Professional Documents

Culture Documents

Principles and Precepts of Economics: Section One

Principles and Precepts of Economics: Section One

Uploaded by

lag0 ratings0% found this document useful (0 votes)

3 views3 pagesOriginal Title

eco_text_sample

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesPrinciples and Precepts of Economics: Section One

Principles and Precepts of Economics: Section One

Uploaded by

lagCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Principles and Precepts of Economics

Topic 1

Defining

Economics

Chapter 1 Defining

Section One Economics

Introduction to Economics

A n economy is ba basically how people use limited

resources for more than one purpose. For example, if you have

enough wood for one projec

project, but need a new picnic table and a

new set of porch steps, yyou will have to decide which project

to build now, an

and which one to put off until additional

resources are av

available. That is essentially what people

mean when they talk about scarcity in economics. Wise

people learn to use limited resources responsibly.

Economics is ththe science of how money and goods are

exchanged.

Perhaps you have experienced

financial

f conflict in your own family.

Understanding

U a family economy

helps

h you to understand how a national

economy

e works. Your parents work

to

t exchange their time, skill, and effort

for

f financial compensation. Then, the

m

money is exchanged at stores or online

sshopping sites for goods or services

nee

needed by your family. Those resources

must then be shared; otherw

otherwise, conflicts will arise.

You can probably think of some things your family needs

weekly, such as groceries or fuel. Perhaps you can recall other

items that were bought with far less frequency, such as a new

vehicle. Most likely, you can think of a time when your family

had a need, but finances were not available to meet that need right

away. As such, you have first-hand knowledge of the concept of

scarcity.

Scarcity: limited resources

Family Economy: family Scarcity is also a community issue. The community could

policies to acquire goods and be your neighborhood, your scouting group, or even your local

services church. Each community has needs and a limited amount of

Compensation: payment for resources to meet those needs. People learn to find new ways

goods or services to get additional resources through cost-cutting, extra jobs,

shopping at thrift stores, or garage sales. For these endeavors to

© Copyright 2016, Paradigm Accelerated Curriculum 1 DUPLICATION BY WRITTEN PERMISSION ONLY.

be successful, people invest their time and a state national guard, and maintaining the

personal resources for the greater good. state government. These things can be

The more successfully you and your family expensive, so in addition to revenue sources

handle your own resources, the more good used by local cities, a state can also require

you can do to help others. its citizens to pay an income tax or sales tax.

Municipal Firemen

The largest of all economies is the

Another type of economy is a local federal economy. Our Federal Government

city economy. People in towns and cities oversees all aspects of governing the nation,

must find ways to raise funds to take care including raising revenues and providing

of sidewalks, provide for police, fire, and protection and essential services. As we will

ambulance services, and a lot of other things see later, our Federal Government provides

that require time and money. Cities raise far more services and resources to its citizens

funds in many ways, including local property than our Founding Fathers ever imagined

or sales taxes, license fees, punitive fees, and or intended. We will learn whether that is a

through utility fees for water, electric, and good or bad thing. Just as state governments

waste management. use state income taxes to raise funds, the

Federal Government collects federal income

A state economy works much like taxes, as well as many other types of taxes,

a local city economy, but on a much larger to raise revenue.

scale. Each state needs to provide services

such as maintaining state highways and Money drives most modern

providing for the common defense through economies, so let’s examine different types

of money. In order for paper money to

have value, it must be backed by something

of value. We will learn more about the

history of money later, but for now let’s just

consider some basic concepts.

Punitive Fees: fees collected by government as

Commodity money refers to using

punishment

Revenue: money collected through taxes

a tangible item of some kind as a source

Income Tax: a tax imposed on annual earnings of money. The most common type of

Founding Fathers: individuals who designed commodity money in history has been

America’s founding documents precious metals, like silver and gold. These

Commodity Money: money based on the value of commodities are rare (so they have value),

silver or gold are easy to mint into coins, and their value is

Tangible: an item detected by human senses universally recognized and accepted.

© Copyright 2016, Paradigm Accelerated Curriculum 2 DUPLICATION BY WRITTEN PERMISSION ONLY.

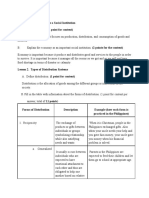

Chapter 1, Section 1, Topic 1

Commodity money is the safest kind its own, and is not backed by anything of real

of money. Until recent times, the United value. In and of itself, it is worthless. So,

States dollar bill was backed by gold and we will study where fiat money originates,

silver, and why it is accepted as payment for

therefore goods or services. For now, remember

a one this: every American bill currency,

dollar bill regardless of the denomination

had value (one’s, five’s,

because it ten’s, twenties,

could be etc.) is fiat money.

traded for Americans

the same accept it because

amount of gold or silver. the federal

People had faith in the government

paper dollar because it was operates on fiat

backed by precious metals. money.

