Professional Documents

Culture Documents

Advanced Accounts Mid Term

Advanced Accounts Mid Term

Uploaded by

Rishabh Singh0 ratings0% found this document useful (0 votes)

32 views2 pagesThe document provides instructions for a mid-semester examination for a Bachelor of Commerce program. It includes 4 multiple choice questions related to advance accounts, covering topics like consignment accounting, joint ventures, and profit calculations. Students are asked to answer the questions in a Word document and upload it to the learning management system.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides instructions for a mid-semester examination for a Bachelor of Commerce program. It includes 4 multiple choice questions related to advance accounts, covering topics like consignment accounting, joint ventures, and profit calculations. Students are asked to answer the questions in a Word document and upload it to the learning management system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

32 views2 pagesAdvanced Accounts Mid Term

Advanced Accounts Mid Term

Uploaded by

Rishabh SinghThe document provides instructions for a mid-semester examination for a Bachelor of Commerce program. It includes 4 multiple choice questions related to advance accounts, covering topics like consignment accounting, joint ventures, and profit calculations. Students are asked to answer the questions in a Word document and upload it to the learning management system.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

Name:

Enrolment No:

UNIVERSITY OF PETROLEUM & ENERGY STUDIES

Mid Semester Examination (Online) – March, 2022

Program:B.Com (H) Semester:

Subject/Course: Advance Accounts Max. Marks: 50

Course Code: FINC-2022 Duration: 2 Hours

IMPORTANT INSTRUCTIONS

1. The student must write his/her name and enrolment no. in the space designated above.

2. The questions have to be answered in this MS Word document.

3. After attempting the questions in this document, the student has to upload this MS Word document on

Blackboard.

Q.No Marks COs

5,000 shirts were consigned by Tanuja & Co. of Delhi to Dabar of Tokyo

at cost of ` 375 each. Tanuja & Co. paid freight ` 50,000 and Insurance `

7,500.

During the transit 500 shirts were totally damaged by fire. Dabar took

delivery of the remaining shirts and paid ` 72,000 on custom duty.

Dabar had sent a bank draft to Tanuja & Co. for ` 2,50,000 as advance

payment. 4,000 shirts were sold by him at ` 500 each. Expenses incurred

1 by Dabar on godown rent and advertisement etc. amounted to ` 10,000. He 10 CO1,2

is entitled to a commission of 5%

One of the customer to whom the goods were sold on credit could not pay

the cost of 25 shirts.

Prepare the Consignment Account and the Account of Dabar in the books

of Tanuja & Co. Dabar settled his account

immediately. Nothing was recovered from the insurer for the damaged

goods.

X and Y entered into a joint venture business to buy and sale garments to

share profits or losses in the ratio of 5:3. X supplied 400 bales of shirting at

` 500 each and also paid ` 18,000 as carriage & insurance. Y supplied 500

bales of suiting at ` 480 each and paid ` 22,000 as advertisement &

carriage. X paid ` 50,000 as advance to X.

2 X sold 500 bales of suiting at ` 600 each for cash and also all 400 bales of 10 CO1,2

shirting at ` 650 each for cash. X is entitles for commission of 2.5% on

total sales plus an allowance of ` 2,000 for looking after business. The joint

venture was closed and the claims were settled.

Prepare Joint Venture A/c and Y’S A/c in the books of X and X’s A/c in

the books of Y.

3 X Ltd. has a retail branch at Puri. Goods are sold at 60% profit on cost. 10 CO1,2

The wholesale price is cost plus 40%. Goods are invoiced from Delhi H.O.

to branch at Puri at Wholesale price. From the following particulars

ascertain the profit made at H.O. and branch for the year ended 31st March

2013.

Particulars H.O Branch

Stock on 01.04.2012 700000 ------

Purchase 4200000 -------

Goods sent to branch 1512000 -------

at I.P

SALES 4284000 1440000

Stock on 31.3.2013 1680000 252000

expenses 80000 40000

Sales at H.O. are made only on wholesale basis and that at branch only to

customers. Stock at H.O. is valued at

invoice price.

4 What is consignment states its features and differentiate consignment with 10 CO1

sale?

Bharat Cycles Ltd. of Mumbai sent 400 cycles @ `200 per cycle to

Chandra & Sons of Udaipur. Consigne paid 1,400 carriage and ` 600 for

insurance. On the way due to truck accident 100 cycles are fully destroyed

and only ¼ of purchase price is received from them. Then Chandra & Sons

5 sold 240 cycle @ ` 250 per cycle and sent the demand draft after deducting 10 CO1, 2

` 1,200 for octroi, ` 600 for sales expenses, and ` 2400 for his commission.

