Professional Documents

Culture Documents

Moodle Valuation

Uploaded by

Eshesh Gupta0 ratings0% found this document useful (0 votes)

22 views2 pagesOriginal Title

Moodle-valuation.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

22 views2 pagesMoodle Valuation

Uploaded by

Eshesh GuptaCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 2

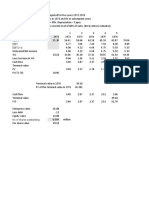

Cash flows of Nicholson File are projected for five years 1972-1976

Sales growth will be 2% in 1972, 4% in 1973 and 6% in subsequent years

EBIT will be 12% of sales. Tax rate = 40%. Depreciation = Capex

Working Capital will continue at the current level of 60% of sales. (No inventory reduction)

WACC is 10%

1 2 3 4 5

1971 1972 1973 1974 1975 1976

Sales 55.30 56.41 58.66 62.18 65.91 69.87 74.06

EBIT 6.77 7.04 7.46 7.91 8.38 8.89

EBIT(1-t) 4.06 4.22 4.48 4.75 5.03 5.33

Unlevered Net income 4.06 4.22 4.48 4.75 5.03 5.33

WC 33.18 33.84 35.20 37.31 39.55 41.92 44.44

Less: Increase in WC 0.66 1.35 2.11 2.24 2.37 2.52

Cash flow 3.40 2.87 2.37 2.51 2.66 2.74

Terminal value 39.10

PV 3.09 2.37 1.78 1.71 1.65

PV(72-76) 10.60

Terminal value in 1976 39.10

PV of this terminal value in 1971 24.281

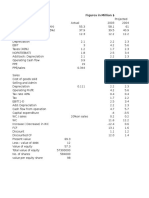

Cash flow 3.40 2.87 2.37 2.51 2.66

Terminal value 39.10

FCF 3.40 2.87 2.37 2.51 41.76

Enterprise value 34.88

Less debt -12

Equity value 22.88

No of shares outstanding 0.584 million

Per share value 39.18

40% tax rate

10%

2.82 …... 3% growth rate

34.88

You might also like

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- Start-Up Sample BPDocument54 pagesStart-Up Sample BPsteven100% (1)

- I Am Sharing 'Cooper-Industries-Inc-Calculations' With YouDocument19 pagesI Am Sharing 'Cooper-Industries-Inc-Calculations' With YouChip choiNo ratings yet

- Tottenham Case HBSDocument38 pagesTottenham Case HBSLatisha UdaniNo ratings yet

- Chapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument3 pagesChapter 4. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen HarrisNo ratings yet

- Case 4 - Victoria ChemicalsDocument18 pagesCase 4 - Victoria ChemicalsYale Brendan CatabayNo ratings yet

- Final Sheet DCF - With SynergiesDocument4 pagesFinal Sheet DCF - With SynergiesAngsuman BhanjdeoNo ratings yet

- Moodle ValuationDocument2 pagesMoodle ValuationEshesh GuptaNo ratings yet

- Capital Raising and Business PlanDocument53 pagesCapital Raising and Business Planyouss efNo ratings yet

- Valuation TemplateDocument16 pagesValuation TemplateFakeNo ratings yet

- ECF 1 AsthaDocument6 pagesECF 1 Asthaasthapatel.akpNo ratings yet

- Finance Project - Group 5Document15 pagesFinance Project - Group 5BabaNo ratings yet

- Backend - Bajaj Auto - Dupont & Z ScoreDocument17 pagesBackend - Bajaj Auto - Dupont & Z ScoreYuvraj BholaNo ratings yet

- Monmouth Inc Figures in Million $Document3 pagesMonmouth Inc Figures in Million $amanNo ratings yet

- 210521-SBI Press Release Q4FY21 FinalDocument2 pages210521-SBI Press Release Q4FY21 Finalprivate penguinNo ratings yet

- Cooper HalfDocument5 pagesCooper HalfVarun BaxiNo ratings yet

- Elnet TechnologDocument10 pagesElnet TechnologankiosaNo ratings yet

- Adani Ports Financial RatiosDocument2 pagesAdani Ports Financial RatiosTaksh DhamiNo ratings yet

- Sambal Owner of ZeeDocument2 pagesSambal Owner of Zeesagar naikNo ratings yet

- AcovaDocument5 pagesAcovafutyNo ratings yet

- Monmouth Inc Solution 5 PDF FreeDocument12 pagesMonmouth Inc Solution 5 PDF FreePedro José ZapataNo ratings yet

