Professional Documents

Culture Documents

Sec Georgia Articles of Incorporation

Uploaded by

api-596713083Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sec Georgia Articles of Incorporation

Uploaded by

api-596713083Copyright:

Available Formats

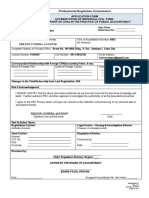

ARTICLES OF INCORPORATION

OF

COIN GRAND EXPRESS

(Under Georgia Business Corporation Code)

ARTICLE I

NAME OF ENTITY

The name of the corporation is COIN GRAND EXPRESS.

ARTICLE II

PRINCIPAL PLACE OF BUSINESS

The principal place of business of the corporation is 252 Adonais Way Atlanta,

Atlanta, GA 30303.

ARTICLE III

REGISTERED AGENT

The name and address of the registered agent is SANCHEZ J. ASHLEY, at 252

Adonais Way Atlanta, Atlanta, GA 30303.

ARTICLE IV

PURPOSE

The purpose for which the corporation is organized is to engage in any lawful act

or activity for which a for-profit corporation may be organized under the laws of

the State of Georgia, including

• coingrandexpress.com is a Forex, Binary and Cryptocurrency automated

trading based platform, offering a high leverage trading on several digital

assets including Bitcoin, Ethereum, Litecoin, and Ripple in addition to the

major, minor and exotic currencies. We specialize in trading the financial

markets with the use of neural network robots coded with artificial

intelligence, thus ensuring high accuracy on our trades and eliminating

human errors which manual trading brings. Our investors’ funds are

secured/safe with us as there are little to no risks involved. Investors earn

profits depending on their invested capital and get 15% referral bonus for

each number of persons introduced requested are completed within 24 to

48 hours into our investors bitcoin wallets with the help of our affiliated

brokers, after top up/plans have been completed in respective rates and

time. We aim at providing wealth for our investors and ourselves. The

company was founded in 2010 and from the very first day, we have grown

exponentially and currently serve clients in more than 150 countries. We

provide our clients with access to top-tier liquidity and wide range of

trading tools, while maintaining security, liquidity, enabling a safe and

efficient trading environment for everyone.

Articles of Incorporation (Rev.133ED59)

ARTICLE V

AUTHORIZED STOCK

The corporation is authorized to issue a total number of (UNLIMITED) shares of

(UNLIMITED) stock without par value.

ARTICLE VI

DIRECTORS

The name and address of the director(S) is:

• BELLA GOLD

ARTICLE VII

INCORPORATOR

The name and address of the incorporator(s) is:

• COINGRANDEXPRESS.COM at 252 Adonais Way Atlanta, Atlanta, GA 30303

ARTICLE VIII

DURATION

The period of duration of the Corporation is perpetual.

Dated this 03 day of July, 2012.

___________________________ COINGRANDEXPRESS.COM___

Signature of Incorporator Name of Incorporator

Articles of Incorporation (Rev.133ED59)

This page intentionally left blank.

Articles of Incorporation (Rev.133ED59)

GENERAL INSTRUCTIONS

WHY IS IT NEEDED

If you want to take advantage of a state's

WHAT IS AN ARTICLES OF INCORPORATION?

tax and legal benefits, you should file a

An Articles of Incorporation, also commonly

Certificate of Incorporation with that

known as a Certificate of Incorporation, is a

Secretary of State when creating your

set of formal documents that contain basic

business. For example, about half of public

information about a company being

corporations choose to incorporate in

created. Because each state has its own

Delaware and Nevada to save taxes. Many

requirements, the Articles of Incorporation

states require companies to file "foreign

are usually filed with the Secretary of State.

registration" documents if they are an out-

Once the Articles of Incorporation are filed

of-state entity incorporated elsewhere but

the Company becomes a registered

doing business in their state.

business entity for legal and tax purposes in

the state.

