Professional Documents

Culture Documents

Required:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMA

Uploaded by

shovonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Required:: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMA

Uploaded by

shovonCopyright:

Available Formats

Class notes on Performance Operations (P1) by Rafiqul Islam, FCMA

Year Year 1 Year 2 Year 3 Year 4 Year 5

Production units 5000 8000 12000 10000 6000

The price of plastic furniture in the first year will be Tk.2000 per unit. The plastic market is very

competitive, so the CFO believes that the price will increase by only 2 percent per year, as compared

to general inflation rate of 5 percent. First year production cost will be Tk.1000 per unit, production

costs are expected to grow at 10 percent per year. The company is subject to 35 percent corporate tax

rate. Management determines that an immediate (year 0) investment in different items of working

capital of Tk.10 lacs is required. Thereafter net working capital would be 10 percent of sales of the

year up to the 4th year and all working capital would be recovered in the 5th year.

The project would be financed by bank loans and equity at a debt-equity ratio of 70:30. Incremental

borrowing rate would be 13.50 percent and required rate of return on share capital is 19.50 percent.

Weighted average cost of capital to be rounded to nearest whole number.

Required:

Calculate Net Present Value (NPV) of the project and advise the company whether to accept the

investment project.

Solution

Question one

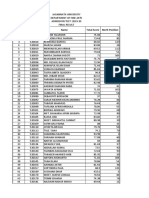

Figure in lacs Taka

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Investments

Plastic Furniture machines -100.00 3.00

Opportunity of land and building -150.00 200.00

Net Working Capital 10.00 10.00 16.32 24.97 21.22 0.00

Change in Working Capital -10.00 0.00 -6.32 -8.65 3.75 21.22

Total Cash flow of investment -260.00 0.00 -6.32 -8.65 3.75 224.22

Income

Sales Revenues 100.00 163.20 249.72 212.20 129.90

Operating costs 50.00 88.00 145.20 133.10 87.84

Depreciation 19.40 19.40 19.40 19.40 19.40

Income before taxes 30.60 55.80 85.12 59.70 22.66

Tax @35% 10.71 19.53 29.792 20.895 7.931

Income after taxes 19.89 36.27 55.33 38.81 14.73

Add: Depreciation 19.40 19.40 19.40 19.40 19.40

Cash flows from Operations 39.29 55.67 74.73 58.21 34.13

Total Cash flow from the project -260.00 39.29 49.35 66.08 61.96 258.35

PV factor @12%

( 13.5%*.65*.70+.19.5%*.3) 1.00 0.89 0.80 0.71 0.64 0.57

Discounted cash flows -260.00 35.08 39.34 47.03 39.37 146.59

NPV 47.42

58 | P a g e

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Organization Chart: Board of DirectorsDocument1 pageOrganization Chart: Board of DirectorsshovonNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Reading Materials - Audit & AssuranceDocument1 pageReading Materials - Audit & AssuranceshovonNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Problem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageProblem ONE: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Class Synopsis - 01Document1 pageClass Synopsis - 01shovonNo ratings yet

- Notification Issued by Financial Reporting Council (FRC)Document1 pageNotification Issued by Financial Reporting Council (FRC)shovonNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Audit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksDocument1 pageAudit & Assurance Module Syllabus Area - Audit & Assurance Particulars Weighting (Indicative %) RemarksshovonNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Class Synopsis - 015Document1 pageClass Synopsis - 015shovonNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Tax Compliance 03Document1 pageTax Compliance 03shovonNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Strategic Management Accounting - M30304: Description 2018 2019Document4 pagesStrategic Management Accounting - M30304: Description 2018 2019shovonNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Assurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020Document117 pagesAssurance Sheet A Combination of Manual & Suggested Answers Up To Nov-Dec, 2020shovonNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Print Receipt CmaDocument1 pagePrint Receipt CmashovonNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- P1 PerfomanceDocument1 pageP1 PerfomanceshovonNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Advantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMADocument1 pageAdvantages and Disadvantages of Appraisal Methods: Class Notes On Performance Operations (P1) by Rafiqul Islam, FCMAshovonNo ratings yet

- Tax Compliance 04Document1 pageTax Compliance 04shovonNo ratings yet

- ICAB - Certificate Level TaxationDocument2 pagesICAB - Certificate Level TaxationshovonNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Tax Compliance 01Document1 pageTax Compliance 01shovonNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- 7 - IT - GOVERNANCE May June 2019Document2 pages7 - IT - GOVERNANCE May June 2019Abdullah al MahmudNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Britt PagesDocument16 pagesBritt PagesshovonNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Affiliation LetterDocument7 pagesAffiliation LettershovonNo ratings yet

- P1 Class Notes by Sir Rafiqul Islam FCMADocument91 pagesP1 Class Notes by Sir Rafiqul Islam FCMAAsmaNo ratings yet

