Professional Documents

Culture Documents

Chapter 6 The Philippine Financial Market

Uploaded by

Elijah SundaeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 6 The Philippine Financial Market

Uploaded by

Elijah SundaeCopyright:

Available Formats

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

SESSION NO. 6 / WEEK NO. 6

MODULE NO. 6: The Philippine Financial

System

1. The structure of the Philippine Financial System

2. Brief Description of Financial Institution: a.) Banking Institution b.) Non-Bank

Financial Institution.

3. The Evolving Philippine Financial System: a.) Signs of Growth in the domestic

market b.) Regulatory Landscape.

4. Financial Stability Assessment of the Philippine Financial System.

5. Current Risk in the Philippine Financial System.

Overview

Well-functioning financial system is crucial to a country's economic health so much so

that when the financial system breaks down, as it has in Russia and in Southeast Asia

recently, severe economic hardship results.

The financial system, through the various financial markets and financial

intermediaries, has the basic function of moving funds from those who have a surplus

to those who have a shortage of funds.

To study the effects of financial markets and financial intermediaries on the economy,

we need to acquire an understanding of their general structure and operation.

The Philippine Financial System 1

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Study Guide

Learning Outcomes

After studying the chapter, you should be able to:

1. Explain the structure of the Philippine Financial System

2. Describe the nature and basic functions of

II. Banking Institutions

a. Private Banking Institutions

b. Government Banks

Non-Bank Financial Institutions a. Private Non-Bank Financial Institutions

b. Government Non-Bank Institutions

3. Understand the evolving Philippine Financial System

•Signs of growth in the domestic market

•Regulatory landscape

4. Learn the Financial Stability Assessment of the Philippine Financial System as of

the end of Second Semester, 2018 prepared by the BSP

5. Be familiar with the current risks in the Philippine Finance System

The Philippine Financial System 2

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Topic Presentation

STRUCTURE OF THE PHILIPPINE FINANCIAL SYSTEM

I. Bangko Sentral Ng Pilipinas

II. Banking Institutions

A. Private Banking Institutions

1. Expanded Commercial Banks/Universal Banks (EKB/UB)

2. Commercial Banks (KB)

3. Thrift Banks (TB)

a. Savings and Mortgage Banks (SMB)

b. Private Development Banks (PDB)

c. Stock Savings and Loan Associations (SSLA)

4. Rural Banks (RB)

5. Cooperative Banks

B. Government banking institutions

1. Development Bank of the Philippines (DBP)

2. Land Bank of the Philippines (LBP)

3. Philippine Al-Amanah Islamic Investment Bank

III. Non-Bank Financial Institutions

A. Private non-bank financial institutions

1. Investment houses

2. Investment banks

3. Financing companies

4. Securities dealers/brokers

5. Savings and loan associations

6. Mutual funds

7. Pawnshops

8. Lending investors

9. Pension funds

10. Insurance companies

11. Credit union

B. Government Non-bank financial institutions

The Philippine Financial System 3

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

1. Government Service Insurance System (GSIS)

2. Social Security System (SSS)

3. Pag-ibig

BRIEF DESCRIPTION OF THE FINANCIAL INSTITUTIONS

I. Bangko Sentral ng Pilipinas (discussed in Chapter 16)

II. Banking Institutions

A. Private Banking Institutions

1. Universal Bank (UB) or Expanded Commercial Bank (EKB) is any commercial bank,

which performs the investment house function in addition to its commercial banking

authority. It may invest in the equities of allied and non-allied enterprises. Allied

enterprises may either be financial or non-financial.

2. Commercial Bank or Domestic Bank (KB) is any commercial bank that is confined

only to commercial bank functions such as accepting drafts and issuing letters of credit,

discounting and negotiating promissory notes, drafts and bills of exchange, and other

evidences of debt, accepting or creating demand deposits, receiving other types of

deposits and deposit substitutes, buying and selling foreign exchange, and gold or

silver bullions, acquiring marketable bonds and other debt securities, and extending

credit subject to such rules that the Monetary Board may promulgate.

3. Thrift Banks (TB) shall include savings and mortgage banks, stock savings and loan

associations and private development banks. Their function is to accumulate the

savings of depositors and invest them together with their capital, loans secured by

bonds, mortgages in real estate and insured improvements thereon, chattel

mortgages, bonds and other forms of security or loans for personal or household

finance, whether, secured or unsecured, or in financing for home building and home

development; in readily marketable and debt securities; in commercial papers and

accounts receivables, drafts, bills of exchange, acceptances or notes arising out of

commercial transactions, and in such other investments and loans which the Monetary

Board may determine as necessary in the furtherance of national economic objectives.

a. Stock Savings and Mortgage Bank (SSMB) is any corporation organized for the purpose

of accumulating the savings of depositors and investing them, together with its

capital, in readily marketable bonds and debt securities; checks, bills of exchange,

acceptances or notes arising out of commercial transactions or in loans secured by

bonds, mortgages or real estate and insured improvements thereon and other forms

of security or in loans for personal or household finances whether secured or

unsecured, and financing for home building and home development.

b. Private Development Bank (PDB) is a bank that exercises all the powers and assumes

all the obligations of the savings and mortgage bank as provided in the General

Banking Act except as otherwise stated. The private development bank helps

construct, expand and rehabilitate agricultural and industrial sectors. The

Development Bank of the Philippines is the government counterpart of the private

development banks and helps the private development banks augment their

capitalization as provided under R.A.4093 as amended.

