Professional Documents

Culture Documents

FM Assignment 02

Uploaded by

Sufyan SarwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FM Assignment 02

Uploaded by

Sufyan SarwarCopyright:

Available Formats

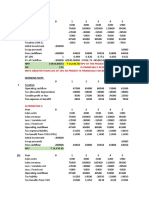

FINANCIAL STATEMENT MODEL

SUFYAN SARWAR 02-112202-006

Sales growth 14% M.UMER KALEEM 02-112202-024

Current assets/Sales 15% WAQAS JABBAR 02-112192-067

Current liabilities/Sales 8% SAAD AHMED SIDD02-112202-015

Net fixed assets/Sales 45%

Salary exp/Sales 10%

Costs of goods sold/Sales 60%

Depreciation rate 10%

Interest rate on debt 9.00%

Interest paid on cash and marketable securities 7.00%

Tax rate 35%

Dividend payout ratio 45%

Part (a)

Year 2020 2021 2022 2023 2024 2025

Income statement

Sales 130000 148200 168948 192600.7 219564.8 250303.9

Costs of goods sold (1,800) -88920 -101369 -115560 -131739 -150182

Interest payments on debt (4,400) -1530 -1530 -1530 -1530 -1530

Interest earned on cash and marketable securities 1,050 534 110 307 524 762

Salary Expense (31,000) -14820 -16895 -19260 -21956 -25030

Depreciation (15,000) -9036 -11620 -13895 -16557 -19666

Profit before tax 78,850 34427 37644 42662 48307 54657

Taxes (23,000) -12050 -13176 -14932 -16907 -19130

Profit after tax 55,850 22378 24469 27730 31399 35527

Dividends (43,140) -10070 -11011 -12479 -14130 -15987

Retained earnings 12,710 12308 13458 15252 17270 19540

Part (b)

Balance sheet

Cash and marketable securities 15000 244 2913 5865 9113 12669

Current assets 16000 22230 25342 28890 32935 37546

Fixed assets

At cost 75000 105726 126683 151222 179913 213412

Depreciation (30,000) -39036 -50657 -64552 -81109 -100775

Net fixed assets 45000 66690 76027 86670 98804 112637

Total assets 76000 89164 104281 121425 140852 162851

Current liabilities 11000 11856 13516 15408 17565 20024

Debt 17000 17000 17000 17000 17000 17000

Stock 27000 27000 27000 27000 27000 27000

Accumulated retained earnings 21000 33308 46766 62017 79287 98827

Total liabilities and equity 76000 89164 104281 121425 140852 162851

Free cash flow calculation

Profit after tax 22378 24469 27730 31399 35527

Add back depreciation 9036 11620 13895 16557 19666

Subtract increase in current assets -6230 -3112 -3548 -4045 -4611

Add back increase in current liabilities 856 1660 1892 2157 2459

Subtract increase in fixed assets at cost -30726 -20957 -24539 -28691 -33499

Add back after-tax interest on debt 995 995 995 995 995

Subtract after-tax interest on cash and mkt. securities -346.7948408 -71.8073464 -199.6899 -340.7555 -495.5478

Free cash flow -4039 14603 16226 18032 20042

Valuing the firm

Weighted average cost of capital 16%

Long-term free cash flow growth rate 6%

Year

FCF -4039 14603 16226 18032 20,042

Terminal value 212444

Total -4039 14603 16226 18032 232486

Enterprise value,Net present value of row total FCF $138,414.11

Add in initial (year 0) cash and mkt. securities 15000

Asset value in year 0 $153,414.11

Subtract out value of firm's debt today -17000

Equity value $136,414.11

The effect of sales growth on equity valuation Growth $136,414.1

0%

2%

4%

6%

8%

10%

12%

14%

16%

The impact of sales growth and WACC on equity valuation 136,414 10% 12% 14% 16% 18% 20% 22% 24% 26%

0%

2%

4%

6%

8%

10%

12%

14%

16%

REQUIRED:

a PREPARE PROJECTED FINANCIAL STATEMENTS FOR 5 YEARS (2021-2025)

b CALCULATE PROJECTED FREE CASH FLOWS FOR 5 YEARS (2021-2025)

c CALCULATE TERMINAL VALUE USING FREE CASH FLOWS

d CALCULATE ENTERPRISE VALUE AND EQUITY VALUE

e PERFORM SENSITIVITY ANALYSIS TO FIND THE IMPACT OF SALES GROWTH ON EQUITY VALUATION

f PERFORM SENSITIVITY ANALYSIS TO FIND THE IMPACT OF SALES GROWTH AND WACC ON EQUITY VALUATION

You might also like

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- The Valuation and Financing of Lady M Case StudyDocument4 pagesThe Valuation and Financing of Lady M Case StudyUry Suryanti RahayuNo ratings yet

- AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-PreviewDocument4 pagesAWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Previewscottshear1No ratings yet

- Case North Country AutoDocument3 pagesCase North Country AutoAnanda Agustin Fitriana100% (2)

- Sales Declaration and Evaluation FormDocument1 pageSales Declaration and Evaluation FormMcAsia Foodtrade Corp100% (1)

- Deloitte Uk Capitalising Your Cloud BookletDocument12 pagesDeloitte Uk Capitalising Your Cloud Bookletng kk100% (1)

- Income Statement Format (KTV) KTV KTVDocument30 pagesIncome Statement Format (KTV) KTV KTVDarlene Jade Butic VillanuevaNo ratings yet

- Accounting and FinanceDocument115 pagesAccounting and FinancekokueiNo ratings yet

- CASE Krakatau Steel (B)Document7 pagesCASE Krakatau Steel (B)Tegar BabarunggulNo ratings yet

- Lesson Plan Abm Semi DetailedDocument4 pagesLesson Plan Abm Semi DetailedLiza Reyes GarciaNo ratings yet

- Module-10 Additional Material FSA Template - Session-11 vrTcbcH4leDocument6 pagesModule-10 Additional Material FSA Template - Session-11 vrTcbcH4leBhavya PatelNo ratings yet

- PROJECTED FINANCIALS AND CASH FLOWSDocument1 pagePROJECTED FINANCIALS AND CASH FLOWSSufyan SarwarNo ratings yet

- ATH Case CalculationDocument4 pagesATH Case CalculationsasNo ratings yet

- Model 2 TDocument6 pagesModel 2 TVidhi PatelNo ratings yet

- S BqFC2 - T5KgahQtv8 SXQ - Module 3 7 iMBA Example LBO TypeDocument8 pagesS BqFC2 - T5KgahQtv8 SXQ - Module 3 7 iMBA Example LBO TypeharshNo ratings yet

- FINANCIAL HIGHLIGHTS OF COMPANY FROM 2011-2016Document1 pageFINANCIAL HIGHLIGHTS OF COMPANY FROM 2011-2016Anushka SinhaNo ratings yet

- Atlas Honda: Financial ModellingDocument19 pagesAtlas Honda: Financial ModellingSaqib NasirNo ratings yet

- FAM Assignment - Rupasree Dey - 01-20-108Document10 pagesFAM Assignment - Rupasree Dey - 01-20-108Rupasree DeyNo ratings yet

- Exhibit 1Document1 pageExhibit 1Vijendra Kumar DubeyNo ratings yet

- Case StudyDocument6 pagesCase Studyrajan mishraNo ratings yet

- HUL Day 7Document21 pagesHUL Day 7Juzer JiruNo ratings yet

- Hori, Trend, VertiDocument10 pagesHori, Trend, VertiRishav BhattacharjeeNo ratings yet

- Earnings QualityDocument4 pagesEarnings Quality司雨鑫No ratings yet

- Chapt 17-18 Suyanto - DDocument8 pagesChapt 17-18 Suyanto - DZephyrNo ratings yet

- Drreddy - Ratio AnalysisDocument8 pagesDrreddy - Ratio AnalysisNavneet SharmaNo ratings yet

- Financial Projection Report On Attock Cement, Pakistan: Financial Management Assignment Submitted To Sir Asim ShaikhDocument7 pagesFinancial Projection Report On Attock Cement, Pakistan: Financial Management Assignment Submitted To Sir Asim ShaikhSyed Atiq TurabiNo ratings yet

- Attock CementDocument18 pagesAttock CementDeepak MatlaniNo ratings yet

- Yilendwe ExcelDocument4 pagesYilendwe Excelsanjay gautamNo ratings yet

- Prepare Income Statement and Balance Sheet For 5 YearsDocument2 pagesPrepare Income Statement and Balance Sheet For 5 Yearsmuhammad farhanNo ratings yet

