Professional Documents

Culture Documents

Cash Flow

Cash Flow

Uploaded by

aditya jain0 ratings0% found this document useful (0 votes)

3 views12 pagesOriginal Title

CashFlow (2)

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views12 pagesCash Flow

Cash Flow

Uploaded by

aditya jainCopyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 12

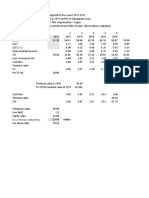

<div id='Fin_Freeze' style='overflow:auto;width:100%;height:100%;border-left:0 px

gray solid;border-bottom:0 px gray solid;padding:0px;margin:0 px;'><table

border='1' CellSpacing=1 cellpadding=0 Width=100%><tr><td style='font-weight:bold'

colspan='4'> Sun Pharmaceutical Industries Ltd.</td><td>(Indian Rupee .in

Crores)</td></tr><tr><td style='height:20px'></td></tr><tr class=GridHeadLeft><td

class=GridHeadLeft_Fin style="cursor:hand;font-weight:bold"> </td><td

class=GridHeadLeft_Fin style='font-weight:bold'>Particulars </td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2021</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2020</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2019</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2018</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2017</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2016</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2015</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2014</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2013</td><td

class=GridHeadRight_Fin style='font-weight:bold'>Mar 2012</td><tr><td

class=GridDataLeftPlus></td><td class=GridDataLeft>No of Months</td><td

class=GridDataRight>12 </td><td

class=GridDataRight_Alt>12 </td><td

class=GridDataRight>12 </td><td

class=GridDataRight_Alt>12 </td><td

class=GridDataRight>12 </td><td

class=GridDataRight_Alt>12 </td><td

class=GridDataRight>12 </td><td

class=GridDataRight_Alt>12 </td><td

class=GridDataRight>12 </td><td

class=GridDataRight_Alt>12 </td></tr><tr id="R6" ><td

class=GridDataLeftPlus_BG></td><td class=GridDataLeft><STRONG>Profit Before

Tax</STRONG></td><td class=GridDataRight><STRONG>2,152.87</STRONG></td><td

class=GridDataRight_Alt><STRONG>3,253.00</STRONG></td><td

class=GridDataRight><STRONG>719.45</STRONG></td><td

class=GridDataRight_Alt><STRONG>280.25</STRONG></td><td

class=GridDataRight><STRONG>-16.80</STRONG></td><td

class=GridDataRight_Alt><STRONG>-1,082.06</STRONG></td><td

class=GridDataRight><STRONG>-1,558.97</STRONG></td><td

class=GridDataRight_Alt><STRONG>-2,801.09</STRONG></td><td

class=GridDataRight><STRONG>663.03</STRONG></td><td

class=GridDataRight_Alt><STRONG>1,725.83</STRONG></td></tr><tr id="R7"><td

class=GridDataLeftPlus_BG style="cursor:pointer"

onclick="javascript:ExpandRows('8,9,10,11,12,13,14,15,16,17,18,19,20,21,22,23,24,25

,26',this);" ><STRONG>+</STRONG></td><td

class=GridDataLeft_BG><STRONG>Adjustment</STRONG></td><td

class=GridDataRight_BG><STRONG>970.42</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-217.09</STRONG></td><td

class=GridDataRight_BG><STRONG>448.66</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-294.77</STRONG></td><td

class=GridDataRight_BG><STRONG>-51.25</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>765.34</STRONG></td><td

class=GridDataRight_BG><STRONG>585.98</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>43.19</STRONG></td><td

class=GridDataRight_BG><STRONG>-73.57</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>112.03</STRONG></td></tr><tr id="R8"><td

class=GridDataLeft></td><td

class=GridDataLeft> Depreciation</td><td

class=GridDataRight>586.81</td><td class=GridDataRight_Alt>561.56</td><td

class=GridDataRight>552.95</td><td class=GridDataRight_Alt>487.24</td><td

class=GridDataRight>422.28</td><td class=GridDataRight_Alt>464.25</td><td

class=GridDataRight>660.68</td><td class=GridDataRight_Alt>101.94</td><td

class=GridDataRight>85.82</td><td class=GridDataRight_Alt>75.72</td></tr><tr

id="R9"><td class=GridDataLeft></td><td

class=GridDataLeft> Impairment</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>70.13</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R10"><td class=GridDataLeft></td><td

class=GridDataLeft> Interest Expeses</td><td

class=GridDataRight>256.98</td><td class=GridDataRight_Alt>408.01</td><td

class=GridDataRight>540.92</td><td class=GridDataRight_Alt>388.31</td><td

class=GridDataRight>223.57</td><td class=GridDataRight_Alt>574.10</td><td

class=GridDataRight>551.25</td><td class=GridDataRight_Alt>18.38</td><td

class=GridDataRight>0.44</td><td class=GridDataRight_Alt>0.43</td></tr><tr

id="R11"><td class=GridDataLeft></td><td

class=GridDataLeft> Profit/Loss on sale of Fixed

Assets</td><td class=GridDataRight>1.92</td><td

class=GridDataRight_Alt>5.10</td><td class=GridDataRight>34.10</td><td

class=GridDataRight_Alt>6.37</td><td class=GridDataRight>11.22</td><td

class=GridDataRight_Alt>-9.59</td><td class=GridDataRight>6.48</td><td

class=GridDataRight_Alt>2.11</td><td class=GridDataRight>0.60</td><td

class=GridDataRight_Alt>3.69</td></tr><tr id="R12"><td class=GridDataLeft></td><td