The Philippine Financial System 4

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

c. Stock Savings and Loan Association (SLA) is any corporation engaged in the business

of accumulating the savings of its members or stockholders and using such

accumulated funds, together with its capital for loans and investment in securities of

productive enterprises, or in securities of the government and its instrumentalities,

provided that they are primarily engaged in servicing the needs of households by

providing personal finance and long term financing for home building and

development.

4. Rural Bank (RB) is any bank authorized by the Central Bank to accept deposits and

make credit available to farmers, businessmen and cottage industries in the rural

areas. Loans may be granted by the rural banks on the security of land without Torrens

title where the owner of private property can show five (5) years or more of peaceful

continuous and uninterrupted possession of the land in the concept of ownership. This

will include portions of friar land estates or other lands administered by the Bureau of

Lands that are covered by sale contracts and purchases and have paid at least five (5)

years installment thereon, without the necessity of prior approval and consent of the

Director of Lands or portions of other estates under the administration of the

Department of Agrarian Reform.

5. Cooperative Banks are banks established to assist the various cooperatives by

lending those funds at reasonable interest rates.

B. Government Institutions Banks or Specialized Government Banking

1. Development Bank of the Philippines- (DBP) provides loans for developmental

purposes, gives loans to the agricultural sector, commercial sector and the industrial

sector.

2. Land Bank of the Philippines (LBP) is a government bank, which provides financial

support in the implementation of the Agrarian Reform Program (CARP) of the

government.

3. Al-Amanah Islamic Investment Bank: Republic Act No. 6048 provides for the charter

of the Al-Amanah Islamic Investment Bank. This Act authorizes the bank to promote

and accelerate the socio-economic development of the Autonomous Region of Muslim

Mindanao by performing banking, financing and investment operations, and to

establish and participate in agriculture, commercial and industrial ventures based on

the Islamic concept of banking.

III. Non-bank Financial Institutions

A. Private non-bank Financial Institutions

1. Investment House is any enterprise, which engages in underwriting securities of

other corporations. It also generates income from sale of investments in securities.

2. Investment Banks. Investment banks, such as Goldman Sachs and Morgan Stanley,

differ from commercial banks in that they do not take in deposits and until very recently

rarely lent directly to households. They provide advice to firms issuing stocks and

bonds or considering mergers with other firms. They also engage in underwriting, in

which they guarantee a price to a firm issuing stocks or bonds and then make a profit

by selling the stocks or bonds at a higher price.

The Philippine Financial System 5

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

3. Financing Company is any business enterprise where the primary purpose is to

extend credit facilities to consumers and to industrial, commercial or agricultural

entities either by discounting or factoring commercial papers or accounts, or by buying

installment contracts, leases, chattel mortgages, or other evidences of indebtedness,

or by leasing motor vehicles, heavy equipment and industrial machineries and

business and office equipment, appliance and other movable properties.

4. Securities Dealer is any person or entity engaged in the business of buying and

selling securities for his own or its client's account thereby making a profit from the

difference between the purchase prices and selling price of securities.

5. Savings and Loan Associations (S&Ls), which have traditionally served individual

savers and residential and commercial mortgage borrowers, accumulate the funds of

many small savers and then lend this money to home buyers and other types of

borrowers. Because the savers obtain a degree of liquidity that would be absent if they

bought the mortgages or other securities directly, perhaps the most significant

economic function of the S&Ls is to "create liquidity". Also, the S&Ls have more

expertise in analyzing credit, setting up loans, and making collections than individual

savers, so they reduce the transaction costs and increase the availability of real estate

loans.

6. Mutual funds are corporations which accept money from savers and then use these

funds to buy stocks, long-term bonds, or short term debt instruments issued by

businesses or government units. These organizations pool funds and thus reduce risks

by diversification. They also achieve economies of scale, which lower the costs of

analyzing securities, managing portfolio, and buying and selling securities. Different

funds are designed to meet the objectives of different types of savers. Hence, there

are bond funds for those who desire safety, stock funds for savers who are willing to

accept significant risks in the hope of higher returns, and still other funds that are used

as interest-bearing checking accounts (the money market funds). There are literally

hundreds of different mutual funds with dozens of different goals and purposes.