Consignor got 12,500 from insurance Co. for abnormal loss. Calculate the

value of abnormal loss and unsold stock. (a) if abnormal loss occurs in

transit of goods (b) if abnormal loss occurs at consignee's godown.

ANSWERS

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Liabilities: Problem 1Document3 pagesLiabilities: Problem 1Frederick Abella0% (1)

- Compensation ManagementDocument24 pagesCompensation ManagementAmit Sharma100% (1)

- Final Account With AnswersDocument23 pagesFinal Account With Answerskunjap0% (1)

- Fiverr Earning SheetDocument1 pageFiverr Earning SheetKagami TaigaNo ratings yet

- Developing A Marketing Strategy For Nonprofit Organizations An Exploratory StudyDocument19 pagesDeveloping A Marketing Strategy For Nonprofit Organizations An Exploratory Studyaurora rebussiNo ratings yet

- Information Security PolicyDocument33 pagesInformation Security PolicyElbert100% (2)

- Test AfarDocument24 pagesTest AfarZyrelle Delgado100% (3)

- Liabilities: Problem 1Document8 pagesLiabilities: Problem 1Frederick AbellaNo ratings yet

- Product and CostDocument49 pagesProduct and CostSahilNo ratings yet

- JPM Intro To Credit DerivativesDocument88 pagesJPM Intro To Credit DerivativesJackTaNo ratings yet

- Business Area: Tcode: Ox03: Whether A Single Business Area Can Be Used by Two or More Company Codes?Document41 pagesBusiness Area: Tcode: Ox03: Whether A Single Business Area Can Be Used by Two or More Company Codes?fharooksNo ratings yet

- 2-28 Computing Cost of Goods Manufactured and Cost of Goods Sold. The Following Are Account Be Balances Relating To 2019 (In Thousands)Document2 pages2-28 Computing Cost of Goods Manufactured and Cost of Goods Sold. The Following Are Account Be Balances Relating To 2019 (In Thousands)Lordy AdanzaNo ratings yet

- AssignmentDocument3 pagesAssignmentjanineNo ratings yet

- Junqueira's Basic Histology Text & Atlas, 12eDocument10 pagesJunqueira's Basic Histology Text & Atlas, 12eRod80% (10)

- CSV Full Document PDFDocument39 pagesCSV Full Document PDFAbhijeet100% (1)

- Answer: C - 465,000Document9 pagesAnswer: C - 465,000kyle G50% (2)

- Prequalifying Exam Level 1 Set B AK FSUU AccountingDocument9 pagesPrequalifying Exam Level 1 Set B AK FSUU AccountingRobert CastilloNo ratings yet

- Consignment Class WorkDocument4 pagesConsignment Class WorkHarsh GossainNo ratings yet

- Model Question Financial Accounting - IIDocument3 pagesModel Question Financial Accounting - IIEswari Gk100% (1)

- Acc17 - Liabilities and Income TaxDocument7 pagesAcc17 - Liabilities and Income TaxRarajNo ratings yet

- Venture of Joint Nature Class NotesDocument22 pagesVenture of Joint Nature Class NotesDbNo ratings yet

- HKABE 2014-15 Paper 1 QuestionDocument14 pagesHKABE 2014-15 Paper 1 QuestionChan Wai KuenNo ratings yet

- 2nd-Year AST FTE 2SAY2223Document10 pages2nd-Year AST FTE 2SAY2223rylNo ratings yet

- 2018 Fin Acc Sem 1Document4 pages2018 Fin Acc Sem 1Namrata BaruaNo ratings yet

- FINAL For Students Premium and Warranry Liability and LiabilitiesDocument8 pagesFINAL For Students Premium and Warranry Liability and LiabilitiesHardly Dare GonzalesNo ratings yet

- Attempt Any Four Questions. All Questions Carry Equal MarksDocument3 pagesAttempt Any Four Questions. All Questions Carry Equal MarksVishwas Srivastava 371No ratings yet

- AFARDocument17 pagesAFARChristine Mae MangahasNo ratings yet

- DySAS General Review Acctg6 - AnsDocument11 pagesDySAS General Review Acctg6 - Ansyasira0% (1)

