Professional Documents

Culture Documents

Daily Equity Market Report - 28.02.2022

Uploaded by

Fuaad DodooOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Equity Market Report - 28.02.2022

Uploaded by

Fuaad DodooCopyright:

Available Formats

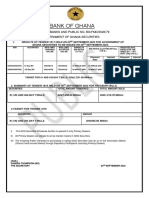

28TH FEBRUARY 2022

DAILY EQUITY MARKET REPORT

GSE EQUITY MARKET PERFORMANCE

EQUITY MARKET HIGHLIGHTS: GSE-CI gained 1.98 points to Indicator Current Previous Change

GSE-Composite Index 2,696.45 2,694.47 1.98 pts

close at 2,696.45; returns -3.33% YTD.

YTD (GSE-CI) -3.33% -3.40% -2.06%

The benchmark GSE Composite Index (GSE-CI) gained 1.98 points to GSE-Financial Stock Index 2,118.96 2,115.36 3.60 pts

YTD (GSE-FSI) -1.53% -1.70% -10.00%

close at 2,696.47 on the first trading day of the week representing a YTD

Market Cap. (GHMN) 62,881.97 62,861.21 20.76

return of -3.33%. The GSE Financial Stock Index (GSE-FSI) also gained Volume Traded 1,944,162 1,708,944 13.76%

3.60 points to close trading at 2,118.96 translating into a YTD return of Value Traded (GH¢) 532,725.66 339,861.99 56.75%

-1.53%.

TOP TRADED EQUITIES

SIC Insurance Company Ltd. (SIC) and CAL Bank PLC. (CAL) both gained Ticker Volume Value (GH¢)

GH¢0.01 and GH¢0.03 to close at GH¢0.15 and GH¢0.85 respectively. SIC 1,722,197 258,329.55

MTNGH 85,242 89,504.10

CAL 71,854 60,622.28

Market Capitalization thus increased by GH¢20.76 million to close at

EGL 35,030 115,599.00

GH¢62.88 billion representing a YTD decline of -2.50% in 2022. ETI 27,034 3,514.42 48.48%

of

value

A total of 1,944,162 shares valued at GH¢532,725.66 were traded in KEY ECONOMIC INDICATORS

eleven equities (11) compared to 1,708,944 shares valued at Indicator Current Previous

Monetary Policy Rate January 2022 14.50% 14.50%

GH¢339,861.99 which changed hands the Friday. SIC at close of market Real GDP Growth Q3 2021 6.6% 3.9%

traded the most, accounting for 48.48% of the total value traded. Inflation January 2022 13.9% 12.6%

Reference rate February 2022 14.01% 13.90%

Source: GSS, BOG, GBA

EQUITY UNDER REVIEW: SCANCOM PLC. (MTNGH)

GAINER & DECLINER

Share Price GH¢1.05 Ticker Close Price Open Price Change YTD

Price Change (YtD) -5.41% (GH¢) (GH¢) Change

Market Capitalization GH¢12,905.00 million SIC 0.15 0.14 7.14% 87.50%

Dividend Yield 0.00%

CAL 0.85 0.82 3.66% -2.30%

Earnings Per Share GH¢0.1532

Avg. Daily Volume Traded 1,503,245 GSE-CI & GSE-FSI YTD PERFORMANCE

Value Traded (YtD) GH¢ 47,747,390 0.50%

0.00%

4-Jan 11-Jan 18-Jan 25-Jan 1-Feb 8-Feb 15-Feb 22-Feb

SBL RECOMMENDED PICKS -0.50%

Equity Price Outlook (Reason) -1.00%

MTN GHANA GH¢ 1.05 Strong 2021 FY Financials -1.50%

BOPP GH¢ 6.00 Strong 2021 FY Financials -2.00% -1.53%

CAL BANK GH¢ 0.85 Strong 2021 Q3 Financials -2.50%

ECOBANK GH¢ 7.60 Strong 2021 Q3 Financials

-3.00%

SOGEGH GH¢ 1.20 Strong 2021 Q3 Financials

-3.50%

-3.33%

-4.00%

GSE-CI GSE-FSI

Disclaimer - SIC Brokerage and its employees do not make any guarantee or other promise as to any results that may be obtained from using our content. No one should make any investment

decision without first consulting his or her own Investment advisor and conducting his or her own research and due diligence. SIC Brokerage disclaims any and all liabilities in the event that any

Information, commentary, analysis, opinions, advice and/or recommendations prove to be inaccurate, incomplete or unreliable, or result in any investment or other losses.

