Professional Documents

Culture Documents

Account Receivables Turnover Ratios

Uploaded by

VasanthKumar Budarpu0 ratings0% found this document useful (0 votes)

27 views4 pagesThis document defines and provides examples of key financial ratios used to analyze a company's financial statements. It discusses ratios related to accounts receivable and inventory turnover, operating expenses, net income, debt-to-equity, cash flow, and free cash flow. Formulas and example calculations are given for ratios such as gross margin, profit margin, earnings per share, times interest earned, and return on stockholders' equity.

Original Description:

Original Title

Account receivables Turnover Ratios

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document defines and provides examples of key financial ratios used to analyze a company's financial statements. It discusses ratios related to accounts receivable and inventory turnover, operating expenses, net income, debt-to-equity, cash flow, and free cash flow. Formulas and example calculations are given for ratios such as gross margin, profit margin, earnings per share, times interest earned, and return on stockholders' equity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

27 views4 pagesAccount Receivables Turnover Ratios

Uploaded by

VasanthKumar BudarpuThis document defines and provides examples of key financial ratios used to analyze a company's financial statements. It discusses ratios related to accounts receivable and inventory turnover, operating expenses, net income, debt-to-equity, cash flow, and free cash flow. Formulas and example calculations are given for ratios such as gross margin, profit margin, earnings per share, times interest earned, and return on stockholders' equity.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

Account receivables Turnover

Net Credit Sales for the year / Average accounts receivables for the year

Ex : 500000 / 42000 = 11.90%

Days Sales in Accounts Receivables

365 days in year / Accounts Receivables turnover in year

Ex : 365 days / 11.90 = 30.67 days

Inventory Turnover

Cost of goods sold for the year / Average inventory for the year

Ex : 380000 / 30000 ( a computed average ) = 12.67

Days sales in Inventory

365 days In year / Inventory Turnover in year

Ex : 365 days / 12.67 = 28.81

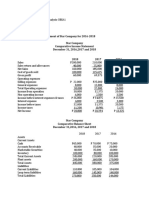

Example of Income caluculate statement

Sales ( As on credit ) 500000

Cost of goods sold 380000

Gross profit 120000

Operating expences

Selling expences 35000

Administrative exp 45000

Total Operating exp 80000

Operating Income 40000

Interest expenses 12000

Income before taxes 28000

Income tax expenses 5000

Net Income after taxes 23000

Debt to Equity

Total Liablities / Total Stockholders Equity : 1

Ex : 481000 / 289000 : 1 = 1.66 : 1

Example of Income caluculate statement

Sales ( As on credit ) 100.0%

Cost of goods sold 76.0%

Gross profit 24.0%

Operating expences

Selling expences 7.0%

Administrative exp 9.0%

Total Operating exp 16.0%

Operating Income 8.0%

Interest expenses 2.4%

Income before taxes 5.6%

Income tax expenses 1.0%

Net Income after taxes 4.6%

Finansial Ratios Based on the Income Statement :

Gross Margin

Gross Profit / Net Sales

Ex : 120000 / 500000 = 24.0%

Profit Margin ( after tax)

Net income after tax / Net Sales

Ex : 23000 / 500000 = 4.6%

Earnings Per Share (EPS)

Net income after tax / Weighted Average Number of Common Shares Outstanding

Ex : 23000 / 100000 = 0.23

Times Interest Earned

Earning for the year before Interest and Income Tax Expense / Interest Expense for

the year

Ex : 40000 / 12000 = 3.3

Return on Stockholders Equity ( after tax )

Net incomes for the year after Taxes / Average Stockholders Equity during the

year

Ex : 23000 / 278000 ( a computed average ) = 8.3%

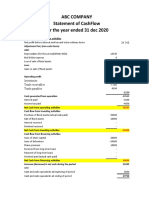

Statement of Cash Flows

Cash Flow from Operating Activities

Net Income 23000

Add : Depreciation Expenses 4000

Increase in accounts receivable (6000)