class=GridDataLeft> Profit/Loss on sale of

Investments</td><td class=GridDataRight>0.00</td><td class=GridDataRight_Alt>-

224.43</td><td class=GridDataRight>-186.24</td><td class=GridDataRight_Alt>-

132.80</td><td class=GridDataRight>-242.81</td><td class=GridDataRight_Alt>-

311.93</td><td class=GridDataRight>-98.89</td><td

class=GridDataRight_Alt>-81.32</td><td class=GridDataRight>-30.72</td><td

class=GridDataRight_Alt>-174.20</td></tr><tr id="R13"><td

class=GridDataLeft></td><td class=GridDataLeft> Dividend

Received</td><td class=GridDataRight>-38.34</td><td class=GridDataRight_Alt>-

925.83</td><td class=GridDataRight>-890.93</td><td class=GridDataRight_Alt>-

815.48</td><td class=GridDataRight>-204.07</td><td class=GridDataRight_Alt>-

39.45</td><td class=GridDataRight>-0.02</td><td

class=GridDataRight_Alt>-0.02</td><td class=GridDataRight>-0.02</td><td

class=GridDataRight_Alt>-0.02</td></tr><tr id="R14"><td class=GridDataLeft></td><td

class=GridDataLeft> Interest Income</td><td

class=GridDataRight>-59.23</td><td class=GridDataRight_Alt>-70.06</td><td

class=GridDataRight>-129.36</td><td class=GridDataRight_Alt>-128.76</td><td

class=GridDataRight>-23.21</td><td class=GridDataRight_Alt>-36.24</td><td

class=GridDataRight>-84.98</td><td class=GridDataRight_Alt>-89.06</td><td

class=GridDataRight>-202.96</td><td class=GridDataRight_Alt>-162.69</td></tr><tr

id="R15"><td class=GridDataLeft></td><td

class=GridDataLeft> Diminution in the value / Write off of

Investments</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>-56.22</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>23.61</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R16"><td class=GridDataLeft></td><td

class=GridDataLeft> Transferred from Revaluation

Reserve</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R17"><td class=GridDataLeft></td><td

class=GridDataLeft> Effect of Exchange Rate Change</td><td

class=GridDataRight>235.32</td><td class=GridDataRight_Alt>239.94</td><td

class=GridDataRight>520.28</td><td class=GridDataRight_Alt>-32.85</td><td

class=GridDataRight>-238.73</td><td class=GridDataRight_Alt>-72.63</td><td

class=GridDataRight>-577.11</td><td class=GridDataRight_Alt>81.37</td><td

class=GridDataRight>45.05</td><td class=GridDataRight_Alt>73.23</td></tr><tr

id="R18"><td class=GridDataLeft></td><td

class=GridDataLeft> Net Prior Year Adjustments</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R19"><td class=GridDataLeft></td><td

class=GridDataLeft> Provision & Written Off</td><td

class=GridDataRight>-7.56</td><td class=GridDataRight_Alt>-252.02</td><td

class=GridDataRight>33.13</td><td class=GridDataRight_Alt>11.23</td><td

class=GridDataRight>13.78</td><td class=GridDataRight_Alt>-5.00</td><td

class=GridDataRight>46.74</td><td class=GridDataRight_Alt>0.02</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R20"><td class=GridDataLeft></td><td

class=GridDataLeft> Excess of cost over fair value of

investments</td><td class=GridDataRight>-9.80</td><td class=GridDataRight_Alt>-

12.90</td><td class=GridDataRight>-11.49</td><td

class=GridDataRight_Alt>-8.14</td><td class=GridDataRight>-20.21</td><td

class=GridDataRight_Alt>-0.57</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R21"><td class=GridDataLeft></td><td

class=GridDataLeft> Taxes Paid</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R22"><td class=GridDataLeft></td><td

class=GridDataLeft> Taxes refunded</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R23"><td class=GridDataLeft></td><td

class=GridDataLeft> Baddebts irrecoverables written

off</td><td class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R24"><td class=GridDataLeft></td><td

class=GridDataLeft> Provision for doubtful debts &

advances</td><td class=GridDataRight>4.32</td><td

class=GridDataRight_Alt>53.54</td><td class=GridDataRight>-14.70</td><td

class=GridDataRight_Alt>-13.57</td><td class=GridDataRight>3.85</td><td

class=GridDataRight_Alt>123.21</td><td class=GridDataRight>37.72</td><td

class=GridDataRight_Alt>9.77</td><td class=GridDataRight>9.15</td><td

class=GridDataRight_Alt>0.96</td></tr><tr id="R25"><td class=GridDataLeft></td><td

class=GridDataLeft> Misc. Expenses written off</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R26"><td class=GridDataLeft></td><td

class=GridDataLeft> Other Adjustments</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>-0.10</td><td

class=GridDataRight>3.08</td><td class=GridDataRight_Alt>9.06</td><td

class=GridDataRight>20.50</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>19.07</td><td class=GridDataRight_Alt>294.91</td></tr><tr

id="R28"><td class=GridDataLeftPlus_BG style="cursor:pointer"

onclick="javascript:ExpandRows('29,30,31,32,33,34',this);"