7. Pawnshops refer to persons or entities engaged in the business of lending money

with personal property, jewelry, and other durable goods as collateral for the loans

given.

8. Lending investor is any person or entity engaged in the business of effecting

securities transactions, giving loans and earns interest from them.

9. Pension funds are retirement plans funded by corporations or government agencies

for their workers and administered primarily by the trust departments of commercial

banks or by life insurance companies. Pension funds invest primarily in bonds, stocks,

mortgages, and real estate.

10. Insurance companies take savings in the form of annual premiums, then invest

these funds in stocks, bonds, real estate, and mortgages, and finally make payments

to the beneficiaries of the insured parties. In recent years, life insurance companies

have also offered a variety of tax-deferred savings plans designed to provide benefits

to the participants when they retire.

11. Credit unions are cooperative associations whose members have a common bond,

such as being employees of the same firm. Members' savings are loaned only to other

members, generally for auto purchases, home improvement loans, and even home

The Philippine Financial System 6

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

mortgages. Credit unions often are the cheapest source of funds available to individual

borrowers.

B. Government Non-bank financial institutions

1. Government Service Insurance System (GSIS). Provides retirement benefits,

housing loans personal loans, emergency and calamity loans to government

employees.

2. Social Security System (SSS). Provides retirement benefits, funeral benefits,

housing loans, personal loans and calamity loans to employees who are working in

private companies and offers.

3. Pag-Ibig. Provides housing loans to both government and private employees.

THE EVOLVING PHILIPPINE FINANCIAL SYSTEM

The Philippine financial system continues to experience growth against a backdrop of

strengthening domestic economy. Political reforms, i.e., tax reforms and greater

infrastructure spending, are projected to drive the domestic growth in 2018 as these

lead to higher spending by both the government and households. The domestic

economy is also seen to gain from the momentum of global economic recovery, based

on the upward revisions of growth projections by third party analysts. However, despite

the positive outlook for the Philippines, there are internal and external developments

that pose downside risks to the domestic financial system.

To counteract the downside risks and smooth functioning of the Philippine financial

system more stringent initiatives are being pursued by the four regulatory agencies,

namely

1. Bangko Sentral ng Pilipinas (BSP)

2. Securities and Exchange Commission (SEC)

3. Insurance Commission (IC)

4. Philippine Deposit Insurance Commission (PDIC)

SIGNS OF GROWTH IN THE DOMESTIC MARKET

In recent years, growth in financial intermediation is observed in the three major

segments of the Philippine financial system.

a. The Philippine banking system has been consistently posting double digit asset growth

since January 2016. Latest data show that total resources of the banking system

amounted to PHP15.3 trillion as of end March 2018, an 11.3 percent increase from

the previous year's level of PHP13.8 trillion. This asset growth trend is mirrored by the

growth in liabilities (see Figure A).

b. Meanwhile, total assets of the insurance industry more than doubled from 2008 to

2016 (see Figure B). Although there was a two-year slowdown after 2013, the growth

rebounded in 2016, posting an 11.2 percent increase. Moreover, there has been a

steady increase in the industry's revenues relative to GDP after the GFC, with a break

The Philippine Financial System 7

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

in the year proceeding typhoon Yolanda in 2013. The life insurance segment continues

to be the driver of the insurance companies' revenues.

c. The securities market has also exhibited growth. The bond market, in particular, is

comprised mostly of peso-denominated government issued securities, to which

outstanding amount as of end-March 2018 grew by 7.1 percent to reach USD117.2

billion (see Figure C). The equities market, on the other hand, registered 12 additional

companies with the PSE in the past three years, bringing the total listed companies to

268, equivalent to PHP17.31 trillion market capitalization as of end-October 2017.

REGULATORY LANDSCAPE

A. Alignment with global standards

a. The BSP has released Circular No. 975 in October 2017 to streamline the

requirements on the issuance of bonds and commercial papers by banks and quasi-

banks and Circular Nos. and 985 in December 2017 in furtherance of liberalizing the

foreign exchange (FX) regulatory framework. It has also set the target to 01 September

2018 for banks to comply with the revised rules on liquidity risk management anchored

on the Principles for Sound Liquidity Risk Management and Supervision under the

Basel III reform agenda.

b. A key priority of the Insurance Commission (IC) is the adoption of international

reporting practices. The IC is preparing for the implementation of the Philippine

Financial Reporting Standards by the Financial Reporting Standards Council that will

be applied to insurance companies. For subsidiaries and branches of Global

Systemically Important Insurers operating in the Philippines, the IC requires keeping

reserves to pay policyholders in the event of insolvency and has set the guidelines for

the orderly acquisition, merger, consolidation, sale of insurance portfolio, and exit from

the domestic insurance business should another financial crisis global in scale triggers

a sell-off.

c. The SEC approved amendments to the Securities Regulation Code (SRC) and the

Corporation Code as well as supporting the bills on regulating Collective Investment

Schemes to enhance local regulations and conform to international best practices.