- Monmouth Inc Solution 5 PDF FreeDocument12 pagesMonmouth Inc Solution 5 PDF FreePedro José ZapataNo ratings yet

- Vikram ThermoDocument12 pagesVikram ThermoAvinash MuralaNo ratings yet

- SBI Press Release - SBI Q4 FY22 & Annual ResultsDocument2 pagesSBI Press Release - SBI Q4 FY22 & Annual ResultsSudarshan VaradhanNo ratings yet

- Ankita CFDocument3 pagesAnkita CFRahul YadavNo ratings yet

- Juniper Ratios - RatiosDocument1 pageJuniper Ratios - Ratiosapi-463022656No ratings yet

- 180523-SBI Press Release FY23Document2 pages180523-SBI Press Release FY23jyottsnaNo ratings yet

- Balance Sheet (All Fig in Crores) : Sources of FundsDocument29 pagesBalance Sheet (All Fig in Crores) : Sources of Fundsaditya_behura4397No ratings yet

- Data Patterns Income&CashFlow - 4 Years - 19052020Document8 pagesData Patterns Income&CashFlow - 4 Years - 19052020Sundararaghavan RNo ratings yet

- UntitledDocument3 pagesUntitledDeannaNo ratings yet

- Narayana Hrudayalaya RatiosDocument10 pagesNarayana Hrudayalaya RatiosMovie MasterNo ratings yet

- 030223-SBI Press Release Q3FY23Document2 pages030223-SBI Press Release Q3FY23arun13091987No ratings yet

- 030224-SBI Press Release Q3FY24 SDocument2 pages030224-SBI Press Release Q3FY24 Sbhanjasomanath4No ratings yet

- Emv Case Study 1Document8 pagesEmv Case Study 1ViddhiNo ratings yet

- M1 14-AZ2 PENROSE Part 1 (Analysis) - BlankDocument5 pagesM1 14-AZ2 PENROSE Part 1 (Analysis) - BlankKhushi singhalNo ratings yet

- Solar Power Doc 3Document4 pagesSolar Power Doc 3Sunil PeerojiNo ratings yet

- MTCDocument23 pagesMTCsozodaaaNo ratings yet

- Fundamental Sheet Bharat RasayanDocument28 pagesFundamental Sheet Bharat RasayanVishal WaghNo ratings yet

- NationDocument1 pageNationbiawa1100% (2)

- Solution To Mini Case (SAPM)Document8 pagesSolution To Mini Case (SAPM)Snigdha IndurtiNo ratings yet

- LP 1Document68 pagesLP 1uzumakideva26No ratings yet

- Marico RatiosDocument2 pagesMarico RatiosAbhay Kumar SinghNo ratings yet

- 040821-SBI Press Release Q1FY22Document2 pages040821-SBI Press Release Q1FY22Prateek WadhwaniNo ratings yet

- Case 1 Bidding Stage: Annexure II (A) DSCR & IRR CalculationDocument4 pagesCase 1 Bidding Stage: Annexure II (A) DSCR & IRR CalculationSantosh HiredesaiNo ratings yet

- Himatsingka Seida LTD.: Ratio Analysis SheetDocument1 pageHimatsingka Seida LTD.: Ratio Analysis SheetNeetesh DohareNo ratings yet

- Profit and Loss Account of Akzo NobelDocument15 pagesProfit and Loss Account of Akzo NobelKaizad DadrewallaNo ratings yet

- Eq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38Document17 pagesEq+ RS /Eq+RS+Dbt K 9.14 Equity Portion 0.62 Debt Portion 0.38sandipandas2004No ratings yet

- Financial Analysis 2 - ScribdDocument6 pagesFinancial Analysis 2 - ScribdSanjay KumarNo ratings yet

- All SummaryDocument17 pagesAll SummarySwati VermaNo ratings yet

- Titan Co LTD (TTAN IN) - GrowthDocument6 pagesTitan Co LTD (TTAN IN) - GrowthSambit SarkarNo ratings yet

- Ratios For SugarDocument4 pagesRatios For SugaromairNo ratings yet

- Financial Analysis: Pakistan Telecommunication LimitedDocument28 pagesFinancial Analysis: Pakistan Telecommunication LimitedSadiqa VahidNo ratings yet

- Financial RatiosDocument2 pagesFinancial RatiosErubiel ChavezNo ratings yet

- Millions of Dollars Except Per-Share DataDocument14 pagesMillions of Dollars Except Per-Share DataAjax0% (1)

