Professional Documents

Culture Documents

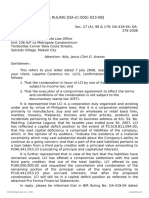

BIR RULING NO. 076-89: April 17, 1989

Uploaded by

andrea ibanezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BIR RULING NO. 076-89: April 17, 1989

Uploaded by

andrea ibanezCopyright:

Available Formats

April 17, 1989

BIR RULING NO. 076-89

28 000-00 076-89

Gentlemen:

This refers to your letter dated February 24, 1989 stating that General Motors

Pilipinas, Inc. (GMPI) is a domestic corporation organized under the laws of the

Philippines; that it is a joint venture corporation owned 60% by General Motors

Overseas Distribution Corporation (GM-US) and 40% by Isuzu Motors Limited of

Japan (ISUZU); that GMPI was engaged in the manufacture of transmissions and

components as well as in the assembly of cars and trucks (largely Isuzu) under the

former PCMP and PTMP programs of government; that in September 1985, due to

economic recession in the Philippines and the depressed automotive market, plus the

non-availability of foreign exchange for the importation of parts for car and truck

assemblies, GMPI ceased its manufacturing and assembly operations; that at the time

operations were terminated, GMPI was insolvent and has since remained insolvent;

that in meetings held in December 1985, the shareholders and the Board of Directors

of GMPI recommended the dissolution of GMPI; that in order to facilitate the

liquidation and dissolution of the company, on September 30, 1986, the stockholders

approved a resolution to shorten GMPI's corporate life to October 15, 1986; that

pursuant to said resolution, GMPI filed with the Securities and Exchange

Commission, an application to amend its Articles of Incorporation to shorten GMPI's

corporate life; that a liquidating trustee was designated to dispose the remaining

assets, satisfy the obligations and wind up the affairs of the company; that based on

the December 31, 1988 unaudited financial statements of GMPI, it has outstanding

liabilities/indebtedness to banks and affiliates in the following amounts: cdasia

Bank Debt

Non-Trade Related Principal P280,150

Interest 54,522

Trade Related Principal 246,942

Interest 48,093

Copyright 1994-2006 CD Technologies Asia, Inc. Taxation 2005 1

Due to Affiliated Companies

Isuzu Motors Limited P113,240

General Motors Corp. (GMC) 19,334 132,574

———— ————

TOTAL P762,281

=======

that the total outstanding liabilities to banks and GMC plus accrued interest amount to

P649,041,000; that the 1987 unaudited financial statements, as submitted with

GMPI's 1987 income tax return, show that as of December 31, 1987 GMPI had a

capital deficiency of P664,522,000; that based on the December 31, 1988 unaudited

financial statements, the capital deficiency is P739,057,000; that pursuant to

liquidation accounting principles, the value of the property, plant and equipment was

adjusted to P20,450,000; that since GM-US, has no further interest to continue its

ownership in the inactive corporate shell of GMPI, GM-US, will assign its 60%

shareholdings in GMPI to Isuzu; that in connection with the proposed acquisition of

the GMPI shares from GM-US it was agreed that GMPI would "clean-up" the

liabilities shown in the financial statements and that it would have no major current

outstanding liabilities except the liability to Isuzu; that it is proposed that this would

be accomplished when the shares are transferred in three steps, as follows: (1) By

having GMPI's creditor banks waive accrued interest totalling P102,615,000 on the

non-trade and trade related debt; (2) By having these banks assign to GM-US, its

GMPI non-trade related receivables totalling P280,150,000. At that time GM-US will

condone the total GMPI indebtedness due to it amounting to P299,484,000 including

the aforementioned non-trade debt as well as other non-trade liabilities due GMC

totalling P19,334,999; (3) By having the banks grant a participation to GM-US in

GMPI trade related receivables totalling P246,942,000 GM-US would then assign

these receivables to Isuzu. As approved by the Central Bank of the Philippines and