Considering the rising popularity of crypto currency, the SEC is also studying the ideal

regulatory treatment of virtual currencies (VCs) from the perspective of investor

protection. For internet-based scams, the SEC coordinates with the Ph pine National

Police and the National Bureau of Investigation which possess the resources and

expertise to assist in the investigation of cybercrimes committed by online

organizations.

d. For its part, the FDIC has entered into a cross-border partnership by way of a

Memorandum of Understanding (MOU) with eight deposit insurance agencies from

Asia, the UK and the US. The MOU fosters enhanced cooperation through exchange

of information, prompt response to technical inquiries, effective support for exchange

of experts and staff, conduct of bilateral meetings, and other collaborations to the

extent permitted by each country's laws, rules and regulations.

B. Deepening capital markets

The Philippine Financial System 8

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Various financial products have been introduced to the different segments of the

domestic market aimed at providing alternative options for raising funds or for investing

money. These include:

(1) dollar-denominated securities,

(2) exchange-traded funds,

(3) green bonds (upcoming),

(4) Personal Equity and Retirement Account,

(5) PHP government fund forward,

(6) public-private partnership shares, and

(7) real estate investment trust.

Furthermore, the SEC has initiated reforms on minimum public ownership, repurchase

agreements and shelf registration that underscore the need for improved liquidity in

the market and the importance of price discovery. The SEC is also finalizing its rules

governing the crowd funding market.

Meanwhile, the BSP, Bureau of the Treasury and SEC, with the support of the DOF,

rolled out in August 2017 the roadmap to accelerate the development of the Philippine

debt market. The three agencies, which comprise the Capital Market Working Group,

agreed to prioritize deepening of the local bond market, creating reliable financial

benchmarks and valuation of financial instruments, and establishing an integrated

financial market infrastructure (FMI).

C. Strengthening surveillance

a. The BSP has recently completed the requirements of becoming a BIS-reporting

country. This will allow access to detailed information on cross-border exposures of

other countries to the Philippines. The BSP through the FSCC has also initiated

collaborations with the Housing and Land Use Regulatory Board to develop a maiden

reportorial template targeted to real estate companies.

To further its conduct of surveillance and understanding of the underlying

developments in the insurance industry, the IC is in the process of building a database

from the quarterly reports required from insurance companies and developing

analytical tools for data mining purposes.

a. Currently, the SEC is proposing the creation of a unit for handling the rules,

regulations, policies, and guidelines concerning anti-money laundering (AML) and

counter terrorist financing (CTF) for covered entities. With the implementation of the

2015 Revised Implementing Rules and Regulations of the SRC, the SEC intends to

amend and update its guidelines on the preparation of the AML manual of covered

entities. Additionally, the SEC aims to prepare an audit plan and program regarding

the conduct of regular audits on covered entities, focusing on the compliance with

AML/CTF requirements.

The Philippine Financial System 9

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

The Philippine Financial System 10

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

FINANCIAL STABILITY ASSESSMENT OF THE PHILIPPINE FINANCIAL SYSTEM

*

At its core, financial stability is preemptive in nature because it needs to mitigate the

buildup of system-wide dislocations before these vulnerabilities take concrete form.

With financial markets constantly evolving, it is however not clear what past data can

tell about future conditions. Adding another layer of complication is the fact that there

are competing measures of systemic risk while a unique set of financial stability

indicators has yet to be defined.

These issues notwithstanding, financial stability is clearly understood to reflect a "well-

functioning” financial market, addressing the financial needs of stakeholders and

avoiding distortions. This view of the overall market will then require a holistic

appreciation of the market situation in various segments of the market. Since these

segments may be experiencing different pressure points, judgment is often essential

in the overall assessment of systemic risks.

This is the reason why the FSR focuses more on thematic topics. While the market

landscape is a useful baseline, the focus is on risks and vulnerabilities that may derail

further growth as well as raise issues that may potentially have systemic implications.

The section on current risks shows how the outstanding debt level has grown rapidly,

particularly in the post-GFC period. Whether the build up of debt is already an issue is

still open for discussion. Yet, what is clear is that interest rates are rising and emerging

market currencies have been depreciating versus the United States dollar (USD).

These must mean that debt servicing is now at a higher cost than in the past, separate

from the issue of having more outstanding debt. This is our central financial stability

issue.

The Philippine Financial System 11

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

The opportunity to discuss fintech and Association of Southeast Asian Nations

(ASEAN) financial integration is taken. There is no doubt that fintech provides benefits

over paper-based face-to-face transactions. This gain is especially of value to an

economy such as the Philippines which is segregated both geographically and by

demographic factors. Nevertheless, the assessment for fintech thus far has focused

on micro risks, e.g., credit and liquidity, among others. The prevailing view is that its

financial stability risks are limited, but this is also premised on the understanding that

fintech remains a small portion of market activity.

