Professional Documents

Culture Documents

Tax Compliance 01

Uploaded by

shovonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Compliance 01

Uploaded by

shovonCopyright:

Available Formats

value.

It is not clear whether in this case, Government would actually buy or uses the pre-

emption right to determine under-declaration.

The manner to be followed in connection with the purchase of a capital asset by the

Government under section 32(4) of the Ordinance shall be as follows:

(1) Where the DCT has reason to believe that any immovable property is being transferred

by a person (hereinafter referred to as the transferor) to another person (person

hereinafter referred to as the transferee) and the fair market value of such property

exceeds the declared value by more than twenty-five per cent, and the consideration

for such transfer as agreed to between the parties has not been truly stated in the

instrument of transfer with the object of facilitating the reduction or evasion of the

liability of the transferor to pay the tax under the Ordinance in respect of any income

arising from the transfer or any other taxes or duties, he may, subject to the provisions

of this rule, initiate proceedings for the acquisition of such property by the Government.

(2) The DCT shall initiate proceedings for acquisition of immovable property under rule 40

by giving a notice to that effect in the official Gazette and a copy of such notice shall

also be published in the two leading newspapers of wide circulation where such

property is located; a copy of such notice shall also be served on the transferor, the

transferee and the person in occupation of the property. However, no such proceedings

shall be initiated after the expiry of a period of two years from the end of the month in

which the instrument of transfer in respect of such property is registered under the

Registration Act, 1908.

(3) Objection against the acquisition of the immovable property in respect of which a notice

has been published in the official Gazette and the newspapers may be made in writing

by the transferor or the transferee to the DCT within 60 days of the publication of the

notice in the official Gazette or newspapers.

(4) The DCT shall fix a date and place for the hearing of the objections against the

acquisition and shall give notice of the same to every person who has made such

objection. However, notice shall also be given to the transferee of such property even

if he has not made any such objection.

(5) After hearing the objections, if any, after taking into account all the relevant materials

on record, if the Deputy Commissioner of Taxes is satisfied that-

(a) The fair market value of such property exceeds the consideration paid therefore by

more than twenty-five per cent of such consideration, and

(b) The consideration for such transfer as agreed to between the parties has not been

truly stated in the instrument of transfer with such object as is referred to in clause

(1); he may make an order for the acquisition of the property under this rule.

(6) Any person aggrieved by an order made under rule 40(5) may prefer an appeal under

the Ordinance to the Appellate Joint Commissioner of Taxes.

(7) As soon as may be after the order of acquisition of any immovable property has been

made under Rule-40(5) and after the disposal of appeal, if any, the DCT may by notice

in writing, order any person who may be in possession of the immovable property to

surrender or deliver possession thereof to him or any other person duly authorized by

him in writing in these behalf within 30 days of the service of the notice.

(8) If any person refuses or fails to comply with a notice under rule 40(7), the DCT or any

other person duly authorized by him under that clause may take possession of the

immovable property and may, for that purpose, requisition the services of any police

Page | 164

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Reverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inDocument19 pagesReverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inAjit GuptaNo ratings yet

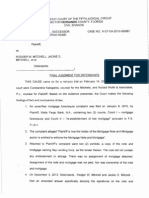

- Final Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Document11 pagesFinal Judgment For Defendants v. Wells Fargo Bank, N.A., in A Residential Mortgage Foreclosure Case After Trial Held in Hernando County, Florida, Before Judge Angel On Feb. 14, 2013.Chuck Kalogianis100% (1)

- Dissolution Deed TitleDocument2 pagesDissolution Deed TitleMuslim QureshiNo ratings yet

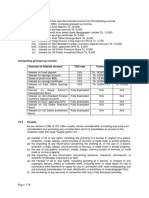

- Court Upholds Tax Deductions But Limits Professional FeesDocument3 pagesCourt Upholds Tax Deductions But Limits Professional Feesjleo1No ratings yet

- P1 Class Notes by Sir Rafiqul Islam FCMADocument91 pagesP1 Class Notes by Sir Rafiqul Islam FCMAAsmaNo ratings yet

- CIR v. Bank of CommerceDocument6 pagesCIR v. Bank of Commerceamareia yapNo ratings yet

- Problem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageProblem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- Class Synopsis - 01Document1 pageClass Synopsis - 01shovonNo ratings yet

- Notification Issued by Financial Reporting Council (FRC)Document1 pageNotification Issued by Financial Reporting Council (FRC)shovonNo ratings yet

- Organization Chart: Board of DirectorsDocument1 pageOrganization Chart: Board of DirectorsshovonNo ratings yet

- Reading Materials - Audit & AssuranceDocument1 pageReading Materials - Audit & AssuranceshovonNo ratings yet

- Advantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageAdvantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- Class Synopsis - 015Document1 pageClass Synopsis - 015shovonNo ratings yet

- Audit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksDocument1 pageAudit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksshovonNo ratings yet

- Required:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageRequired:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- 7 - IT - GOVERNANCE May June 2019Document2 pages7 - IT - GOVERNANCE May June 2019Abdullah al MahmudNo ratings yet