><STRONG>+</STRONG></td><td class=GridDataLeft_BG><STRONG>Changes In working

Capital</STRONG></td><td class=GridDataRight_BG><STRONG>-1,148.37</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-1,393.00</STRONG></td><td

class=GridDataRight_BG><STRONG>111.50</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-865.29</STRONG></td><td

class=GridDataRight_BG><STRONG>-769.35</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-585.04</STRONG></td><td

class=GridDataRight_BG><STRONG>1,315.06</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>501.61</STRONG></td><td

class=GridDataRight_BG><STRONG>-314.22</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-354.25</STRONG></td></tr><tr id="R29"><td

class=GridDataLeft></td><td class=GridDataLeft> Trade &

Other receivables</td><td class=GridDataRight>-462.17</td><td

class=GridDataRight_Alt>-921.72</td><td class=GridDataRight>169.85</td><td

class=GridDataRight_Alt>-538.53</td><td class=GridDataRight>-668.11</td><td

class=GridDataRight_Alt>-304.96</td><td class=GridDataRight>277.11</td><td

class=GridDataRight_Alt>-186.88</td><td class=GridDataRight>-27.71</td><td

class=GridDataRight_Alt>-294.31</td></tr><tr id="R30"><td

class=GridDataLeft></td><td

class=GridDataLeft> Inventories</td><td

class=GridDataRight>-532.05</td><td class=GridDataRight_Alt>158.95</td><td

class=GridDataRight>-656.98</td><td class=GridDataRight_Alt>172.64</td><td

class=GridDataRight>-166.73</td><td class=GridDataRight_Alt>57.09</td><td

class=GridDataRight>424.27</td><td class=GridDataRight_Alt>-49.62</td><td

class=GridDataRight>-228.69</td><td class=GridDataRight_Alt>-167.89</td></tr><tr

id="R31"><td class=GridDataLeft></td><td

class=GridDataLeft> Loans & Advances</td><td

class=GridDataRight>155.77</td><td class=GridDataRight_Alt>297.53</td><td

class=GridDataRight>-130.23</td><td class=GridDataRight_Alt>-770.44</td><td

class=GridDataRight>-181.42</td><td class=GridDataRight_Alt>-168.18</td><td

class=GridDataRight>2,783.54</td><td class=GridDataRight_Alt>-2,533.00</td><td

class=GridDataRight>-79.19</td><td class=GridDataRight_Alt>-46.55</td></tr><tr

id="R32"><td class=GridDataLeft></td><td

class=GridDataLeft> Investments</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R33"><td class=GridDataLeft></td><td

class=GridDataLeft> Trade & Other payables</td><td

class=GridDataRight>-309.92</td><td class=GridDataRight_Alt>-927.76</td><td

class=GridDataRight>728.86</td><td class=GridDataRight_Alt>271.04</td><td

class=GridDataRight>246.91</td><td class=GridDataRight_Alt>-168.99</td><td

class=GridDataRight>-2,169.86</td><td class=GridDataRight_Alt>3,271.11</td><td

class=GridDataRight>21.37</td><td class=GridDataRight_Alt>154.50</td></tr><tr

id="R33.1"><td class=GridDataLeft></td><td

class=GridDataLeft> Decrease / (Increase) in LT loans &

Advances</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R33.2"><td

class=GridDataLeft></td><td class=GridDataLeft> (Increase) /

Decrease in Other non current Assets</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R33.3"><td

class=GridDataLeft></td><td class=GridDataLeft> Increase /

(Decrease) in Other non current Liabilities</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R33.4"><td class=GridDataLeft></td><td

class=GridDataLeft> Increase / (Decrease) in LT

Provisions</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R34"><td class=GridDataLeft></td><td

class=GridDataLeft> Other </td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R36"><td class=GridDataLeftPlus_BG style="cursor:pointer"

onclick="javascript:ExpandRows('37,38,39,40',this);" ><STRONG>+</STRONG></td><td

class=GridDataLeft_BG><STRONG> Cash Flow after changes in Working

Capital</STRONG></td><td class=GridDataRight_BG><STRONG>1,974.92</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>1,642.91</STRONG></td><td

class=GridDataRight_BG><STRONG>1,279.61</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-879.81</STRONG></td><td

class=GridDataRight_BG><STRONG>-837.40</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-901.76</STRONG></td><td

class=GridDataRight_BG><STRONG>342.07</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-2,256.29</STRONG></td><td

class=GridDataRight_BG><STRONG>275.24</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>1,483.61</STRONG></td></tr><tr id="R37"><td

class=GridDataLeft></td><td class=GridDataLeft> Interest

Paid</td><td class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R38"><td class=GridDataLeft></td><td

class=GridDataLeft> Tax Paid</td><td class=GridDataRight>-

237.67</td><td class=GridDataRight_Alt>-337.06</td><td class=GridDataRight>-

37.43</td><td class=GridDataRight_Alt>-291.42</td><td class=GridDataRight>-

783.60</td><td class=GridDataRight_Alt>-352.73</td><td class=GridDataRight>-

193.48</td><td class=GridDataRight_Alt>-148.77</td><td

class=GridDataRight>-168.76</td><td class=GridDataRight_Alt>-144.43</td></tr><tr

id="R39"><td class=GridDataLeft></td><td

class=GridDataLeft> Other Direct Expenses paid</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R40"><td class=GridDataLeft></td><td

class=GridDataLeft> Extra & Other Item</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr id="R41"

