ZisanNo ratings yet

- Liabilites 2000 2001 Assets 2000 2001: Balance SheetDocument9 pagesLiabilites 2000 2001 Assets 2000 2001: Balance SheetGiri SukumarNo ratings yet

- Tugas EFNDocument3 pagesTugas EFNCynthia WibowoNo ratings yet

- BTVN Chap 03Document14 pagesBTVN Chap 03Nguyen Phuong Anh (K16HL)No ratings yet

- Afa Assignment: Ratio AnalysisDocument7 pagesAfa Assignment: Ratio AnalysisKathir VelNo ratings yet

- Income Statement: Excess CashDocument9 pagesIncome Statement: Excess CashAlejandra San Roman AmadorNo ratings yet

- Apex Foods Quick RatioDocument40 pagesApex Foods Quick RatioriyadhhasanNo ratings yet

- AirThreads Valuation SolutionDocument20 pagesAirThreads Valuation SolutionBill JoeNo ratings yet

- Estimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Document5 pagesEstimating Equity Free Cash Flow All Equity Financed Project (Unlevered)Somlina MukherjeeNo ratings yet

- Case StudyDocument6 pagesCase Studyrajan mishraNo ratings yet

- IntoductionDocument7 pagesIntoductionaamit87No ratings yet

- Super Project AnalysisDocument6 pagesSuper Project AnalysisDHRUV SONAGARANo ratings yet

- AirThread CalcDocument15 pagesAirThread CalcSwati VermaNo ratings yet

- Chapter 3. Exhibits y AnexosDocument24 pagesChapter 3. Exhibits y AnexosJulio Arroyo GilNo ratings yet

- S6 E Working FinalDocument9 pagesS6 E Working FinalROHIT PANDEYNo ratings yet

- Ejemplo de Analisis Vertical y Horizontal Caso NikeDocument14 pagesEjemplo de Analisis Vertical y Horizontal Caso NikeDiego Blanco CastroNo ratings yet

- Total Sales 4800 8000 Gross Profit 1968 3200Document28 pagesTotal Sales 4800 8000 Gross Profit 1968 3200lika rukhadzeNo ratings yet

- FM Assignment 02Document1 pageFM Assignment 02Sufyan SarwarNo ratings yet

- Normalized Measures - Revenues and Profit Market Value and AssetsDocument15 pagesNormalized Measures - Revenues and Profit Market Value and AssetsNikith NatarajNo ratings yet

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocument6 pagesModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNo ratings yet

- Almarai Annual Report enDocument128 pagesAlmarai Annual Report enHassen AbidiNo ratings yet

- 40 CrosDocument11 pages40 CrosAijaz AslamNo ratings yet

- Mark and Spencer Excel For Calc - 130319 FINAL DRAFTDocument12 pagesMark and Spencer Excel For Calc - 130319 FINAL DRAFTRama KediaNo ratings yet

- Firm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearDocument9 pagesFirm Price Shares Deckers Outdoor Nike Timberland Columbia SportswearKshitishNo ratings yet

- Havells Income STMT 2009-2013Document11 pagesHavells Income STMT 2009-2013K.GayathiriNo ratings yet

- Final ExamDocument10 pagesFinal ExamMustafa Azeem MunnaNo ratings yet

- Key Operating and Financial Data 2017 For Website Final 20.3.2018Document2 pagesKey Operating and Financial Data 2017 For Website Final 20.3.2018MubeenNo ratings yet

- Project EngieDocument32 pagesProject EngieVijendra Kumar DubeyNo ratings yet

- Albk - 2QFY11 PresentataionDocument44 pagesAlbk - 2QFY11 PresentataionManjith NNo ratings yet

- Income Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisDocument1 pageIncome Statement Balance Sheet Latest Quarterly/Halfyearly Ratio AnalysisSandy SinghNo ratings yet

- Fund Flow Statement - Feb-21Document128 pagesFund Flow Statement - Feb-21Suneet GaggarNo ratings yet

- Financials of Co ' B' and Co ' S'Document8 pagesFinancials of Co ' B' and Co ' S'ABC XYZNo ratings yet

- Review Report 311210Document1 pageReview Report 311210Hriday PandeyNo ratings yet

- Airthread Acquisition: Income StatementDocument31 pagesAirthread Acquisition: Income StatementnidhidNo ratings yet

- Common Size Analysis: Hul Profit and Loss StatementDocument7 pagesCommon Size Analysis: Hul Profit and Loss Statementamlan dasNo ratings yet

- Nike Case Study VrindaDocument4 pagesNike Case Study VrindaAnchal ChokhaniNo ratings yet

- Valuation PracticeDocument19 pagesValuation PracticeAkash PatilNo ratings yet

- Chocolat AnalysisDocument19 pagesChocolat Analysisankitamoney1No ratings yet

- Go Rural FM AssignmentDocument31 pagesGo Rural FM AssignmentHumphrey OsaigbeNo ratings yet

- Creative Sports Solution-RevisedDocument4 pagesCreative Sports Solution-RevisedRohit KumarNo ratings yet

- Day 1 - Financial SpreadsheetDocument30 pagesDay 1 - Financial SpreadsheetdevangNo ratings yet

- The - Model - Class WorkDocument16 pagesThe - Model - Class WorkZoha KhaliqNo ratings yet

- ForecastingDocument1 pageForecastingKwaku Obeng-AppiahNo ratings yet

- Supreme Annual Report 2019Document148 pagesSupreme Annual Report 2019adoniscalNo ratings yet

- Telecom Industry ForecastDocument23 pagesTelecom Industry Forecastcharan ranaNo ratings yet