Professional Documents

Culture Documents

Project 2

Uploaded by

Shivaram NayakOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project 2

Uploaded by

Shivaram NayakCopyright:

Available Formats

© May 2020| IJIRT | Volume 6 Issue 12 | ISSN: 2349-6002

A study on the performance of Micro Finance with

respect to Self Help Groups in Karnataka

Dr. Jagannatha

Assistant Professor, Government First Grade College, Madhugiri

Abstract - Micro-Finance is emerging as a powerful technology and poor economics and instability of

instrument for poverty alleviation in the new economy. output of agriculture production and related sectors are

In India, Micro-Finance is dominated by Self Help some of the symptoms of it. The poor stays poor, not

Groups (SHGs) - Banks linkage Programme, aimed at

because they are lazy, but because they have no access

providing a cost-effective mechanism for providing

to capital. Microfinance is the supply of loans, savings,

financial services to the ‘unreached poor’. In the Indian

context terms like “small and marginal farmers”, “rural and other basic financial services to the poor. As these

artisans” and “economically weaker sections” have been financial services usually involve small amounts of

used to broadly define micro-finance customers. money - small loans, small savings, etc. - the term

Research has shown that, over time, microfinance “micro finance” helps to differentiate these services

customers increase their income and assets, increase the from those which formal banks provide. Microfinance

number of years of schooling that their children receive refers to small savings, credit and insurance services

and have shown improved health and nutrition of their extended to socially and economically disadvantaged

families. A more refined model of micro-credit delivery

segments of society. It is emerging as a powerful tool

has evolved lately, which emphasizes the combined

for poverty alleviation and women empowerment in

delivery of financial services along with technical

assistance and agricultural business development India. During 2016-17, the demand for microcredit has

services. Compared to the wider SHG bank linkage been estimated at up to $30 billion; the supply is less

movement in India, private Micro Finance Institutions than $2.2 billion combined by all involved in the

have limited outreach, because SHG’s open bank sector.

account with either commercial banks or regional rural Due to the sheer size of the population living in

banks or co-operative societies. However, it is seen that poverty, India is strategically significant in the global

recently large number of microfinance institutions are efforts to alleviate poverty and to achieve the

transforming into Non-Bank Financial Institutions

Millennium Development Goal of halving the world’s

(NBFCs). This changing face of microfinance in India

poverty by 2015. Over the last five decades, the

appears to be positive in terms of the ability of

microfinance to attract more funds and therefore microfinance industry has achieved significant growth

increase outreach. in part due to the participation of commercial banks.

Despite this growth, the poverty situation in India

Index Terms - Micro finance, Financial inclusion, continues to be challenging. A large number of small

Marginal farmers, NBFC’s, Self Help Groups. loans are needed to serve the poor, but lenders prefer

dealing with large loans in small numbers to minimize

INTRODUCTION administration costs. They also look for collateral with

a clear title - which many low-income households do

India is facing many socio and economic problems. not have. In addition, bankers tend to consider low

One of the major problems is abject poverty. As per income households a bad risk imposing exceedingly

Suresh D. Tendulkar Committee Report, about 22 high information monitoring costs on operation. This

percent of the total people in India are under below leads to the need and importance of microfinance.

poverty line under minimum recall period status. With Women as micro and small entrepreneurs have

low per capita income, heavy population pressure, increasingly become the key target group for micro

prevalence of massive unemployment and finance programs. Consequently, providing access to

underemployment, low rate of capital formation, micro finance facilities is not only considered a pre-

misdistribution of wealth and assets, prevalence of low

IJIRT 150420 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 948

© May 2020| IJIRT | Volume 6 Issue 12 | ISSN: 2349-6002

condition for poverty alleviation, but also considered literacy, healthcare, and infrastructure

as a strategy for empowering women. In developing development.

countries like India micro finance is playing an 3. Financial Sustainability Paradigm: This (also

important role, promoting gender equality, and is referred to as the financial systems approach or

helping in empowering women so that they can live sustainability approach) underlies the models of

quality life with dignity. Microfinance has improved microfinance promoted since the mid-1990s by

the wellbeing of women clients and their families. most donor agencies and the Best Practice

Microfinance has a positive effect on the guidelines promoted in publications by USAID,

empowerment of women by creating an World Bank, UNDP and CGAP. The ultimate aim

“empowerment indicator”. These indicators can be is large programs which are profitable and fully

based on the following factors: self-supporting in competition with other private

• Mobility and Economic security- enables poor sector banking institutions and able to raise funds

women in making them economic agents of from international financial markets rather than

change by increasing their income and relying on funds from development agencies.

productivity.