><td class=GridDataLeftPlus_BG></td><td

class=GridDataLeft><STRONG> Cash From Operating

Activities</STRONG></td><td class=GridDataRight><STRONG>1,737.25</STRONG></td><td

class=GridDataRight_Alt><STRONG>1,305.85</STRONG></td><td

class=GridDataRight><STRONG>1,242.18</STRONG></td><td

class=GridDataRight_Alt><STRONG>-1,171.23</STRONG></td><td

class=GridDataRight><STRONG>-1,621.00</STRONG></td><td

class=GridDataRight_Alt><STRONG>-1,254.49</STRONG></td><td

class=GridDataRight><STRONG>148.59</STRONG></td><td

class=GridDataRight_Alt><STRONG>-2,405.06</STRONG></td><td

class=GridDataRight><STRONG>106.48</STRONG></td><td

class=GridDataRight_Alt><STRONG>1,339.18</STRONG></td></tr><tr id="R42"><td

class=GridDataLeftPlus_BG style="cursor:pointer"

onclick="javascript:ExpandRows('43,44,45,46,47,48,49,50,51,52,53,54,55,56',this);"

><STRONG>+</STRONG></td><td class=GridDataLeft_BG><STRONG>Cash Flow from Investing

Activities</STRONG></td><td class=GridDataRight_BG><STRONG>-601.80</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>1,479.29</STRONG></td><td

class=GridDataRight_BG><STRONG>433.69</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>1,391.62</STRONG></td><td

class=GridDataRight_BG><STRONG>2,381.38</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>3,639.20</STRONG></td><td

class=GridDataRight_BG><STRONG>2,152.81</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>519.14</STRONG></td><td

class=GridDataRight_BG><STRONG>460.54</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-773.69</STRONG></td></tr><tr id="R43"><td

class=GridDataLeft></td><td class=GridDataLeft> Purchase of Fixed

Assets</td><td class=GridDataRight>-751.42</td><td class=GridDataRight_Alt>-

571.80</td><td class=GridDataRight>-596.71</td><td class=GridDataRight_Alt>-

746.16</td><td class=GridDataRight>-1,094.01</td><td class=GridDataRight_Alt>-

563.94</td><td class=GridDataRight>-1,027.98</td><td class=GridDataRight_Alt>-

434.32</td><td class=GridDataRight>-429.54</td><td class=GridDataRight_Alt>-

388.24</td></tr><tr id="R44"><td class=GridDataLeft></td><td

class=GridDataLeft> Sale of Fixed Assets</td><td

class=GridDataRight>52.94</td><td class=GridDataRight_Alt>6.35</td><td

class=GridDataRight>12.31</td><td class=GridDataRight_Alt>6.27</td><td

class=GridDataRight>9.73</td><td class=GridDataRight_Alt>14.45</td><td

class=GridDataRight>14.84</td><td class=GridDataRight_Alt>2.06</td><td

class=GridDataRight>1.09</td><td class=GridDataRight_Alt>3.09</td></tr><tr

id="R45"><td class=GridDataLeft></td><td

class=GridDataLeft> Profit/Loss on sale of Fixed Assets</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R46"><td class=GridDataLeft></td><td

class=GridDataLeft> Profit/Loss on sale of Investments</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R47"><td class=GridDataLeft></td><td

class=GridDataLeft> Purchase of Investment</td><td

class=GridDataRight>-7,837.25</td><td class=GridDataRight_Alt>-14,894.11</td><td

class=GridDataRight>-17,405.28</td><td class=GridDataRight_Alt>-16,911.00</td><td

class=GridDataRight>-17,642.59</td><td class=GridDataRight_Alt>-13,199.94</td><td

class=GridDataRight>-10,714.23</td><td class=GridDataRight_Alt>-19,508.15</td><td

class=GridDataRight>-15,562.44</td><td

class=GridDataRight_Alt>-14,677.76</td></tr><tr id="R48"><td

class=GridDataLeft></td><td class=GridDataLeft> Sale of

Investments</td><td class=GridDataRight>8,211.48</td><td

class=GridDataRight_Alt>14,841.39</td><td class=GridDataRight>17,200.78</td><td

class=GridDataRight_Alt>16,910.88</td><td class=GridDataRight>20,887.45</td><td

class=GridDataRight_Alt>13,438.49</td><td class=GridDataRight>11,793.02</td><td

class=GridDataRight_Alt>20,390.18</td><td class=GridDataRight>15,922.26</td><td

class=GridDataRight_Alt>14,468.78</td></tr><tr id="R49"><td

class=GridDataLeft></td><td class=GridDataLeft> Investment in

Subsidiaries</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>857.09</td><td class=GridDataRight>858.04</td><td