the SEC, Isuzu would accept pesos from GMPI in repayment of the trade debt and

simultaneously reinvest the pesos in GMPI as paid-in surplus; that subsequent to the

three-step transaction outlined above, and after GM-US assignment of GMPI shares

to Isuzu, the latter as the new 100% parent company may consider infusing additional

capital to restore the business into a viable operation and eliminate the capital

deficiency; that inasmuch as the business operations of the company will be revived

in the future by Isuzu, the company will resume its "going concern" status following

the transfer of share by GM-US; and that as a going concern, its assets previously

adjusted to liquidation values shall be restored to its valuation prior to liquidation of

P19,579,000 including depreciation and amortization up to December 31, 1988.

In connection therewith, you now request confirmation of your opinion to the

Copyright 1994-2006 CD Technologies Asia, Inc. Taxation 2005 2

effect that the bank's waiver of accrued interest on the non-trade and trade related

indebtedness of GMPI and GM-US condonation or forgiveness of GMPI's non-trade

related indebtedness are not subject to income tax nor to gift tax.

In reply, thereto, I have the honor to inform you that your opinion is hereby

confirmed. Cancellation and forgiveness of indebtedness may amount to a payment of

income, to a gift, or to a capital transaction, dependent upon the circumstances. If for

example, an individual performs services for a creditor who, in consideration thereof

cancels the debt, income to that amount is realized by the debtor as compensation for

his services. If, however, a creditor merely desires to benefit a debtor and without any

consideration therefor cancels the debt, the amount of the debt is a gift from the

creditor to the debtor and need not be included in the latter's gross income. If a

corporation to which a stockholder is indebted forgives the debt, the transaction has

the effect of the payment of a dividend. (Sec. 50 Revenue Regulations No. 2) The

waiver of interest by the banks on non-trade and trade related indebtedness of GMPI

is not subject to income tax considering that the deduction of said interest as expense

in prior years did not offset nor reduce the taxable income of GMPI since it was in a

financial loss position even without the deduction. (See Barnhart-Marrow

Consolidated v. Commissioner of Internal Revenue, 47 BTA 590) Moreover, when a

creditor cancels a debt as part of a business transaction, the debtor is enriched or its

net assets has been increased and, therefore, he realized taxable income (Philippine

Fiber Processing Co. v. CIR, CTA Case No. 1407 Dec. 29, 1966). However, a

transaction whereby nothing of exchangeable value comes to or is received by a

taxpayer does not give rise to or create taxable income. (See Dallas Transfer and

Terminal Warehouse Co. v. Commissioner of Internal Revenue 5 Cir. 70 F 2d 95,

13AFTR 930) Accordingly, the condonation of GMPI's indebtedness by GM-US is

not subject to income tax since before and after the condonation GMPI remains

insolvent, i.e., in a capital deficiency position. The condonation is likewise not subject

to gift tax since there is no donative interest on the part of GM-US but solely for

business consideration since Isuzu will only acquire the GMPI shares from GM-US if

GMPI has a "clean" balance sheet with no outstanding liabilities except those to

Isuzu.

Moreover, a return to solvency due to a possible future additional capital

infusion by Isuzu and/or subsequent profitability in a different taxable year will not

affect the non-taxability of the condonation. cdta

Very truly yours,

Copyright 1994-2006 CD Technologies Asia, Inc. Taxation 2005 3

(SGD.) JOSE U. ONG

Commissioner

Copyright 1994-2006 CD Technologies Asia, Inc. Taxation 2005 4

You might also like

- Full Download Leadership Theory and Practice 7th Edition Northouse Solutions ManualDocument34 pagesFull Download Leadership Theory and Practice 7th Edition Northouse Solutions Manualdanielcmmmadams100% (37)

- Wisconsin Inspection Bureau V WhitmanDocument4 pagesWisconsin Inspection Bureau V WhitmanPrinceNo ratings yet