Decrease in inventory 9000

Decrease in accounts payable (5000)

Cash provided (used) in operating activities 25000

Cash Flow from Investing Acitivities

Capital Expindatures (28000)

Proceeds from sale of Property 7000

Cash Provided (used) by investing activities 21000

Cash Flow from Financing Activities

Borrowings of long term debt 10000

Cash devidents (5000)

Purchase of treasury stock (8000)

Cash provided (used) by financing activities 3000

Net increase in cash 1000

Cash at the beginning of the year 1200

Cash at the end of the year 2200

Free Cash Flow

Cash Flow Provided by Operating Activities – Capital Expenditures

Ex : 25000 – 28000 = 3000

You might also like

- Handsout 06 Chap 03 Part 02Document4 pagesHandsout 06 Chap 03 Part 02Shane VeiraNo ratings yet

- FinancialDocument15 pagesFinancialAdrià BurgellNo ratings yet

- Problem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementDocument4 pagesProblem 1: Ritchelle G. Reyes Mr. Marvin Dente 2.1 Bsa-Cy1 Financial ManagementRavena ReyesNo ratings yet

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- Income StatementDocument6 pagesIncome StatementMohamed Yusuf KarieNo ratings yet

- Book 1Document5 pagesBook 1Muhammad AdnanNo ratings yet

- Magsino Hannah Florence Activity 5 Discounted Cash FlowsDocument36 pagesMagsino Hannah Florence Activity 5 Discounted Cash FlowsKathyrine Claire Edrolin100% (2)

- Muhammad Luthfi Mahendra - 2001036085 - Tugas 5Document5 pagesMuhammad Luthfi Mahendra - 2001036085 - Tugas 5luthfi mahendraNo ratings yet

- Cash Flow Statement StudentDocument60 pagesCash Flow Statement StudentJanine MosatallaNo ratings yet

- FinStat and FinAnaDocument38 pagesFinStat and FinAnaHaizii PritziiNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash FlowMd. Omar Sakib HossainNo ratings yet

- Surendra Sir BuscalcualtionDocument3 pagesSurendra Sir BuscalcualtionPrasiddha PradhanNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Assignment 2 Topic 5. Financial SourcesDocument2 pagesAssignment 2 Topic 5. Financial SourcesnacargamerNo ratings yet

- FSA-Tutorial 3-Fall 2023 With SolutionsDocument4 pagesFSA-Tutorial 3-Fall 2023 With SolutionschtiouirayyenNo ratings yet

- Net Income Versus Cash Flow: Lecture No.24 Professor C. S. Park Fundamentals of Engineering EconomicsDocument8 pagesNet Income Versus Cash Flow: Lecture No.24 Professor C. S. Park Fundamentals of Engineering EconomicsNivika TiffanyNo ratings yet

- Working Lecture 7Document17 pagesWorking Lecture 7Sara KarenNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- Income Statement TestDocument2 pagesIncome Statement TestAndini OleyNo ratings yet

- Cash Flow Statement-ExampleDocument18 pagesCash Flow Statement-ExampleAnakha RadhakrishnanNo ratings yet

- Homework N3Document24 pagesHomework N3Maiko KopadzeNo ratings yet

- SPM Example 3Document8 pagesSPM Example 3inderNo ratings yet

- Accounting Sharim Final ExamDocument5 pagesAccounting Sharim Final ExamsubhanNo ratings yet

- Economy ExcelDocument7 pagesEconomy ExcelCarina MariaNo ratings yet

- Managerial Economics Assignment Bratu Carina Maria BA EXCELDocument7 pagesManagerial Economics Assignment Bratu Carina Maria BA EXCELCarina MariaNo ratings yet

- Comparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018Document5 pagesComparative Income Statement of Star Company For 2016-2018 Star Company Comparative Income Statement December 31, 2016,2017 and 2018JonellNo ratings yet

- Business Finance SamplesDocument2 pagesBusiness Finance SamplesjoeromesantosNo ratings yet