class=GridDataRight_Alt>1,152.95</td><td class=GridDataRight>-0.61</td><td

class=GridDataRight_Alt>3,830.50</td><td class=GridDataRight>894.70</td><td

class=GridDataRight_Alt>-616.22</td><td class=GridDataRight>471.59</td><td

class=GridDataRight_Alt>-380.69</td></tr><tr id="R50"><td

class=GridDataLeft></td><td class=GridDataLeft> Dividend

Income</td><td class=GridDataRight>38.34</td><td

class=GridDataRight_Alt>1,350.07</td><td class=GridDataRight>476.45</td><td

class=GridDataRight_Alt>815.48</td><td class=GridDataRight>204.07</td><td

class=GridDataRight_Alt>39.45</td><td class=GridDataRight>0.02</td><td

class=GridDataRight_Alt>0.02</td><td class=GridDataRight>0.02</td><td

class=GridDataRight_Alt>0.02</td></tr><tr id="R51"><td class=GridDataLeft></td><td

class=GridDataLeft> Interest Income</td><td

class=GridDataRight>42.40</td><td class=GridDataRight_Alt>28.35</td><td

class=GridDataRight>119.20</td><td class=GridDataRight_Alt>144.00</td><td

class=GridDataRight>16.90</td><td class=GridDataRight_Alt>55.00</td><td

class=GridDataRight>89.26</td><td class=GridDataRight_Alt>105.64</td><td

class=GridDataRight>207.69</td><td class=GridDataRight_Alt>144.72</td></tr><tr

id="R52"><td class=GridDataLeft></td><td

class=GridDataLeft> Increase/ Decrease in Loans</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>32.00</td><td class=GridDataRight_Alt>-32.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>25.15</td><td

class=GridDataRight>1,103.18</td><td class=GridDataRight_Alt>310.19</td><td

class=GridDataRight>-131.06</td><td class=GridDataRight_Alt>51.38</td></tr><tr

id="R53"><td class=GridDataLeft></td><td class=GridDataLeft> Loans

& advances given to subsidiaries / partnership firms etc.</td><td

class=GridDataRight>-358.29</td><td class=GridDataRight_Alt>-138.05</td><td

class=GridDataRight>-263.10</td><td class=GridDataRight_Alt>51.20</td><td

class=GridDataRight>0.44</td><td class=GridDataRight_Alt>0.04</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R54"><td class=GridDataLeft></td><td

class=GridDataLeft> Advances for capital expenditure</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R55"><td class=GridDataLeft></td><td

class=GridDataLeft> Intercorporate deposits</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R56"><td class=GridDataLeft></td><td class=GridDataLeft> Other

Investment Activities</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>269.74</td><td class=GridDataRight>-19.07</td><td

class=GridDataRight_Alt>5.01</td></tr><tr id="R58"><td class=GridDataLeftPlus_BG

style="cursor:pointer"

onclick="javascript:ExpandRows('59,60,61,62,63,64,65,66,67,68,69,70,71,72,73,74,75,

76,77,78,79',this);" ><STRONG>+</STRONG></td><td class=GridDataLeft_BG><STRONG>Cash

from Financing Activites</STRONG></td><td class=GridDataRight_BG><STRONG>-

1,126.29</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-2,871.15</STRONG></td><td

class=GridDataRight_BG><STRONG>-1,468.59</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-272.10</STRONG></td><td

class=GridDataRight_BG><STRONG>-752.99</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-2,368.03</STRONG></td><td

class=GridDataRight_BG><STRONG>-2,674.09</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>1,742.10</STRONG></td><td

class=GridDataRight_BG><STRONG>-508.99</STRONG></td><td

class=GridDataRight_Alt_BG><STRONG>-420.21</STRONG></td></tr><tr id="R59"><td

class=GridDataLeft></td><td class=GridDataLeft> Increase /

(Decrease) in Loan Funds</td><td class=GridDataRight>-2,891.33</td><td

class=GridDataRight_Alt>-1,863.89</td><td class=GridDataRight>-115.69</td><td

class=GridDataRight_Alt>262.46</td><td class=GridDataRight>1,115.89</td><td

class=GridDataRight_Alt>-1,757.45</td><td class=GridDataRight>-1,714.57</td><td

class=GridDataRight_Alt>2,400.20</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R60"><td class=GridDataLeft></td><td

class=GridDataLeft> Proceeds from Long Term Borrowings</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R61"><td class=GridDataLeft></td><td

class=GridDataLeft> Repayment of Long Term Borrowings</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R62"><td class=GridDataLeft></td><td

class=GridDataLeft> Proceeds from Debenture / Bonds</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R63"><td class=GridDataLeft></td><td

class=GridDataLeft> Repayment of Debenture / Bonds</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R64"><td class=GridDataLeft></td><td class=GridDataLeft> Short