Independent of where you incorporate,

companies may also need to create

WHAT SHOULD BE INCLUDED

corporate bylaws to formalize the

A basic Articles of Incorporation will include

incorporation process. Corporate bylaws

the following details:

establish the everyday rules and guidelines

of running a business and not mixing your

• Full Name of Corporation: check personal debts and assets with those of

whether the company name is still your business.

available at your Secretary of State

(i.e. California allows you to check CONSEQUENCES OF NOT INCORPORATING

online) and be sure to include one of If you do not use an Articles of

a corporate suffix at the end of the Incorporation, the default assumption is

name: that you are a sole proprietor. As an

o Corporation or Corp. unincorporated business, the law treats you

o Company or Co. and your business as one entity. For tax

o Incorporated or Inc. purposes, the IRS allows you to file one

o Limited or Ltd. form for yourself and your company. In the

• Principal Place of Business: address worst case, a creditor can go after both

of the corporation your personal and company assets for a

• Registered Agent: person of business debt. Here are some of the

business who receives legal notices possible consequences that could be

and paperwork prevented by properly incorporating our

• Business Purpose: the reason your business and filing Articles of Incorporation:

corporation is being created (i.e. any

lawful activity) • Lost Money (i.e. Unexpected legal

• Stock: total number of authorized bills, potential tax savings associated

shares, type of stock, and par value Lost Money (i.e. Unexpected legal

of stock bills, potential tax savings associated

• Incorporator: a person at least 18 with incorporating)

years old who is setting up the • Lost Time (i.e. Time spent

company defending your personal assets from

• Director: person(s) who will oversee creditors or the public, Cleaning up

the overall affairs of the company mistakes instead of preventing them

• Officer: person(s) who will manage in the first place)

daily business affairs (i.e. President. • Opportunity Cost (i.e. LOSS of

VP, Secretary) liability protection available to

• Duration: length of time the incorporated businesses. Peace of

company will exist. often the default mind that your personal home and

is perpetual" bank accounts are protected)

MOST COMMON SITUATIONS In contrast, if you follow proper procedures,

A Certificate of Incorporation is often used a formally incorporated business legally

when a company wants to be legally separates you from your company. You the

recognized as a business entity to minimize owner cannot be held personally liable for

taxes and gain liability protection.

Articles of Incorporation (Rev.133ED59)

company debts, obligations, or risks. The

increased liability protection is particularly

useful if your business has employees or if

your products or services put you at risk of

being sued by the general public. Retail

businesses, in danger of lawsuits for a slip

and fall or other small mishaps, should

consider purchasing general business

liability insurance to cover any

accidents.

Articles of Incorporation (Rev.133ED59)

You might also like

- Ohio Articles of IncorporationDocument6 pagesOhio Articles of IncorporationRocketLawyerNo ratings yet

- Statement: Company NameDocument6 pagesStatement: Company NameBleep NewsNo ratings yet

- Certificate of Company Officer, 2021Document1 pageCertificate of Company Officer, 2021David WebbNo ratings yet

- Affidavit of Consent: AffiantDocument4 pagesAffidavit of Consent: AffiantDamilac 1223No ratings yet

- Authority of SignatoryDocument1 pageAuthority of Signatorydonaldhax01No ratings yet

- Coinbase NYAG Signed Cover Letter - May 1 2018Document5 pagesCoinbase NYAG Signed Cover Letter - May 1 2018JournalducoinNo ratings yet

- Articles and Memorandum of AssociationDocument15 pagesArticles and Memorandum of AssociationRokan uddinNo ratings yet

- China Trust Application Form (L)Document2 pagesChina Trust Application Form (L)bimbot100% (2)

- SpaDocument3 pagesSpaAhcai SepetNo ratings yet

- Directors CertificateDocument2 pagesDirectors CertificateCesar DionidoNo ratings yet

- Notary Statement ExamplesDocument1 pageNotary Statement ExamplesMariagmzNo ratings yet