- Real Dicom Captiva RealDocument2 pagesReal Dicom Captiva RealIrakli DevidzeNo ratings yet

- Ratio Analysis: Liquidity RatiosDocument2 pagesRatio Analysis: Liquidity RatiosSuryakantNo ratings yet

- Samsung FY17 Q1 PresentationDocument8 pagesSamsung FY17 Q1 PresentationJeevan ParameswaranNo ratings yet

- Stat RatiosDocument4 pagesStat Ratiosmaashima20No ratings yet

- Acme Sol - For StudentsDocument9 pagesAcme Sol - For StudentsBarsha MahapatraNo ratings yet

- Assignment 5 (170044)Document7 pagesAssignment 5 (170044)mishal zikriaNo ratings yet

- The JPEG 2000 SuiteFrom EverandThe JPEG 2000 SuitePeter SchelkensNo ratings yet

- Walt Disney Yen Financiing BDocument14 pagesWalt Disney Yen Financiing BEshesh GuptaNo ratings yet

- Dummy CaseDocument7 pagesDummy CaseEshesh GuptaNo ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- Southport Minerals CombinedDocument20 pagesSouthport Minerals CombinedEshesh GuptaNo ratings yet

- Toy World ADocument11 pagesToy World AEshesh GuptaNo ratings yet

- Baldwinsolution-For Class DiscussionDocument2 pagesBaldwinsolution-For Class DiscussionEshesh GuptaNo ratings yet

- Cooper Industries ADocument16 pagesCooper Industries AEshesh GuptaNo ratings yet

- Southport Minerals CombinedDocument20 pagesSouthport Minerals CombinedEshesh GuptaNo ratings yet

- Solution - Prestige Telephone Co.: Cost Variable FixedDocument2 pagesSolution - Prestige Telephone Co.: Cost Variable FixedEshesh GuptaNo ratings yet

- Du Pont Titanium ADocument15 pagesDu Pont Titanium AEshesh GuptaNo ratings yet

- Cash FlowDocument12 pagesCash FlowEshesh GuptaNo ratings yet

- Investment Analysis and Lockheed Tri Star ADocument9 pagesInvestment Analysis and Lockheed Tri Star AEshesh GuptaNo ratings yet

- Huron-Question 3 - Normal CapacityDocument2 pagesHuron-Question 3 - Normal CapacityEshesh GuptaNo ratings yet

- CPI Formula Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument3 pagesCPI Formula Excel Template: Prepared by Dheeraj Vaidya, CFA, FRMEshesh GuptaNo ratings yet

- LilacDocument14 pagesLilacEshesh GuptaNo ratings yet

- Sample Problem For Aggregate Production PlanningDocument1 pageSample Problem For Aggregate Production PlanningEshesh GuptaNo ratings yet

- Rate of Inflation Template: Prepared by Dheeraj Vaidya, CFA, FRMDocument3 pagesRate of Inflation Template: Prepared by Dheeraj Vaidya, CFA, FRMEshesh GuptaNo ratings yet

- APP Sample Problem-InClassV2Document3 pagesAPP Sample Problem-InClassV2Hemant ChawlaNo ratings yet

- ICICI Bank InternationalDocument2 pagesICICI Bank InternationalEshesh GuptaNo ratings yet

- Problem Set 2Document7 pagesProblem Set 2Eshesh GuptaNo ratings yet

- CASE: Managing Customer Relationship Gaps at SKF: Fredrik Nordin Danilo Brozovic Christian Kowalkowski Mats VilgonDocument9 pagesCASE: Managing Customer Relationship Gaps at SKF: Fredrik Nordin Danilo Brozovic Christian Kowalkowski Mats VilgonEshesh GuptaNo ratings yet

- Laspeyres Index Excel TemplateDocument2 pagesLaspeyres Index Excel TemplateEshesh GuptaNo ratings yet

- Quiz 2 SMGT - SectionA - XC20200038 - EsheshGuptaDocument2 pagesQuiz 2 SMGT - SectionA - XC20200038 - EsheshGuptaEshesh GuptaNo ratings yet

- Cash FlowDocument12 pagesCash FlowEshesh GuptaNo ratings yet

- Profitand LossDocument26 pagesProfitand LossEshesh GuptaNo ratings yet

- Financial Analysis GlossaryDocument6 pagesFinancial Analysis GlossarySergio OlarteNo ratings yet

- Balance SheetDocument47 pagesBalance SheetNITIN SHARMANo ratings yet