Source: Financial Stability Report (www.bsp.gov/publications/regular_fsr.asp) *

December 31, 2018

The intention is to allow fintech to develop further. One should be mindful of a key

lesson from the GFC that systemic risks may arise from seemingly smaller shocks

because accounting for the amplifying effects of interconnectedness was neglected.

Regulatory sandboxes and constant dialogues among stakeholders are critical to

ensure that one remains vigilant of the downside risks from the "disruptive" side of

fintech.

Similar to fintech, the business case is compelling for the integration of the financial

markets among member states of the ASEAN. The region continues to outpace global

growth, it saves at a higher rate than the rest of the world and it is home to a vast base

of millennials who are tech-savvy and drive retail markets. With much of ASEAN's

savings actually deployed out of the region, financial integration should provide a better

and more organized platform for retaining such savings and funding the region's

growth even more.

Yet, higher levels of cross-border interconnectedness will also provide another

possible venue for contagion risk. More generally, the previous works of Dani Rodrik

and Dirk Schoenmaker, respectively, suggest that there may be trade-offs between

sovereign policy, regional integration and financial stability. This section presents a

discussion of the issues as it is certainly relevant to the current work of various

committees on ASEAN integration.

CURRENT RISKS IN THE PHILIPPINE FINANCIAL SYSTEM

A. Repricing, refinancing and repayment risks (3Rs)

Several jurisdictions have pointed to various sources of risks that heighten financial

stability concerns. These are:

(1) The normalization of US monetary policy creates the incentive for global capital

flows to be directed towards the US, affecting asset and currency prices along the way.

(2) A slowdown in global growth and deceleration of international trade will undermine

the growth of many economies.

(3) Higher debt levels across countries will continue to leave economies vulnerable to

the changes in the growth outlook and the (continuing) rise in interest rates.

The risks flagged by other jurisdictions highlight the fact that global developments

largely affect the domestic economies. The impact, however, is much more significant

for a small and open economy such as the Philippines which is a price taker, rather

than a price setter. There are risks with rising Philippine interest rates and a local

The Philippine Financial System 12

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

currency (LCY) that continues to depreciate against the US dollar. Drivers of growth

are shifting from quarter to quarter and the authorities need to be cognizant of the

factors that could derail the growth momentum. All of these market changes have to

be understood in the context of repricing, refinancing and repayment risks.

B. Developments in the credit market

Local intermediation continues to be peso-funded but with some support from foreign

currency (FCY) sources. The total loan portfolio of the banking system increased

significantly over the years (Figure 3.1) and is principally funded by peso deposits.

Looking at the spot and forward rates in the currency and interest rate markets, the

incentive would have been to borrow in Philippine peso and to invest these in US dollar

instruments. Yet, this is not the case and instead, banks have increased their FCY

debts to augment the growth in domestic currency loans (Figure 3.2).

This can be validated in Figure 3.3 which shows that borrowings of Philippine banks

from BIS-reporting jurisdictions have increased to USD11.7 billion as of end-December

2017. This can only mean that Philippine banks want to maximize the benefits of taking

on added credit risks in Philippine peso terms and they see as manageable the cross-

currency risks from sourcing the incremental funds from FCY loans.

C. Continuous demand for credit by corporate enterprises and households is evident

in the domestic economy

This funding strategy is a clear positive vote for local economic activity. Specifically,

non-financial corporation's (NFCs) and households account for a significant portion of

the incremental loans provided by the banking system. As a matter of fact, firms listed

in the PSE15 exhibited a rising debt to-equity ratio, from about 45 percent in 2008 to

more than 86 percent as of end-March 2018 (Figure 3.4).

Apart from bank loans, NFCs have also resorted to the bond market for their financing

needs. Figure 3.5 shows increasing levels of corporate debt issuances, both in LCY

and in US dollars. The level of corporate debt issued in US dollars, in particular, had

increased since 2010, reaching USD11.2 billion as of end-March 2018 after tapering

in recent periods.

Data limitation prevents an accurate assessment of household debt. As a proxy, Figure

3.6 shows rising consumer loans since 2012, of which majority were residential real

estate loans and motor vehicle loans. Nevertheless, beyond the increase in consumer

loans, the greater concern lies with what appears to be higher household leverage.

Aside from consumer loans, the 2014 BSP Consumer Finance Survey (CFS) indicates

that less than 14 percent of the households were borrowing from banks to finance the

purchase of a residential real estate, motor vehicle or household appliance (Figure

3.7). This only makes urgent the need to get a better handle of household debt outside

the formal sector. Box Article 4 presents an alternative way of estimating household

indebtedness using the Family Income and Expenditure Survey (FIES).16

The continuous demand for credit is welcomed as it represents further "financial

deepening" of the economy. However, one has to also appreciate the higher debt

levels against the potential risks from rising interest rates and the peso depreciation.