Term Loans</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>4.64</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R65"><td class=GridDataLeft></td><td

class=GridDataLeft> Increase / (Decrease) in Preference

Capital</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R66"><td class=GridDataLeft></td><td

class=GridDataLeft> Proceeds from Prefernce Shares Capital</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R67"><td class=GridDataLeft></td><td

class=GridDataLeft> Redemtion of Prefernce Shares Capital</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R68"><td class=GridDataLeft></td><td

class=GridDataLeft> proceeds from Shares Warrants</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R69"><td class=GridDataLeft></td><td

class=GridDataLeft> Proceeds from Issue of Equity Share

Capital</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.38</td><td

class=GridDataRight_Alt>0.91</td><td class=GridDataRight>2.48</td><td

class=GridDataRight_Alt>9.13</td><td class=GridDataRight>74.87</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R70"><td class=GridDataLeft></td><td

class=GridDataLeft> Buy Back of Equity Shares Capital</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>-5.88</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>-678.42</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R71"><td class=GridDataLeft></td><td

class=GridDataLeft> Equity Dividend Paid</td><td

class=GridDataRight>-1,559.47</td><td class=GridDataRight_Alt>-1,379.19</td><td

class=GridDataRight>-480.18</td><td class=GridDataRight_Alt>-798.14</td><td

class=GridDataRight>-239.92</td><td class=GridDataRight_Alt>-721.68</td><td

class=GridDataRight>-310.48</td><td class=GridDataRight_Alt>-517.54</td><td

class=GridDataRight>-440.12</td><td class=GridDataRight_Alt>-352.37</td></tr><tr

id="R72"><td class=GridDataLeft></td><td

class=GridDataLeft> Preference Dividend</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R73"><td class=GridDataLeft></td><td

class=GridDataLeft> Interest Paid</td><td class=GridDataRight>-

297.07</td><td class=GridDataRight_Alt>-155.07</td><td class=GridDataRight>-

267.57</td><td class=GridDataRight_Alt>-283.69</td><td class=GridDataRight>-

143.56</td><td class=GridDataRight_Alt>-364.49</td><td class=GridDataRight>-

331.98</td><td class=GridDataRight_Alt>-18.24</td><td

class=GridDataRight>-0.30</td><td class=GridDataRight_Alt>-0.43</td></tr><tr

id="R74"><td class=GridDataLeft></td><td

class=GridDataLeft> Changes in working capital borrowings</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>-180.00</td><td

class=GridDataRight>-339.13</td><td class=GridDataRight_Alt>-34.32</td><td

class=GridDataRight>-1.81</td><td class=GridDataRight_Alt>-10.23</td></tr><tr

id="R75"><td class=GridDataLeft></td><td class=GridDataLeft> Loans

(to) / from subsidiaries</td><td class=GridDataRight>3,196.58</td><td

class=GridDataRight_Alt>1,150.77</td><td class=GridDataRight>-604.97</td><td

class=GridDataRight_Alt>546.70</td><td class=GridDataRight>-801.99</td><td

class=GridDataRight_Alt>793.43</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R76"><td class=GridDataLeft></td><td

class=GridDataLeft> Net inc/dec in cash / Export credit facilities

and other short term loans</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R77"><td class=GridDataLeft></td><td

class=GridDataLeft> Income tax on dividend paid</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>-192.89</td><td

class=GridDataRight>-0.56</td><td class=GridDataRight_Alt>-0.34</td><td

class=GridDataRight>-7.47</td><td class=GridDataRight_Alt>-146.97</td><td

class=GridDataRight>-52.80</td><td class=GridDataRight_Alt>-88.00</td><td

class=GridDataRight>-71.40</td><td class=GridDataRight_Alt>-57.18</td></tr><tr

id="R78"><td class=GridDataLeft></td><td

class=GridDataLeft> Expenses on issue of shares</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R79"><td class=GridDataLeft></td><td

class=GridDataLeft> Other Financial Activities</td><td

class=GridDataRight>425.00</td><td class=GridDataRight_Alt>-425.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr id="R81"

