Professional Documents

Culture Documents

Premium Receipts

Uploaded by

Thakur Pranay SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premium Receipts

Uploaded by

Thakur Pranay SinghCopyright:

Available Formats

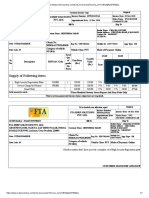

Premium Receipt

Receipt No.: 324790146APR2101 | Receipt Date: 09-APR-2021

Personal Details

Policy Number: 324790146 Email ID: mahenapple@gmail.com

Policyholder Name: Mr. Mahendra Sharma PAN Number: ALNPA3853H

Address: FLAT NO. 302, AASHRAY HOM BRAHMAN BASTHI Customer GSTIN: Not Available

NEXT TO SHARADA COLLAGE Current Residential State: Telangana

Secunderabad- 500061

Telangana

Mobile Number: 9177937778

Policy Details

Plan Name: Max Life Online Term Plan Plus Policy Commencement Date: 02-JUL-2019

Life Insured: Mr. Mahendra Sharma Policy Term: 39 Years Premium Payment Term: Regular

Premium Payment Frequency: Monthly Date of Maturity: 02-JUL-2058 Modal Premium (incl. GST): ` 2,004.11

Late Payment Fee (incl GST): ` 0.00 Premium Received (incl. GST): ` 2,004.11

GST Details Connect for more details

Coverage Taxable SGST/UTGST CGST IGST Name

Type Value (`) Rate Amount (`) Rate Amount (`) Rate Amount (`) Customer Services Customer Advisory Team

Base 1,698.39 NA 0.00 NA 0.00 18% 305.71

Rider 0.00 NA 0.00 NA 0.00 18% 0.00

Contact Number

Late Payment 0.00 NA 0.00 NA 0.00 18% 0.00

18601205577

Total GST Value: ` 305.71

GSTIN: 06AACCM3201E1Z7 GST Regd. State: Haryana SAC CODE: 997132

Total Sum Assured of base

plan and term rider (if any)

02-APR-2021 to

` 1,00,00,000.00 ` 2,004.11 01-MAY-2021 02-MAY-2021

*Important Note:

1.For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk commencement starts

after acceptance of risk by us.

2.Amount received would be adjusted against the due premium as per terms and conditions of the policy.

3.Premiums may be eligible for tax benefits under section 80C/80CCC/80D/37(1) of the income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable to change due

to changes in legislation or government notification.

4.GST shall comprise CGST, SGST / UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable taxes, cesses and levies, as per prevailing laws, shall be borne by you. For GST

purposes, this premium receipt is Tax invoice. Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%, Single Premium Annuity is 10%, Term and Health is 100%.

Authorised Signatory

PRM21V5.8 09032021 PRODUCT UIN: 104N092V03

E.&O.E 2021-04-09.03.35.14.280981

You might also like

- Managing Birs Tax Assessment FreeebookDocument88 pagesManaging Birs Tax Assessment FreeebookJohn Patrick Guillen100% (1)

- TPS - Tax Forms Done Tax ReturnDocument42 pagesTPS - Tax Forms Done Tax ReturnLuis Castro100% (1)

- Tax Mock Bar ExamDocument6 pagesTax Mock Bar ExamMarco RvsNo ratings yet

- HDFC ERGO General Insurance Company Limited: Policy No. 2311 1001 8502 4001 000Document3 pagesHDFC ERGO General Insurance Company Limited: Policy No. 2311 1001 8502 4001 000Suresh KumarNo ratings yet

- Installation ChargesVDocument1 pageInstallation ChargesVbaby yodaNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- InvoiceDocument1 pageInvoiceAbhijitChandraNo ratings yet

- Invoice NF29188202112850Document3 pagesInvoice NF29188202112850Prem KumarNo ratings yet

- Mattress InvoiceDocument1 pageMattress InvoiceSMNo ratings yet

- Tax Invoice SEODocument2 pagesTax Invoice SEOyashaswi rajNo ratings yet

- SampleDocument11 pagesSampleYanyan RivalNo ratings yet

- Tax Invoice TitleDocument1 pageTax Invoice TitleKalpesh TomarNo ratings yet

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)ISHANNo ratings yet

- Invoice 1Document1 pageInvoice 1Anupam PriyamNo ratings yet

- Receipt 100Document1 pageReceipt 100Sijo XaviarNo ratings yet

- SONDHI GAS SERVICE tax invoiceDocument2 pagesSONDHI GAS SERVICE tax invoiceNavneetNo ratings yet

- PSG TECH Online Fee ReceiptDocument1 pagePSG TECH Online Fee ReceiptVishalSelvanNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Arvind MiraseNo ratings yet

- Booking Request ID: Visiting Purpose: Booking Confirmed On: SubjectDocument1 pageBooking Request ID: Visiting Purpose: Booking Confirmed On: SubjectPratik SharmaNo ratings yet