• Ability to make small and large purchases. REVIEW OF LITERATURE

• Involvement in major household decisions.

• Relative freedom from domination within the Hulme and Mosley (1996): While acknowledging the

family. Political and legal awareness. role microfinance can have in helping to reduce

• Involvement in political campaigning and protests poverty, concluded from their research on

and to access to markets and information. They microfinance that “most contemporary schemes are

become more confident and get better control of less effective than they might be” (1996, p.134). They

the resources. state that microfinance is not a panacea for poverty-

The process can be viewed from three important alleviation and that in some cases the poorest people

dimensions. They are: have been made worse-off by microfinance.

1. Feminist Empowerment Paradigm: Here the

underlying concerns are gender equality and Littlefield, Murdoch and Hashemi (2003): More

women’s human rights. Women’s empowerment recently, commentators such as Littlefield, Murdoch

is seen as an integral and inseparable part of a and Hashemi (2003), Simanowitz and Brody (2004)

wider process of social transformation. The main and the IMF (2005) have commented on the critical

target group is poor women and women capable role of microfinance in achieving the Millennium

of providing alternative female role models for Development Goals. Littlefield, Murdoch and

change. Micro-finance is promoted as an entry Hashemi (2003) state “microfinance is a critical

point in the context of a wider strategy for contextual factor with strong impact on the

women’s economic and socio-political achievements of the MDGs…microfinance is unique

empowerment which focuses on gender among development interventions: it can deliver social

awareness and feminist organization. benefits on an ongoing, permanent basis and on a large

2. Poverty Reduction Paradigm: The poverty scale”. Referring to various case studies, they show

alleviation paradigm underlies many NGO how microfinance has played a role in eradicating

integrated poverty-targeted community poverty, promoting education, improving health, and

development programs. Poverty alleviation here empowering women (2003).

is defined in broader terms than market incomes

to encompass increasing capacities and choices Chintamani Prasad Patnaik (March 2012): Has

and decreasing the vulnerability of poor people. examined that microfinance seems to have generated a

The main focus of programs as a whole is on view that microfinance development could provide an

developing sustainable livelihoods, community answer to the problems of rural financial market

development and social service provision like development. While the development of microfinance

is undoubtedly critical in improving access to finance

for the unserved and underserved poor and low-

IJIRT 150420 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 949

© May 2020| IJIRT | Volume 6 Issue 12 | ISSN: 2349-6002

income households and their enterprises, it is OBJECTIVES OF THE STUDY

inadequate to address issues of rural financial market

development. It is envisaged that self-help groups will 1. To understand the concept of micro finance and

play a vital role in such strategy. its importance.

2. To study the Progress of SHGs formation in the

Johnson and Rogaly (1997, p.122): They argue (1997) state of Karnataka.

that in addressing the question of the impact of 3. To study the number of Women SHGs in the state

microfinance, NGOs must go beyond analyzing of Karnataka.

quantitative data detailing the numbers of users, and 4. To know the SHGs Savings with Bank in the state

volumes and size of loans disbursed, to understanding of Karnataka.

how their projects are impacting on clients’

livelihoods. RESEARCH METHODOLOGY

RESEARCH GAP

It is descriptive research in nature. Data collected

The previous studies have not concentrated in through secondary sources mainly through some

assessing the role played by SHG, in promoting journals and articles and also through research papers.

‘Micro entrepreneurs. Since SHG takes care of the The data is collected from microfinance related and

initial investment needed by the group members to content related articles and websites. Secondary data

take up revenue generating activities, many are is also collected from various published reports of

involved in manufacturing activities, but operations Apex Bank Ltd. and NABARD, research articles, and

are carried out in small scale. Necessary availability of from official circulars.

finance helps them to upgrade their operations. Earlier Commercial banks accounted for 67.5% of bank loans

studies have failed to identify this strength. The disbursed to 61.8% SHGs during the year. The share

available literature to understand the rural consumer of RRBs in credit disbursement to SHGs stood at

demographics, their tastes and preferences is very less. 24.6%. However, the number of SHGs declined

Gaining an insight on rural consumers psyche is substantially to 25.7% from 32.1%. The average loan

essential to offer them the value proposition tailored to disbursement by RRBs during the year was Rs.

meet their needs and preferences. They prefer to 1,94,833. The share of Cooperatives both in number of

transact in cash not digital payments approach. SHGs provided bank loan during the year as well as

Therefore, having cash-based transaction system is the quantum of loan disbursed declined in 2015-16 as

inevitable. compared to previous year. The average loan per SHG

provided by Cooperatives was Rs. 1,27,894.