- IN RE Petition For The Probate of The Last Will and Testament of Cecilia Esguerra Cosico VsDocument2 pagesIN RE Petition For The Probate of The Last Will and Testament of Cecilia Esguerra Cosico Vsfglenn dizon0% (1)

- Colin Combe - Introduction To Management (2014, Oxford University Press) - Libgen - LiDocument660 pagesColin Combe - Introduction To Management (2014, Oxford University Press) - Libgen - Lisdysangco100% (1)

- G.R. No. 180226 (Notice) - Paterno v. Arcaya-ChuaDocument13 pagesG.R. No. 180226 (Notice) - Paterno v. Arcaya-ChuaJennyMariedeLeon100% (1)

- BIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Document5 pagesBIR Ruling (DA - (C-005) 023-08) (Condonation of Debt)Archie Guevarra100% (3)

- Revenue Regulations No. 02-40Document39 pagesRevenue Regulations No. 02-40saintkarri92% (12)

- Cir VS Manila BankersDocument1 pageCir VS Manila BankersAnny YanongNo ratings yet

- BNL MANAGEMENT CORPORATION, Et Al.,petitioners v. REYNALDO UYDocument2 pagesBNL MANAGEMENT CORPORATION, Et Al.,petitioners v. REYNALDO UYabbywinster100% (1)

- List of Cases Civil Law 2018-2019Document18 pagesList of Cases Civil Law 2018-2019Rizza Angela MangallenoNo ratings yet

- RR 8-98Document3 pagesRR 8-98matinikkiNo ratings yet

- Bir Ruling No. 1243-18 - JvsDocument3 pagesBir Ruling No. 1243-18 - Jvsjohn allen MarillaNo ratings yet

- Adoption of Karen Herico LicerioDocument2 pagesAdoption of Karen Herico LiceriojonessamenorcaNo ratings yet

- BIR Rul. 85-95Document3 pagesBIR Rul. 85-95sdysangcoNo ratings yet

- BIR Ruling 184-90Document1 pageBIR Ruling 184-90Anonymous ensCwqNo ratings yet

- Case Digest (Metro Pacific Corp. vs. CIRDocument2 pagesCase Digest (Metro Pacific Corp. vs. CIRAngelo CastilloNo ratings yet

- RR 2 (1940)Document41 pagesRR 2 (1940)Mariano Rentomes100% (1)

- Bir Ruling 317-92Document1 pageBir Ruling 317-92matinikkiNo ratings yet

- Lagrosas V Brsitol Myers (GR 168637)Document2 pagesLagrosas V Brsitol Myers (GR 168637)Verlie FajardoNo ratings yet

- 16 Eastern Telecommunications Philippines, Inc. v. International Communication CorporationDocument2 pages16 Eastern Telecommunications Philippines, Inc. v. International Communication CorporationRem SerranoNo ratings yet

- Legaspi Towers 300 Vs MUERDocument4 pagesLegaspi Towers 300 Vs MUERGenevieve BermudoNo ratings yet

- RMC 48-90Document2 pagesRMC 48-90cmv mendozaNo ratings yet

- RR 14-77Document1 pageRR 14-77cheska_abigail950No ratings yet

- BIR Rul. 102-95Document2 pagesBIR Rul. 102-95sdysangcoNo ratings yet

- Vat Ruling No 7-2006Document2 pagesVat Ruling No 7-2006MCNo ratings yet

- Asia's Emerging Dragon Corporation vs. Department of Transportation and CommunicationsDocument133 pagesAsia's Emerging Dragon Corporation vs. Department of Transportation and CommunicationsBoyTibsNo ratings yet

- Bir Ruling No. 455-93Document2 pagesBir Ruling No. 455-93Cristelle Elaine ColleraNo ratings yet

- RR 12-85Document3 pagesRR 12-85mnyng100% (1)