- Invoice 4Document1 pageInvoice 4api-368429342No ratings yet

- Tax Suggested Answers (1994-2006) - NoRestrictionDocument143 pagesTax Suggested Answers (1994-2006) - NoRestrictiondenjo bonillaNo ratings yet

- Medical Bill Invoice KarnadakaDocument1 pageMedical Bill Invoice Karnadakaganesamoorthy1987No ratings yet

- D-Vois Communications Private Limited: Comments Signature IrnnoDocument1 pageD-Vois Communications Private Limited: Comments Signature IrnnoKushal KumarNo ratings yet

- Tax Invoice BillDocument1 pageTax Invoice BillDevendra Pratap SinghNo ratings yet

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsSourav GhoshNo ratings yet

- InvoiceDocument1 pageInvoiceBaidya NarzaryNo ratings yet

- Customer Receipt for Just Dial ServicesDocument2 pagesCustomer Receipt for Just Dial ServicesSurinder GhattauraNo ratings yet

- InvoiceDocument1 pageInvoiceRajan BuradNo ratings yet

- InvoiceDocument1 pageInvoiceKapil BhardwajNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)R SubbiahNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rahul ChandrawarNo ratings yet

- Tax Invoice: AARSH INDANE (0000305336)Document2 pagesTax Invoice: AARSH INDANE (0000305336)Ashvin RamanaNo ratings yet

- Marathi-Hindi dictionary order invoiceDocument1 pageMarathi-Hindi dictionary order invoicesailee vaidyaNo ratings yet

- Product Name Validity Price: Samajho LearningDocument1 pageProduct Name Validity Price: Samajho LearningMohammad JaveedNo ratings yet

- Complete TV Protection (3 Years) : Grand Total 629.00Document1 pageComplete TV Protection (3 Years) : Grand Total 629.00VasanthKumarNo ratings yet

- feeReceiptDD PDFDocument1 pagefeeReceiptDD PDFMayank GoyalNo ratings yet

- Crystal Reports ActiveX DesignerDocument3 pagesCrystal Reports ActiveX DesignerMohit PanchalNo ratings yet

- Tax Invoice: Being Amount Paid For Advertising Listings On Just DialDocument2 pagesTax Invoice: Being Amount Paid For Advertising Listings On Just DialcubadesignstudNo ratings yet

- Lucky ScootyDocument1 pageLucky ScootyPramodKumarNo ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Discount Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Discount Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountNishitha DasNo ratings yet

- InvoiceDocument1 pageInvoiceKuldeep Krishan Trivedi Sr.No ratings yet

- Invoice 191Document1 pageInvoice 191Ayan SinhaNo ratings yet

- Tax Invoice for HeadphonesDocument1 pageTax Invoice for HeadphonesNavneet NigamNo ratings yet

- Buyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryDocument1 pageBuyer MR - Harish Karimnagar Ph:9989088769 Gstin/Uin: 36AAWCS2706E2Z5 State Name: Telangana, Code: 36 Terms of DeliveryPAPPU RANJITH KUMARNo ratings yet

- Withholding Tax On Compensation - RR11-2018Document32 pagesWithholding Tax On Compensation - RR11-2018Linda PantanillaNo ratings yet

- Tax Invoice BillDocument1 pageTax Invoice BillAnkit DwivediNo ratings yet

- Renewal Premium Receipt: Invoice Number: A150048237100041Document1 pageRenewal Premium Receipt: Invoice Number: A150048237100041Aasiya shadab KhanNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Tax Invoice: United ShuttersDocument2 pagesTax Invoice: United Shuttersmohammad yasirNo ratings yet

- Railway Recruitment Board - Online Registration: Payment DetailsDocument2 pagesRailway Recruitment Board - Online Registration: Payment DetailsAbhay SinghNo ratings yet

- Tally Bill The Perfect 1Document1 pageTally Bill The Perfect 1Unnat aggarwalNo ratings yet

- Indian Railways GST Details:: Satark Bharat, Samriddh Bharat (Vigilant India, Prosperous India)Document3 pagesIndian Railways GST Details:: Satark Bharat, Samriddh Bharat (Vigilant India, Prosperous India)BERYL MNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Rinki MurmuNo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- Tax Invoice for Philips Vacuum CleanerDocument1 pageTax Invoice for Philips Vacuum CleanerHimanshu JainNo ratings yet

- TSRTC Bus PassDocument2 pagesTSRTC Bus PassdhurthiNo ratings yet

- Sri Vasavi Medical Agencies Invoice Rpaug002Document1 pageSri Vasavi Medical Agencies Invoice Rpaug002amareshNo ratings yet