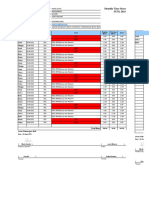

Total Savings of SHG with Banks

Total Savings of SHGs with Loans disbursed to SHGs Total Outstanding Bank NPAs

Name of the Banks as on 31 March 2016 by Banks during the year Loans against SHGs

Agency No. of Savings No. of SHGs Loans No. of Loan Amount of NPA

SHGs Amount disbursed SHGs Outstanding Gross NPA (%)

Commercial

Banks 41,40,111 9,03,389 11,32,281 25,18,497 26,26,364 37,14,562 2,32,140 6.25

% Share 52.6 66.0 61.8 67.5 56.2 65.0 62.98

Regional Rural

Banks 22,56,811 2,48,428 4,70,399 9,16,493 14,45,476 16,10,935 1,06,429 6.61

% Share 28.56 18.1 25.7 24.6 30.9 28.2 28.87

Cooperative

Banks 15,06,080 2,17,322 2,29,643 2,93,700 6,00,781 3,86,426 30,054 7.78

% Share 19.1 15.9 12.5 7.9 12.9 6.8 8.15

Total (in Rs.

Lakh) 79,03,002 13,69,139 18,32,323 37,28,690 46,72,621 57,11,923 3,68,623 6.45

Source: Status of Micro Finance in India 2015-16, Micro Credit Innovations Department, NABARD, Mumbai.

The following table depicts the Savings of SHG’s with different financial institutions in the Karnataka (as on 31st

March 2016).

IJIRT 150420 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 950

© May 2020| IJIRT | Volume 6 Issue 12 | ISSN: 2349-6002

Commercial Bank Regional Rural Bank (RRB) Co-operative societies Total (amount in Lakh rupees)

No. of SHG Savings Amount No. of SHG Savings Amount No. of SHG Savings Amount No. of SHG Savings Amount

6,05,154 79,879.15 1,37,921 16,132.89 2,19,371 48,230.09 9,62,446 1,44,242.13

The following table depicts the total loan disbursed to SHG’s from different financial institutions in the Karnataka (as

on 31st March 2016).

Commercial Bank Regional Rural Bank (RRB) Co-operative societies Total (amount in Lakh rupees)

No. of SHG Loan disbursed No. of SHG Loan disbursed No. of SHG Loan disbursed No. of SHG Loan disbursed

1,95,477 4,83,737.82 43,056 65,159.58 42,856 77,010.73 2,81,389 6,25,908.13

Source: Micro credit division, NABARD

Progress under Microfinance – Bank Loans outstanding against SHGs in the state of Karnataka during 2014-2015 -

Regional Rural Banks

Sl. Name of the bank Total Loans Outstanding Out of Total-Loan outstanding under Out of Total-Loan outstanding

No. against SHGs SGSY/NRLM & other Govt. exclusive to women SHGs

sponsored program

No. of Loans Outstanding No. of Loans Outstanding (in No. of Loans Outstanding

SHGs (in lakhs) SHGs lakhs) SHGs (in lakhs)

1 Kaveri Grameena 18993 32843.35 17521 32804.10 16043 27628.60

Bank

2 Karnataka Vikasa 17213 13407.53 11983 9537.85 15467 12534.28

Grameena Bank

3 Pragathi Krishna 25679 35166.00 1495 1922.00 20151 32495.13

Grameena Bank

Total 61885 81416.88 30999 44263.95 51611 72658.01

Source: NABARD Website

Analysis: have increased magnificently in the recent years,

The above table depicts Progress under Microfinance indicating positive growth. This is definitely an

– Bank loans outstanding against SHGs with Regional encouraging indicator, as self-help groups play a vital

Rural Banks in the state of Karnataka as on 31-03- role in women empowerment. This further reiterates

2015. From the table it can be observed that in terms that, the weaker section who are in need of small

of Bank loans outstanding against SHGs, Pragathi finance, will have easy accessibility due to more

Krishna Grameena Bank stands highest with an number of non-banking financial intermediaries.