- South Carolina Articles of OrganizationDocument3 pagesSouth Carolina Articles of OrganizationhowtoformanllcNo ratings yet

- Kansas Articles of IncorporationDocument3 pagesKansas Articles of IncorporationRocketLawyerNo ratings yet

- Reinstatement FormDocument2 pagesReinstatement FormNikken, Inc.No ratings yet

- Share Certificate BLANKdocDocument1 pageShare Certificate BLANKdoccarlwmillsNo ratings yet

- Gift LetterDocument1 pageGift LetterTony Dalia MedranoNo ratings yet

- AVI-SPL Employee HandbookDocument60 pagesAVI-SPL Employee HandbookNatNo ratings yet

- US Internal Revenue Service: p4163Document134 pagesUS Internal Revenue Service: p4163IRSNo ratings yet

- Financial StatementDocument184 pagesFinancial StatementTanto RizkiyanaNo ratings yet

- California LLC 1Document1 pageCalifornia LLC 1Freeman LawyerNo ratings yet

- For Amo WebinarsDocument79 pagesFor Amo WebinarsLiezl Tizon ColumnasNo ratings yet

- Certification of Ownership of VehicleDocument2 pagesCertification of Ownership of VehicleEquator EnergyNo ratings yet

- FBN App StatementDocument2 pagesFBN App StatementBecca FriasNo ratings yet

- ACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyDocument4 pagesACD-BOA-01 Rev 04 App Form Accreditation of Individual CPA Firm Partnership of CPAs in The Practice of Public AccountancyErlene CompraNo ratings yet

- Secretary - S Certificate To Apply For A Loan or Credit AccommodationDocument2 pagesSecretary - S Certificate To Apply For A Loan or Credit AccommodationJen DCNo ratings yet

- Business Permit Application - Renewal (Cagayan de Oro City)Document1 pageBusiness Permit Application - Renewal (Cagayan de Oro City)KarlJosephNorigaNo ratings yet

- Account Opening Form and Investment FormDocument5 pagesAccount Opening Form and Investment FormEngr Muhammad Talha IslamNo ratings yet

- Amla CF (Draft)Document25 pagesAmla CF (Draft)Araceli GloriaNo ratings yet

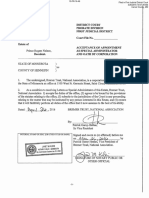

- Acceptance of Appointment and OathDocument2 pagesAcceptance of Appointment and OathMinnesota Public RadioNo ratings yet

- Polk County Circuit Court Clerk ReportDocument11 pagesPolk County Circuit Court Clerk ReportDan LehrNo ratings yet

- Application Form For Foreign Exchange Services: Specify)Document7 pagesApplication Form For Foreign Exchange Services: Specify)Reena Rizza Ocampo0% (1)

- SPA ZERNA Occupancy PermitDocument7 pagesSPA ZERNA Occupancy Permitadelainezernagmail.comNo ratings yet

- Rental Confirmation - CF158943 - 11042020 - 102426 3Document5 pagesRental Confirmation - CF158943 - 11042020 - 102426 3sabah khalifaNo ratings yet

- Chapter 02 - Statement of Financial Position and Income StatementDocument20 pagesChapter 02 - Statement of Financial Position and Income StatementThorngsokhom0% (1)

- EO 98 - How To Apply TINDocument7 pagesEO 98 - How To Apply TINPeterSalas100% (1)

- Power of Attorney New York Statutory Short FormDocument7 pagesPower of Attorney New York Statutory Short FormProject FINDNo ratings yet

- Articles of AssociationDocument4 pagesArticles of AssociationChandrakant HakeNo ratings yet

- 7 Sure-Ways To Cancel Bir Letters of Authority Internal Revenue ServiceDocument3 pages7 Sure-Ways To Cancel Bir Letters of Authority Internal Revenue ServiceDante Bauson JulianNo ratings yet