You might also like

- Daily Equity Market Report - 11.10.2022Document1 pageDaily Equity Market Report - 11.10.2022Fuaad DodooNo ratings yet

- Substandard (Contaminated) Paediatric Medicines Identified in WHODocument4 pagesSubstandard (Contaminated) Paediatric Medicines Identified in WHOFuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 14.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 14.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 18.10.2022Document1 pageDaily Equity Market Report - 18.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 17.10.2022Document1 pageDaily Equity Market Report - 17.10.2022Fuaad DodooNo ratings yet

- 19th Edition of The Ghana Club 100 Rankings OutcomeDocument3 pages19th Edition of The Ghana Club 100 Rankings OutcomeFuaad DodooNo ratings yet

- Fixed Income Market Report - 10.10.2022Document1 pageFixed Income Market Report - 10.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 07.10.2022Document2 pagesWeekly Capital Market Report - Week Ending 07.10.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 06.10.2022Document1 pageDaily Equity Market Report - 06.10.2022Fuaad DodooNo ratings yet

- Press Release 2Document1 pagePress Release 2Fuaad DodooNo ratings yet

- R9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Document4 pagesR9 News Release Gender Inequalities Persist in Ghana Afrobarometer BH MA 4oct22Fuaad DodooNo ratings yet

- Daily Equity Market Report - 28.09.2022Document1 pageDaily Equity Market Report - 28.09.2022Fuaad DodooNo ratings yet

- Regulatory Order To ECG - 221004 - 180752Document6 pagesRegulatory Order To ECG - 221004 - 180752Fuaad DodooNo ratings yet

- Daily Equity Market Report - 04.10.2022Document1 pageDaily Equity Market Report - 04.10.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 03.10.2022Document1 pageFixed Income Market Report - 03.10.2022Fuaad DodooNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseFuaad DodooNo ratings yet

- Daily Equity Market Report - 05.10.2022Document1 pageDaily Equity Market Report - 05.10.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 30.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 30.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report 03.10.2022 2022-10-03Document1 pageDaily Equity Market Report 03.10.2022 2022-10-03Fuaad DodooNo ratings yet

- Imf MeetingDocument1 pageImf MeetingFuaad DodooNo ratings yet

- Daily Equity Market Report - 27.09.2022Document1 pageDaily Equity Market Report - 27.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 29.09.2022Document1 pageDaily Equity Market Report - 29.09.2022Fuaad DodooNo ratings yet

- Daily Equity Market Report - 26.09.2022Document1 pageDaily Equity Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Fixed Income Market Report - 26.09.2022Document1 pageFixed Income Market Report - 26.09.2022Fuaad DodooNo ratings yet

- Weekly Capital Market Report - Week Ending 23.09.2022Document2 pagesWeekly Capital Market Report - Week Ending 23.09.2022Fuaad DodooNo ratings yet

- Auctresults 1817Document1 pageAuctresults 1817Fuaad DodooNo ratings yet

- Daily Equity Market Report - 19.09.2022Document1 pageDaily Equity Market Report - 19.09.2022Fuaad DodooNo ratings yet

- Nimed Financial Market Review (16.09.2022)Document4 pagesNimed Financial Market Review (16.09.2022)Fuaad DodooNo ratings yet

- Daily Equity Market Report 20.09.2022 2022-09-20Document1 pageDaily Equity Market Report 20.09.2022 2022-09-20Fuaad DodooNo ratings yet

- Daily Equity Market Report - 22.09.2022Document1 pageDaily Equity Market Report - 22.09.2022Fuaad DodooNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Problem Quiz CH 15Document3 pagesProblem Quiz CH 15Steve Smith FinanceNo ratings yet

- Five Forces Model of FPTDocument3 pagesFive Forces Model of FPTChau Nguyen Thi MinhNo ratings yet