outstanding loan of Rs 35,166 lakhs. It can also be In terms of Bank loans outstanding against SHGs,

depicted that in terms of Bank loans outstanding HDFC Bank stands highest with an outstanding loan

against SHGs out of total SHGs – loan outstanding of Rs 18,776.81 lakhs. It can also be depicted that in

under SGSY/NRLM & other Govt. sponsored terms of Bank loans outstanding against SHGs out of

programme scheme, Kaveri Grameena Bank stands total SHGs – loan outstanding under SGSY/NRLM &

highest with an outstanding loan of Rs 32,804.10 other Govt. sponsored program scheme, Karnataka

lakhs. It can also be observed that in terms of Bank Bank stands highest with an outstanding loan of Rs

loans outstanding against SHGs out of total SHGs in 338.20 lakhs. It can also be observed that in terms of

case of exclusively women SHGs, Pragathi Krishna Bank loans outstanding against SHGs out of total

Grameena Bank stands highest with an outstanding SHGs in case of exclusively women SHGs, HDFC

loan of Rs 32,495.13 lakhs. The above tables clearly Bank stands highest with an outstanding loan of Rs

indicate that that resource mobilization by financial 18,776.81 lakhs. The following table depicts this

institutions and loan disbursement to self-help groups information.

Progress under Microfinance – Bank Loans outstanding against SHGs in the state of Karnataka as on 31-03-2015 -

Private Sector Commercial Banks

Sl. Name of the bank Total Loans Outstanding Out of Total-Loan outstanding Out of Total-Loan outstanding

No. against SHGs under SGSY/NRLM & other exclusive to women SHGs

Govt. sponsored program

IJIRT 150420 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 951

© May 2020| IJIRT | Volume 6 Issue 12 | ISSN: 2349-6002

No. of Loans Outstanding No. of Loans Outstanding No. of Loans Outstanding

SHGs (in lakhs) SHGs (in lakhs) SHGs (in lakhs)

3 Federal Bank 6 10.61 0 0.00 0 0.00

4 HDFC Bank 11634 18776.81 0 0.00 11643 18776.81

5 ICICI Bank 5748 61.19 0 0.00 5648 9.53

6 ING Vyasa Bank 154 132.51 0 0.00 154 132.51

7 Karnataka Bank 1700 2076.01 307 338.20 1434 1744.91

Total 19242 21057.13 307 338.20 188.70 20663.76

Source: NABARD Website

CONCLUSION

Microfinance has a huge potential to grow.

Microfinance is moving from just a subsidy dependent

activity to a serious business proposition. The

challenges ahead are to build and strengthen the

limited institutional capability of retailers. From the

above study it is found that progress of women SHGs

in Karnataka year by year is commendable. From the

study it is also found that SHGs have been identified

as a way to alleviate poverty and women

empowerment.

REFERENCES

[1] National Bank for Agriculture and Rural

development website.

[2] Micro credit division, NABARD.

[3] Population census report, 2011 published by

Government of India.

[4] Karnataka State Apex Co-operative Bank,

Chamrajpet, Bangalore.

[5] Chiranjeevulu T. (2003). Empowering Women

through Self Help Groups, Kurukshetra, Volume

51, No.5, March 2003, Pp.16-19, 0023-5660.

[6] Gadekar, H.H. (2005). Women Empowerment

through SHG Industrial Society Ltd. The Co-

operator. Volume 43, No.3, September 2005, Pp.

128-30, 0573-9713.

[7] Government of Karnataka (2015). Social,

Economic and Caste census report- 2015.

[8] Mani Singh, CH., (2001), Self Help Groups: some

Organizational Aspects, The Co-operator,

Volume 38, No.11, May 2001, Pp.497-99, ISSN:

0573-9713.