Remember, commodity

money is the best kind of money. In the next topic, we will learn

about how government policies affect

Another type of money is called household economics.

representative money. This really isn’t

money at all, but represents real money. A

classic example is a check. If your employer

pays your wages with a check, you are paid

in representative money. You can take it to

a bank and exchange it for cash, which you

can then spend on goods or services. Of

course, you can deposit the funds into your

own checking account and write checks for

the things you need, thus using representative

money. LIFE PRINCIPLE:

Fiat money represents the worst kind

of money, because it has no intrinsic value.

People accept fiat money as payment for

goods or services because most governments

operate on fiat money. It has no real value of

Representative Money: check, money order, or

bank draft “Never spend your money before

Fiat Money: money made legal through you have earned it.”

government decree

Intrinsic: in and of itself -Thomas Jefferson

Denomination: the printed value of currency (Founder, 3rd U.S. President)

© Copyright 2016, Paradigm Accelerated Curriculum 3 DUPLICATION BY WRITTEN PERMISSION ONLY.

You might also like

- Cryptotrading Pro PDFDocument272 pagesCryptotrading Pro PDF425acb100% (3)

- 10 Practical Tools For A Resilient Local EconomyDocument2 pages10 Practical Tools For A Resilient Local EconomyJoanne PoyourowNo ratings yet

- Solution Manual For Principles of Economics 9th Edition N Gregory MankiwDocument24 pagesSolution Manual For Principles of Economics 9th Edition N Gregory MankiwToddNovakiqzmg93% (46)

- Quarter 1 Module 1: Economics As An Applied ScienceDocument25 pagesQuarter 1 Module 1: Economics As An Applied ScienceRubelyn Morales80% (5)

- NCERT Class 11 StatisticsDocument135 pagesNCERT Class 11 Statisticsuzbeck0028No ratings yet

- Module 1 FINP7Document3 pagesModule 1 FINP7gfdhgfhgfhgfhNo ratings yet

- Ebook PDF Multinational Financial Management 11th EditionDocument61 pagesEbook PDF Multinational Financial Management 11th Editionjefferson.kleckner559100% (48)

- Dwnload Full Principles of Macroeconomics Canadian 7th Edition Mankiw Solutions Manual PDFDocument36 pagesDwnload Full Principles of Macroeconomics Canadian 7th Edition Mankiw Solutions Manual PDFjosephsal1vv100% (10)

- 11th Social-Economics-Statistics For EconomicsDocument135 pages11th Social-Economics-Statistics For EconomicsChaitanya Kumar Katta100% (1)

- Basic MicroeconomicsDocument6 pagesBasic MicroeconomicsMark Levien ReluyaNo ratings yet

- Week 1 - LS4 - ResourcesDocument3 pagesWeek 1 - LS4 - ResourcesFahmia Angkal SalilaguiaNo ratings yet

- Lesson 1. The Economy As A Social InstitutionDocument6 pagesLesson 1. The Economy As A Social InstitutionKarl Harvey Drangey IgnatiusNo ratings yet

- Geo His 3 Unit 11Document16 pagesGeo His 3 Unit 11Fuencisla FeierNo ratings yet

- BL-ECON-6110-LEC-1923T INTRODUCTORY TO ECONOMICS Lesson 1 - Defining EconomicsDocument15 pagesBL-ECON-6110-LEC-1923T INTRODUCTORY TO ECONOMICS Lesson 1 - Defining EconomicsDougie ChanNo ratings yet

- Final Module 1Document15 pagesFinal Module 1Judy Ann VicenteNo ratings yet

- Econ 221 Chapter 4. Introduction To EconomicsDocument11 pagesEcon 221 Chapter 4. Introduction To EconomicsGrace CumamaoNo ratings yet

- EconomicsDocument38 pagesEconomicsEdgar KabahiziNo ratings yet

- Econ 20A Lecture 1 The Ten Principles of EconomicsDocument6 pagesEcon 20A Lecture 1 The Ten Principles of EconomicsMiranda ThomasNo ratings yet

- Econ101 10principlesDocument4 pagesEcon101 10principlesSaavedra, Reymarc L. 瑞马No ratings yet

- TLE G6 Q2 Module 2Document10 pagesTLE G6 Q2 Module 2Matt The idkNo ratings yet

- Learning ContentDocument11 pagesLearning ContentRegilyn Montero Arevalo100% (1)

- Q4 Elem HE 6 Week1Document4 pagesQ4 Elem HE 6 Week1Razelle DC Garcia100% (1)