This is a debt service burden issue and is at the core of what is referred to as the 3Rs

or repricing, refinancing and repayment risks.

The Philippine Financial System 13

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

The Philippine Financial System 14

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

The Philippine Financial System 15

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Guided Exercises / Learning Activities

REVIEW QUESTIONS

1. Compare the function of a commercial bank with the function of universal bank

2. Enumerate 3 government banks.

3. Which of the following is not a thrift bank?

a. Private development bank

b. Stock savings and loan associations

c. Stock savings and mortgage banks

d. Cooperative banks

4. A bank which caters to farmers businessmen and cottage industries in the rural

areas

a. Rural bank

b. Cooperative bank

c. Saving and loans association

d. Universal bank

5. Which of the following is not a government bank?

a Land Bank of the Philippines

b. Al-Amanah Islamic Investment Bank

c. Philippine National Bank d. Development Bank of the Philippines

6. Which of the following is not a government agency that regulates financial

institutions?

a. Insurance Commission

b. Bangko Senral ng Pilipinas

c. Securities and Exchange Commission

d. Bureau of Internal Revenue

7. Explain briefly how the following regulatory agencies intend to align their policies,

roles and practices with global standards

a. BSP

b. SEC

c. Insurance Commission

8. Discuss briefly the following current risks in the Philippine Financial system

a. Repricing, refinancing and repayment risks

b. Developments in the credit market

c. Increasing demand for credit by corporate business and households

The Philippine Financial System 16

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Assessment

The Philippine Financial System 17

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

Assignment

The Philippine Financial System 18

RIZAL TECHNOLOGICAL UNIVERSITY

Cities of Mandaluyong and Pasig

References

BOOK: FINANCIAL MARKETS AND INSTITUTION

Author/s:

Ma. Elenita Balatbat Cabrera, BBA, MBA, CPA, CMA

Gilbert Anthony B. Cabrera, BBA, MBA, CPA

The Philippine Financial System 19

You might also like

- INTACC DQsDocument9 pagesINTACC DQsMa. Alessandra BautistaNo ratings yet

- INCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Document7 pagesINCTAXA (Basic Income Tax, Final Tax On Passive Income and Capital Gains Tax) - 2Erlle AvllnsaNo ratings yet

- ACCO 20063 Homework 1 Assigned Activities From IM 1Document3 pagesACCO 20063 Homework 1 Assigned Activities From IM 1Vincent Luigil AlceraNo ratings yet

- Lim Tong Lim v. Phil Fishing Gear IndustriesDocument10 pagesLim Tong Lim v. Phil Fishing Gear IndustriesPatrick Jorge SibayanNo ratings yet

- Pas 12Document2 pagesPas 12JennicaBailonNo ratings yet

- Module 6 - The Financial System PDFDocument10 pagesModule 6 - The Financial System PDFRodel Novesteras ClausNo ratings yet

- Solution Chapter 14Document26 pagesSolution Chapter 14grace guiuanNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Notes For Civil Code Article 1177 and Article 1178Document5 pagesNotes For Civil Code Article 1177 and Article 1178Chasz CarandangNo ratings yet

- CH10 Long Term Decision Payongayong-3Document1 pageCH10 Long Term Decision Payongayong-3Nadi HoodNo ratings yet

- Pledge - Mortgage - Chattel MortgageDocument23 pagesPledge - Mortgage - Chattel MortgageJohn Kayle BorjaNo ratings yet

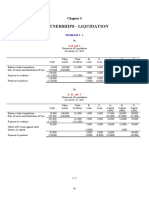

- Partnerships - Liquidation: Problem 3 - 1Document20 pagesPartnerships - Liquidation: Problem 3 - 1marieieiemNo ratings yet

- Partnership Incorporation and LiquidationDocument3 pagesPartnership Incorporation and Liquidationrav danoNo ratings yet

- The Primary Objective of Every Cooperative Is To Help Improve The Quality of Life of Its Members. Toward This End, The Cooperative Shall Aim ToDocument2 pagesThe Primary Objective of Every Cooperative Is To Help Improve The Quality of Life of Its Members. Toward This End, The Cooperative Shall Aim ToRosemarie CruzNo ratings yet

- CASTILLO, Erica Miles C. - LAWS ON OBLIGATION AND CONTRACT ACTIVITY#1Document3 pagesCASTILLO, Erica Miles C. - LAWS ON OBLIGATION AND CONTRACT ACTIVITY#1Miles CastilloNo ratings yet

- Fundamentals of Income TaxationDocument11 pagesFundamentals of Income TaxationJane100% (1)

- Comprehensive ReceivablesDocument41 pagesComprehensive ReceivablesddalgisznNo ratings yet

- Business Laws and Regulations Session Topic 1: The Cooperative Code of The Philippines Learning OutcomesDocument6 pagesBusiness Laws and Regulations Session Topic 1: The Cooperative Code of The Philippines Learning OutcomesYolly DiazNo ratings yet