- Scott Consultants Vs CADocument1 pageScott Consultants Vs CAEllen Glae DaquipilNo ratings yet

- BIR Ruling 05-90Document1 pageBIR Ruling 05-90Andrea RioNo ratings yet

- City of Makati v. CIR - DigestDocument5 pagesCity of Makati v. CIR - DigestAlyssa Marie SobereNo ratings yet

- 068 CALDO Olave v. CanlasDocument2 pages068 CALDO Olave v. CanlasPatrick CaldoNo ratings yet

- 21 The Law Firm of Laguesma vs. COADocument2 pages21 The Law Firm of Laguesma vs. COACheeno PelayoNo ratings yet

- Liquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119Document3 pagesLiquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119brendamanganaanNo ratings yet

- Evidence - Custodio ReviewerDocument51 pagesEvidence - Custodio Revieweraster beane100% (1)

- Cir V RufinoDocument3 pagesCir V Rufinochrissamagat100% (1)

- LZK Holdings and Development Corporation Vs Planters Development BankDocument2 pagesLZK Holdings and Development Corporation Vs Planters Development BankThomas Vincent O. PantaleonNo ratings yet

- RR 10-98Document2 pagesRR 10-98matinikkiNo ratings yet

- Escheat or Reversion ProceedingsDocument30 pagesEscheat or Reversion ProceedingsRonna Faith MonzonNo ratings yet

- Cir vs. PlacerdomeDocument2 pagesCir vs. PlacerdomeMIKHAEL MEDRANONo ratings yet

- Manotoc v. CADocument3 pagesManotoc v. CAJazz TraceyNo ratings yet

- Ungab Doctrine and Fortune Tobacco Doctrine TAXDocument2 pagesUngab Doctrine and Fortune Tobacco Doctrine TAXGeorge PandaNo ratings yet

- Criminal Law - People-V-NieveraDocument3 pagesCriminal Law - People-V-NieveraAmmie AsturiasNo ratings yet

- Eleosida v. Local Civil Registrar of QCDocument2 pagesEleosida v. Local Civil Registrar of QCEurika RosarioNo ratings yet

- Dof Order No. 149-95Document1 pageDof Order No. 149-95matinikkiNo ratings yet

- CIR v. MarubeniDocument9 pagesCIR v. MarubeniMariano RentomesNo ratings yet

- Cir Vs Sekisui Jushi PH: Doctrine/SDocument2 pagesCir Vs Sekisui Jushi PH: Doctrine/SIshNo ratings yet

- Tax Refunds and Credits: Nature and BasisDocument3 pagesTax Refunds and Credits: Nature and BasisJoshua Erik MadriaNo ratings yet

- Rivera Vs FlorendoDocument2 pagesRivera Vs FlorendoHv EstokNo ratings yet

- Francler Onde VS Office of The Local Civil Registrar of Las Pinas CityDocument2 pagesFrancler Onde VS Office of The Local Civil Registrar of Las Pinas CityCarmille MagnoNo ratings yet

- BIR Ruling 205-99Document3 pagesBIR Ruling 205-99Raymond SanchezNo ratings yet

- Rivera vs. Florendo DigestDocument2 pagesRivera vs. Florendo DigestJayson Lloyd P. MaquilanNo ratings yet

- Buyco v. BaraquiaDocument2 pagesBuyco v. BaraquiaJajang MimidNo ratings yet

- De Papa V CamachoDocument2 pagesDe Papa V CamachoAngela Conejero50% (2)

- Peralta Summary NotesDocument4 pagesPeralta Summary NotesMemai Avila100% (1)

- RR 16-99Document6 pagesRR 16-99matinikkiNo ratings yet

- 32 College of Oral & Dental Surgery V CTADocument2 pages32 College of Oral & Dental Surgery V CTAReinier Jeffrey AbdonNo ratings yet