- Proof of Address Letter: (Letter From Relative or Friend)Document1 pageProof of Address Letter: (Letter From Relative or Friend)Jérôme JourdaNo ratings yet

- Account Reactivation FormDocument1 pageAccount Reactivation FormEmmanuel OguaforNo ratings yet

- BIR FormsDocument24 pagesBIR FormsKezziah Niña AbellanosaNo ratings yet

- Company Memorandum Sample BangladeshDocument10 pagesCompany Memorandum Sample Bangladeshsovon.ad0% (2)

- Engagementletter-SEC REGISTRATION - DVDocument4 pagesEngagementletter-SEC REGISTRATION - DVDv AccountingNo ratings yet

- Power of AttorneyDocument1 pagePower of AttorneyAnonymous hQaiWlyNo ratings yet

- Account Closing LetterDocument4 pagesAccount Closing LetterNorhian AlmeronNo ratings yet

- Articles of Incorporation SampleDocument3 pagesArticles of Incorporation SampleLincoln Reserve Group Inc.No ratings yet

- 267731702final PDFDocument5 pages267731702final PDFelmarcomonal100% (1)

- 1601 C CompensationDocument2 pages1601 C Compensationjon_cpaNo ratings yet

- Contractual AgreementDocument2 pagesContractual AgreementCezs Rose YumangNo ratings yet

- Stock Certificate Template 04Document1 pageStock Certificate Template 04Jess EstradaNo ratings yet

- Equality - BDO SecCert - 21 May 2020-w - Dan SignatureDocument2 pagesEquality - BDO SecCert - 21 May 2020-w - Dan SignatureseanNo ratings yet

- Tax Filing Reminders: OutlineDocument30 pagesTax Filing Reminders: OutlineMarc Nathaniel RanayNo ratings yet

- Business Sale AgreementDocument2 pagesBusiness Sale AgreementBazmir zaheryNo ratings yet

- Bank of America Deed To FHLMC Dory GOEBEL 10 Mar 2005Document3 pagesBank of America Deed To FHLMC Dory GOEBEL 10 Mar 2005William A. Roper Jr.No ratings yet

- Format For Company Bank Account OpeningDocument2 pagesFormat For Company Bank Account OpeningDeepeshNo ratings yet

- Maryland Articles of IncorporationDocument4 pagesMaryland Articles of IncorporationkevinNo ratings yet

- Document 2Document5 pagesDocument 2snowFlakes ANo ratings yet

- Corporate Law-Sace-Final SubmissionDocument25 pagesCorporate Law-Sace-Final SubmissionSoumya Shefali ChandrakarNo ratings yet

- Corporate Law Sace Final SubmissionDocument25 pagesCorporate Law Sace Final SubmissionSoumya Shefali ChandrakarNo ratings yet

- 8272 Mohammad Anher Meah Company Law 30937 1782697881Document20 pages8272 Mohammad Anher Meah Company Law 30937 1782697881NomanNo ratings yet

- VMware NSX - SDN Ninja Program DatasheetDocument4 pagesVMware NSX - SDN Ninja Program DatasheetSarah AliNo ratings yet

- Civil TutorialDocument638 pagesCivil TutorialEmmanuel Mends FynnNo ratings yet

- Manonmaniam Sundaranar University: B.B.A. - Ii YearDocument61 pagesManonmaniam Sundaranar University: B.B.A. - Ii YearLovely Dhanaa4848No ratings yet

- Intermediate Macroeconomics Sec 222Document163 pagesIntermediate Macroeconomics Sec 222Katunga MwiyaNo ratings yet

- Book 1Document30 pagesBook 1uday sonawaneNo ratings yet

- Full Text 01Document115 pagesFull Text 01Datu Harrief Kamenza LaguiawanNo ratings yet

