Professional Documents

Culture Documents

Tax Compliance 03

Uploaded by

shovon0 ratings0% found this document useful (0 votes)

4 views1 pageTAX COMPLIANCE 03

Original Title

TAX COMPLIANCE 03

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTAX COMPLIANCE 03

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageTax Compliance 03

Uploaded by

shovonTAX COMPLIANCE 03

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Illustration:

Mr. Rolex is a non-resident foreigner and received Tk. 7,000 as dividend from a Public

Limited Company incorporated in Bangladesh. Here, rate of TDS was 30%and thus, after

grossing up, the amount of gross dividend will be Tk. 10,000 (7,000 100/70).

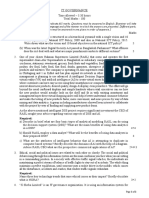

10.3 Interest Income other than interest on securities

All interest income other than those considered in ‘Interest on Securities’ are considered

under this category. All possible sources of income, exemption limit and TDS rates are

given in the table below:

Sources of Interest income TDS rate Exemption

1. Interest on savings / Fixed 10% (If

deposits from a Bank, co- there is no No exemption

operative bank, non-banking TIN then

financial institution, leasing the rate will

company, housing finance be 15%)

company

2. Share of profit from any bank run 10% (If No exemption

on Islamic Principles. there is no

TIN then

the rate will

be 15%)

3. Interest on Savings Certificates: Tax will not be deducted from

a. 5 years Bangladesh interest on pensioners’

Sanchayapatra savings certificate if total

b. 3 monthly profit based 3-year 10% accumulated investment at

Bangladesh Sanchayapatra and it is the end of the income year at

c. Pensioners’ Sanchayapatra final u/s this type of savings certificate

d. Paribar Sanchayapatra 82C does not exceed

Tk.5,00,000.

4. Interest on Post Office Savings 10% No exemption

Bank account

5. Interest on Non-Resident Foreign Nil Fully exempted

Currency Deposit Account

6. Interest on DPS run by a 10% (If Only interest on Govt.

commercial Bank and approved by there is no approved DPS is tax free as

the government. TIN then per SRO.

the rate will

be 15%)

7. Interest on Wage Earners’ Bond. Nil Tax free

8. US Dollar Premium Bond Nil As per 6th schedule (Part-A)

9. US Dollar Investment Bond Nil Para-24A

10. Euro Premium Bond Nil

11. Euro Investment Bond Nil

12. Pound starling Premium Bond Nil

13. Pound starling Investment Bond Nil

Grossing up: Grossing up is important for interest income across items 1, 2, 3, 4, 5, 7 and

8 where TDS is applicable. It is not required for other 3 items (6, 9& 10) which is fully

exempted from tax and thus no tax is deducted at source.

Page | 177

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Election Offenses Omnibus Election CodeDocument12 pagesElection Offenses Omnibus Election CodeRaziele RanesesNo ratings yet

- Accounts Form 4 - 2021Document51 pagesAccounts Form 4 - 2021gangstar sippas100% (1)

- Regional Trial Court: CIVIL CASE No. 123456Document8 pagesRegional Trial Court: CIVIL CASE No. 123456Martel John MiloNo ratings yet

- Англійська моваDocument42 pagesАнглійська моваUyên Trâm TrầnNo ratings yet

- Welles, Hellenistic Tarsus (1962)Document35 pagesWelles, Hellenistic Tarsus (1962)alverlin100% (1)

- P1 Class Notes by Sir Rafiqul Islam FCMADocument91 pagesP1 Class Notes by Sir Rafiqul Islam FCMAAsmaNo ratings yet

- Organization Chart: Board of DirectorsDocument1 pageOrganization Chart: Board of DirectorsshovonNo ratings yet

- Reading Materials - Audit & AssuranceDocument1 pageReading Materials - Audit & AssuranceshovonNo ratings yet

- Problem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageProblem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- Class Synopsis - 01Document1 pageClass Synopsis - 01shovonNo ratings yet

- Notification Issued by Financial Reporting Council (FRC)Document1 pageNotification Issued by Financial Reporting Council (FRC)shovonNo ratings yet

- Audit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksDocument1 pageAudit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksshovonNo ratings yet

- Class Synopsis - 015Document1 pageClass Synopsis - 015shovonNo ratings yet

- Tax Compliance 04Document1 pageTax Compliance 04shovonNo ratings yet

- Strategic Management Accounting - M30304: Description 2018 2019Document4 pagesStrategic Management Accounting - M30304: Description 2018 2019shovonNo ratings yet

- Assurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020Document117 pagesAssurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020shovonNo ratings yet

- Print Receipt CmaDocument1 pagePrint Receipt CmashovonNo ratings yet

- P1 PerfomanceDocument1 pageP1 PerfomanceshovonNo ratings yet

- Required:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageRequired:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- Advantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageAdvantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- ICAB - Certificate Level TaxationDocument2 pagesICAB - Certificate Level TaxationshovonNo ratings yet