><td class=GridDataLeftPlus_BG></td><td

class=GridDataLeft><STRONG> Net Cash Inflow /

Outflow</STRONG></td><td class=GridDataRight><STRONG>9.16</STRONG></td><td

class=GridDataRight_Alt><STRONG>-86.01</STRONG></td><td

class=GridDataRight><STRONG>207.28</STRONG></td><td

class=GridDataRight_Alt><STRONG>-51.71</STRONG></td><td

class=GridDataRight><STRONG>7.39</STRONG></td><td

class=GridDataRight_Alt><STRONG>16.68</STRONG></td><td

class=GridDataRight><STRONG>-372.69</STRONG></td><td

class=GridDataRight_Alt><STRONG>-143.82</STRONG></td><td

class=GridDataRight><STRONG>58.03</STRONG></td><td

class=GridDataRight_Alt><STRONG>145.28</STRONG></td></tr><tr id="R82" ><td

class=GridDataLeftPlus_BG></td><td

class=GridDataLeft><STRONG> Opening Cash & Cash

Equivalents</STRONG></td><td class=GridDataRight><STRONG>220.50</STRONG></td><td

class=GridDataRight_Alt><STRONG>302.76</STRONG></td><td

class=GridDataRight><STRONG>97.80</STRONG></td><td

class=GridDataRight_Alt><STRONG>147.52</STRONG></td><td

class=GridDataRight><STRONG>140.99</STRONG></td><td

class=GridDataRight_Alt><STRONG>120.85</STRONG></td><td

class=GridDataRight><STRONG>76.32</STRONG></td><td

class=GridDataRight_Alt><STRONG>221.81</STRONG></td><td

class=GridDataRight><STRONG>168.72</STRONG></td><td

class=GridDataRight_Alt><STRONG>20.38</STRONG></td></tr><tr id="R83"><td

class=GridDataLeft></td><td class=GridDataLeft> Cash & Cash

Equivalent on Amalgamation / Take over / Merger</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>487.93</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R84"><td class=GridDataLeft></td><td class=GridDataLeft> Cash

& Cash Equivalent of Subsidiaries under liquidations</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td><td

class=GridDataRight>0.00</td><td class=GridDataRight_Alt>0.00</td></tr><tr

id="R85"><td class=GridDataLeft></td><td

class=GridDataLeft> Translation adjustment on reserves / op cash

balalces frgn subsidiaries</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td><td class=GridDataRight>0.00</td><td

class=GridDataRight_Alt>0.00</td></tr><tr id="R86"><td class=GridDataLeft></td><td

class=GridDataLeft> Effect of Foreign Exchange

Fluctuations</td><td class=GridDataRight>-7.32</td><td

class=GridDataRight_Alt>3.75</td><td class=GridDataRight>-2.32</td><td

class=GridDataRight_Alt>1.99</td><td class=GridDataRight>-0.86</td><td

class=GridDataRight_Alt>0.52</td><td class=GridDataRight>1.64</td><td

class=GridDataRight_Alt>-1.67</td><td class=GridDataRight>-4.94</td><td

class=GridDataRight_Alt>3.06</td></tr><tr id="R87" ><td

class=GridDataLeftPlus_BG></td><td

class=GridDataLeft><STRONG> Closing Cash & Cash

Equivalent</STRONG></td><td class=GridDataRight><STRONG>222.34</STRONG></td><td

class=GridDataRight_Alt><STRONG>220.50</STRONG></td><td

class=GridDataRight><STRONG>302.76</STRONG></td><td

class=GridDataRight_Alt><STRONG>97.80</STRONG></td><td

class=GridDataRight><STRONG>147.52</STRONG></td><td

class=GridDataRight_Alt><STRONG>138.05</STRONG></td><td

class=GridDataRight><STRONG>193.20</STRONG></td><td

class=GridDataRight_Alt><STRONG>76.32</STRONG></td><td

class=GridDataRight><STRONG>221.81</STRONG></td><td

class=GridDataRight_Alt><STRONG>168.72</STRONG></td></tr><tr

style='height:10px;'><td colspan='6'></td></tr><tr><td colspan='6'><table

cellspacing='0' cellpadding='0' border='0'> <tr style='height:20px;'> <td

class='blackTxtBold'> <b> Note : </b></td><td></td><td

class='NormalText'> Please Use '<b> + </b>' Symbol For Grouping and ' <b> -

</b> ' For Ungrouping </td></tr></table></td></tr></table></table></div>

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 1018 BaDocument4 pages1018 BaHoàng Long NguyễnNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Real Estate Mortgage AgreementDocument3 pagesReal Estate Mortgage AgreementKen BaxNo ratings yet

- Cma Inter MCQ Booklet Financial Accounting Paper 5Document175 pagesCma Inter MCQ Booklet Financial Accounting Paper 5DGGI BPL Group1No ratings yet

- Type The Document SubtitleDocument7 pagesType The Document SubtitleSyed Muhammad Imran100% (1)

- The Economist 2022.04.23Document335 pagesThe Economist 2022.04.23李建璋No ratings yet

- Map Your Ai Use Cases by Opportunity Ready The It Team To Drive SuccessDocument17 pagesMap Your Ai Use Cases by Opportunity Ready The It Team To Drive SuccessMax ParraNo ratings yet

- Self DeclarationDocument1 pageSelf DeclarationEshesh GuptaNo ratings yet

- Company Profile: Flipkart Is An Indian E-Commerce Company, HeadquarteredDocument20 pagesCompany Profile: Flipkart Is An Indian E-Commerce Company, HeadquarteredPulkit BankaNo ratings yet

- Introduction To Management Science: A Modeling and Case Studies Approach With Spreadsheets, 6 EditionDocument3 pagesIntroduction To Management Science: A Modeling and Case Studies Approach With Spreadsheets, 6 EditionEshesh Gupta0% (1)

- Southport Minerals CombinedDocument20 pagesSouthport Minerals CombinedEshesh GuptaNo ratings yet

- Moodle ValuationDocument2 pagesMoodle ValuationEshesh GuptaNo ratings yet

- Cooper Industries ADocument16 pagesCooper Industries AEshesh GuptaNo ratings yet

- Moodle ValuationDocument2 pagesMoodle ValuationEshesh GuptaNo ratings yet

- Investment Analysis and Lockheed Tri Star ADocument9 pagesInvestment Analysis and Lockheed Tri Star AEshesh GuptaNo ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Du Pont Titanium ADocument15 pagesDu Pont Titanium AEshesh GuptaNo ratings yet