- Mock Paper-1 (WIth Answer)Document13 pagesMock Paper-1 (WIth Answer)RNo ratings yet

- ACC 108 Prov Conting Prem WarrantDocument4 pagesACC 108 Prov Conting Prem WarrantGhie RodriguezNo ratings yet

- 20ucm2c03 20 05 2021Document3 pages20ucm2c03 20 05 2021VISHAGAN MNo ratings yet

- Chapter 1-4 QuizDocument11 pagesChapter 1-4 Quizspur iousNo ratings yet

- Far Drill2Document4 pagesFar Drill2Jung Hwan SoNo ratings yet

- Mock Test Qe1 1Document31 pagesMock Test Qe1 1Ma. Fatima H. FabayNo ratings yet

- For Students Provision and Contingent LiabilityDocument4 pagesFor Students Provision and Contingent LiabilityHardly Dare GonzalesNo ratings yet

- Intacc3 Other Problems On ProvisionsDocument8 pagesIntacc3 Other Problems On ProvisionsMa. Nica Del RosarioNo ratings yet

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Prime Academy 34 Session Progress Test - Advanced Accounting No. of Pages: 7 Total Marks: 75 Time Allowed: 2Hrs Part - ADocument46 pagesPrime Academy 34 Session Progress Test - Advanced Accounting No. of Pages: 7 Total Marks: 75 Time Allowed: 2Hrs Part - ALalitha NagarajanNo ratings yet

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- AFAR FinalMockBoard ADocument11 pagesAFAR FinalMockBoard ACattleyaNo ratings yet

- PAS37 ProbsDocument4 pagesPAS37 ProbsAngelicaNo ratings yet

- Nulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Document2 pagesNulpmss - 47.11.34.16110.03.2022 - 2 PM - Bomhc101 - Financial Accounting - 2021Shyamal dasNo ratings yet

- MTP 2 AccountsDocument8 pagesMTP 2 AccountssuzalaggarwalllNo ratings yet

- BMGT 220 Accounting Principles ExamDocument9 pagesBMGT 220 Accounting Principles ExamPrinciples of Accounting0% (1)

- PPE and Inventory-For DiscussionDocument8 pagesPPE and Inventory-For DiscussionAndrea Gail GatpandanNo ratings yet

- FTME Key To CorrectionDocument12 pagesFTME Key To CorrectionABMAYALADANO ,ErvinNo ratings yet

- Inter Classwork ModuleDocument90 pagesInter Classwork ModuleAjith Rohith GopakumarNo ratings yet

- IA 1 and 2 - Midterm Quiz - Student FileDocument21 pagesIA 1 and 2 - Midterm Quiz - Student FileDaniella Mae ElipNo ratings yet

- ACCTG 16 FAR W2 Problems Part 2 PDFDocument6 pagesACCTG 16 FAR W2 Problems Part 2 PDFLabLab ChattoNo ratings yet

- BSAMERCHANDISING2021Document5 pagesBSAMERCHANDISING2021Jean MaeNo ratings yet

- Human Resources 3Document104 pagesHuman Resources 3Harsh 21COM1555No ratings yet

- Trắc nghiệmDocument8 pagesTrắc nghiệmHồ Đan Thục0% (1)

- FAR-08 Provision & ContingenciesDocument4 pagesFAR-08 Provision & ContingenciesKim Cristian MaañoNo ratings yet

- ExtAud 3 Quiz 5 Wo AnswersDocument8 pagesExtAud 3 Quiz 5 Wo AnswersJANET ILLESESNo ratings yet

- Test2 AfarDocument24 pagesTest2 AfarZyrelle DelgadoNo ratings yet

- 1018 - Comcc1 - L - 2 - Financial AccountingDocument2 pages1018 - Comcc1 - L - 2 - Financial AccountingPrashantNo ratings yet

- Consignments: Customers in Accounting For Revenues FromDocument22 pagesConsignments: Customers in Accounting For Revenues FromVine AlparitoNo ratings yet

- DocxDocument4 pagesDocxKimmy Shawwy0% (1)

- 9419 - Joint ArrangementDocument4 pages9419 - Joint Arrangementjsmozol3434qcNo ratings yet

- 2015 Bcom Iisem AfaDocument4 pages2015 Bcom Iisem AfaSanthosh KumarNo ratings yet

- Model Evaluation February 2011 AccountingDocument4 pagesModel Evaluation February 2011 Accountingsharathk916No ratings yet