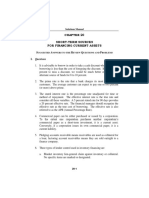

- Microsoft Word - FAR01 - Accounting For Equity InvestmentsDocument4 pagesMicrosoft Word - FAR01 - Accounting For Equity InvestmentsDisguised owlNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- Module 6 - Ppe RevalutionDocument4 pagesModule 6 - Ppe RevalutionARISNo ratings yet

- Intacc 3 HWDocument7 pagesIntacc 3 HWMelissa Kayla ManiulitNo ratings yet

- Quiz Cpa EsDocument4 pagesQuiz Cpa Esmusic niNo ratings yet

- Nature and Background of The Specialized IndustryDocument3 pagesNature and Background of The Specialized IndustryEly RiveraNo ratings yet

- Chapter 10 - AnswerDocument15 pagesChapter 10 - AnswerAgentSkySkyNo ratings yet

- CVP Analysis in One ProductDocument6 pagesCVP Analysis in One ProductShaira GampongNo ratings yet

- Activities/Assessments:: Origin / Rating Poor Needs Improvement Satisfactory V Good Excellent TotalDocument13 pagesActivities/Assessments:: Origin / Rating Poor Needs Improvement Satisfactory V Good Excellent TotalAmethyst LeeNo ratings yet

- Statistics Module 4Document13 pagesStatistics Module 4Sean ThyrdeeNo ratings yet

- Cost Accounting CycleDocument8 pagesCost Accounting CycleRosiel Mae CadungogNo ratings yet

- Week 9 Job Orderprocess Costing ActivityDocument8 pagesWeek 9 Job Orderprocess Costing ActivityfbaabgfgbfdNo ratings yet

- Jedah Noel - ASSIGNMENT 1 - Partnership FormationDocument2 pagesJedah Noel - ASSIGNMENT 1 - Partnership FormationJeddieh NoelNo ratings yet

- Midterm AISDocument6 pagesMidterm AISPhilip Dan Jayson LarozaNo ratings yet

- CE - Taxation and Law 2Document34 pagesCE - Taxation and Law 2rylNo ratings yet

- Inventories - ExercisesDocument3 pagesInventories - ExercisesAleiza MalaluanNo ratings yet

- Various Entry Strategies Used by Firms To Initiate International Business ActivityDocument14 pagesVarious Entry Strategies Used by Firms To Initiate International Business Activitymvlg26No ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Questions: Buy This Full Document at Http://test-Bank - UsDocument35 pagesQuestions: Buy This Full Document at Http://test-Bank - UsSami KhanNo ratings yet

- 2016 Vol 1 CH 4 AnswersDocument15 pages2016 Vol 1 CH 4 Answersbebe_cute06XDNo ratings yet

- Answer Key - M1L4 PDFDocument4 pagesAnswer Key - M1L4 PDFEricka Mher IsletaNo ratings yet

- Managerial Economics: Production Function Group ActivityDocument8 pagesManagerial Economics: Production Function Group ActivityFranchel DakisNo ratings yet

- CHAPTER 17 - PAS 23 Borrowing CostsDocument16 pagesCHAPTER 17 - PAS 23 Borrowing CostsMarriel Fate CullanoNo ratings yet

- Year 1Document17 pagesYear 1lov3m3No ratings yet

- Gbermic 11-12Document13 pagesGbermic 11-12Paolo Niel ArenasNo ratings yet

- GARCIA Module 4 Final PE 3Document4 pagesGARCIA Module 4 Final PE 3pat patNo ratings yet

- Short-Term Sources For Financing Current AssetsDocument11 pagesShort-Term Sources For Financing Current AssetsAlexandra TagleNo ratings yet

- Reverse Acquisition MillanDocument5 pagesReverse Acquisition MillanJessica IslaNo ratings yet

- CFAS - PAS 7 - Statement of Cash FlowDocument14 pagesCFAS - PAS 7 - Statement of Cash FlowCarlo Lopez CantadaNo ratings yet

- Finman Multiple Choice Reviewer - CompressDocument9 pagesFinman Multiple Choice Reviewer - CompressAerwyna AfarinNo ratings yet

- Receivables AssignmentDocument24 pagesReceivables AssignmentRhona RamosNo ratings yet

- CFASDocument4 pagesCFASBruce Devin Pabayos SolanoNo ratings yet

- CF04 Part 3 - Petty Cash FundDocument51 pagesCF04 Part 3 - Petty Cash FundABMAYALADANO ,ErvinNo ratings yet

- ACCOUNTING 4 Retained EarningsDocument2 pagesACCOUNTING 4 Retained EarningsJoy ConsigeneNo ratings yet

- Operations MGT Module #1Document1 pageOperations MGT Module #1Jude Vicente50% (2)