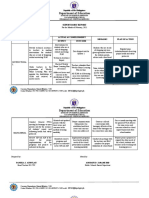

- Department of Education: Supervisory Report School/District: Cacawan High SchoolDocument17 pagesDepartment of Education: Supervisory Report School/District: Cacawan High SchoolMaze JasminNo ratings yet

- Ulcerativecolitis 170323180448 PDFDocument88 pagesUlcerativecolitis 170323180448 PDFBasudewo Agung100% (1)

- Carbon Trading-The Future Money Venture For IndiaDocument11 pagesCarbon Trading-The Future Money Venture For IndiaijsretNo ratings yet

- Operating BudgetDocument38 pagesOperating BudgetRidwan O'connerNo ratings yet

- JournalDocument6 pagesJournalAlyssa AlejandroNo ratings yet

- C.V FinalDocument4 pagesC.V Finalcastillo_leoNo ratings yet

- MicroStation VBA Grid ProgramDocument16 pagesMicroStation VBA Grid ProgramVũ Trường GiangNo ratings yet

- Civil Service Exam Reviewer For Professional and Sub-Professional LevelsDocument6 pagesCivil Service Exam Reviewer For Professional and Sub-Professional LevelsSherylyn Cruz0% (1)

- Tribune Publishing FilingDocument11 pagesTribune Publishing FilingAnonymous 6f8RIS6No ratings yet

- Case Study of Hyper Loop TrainDocument3 pagesCase Study of Hyper Loop TrainkshitijNo ratings yet

- Soni Musicae Diato K2 enDocument2 pagesSoni Musicae Diato K2 enknoNo ratings yet

- Light Waves: Edexcel Igcse / Certificate in PhysicsDocument34 pagesLight Waves: Edexcel Igcse / Certificate in PhysicsertugozNo ratings yet

- Make An Acknowledgment Receipt Showing A Full Payment of A Loan (Extinguishment by Payment)Document5 pagesMake An Acknowledgment Receipt Showing A Full Payment of A Loan (Extinguishment by Payment)Kim Cyrah Amor GerianNo ratings yet

- Social Class 10 2019Document14 pagesSocial Class 10 2019krishnareddy_chintalaNo ratings yet

- Gender Inequality in Bangladesh PDFDocument20 pagesGender Inequality in Bangladesh PDFshakilnaimaNo ratings yet

- Ultimate India Bucket ListDocument5 pagesUltimate India Bucket Listgacawe6143No ratings yet

- Arnold Böcklin Was Born in Basel, Switzerland inDocument6 pagesArnold Böcklin Was Born in Basel, Switzerland inDragos PlopNo ratings yet

- Script For My AssignmentDocument2 pagesScript For My AssignmentKarylle Mish GellicaNo ratings yet

- Germany: Country NoteDocument68 pagesGermany: Country NoteeltcanNo ratings yet

- scs502 Module Three Observational Study WorksheetDocument2 pagesscs502 Module Three Observational Study Worksheetharshit.prajapati74No ratings yet

- 938e4INDEMNITY BOND BY PARENTS PDFDocument1 page938e4INDEMNITY BOND BY PARENTS PDFudit satijaNo ratings yet

- MergedDocument6 pagesMergedmarianne mataNo ratings yet

- Tugas Lk7 Dan 10 Garuda PancasilaDocument5 pagesTugas Lk7 Dan 10 Garuda PancasilaarifuddinNo ratings yet

- IPCC - Fast Track Accounting - 35e PDFDocument37 pagesIPCC - Fast Track Accounting - 35e PDFRam IyerNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet

- Legal Guide for Starting & Running a Small BusinessFrom EverandLegal Guide for Starting & Running a Small BusinessRating: 4.5 out of 5 stars4.5/5 (9)

- The Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysFrom EverandThe Real Estate Investing Diet: Harnessing Health Strategies to Build Wealth in Ninety DaysNo ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Global Bank Regulation: Principles and PoliciesFrom EverandGlobal Bank Regulation: Principles and PoliciesRating: 5 out of 5 stars5/5 (2)