- Scarcity and WantsDocument54 pagesScarcity and WantsMart NulazNo ratings yet

- Unit1-Topic2 Handout-Ten Principles of EconomicsDocument4 pagesUnit1-Topic2 Handout-Ten Principles of EconomicsRudolph FelipeNo ratings yet

- Hele 1ST GRADINGDocument19 pagesHele 1ST GRADINGNeil DeclaroNo ratings yet

- 10 Principles of Micro EconomicsDocument12 pages10 Principles of Micro EconomicsROHIT GOYAL 2123531No ratings yet

- Philippine Christian University: Understanding Culture, Society, and Politics (G 12) W 9 MAY 4-8, 2020Document7 pagesPhilippine Christian University: Understanding Culture, Society, and Politics (G 12) W 9 MAY 4-8, 2020Adrian DoblasNo ratings yet

- Reviewer Beed 9Document4 pagesReviewer Beed 9Pat VNo ratings yet

- Chapter 1 Study GuideDocument18 pagesChapter 1 Study GuidehollyevaNo ratings yet

- Applied Econ Simplified Moddule 1Document10 pagesApplied Econ Simplified Moddule 1Michael Fernandez ArevaloNo ratings yet

- Microeconomic Theory and Practice: Resource Utilization and EconomicsDocument4 pagesMicroeconomic Theory and Practice: Resource Utilization and EconomicsYah Yah CarioNo ratings yet

- Applied Economics Module 1 Q1Document15 pagesApplied Economics Module 1 Q1zettevasquez8No ratings yet

- Tle6 Q1 Week2Document6 pagesTle6 Q1 Week2Roy Bautista Manguyot100% (1)

- Econ HomeworkDocument2 pagesEcon HomeworkSithumi De SilvaNo ratings yet

- Manecon NotesDocument12 pagesManecon Noteskarenrinon06No ratings yet

- Microeconomics 10 PrinciplesDocument21 pagesMicroeconomics 10 PrinciplesSazain zahidNo ratings yet

- MODULE 1-Introduction in EconomicsDocument17 pagesMODULE 1-Introduction in EconomicsJohnmar Dela CruzNo ratings yet

- EconomicsDocument78 pagesEconomicsEliz CiprianoNo ratings yet

- Kami Export - 4T5KVBN2HcLLj3xggQ - LNWDocument26 pagesKami Export - 4T5KVBN2HcLLj3xggQ - LNWSylis VigilNo ratings yet

- Chapter One 1. Subject Matter of EconomicsDocument18 pagesChapter One 1. Subject Matter of Economicshayelom nigusNo ratings yet

- Module 1Document8 pagesModule 1AMYTHELNo ratings yet

- Fianance Q1W1 ModuleDocument7 pagesFianance Q1W1 Modulemara ellyn lacsonNo ratings yet

- Micro Economics Lecture 1Document1 pageMicro Economics Lecture 1mostafa abdoNo ratings yet

- Home ManagementDocument35 pagesHome ManagementNoraya AmbilNo ratings yet

- TLE HE 6 Module 1Document21 pagesTLE HE 6 Module 1Charish MaeNo ratings yet

- Texts For Special Translation Part I - RevisedDocument88 pagesTexts For Special Translation Part I - RevisedMacrame WorldNo ratings yet

- Economics Hand OutDocument2 pagesEconomics Hand OutCamille SantosNo ratings yet

- Foundation of EconomicsDocument32 pagesFoundation of EconomicsHusain khambatiNo ratings yet

- Review Lecture Notes Chapter 1Document4 pagesReview Lecture Notes Chapter 1- OriNo ratings yet

- MM Elect 6 Industrial and Agricultural Marketing Chapter 2Document2 pagesMM Elect 6 Industrial and Agricultural Marketing Chapter 2Drake Lawrence FuentabellaNo ratings yet

- Applied Economics NOTESDocument8 pagesApplied Economics NOTESMary Antonette VeronaNo ratings yet

- Merged File of All Units EDITEDDocument170 pagesMerged File of All Units EDITEDvinit tandel100% (1)

- Ten Principles of Economics: in This Chapter You Will - .Document7 pagesTen Principles of Economics: in This Chapter You Will - .Zafar Hameed GajizaiNo ratings yet

- AP Chapter1 Less 2Document2 pagesAP Chapter1 Less 2Hannah Denise BatallangNo ratings yet

- Resource Management Unit IIDocument14 pagesResource Management Unit IIGautam SinghNo ratings yet

- 01 Economics ReviewerDocument6 pages01 Economics Reviewerortega.johnrhonlieNo ratings yet

- Centro Cultural Sampedrano Introduction To Economics 11 "A" Pre-Med 03/26/2021Document6 pagesCentro Cultural Sampedrano Introduction To Economics 11 "A" Pre-Med 03/26/2021Grace MoranNo ratings yet