- Baldwinsolution-For Class DiscussionDocument2 pagesBaldwinsolution-For Class DiscussionEshesh GuptaNo ratings yet

- Solution - Prestige Telephone Co.: Cost Variable FixedDocument2 pagesSolution - Prestige Telephone Co.: Cost Variable FixedEshesh GuptaNo ratings yet

- Sample Problem For Aggregate Production PlanningDocument1 pageSample Problem For Aggregate Production PlanningEshesh GuptaNo ratings yet

- Huron-Question 3 - Normal CapacityDocument2 pagesHuron-Question 3 - Normal CapacityEshesh GuptaNo ratings yet

- Laspeyres Index Excel TemplateDocument2 pagesLaspeyres Index Excel TemplateEshesh GuptaNo ratings yet

- Rate of Inflation Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument3 pagesRate of Inflation Template: Prepared by Dheeraj Vaidya, CFA, FRMEshesh GuptaNo ratings yet

- ICICI Bank InternationalDocument2 pagesICICI Bank InternationalEshesh GuptaNo ratings yet

- CPI Formula Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument3 pagesCPI Formula Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMEshesh GuptaNo ratings yet

- Name: Education: Work ExperienceDocument3 pagesName: Education: Work ExperienceEshesh GuptaNo ratings yet

- PROFILE SiddharthDocument3 pagesPROFILE SiddharthEshesh GuptaNo ratings yet

- CASE: Managing Customer Relationship Gaps at SKF: Fredrik Nordin Danilo Brozovic Christian Kowalkowski Mats VilgonDocument9 pagesCASE: Managing Customer Relationship Gaps at SKF: Fredrik Nordin Danilo Brozovic Christian Kowalkowski Mats VilgonEshesh GuptaNo ratings yet

- DTM2601 03Document5 pagesDTM2601 03Phumlani MhlengiNo ratings yet

- MISLA6201 - Law On Obligations and Contracts: Bs in AccountancyDocument21 pagesMISLA6201 - Law On Obligations and Contracts: Bs in AccountancyRegine VegaNo ratings yet

- TATADocument4 pagesTATAorient finservNo ratings yet

- Delhi Value Added Tax ActDocument3 pagesDelhi Value Added Tax ActDheerajNo ratings yet

- Entrep Chapter 13Document15 pagesEntrep Chapter 13Maddie ZonnieNo ratings yet

- Higher Education Loans Board: Loan Disbursement ReportDocument2 pagesHigher Education Loans Board: Loan Disbursement ReportEdward KalvisNo ratings yet

- Case Study of Umpqua BankDocument2 pagesCase Study of Umpqua BankAns MuhammadNo ratings yet

- AdVacc Q1Document5 pagesAdVacc Q1Red Yu100% (1)

- Quotation: Syarikat Takaful Malaysia Keluarga Berhad (Head OfficeDocument5 pagesQuotation: Syarikat Takaful Malaysia Keluarga Berhad (Head OfficeakmabushNo ratings yet

- 410 For BhiwandiDocument9 pages410 For BhiwandirajasmudafaleNo ratings yet

- R. G. D. Allen - Technical ProgressDocument28 pagesR. G. D. Allen - Technical ProgressArturo GuevaraNo ratings yet

- Lesson 8 - Bank Reconciliation StatementDocument18 pagesLesson 8 - Bank Reconciliation StatementLio MelNo ratings yet

- Chapter 8 Online Problem Set Revised AnswersDocument6 pagesChapter 8 Online Problem Set Revised AnswersMarian NguyenNo ratings yet

- Monitor and Control Accounts ReceiptsDocument11 pagesMonitor and Control Accounts ReceiptsrameNo ratings yet

- CBEC BrazilDocument23 pagesCBEC BrazilBeiersdorf HamburgoNo ratings yet

- Luxury Fashion Fullpagedownload StatistaDocument11 pagesLuxury Fashion Fullpagedownload StatistaZoë PóvoaNo ratings yet

- Sustainable Marketing Activities of Traditional Fashion Market and Brand LoyaltyDocument5 pagesSustainable Marketing Activities of Traditional Fashion Market and Brand LoyaltyAhmad MahmudNo ratings yet

- Microfinance Institutions in BangladeshDocument11 pagesMicrofinance Institutions in BangladeshSanzida HaqueNo ratings yet

- LeagueTable Old29Document28 pagesLeagueTable Old29rohitmahaliNo ratings yet

- Cma Inter GR 1 Financial Accounting Marathon Part - 2Document68 pagesCma Inter GR 1 Financial Accounting Marathon Part - 2jhaaman991No ratings yet

- Financial Performance Analysis of PrivatDocument11 pagesFinancial Performance Analysis of Privatprteek kumarNo ratings yet

- Sample Cash Flow Projection TemplateDocument1 pageSample Cash Flow Projection TemplateAndraya BarthoNo ratings yet

- Easy Problem Chapter 6Document4 pagesEasy Problem Chapter 6Natally LangfeldtNo ratings yet