IJIRT 150420 INTERNATIONAL JOURNAL OF INNOVATIVE RESEARCH IN TECHNOLOGY 952

You might also like

- Poverty Alleviation Through Micro Finance in India: Empirical EvidencesDocument8 pagesPoverty Alleviation Through Micro Finance in India: Empirical EvidencesRia MakkarNo ratings yet

- PROJECT PROPOSAL (Micro Finance) - Yash SolankiDocument12 pagesPROJECT PROPOSAL (Micro Finance) - Yash Solankichintan05ec100% (4)

- Microfinance and Its Impact On IndiaDocument60 pagesMicrofinance and Its Impact On Indiabagal07100% (1)

- Project Report On "A Critical Analysis of Micro Finance in India"Document36 pagesProject Report On "A Critical Analysis of Micro Finance in India"Sanjay ShahNo ratings yet

- Micro Finance and Women Empowerment With Special Reference To Self-Help Groups (SHG)Document4 pagesMicro Finance and Women Empowerment With Special Reference To Self-Help Groups (SHG)Editor IJTSRDNo ratings yet

- FMI final reportDocument30 pagesFMI final reportVIDUSHINo ratings yet

- 6 MT Done PDFDocument4 pages6 MT Done PDFSam GregoryNo ratings yet

- Joint Liability Groups (JLGS) - The Saviors of Urban Poor: Padma K.M.S., Venkata Subrahmanyam C.V., Dr. A. M. SureshDocument5 pagesJoint Liability Groups (JLGS) - The Saviors of Urban Poor: Padma K.M.S., Venkata Subrahmanyam C.V., Dr. A. M. Sureshaaditya01No ratings yet

- Definition of Microfinance and its Role in Fighting PovertyDocument6 pagesDefinition of Microfinance and its Role in Fighting PovertyAyush BhavsarNo ratings yet

- Microfinance and Women EmpowermentDocument6 pagesMicrofinance and Women EmpowermentRasel Talukder100% (1)

- Challenges of Micro FinanceDocument9 pagesChallenges of Micro FinancebharathNo ratings yet

- Impact of Self-Help Groups on Socio-Economic Empowerment of WomenDocument13 pagesImpact of Self-Help Groups on Socio-Economic Empowerment of WomenUsha JadhavNo ratings yet

- MicrofinanceDocument65 pagesMicrofinanceRahul AksHNo ratings yet

- PHD DissertationDocument14 pagesPHD DissertationShito Ryu100% (1)

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Document55 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 2Rohit KumarNo ratings yet

- Micro Finance and The Empowerment of WomenDocument10 pagesMicro Finance and The Empowerment of WomenDivya Sunder Raman67% (3)

- A Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Document63 pagesA Study On Role and Effects of Microfinance Banks in Rural Areas in India 1Rohit KumarNo ratings yet

- Microfinance A Tool For Poverty Alleviation, A Case Study of District RajouriDocument4 pagesMicrofinance A Tool For Poverty Alleviation, A Case Study of District Rajourifaiqul hazmiNo ratings yet

- df88238bd33011f931cb1a23924157361cf3Document6 pagesdf88238bd33011f931cb1a23924157361cf3raghav.samaniNo ratings yet

- Challenges of microfinance in India and achieving sustainable developmentDocument5 pagesChallenges of microfinance in India and achieving sustainable developmentEdris YawarNo ratings yet

- Sakshi Pote Tybbi ProjectDocument93 pagesSakshi Pote Tybbi ProjectAkshataNo ratings yet

- Report On Micro FinanceDocument54 pagesReport On Micro Financemohsinmalik07100% (1)

- Does Micro Finance Benefit The PoorDocument19 pagesDoes Micro Finance Benefit The PoorWamene100% (1)

- A Study On Impact of Microfinance On Women EmpowermentDocument92 pagesA Study On Impact of Microfinance On Women EmpowermentAbhishek Eraiah100% (3)

- Need For MF Gap DD and SSDocument2 pagesNeed For MF Gap DD and SSalviarpitaNo ratings yet

- CH Allen EgsDocument5 pagesCH Allen EgsY N S Y SNo ratings yet

- Women empowered through microfinance opportunitiesDocument28 pagesWomen empowered through microfinance opportunitiesAf UsmanNo ratings yet

- Edited MicrofinanceDocument59 pagesEdited Microfinancedarthvader005No ratings yet

- Project On Micro FinanceDocument44 pagesProject On Micro Financeredrose_luv23o.in@yahoo.co.in88% (8)

- SHG SMP SPP Rev PaperDocument24 pagesSHG SMP SPP Rev Papersundram vatsaNo ratings yet

- Welfare Impacts of Microfinance On Entrepreneurship and Financial Sustainability: A Case Study On Islamic and Conventional Micro FinancingDocument17 pagesWelfare Impacts of Microfinance On Entrepreneurship and Financial Sustainability: A Case Study On Islamic and Conventional Micro FinancingmairaNo ratings yet

- Microfinance in India StudyDocument6 pagesMicrofinance in India StudyShruti SrivastavaNo ratings yet