- Communication S2Document62 pagesCommunication S2Araicha AssiaNo ratings yet

- Lesson 6 USCPDocument7 pagesLesson 6 USCPKathleen SingularNo ratings yet

- 2 EconomicsDocument14 pages2 EconomicsThuyhuyen VoNo ratings yet

- The Business of Tomorrow: A World Without Cost-of-Living Issues, Poverty or Debt - A World Based on NeedsFrom EverandThe Business of Tomorrow: A World Without Cost-of-Living Issues, Poverty or Debt - A World Based on NeedsNo ratings yet

- WRX WhitepaperDocument22 pagesWRX WhitepaperJoyel DsouzaNo ratings yet

- Letter To GodDocument8 pagesLetter To GodMack Tripathi100% (1)

- CH 14Document9 pagesCH 14Pola PolzNo ratings yet

- Gasoil Outright - Middle East Gasoil FOB Arab Gulf (Platts) FutureDocument2 pagesGasoil Outright - Middle East Gasoil FOB Arab Gulf (Platts) Futureali alakaldiNo ratings yet

- Fund Size TER (Inm ) in % P.ADocument69 pagesFund Size TER (Inm ) in % P.ASam UkiyoNo ratings yet

- M7 MoneyDocument35 pagesM7 MoneyJohnny SinsNo ratings yet

- 221020-Dampak Resesi Dan Inflasi Global Terhadap Dunia Usaha Indonesia-WMGDocument18 pages221020-Dampak Resesi Dan Inflasi Global Terhadap Dunia Usaha Indonesia-WMGIPutuAdi SaputraNo ratings yet

- Algeria ProjectDocument24 pagesAlgeria ProjectAli SarwarNo ratings yet

- All Type of G.KDocument53 pagesAll Type of G.KShahidNo ratings yet

- Cotton University Cotton University Cotton University: Panbazar, Guwahati-01 Panbazar, Guwahati-01 Panbazar, Guwahati-01Document1 pageCotton University Cotton University Cotton University: Panbazar, Guwahati-01 Panbazar, Guwahati-01 Panbazar, Guwahati-01Mousumi DeviNo ratings yet

- Lednyr Ots Ognimod Tanay - Pililla Rizal Buy and Sell GroupDocument1 pageLednyr Ots Ognimod Tanay - Pililla Rizal Buy and Sell Grouparianne Dela cruzNo ratings yet

- Solved in September 1992 A Speculative Attack Compelled The United KingdomDocument1 pageSolved in September 1992 A Speculative Attack Compelled The United KingdomM Bilal SaleemNo ratings yet

- Rbi Working Paper Series: Estimation of Counterfeit Currency Notes in India - Alternative MethodologiesDocument39 pagesRbi Working Paper Series: Estimation of Counterfeit Currency Notes in India - Alternative MethodologiesAKHIL H KRISHNANNo ratings yet

- Palembang CoinsDocument29 pagesPalembang CoinsPablo Bustamante CarrascoNo ratings yet

- Chapter 11Document23 pagesChapter 11Fazila AzharNo ratings yet

- Interest Rates On FCNR DepositsDocument2 pagesInterest Rates On FCNR DepositsashishNo ratings yet

- Article 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaDocument9 pagesArticle 1: (Sept 16 2020) US Broke Rules by Imposing Tariffs On ChinaPranave NellikattilNo ratings yet

- PeruDocument79 pagesPeruFernando DiazNo ratings yet

- PAST TENSE ExercisesDocument5 pagesPAST TENSE ExercisesgeorgicristeaNo ratings yet

- LIZ LISA Official Online Store Girly Fashion TokDocument1 pageLIZ LISA Official Online Store Girly Fashion ToksinzvaNo ratings yet

- Sample PaperDocument5 pagesSample Papervenika.batrviiiNo ratings yet

- Aryan Shrivastava - F007 - ManagementDocument13 pagesAryan Shrivastava - F007 - ManagementAryan ShrivastavNo ratings yet

- Bit CoinDocument53 pagesBit CoinsiesmannNo ratings yet

- International Business Finance FINS3616: By: Mishal Manzoor M.manzoor@unsw - Edu.auDocument48 pagesInternational Business Finance FINS3616: By: Mishal Manzoor M.manzoor@unsw - Edu.auKelvin ChenNo ratings yet

- Volume 5 SFMDocument16 pagesVolume 5 SFMrajat sharmaNo ratings yet

- Summer Assignment Class 4Document14 pagesSummer Assignment Class 4Moinuddin RangrejNo ratings yet

- Sale - ST 2023-24 104 - 22-01-2024Document2 pagesSale - ST 2023-24 104 - 22-01-2024Satya SagarNo ratings yet