- Hand Out 2Document6 pagesHand Out 2Layka ResorezNo ratings yet

- Audit of Liabilities - Set ADocument5 pagesAudit of Liabilities - Set AZyrah Mae SaezNo ratings yet

- 640 / 240 / 260: Advanced Financial Accounting (New Regulations)Document7 pages640 / 240 / 260: Advanced Financial Accounting (New Regulations)Emind Annamalai JPNagarNo ratings yet

- Qualifying Examination: Financial Accounting 2Document11 pagesQualifying Examination: Financial Accounting 2Patricia ByunNo ratings yet

- Fundamental of Accounting I Assigment IIDocument6 pagesFundamental of Accounting I Assigment IIadinannejash146No ratings yet

- 25511764Document8 pages25511764JessaNo ratings yet

- Compre23 FARDocument12 pagesCompre23 FARchristinemariet.ramirezNo ratings yet

- Ahenkye Pasco Accounting 1 and 2 Notes and Solved Past QuestionsDocument208 pagesAhenkye Pasco Accounting 1 and 2 Notes and Solved Past QuestionspeterokotettehNo ratings yet

- Mis AssignmentDocument4 pagesMis AssignmentKajaNo ratings yet

- Lecture 4 Pest AnalysisDocument15 pagesLecture 4 Pest AnalysisLa Casa de Calma FurnitureNo ratings yet

- MGMT 300 Final Exam Study GuideDocument16 pagesMGMT 300 Final Exam Study GuideKamy Mi AchiNo ratings yet

- Statement of Profit & Loss Balance Sheet Revenue Equity & LiabilitiesDocument5 pagesStatement of Profit & Loss Balance Sheet Revenue Equity & LiabilitiesRavi BhattNo ratings yet

- Inventory Management System (Abstract)Document2 pagesInventory Management System (Abstract)Danesh HernandezNo ratings yet

- Ananas: Microenvironment AnalysisDocument28 pagesAnanas: Microenvironment AnalysisLê Hồng NhungNo ratings yet

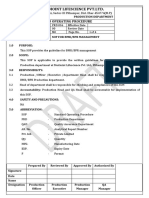

- Medioint Lifescience PVT - LTD.: Standard Operating ProcedureDocument4 pagesMedioint Lifescience PVT - LTD.: Standard Operating ProcedureChoudhary DhirajNo ratings yet

- Axis Bank ReportDocument17 pagesAxis Bank ReportPriyanka KhandelwalNo ratings yet

- Foundations of Organizational Structure PDFDocument13 pagesFoundations of Organizational Structure PDFElizaNo ratings yet

- Statement No. 6 of The Governmental Accounting Standards BoardDocument31 pagesStatement No. 6 of The Governmental Accounting Standards BoardSteffi DorothyNo ratings yet

- Mis Project (Mis 1)Document18 pagesMis Project (Mis 1)philsonmanamelNo ratings yet

- Industrial Overview and Profile: Introduction To H.D.D.C.FDocument61 pagesIndustrial Overview and Profile: Introduction To H.D.D.C.FRajveer ShyoranNo ratings yet

- SIP REPORT ON Mulshi Institute of Business ManagementDocument47 pagesSIP REPORT ON Mulshi Institute of Business ManagementSiddharth SomeshNo ratings yet

- Global Payments Asia Pacific Philippines IncDocument3 pagesGlobal Payments Asia Pacific Philippines IncahgaseX JJpsNo ratings yet

- The Benefits and Pitfalls of Contemporary Pop-Up Shops: SciencedirectDocument14 pagesThe Benefits and Pitfalls of Contemporary Pop-Up Shops: SciencedirectArun Manickam RNo ratings yet

- Principal of Management (MGT 201) Spring - Section Course InstructorDocument16 pagesPrincipal of Management (MGT 201) Spring - Section Course InstructorSaieed AfridiNo ratings yet

- Accounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionDocument44 pagesAccounting Principles 10th Edition Weygandt Kimmel Chapter 1 Solutions For Chapter 1 Accounting in ActionSumit Kumar Dam33% (3)

- Organizational Culture - AssignmentDocument6 pagesOrganizational Culture - AssignmentAkshatNo ratings yet

- Checklist For Reviewing and Analyzing CPM Schedule Updates: © 2001, Dan Fauchier, All Rights ReservedDocument2 pagesChecklist For Reviewing and Analyzing CPM Schedule Updates: © 2001, Dan Fauchier, All Rights ReservedhusnimadiNo ratings yet