- Micro Finance in India-For Poverty Reduction: Priyanka Ramath & PreethiDocument4 pagesMicro Finance in India-For Poverty Reduction: Priyanka Ramath & PreethiSahil JainNo ratings yet

- Micro Finance in IndiaDocument22 pagesMicro Finance in IndiaGeet SinghiNo ratings yet

- Sage University: TopicDocument25 pagesSage University: TopicJyotika 2003No ratings yet

- 10 MT Done PDFDocument5 pages10 MT Done PDFSam GregoryNo ratings yet

- Rajni Sinha PDFDocument23 pagesRajni Sinha PDFshivani mishraNo ratings yet

- Role of Microfinance Institutions in Rural Development B.V.S.S. Subba Rao AbstractDocument13 pagesRole of Microfinance Institutions in Rural Development B.V.S.S. Subba Rao AbstractIndu GuptaNo ratings yet

- Microfinance Scope & Future in IndiaDocument4 pagesMicrofinance Scope & Future in IndiamijjinNo ratings yet

- Vidya.v. Kumar ProjectDocument54 pagesVidya.v. Kumar Projectwolverdragon100% (1)

- Role of Microfinance Institution in Financial InclusionDocument15 pagesRole of Microfinance Institution in Financial Inclusionswati_agarwal67No ratings yet

- PRT 2Document54 pagesPRT 2muhammad.salman100No ratings yet

- Macroeconomics: The Goals of Macroeconomic PolicyDocument13 pagesMacroeconomics: The Goals of Macroeconomic Policyduarif14No ratings yet

- Report On Micro FinanceDocument55 pagesReport On Micro FinanceSudeepti TanejaNo ratings yet

- Eco-Geo Assignment IDocument11 pagesEco-Geo Assignment INal ChowdhuryNo ratings yet

- Role of Microfinance in Financial Inclusion in Bihar-A Case StudyDocument10 pagesRole of Microfinance in Financial Inclusion in Bihar-A Case Studyfida mohammadNo ratings yet

- Unlocking Vistas of Islamic Microfinance in India - A Model For Poverty Reduction (Final)Document15 pagesUnlocking Vistas of Islamic Microfinance in India - A Model For Poverty Reduction (Final)Naumankhan83No ratings yet

- 2021 IJPR-Roleof Microfinancein Economic Development-Adhyayan Vol 11 Issue 2Document10 pages2021 IJPR-Roleof Microfinancein Economic Development-Adhyayan Vol 11 Issue 2Venkat SNo ratings yet

- Effect of Microfinance On Poverty Reduction A Critical Scrutiny of Theoretical LiteratureDocument18 pagesEffect of Microfinance On Poverty Reduction A Critical Scrutiny of Theoretical LiteratureLealem tayeworkNo ratings yet

- Thesis ProposalDocument30 pagesThesis ProposalmlachuNo ratings yet

- RamakantDocument41 pagesRamakantArchitNo ratings yet

- Microfinance's Role in Fighting Poverty and Empowering Women in India (38 charactersDocument3 pagesMicrofinance's Role in Fighting Poverty and Empowering Women in India (38 charactersAman AroraNo ratings yet

- Microfinance in India - Growth and Present StatusDocument16 pagesMicrofinance in India - Growth and Present StatusIJOPAAR JOURNALNo ratings yet

- Assignment MicrofinanceDocument28 pagesAssignment MicrofinanceKamrul MozahidNo ratings yet

- SynopsisDocument12 pagesSynopsisAnnie MittalNo ratings yet

- Analysis of The Effects of Microfinance PDFDocument13 pagesAnalysis of The Effects of Microfinance PDFxulphikarNo ratings yet

- Role of Micro Finance in Rural Development of IndiDocument7 pagesRole of Micro Finance in Rural Development of Indisonujaiswal1267% (6)

- Impact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictDocument8 pagesImpact of Micro Finance On Living Standard With Reference To Microfinance Holders in Kurunegala DistrictInternational Journal of Business Marketing and ManagementNo ratings yet

- Micro-Financing and the Economic Health of a NationFrom EverandMicro-Financing and the Economic Health of a NationNo ratings yet

- Building Financial Resilience: Do Credit and Finance Schemes Serve or Impoverish Vulnerable People?From EverandBuilding Financial Resilience: Do Credit and Finance Schemes Serve or Impoverish Vulnerable People?No ratings yet