- SDocument8 pagesSdebate ddNo ratings yet

- Accounting Excel SheetsDocument8 pagesAccounting Excel Sheetskokila amarasingheNo ratings yet

- Weller Company Cash FlowDocument3 pagesWeller Company Cash Flowsuske.uchiha2000No ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- CH 12 Exhibit 22Document4 pagesCH 12 Exhibit 22ЭниЭ.No ratings yet

- Chapter 8Document14 pagesChapter 8Kanton FernandezNo ratings yet

- Retained EarningsDocument30 pagesRetained EarningsPooja SreeNo ratings yet

- TP1-W2-S3-R0 Sri Annisa KatariDocument3 pagesTP1-W2-S3-R0 Sri Annisa Katarisri annisa katariNo ratings yet

- Basic Finance I.Z.Y.X Comparative Income StatementDocument3 pagesBasic Finance I.Z.Y.X Comparative Income StatementKazia PerinoNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Engaging Activity 1 Financial AnalysisDocument3 pagesEngaging Activity 1 Financial AnalysisCatherineNo ratings yet

- Assignment 6Document8 pagesAssignment 6Lara Lewis AchillesNo ratings yet

- A. Trend Percentages: RequiredDocument5 pagesA. Trend Percentages: RequiredAngel NuevoNo ratings yet

- FORMAT Complete The BS ISDocument1 pageFORMAT Complete The BS ISAmien MujibNo ratings yet

- Accounting RatiosDocument7 pagesAccounting Ratios27h4fbvsy8No ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Business NotesDocument18 pagesBusiness Notesshally tanNo ratings yet

- Financial StatementsDocument5 pagesFinancial StatementsCA AlmazanNo ratings yet

- Metron Assignment 2-AnaitaDocument7 pagesMetron Assignment 2-AnaitaAnaita DaruwalaNo ratings yet

- Cash FlowDocument3 pagesCash FlowErica BrionesNo ratings yet

- Chapter 1 - Introduction To Published AccountsDocument20 pagesChapter 1 - Introduction To Published AccountsParas VohraNo ratings yet

- Solving - Business Finance 1-6Document28 pagesSolving - Business Finance 1-6Samson, Ma. Louise Ren A.No ratings yet

- Final Exam - FA PDFDocument7 pagesFinal Exam - FA PDFNga NguyễnNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Microsoft Corporation Financial StatementDocument6 pagesMicrosoft Corporation Financial StatementMega Pop LockerNo ratings yet

- Income Statement - Bells Manufacturing Year Ending December 31, 2015Document12 pagesIncome Statement - Bells Manufacturing Year Ending December 31, 2015Elif TuncaNo ratings yet

- Use The Following Information To Answer Items 5 - 7Document4 pagesUse The Following Information To Answer Items 5 - 7acctg2012No ratings yet

- ACCTG 115 Lecture (01-27-2022)Document3 pagesACCTG 115 Lecture (01-27-2022)Janna Mari FriasNo ratings yet

- Income Statement PreparationDocument11 pagesIncome Statement PreparationIbi Ifti100% (1)

- Cash FlowDocument13 pagesCash FlowAbdul Hadi SheikhNo ratings yet

- AA367Document11 pagesAA367Meena DasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Standard CostingDocument21 pagesStandard CostingParth ParthNo ratings yet

- ACCTG 102 Practice Sets Quizzes ExamsDocument25 pagesACCTG 102 Practice Sets Quizzes ExamsheythereitsclaireNo ratings yet

- 1Bdc Cpa Review Institute: Cost AccountingDocument8 pages1Bdc Cpa Review Institute: Cost AccountingJason BautistaNo ratings yet

- Câu Nội dung 1: In Đậm Đáp Án, Ý Kiến Khác Tô ĐỏDocument15 pagesCâu Nội dung 1: In Đậm Đáp Án, Ý Kiến Khác Tô ĐỏThùy Vân NguyễnNo ratings yet