- Affiliation LetterDocument7 pagesAffiliation LettershovonNo ratings yet

- 7th Merit List Circular C Unit 2018-2019Document1 page7th Merit List Circular C Unit 2018-2019shovonNo ratings yet

- International Standard Book Number-IsBN TDocument9 pagesInternational Standard Book Number-IsBN TshovonNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- 0485c6e71cda08e995c857504fa1d86fDocument3 pages0485c6e71cda08e995c857504fa1d86fshovonNo ratings yet

- Device InfoDocument1 pageDevice InfoshovonNo ratings yet

- DateDocument2 pagesDateshovonNo ratings yet

- Subject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyDocument2 pagesSubject: Letter of Cake & Desert Sponsorship For AIS 21 Graduation Completion CeremonyshovonNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Dhaka University Day 2018Document16 pagesDhaka University Day 2018shovonNo ratings yet

- Dhaka University Day 2018Document16 pagesDhaka University Day 2018shovonNo ratings yet

- Business CombinationDocument24 pagesBusiness CombinationArifinNo ratings yet

- Financial Reporting & DisclosureDocument7 pagesFinancial Reporting & DisclosureSharifMahmud100% (1)

- Sector Rotation Over Business CyclesDocument34 pagesSector Rotation Over Business CyclesHenry Do100% (1)

- Financial Modeling BasicsDocument28 pagesFinancial Modeling BasicsOmer Crestiani100% (1)

- KPPKD ADocument531 pagesKPPKD ARishabhrajRajendra100% (1)

- Money Supply: Economics ProjectDocument9 pagesMoney Supply: Economics ProjectabhimussoorieNo ratings yet

- Bank Mandiri Equity UpdateDocument5 pagesBank Mandiri Equity UpdateAhmad SantosoNo ratings yet

- Phillips4e Appendix DDocument23 pagesPhillips4e Appendix DGaurav SharmaNo ratings yet

- Finan MGT DoneDocument22 pagesFinan MGT DonesnehitachatterjeeNo ratings yet

- Strategic Analysis - Swatch CaseDocument15 pagesStrategic Analysis - Swatch CaseSanae BmhmzNo ratings yet

- XLS915-XLS-ENG DesarrolladoDocument10 pagesXLS915-XLS-ENG DesarrolladoYessu Amhed Condori RavichaguaNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Larisa Warren, The Owner of East Coast Yachts, Has DecidedDocument2 pagesLarisa Warren, The Owner of East Coast Yachts, Has DecidedammelukNo ratings yet

- SGV Cup - Elims With AnswersDocument12 pagesSGV Cup - Elims With AnswersMJ YaconNo ratings yet

- The Bankers Code BookDocument226 pagesThe Bankers Code BookNICOLETTENo ratings yet

- How To Start A Family Office by Richard C WilsonDocument98 pagesHow To Start A Family Office by Richard C WilsonRuda Thales Lins Meireles100% (1)

- Ind Nifty 500Document2 pagesInd Nifty 500sadhikastocks15042018No ratings yet

- Leverage Analysis ProjectDocument106 pagesLeverage Analysis Projectbalki123No ratings yet

- FIN 370 Week 5 Questions and Problem Sets (Solutions)Document3 pagesFIN 370 Week 5 Questions and Problem Sets (Solutions)KyleWalkeer0% (2)

- Corporate FinanceDocument310 pagesCorporate Financeaditya.c122No ratings yet

- TVM SolutionDocument27 pagesTVM SolutionRashed Hussain RatulNo ratings yet

- Bank Windhoek Investment Fund Fact Sheet Nov 2014Document1 pageBank Windhoek Investment Fund Fact Sheet Nov 2014poiqweNo ratings yet

- Credit Rating Agencies and Their RoleDocument31 pagesCredit Rating Agencies and Their RoleAmit Sharma0% (1)

- MT103cash TansferDocument20 pagesMT103cash TansferPastor Carlos MolinaNo ratings yet

- Financial Markets and Institutions Course OutlineDocument13 pagesFinancial Markets and Institutions Course OutlineTNo ratings yet

- Financial Statement Analysis of Jamuna Bank LtdDocument33 pagesFinancial Statement Analysis of Jamuna Bank LtdWarisur RahmanNo ratings yet

- Mock Exam C - Afternoon SessionDocument21 pagesMock Exam C - Afternoon SessionNam Hoàng ThànhNo ratings yet

- Buying An Existing Business: Multiple Choice QuestionsDocument30 pagesBuying An Existing Business: Multiple Choice QuestionsEngMohamedReyadHelesy100% (1)

- The Learning Generation - Investing in Education For A Changing WorldDocument176 pagesThe Learning Generation - Investing in Education For A Changing WorldRBeaudryCCLE100% (2)

- Ratio Analysis of Amararaja BatteriesDocument72 pagesRatio Analysis of Amararaja BatteriesE.GOPINADH100% (4)

- Learn options trading and strategies onlineDocument8 pagesLearn options trading and strategies onlinekrana26No ratings yet