- Cost AssignmentDocument16 pagesCost Assignmentmuhammad salmanNo ratings yet

- Dreddy FinalDocument11 pagesDreddy FinalNavneet SharmaNo ratings yet

- Consolidated Income Statement AnalysisDocument23 pagesConsolidated Income Statement AnalysisJayash KaushalNo ratings yet

- Ratio Analysis of WALMART INCDocument5 pagesRatio Analysis of WALMART INCBrian Ng'enoNo ratings yet

- ForecastingDocument9 pagesForecastingQuỳnh'ss Đắc'ssNo ratings yet

- 322 Assignment 2 SubmissionDocument9 pages322 Assignment 2 SubmissionMirza Mushahid BaigNo ratings yet

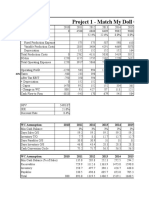

- Project 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015Document4 pagesProject 1 - Match My Doll Clothing Line: WC Assumption: 2010 2011 2012 2013 2014 2015rohitNo ratings yet

- Fructose Financial PlanDocument10 pagesFructose Financial PlandoieNo ratings yet

- Income Statement: Cost of Goods Sold 540,000 768000 999600 1300920Document4 pagesIncome Statement: Cost of Goods Sold 540,000 768000 999600 1300920ASIF RAFIQUE BHATTINo ratings yet

- Financial Modeling BasicsDocument2 pagesFinancial Modeling BasicsMahmood AhmadNo ratings yet

- Alternative 1Document10 pagesAlternative 1Sreyas S KumarNo ratings yet

- Aqua Pure Water Refilling Station Financial StatementsDocument22 pagesAqua Pure Water Refilling Station Financial StatementsCukeeNo ratings yet

- Past Papers2Document46 pagesPast Papers2leylaNo ratings yet

- ZYBEAK Balance SheetDocument1 pageZYBEAK Balance SheetVidhya SelvamNo ratings yet

- Financial Ratios of BNL Stores For The Years 2018-19-20 Liquidity RatiosDocument3 pagesFinancial Ratios of BNL Stores For The Years 2018-19-20 Liquidity RatiosKushagri MangalNo ratings yet

- Group 14 - Bata ValuationDocument43 pagesGroup 14 - Bata ValuationSUBHADEEP GUHA-DM 20DM218No ratings yet

- Balance sheet and income statement analysisDocument8 pagesBalance sheet and income statement analysisAnindya BasuNo ratings yet

- Bhimsen CaseDocument2 pagesBhimsen CaseNikhil Gauns DessaiNo ratings yet

- ASSIGNMENT NO.2 (Entrepreneurship)Document9 pagesASSIGNMENT NO.2 (Entrepreneurship)Malik Mughees AwanNo ratings yet

- Loganathan Exp 5Document2 pagesLoganathan Exp 5loganathanloganathancNo ratings yet

- Income Statement, Balance Sheet, Cash Flow AnalysisDocument35 pagesIncome Statement, Balance Sheet, Cash Flow AnalysisChirag SharmaNo ratings yet

- Estimating Equity FCFDocument5 pagesEstimating Equity FCFSomlina MukherjeeNo ratings yet

- Intrinsic Value Analysis of Tata Motors LtdDocument24 pagesIntrinsic Value Analysis of Tata Motors LtdApurvAdarshNo ratings yet

- Income Statement Format (KTV) To Ediiiiittttttt DarleneDocument25 pagesIncome Statement Format (KTV) To Ediiiiittttttt DarleneDarlene Jade Butic VillanuevaNo ratings yet

- Performance at A GlanceDocument7 pagesPerformance at A GlanceLima MustaryNo ratings yet

- Comparative Income Statement for Reliance Industries LtdDocument23 pagesComparative Income Statement for Reliance Industries LtdManan Suchak100% (1)

- Financial WorksheetDocument4 pagesFinancial WorksheetCarla GonçalvesNo ratings yet

- Hinopak Motors Financial Statement Analysis for 2022 vs 2021Document8 pagesHinopak Motors Financial Statement Analysis for 2022 vs 2021Shamsuddin SoomroNo ratings yet

- Case 9 Fin315Document20 pagesCase 9 Fin315gaiaNo ratings yet

- Profitability, turnover, liquidity and solvency ratios 2018-2020Document3 pagesProfitability, turnover, liquidity and solvency ratios 2018-2020Mohit VermaNo ratings yet