- SunwayTes Management Accountant Progress Test 2Document13 pagesSunwayTes Management Accountant Progress Test 2FarahAin FainNo ratings yet

- Inventory 1Document8 pagesInventory 1Ren AikawaNo ratings yet

- MULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionDocument19 pagesMULTIPLE CHOICE. Choose The One Alternative That Best Completes The Statement or Answers The QuestionKang ChulNo ratings yet

- Hho8e - P6-29A.xls - Corregido A Los Datos Del LibroDocument3 pagesHho8e - P6-29A.xls - Corregido A Los Datos Del LibroXimena ChumaceroNo ratings yet

- Income Statement TaskDocument5 pagesIncome Statement Taskiceman2167No ratings yet

- Management InformationDocument10 pagesManagement InformationTanjil AhmedNo ratings yet

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyFery AnnNo ratings yet

- Chapter 3 Systems Design Job Order CostingDocument3 pagesChapter 3 Systems Design Job Order CostingQurat SaboorNo ratings yet

- (ACCT2010) (2017) (F) Midterm In5mue0 38655Document4 pages(ACCT2010) (2017) (F) Midterm In5mue0 38655Pak HoNo ratings yet

- Ag Coop Is A Large Farm Cooperative With A Number ofDocument2 pagesAg Coop Is A Large Farm Cooperative With A Number ofAmit PandeyNo ratings yet

- Ia1 - Final ExaminationDocument7 pagesIa1 - Final ExaminationLorence IbañezNo ratings yet

- Solutions To Chapter 7 Long-Term Debt-Paying AbilityDocument32 pagesSolutions To Chapter 7 Long-Term Debt-Paying AbilityGing freexNo ratings yet

- Perpetual and Periodic Inventory System 1Document45 pagesPerpetual and Periodic Inventory System 1Kathleen SantiagoNo ratings yet

- Finman 244 SummaryDocument144 pagesFinman 244 Summaryhermanschreiber47No ratings yet

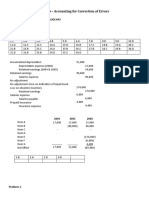

- Unit 4 - Accounting For Correction of Errors: Cabueñas, Brenton C. Bsa - 3 Audcap2 Problem 1 AnswersDocument14 pagesUnit 4 - Accounting For Correction of Errors: Cabueñas, Brenton C. Bsa - 3 Audcap2 Problem 1 AnswersSel BarrantesNo ratings yet

- Fa July 2022 (A)Document4 pagesFa July 2022 (A)Ieymarh Fatimah100% (1)

- 15 Advanced Management Accounting PDFDocument326 pages15 Advanced Management Accounting PDFZahid UsmanNo ratings yet

- Financial Planning: 6.1 Start-Up Cost and Capital ExpenditureDocument4 pagesFinancial Planning: 6.1 Start-Up Cost and Capital ExpenditurearefeenaNo ratings yet

- System Design - Process CostingDocument38 pagesSystem Design - Process CostingAbuShahidNo ratings yet

- Original Research Paper Commerce: A Study On Financial Performance Analysis of Indian Tobacco Corporation LimitedDocument6 pagesOriginal Research Paper Commerce: A Study On Financial Performance Analysis of Indian Tobacco Corporation Limitedemmanual cheeranNo ratings yet

- Hampton Machine Tool CompanyDocument6 pagesHampton Machine Tool CompanyClaudia Torres50% (2)

- Standard CostingDocument99 pagesStandard CostingcaironsalamNo ratings yet

- CostDocument17 pagesCostRomiline UmayamNo ratings yet

- The Fall of Ravi RestaurantDocument11 pagesThe Fall of Ravi RestaurantialimughalNo ratings yet

- Additional Topics in Variance Analysis: Solutions To Review QuestionsDocument36 pagesAdditional Topics in Variance Analysis: Solutions To Review QuestionskrrrNo ratings yet

- Managerial Accounting Workbook Version 1Document87 pagesManagerial Accounting Workbook Version 1krish lopezNo ratings yet