- LBO Structuring and Modeling in Practice - Readings Volume 2Document245 pagesLBO Structuring and Modeling in Practice - Readings Volume 2Zexi WUNo ratings yet

- Reviewer 1, Fundamentals of Accounting 2Document13 pagesReviewer 1, Fundamentals of Accounting 2Hunson Abadeer76% (17)

- APT Literature ReviewDocument11 pagesAPT Literature Reviewdiala_khNo ratings yet

- Asignación 4 LSFPDocument6 pagesAsignación 4 LSFPElia SantanaNo ratings yet

- GML Investissement Ltée AND Ireland Blyth Limited: Amalgamation ProposalDocument44 pagesGML Investissement Ltée AND Ireland Blyth Limited: Amalgamation Proposalelvis007No ratings yet

- DDMPR Q1 2021 Quarterly ReportDocument36 pagesDDMPR Q1 2021 Quarterly ReportChristian John RojoNo ratings yet

- Lecture 12 - Recap (Solutions)Document19 pagesLecture 12 - Recap (Solutions)Stefano BottariNo ratings yet

- Capital Budgeting Techniques 1Document42 pagesCapital Budgeting Techniques 1Cyrille Keith FranciscoNo ratings yet

- 2203 Week 5 TemplateDocument39 pages2203 Week 5 TemplateHORTENSENo ratings yet

- International Corporate FinanceDocument380 pagesInternational Corporate FinanceBiju GeorgeNo ratings yet

- Last Time Tips by CA Ankit PatwariDocument41 pagesLast Time Tips by CA Ankit PatwariSundarNo ratings yet

- Fredun PharmaDocument37 pagesFredun PharmaBandaru NarendrababuNo ratings yet

- Quiz 2 Investments - QuestionsDocument1 pageQuiz 2 Investments - QuestionsJessica Marie MigrasoNo ratings yet

- Profitability Ratio FM 2Document28 pagesProfitability Ratio FM 2Amalia Tamayo YlananNo ratings yet

- Principles of Option PricingDocument32 pagesPrinciples of Option PricingIzaniey Ismail100% (1)

- Value at Risk FinalDocument27 pagesValue at Risk FinalAnu BumraNo ratings yet

- A Training Report On ItcDocument31 pagesA Training Report On Itclakshya rajputNo ratings yet

- Lesson 8 Developing A Trading Plan & Resources: by Adam KhooDocument10 pagesLesson 8 Developing A Trading Plan & Resources: by Adam Khoodaysan50% (2)

- Bank of Uganda: How To Invest in Uganda Government Treasury BondsDocument6 pagesBank of Uganda: How To Invest in Uganda Government Treasury BondsMugayak1986100% (1)

- Solman EquityDocument12 pagesSolman EquityBrunxAlabastroNo ratings yet

- No Par Value Stock DefinitionDocument2 pagesNo Par Value Stock DefinitionblezylNo ratings yet

- Case AIFSDocument11 pagesCase AIFSSara Ceniceros100% (1)

- Adv Business Calculations L3 (Singapore) Model Answers Series 4 2008 PDFDocument12 pagesAdv Business Calculations L3 (Singapore) Model Answers Series 4 2008 PDFKhin Zaw HtweNo ratings yet

- Ebook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFDocument67 pagesEbook Using Financial Accounting Information The Alternative To Debits and Credits PDF Full Chapter PDFjohn.gallardo475100% (24)

- What Ratios Are Most Important in Assessing Current and Predicting Future Value Creation For SearsDocument1 pageWhat Ratios Are Most Important in Assessing Current and Predicting Future Value Creation For SearsMichelle Ang100% (2)

- Financial Accounting The Impact On Decision Makers 9th Edition Porter Test BankDocument50 pagesFinancial Accounting The Impact On Decision Makers 9th Edition Porter Test Bankpatrickbyrdgxeiwokcnt100% (34)

- Laporan Keuangan Konsolidasian BUDI 230318 PDFDocument70 pagesLaporan Keuangan Konsolidasian BUDI 230318 PDFBahrul UlumNo ratings yet

- Advanced AccountingDocument14 pagesAdvanced AccountingPrecilla IrosidoNo ratings yet