- 52 CIR V LedesmaDocument4 pages52 CIR V LedesmaMiggy CardenasNo ratings yet

- BIR Ruling DA - (C-267) 672-09Document3 pagesBIR Ruling DA - (C-267) 672-09Marlene TongsonNo ratings yet

- BIR Ruling (DA-335) 815-09Document5 pagesBIR Ruling (DA-335) 815-09Ren Mar CruzNo ratings yet

- Bir Ruling (Da - (C-005) 023-08)Document4 pagesBir Ruling (Da - (C-005) 023-08)Marlene TongsonNo ratings yet

- 23 CIR Vs Secretary of Justice and PAGCORDocument4 pages23 CIR Vs Secretary of Justice and PAGCORIan Villafuerte100% (1)

- An Introduction To Theory and PracticeDocument16 pagesAn Introduction To Theory and PracticesdysangcoNo ratings yet

- Approaches Essay and Discussion QuestionsDocument1 pageApproaches Essay and Discussion QuestionssdysangcoNo ratings yet

- LLM FAQsDocument5 pagesLLM FAQssdysangcoNo ratings yet

- 1987 PH Constitution (Filipino)Document77 pages1987 PH Constitution (Filipino)sdysangcoNo ratings yet

- NUS - Faculty of Law - Asia's Global Law SchoolDocument6 pagesNUS - Faculty of Law - Asia's Global Law SchoolsdysangcoNo ratings yet

- 2008 Political LawDocument4 pages2008 Political LawsdysangcoNo ratings yet

- Opinion - Why I Stopped Running During The Pandemic (And How I Started Again) - The New York TimesDocument3 pagesOpinion - Why I Stopped Running During The Pandemic (And How I Started Again) - The New York TimessdysangcoNo ratings yet

- Application ProceduresDocument3 pagesApplication ProceduressdysangcoNo ratings yet

- Opinion - How To Run The New York City Marathon, Slowly - The New York TimesDocument3 pagesOpinion - How To Run The New York City Marathon, Slowly - The New York TimessdysangcoNo ratings yet

- The Legacy of NeofunctionalismDocument10 pagesThe Legacy of NeofunctionalismsdysangcoNo ratings yet

- 2006 Political and Public International LawDocument3 pages2006 Political and Public International LawsdysangcoNo ratings yet

- 2007 Civil LawDocument4 pages2007 Civil LawsdysangcoNo ratings yet

- A Practical Guide To CertiorariDocument23 pagesA Practical Guide To CertiorarisdysangcoNo ratings yet

- G.R. No. 107383Document3 pagesG.R. No. 107383sdysangcoNo ratings yet

- 2006 Civil LawDocument5 pages2006 Civil LawsdysangcoNo ratings yet

- Petitioners Vs Vs Respondents: Third DivisionDocument4 pagesPetitioners Vs Vs Respondents: Third DivisionsdysangcoNo ratings yet

- Petitioner Respondents: RCBC Bankard Services Corporation, Moises Oracion, Jr. and EmilyDocument13 pagesPetitioner Respondents: RCBC Bankard Services Corporation, Moises Oracion, Jr. and EmilysdysangcoNo ratings yet

- First Division: Notice NoticeDocument10 pagesFirst Division: Notice NoticesdysangcoNo ratings yet

- GR No 246466 PEOPLE OF THE PHILIPPINES VS REYMAR MASILANG Y LACISTEDocument9 pagesGR No 246466 PEOPLE OF THE PHILIPPINES VS REYMAR MASILANG Y LACISTEsdysangcoNo ratings yet

- G.R. No. 179243 - Alejandro v. BernasDocument9 pagesG.R. No. 179243 - Alejandro v. BernassdysangcoNo ratings yet

- G.R. Nos. L-20246-48Document4 pagesG.R. Nos. L-20246-48sdysangcoNo ratings yet

- Fabric Study - (Textbook + Practical Manual) XIIDocument90 pagesFabric Study - (Textbook + Practical Manual) XIIAn Bn50% (2)