- Tax Compliance 01Document1 pageTax Compliance 01shovonNo ratings yet

- 7 - IT - GOVERNANCE May June 2019Document2 pages7 - IT - GOVERNANCE May June 2019Abdullah al MahmudNo ratings yet

- Britt PagesDocument16 pagesBritt PagesshovonNo ratings yet

- Affiliation LetterDocument7 pagesAffiliation LettershovonNo ratings yet

- Affiliation LetterDocument7 pagesAffiliation LettershovonNo ratings yet

- 7th Merit List Circular C Unit 2018-2019Document1 page7th Merit List Circular C Unit 2018-2019shovonNo ratings yet

- International Standard Book Number-IsBN TDocument9 pagesInternational Standard Book Number-IsBN TshovonNo ratings yet

- 0485c6e71cda08e995c857504fa1d86fDocument3 pages0485c6e71cda08e995c857504fa1d86fshovonNo ratings yet

- Device InfoDocument1 pageDevice InfoshovonNo ratings yet

- DateDocument2 pagesDateshovonNo ratings yet

- Subject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyDocument2 pagesSubject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyshovonNo ratings yet

- Dhaka University Day 2018Document16 pagesDhaka University Day 2018shovonNo ratings yet

- Dhaka University Day 2018Document16 pagesDhaka University Day 2018shovonNo ratings yet

- Investment Pattern of Salaried Persons in MumbaiDocument62 pagesInvestment Pattern of Salaried Persons in MumbaiyopoNo ratings yet

- Es 221 - Dynamics of Rigid Bodies: I. Kinetics of A Particle (Force & Acceleration)Document4 pagesEs 221 - Dynamics of Rigid Bodies: I. Kinetics of A Particle (Force & Acceleration)Jerard BalalaNo ratings yet

- Philips - 32pfl3403d 27 TP 1.2Document6 pagesPhilips - 32pfl3403d 27 TP 1.2JuanKaNo ratings yet

- Angels RevengeDocument5 pagesAngels RevengeCora MoraNo ratings yet

- Human Rights Sarmiento Chap 1Document11 pagesHuman Rights Sarmiento Chap 1nesteamackNo ratings yet

- Starbucks Corporation: Form 10-KDocument139 pagesStarbucks Corporation: Form 10-KShady Mohsen MikhealNo ratings yet

- Jude Whole Study PDFDocument15 pagesJude Whole Study PDFStar RangerNo ratings yet

- 论公民不服从(小姜老师整理)Document24 pages论公民不服从(小姜老师整理)James JiangNo ratings yet

- Marc Johanna L. Villacora Activity 2.1 Citizenship TrainingDocument6 pagesMarc Johanna L. Villacora Activity 2.1 Citizenship TrainingDhision VillacoraNo ratings yet

- Hanata Print Quotation - DP Freeport Indonesia - 13 - Jan - 2022Document1 pageHanata Print Quotation - DP Freeport Indonesia - 13 - Jan - 2022Acara DPFINo ratings yet

- Case Digest - LTDDocument3 pagesCase Digest - LTDEmNo ratings yet

- Property Law Assignment (Landlord & Tenant)Document11 pagesProperty Law Assignment (Landlord & Tenant)AndyNo ratings yet

- ADC Exam2 PDFDocument3 pagesADC Exam2 PDFrahulpatel1202No ratings yet

- Form GST Mov-02 Order For Physical VerificationDocument1 pageForm GST Mov-02 Order For Physical VerificationShruti SantoshNo ratings yet

- City of Doral Digitally Signed and Sealed Documents StatementDocument1 pageCity of Doral Digitally Signed and Sealed Documents StatementVicente Ali Diaz SanchezNo ratings yet

- ETSO-C127a CS-ETSO 0Document6 pagesETSO-C127a CS-ETSO 0Anurag MishraNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- School Governing Council (SGC) in School PlanningDocument49 pagesSchool Governing Council (SGC) in School PlanningCONRADO FERNANDEZNo ratings yet

- Edited-Preschool LiteracyDocument22 pagesEdited-Preschool LiteracyEdna ZenarosaNo ratings yet

- Coca ColaDocument31 pagesCoca ColaAnmol JainNo ratings yet

- A-Life Medik FamiliDocument2 pagesA-Life Medik FamiliZaiham ZakariaNo ratings yet

- Assignment 21 - EXERCISE 4.0Document2 pagesAssignment 21 - EXERCISE 4.0Ravi TNo ratings yet

- Apollo Contacts ExportDocument36 pagesApollo Contacts Exportanasakram701No ratings yet

- API 660 InterpretationsDocument3 pagesAPI 660 InterpretationsMuhammadShabbir0% (1)

- Review of Related Literature and StudiesDocument11 pagesReview of Related Literature and StudiesDevilo AtutuboNo ratings yet