- Balance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015Document4 pagesBalance Sheet As On 31 December 2014-2016: Amount in Millions 2016 2015 2014 V 2016 2015sanameharNo ratings yet

- Sales and Cost Plan (Income Statement)Document4 pagesSales and Cost Plan (Income Statement)Ramira EdquilaNo ratings yet

- ROI CALCULATION - MBA MKT 1 - Shivam JadhavDocument4 pagesROI CALCULATION - MBA MKT 1 - Shivam JadhavShivam JadhavNo ratings yet

- COMPUTERISED AC - OdsDocument10 pagesCOMPUTERISED AC - OdsRukaiya Abdul AzizNo ratings yet

- Safari 3Document4 pagesSafari 3Bharti SutharNo ratings yet

- The Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Document4 pagesThe Valuation and Financing of Lady M Confections: 23600 Cash BEP 1888000,00Rahul VenugopalanNo ratings yet

- Lady M SolutionDocument4 pagesLady M SolutionRahul VenugopalanNo ratings yet

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- IAS 20 - Accounting For Government Grants and Disclosure of Government AssistanceDocument2 pagesIAS 20 - Accounting For Government Grants and Disclosure of Government AssistanceMarc Eric RedondoNo ratings yet

- Startup Financial Planning - PPT DownloadDocument7 pagesStartup Financial Planning - PPT DownloadhomsomNo ratings yet

- Spanco Telesystems Solutions LTD.: Investment HighlightsDocument8 pagesSpanco Telesystems Solutions LTD.: Investment HighlightsKunalNo ratings yet

- KFS3122 Entrepreneurship Slides 8Document37 pagesKFS3122 Entrepreneurship Slides 8Poovarashan ManimaranNo ratings yet

- Questionare First Long ExamDocument1 pageQuestionare First Long ExamMaia Besa Delastrico-AbaoNo ratings yet

- Retirement Agreement 1Document6 pagesRetirement Agreement 1liza avilaNo ratings yet

- 1a. IR8A (M) - YA 2012 - v1Document1 page1a. IR8A (M) - YA 2012 - v1freepublic9No ratings yet

- October 02.10.2013.G.O.Ms - No.793 G.Published 39-VI-1.pdf Lorries Allowed Time Kothavalchavadi Police Limit .Document13 pagesOctober 02.10.2013.G.O.Ms - No.793 G.Published 39-VI-1.pdf Lorries Allowed Time Kothavalchavadi Police Limit .Lauren WhiteNo ratings yet

- Contemporary AccountingDocument22 pagesContemporary AccountingRadhakrishna Mishra50% (2)

- Workshop 6 SOL Additional QuestionDocument5 pagesWorkshop 6 SOL Additional Questiontimlee38100% (1)

- Al Ijarah Vs Hire PurchaseDocument3 pagesAl Ijarah Vs Hire Purchasesimson singawahNo ratings yet

- Afm MCQDocument10 pagesAfm MCQJibu MathewNo ratings yet

- Divya ProjectDocument60 pagesDivya ProjectvarunNo ratings yet

- Project On Tata MotorsDocument41 pagesProject On Tata MotorsLawi Anupam100% (6)

- 2bitz DR - Amiruddinbinahamat ErrorDocument30 pages2bitz DR - Amiruddinbinahamat ErrorKustia FebriaNo ratings yet

- 2012 Annual Report HighlightsDocument100 pages2012 Annual Report HighlightsuttaramenonNo ratings yet

- Butterstick AlishaDocument22 pagesButterstick AlishaShruti SarrafNo ratings yet

- Harry S House of Hamburgers HHH Wants To Prepare A CashDocument1 pageHarry S House of Hamburgers HHH Wants To Prepare A CashAmit PandeyNo ratings yet

- Inventory and Account ReportsDocument58 pagesInventory and Account Reportsadiirwanto80% (5)

- 2015 AR Indopoly - SpreadDocument107 pages2015 AR Indopoly - SpreadirmaNo ratings yet

- The Philippine Stock ExchangeDocument23 pagesThe Philippine Stock Exchangetelos12281149No ratings yet

- 1 Introduction To Accounting Concepts and Structure UDDocument9 pages1 Introduction To Accounting Concepts and Structure UDERICK MLINGWANo ratings yet

- Final MM Case StudyDocument6 pagesFinal MM Case StudyAurang ZaibNo ratings yet