- Statement SummaryDocument1 pageStatement SummaryMurali KrishnaNo ratings yet

- Certificate For COVID-19 Vaccination: Beneficiary DetailsDocument1 pageCertificate For COVID-19 Vaccination: Beneficiary DetailsArjun SinghNo ratings yet

- Original For Recipient Duplicate For Transporter Triplicate For SupplierDocument1 pageOriginal For Recipient Duplicate For Transporter Triplicate For SupplierPraveen KumarNo ratings yet

- InvoiceDocument1 pageInvoiceRPGERNo ratings yet

- Purchase Order: Fatehgarh Road, Village Nangli, Amritsar (Punjab) 143001-INDIADocument2 pagesPurchase Order: Fatehgarh Road, Village Nangli, Amritsar (Punjab) 143001-INDIAankurbhatiaNo ratings yet

- Invoice: Po Number Payment Terms Salesperson RecipientDocument1 pageInvoice: Po Number Payment Terms Salesperson RecipientBayu SuryaNo ratings yet

- InvoiceDocument1 pageInvoiceSümît DãsNo ratings yet

- Account Statement From 17 Nov 2017 To 17 May 2018Document3 pagesAccount Statement From 17 Nov 2017 To 17 May 2018ganeshNo ratings yet

- Flight TicketDocument2 pagesFlight TicketThakur Pranay SinghNo ratings yet

- PGEscalation MatrixDocument1 pagePGEscalation MatrixThakur Pranay SinghNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- China Bank Vs CIR Passive Investment IncomeDocument7 pagesChina Bank Vs CIR Passive Investment IncomeThremzone17No ratings yet

- cLUBBING OF iNCOMEDocument18 pagescLUBBING OF iNCOMEDipinderNo ratings yet

- Template Slip Gaji Sederhana Dengan Kalkulator OtomatisDocument5 pagesTemplate Slip Gaji Sederhana Dengan Kalkulator OtomatisAden LeaNo ratings yet

- Calculating tax liability and interest for indirect tax paymentsDocument3 pagesCalculating tax liability and interest for indirect tax paymentsPraveen JoeNo ratings yet

- InvoiceDocument1 pageInvoiceAman MadhukarNo ratings yet

- Tax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalDocument1 pageTax Receipt Transport Department, Government of West Bengal Registration Authority UTTAR DINAJPUR RTO, West BengalSiwam ChoudharyNo ratings yet

- Salary Nov 2020Document2 pagesSalary Nov 2020Tarun RawatNo ratings yet

- Digitalized Economy Taxation Developments SummaryDocument148 pagesDigitalized Economy Taxation Developments SummaryRating AaNo ratings yet

- Company Name Employee Provident Fund Calculator (EPF)Document2 pagesCompany Name Employee Provident Fund Calculator (EPF)Roosy RoosyNo ratings yet

- NCR Frontliners 2017 TaxDocument12 pagesNCR Frontliners 2017 Taxjsus22No ratings yet

- Consulting Company Provides Tax Services and Accounting SupportDocument5 pagesConsulting Company Provides Tax Services and Accounting SupportsuhemiNo ratings yet

- Return of Organization Exempt From Income Tax: Paid Preparer Use OnlyDocument56 pagesReturn of Organization Exempt From Income Tax: Paid Preparer Use OnlySGNo ratings yet

- Chapter 08 Application The Costs of TaxationDocument28 pagesChapter 08 Application The Costs of TaxationThịnh Nguyễn PhúcNo ratings yet

- Charity Membership Form TemplateDocument2 pagesCharity Membership Form TemplateLIJITH KUMARNo ratings yet

- SlipDocument1 pageSlipPratikDuttaNo ratings yet

- Due Diligence-Tax Due DilDocument4 pagesDue Diligence-Tax Due DilEljoe VinluanNo ratings yet

- STAR LORD CORP. EMPLOYEE STOCK OPTIONSDocument20 pagesSTAR LORD CORP. EMPLOYEE STOCK OPTIONSadieNo ratings yet

- Mrunal Lecture 21 @Document6 pagesMrunal Lecture 21 @BASIC LIFENo ratings yet

- Problems 3 PRELIM TASK FINALDocument4 pagesProblems 3 PRELIM TASK FINALJohn Francis RosasNo ratings yet

- Bangladesh Tax Handbook 2015-2016Document128 pagesBangladesh Tax Handbook 2015-2016Syed Tamjidur RahmanNo ratings yet

- Question Tax Project Jan 2022 - 18012022Document7 pagesQuestion Tax Project Jan 2022 - 18012022MOHAMAD FARHAN AQMAL MOHD HERMIENo ratings yet

- DTC Agreement Between Israel and BelgiumDocument30 pagesDTC Agreement Between Israel and BelgiumOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Tax I R K FINAL AS AT 20 2 06Document315 pagesTax I R K FINAL AS AT 20 2 06Adarsh. UdayanNo ratings yet