- Cimb Clicks Apr 2020Document3 pagesCimb Clicks Apr 2020roslan musaNo ratings yet

- Growth of Commercial Bank in IndiaDocument2 pagesGrowth of Commercial Bank in Indiavinayak_874580% (5)

- Customers Satisfaction Towards CRM Practices Adhered by Public Sector Banks in E-Banking EraDocument6 pagesCustomers Satisfaction Towards CRM Practices Adhered by Public Sector Banks in E-Banking EraIAEME PublicationNo ratings yet

- Bank Management System Bbanking NotesDocument62 pagesBank Management System Bbanking NotesSarathKumar Nair100% (2)

- BankFin Midterm Mod 4Document6 pagesBankFin Midterm Mod 4Devon DebarrasNo ratings yet

- Chap - 9 Book Keeping XI HALLDocument114 pagesChap - 9 Book Keeping XI HALLKirtee TiwariNo ratings yet

- Answer The Following Questions. Each Question Is of 1 MarkDocument16 pagesAnswer The Following Questions. Each Question Is of 1 MarkTeamFST SATANNo ratings yet

- HBP Case - DatasetDocument534 pagesHBP Case - DatasetTim WuNo ratings yet

- K ModelDocument19 pagesK ModelPritchard MatamboNo ratings yet

- Investment banking interview brainteasers optimizedDocument5 pagesInvestment banking interview brainteasers optimizeddebraNo ratings yet

- India cuts GDP growth forecast to 5.8% for 2023Document26 pagesIndia cuts GDP growth forecast to 5.8% for 2023Ritik TiwariNo ratings yet

- Economic Impact of E-Banking in NigeriaDocument8 pagesEconomic Impact of E-Banking in NigeriaRica RegorisNo ratings yet

- ICM Membership FormDocument2 pagesICM Membership FormShahzad AliNo ratings yet

- Banks CHDocument8 pagesBanks CHabeerNo ratings yet

- General Mathematics - Grade 11 Stocks and Bonds: I. Introductory ConceptDocument23 pagesGeneral Mathematics - Grade 11 Stocks and Bonds: I. Introductory ConceptMaxine ReyesNo ratings yet

- Financial Statements Analysis: Bangko de Oro & Bank of The Philippine IslandsDocument34 pagesFinancial Statements Analysis: Bangko de Oro & Bank of The Philippine IslandsNikol DayanNo ratings yet

- Supplier Registration Form - Right To Care NPC (Updated Template)Document3 pagesSupplier Registration Form - Right To Care NPC (Updated Template)Ian LuambiaNo ratings yet

- Statement of Account: Lot 1232 RPR Kidurong Ph1 Lorong 5 Jalan TG Kidurong Bintulu 97000 SARAWAKDocument25 pagesStatement of Account: Lot 1232 RPR Kidurong Ph1 Lorong 5 Jalan TG Kidurong Bintulu 97000 SARAWAKKathleen TandangNo ratings yet

- ProjectDocument40 pagesProjectAbdul OGNo ratings yet

- TLE 10 NotesDocument5 pagesTLE 10 NotesscrthhNo ratings yet

- Bangued Loan Agreement RatificationDocument2 pagesBangued Loan Agreement RatificationAmelia BersamiraNo ratings yet

- Timesheet Herdi Juni 2023-1Document2 pagesTimesheet Herdi Juni 2023-1radit.d.hikenNo ratings yet

- Your DetailsDocument2 pagesYour DetailsAveksha RankaNo ratings yet

- The Edge 04032021Document21 pagesThe Edge 04032021VetriiNo ratings yet

- Stockifi Poonawalla Fincorp Detailed Note WWW Stockifi in D67eb7eed6Document13 pagesStockifi Poonawalla Fincorp Detailed Note WWW Stockifi in D67eb7eed6Myeduniya MEDNo ratings yet

- Credit and CollectionDocument116 pagesCredit and Collectionhadassah Villar100% (14)

- L33 10 PDFDocument1 pageL33 10 PDF魏釨洋No ratings yet

- FinScope Uganda Survey Report 2018Document38 pagesFinScope Uganda Survey Report 2018CE LuziraNo ratings yet

- GL Code CSI Mania-4Document10 pagesGL Code CSI Mania-4Abhishek ParasharNo ratings yet

- UnlockedDocument143 pagesUnlockedRizky Melani Dian PratiwiNo ratings yet