- YB1941Document504 pagesYB1941Brendan Paul Valiant100% (1)

- National Geographic Kids - 2020 10Document36 pagesNational Geographic Kids - 2020 10Vilius ŽirgulisNo ratings yet

- CLASS NOTES - Bill of PreliminariesDocument38 pagesCLASS NOTES - Bill of PreliminariesJeany Rose Borata0% (1)

- Law and It AssignmentDocument16 pagesLaw and It AssignmentQadir JavedNo ratings yet

- Chart Book - Corporate Restructuring Insolvency Liquidation and Winding Up - CS Vaibhav Chitlangia - Yes Academy, PuneDocument47 pagesChart Book - Corporate Restructuring Insolvency Liquidation and Winding Up - CS Vaibhav Chitlangia - Yes Academy, PuneJohn carollNo ratings yet

- Compound Interest Compounding More Than Once A YearDocument15 pagesCompound Interest Compounding More Than Once A YearJerry Mae RanesNo ratings yet

- BS en 14399-3-2015Document32 pagesBS en 14399-3-2015WeldedSplice100% (3)

- Evidence NotesDocument4 pagesEvidence NotesAdv Sheetal SaylekarNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- ManagerDocument2 pagesManagerapi-121454716No ratings yet

- Consolidation of Financial InstitutionsDocument2 pagesConsolidation of Financial InstitutionsPatricia SorianoNo ratings yet

- Nabi Musa and The MountainDocument2 pagesNabi Musa and The MountainmubeenNo ratings yet

- Approved JudgmentDocument42 pagesApproved JudgmentANDRAS Mihaly AlmasanNo ratings yet

- Akbar ArchiectureDocument52 pagesAkbar ArchiectureshaazNo ratings yet

- Crossroads of European Histories Multiple Outlooks On Five Key Moments in The History of Europe by Stradling, RobertDocument396 pagesCrossroads of European Histories Multiple Outlooks On Five Key Moments in The History of Europe by Stradling, RobertFarah ZhahirahNo ratings yet

- Q4 Applied Eco Learning Material Week7Document8 pagesQ4 Applied Eco Learning Material Week7marvi salmingoNo ratings yet

- Manonmaniam Sundaranar University Tirunelveli - 12: Appendix - Ae24Document39 pagesManonmaniam Sundaranar University Tirunelveli - 12: Appendix - Ae24Gopi KrishzNo ratings yet

- Gender and FamilyDocument21 pagesGender and Familychristian garciaNo ratings yet

- Health Benefits of Financial Inclusion A Literature ReviewDocument7 pagesHealth Benefits of Financial Inclusion A Literature Reviewl1wot1j1fon3No ratings yet

- All MinistryDocument2 pagesAll MinistryManish BodarNo ratings yet

- Fixed Assets: User GuideDocument165 pagesFixed Assets: User GuideAi Li HengNo ratings yet

- How It Began: The Chief Girl Scout Medal SchemeDocument7 pagesHow It Began: The Chief Girl Scout Medal SchemeShiarra Madeline RamosNo ratings yet

- Jaime U. Gosiaco, vs. Leticia Ching and Edwin CastaDocument33 pagesJaime U. Gosiaco, vs. Leticia Ching and Edwin CastaClaudia Rina LapazNo ratings yet

- Sentence CorrectionDocument19 pagesSentence CorrectionVinay SinghNo ratings yet

- Scale Aircraft Modelling December 2017 PDFDocument96 pagesScale Aircraft Modelling December 2017 PDFAnonymous N13Jdn100% (2)

- Pulalun Gets Recognition - Quo Vadis Other SultansDocument2 pagesPulalun Gets Recognition - Quo Vadis Other SultansIcas PhilsNo ratings yet

- Coke CaseDocument1 pageCoke Caserahul_madhyaniNo ratings yet

- Fashion Design 6Document7 pagesFashion Design 6RichaNo ratings yet