- Lumpsum LiquidationDocument28 pagesLumpsum LiquidationCAMILLE100% (1)

- CHAPTER 2 - Nature and Formation of A PartnershipDocument6 pagesCHAPTER 2 - Nature and Formation of A PartnershipRamm Raven CastilloNo ratings yet

- Quiz-Review CfasDocument5 pagesQuiz-Review CfasMa Louise Ivy RosalesNo ratings yet

- Partnership LiquidationDocument5 pagesPartnership LiquidationChristian PaulNo ratings yet

- Module 1.a The Accountancy ProfessionDocument6 pagesModule 1.a The Accountancy ProfessionJonathanTipay0% (1)

- Brown Creative Company Profile Presentation 3Document20 pagesBrown Creative Company Profile Presentation 3Florence Joy AbkilanNo ratings yet

- Financial Markets - Chapter 2Document4 pagesFinancial Markets - Chapter 2Jarabata Lai SalveNo ratings yet

- Asset and LiabilityDocument30 pagesAsset and LiabilitymailsubratapaulNo ratings yet

- Hamilton Financial IndexDocument52 pagesHamilton Financial IndexThe Partnership for a Secure Financial FutureNo ratings yet

- The Global Financial System Has Seven Basic Economic FunctionsDocument5 pagesThe Global Financial System Has Seven Basic Economic FunctionsArpitaNo ratings yet

- Business Finance: Senior High School Senior High School Senior High SchoolDocument14 pagesBusiness Finance: Senior High School Senior High School Senior High SchoolLeteSsieNo ratings yet

- Emerging Trends in Real Estate Europe 2021Document78 pagesEmerging Trends in Real Estate Europe 2021soraya7560No ratings yet

- Policy Briefing - Infrastructure Investment V03 WEBDocument15 pagesPolicy Briefing - Infrastructure Investment V03 WEBRishi KumarNo ratings yet

- At 0311Document66 pagesAt 0311TradingSystem100% (2)

- The Crypto OTC Market at A Glance - v5Document3 pagesThe Crypto OTC Market at A Glance - v5Abra ChakraNo ratings yet

- Solution Manual For Fundamentals of Investing Smart Gitman Joehnk 12th EditionDocument37 pagesSolution Manual For Fundamentals of Investing Smart Gitman Joehnk 12th Editionpotassicdaywomanslqia100% (26)

- Balance Sheet OptimizationDocument32 pagesBalance Sheet OptimizationImranullah KhanNo ratings yet

- Articles Banking Terms Glossary of BankinDocument27 pagesArticles Banking Terms Glossary of Bankincoolguy.sudheer604762No ratings yet

- Apollo Tyres Final)Document65 pagesApollo Tyres Final)Mitisha GaurNo ratings yet

- Industry Analysis of The Indian Power Sector: Group AssignmentDocument12 pagesIndustry Analysis of The Indian Power Sector: Group Assignmentनिशांत मित्तलNo ratings yet

- Cash Management Services and Information TechnologyDocument10 pagesCash Management Services and Information Technologym_dattaiasNo ratings yet

- Fiqh MuamalatDocument54 pagesFiqh Muamalataliaa lyanaNo ratings yet

- Summary - Reading 20Document5 pagesSummary - Reading 20derek_2010No ratings yet

- Midterm Reviewer in SbaDocument7 pagesMidterm Reviewer in SbaMaribeth AnorNo ratings yet

- Calypso Corporate Technology PDFDocument4 pagesCalypso Corporate Technology PDFCalypso TechnologyNo ratings yet

- SSRN Id313681Document48 pagesSSRN Id313681casefortrilsNo ratings yet

- Consumer Behaviour Towards Mutual FundDocument169 pagesConsumer Behaviour Towards Mutual FundShanky Kumar100% (1)

- Chapter 4 Financial PerformanceDocument19 pagesChapter 4 Financial Performancejoann121887No ratings yet

- BFM - Ch-14 - Module CDocument8 pagesBFM - Ch-14 - Module CFara MohammedNo ratings yet

- FY20 PresentationDocument49 pagesFY20 PresentationTrilok BavishiNo ratings yet

- A Study On Financial Statement Analysis in J.q.tyreDocument79 pagesA Study On Financial Statement Analysis in J.q.tyrek eswariNo ratings yet

- Annual Report2011Document181 pagesAnnual Report2011Rashid AyubiNo ratings yet

- Chapter 3Document48 pagesChapter 3SundaraMathavanNo ratings yet

- Dela Cruz MLT q11Document2 pagesDela Cruz MLT q11Mitzchell LeiNo ratings yet

- Assignment 3Document33 pagesAssignment 3Muhd noor fitri OmarNo ratings yet

- NPM Berpe LuluDocument11 pagesNPM Berpe LuluChia noNo ratings yet

- Chapter 2., Questions and AnswersDocument6 pagesChapter 2., Questions and AnswersMohammad Anik100% (1)