- Tax Compliance 04Document1 pageTax Compliance 04shovonNo ratings yet

- Tax Compliance 03Document1 pageTax Compliance 03shovonNo ratings yet

- Assurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020Document117 pagesAssurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020shovonNo ratings yet

- P1 PerfomanceDocument1 pageP1 PerfomanceshovonNo ratings yet

- Print Receipt CmaDocument1 pagePrint Receipt CmashovonNo ratings yet

- Strategic Management Accounting - M30304: Description 2018 2019Document4 pagesStrategic Management Accounting - M30304: Description 2018 2019shovonNo ratings yet

- Device InfoDocument1 pageDevice InfoshovonNo ratings yet

- ICAB - Certificate Level TaxationDocument2 pagesICAB - Certificate Level TaxationshovonNo ratings yet

- Affiliation LetterDocument7 pagesAffiliation LettershovonNo ratings yet

- Affiliation LetterDocument7 pagesAffiliation LettershovonNo ratings yet

- Britt PagesDocument16 pagesBritt PagesshovonNo ratings yet

- International Standard Book Number-IsBN TDocument9 pagesInternational Standard Book Number-IsBN TshovonNo ratings yet

- Subject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyDocument2 pagesSubject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyshovonNo ratings yet

- 0485c6e71cda08e995c857504fa1d86fDocument3 pages0485c6e71cda08e995c857504fa1d86fshovonNo ratings yet

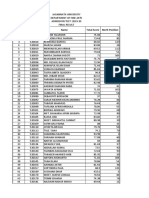

- 7th Merit List Circular C Unit 2018-2019Document1 page7th Merit List Circular C Unit 2018-2019shovonNo ratings yet

- DateDocument2 pagesDateshovonNo ratings yet

- Dhaka University Day 2018Document16 pagesDhaka University Day 2018shovonNo ratings yet

- Dhaka University Day 2018Document16 pagesDhaka University Day 2018shovonNo ratings yet

- HSBC Premier Savings Terms & Charges Disclosure: EligibilityDocument3 pagesHSBC Premier Savings Terms & Charges Disclosure: EligibilityAndi PrabowoNo ratings yet

- Foreign Portfolio Investments in India: Causes and Impact/TITLEDocument25 pagesForeign Portfolio Investments in India: Causes and Impact/TITLElogeshNo ratings yet

- Arvind Mills AnalysisDocument18 pagesArvind Mills AnalysisAnup AgarwalNo ratings yet

- IPSFDocument7 pagesIPSFmanikandan BalasubramaniyanNo ratings yet

- Annual Refresher Program in Teaching (ARPIT) through National Resource Centres (NRCsDocument14 pagesAnnual Refresher Program in Teaching (ARPIT) through National Resource Centres (NRCsthensureshNo ratings yet

- Hedge AccountingDocument8 pagesHedge AccountingDilip YadavNo ratings yet

- GFMS Gold Survey 2015Document116 pagesGFMS Gold Survey 2015Idra HoNo ratings yet

- Priyank ST03Document2 pagesPriyank ST03pkNo ratings yet

- Oct 2022 Unit 2 QPDocument32 pagesOct 2022 Unit 2 QPKarama OmarNo ratings yet

- Cadbury Schweppes DF 2006Document1 pageCadbury Schweppes DF 2006JORGENo ratings yet

- Bcoc 136Document2 pagesBcoc 136Suraj JaiswalNo ratings yet

- NH Retirement System Pensions 2018Document1,510 pagesNH Retirement System Pensions 2018portsmouthherald33% (3)

- Case Fair Macro13e Accessible Ppt 05 (Автосохраненный)Document30 pagesCase Fair Macro13e Accessible Ppt 05 (Автосохраненный)Zhanerke NurmukhanovaNo ratings yet

- Idx Monthly Oct 2023Document154 pagesIdx Monthly Oct 2023ikhsan AdiNo ratings yet

- The Balance Sheet of Poodle Company at The End of PDFDocument1 pageThe Balance Sheet of Poodle Company at The End of PDFCharlotteNo ratings yet

- Journal Entries For PartnershipsDocument11 pagesJournal Entries For PartnershipsRosette Revilala100% (1)

- Bank Account SecrecyDocument143 pagesBank Account SecrecySayeedMdAzaharulIslamNo ratings yet

- Household Budget Tracker Shows Income Over ExpensesDocument6 pagesHousehold Budget Tracker Shows Income Over ExpensesDavin AgustaNo ratings yet

- Mutual Fund AnalysisDocument53 pagesMutual Fund AnalysisVijetha EdduNo ratings yet

- Cfas Midterms q1Document3 pagesCfas Midterms q1Rommel Royce CadapanNo ratings yet

- Profile of DirectorsDocument5 pagesProfile of DirectorsSho NaNo ratings yet

- MIT18 S096F13 Lecnote14Document34 pagesMIT18 S096F13 Lecnote14eni100% (1)

- Invoice2022 09 28 PDFDocument1 pageInvoice2022 09 28 PDFShifa BelvinaNo ratings yet

- Fringe BenefitDocument2 pagesFringe Benefitbcbi2010No ratings yet

- How To Use KEATDocument5 pagesHow To Use KEATAamir KhanNo ratings yet